Are you planning to open your own hotel?

Great! It’s an exciting venture filled with endless opportunities in the world of hospitality!

But before you start, it’s crucial to manage your finances carefully and understand the fundamental aspects of your hotel’s financial performance and long-term success. So, you’ll need to have a solid financial plan in place!

Well, if you feel like you need help writing one, you’re at the right place. This sample hotel financial plan will help you get started.

Key Takeaways

- The income statement, balance sheet, cash flow projection, and break-even analysis are the primary elements of a financial plan.

- Enhance the accuracy of your plan by exploring the methods of test assumptions and scenario analysis.

- Make reliable financial projections with thorough industry research, clear market understanding, and realistic assumptions.

- Be practical and conservative about your revenue forecasts and cash flows to grab investors’ attention.

- Preparing a hotel financial plan is much easier and faster when you use financial planning software.

Hotel Financial Outlook

Before jumping right into financial planning, let’s take a moment to explore the financial state of the hotel industry.

The hotel industry has been experiencing steady growth with the increasing travel demand, technological advancements, and evolving guest expectations.

Here are some key highlights from the industry:

- The global market size of the hotel and resort industry reached a whopping value of $1.06 trillion in 2023, with 1,842 hotels opened worldwide.

- There were a total of 1,842 new hotel openings worldwide. And it is expected to increase to 2,707 in 2024.

- In the United States, the market size of the hotel and motel sector was valued at approximately $225 billion, while the hotel room revenue reached $189.07 billion.

- New York City has the highest hotel rates in the United States, with an average price of $504, while Miami has $198.

So, it’s undoubtedly a rewarding market for anyone who wants to open a new hotel, but owners must stay innovative and customer-focused to thrive in this competitive landscape.

Now, without further ado; let’s understand how to draft a winning financial plan.

How to Create a Hotel Financial Plan

1. Calculate Business Startup Costs

Once you’ve decided to start your hotel business, it’s very crucial to have a clear understanding of your finances, right? So, you’ll need to calculate the hotel startup costs very first!

You may start by identifying all the initial expenses associated with your hotel venture. It includes property acquisition or lease, renovations, furniture, fixtures, equipment, insurance & licensing fees, marketing, staffing, and operating expenses

You can also research local market conditions and industry benchmarks to evaluate the typical costs of opening a new hotel. This will help you get accurate estimates.

Try to be clear and comprise every potential cost, no matter how small it is. You can make a specific list of all the expenses, as shown in the below table:

| Expense Category | Average costs |

|---|---|

| Property Acquisition or Lease | $500,000 to $5,000,000 |

| Renovations or Construction | $100,000 to $1,000,000 |

| Furniture, Fixtures, and Equipment | $50,000 to $100,000 |

| Insurance Fees | $10,000 to $100,000 |

| Staffing and Training | $50,000 to $100,000 |

| Marketing and Advertising | $25,000 to $50,000 |

| Licensing and Permits | $10,000 to $30,000 |

So, having a fair idea of startup costs will help you create a proper budget and determine the necessary capital to launch your business successfully.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $14/month

2. Determine Financing Requirements & Strategy

Sometimes, people don’t have enough money to start their own business. So, they might need to ask for help from others to get the initial investment.

For your hotel business, you’ll need to evaluate the current monetary position and determine how much startup capital you’ll require to fund your business. Also, assess various financing options and develop a clear strategy to secure funding.

Here are a few funding options you may consider:

- Traditional bank loans

- Partnerships

- Crowdfunding campaigns

- Private investors or venture capitalists

- Small Business Administration (SBA) loans

For each above option, you must evaluate the interest rates, repayment terms, and potential equity dilution. This will let you devise a financing strategy that aligns with your investment goals and risk tolerance.

Then, you can decide which funding option is the most appropriate for your hotel venture.

Furthermore, while seeking credit from banks or investors, you’ll need a professional document that projects how your hotel’s financial modeling works. It will assist potential lenders to have a better idea of your business.

3. Understand Your Business Model

Developing a scalable business model is a crucial aspect of a financial plan. This is something you have to decide before you start running your business.

It is a strategic framework that defines how you generate income, manage expenses, and reach your financial objectives.

Here is a list of different types of business models you may consider:

- Full-service hotels

- Limited-service hotels

- Boutique hotels

- Luxurious amenities

- Resorts

While deciding on any of the above models, you have to understand their financial considerations, including rental potential, initial investment, market demand, operating expenses, and risk management.

This will help you make well-informed decisions and achieve your financial goals in the long run.

4. Identify Revenue Streams

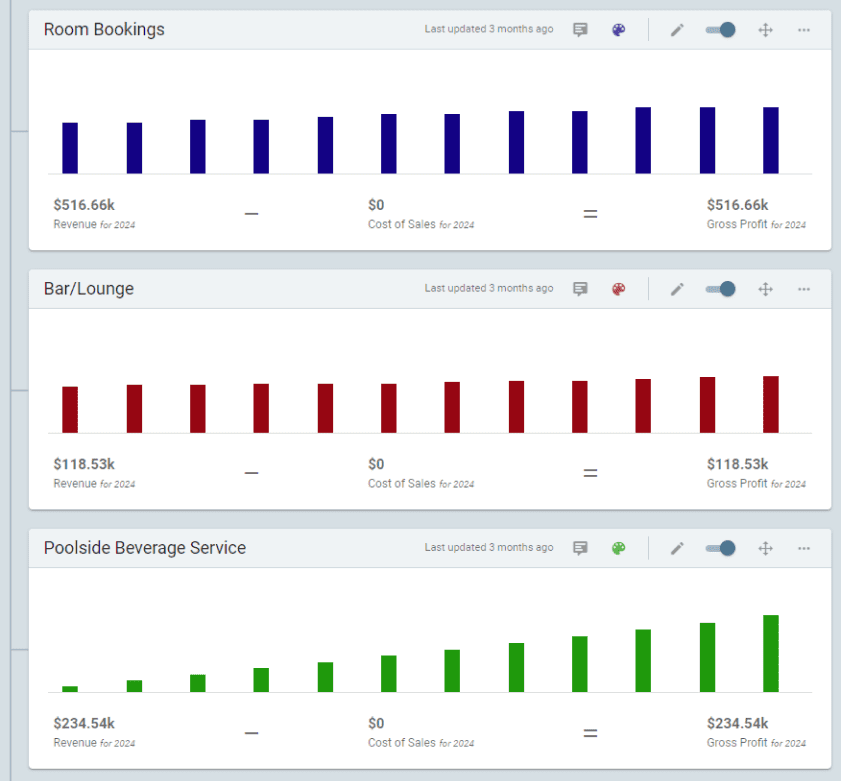

Identifying your business revenue streams is an essential part of maximizing profitability. So, try to diversify your income sources beyond room bookings revenue.

It will help potential investors or lenders determine how much revenue your business intends to generate over the next few years.

For instance, you may include the following revenue streams in your hotel financial projections:

- Food and beverage sales

- Event hosting

- Spa services

- Recreational activities

- Laundry, parking, & transportation services

Doing so will help you maximize its income potential, better meet client needs, and ensure fostering guest loyalty.

Well, using Upmetrics could be a great help here. It will not just calculate financial projections but also help you identify relevant revenue streams.

For better understanding, you may consider the following example prepared using Upmetrics:

Furthermore, it allows you to make informed decisions about your revenue by using different ways to forecast income streams, such as unit sales, the charge per service, recurring/hourly charges, or fixed amounts.

So, this can be an effective and accurate way of estimating your income potential.

5. Market Analysis and Pre-Assumptions

A successful business requires a comprehensive market analysis to gain valuable insights into the local business landscape.

While writing a hotel business plan, you’ve already conducted thorough market research and got a better idea of hotel trends, competitor offerings, guest demographics, and pricing dynamics.

So, it’s time to use that knowledge to prepare a financial forecast and make realistic assumptions about room rates, market demand, occupancy levels, guest preferences, and operating expenses.

Here are a few key components that you should include in your plan:

Pricing Strategy

When it comes to devising a pricing strategy, there’s no bound law. Yet, you’ll need to analyze a few factors, such as your hotel services, guest preferences, regional market conditions, seasonality, and competitor pricing strategies, to establish optimal pricing.

You may conduct a competitive market analysis to comprehend the prevailing market prices and set competitive yet profitable room rates and pricing for ancillary services.

Remember, your prices should reflect the value of your hotel’s offerings and still help you generate sufficient returns on your investment.

Sales Forecast

A sales forecast is a primary element of any business, serving as the cornerstone for its profitability and growth.

It helps you estimate the future sales volume of your hotel based on historical data, market trends, anticipated demand, and marketing strategies.

You can also analyze a few factors, such as occupancy rates, average daily rate, and revenue per available room (RevPAR) to predict hotel room revenue.

Furthermore, try to forecast incomes from food & beverage sales, event hosting, and other revenue streams.

Business Expenses

Generally, business expenses are operating costs or day-to-day expenses that will keep your business running smoothly.

For your hotel’s operating expenses, you may conduct a detailed analysis of fixed costs (e.g., rent, insurance) and variable costs (e.g., payroll, utilities).

Additionally, you may consider a few factors, like market trends, inflation rates, and industry benchmarks that will guide your expense projections and confirm they are accurate and realistic.

Here, you should note one thing—you must account for probable cost overruns or unexpected expenses during business operations. So, be conservative in your financial projections.

6. Make Financial Projections

If you want to attract investors, let the numbers do the talking. This is so because potential investors or stakeholders will look at the financial reports once and decide whether or not to invest in your business.

So, ensure that the key financial reports give a clear picture of the financial feasibility and profitability of your hotel business.

Here’s a list of several financial statements and analyzes you should incorporate into your projections:

Cash flow statement

A cash flow statement helps you track the cash flow in and out of your business over a specific timeframe, generally monthly, quarterly, or annually.

It provides a detailed explanation of how much cash your hotel brings in, pays out, and ends with the cash balance. Typically, it’s an illustration of how well your hotel is generating cash.

You may take into account the cash flows related to room bookings, food and beverage sales, renovations, property acquisitions & management, loan repayments, borrowing, and investments.

Be realistic about your financial assumptions and measure your business’s liquidity, capability to meet financial obligations, and sufficiency of cash flow to fund future investments and expense outlays.

Balance sheet

A balance sheet provides a quick overview of your business’s financial position at a specific time.

It clearly demonstrates what you own, what you owe to vendors or other debtors, and what’s left over for you. After all, it has three main elements:

- Assets: Cash, property, equipment, and accounts receivable

- Liabilities: Debts, loan repayments, and accounts payable

- Equity: Owners’ equity & other investments, stock proceeds, and retained earnings

Ideally, it is formulated as, assets = liabilities + equity

By looking at your balance sheet, anyone can get the exact idea of how financially stable your business is, how much cash you hold, and where your money is tied up.

Income statement

The income statement is also known as a profit and loss statement(P&L), explaining how your business made a profit or incurred a loss over a specific period, typically monthly, quarterly, or annually.

Depending on the structure and type of your business, consider adding these factors—revenue or sales, operating expenses, and gross margin to your profit and loss statement.

You may calculate the gross margin by subtracting the cost of sales or COGS from revenue. It enables you to determine your business’s efficiency in utilizing resources.

Further, the P&L statement should also include operating income, which is equivalent to EBITDA. And the net income is the ultimate goal of any business, found at the end by deducting the operational expenses from EBITDA.

Overall, the income statement helps you gauge your business’s profitability, financial performance, and feasibility in the long run.

Break-even Analysis

The break-even analysis allows you to determine the point at which your business’s total revenue matches its total expenses, causing no profit or loss.

It helps you evaluate the minimum level of sales volume or revenue needed to cover your hotel’s fixed and variable costs.

This analysis provides valuable insights into your financial sustainability and helps you set sales targets, pricing strategies, and cost-control criteria.

What is the average break-even period for a hotel?

Typically, the average break-even period for a hotel can vary widely based on a few factors, such as location, market conditions, competitive positioning, guest preferences, room bookings, seasonal fluctuations, and operational efficiency. However, the hotel may take approximately 2 to 5 years to reach the break-even point and achieve profitability sooner.

7. Test Assumptions and Scenario Analysis

As your entire plan is prepared based on assumptions, you’ll need to regularly review and stress-test your financial projections to check their relevance with market realities and business performance.

In this stage, you may consider various “what-if” situations and think about scenarios where things go well or don’t.

For instance, you’ll need to consider the changes in booking rates, occupancy rates, average daily rates, and economic downturns to measure the stability of your hotel financial plan.

By performing test assumptions and sensitivity analysis, you can adjust your strategies accordingly to mitigate risks, optimize returns, and make well-informed business decisions.

8. Monitor and Update Your Plan

Once your plan is ready, continuously evaluate and monitor your hotel’s financial performance closely against the financial projections and key performance indicators(KPIs).

You can compare the actual financial results with the projected income streams, expenses, and ROI to take note of any variances or deviations from the plan.

If some factors are remarkably different from projections, recognize the causes behind them. This will help you understand which areas need improvement and which works as anticipated.

Also, review and update your strategies accordingly to optimize financial results and achieve long-term success.

Now that you know how to draft a detailed hotel financial plan, it’s time to explore an example for easy understanding.

Hotel Financial Plan Example

Building a hotel financial plan from scratch can be overwhelming, right? But not to worry; we’re here to help you with a realistic financial plan example prepared using Upmetrics.

It includes all the key elements of the hotel’s financial projection, including the income statement, balance sheet, cash flow statement, and break-even point. This will streamline the entire planning process and help you get started.

Start Preparing Your Hotel Financial Plan

And that’s a wrap. We’ve discussed all the fundamental aspects of financial planning. Now, it’s time to put that knowledge into action.

But still, feeling swamped by the thought of crafting a financial plan? Don’t worry; Upmetrics’ AI financial forecasting tool can be your savior here!

It will help you create accurate financial projections and make your financial planning process a breeze. You’ll just have to input your key assumptions and let it figure out the rest!

So, what are you waiting for? Start planning now with Upmetrics!

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.