Financial planning is essential for any business to grow, thrive, and succeed.

Whether it’s a new opportunity or an impending threat—planning for different hypothetical situations strategically and financially creates a safety net that safeguards your business from hitting failure.

Well, pro forma statements, with their forward-looking nature, help you evaluate your future finances and strategize for business accordingly.

But what is it really?

In this blog post, we will learn everything about pro forma business plan statements and steps to create.

Ready to dive in? Let’s get started.

What are pro forma financial statements?

Pro forma statements are projected financial statements that predict the future financial position of a business based on current trends and assumptions. These statements offer a snapshot of financials under different scenarios, helping companies plan efficiently.

A pro forma statement serves as a financial blueprint allowing businesses to set realistic goals, anticipate risks, assess outcomes, and track their goals. When included in a business plan, these statements typically include the income statement, balance sheet, and cash flow statement.

Why integrate pro forma statements into your business plan?

Although pro forma isn’t calculated using generally accepted accounting principles, these statements offer significant value while making important strategic decisions.

That said, let’s check out more benefits of adding statements of pro forma projections to your business plan:

- Pro forma statements help secure funding from investors by offering them an insight into your expected profitability, growth rate, ROI, and the overall financial health of your company.

- A pro forma statement aids in strategic decision-making by helping you evaluate the financial impact of different situations. For instance, the impact of launching a new product or expanding into a foreign market.

- Pro forma statements nudge you to make timely adjustments to your business strategies by helping you set and track your financial metrics.

- A pro forma statement helps you prepare for different situations by identifying potential challenges and prompting you to develop efficient strategies.

Types of pro forma statements

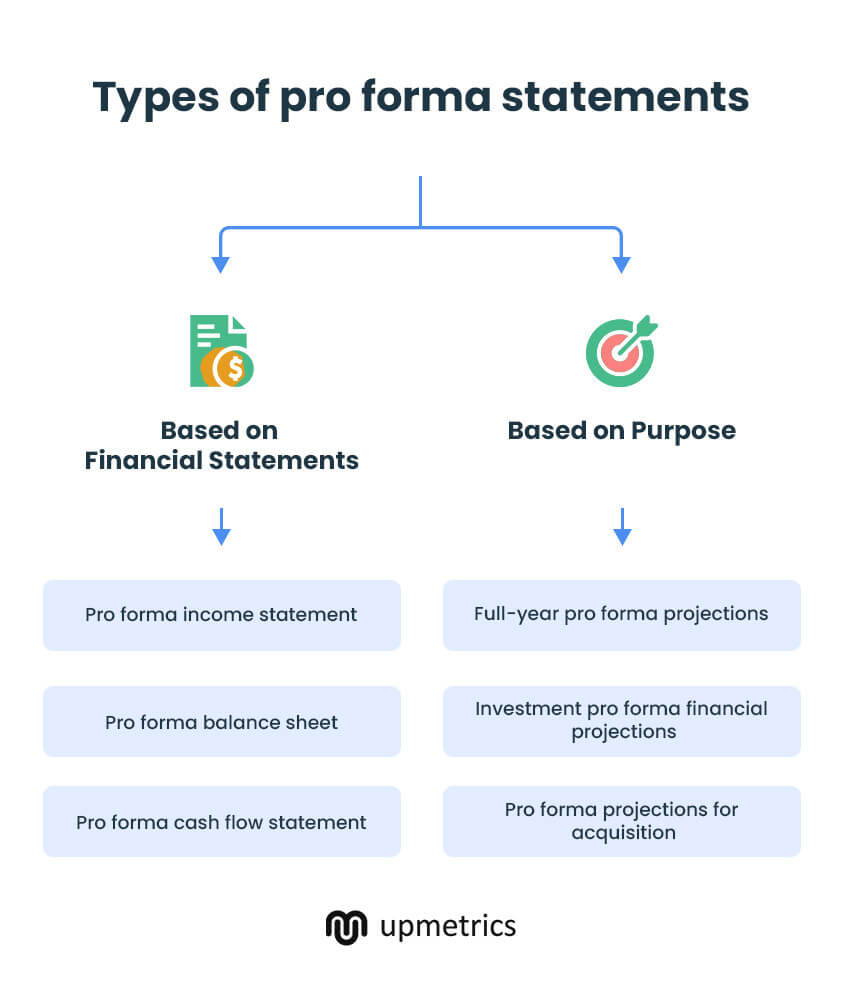

Let’s now understand the type of pro forma statements to include in your business plan.

1. Pro forma statements based on financial statements

A pro forma includes three financial statements—pro forma income statement, pro forma balance sheet, and pro forma cash flow statement.

Let’s understand these three types in detail.

Pro forma income statement

The most important aspect of financial planning and management is projecting the sales, revenue, costs, and expenses of a business in the future.

Pro Forma income statements do exactly that. They offer insight into expected revenue and expenses and help you assess a business’s profits and retained earnings in a specific financial period.

Pro forma income statements are often used to evaluate the financial viability of launching new products, business expansion, mergers, acquisitions, and other strategic decisions. These statements help you assess what a business income would look like in certain situations.

Pro forma balance sheet

Pro forma balance sheets are similar to actual balance sheets in terms of formatting. However, certain or all the values in such balance sheets are projected based on certain events such as loans, acquisitions, or mergers.

You can use these balance sheets to assess the financial health of your company at a certain stipulated time in the future. It offers an expected value of assets, liabilities, and equity under different situations, thereby, helping you make informed choices.

Moreover, you can use a pro forma balance sheet to evaluate the impact of a specific loan, acquisition, merger, or financing round on a business’s financials by offering you an overall understanding of making such decisions.

Pro forma cash flow statement

Pro forma cash flow statements illustrate the cash inflow and outflow over a period. It is used to assess the financial health of your company and to ensure that the business never runs out of cash.

Pro forma cash flow projections can be for short-term, mid-term, and long-term. It is often used to evaluate if the company will have enough cash to make significant purchases and investments and to maintain day-to-day operations.

2. Pro forma Statements based on purpose

While an income statement, cash flow statement, and a balance sheet remain quintessential parts of pro forma projections, there are different types of pro forma statements based on distinct purposes.

Full-year pro forma projections

Full-year pro forma statements take into account the financials for the fiscal year till the present time and then add projected outcomes for the remaining year. This will help you illustrate the company’s financial position by the end of the year.

Such statements offer investors a comprehensive overview of the business and its expected performance.

Investment pro forma financial projections

An investment pro forma statement shows how securing a loan and making their interest payout will affect the business’s financial position in the future.

Such financial pro formas are required when you want to convince your business partners about the value of potential financing.

Pro forma projections for acquisition

Such pro forma projections merge the past financial statements of your business and the business you want to acquire to show how the financials would have looked in case of a merger. It helps you decide on acquisition and merger opportunities.

Projections for risk analysis

While preparing your startup financial plan, you need to account for various progressive and aggressive situations that may affect your company’s financial health.

These pro forma statements consider various best-case and worst-case scenarios to evaluate the company’s future financial performance in different situations. It helps you plan for risks and equips you to face them strategically.

Now that you’re aware of the different types of pro forma statements, let’s understand the process of creating pro forma statements useful for your business.

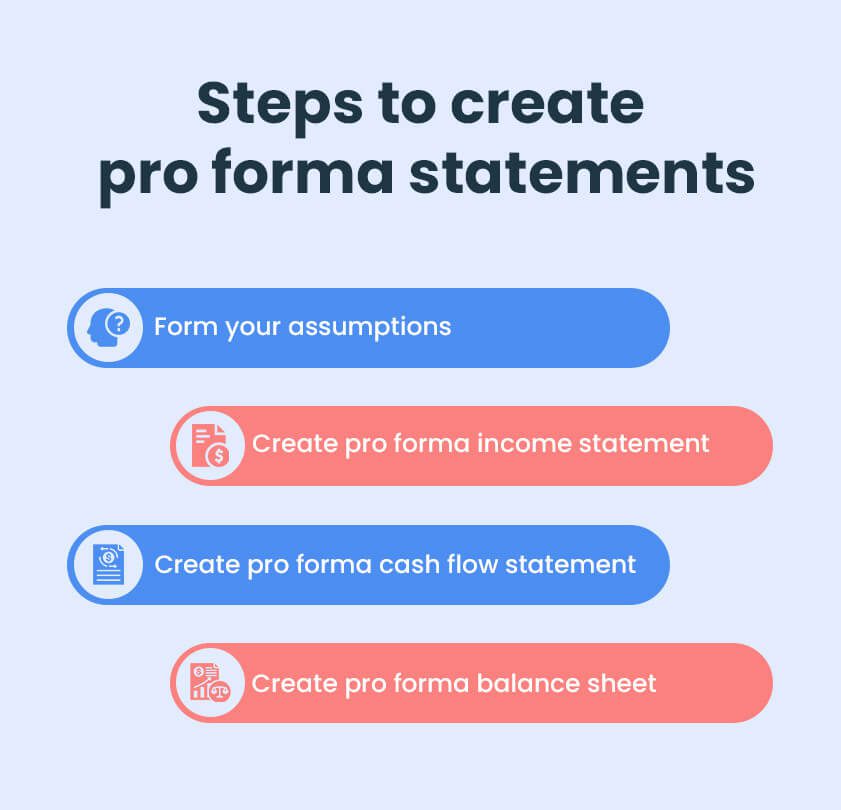

How to create pro forma statements for your business plan

Here’s a quick step-by-step guide to creating your pro forma financial statements.

1. Form your assumptions

To create your comprehensive pro forma statements, you first need to form realistic assumptions for different business components. This includes projecting your sales, expenses, revenue, and capital expenditure for different scenarios.

You should also consider the funding you will require and the investments you would make under different business circumstances.

Ensure that you carry out extensive research and study the historical data to form realistic projections. These projections will form the basis for your income statement, balance sheet, and cash flow forecast.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Create a pro forma income statement

A pro forma income statement offers an estimate of a company’s financial performance in the future. To get an insight into your expected revenue, expenses, and net profit, create your projected income statement as follows:

- Calculate your COGS (cost of goods sold) and subtract it from your revenue projections to determine your gross profit.

- Estimate your operating expenses. Take everything from rent to salaries into account and then calculate your operating income.

- Also, calculate your other income and expenses and make necessary adjustments to get your net pro forma profit.

Now, place these together in your P&L format and add them to your business plan.

3. Create a pro forma cash flow statement

Next, prepare a pro forma cash flow statement. It’s similar to preparing your actual cash flow forecast. However, here you take the values from your pro forma income statement to plot the cash inflow and outflow.

Be it a new investment, purchase of an asset, repayment of debt, or your operating activities—plot every activity that involves money.

The calculations will either give you a negative or a positive cash flow. To clarify, a negative cash flow indicates a scarcity of money and a positive cash flow indicates extra money at hand to make new purchases or investments.

Now, add your pro forma CFS to the business plan and use it to assess the future cash position of your business.

4. Create a Pro forma balance sheet

A pro forma balance sheet will offer a financial snapshot of your business at a certain point in time in the future. To prepare your pro forma balance sheet:

- List down your current and long-term assets, and calculate your total assets.

- Make note of your liabilities, both short-term and long term to calculate your total liabilities.

- Add your equities, liquidity, and retained earnings from an income statement to your balance sheet.

- Ensure that the liabilities are equal to your assets and add them to your business plan.

Following this, you will have your pro forma statements ready in no time. Ready to jump right in? Let’s take a quick look at a pro forma business plan template to place your statements together.

Pro forma business plan example

Refer to this example of a pro forma business plan and use it as a reference point to build yours.

Executive Summary

In this pro forma business plan, we forecast our company’s sales, expenses, capital expenditures, and funding needs over the next five years. Our projections show positive net income, a strong financial position with increasing equity, and healthy cash flow, underscoring our business’s viability and long-term potential.

Background

Auto Gear, a leader in auto products and services, has been operating for 10 years across 10 countries. With a solid financial track record, we aim to expand into new markets, seeking $8 million in funding to facilitate this growth.

Business Plan Pro Forma

This section provides detailed pro forma statements for sales, expenses, capital expenditures, funding requirements, and cash flow, illustrating the viability and growth potential of Auto Gear.

Sales Forecast

Auto Gear forecasts 20% annual sales growth driven by market expansion, innovation, and enhanced customer service.

- Year 1: $12 million

- Year 2: $14.4 million

- Year 3: $17.28 million

- Year 4: $20.74 million

- Year 5: $24.89 million

Expense Forecast

Auto Gear anticipates slower expense growth due to economies of scale in the long term.

- Year 1: $8 million, 15% increase

- Year 2: $8.8 million, 10% increase

- Year 3: $9.5 million, 8% increase

- Year 4: $10.07 million, 6% increase

- Year 5: $10.58 million, 5% increase

Capital Expenditure Forecast

The capital expenditure at Auto Gear will report a 20% annual growth to accommodate research and new product launch shifts

- Year 1: $2 million

- Year 2: $2.4 million

- Year 3: $2.88 million

- Year 4: $3.46 million

- Year 5: $4.15 million

Funding requirements

Auto Gear needs $8 million in funding for research, new product launches, and marketing to support its expansion in new markets.

Cash flow forecast

Auto Gear’s pro forma cash flow statement predicts positive cash flow throughout the forecast period, ensuring liquidity and operational stability.

- Year 1: $2 million

- Year 2: $3.2 million

- Year 3: $4.6 million

- Year 4: $5.6 million

- Year 5: $6.8 million

Before we conclude this blog post, here’s one last segment that needs clarity.

Pro forma statements vs. budgets

Pro forma and budgets are important financial statements that offer a future financial overview of your business. However, that’s the only similarity between them.

With this table, you can understand the differences between these two statements better.

| Difference | Pro Forma Statements | Budget |

|---|---|---|

| Meaning | Pro forma statements are financial projections based on hypothetical situations and assumptions. | Budgets are financial plans highlighting the expected expenses and the resource allocation for a specific time in the future. |

| Purpose | To estimate the future financial performance of a company under various scenarios. | To plan and control the financial resources by setting spending limits and monitoring the performance. |

| Uses | Pro forma statements are used to assess a business’s viability and to make strategic decisions. | Budgets are used for cost control and short-term goal achievement. |

Simply put, pro forma projections assist in long-term financial planning while a budget helps in the achievement of short-term goals.

Prepare your Pro Forma Financial Statements with Upmetrics

Accurate and forward-thinking business and financial planning is quintessential to building a successful business.

That being said, pro forma projections offer the numerical perspective of your business’s financial position and performance in the future. It’s much easier to make decisions when you have clearly outlined sales, revenue, expenses, and funding demands in sight.

Don’t worry. It’s quite easy to create your pro forma projections when you have a business planning app like Upmetrics at your disposal.

Its financial forecasting feature allows you to plan for multiple scenarios and create financial statements and projections for up to 7 years. It generates interactive visual reports and offers AI functionality to simplify financial planning.

This easy-to-use tool has everything you need to plan efficiently.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.