Starting a bakery sounds pretty great—fresh bread in the oven, happy customers at the counter, and the smell of pastries filling the place. But turning that dream into a real business? That takes more than a good recipe.

Whether you’re planning to open your first shop or grow what you’ve already started, you’ll need a clear plan to keep things on track.

Not sure how to put one together?

Don’t worry! This bakery business plan template will walk you through it step by step.

Key Takeaways

- Conduct a detailed industry analysis of the bakery market to understand market trends, target market, and the growth scope of your business.

- Outline the business goals and devise a business strategy that is in line with your bakery’s branding image.

- Analyze the competitive landscape of your business and identify local businesses that will offer direct and indirect competition to your business.

- Make calculations, assumptions, and projections to form key reports such as income statement, balance sheet, Cash Flow statement, and Break-even analysis.

- Determine the operations of your bakery business by outlining the procedures, processes, and equipment required to kickstart the business.

- Determine the baked goods and services you will sell through your bakery business.

Why is a bakery business plan important?

A business plan helps achieve your business objectives by creating a roadmap that will guide your bakery business in a strategic direction. An actionable well-drafted plan offers an in-depth view of your business idea and are a few benefits you must know:

- A business plan instills clarity in your business idea. All the ideas that were messed up in your mind start getting a clear point of view once you start writing a plan.

- A business plan is your checklist to understand what different aspects of the business need- the resources, equipment, manpower, licenses, etc.

- It helps crystallize your business vision and what it aims to achieve in the bakery market.

- A business plan optimizes the bakery operations and brings down the operating expenses by ensuring the resourceful allocation of bakery resources.

- A plan evaluates the financial aspects and viability of your bakery idea before you actually invest money in the business.

And, of course, a well-crafted plan will get you essential funds to get started in the bakery market. Moving forward, let’s craft a spectacular plan for your bakery business.

How to Write a Bakery Business Plan: A Complete Guide

From writing an executive summary to creating your financial plan- let’s decode the key elements of writing a business plan.

1. Get a business plan template

Before you start writing a business plan, consider getting a sample template to simplify the entire plan writing process.

A lot of information goes into writing a comprehensive business plan. Addressing all the key components in brief details is a challenging task.

However, by using a template, you can add structure to your plan. Not only that, it will help you organize the information clearly in a cohesive manner. With appropriate prompts, you will know exactly what to write in each section.

We know you would start searching for a template. Well, the Upmetrics business planning template is perfectly relevant and suited for your bakery business. It’s intuitive, modern, and available for free download.

Pro-tip

Need Assistance Writing a Bakery Business Plan?

Get Upmetrics’ business plan template, import data directly into the editor, and start editing using Upmetrics AI Assistant.

2. Write an executive summary

The executive summary is a concise description of your entire bakery business plan. It highlights the key findings and entices the reader to delve further into your business plan. So make sure to keep it interesting.

A well-drafted executive summary includes an answer to every question, a potential investor might have.

For instance,

- What is the core objective of your bakery business?

- What are the pain points of your target customers and what solutions can you offer?

- What type of baked goods will you offer?

- What is your target market?

- What is your marketing strategy?

- What are the financial highlights of your bakery business?

As you start writing, remember that the executive summary should summarize the plan and not your business idea.

Lastly, fit your compelling summary description in 1-2 pages.

3. Conduct a competitive and market analysis

The market analysis section paints a clear picture of your ideal target market, bakery industry trends, and your competitors in the market. In a way, this section is your chance to validate the potential success of your bakery shop.

The market analysis section of your bakery plan must include:

Market share, growth potential, and industry trends

Identify your targeted available market (TAM) through thorough market research and determine your share in the bakery market. Analyze the emerging trends in the bakery market and assess your growth potential as a retail bakery.

Understanding of the target market

Who will be your potential customer at a bakery shop?

It gets much easier to succeed in the market when you have a clear understanding of who your target customers are.

In this section of customer analysis, you will create a buyer’s persona of your ideal customer by understanding their psychographic and demographic details.

Competitor analysis

This is an equally important part of the market study, where you evaluate the position and competitive landscape of your bakery shop.

Begin by identifying your top competitors and evaluate your strengths, weaknesses, opportunities, and threats against other bakeries. Establish your competitive edge and show the potential investors that your business stands a promising opportunity in the competitive market.

Want to Perform Competitive Analysis for your Business?

Discover your competition’s secrets effortlessly with our user-friendly and Free Competitor Analysis Generator!

4. Prepare a company overview

The company overview section of a bakery’s business plan is a brief description of your bakery business concept, its legal structure, location, and value proposition.

Be creative and write a compelling section that can propel the readers’ interest in your business idea.

Wondering what to include in your bakery’s company overview section? Let’s check:

- Type of bakery business: retail bakery, specialty bakery, cloud bakery, mobile bakery, etc.

- Business structure: Sole proprietorship, LLC, partnership LLC, corporation, etc.

- Mission statement

- Value proposition

- Quantifiable business goals and milestones

- History and background of the bakery, if applicable

- Partnership and ownership structure

- Name of owners/ partners

- Operating hours

- Service style

Drill down to details and make this section an engaging read.

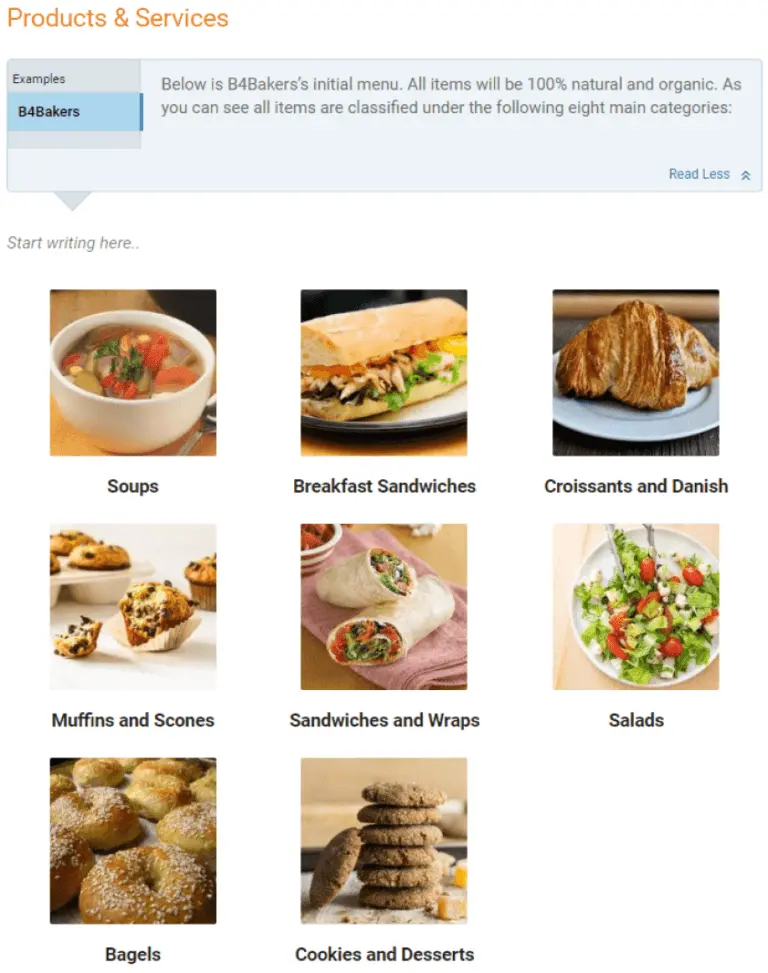

5. Describe your products and services

After describing your bakery structure and mission statement in the previous section, you will now outline the product and service offerings of your bakery shop.

As a bakery business, you may sell a variety of delicious baked goods such as pastries, cakes, fresh bread, cookies, tarts, pies, donuts, sweet buns, etc. Add this to your product section and also non-baked goods such as savory snacks, coffee, etc, if it’s on your menu offering.

Specifically mention, if you will have products for special diets, i.e. gluten-free, keto-friendly, sugar-free, vegan baked goods, etc.

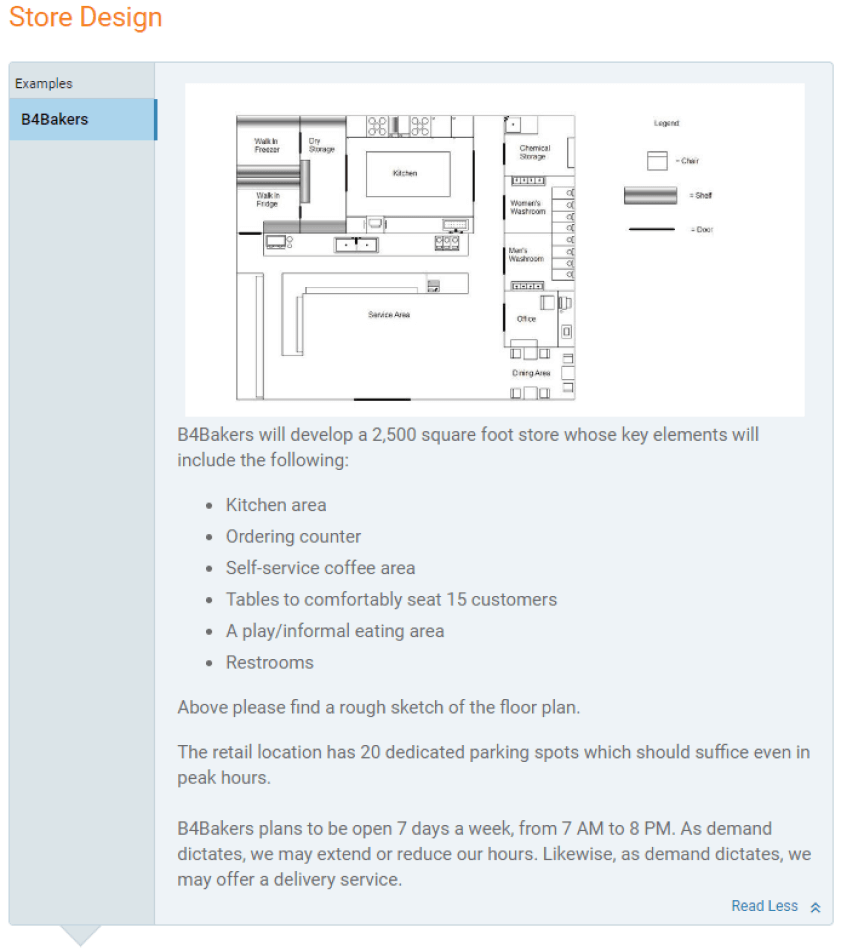

6. Bakery store design and layout

An effective bakery business plan must include a blueprint of your bakery shop’s layout and design to demonstrate the bakery’s concept practically to the readers.

Mention your bakery size and the space allocated for the back of the house and front of the house operations. Also, explain how the proposed layout will increase the efficiency of your business operations in great detail.

In this section, you will also talk about the decor and theme that will create a warm ambiance for your target audience. Keep in mind that the decor should reflect the branding image you want to create in your target market.

Offer an immersive experience to the readers while explaining this section.

7. Prepare a bakery marketing plan

The bakery marketing plan offers a detailed outlook of marketing strategies you will use to market and promote your bakery shop. Consider it as a roadmap that will guide you in building a brand of sustainable value in the market.

So how do you build a perfect marketing plan?

Begin by identifying the marketing channels and different types of digital marketing campaigns that will work best for your potential customers. Now, allocate the monthly budget to different marketing activities. Lastly, devise a marketing strategy for each channel with a clear plan of action.

Here are a few marketing strategies that are popularly used by successful bakery businesses:

- Social media platforms for brand development

- Email marketing for promotional offers

- Video content such as easy baking recipes, tips, tricks, etc

- Online workshops and live sessions

- Influencer marketing

- Tasting events and sampling

- Customer testimonials

Now detail all your plans in this section and show your investors that you have a solid way to establish your business’s popularity in its target market.

8. Outline your organizational structure

In this section of your bakery business plan, you introduce the management team and employees at your shop. Also, highlight the organizational structure and hierarchy of employees in the organization.

Begin by introducing the owners and their role in your organization. Highlight their experience in the bakery industry and the key skills that can benefit the business.

Introduce your talented baker and their role in recipe development and standardization. Show their experience in the baking field and prove their asset worthiness.

Draw a clear flowchart depicting the flow of authority and responsibility in your bakery business. It is your chance to show the investors that you have a team and knack to take this business on a successful path.

9. Create a logistics and operational plan

The operations plan of your bakery business plan is a strategic document highlighting the processes, procedures, and resources needed to efficiently run your bakery shop.

A well-planned operations plan is like a business manual that has answers to all the questions one might have while running a bakery shop.

Wondering what to add to your operations plan? Well try to include answers to the following questions to make it detailed and comprehensive:

- Physical facilities: What will be your bakery location to produce bakery goods? Will you serve customers from that location or a different shop? Are you planning to sell the bakery goods online?

- Suppliers: Where will you get the raw materials and supplies for producing bakery goods? Who will supply non-bakery items like scones, sandwiches, and savory snacks?

- Inventory: Where will you store the raw material and ingredients? What will be the shelf life of these ingredients? How will you manage the stock levels? What are the minimum thresholds for different items and how long it takes to stock them?

- Production: Who will bake the goods? How long is the process? Will everything be made fresh or in batches to be stored for a few days? Will there be recipe cost cards for each menu item? How will you meet an unexpected spike in demand?

- Bakery Equipment: What type of bakery equipment will you require? Will there be a POS system at your store? What other technologies will you use? How will you take online orders?

The amount of precision here will help you regulate your operating expenses once the bakery starts serving the customers. Proper planning is advisable at this stage.

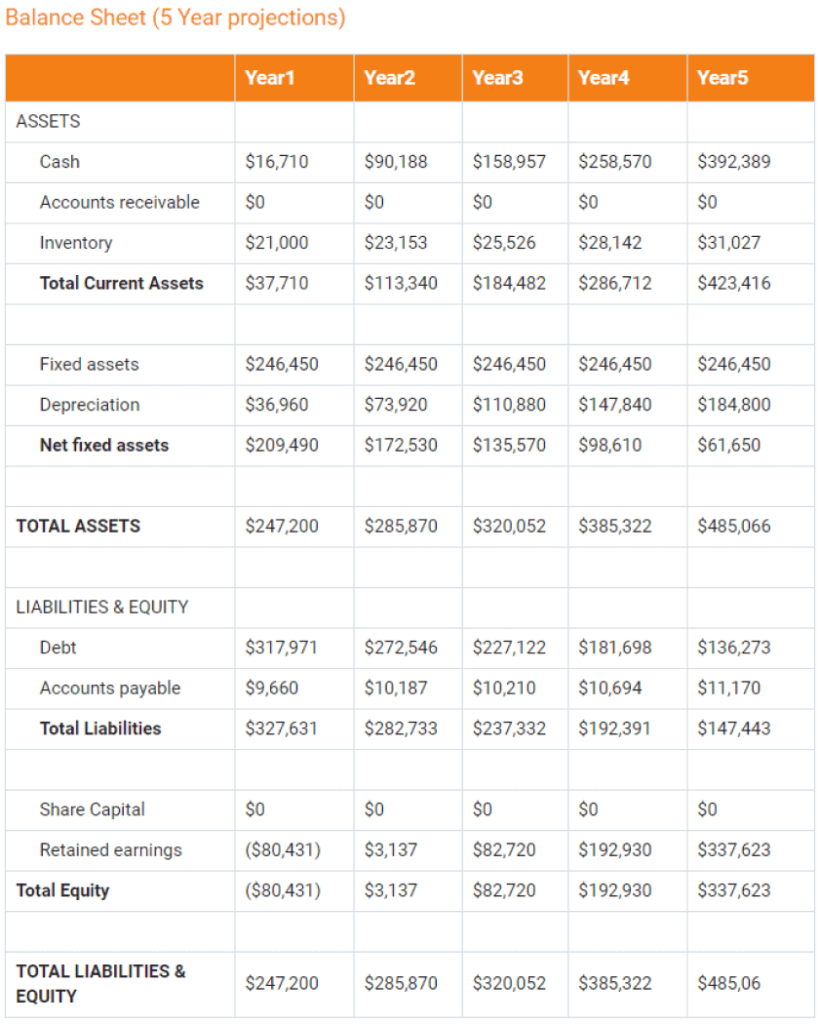

10. Create a Financial Plan

And now comes the most exciting part for investors a financial plan. The figures in financial statements are helpful in determining the viability of your business idea. So this section holds a considerable weightage in terms of whether you will get funding or not.

To ensure you create a comprehensive bakery financial plan, including financial projections for these key components:

- Cost of starting a bakery shop

- Sales forecast

- Revenue projection

- Operating expenses

- Pricing strategy

- Income statement/ Profit & Loss statement

- Break-even analysis

- Cash flow statement

- Balance sheet

- Business ratios

In this section, you will also evaluate your funding requirements and identify the funding sources for your business. i.e. bank loans, SBA-guaranteed loans, angel investors, and personal savings.

Having realistic financial projections at hand will help you realize your financial goals while evaluating the sustainability of your bakery business.

However, creating the projections for all these elements from scratch can get overwhelming. Additionally, you also need to work on visuals and graphs to add impact and clarity to your plan.

Well, there is an easy way. Create your plan with the Upmetrics Financial forecasting tool. This tool will generate key reports and visuals that can be easily downloaded and added to your plan.

We hope this sample plan will guide you in writing a perfect business plan. Now, let’s move forward and check the industry trends ruling the bakery world.

Bakery Industry Highlights 2025

The U.S. bakery industry is steady, crowded, and still full of opportunities!

People crave bread, cakes, and pastries, but now they also want healthier, fresher, and more local options. From big brands to neighborhood shops, everyone’s adapting to changing tastes.

Here’s a quick look at where the bakery market stands in 2025:

- Market size: The North American bakery market is worth about $103.78 billion this year. It’s expected to grow slowly but steadily, reaching $114.81 billion by 2030.

- Global market: Worldwide, the bakery market hit $248.8 billion in 2024 and is growing at a decent pace—about 4.4% per year through 2034.

- Number of bakery cafes: As of 2024, there are 9,078 bakery cafes in the U.S.—a slight increase from the year before.

- Revenue from baked goods: Bread brings in around $25.93 billion in U.S. revenue, and pastries and cakes add another $27.29 billion. That’s a whopping $53 billion total.

- Total consumption: Americans consume around 6.87 billion kilograms of bread a year, roughly 26 kg per person. Cakes and pastries aren’t far behind at 2.75 billion kilograms annually.

- Health-focused baking: The gluten-free options are in high demand. In 2024, it was already worth $2.27 billion, and it’s expected to grow nearly 10% a year through 2030.

- Big players: Around 55% of all U.S. commercial bakery revenue comes from just three companies—Grupo Bimbo, Flowers Foods, and Campbell Soup Co. That makes it harder for smaller brands to compete at scale.

Download a sample Bakery business plan

Need help writing your own bakery business plan? Well, download our bakery business plan pdf and write your plan section-by-section with utmost precision.

Upmetrics templates are perfectly suited for entrepreneurs who need a little help to kickstart their business planning. Import the data into the editor and start planning.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Write your business plan with Upmetrics

Optimize your business planning with Upmetrics.

With more than 400+ business plan examples, we offer invaluable guidance to help you write a cohesive business plan.

Whether you are writing a business plan to strategically grow your business or attract investors, Upmetrics’ invaluable resources like AI assistance, forecasting tools, and step-by-step guides will serve you perfectly.

Let’s bake a recipe for success together.