Whether you are dreaming of opening a cozy neighborhood pub, a modern cocktail lounge, or a vibrant sports bar, you’ve come to the right place!

However, creating a realistic financial plan is not just a necessary step of drafting a business plan—it’s the most pivotal aspect of your business planning.

If you need help writing the financial section of your plan, we’ll walk you through every step of the financial plan, from estimating start-up costs to projecting revenue streams and managing cash flows.

Additionally, our bar financial plan will provide valuable insights and practical tips to turn your passion for owning a successful bar into a reality.

So, grab a drink and settle in; let’s start by understanding the basics of a bar financial plan.

What is a Bar Financial Plan?

A bar’s financial plan reflects the current monetary position of a bar business and summarizes its long-term financial goals, profit & loss, and strategies to achieve desired outcomes.

Though it is the last section of a business plan, it’s the most important part as it will help you convince investors to invest in your business.

Well, the financial plan consists of key financial reports like income statement, cash flow statement, break-even analysis, balance sheet, and funding needs.

These reports give investors a detailed outlook of your bar business’s projected performance, including its revenue potential, risks, and rewards that your business can bring.

Instead of paragraphs, the financial section of a business plan is presented best with figures, diagrams, charts, and graphs.

Key Takeaways

- Develop a realistic financial plan for your bar by evaluating the current financial condition and projecting the initial expenses.

- Determine the profitability of your bar business with key financial reports.

- Improve the accuracy of your plan by verifying assumptions and performing sensitivity analysis.

- Include your bar’s financial snapshots and pique investors’ attention.

- Consider using user-friendly financial forecasting software to ease your planning approach.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $14/month

How to Prepare a Bar Financial Plan?

If you’re feeling overwhelmed with creating a financial plan, this step-by-step guide will help you prepare a realistic financial model for your bar. Also, it ensures that you have all the details.

1. Identify Your Funding Requirements

Before opening your bar, you will need to have a clear understanding of your finances, right? So, the first step is to estimate the bar startup costs.

The bar startup costs should include all initial investments, like leasing or purchasing a bar location, buying necessary equipment like bar fixtures and furniture, getting business licenses and insurance, covering utility bills, stocking up on inventory, and more.

Apart from these expenses, you’ll need to budget for the ongoing operational costs to keep your bar’s daily operations smooth during the first few months.

This will include staff salaries, rent or mortgage payments, utilities, inventory replenishment, and marketing expenses.

Once you’ve calculated the total amount you require for your business, then you can explore funding options.

2. Determine Your Funding Strategy

Not everyone has a pile of money ready to start a business. Sometimes, you’ll need to ask for help from potential lenders and get enough money to start your bar.

Here are some potential funding resources you may consider for your bar venture:

- Personal loans from friends and family

- Bank loans

- Small Business Administration (SBA) loans

- Angel investors

- Real estate loans

- Equipment Financing

Before you seek financing from banks, investors, or other sources, it’s very important to consider the associated costs, terms, and benefits of different funding options.

After that, choose the funding sources that suit your bar business’s needs and long-term profitability goals.

3. Select a Business & Financial Planning Software

As you know—starting and operating a bar will overwhelm you with responsibilities. So, having a financial planning or forecasting tool is a smart choice for several reasons.

Firstly, financial software will help you organize and automate various financial reports efficiently, saving time and reducing the risk of errors in calculations and data entry.

Furthermore, it often comes with specific built-in features and templates designed for making comprehensive financial plans. It also allows users to navigate complex financial concepts and ensure to include all essential components of the plan.

Overall, selecting financial software will simplify the entire financial planning process, improve accuracy, and empower businesses to make better financial decisions.

If you are struggling to choose from too many options, consider a tool that is easy to use, offers a range of functions, and allows seamless integration of Excel data.

Pro-tip

Create a Bar Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

4. Pre-Assumptions & Market Analysis

Before diving into the financial projections, it’s time to lay a solid foundation by considering the various aspects of your bar business. Here are some of them:

Sales forecast

It is essential to estimate the future sales volume of your bar. For forecasting sales, you should consider a few factors, such as market trends, customer preferences, or seasonal fluctuations. Also, break down your forecast into daily, weekly, monthly, quarterly, and yearly figures to get insights into your revenue stream and production levels.

Pricing strategy

Your pricing strategy is crucial in positioning your bar in the market. So, analyze all the factors like your products, customer preferences, and the local competition to decide optimal pricing. Remember, your pricing strategy should reflect the value your bar brings to customers and remain competitive.

Overhead budget

These are the essential day-to-day expenses that keep your bar operations running smoothly. So, account for various costs like payroll, rent, ingredients, maintenance, and other monthly expenses to create an accurate overhead budget. Also, gathering precise estimations from the suppliers assures your budget is realistic.

5. Prepare Financial Projections

If you want to attract investors for your bar business, let the numbers do the talking. So, make sure that your key financial reports provide a clear picture of your bar’s financial health. And this will be the deciding factor for potential investors.

Here are the key components of financial projection:

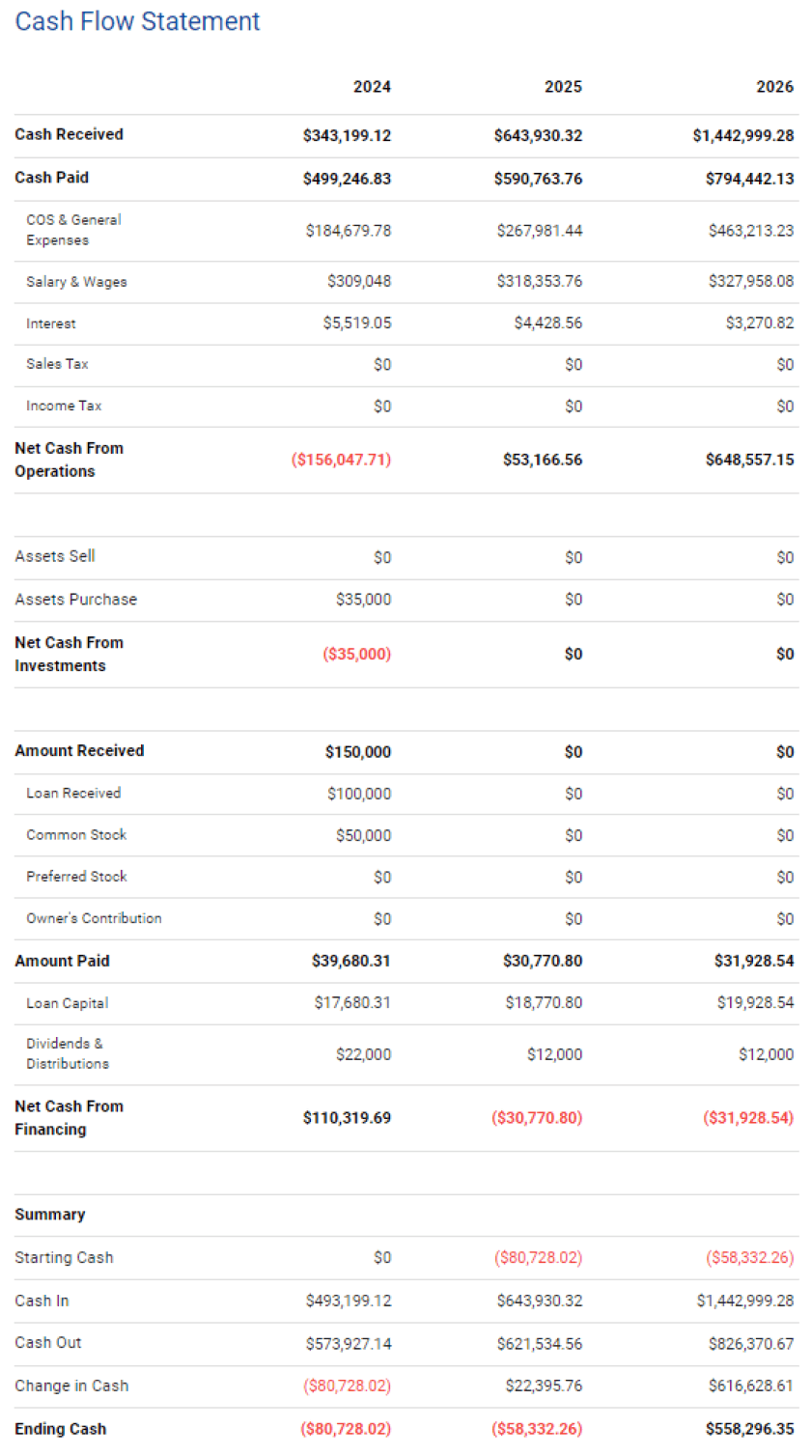

Cash flow statement

A cash flow statement helps you assess the financial health of your bar business. It gives you valuable insights into whether you have enough funds to sustain smooth operations and make necessary investments.

To develop an accurate cash flow statement for your bar, you’ll need to consider several critical factors, including sales figures, the cost of goods sold(including alcohol, mixers, and garnishes), and the budget for overhead costs(rent, staff salaries, & utilities).

Here’s an example of the cash flow statement for the bar business over the next 3 years, prepared using Upmetrics:

Income Statement

The income statement, also known as the profit and loss statement, provides specific insight into your bar’s profitability, long-term financial goals, and business growth over the next 3-5 years.

So, you’ll need the cost of goods sold and revenue projections to calculate your bar’s gross profit.

After that, deduct the operating expenses, including ingredients, labor, and rent to calculate the net income of your bar business. This is what engages investors the most.

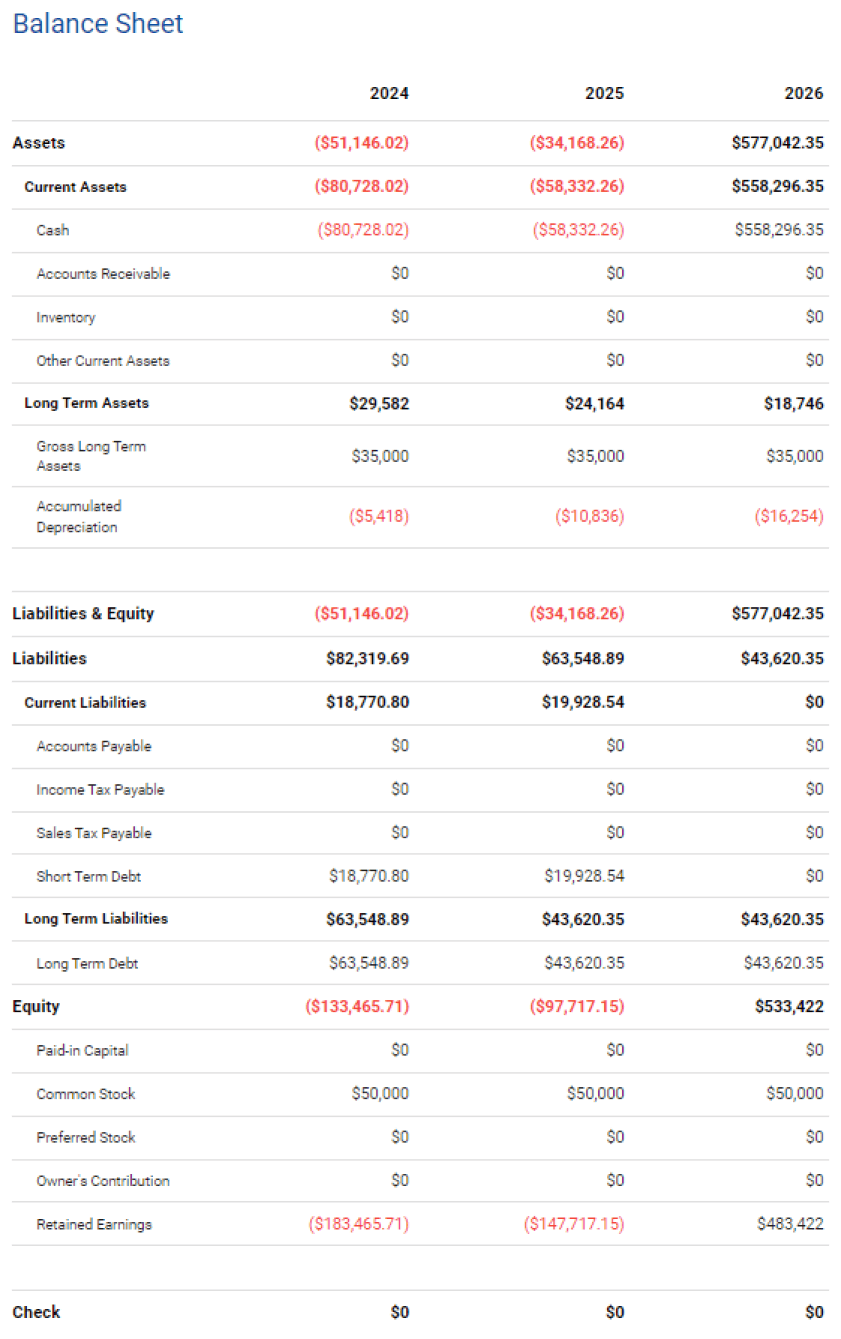

Balance sheet

A balance sheet indicates what it owns and to whom it owes. It has three main sections; assets, liabilities, and equity.

Assets include things tangible and intangible resources, from cash reserves and liquor inventory to fixtures and furnishings.

On the other hand, liabilities are debts and financial obligations, including loans, unpaid bills & payments to suppliers and vendors.

Lastly, equity reflects the owner’s investment in the business or any stake held by investors, along with expected profits.

Investors pay attention to the balance sheet as it helps them understand how your bar’s finances are organized and its potential for profitability.

Here, you’ll find an example of the projected balance sheet for the bar business over the next 3 years:

Break-even Analysis

Earning profits is the ultimate goal of any business, so how do you get to know when you will start making profits?

This is where break-even analysis comes into the picture to help you determine how much sales volume is needed to balance costs and revenue.

First, identify fixed costs(rent, salaries, & utilities). Then, calculate variable costs per item(along with ingredient prices). Next, decide the selling price per item.

Then, subtract variable costs from the selling price to find the margin. Divide total fixed costs by the contribution margin per item to get the break-even point in units. This will tell you the minimum number of items you’ll need to sell to cover expenses.

Well, reaching the break-even point may take time, especially if there are loans to settle. However, you can keep your business profitable with the right understanding of fixed costs.

6. Test Assumptions

Your whole financial plan is built on predictions. Even if you’ve planned every detail carefully, unexpected challenges can still arise.

During this stage, it’s crucial to think about various “what-if” situations. So, imagine different scenarios, where things go well, and others where they don’t.

First, understand which scenario has the greatest impact on the profitability and sales of the bar business. Consider performing sensitive analysis and stress testing of various scenarios for the financial plan of your bar.

By testing assumptions through sensitivity analysis and stress testing, you can refine your financial plan, mitigate potential risks, and make well-informed decisions to ensure the success of your bar business.

7. Monitor & Update Your Plan

Creating a financial plan is only the starting point. To make it work, you’ll need to monitor and adjust it as required.

Remember, your financial plan is based on assumptions and market analysis. Real-world circumstances can impact your bar differently than you expected.

Thus, it’s crucial to monitor your business’s financial performance regularly. Compare the figures in your financial plan with the actual numbers, and take note of any differences.

By regularly reviewing your financial plan, you can spot trends, patterns, and potential issues on a prior basis. This can help you understand which areas need improvement and which are working as expected.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

Now that you have all the information to create a solid bar financial plan, it’s time to start making projections and doing the necessary calculations.

Keep in mind that your plan should be flexible and adaptable to changing circumstances. It is not only about the financial plan, but the whole bar business plan should be flexible.

Download Free Bar Financial Plan Example

Need help creating a financial plan from scratch? Well, here you go; download our free bar financial plan example prepared using Upmetrics to help you get started.

It includes all the key components of a business’s financial projections, including the balance sheet, cash flow statement, income(P&L) statement, and break-even analysis. And this will simplify your bar’s financial planning.

Related Bar Business Resources

Start Preparing Your Bar Financial Plan

And that’s a wrap—we’ve discussed the fundamental aspects of the bar’s financial planning. So, it’s time to put that knowledge into action.

But if you still feel swamped by the thought of creating a financial plan, don’t worry. We’ve got you covered.

Our robust financial planning tool is here to make your process a breeze. You just need to enter your financial assumptions, and we’ll handle the rest.

So, don’t delay any longer; let’s get started on your financial plan now!