Ready to start your own florist business?

Well, opening a flower shop can be an exciting venture filled with beautiful blooms and ample opportunities!

But before you dive in, you’ll need to plan your finances carefully and understand the fundamental aspects of your flower shop’s financial success and sustainability.

So, it’s crucial to create a solid financial plan!

If you’ve never done financial planning before, the process might seem intimidating in the first place. But not to worry; this sample flower shop financial plan will help you get started.

Key Takeaways

- The income statement, balance sheet, cash flow projection, and break-even analysis are the primary elements of a financial plan.

- Be practical and conservative about your revenue forecasts and cash flows to grab investors’ attention.

- Writing a flower shop financial plan is much easier and faster when you use financial planning software.

- Enhance the accuracy of your plan by exploring the methods of test assumptions and scenario analysis.

- Make reliable financial projections with thorough industry research, clear market understanding, and realistic assumptions.

Flower Shop Financial Outlook

Before jumping right into financial planning, let’s take a moment to explore the financial state of the flower shop industry.

The florist industry is currently experiencing steady growth with the rising demand for floral arrangements for weddings, funerals, and special occasions.

Here are some key highlights from the industry:

- The global cut flower market is projected to reach approximately $45.5 billion by 2027, with a steady growth rate of 4.6%.

- In the United States, the florist industry generated a total revenue of $8.6 billion in 2023, showing a 3.9% increase from the previous year.

- The US floral industry employed 80,928 individuals as of 2023. So, there are ample opportunities for growth and development in this sector.

- The US florist industry pays a collective sum of $1.8 billion in wages, and the average annual wage per employee stands at $81,281.

It’s indeed a rewarding market for anyone who wants to open a flower shop, but flower shop owners must stay innovative and customer-focused to succeed in this competitive landscape.

Now, without further ado; let’s understand how to draft a winning financial plan.

How to Prepare a Flower Shop Financial Plan

1. Calculate Business Startup Costs

Once you’ve decided to start a florist business, it’s very crucial to have a clear idea of your finances, right? So, you’ll need to calculate the startup costs very first!

You may start by identifying all the initial expenses associated with your flower shop, including storefront rent, renovation or decor, inventory of flowers or plants, equipment, utilities, insurance & licensing fees, marketing, and overhead costs.

You can also research local market conditions and industry benchmarks to evaluate the typical costs of opening a flower shop. This will help you get accurate estimates.

Try to be clear and comprise every potential cost, no matter how small it is. You can make a specific list of all the expenses, as shown in the below table:

| Expense Category | Average costs |

|---|---|

| Storefront rent | $1,500 to $5,000 |

| Renovations & improvements | $2,000 to $15,000 |

| Marketing costs | $3,000 to $5,000 |

| Insurance fees | $500 to $1,500 |

| Legal expenses | $1,000 to $3,000 |

| Business licenses and permits | $500 to $2,000 |

So, having a clear understanding of startup costs will help you create a proper budget and determine the necessary capital to launch your business successfully.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $14/month

2. Determine Financing Requirements & Strategy

Sometimes, people don’t have enough money to start their own business. So, they might need to ask for help from others to get the initial investment.

For your flower shop, you may evaluate the current monetary position and determine how much startup capital you’ll require to fund your business. Also, assess various financing options and develop a clear strategy to secure funding.

Here are a few funding options you may consider:

- Bank loans

- Small Business Administration (SBA) loans

- Angel investors

- Partnerships

- Crowdfunding

- Venture Capital (VC) firms

For each option, you have to evaluate the terms, interest rates, and repayment methods. This will let you devise a financing strategy that aligns with your investment goals and risk tolerance.

Then, you can decide which funding option is the most appropriate for your florist business.

Furthermore, while seeking credit from banks or investors, you’ll need a professional document that projects how your flower shop’s financial modeling works. It will assist potential lenders to have a better idea of your business.

3. Understand Your Business Model

Developing a scalable business model is a crucial aspect of a financial plan. This is something you have to decide before you start running your business.

It is a strategic framework that defines how you generate income, manage expenses, and reach your financial objectives.

Here is a list of different types of flower shop businesses you may consider:

- Retail flower shop

- Online store

- In-store & online shop

- Mobile flower cart

While deciding on any of the above models, you have to understand their financial considerations, including revenue potential, scalability, market demand, customer acquisition costs, and operating expenses.

This will help you make well-informed decisions and achieve your financial goals in the long run.

4. Identify Revenue Streams

Identifying your business revenue streams is an essential part of maximizing profitability. So, try to diversify your income sources within the floral market and create a robust portfolio.

It will allow potential investors or lenders to determine how much revenue your business intends to generate over the next few years.

For instance, you may include the following revenue streams in your flower shop financial projections:

- Flower sales

- Floral arrangements for events

- Delivery services

- Floral workshops or classes

Diversifying your shop’s revenue streams will help you earn extra money and mitigate potential risks related to seasonal fluctuations in demand.

Well, using Upmetrics could be a great help here. It will not just calculate financial projections but also help you identify relevant revenue streams.

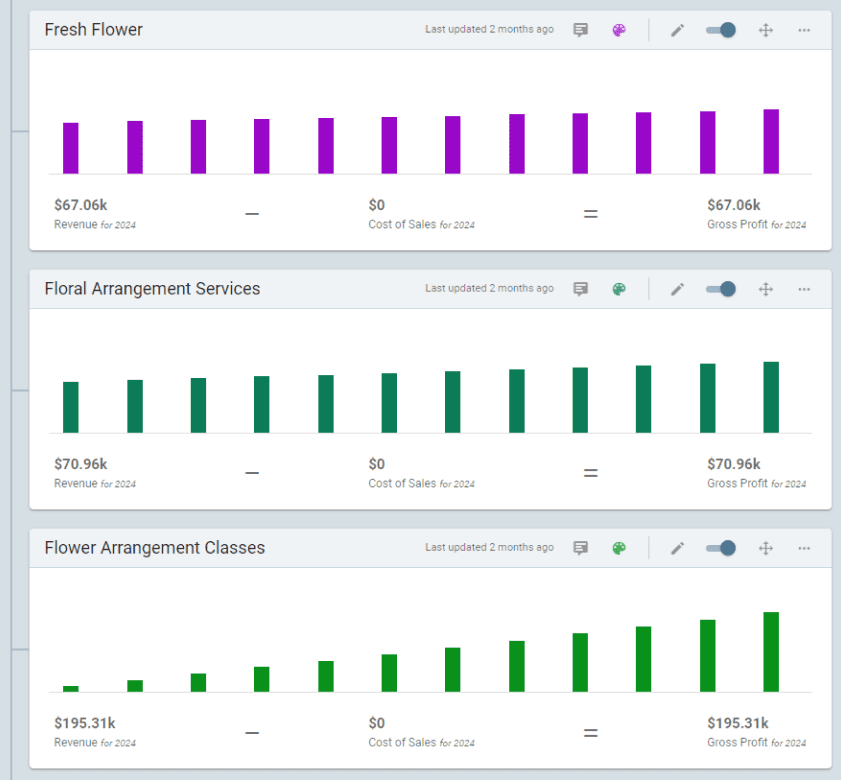

For better understanding, you may consider the following example prepared using Upmetrics:

Furthermore, it allows you to make informed decisions about your revenue by using different ways to forecast income streams, such as unit sales, the charge per service, recurring/hourly charges, or fixed amounts.

So, this can be an effective and accurate way of estimating your income potential.

5. Market Analysis and Pre-Assumptions

A successful business requires a comprehensive market analysis to gain valuable insights into the local business landscape.

While writing a flower shop business plan, you’ve already conducted thorough market research and had adequate knowledge of the target market, customer demographics, demand for floral products/services, and local competitors.

So, it’s time to use that knowledge to prepare a financial forecast and make realistic assumptions about customer acquisition costs, average transaction values, and seasonal variations in flower demand.

Here are a few key components that you should include in your plan:

Pricing Strategy

When it comes to devising a pricing strategy, there’s no bound law. Yet, you’ll need to analyze a few factors, such as your flower shop offerings, product costs, target market preferences, perceived value, and local competition, to develop optimal pricing.

You may conduct a competitive market analysis to comprehend the general market rates and set competitive yet profitable sales prices.

Remember, your prices should reflect the value of your floral products or services and still help you generate sufficient returns on your investment.

Sales Forecast

A sales forecast is a primary element of any business, serving as the cornerstone for its profitability and growth. It involves forecasting future sales volume and revenue based on historical data, market trends, and other relevant factors.

As a flower shop owner, you can use sales forecasts to anticipate the demand for different types of flowers, arrangements, or services over a specific period, such as a month or a year.

While estimating it, you may consider a few factors, such as pricing strategy, seasonal fluctuations, consumer behavior, marketing initiatives, and competitive landscape.

With accurate sales forecasts, you can plan inventory levels, staffing, and marketing campaigns that fulfill customer demand and maximize sales revenue.

Business Expenses

Generally, business expenses are operating costs or day-to-day expenses that will keep your flower shop running smoothly.

For a florist venture, you may conduct a detailed analysis of your anticipated expenses, including rent, inventory purchases, delivery fees, salaries, utilities, taxes, insurance, marketing, and commissions.

In addition to that, you may consider a few factors, like market trends, seasonal demand, supplier prices, and industry standards, while evaluating your business expenses.

Here, you should note one thing—you must account for probable cost overruns or unexpected expenses during business operations. So, be conservative in your financial projections.

6. Make Financial Projections

If you want to attract investors, let the numbers do the talking. This is so because potential investors or stakeholders will look at the financial reports once and decide whether or not to invest in your business.

So, ensure that your key reports give a clear picture of your flower shop’s financial health and viability.

Here’s a list of several financial statements and analyzes you should incorporate into your projections:

Cash flow statement

A cash flow statement helps you track the cash flow in and out of your business over a specific timeframe, generally monthly, quarterly, or annually.

It provides a detailed explanation of how much cash your flower shop brings in, pays out, and ends with the cash balance. Typically, it’s an illustration of how well your florist business is generating cash.

You may take into account the cash flows related to sales, equipment, renovations, loan repayments, borrowing, or equity investments.

Be realistic about your financial assumptions and measure your business’s liquidity, capability to meet financial obligations, and sufficiency of cash flow to fund future investments and expense outlays.

Balance sheet

A balance sheet provides a quick overview of your business’s financial position at a specific time.

It clearly demonstrates what you own, what you owe to vendors or other debtors, and what’s left over for you. After all, it has three main elements:

- Assets: Cash, inventory, equipment, and accounts receivable

- Liabilities: Debts, loan repayments, and accounts payable

- Equity: Owners’ equity & other investments, stock proceeds, and retained earnings

Ideally, it is formulated as, assets = liabilities + equity

By looking at your balance sheet, anyone can get the exact idea of how financially stable your business is, how much cash you hold, and where your money is tied up.

Income statement

The income statement is also known as a profit and loss statement(P&L), explaining how your business made a profit or incurred a loss over a specific period, typically monthly, quarterly, or annually.

Depending on the structure and type of your floral business, consider adding these factors—revenue or sales, operating expenses, and gross margin to your profit and loss statement.

You may calculate the gross margin by subtracting the cost of sales or COGS from revenue. It enables you to determine your business’s efficiency in utilizing resources.

Further, the P&L statement should also include operating income, which is equivalent to EBITDA. And the net income is the ultimate goal of any business, found at the end by deducting the operational expenses from EBITDA.

Overall, the income statement helps you gauge your business’s profitability, financial performance, and feasibility in the long run.

Break-even Analysis

The break-even analysis allows you to determine the point at which your florist business’s total revenue matches its total expenses, causing no profit or loss.

It helps you evaluate the minimum level of sales and revenue needed to cover your flower shop’s fixed and variable costs.

This analysis provides valuable insights into your financial sustainability and helps you set sales targets, pricing strategies, and cost-control criteria.

What is the average break-even period for a flower shop?

Typically, the average break-even period for a flower shop can vary widely based on a few factors, such as location, pricing strategy, customer acquisition costs, market conditions, seasonal fluctuations, and operational efficiency. However, the florist business takes approximately 1 to 2 years to reach the break-even point and achieve profitability.

7. Test Assumptions and Scenario Analysis

As your entire plan is prepared based on assumptions, you’ll need to regularly review and stress-test your financial projections to check their relevance with market realities and business performance.

In this stage, you may consider various “what-if” situations and think about scenarios where things go well or don’t.

For instance, you’ll need to consider the changes in pricing, sales volume, or operating costs to measure the stability of your florist financial plan.

By performing test assumptions and sensitivity analysis, you can adjust your strategies accordingly to mitigate risks, optimize returns, and make well-informed business decisions.

8. Monitor and Update Your Plan

Once your plan is ready, continuously evaluate and monitor your flower shop’s financial performance closely against the financial projections and key performance indicators(KPIs).

You can compare the actual financial results with the projected income streams, expenses, and ROI to take note of any variances or deviations from the plan.

If some factors are remarkably different from projections, recognize the causes behind them. This will help you understand which areas need improvement and which works as anticipated.

Also, review and update your strategies accordingly to optimize financial results and achieve long-term success.

Now that you know how to create a solid flower shop financial plan, it’s time to explore an example for easy understanding.

Flower Shop Financial Plan Example

Creating a flower shop financial plan from scratch can be overwhelming, right? But not to worry; we’re here to help you with a realistic financial plan example prepared using Upmetrics.

It includes all the key elements of the flower shop’s financial projection, including the income statement, balance sheet, cash flow statement, and break-even point. This will streamline the entire planning process and help you get started.

Start Preparing Your Flower Shop Financial Plan

And that’s a wrap. We’ve discussed all the fundamental aspects of financial planning. So, use that knowledge to draft your startup financial plan.

Still, feel swamped? Don’t worry; we have an easy way for you!

Upmetrics’ AI-based financial forecasting feature will help you create accurate financial projections and make informed decisions for your business’s future.

Just input your financial assumptions and let it figure out the rest!

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.