Executive Summary

EmberHouse Hookah Lounge, LLC is an indoor hookah lounge at 3821 North Dale Mabry Highway in Tampa. The space offers high-quality hookah sessions, custom in-house blends, a non-alcoholic bar, and light food plates. The concept targets groups seeking a social setting without alcohol and communities already familiar with hookah culture. The Egypt Lake–Leto corridor provides steady evening activity from nearby restaurants, hospitality workers, and college students.

Location and Demand

The corridor witnesses many vehicles each day and has seen notable growth in late-evening venues since 2022. Nearby establishments create reliable cross-traffic. Local hookah lounges show average ticket sizes between $19 and $32, which supports EmberHouse’s pricing model and projected seat turnover.

Funding Request

The founders seek a $185,000 commercial startup loan from PNC Bank on a 7-year term at 10.1% fixed interest. Owners will contribute $55,000 in equity. Collateral includes furnishings, ventilation equipment, POS systems, and inventory. Funds cover buildout, ventilation upgrades, equipment, furnishings, licensing, insurance, inventory, and launch marketing.

Startup Budget

Total startup costs equal $155,000, including three to four months of working capital. The remaining loan balance supports fit-out quality, ventilation performance, and early promotional activity.

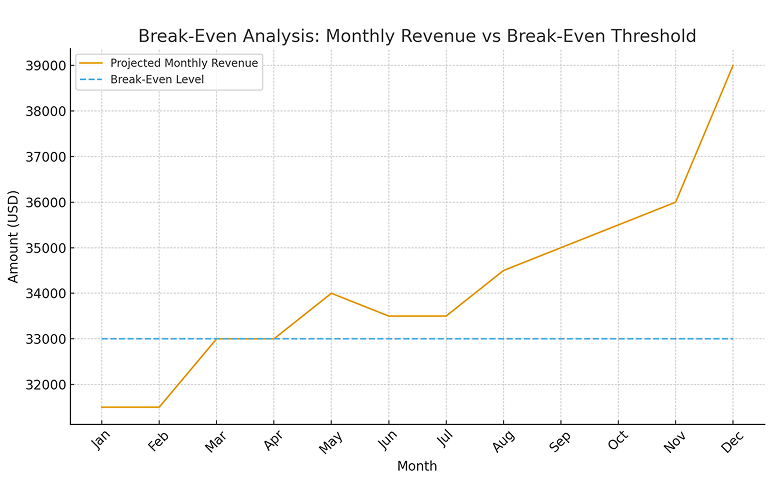

Revenue Outlook and Break-Even

Year 1 revenue is projected at $410,000 with an EBITDA of $38,000. Break-even is approximately $33,000 per month, equal to roughly 55 to 75 hookah sessions nightly across the week when combined with beverage and food sales. Higher-margin items such as mocktails, shisha, and charcoal help support stable contribution margins.

Competitive Position

EmberHouse differentiates itself through advanced air filtration, stricter safety controls, pod-based group seating, custom blends, and a focused non-alcoholic bar program. These features support consistent experiences and help expand average ticket value without adding operational complexity.

Management Strength

Operations are led by Aamir Qureshi, who brings six years of direct industry experience and a track record of developing signature mixes. Marketing and events are led by co-founder Lena Ortiz, who has run nightlife and hospitality promotion campaigns. The combined skill set covers operational control, brand building, event programming, and local customer acquisition.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you

Company Overview

Business Identity

EmberHouse Hookah Lounge, LLC is a Florida-registered limited liability company created to operate a late-evening hookah lounge with café-style seating, a non-alcoholic bar, and a light food program. The brand centers on a calm, atmospheric setting supported by clean ventilation, controlled service, and consistent product quality. The business is located at 3821 North Dale Mabry Highway, Suite 104, Tampa, in the Egypt Lake–Leto corridor.

Concept and Experience Thesis

The lounge is designed for groups and individuals who prefer a social environment without alcohol. The concept emphasizes comfort, controlled airflow, steady service timing, and a curated hookah experience. Features such as pod-style seating, signature in-house blends, quiet-zone sections, and a focused drink menu reinforce a predictable guest experience. The environment is meant to feel steady and safe rather than chaotic or club-like.

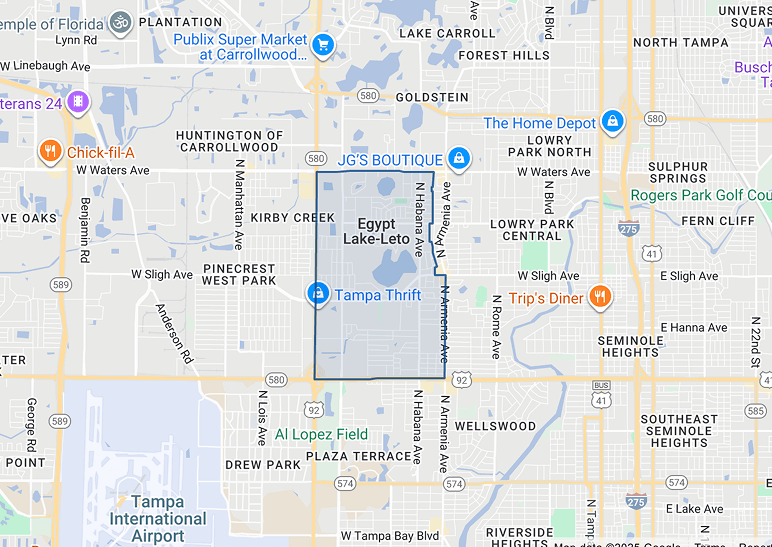

Location Rationale

The Egypt Lake–Leto area has strong evening activity from restaurants, bars, hospitality employers, and nearby residential clusters. This brings in a large number of vehicles per day, creating a steady flow of potential customers. The immediate neighborhood has a large Middle Eastern, South Asian, and African demographic with existing cultural familiarity with hookah. The presence of college students from USF and Hillsborough Community College adds another layer of demand, especially during exam seasons when late-evening social spaces become more active.

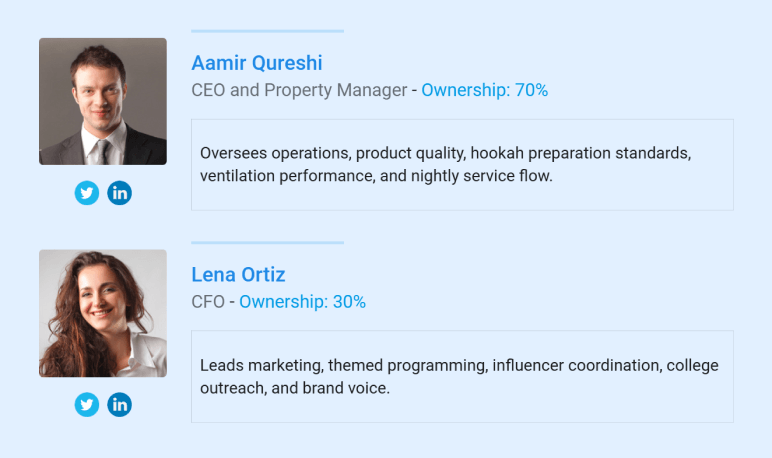

Ownership and Roles

The company is co-owned by:

Mission and Customer Focus

EmberHouse aims to provide a consistent, refined hookah experience supported by clean air, attentive service, and an atmosphere not reliant on alcohol sales. The target customers include ages 21 to 38, college students, service-industry workers, and cultural communities that value quality shisha, comfortable seating, and late-evening availability. Pricing, seating layout, and menu design are structured around the typical spending patterns and group behaviors of these groups.

Concept Reason

Hookah lounges require predictable air management, safety controls, coal-handling paths, and guest pacing. EmberHouse addresses these needs through an upgraded CaptiveAire ventilation system, controlled seating zones, strict ID checks, and clear shift assignments for attendants. These measures reduce typical operational risks and support an experience that appeals to customers who prefer a clean, organized setting over smoke-heavy or poorly ventilated venues.

Market Analysis

Local Market Context

Tampa’s broader hospitality and tourism economy has shown measurable strength in recent years, providing a favorable backdrop for experience-based concepts such as EmberHouse. In 2022, direct visitor spending in Hillsborough County reached $5.4 billion, a 21% increase over the prior year, driving total economic output to $8.5 billion in business sales, including lodging, food and beverage, and entertainment categories. Visitor activity sustained tens of thousands of jobs and generated significant state and local tax revenues.

In terms of regional economic momentum, Tampa Bay’s overall economy expanded noticeably post-pandemic. Federal data shows the broader Tampa Bay metro area’s gross domestic product rose by 4.3% from 2022 to 2023, situating the region among the fastest-growing large metropolitan economies in the United States.

These trends—tourism recovery, strong visitor spending on food and entertainment, and ongoing economic expansion—contribute to steady demand for late-evening social venues such as hookah lounges.

Target Customer

EmberHouse is built around well-defined customer groups already active in the area:

- Ages 21 to 38 — the primary demographic for hookah venues nationally and locally.

- College students from USF and Hillsborough Community College — consistent weeknight demand, especially during exam periods.

- Hospitality and service workers — a large local segment finishing evening shifts and seeking late-night social spaces.

- Middle Eastern, South Asian, and African communities — strong cultural familiarity with hookah and steady group visitation patterns.

- Non-alcohol social groups — customers who prefer relaxed, conversation-focused environments over bar-centric settings.

We noticed these segments help stabilize volume across weekdays and weekends, reducing reliance on high-peak nights.

Local Spending Behavior

North Dale Mabry Highway is one of Tampa’s primary north–south commercial corridors and carries substantial daily vehicle traffic. According to the Florida Department of Transportation’s average annual daily traffic counts, segments of Dale Mabry Highway in the surrounding area typically record approximately 19,000 to more than 22,000 vehicles per day, with higher volumes at major intersections along the corridor. This sustained traffic level provides consistent visibility and access for retail and hospitality businesses operating in the area.

Competitor Set

Direct competitors include:

- Zaza Hookah Lounge

- Cloud9 Hookah

- Sahara Nights Lounge

All three operate within a short driving radius and draw from similar demographic pools. Their models rely on standard ventilation, traditional seating formats, and typical flavor menus. Competitive pressure is consistent but does not outpace demand in the area. The market supports multiple lounges due to population density, cultural familiarity, and extended nighttime activity.

EmberHouse Differentiation

The lounge stands apart through:

- Advanced air-filtration systems that exceed the norm for local competitors.

- Reserved pod seating for groups who prefer privacy and longer stays.

- House-blended mixes that add variety beyond standard brand flavors.

- Full non-alcoholic bar offering mocktails, teas, and cold brew.

- Strict ID enforcement and a quiet-zone section to draw customers who prefer safe, controlled environments.

These features are directly relevant to target demographics that value comfort, consistency, and quality over chaotic or smoke-heavy venues.

Demand Stability Across the Week

| Period | Primary Drivers | Expected Behavior | Operational Impact |

|---|---|---|---|

| Weekdays (Mon–Thu) | College students, service workers, and cultural community regulars | Consistent moderate traffic; study groups and post-shift visits | Stable table turnover, predictable staffing levels |

| Weekends (Fri–Sat) | Nightlife spillover, group celebrations, corridor visitors | Highest peak traffic; longer stay times | Increased ventilation load, higher hookah and mocktail volume |

| Sundays | Students, local residents | Slower early hours, moderate late-evening demand | Ideal for student discounts and quiet-zone usage |

| Seasonal Peaks | University exam seasons, holidays, and winter months | Noticeable uplift in late-evening sessions | Higher demand for reserved pods and premium mixes |

Regulatory Environment Overview

Tampa’s hookah venues operate under tobacco retail permits, indoor smoking ventilation rules, and strict ID laws for age 21 and above. EmberHouse’s planned CaptiveAire system and dual ID checks directly address these requirements, reducing regulatory exposure compared to lounges with less stringent controls.

Stop searching the internet for industry & market data

Get AI to bring curated insights to your workspace

Business Offerings

Hookah Sessions and Pricing Structure

EmberHouse offers a structured hookah menu designed to match Tampa’s established spending patterns while maintaining clear differentiation. Pricing is organized by session type and add-ons:

| Session Type | Description | Price |

|---|---|---|

| Single Hose Standard | Standard bowl and one hose setup | $22 |

| Dual Hose | Two-hose setup for shared sessions | $28 |

| Premium Mixes (Fruit Base) | House or branded mixes served with a fruit base | $34 |

| Ice Hose Add-On | Ice-cooled hose enhancement | $4 |

| Head Change (Same Session) | Bowl replacement during the same session | $12 |

This range fits the city’s typical $19 to $32 per-person spend and supports stable table-level contribution margins.

Shisha Flavor Program

The lounge carries branded flavors from Starbuzz, Al Fakher, and Fumari. Alongside these, we develop our own house blends such as watermelon mint, peach frost, and citrus storm. Seasonal mixes like fall spice or summer mint fusion help maintain ongoing customer interest and support marketing efforts such as monthly signature blend drops. These offerings allow the menu to stay familiar but not generic, encouraging repeat visitation.

Non-Alcoholic Beverage Bar

EmberHouse operates a focused non-alcoholic bar featuring:

Our beverage lineup appeals to cultural communities, college students, and groups seeking a sober-friendly social space. Mocktails, chai, and cold brew carry strong margins, strengthening overall unit economics.

Light Food Menu

The food selection is intentionally simple to minimize prep demands while supporting longer stay times:

These items anchor the lounge’s position as a relaxed evening destination without requiring a full kitchen or high labor complexity.

Customer Experience Flow

The typical session follows a controlled process: Guests arrive at pod seating or assigned tables, select flavors with staff guidance, receive setup from trained hookah attendants, and order beverages or small food items. Staff monitor coal timing and bowl life, maintaining air quality through the CaptiveAire system. The setup supports consistent pacing during both weekday and weekend nights.

Why the Offer Structure Works

Our menu is designed to balance variety, labor control, and strong margins. Signature blends differentiate the lounge. Mocktails and fruit-based premium mixes add revenue without increasing operational complexity. Light plates extend the length of stay without requiring full kitchen production. Together, these elements support the financial model and help stabilize monthly revenue near the break-even threshold.

Operations Plan

Operating Hours and Service Rhythm

EmberHouse operates on a late-evening schedule designed to match the corridor’s foot traffic and the habits of students, service workers, and nightlife spillover. Hours are:

| Operating Days | Operating Hours |

|---|---|

| Monday to Thursday | 5:00 PM to 1:00 AM |

| Friday to Saturday | 5:00 PM to 2:30 AM |

| Sunday | 6:00 PM to midnight |

The rhythm of service follows a predictable pattern. Early evenings attract small groups and students, while late evenings draw larger parties and post-shift hospitality workers. On weekends, the lounge sees extended stay times and higher use of pod seating. Daily pacing is structured around two shifts, with a transition overlap to maintain coal quality, table resets, and continuous ventilation control.

Staffing Structure and Shift Logic

Staffing for Year 1 is built on a simple, repeatable model:

- General Manager — $48,000/year

- Three Hookah Attendants — $16.50/hour

- Two Servers — $15/hour plus tips

- Bar Lead (non-alcoholic bar) — $16/hour

- Security (weekends) — $22/hour

- Cleaner (contracted) — $600/month

- Bookkeeper — $200/month

Shift timing:

- Evening Shift: 4:30 PM to 11:00 PM

- Late Shift: 8:00 PM to close

The overlap ensures coal management, bowl timing, and guest handoff remain uninterrupted. Hookah attendants focus on bowl setup, coal cycling, and flavor accuracy. Servers and the bar lead handle beverages and food. Security is present during peak nights to enforce ID rules.

Compliance and Safety Systems

For an indoor hookah lounge, continuous compliance is a business-continuity requirement. EmberHouse treats permits and safety controls as daily operating inputs, not administrative tasks.

Regulatory and Permit Requirements

We will operate under Florida and local regulations governing tobacco retail, indoor smoking, and late-evening hospitality use.

The primary authorization is the Florida Retail Tobacco Products Dealer Permit, which allows the sale and on-site consumption of tobacco products, including shisha. This permit is required before opening, must be displayed on the premises, and is renewed annually. Management maintains a renewal calendar and inspection readiness file to ensure uninterrupted validity.

Additional required approvals include a local business tax receipt, sales and use tax registration, certificate of occupancy, and fire department inspection with specific review of coal handling and storage practices. Indoor smoking ventilation approval is secured based on the installed CaptiveAire system capacity and zoning. Where applicable, security camera requirements are met and maintained.

Permit documentation is stored on-site and digitally. Opening procedures include a compliance check to confirm all required postings and system readiness.

Age Verification and Enforcement Controls

Age enforcement is a primary regulatory risk for tobacco venues. EmberHouse applies layered controls to prevent underage access.

All guests are verified at entry with government-issued identification. During peak periods, weekend door security is dedicated to age enforcement rather than crowd control. Staff are trained on refusal protocols and escalation procedures. If needed, a secondary ID check is performed prior to hookah service. These controls reduce citation risk and support inspection outcomes.

Fire, Coal-Handling, and Ventilation Safety

Coal handling follows a defined workflow that separates prep, transport, service, and disposal. Coal staging areas are positioned to limit transit distance and reduce spill or burn risk. Fire extinguishers and heat-rated containers are placed at required locations and inspected on schedule.

Air quality and smoke load are managed through a high-capacity CaptiveAire ventilation system with zoned airflow aligned to seating pods and high-occupancy areas. The system operates continuously during service hours, with daily pre-open checks and scheduled quarterly maintenance. Logs are retained for inspection review.

Ongoing Compliance Monitoring

Compliance ownership sits with the General Manager under the oversight of the Operations Lead. Responsibilities include permit renewal tracking, inspection readiness, staff training refreshers, and incident documentation. Any regulatory notice or complaint triggers an immediate review and corrective action.

By integrating permits, age controls, fire safety, and ventilation into a single operating framework, EmberHouse reduces regulatory exposure and supports consistent, interruption-free operations. This approach addresses the highest-risk areas for indoor hookah lounges and aligns with lender expectations for controlled, compliant retail operations.

Facility Capacity

EmberHouse is designed to balance group social use with airflow control and staff efficiency. Seating is organized into defined zones rather than open floor sprawl.

| Capacity Element | Count |

|---|---|

| Group seating pods | 8 pods |

| Standard tables | 6 tables |

| Total seating units | 14 |

| Average seats per pod | 5–6 |

| Average seats per table | 3–4 |

| Estimated total seats | 68–72 seats |

Average Party Size and Session Behavior

Hookah usage patterns are predictable and materially different from quick-turn food service.

Average party size:

- Weekdays: 3–4 guests

- Weekends: 4–6 guests

Average session length:

- Weekdays: 75–90 minutes

- Weekends: 90–120 minutes

Note: Longer stays increase per-table revenue through add-ons without increasing customer acquisition cost.

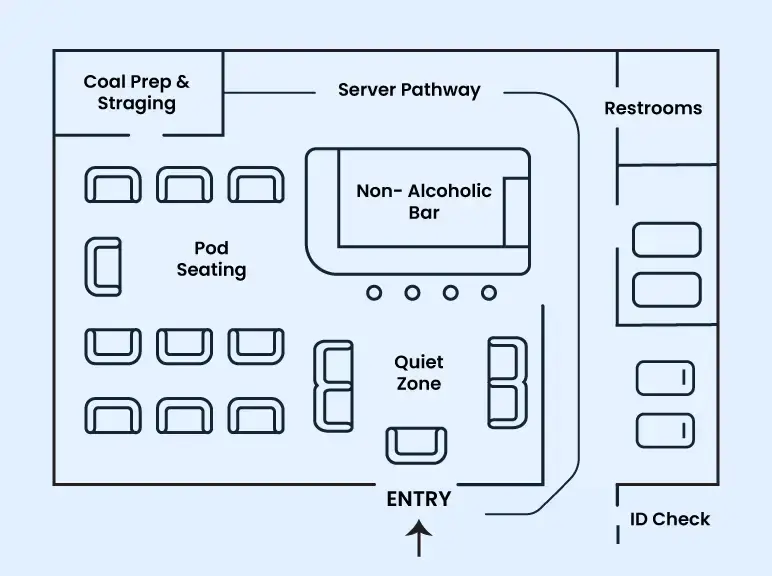

Facility Layout and Guest Flow

We’ve planned the lounge layout around comfort, airflow, and staff efficiency. Key elements include:

- Pod seating zones for groups, designed to control airflow and maintain privacy.

- Quiet-zone section positioned away from high-traffic areas for studying and relaxed conversations.

- Non-alcoholic bar counter accessible from both pod sections and standard tables.

- Coal prep and staging area located close to the attendants’ pathway to reduce transit time.

- Ventilation zoning aligned with high-capacity CaptiveAire airflow lines.

Guest flow begins at the entry checkpoint for ID verification, followed by seating assignment. Servers handle drink and food orders while attendants perform bowl setup and coal placement. Pathways between tables are kept wide enough to support safe movement during peak traffic hours.

Equipment and Vendor Network

We source core equipment from reputable suppliers to ensure consistent performance and easier maintenance:

- Hookahs from Khalil Mamoon and Amira

- Bowls from Alpaca and Mason

- Charcoal from Titanium Coconut Coals

- Ventilation from CaptiveAire’s high-capacity system

- Furniture from RestaurantFurniture.net custom lounge sets

- POS through Toast

- LED lighting and sound through Chauvet DJ

This vendor set reduces breakdown risk, supports predictable supply cycles, and helps maintain the quality of airflow, flavor, and ambiance.

Daily Controls

Daily controls include:

- Opening checks for ventilation, coal stations, bar prep, and seating setup

- Bowl and hose inspection

- End-of-night cleaning routines plus monthly deep cleans

- Inventory logs tracked in Toast and reviewed weekly by the General Manager

These controls reduce waste, prevent flavor inconsistencies, and stabilize margins.

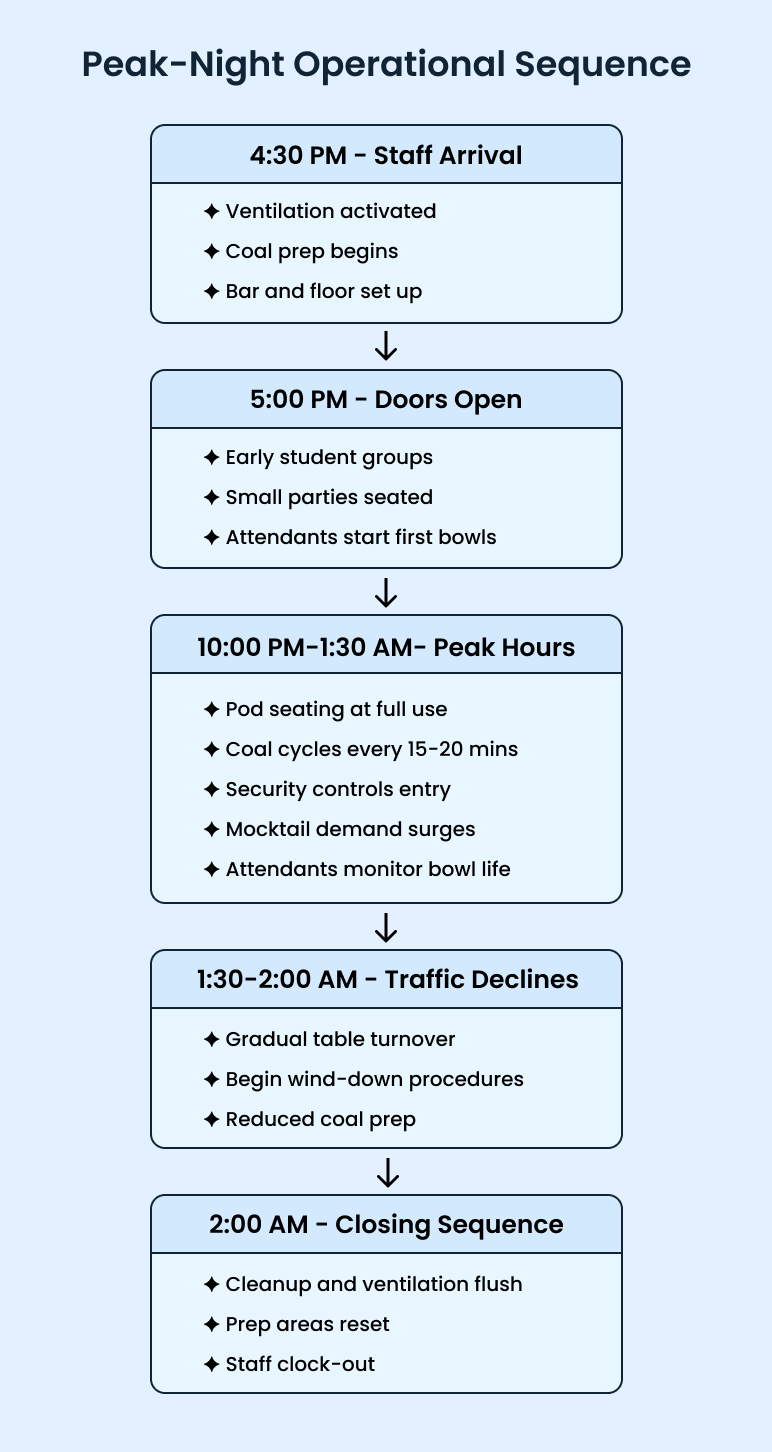

Example: Peak-Night Operational Sequence

Our typical Friday night sequence would look something like this:

This sequence shows the lounge’s controlled approach to airflow, service timing, and compliance during high-demand periods.

Does your plan sound generic and template-like

Refine your plan to adapt to investor/lender interests

Marketing and Sales Plan

Marketing Strategy

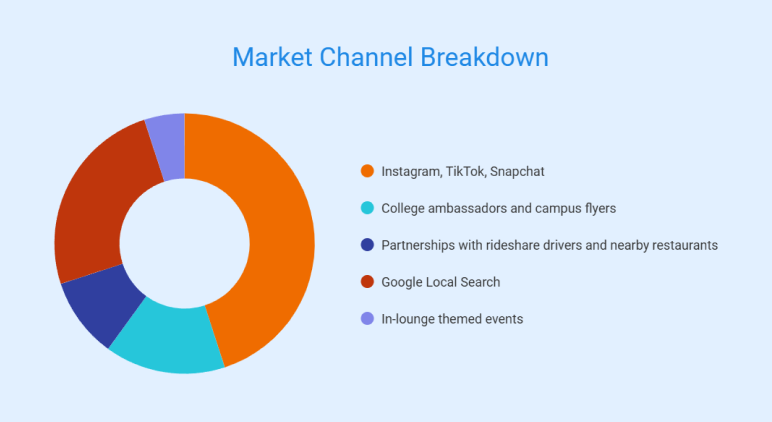

EmberHouse uses a channel mix calibrated for a nightlife-oriented, youth-driven customer base.

- Instagram, TikTok, Snapchat – 45%

Short-form content drives awareness, aesthetic appeal, and flavor or event announcements. These platforms align with the visual nature of hookah culture and the 21 to 38 age segment.

- Google Local Search – 25%

Customers searching for “hookah near me” or late-night lounges tend to convert quickly. Maintaining updated hours, reviews, and menu items supports steady discovery.

- College ambassadors and campus flyers – 15%

USF and Hillsborough Community College provide consistent weekday volume. Student ambassadors help promote weeknight specials and study-friendly seating areas.

- Partnerships with rideshare drivers and nearby restaurants – 10%

Drivers refer nightlife traffic, while nearby restaurants can send overflow customers or late-hour diners seeking a secondary spot.

- In-lounge themed events – 5%

Weekly themes help build repeat patterns and reinforce brand identity.

This mix suits the local corridor where late-evening entertainment is clustered, and digital discovery heavily influences foot traffic.

Customer Acquisition Tactics

The acquisition plan uses predictable hooks that appeal to both cultural communities and student audiences:

- Weekly themed nights tied to house blends or music styles

- Student discounts from Sunday to Wednesday

- A monthly “signature blend” drop to stimulate repeat visits

- A points-based rewards program executed through Toast

- Social contests promoting pod reservations

Launch Promotions

EmberHouse’s opening strategy is designed to create immediate visibility and fast trial volume:

- Buy-one-get-half-off a second hookah during opening week

- Free fruit-based upgrade for the first two hundred customers

- Social contest awarding a private pod for a group night

These promotions focus on high-demand items and group behaviors typical of hookah lounges, maximizing word-of-mouth momentum during the first month.

Ad Budget and Digital Spend

The first quarter allocates $1,600/month for paid digital campaigns. CPC ranges between 70¢ and $1.20 for nightlife keywords in Tampa. Ads target radius-based audiences around North Dale Mabry and key student zones.

Spend is distributed across Google local-intent searches and social retargeting, matching the corridor’s mobile-first decision behavior.

Sales Drivers

Sales rely on:

- Predictable hookah session volume across weekdays

- Higher weekend pod occupancy

- Beverage upsells, especially mocktails and tea

- Add-ons such as ice hoses, upgraded bowls, and fruit-based options

The model’s strength comes from its high-margin items and steady per-table spending. We don’t rely on alcohol sales, which simplifies compliance and reduces volatility.

Management & Organization

Ownership Structure

EmberHouse Hookah Lounge, LLC is owned by Aamir Qureshi and Lena Ortiz. Aamir holds 70% of the company and leads all operational areas. Lena holds 30% and oversees marketing and event programming. The structure reflects the depth of each founder’s involvement and the distinct responsibilities they carry within the business.

Founder Roles and Experience

Aamir Qureshi brings 6 years of direct hookah lounge management experience in Tampa. His background spans staff supervision, nightly service pacing, bowl preparation standards, coal-handling routines, and ventilation oversight. He also created three signature blends that became favored by regular customers in his previous role. His operational capability forms the foundation for EmberHouse’s quality control and service predictability.

Lena Ortiz manages marketing and customer engagement. She has worked on nightlife promotions and hospitality campaigns, giving her experience with influencer coordination, digital content planning, and event-driven foot traffic. Her approach aligns with the lounge’s target demographic, especially students, groups, and young professionals who respond well to social content and weekly themes. She also manages campus outreach and partnerships with rideshare drivers and nearby restaurants.

Management Approach

The founders operate EmberHouse through a clear division of responsibilities. Aamir focuses on internal systems, such as ventilation checks, inventory controls, staffing routines, and nightly guest flow. Lena develops and executes the marketing calendar, manages social channels, and coordinates themed nights that support consistent mid-week activity. This division ensures that both operational reliability and demand generation receive equal attention.

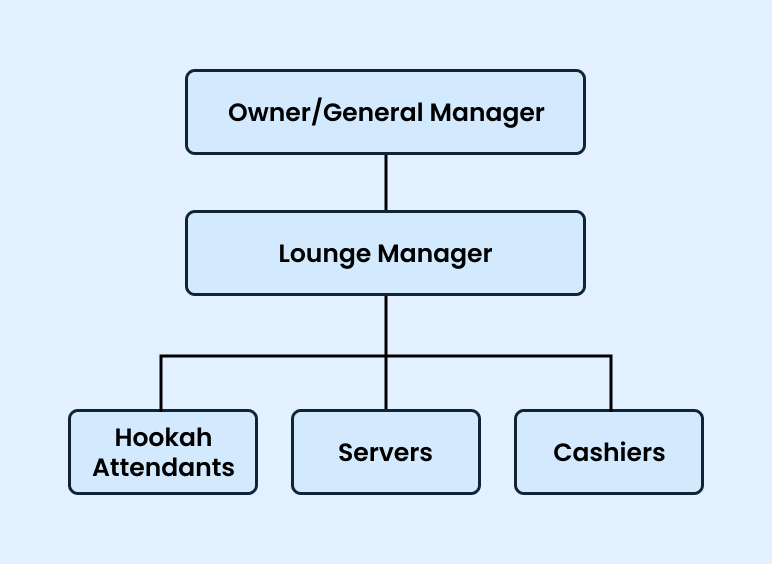

A General Manager works directly under Aamir and oversees nightly execution, staff scheduling, coal-staging routines, and customer service. Hookah attendants, servers, the bar lead, and weekend security report through the General Manager, keeping all on-floor communication centralized. The cleaner and bookkeeper serve as scheduled contractors and maintain operational continuity without adding unnecessary labor overhead.

Staffing Hierarchy

The Year 1 staffing structure is straightforward:

The management system is simple enough for fast nights yet structured enough to support lender expectations. Aamir’s operational discipline pairs well with Lena’s ability to drive visibility and foot traffic. The General Manager acts as the stabilizing layer between them and the staff, reducing the risk of bottlenecks during peak hours. This balanced structure supports consistent service, predictable training standards, and an organized nightly workflow.

Don’t spend weeks on your first draft

Complete your business plan in less than an hour

Financial Plan

Historical Financial Summary

We’re a new venture with no past revenue or expenses. The only historical financial inputs are the founders’ $55,000 in personal savings allocated toward startup costs. No pre-existing debt or liabilities carry into the business.

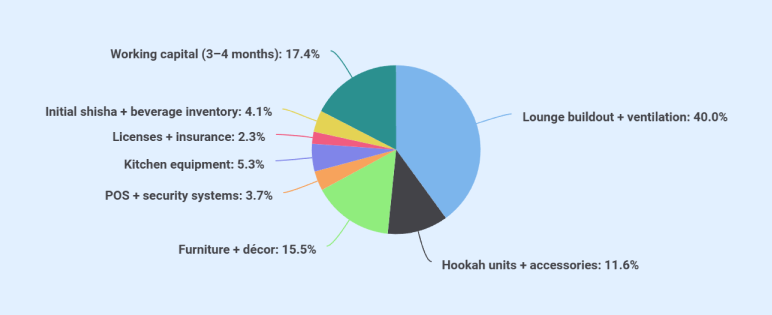

Purchase Overview

Startup investment equals $155,000.

Startup Cost Table

| Category | Cost |

|---|---|

| Lounge buildout + ventilation | 62,000 |

| Hookah units + accessories | 18,000 |

| Furniture + décor | 24,000 |

| POS + security systems | 5,800 |

| Kitchen equipment | 8,200 |

| Licenses + insurance | 3,600 |

| Initial shisha + beverage inventory | 6,400 |

| Working capital (3–4 months) | 27,000 |

| Total Required Investment | 155,000 |

Funded by a 185,000 PNC commercial loan (7 years, 10.1% fixed) + $55,000 owner equity, giving the business buffer capital for contingencies.

(Note: Collateral includes all equipment, furnishings, POS, ventilation systems, and owner guarantees.)

Important Assumptions

These assumptions are used consistently across forecasts:

- COGS averages 26% of revenue (shisha ~18%, drinks ~20–28%, food ~32%).

- Operating expenses increase by 5% annually.

- Depreciation occurs on a straight 5-year schedule for equipment and furnishings.

- Loan: 185,000 at 10.1% fixed, 7-year amortization.

- Sales tax handled outside projections (not part of P&L).

- Opening month is Year 1, Month 1 for financial modeling simplicity.

- No alcohol sales, so compliance costs remain controlled.

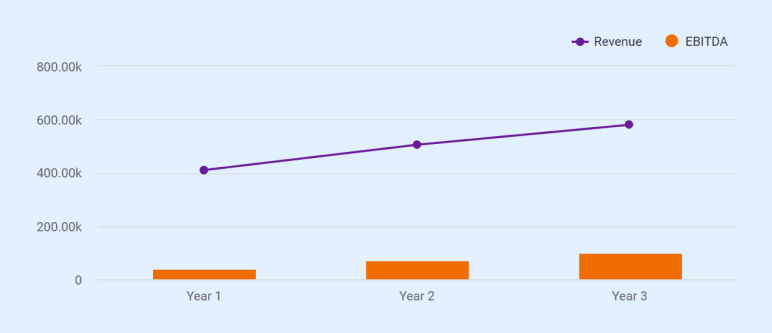

Revenue Forecasts (3 Years)

| Year | Revenue | EBITDA |

|---|---|---|

| Year 1 | 410,000 | 38,000 |

| Year 2 | 505,000 | 72,000 |

| Year 3 | 580,000 | 98,000 |

Monthly Projections (Year 1)

| Month | Revenue | COGS (26%) | Gross Profit | Operating Expenses | EBITDA |

|---|---|---|---|---|---|

| Jan | 31,500 | 8,190 | 23,310 | 21,200 | 2,110 |

| Feb | 31,500 | 8,190 | 23,310 | 20,800 | 2,510 |

| Mar | 33,000 | 8,580 | 24,420 | 20,600 | 3,820 |

| Apr | 33,000 | 8,580 | 24,420 | 20,400 | 4,020 |

| May | 34,000 | 8,840 | 25,160 | 20,300 | 4,860 |

| Jun | 33,500 | 8,710 | 24,790 | 19,800 | 4,990 |

| Jul | 33,500 | 8,710 | 24,790 | 19,600 | 5,190 |

| Aug | 34,500 | 8,970 | 25,530 | 19,700 | 5,830 |

| Sep | 35,000 | 9,100 | 25,900 | 20,500 | 5,400 |

| Oct | 35,500 | 9,230 | 26,270 | 20,900 | 5,370 |

| Nov | 36,000 | 9,360 | 26,640 | 21,200 | 5,440 |

| Dec | 39,000 | 10,140 | 28,860 | 24,200 | 4,660 |

| Total | 410,000 | 106,600 | 303,400 | 249,400 | 38,000 |

Projected Profit & Loss Statement (3 Years)

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | 410,000 | 505,000 | 580,000 |

| COGS (26 percent) | 106,600 | 131,300 | 150,800 |

| Gross Profit | 303,400 | 373,700 | 429,200 |

| Operating Expenses | 249,400 | 281,000 | 313,000 |

| EBITDA | 38,000 | 72,000 | 98,000 |

| Depreciation | 16,000 | 16,000 | 16,000 |

| Operating Income | 22,000 | 56,000 | 82,000 |

| Interest Expense | 16,900 | 14,200 | 11,000 |

| Pre-Tax Income | 5,100 | 41,800 | 71,000 |

| Income Tax (21 percent) | 1,071 | 8,778 | 14,910 |

| Net Profit | 4,029 | 33,022 | 56,090 |

The first year’s thin net margin is typical for lounges with ventilation-heavy startup costs.

Projected Balance Sheets (3 Years)

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Cash | 18,000 | 41,000 | 78,000 |

| Inventory | 6,000 | 6,500 | 7,000 |

| Equipment & Furnishings (Net) | 64,000 | 48,000 | 32,000 |

| Other Assets | 3,000 | 3,000 | 3,000 |

| Total Assets | 91,000 | 98,500 | 120,000 |

| Loan Balance | 157,000 | 128,000 | 96,000 |

| Accounts Payable | 6,000 | 6,500 | 7,000 |

| Owner Equity | 55,000 | 55,000 | 55,000 |

| Retained Earnings | -127,000 (startup capitalization effect) | -90,000 | -38,000 |

| Total Liabilities & Equity | 91,000 | 98,500 | 120,000 |

Note: Year 1 retained earnings reflect heavy initial investment; normal for startups.

Projected Cash Flow (3 Years)

| Cash Flow Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Net Income | 4,029 | 33,022 | 56,090 |

| Add Back: Depreciation (non-cash) | 16,000 | 16,000 | 16,000 |

| Operating Cash Flow (Before WC) | 20,029 | 49,022 | 72,090 |

| Change in Working Capital | -6,500 | -4,000 | -3,000 |

| Net Cash from Operations | 13,529 | 45,022 | 69,090 |

| Loan Principal Paid | -28,000 | -29,000 | -32,000 |

Break-Even Analysis

Break-even revenue: ~$33,000/month

Break-even units: 55–75 nightly sessions across the week

Drivers:

- High-margin shisha

- Mocktails and tea

- Premium fruit-based mixes

- Predictable late-night traffic

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.