Executive Summary

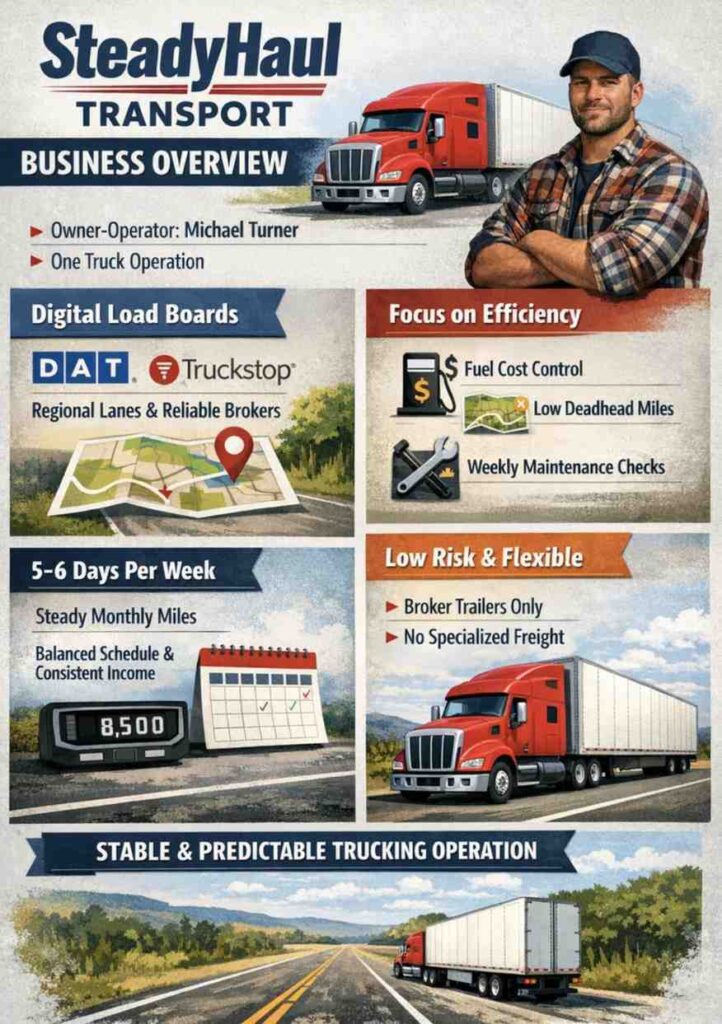

SteadyHaul Transport is a single-truck, owner-operator trucking business based in Columbus, Ohio. Michael Turner owns and operates the company. He will run regional dry van freight across Ohio, Indiana, Kentucky, Michigan, and Pennsylvania.

Our business objective is to build a steady income from one truck while keeping costs controlled and cash flow stable. SteadyHaul will focus only on regional dry van loads. Typical runs range from 300 to 600 miles. This approach limits fuel risk, reduces deadhead miles, and allows regular home time.

The U.S. trucking freight industry generates more than $906 billion in annual revenue, according to the American Trucking Associations (ATA). Dry van freight represents the largest share of this market.

The Midwest remains one of the most active regions due to manufacturing plants, retail distribution centers, and short-haul freight movement. This creates consistent demand for small operators who can run flexible lanes and respond quickly to the needs of brokers.

SteadyHaul targets this demand by running efficient regional lanes at an average rate of $2.10 per mile. Startup funding totals $48,500, comprising $12,000 in owner cash and $36,500 in loans. The business prioritizes stability over expansion.

Business Model

SteadyHaul Transport will operate as a simple, one-truck owner-operating business. Michael Turner will handle driving, dispatching, load booking, and basic recordkeeping. The goal will be to keep the operation small, predictable, and easy to manage during the first year.

Loads will come mainly from digital freight matching platforms like DAT and Truckstop. The business will focus on repeatable regional lanes instead of chasing high-risk spot loads. Brokers with fast and reliable payment terms will get priority to keep cash moving smoothly.

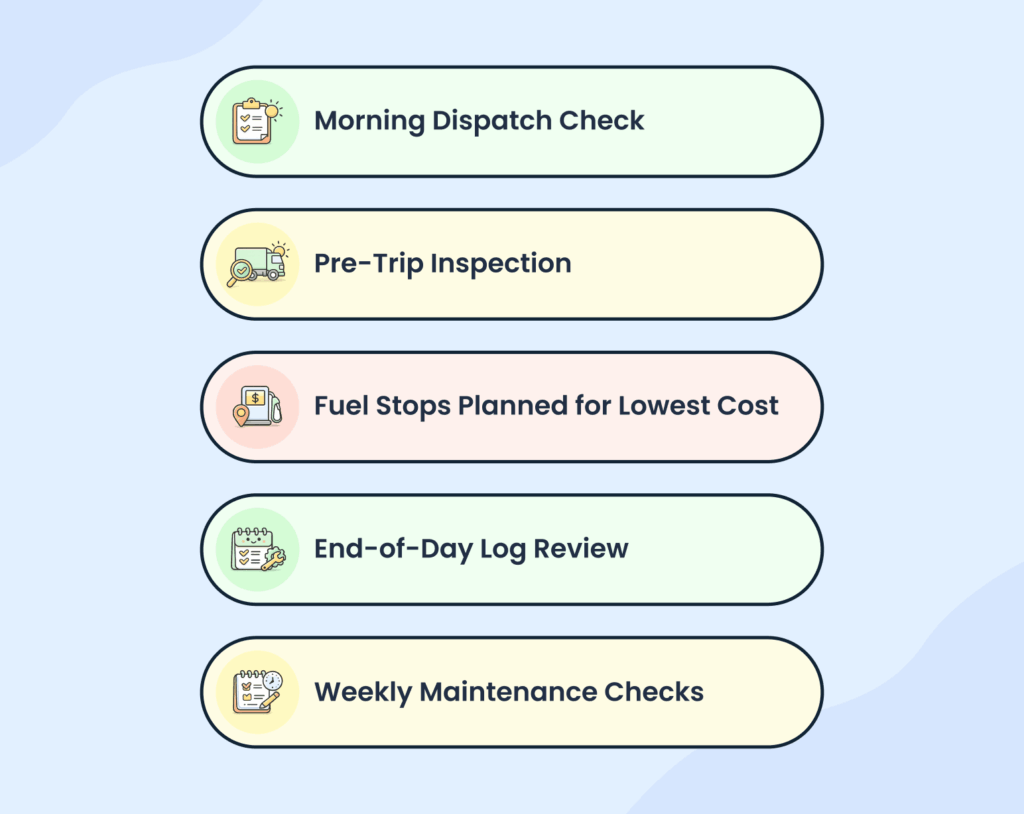

Dispatch decisions will focus on cost control. Fuel stops will be planned around route efficiency and price. Loads with excessive deadhead miles or tight delivery windows will be avoided. Maintenance checks will happen weekly to reduce breakdown risk.

The truck will run five to six days per week with planned rest days. Monthly miles will stay within a steady range to balance income and truck life. The business will use broker-provided trailers and avoid specialty freight, keeping risk low while staying flexible as a new operation.

Funding Request

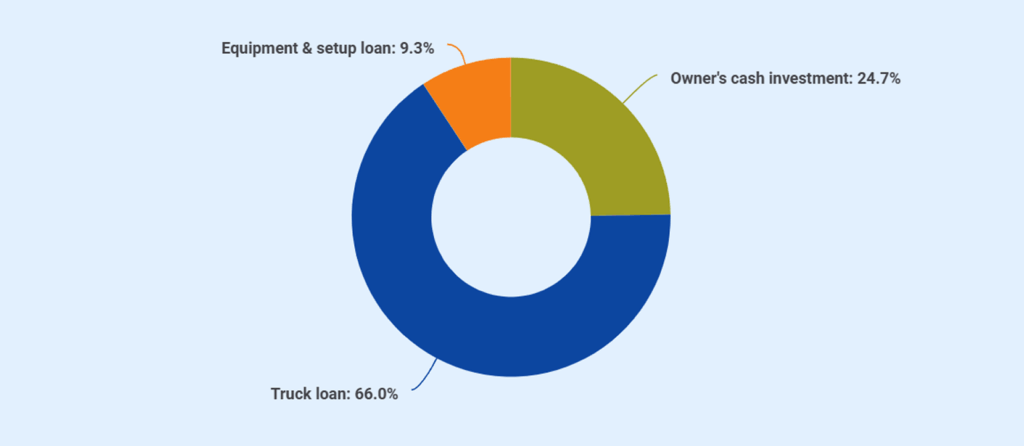

The total capital required to launch the business is $48,500, structured through a combination of owner equity and equipment financing. The funding plan separates vehicle financing from startup working capital to reflect how these loans are actually issued and used.

The primary truck is financed directly through Kemba Credit Union as a used vehicle loan. This loan does not provide cash to the business and is applied solely toward the truck purchase. The owner contributes the required down payment and initial working capital from personal funds.

Loan repayments will be supported by monthly operating cash flow generated from regional dry van freight. The truck loan carries an estimated 9.5% interest rate, a five-year term, and an expected monthly payment of approximately $670, which the business can support under conservative revenue assumptions.

| Source | Purpose | Amount ($) |

|---|---|---|

| Owner’s cash investment | Down payment and working capital | 12,000 |

| Kemba Credit Union | Used truck loan | 32,000 |

| Kemba Credit Union | Equipment and setup loan | 4,500 |

| Total Startup Funding Required | 48,500 |

Financials

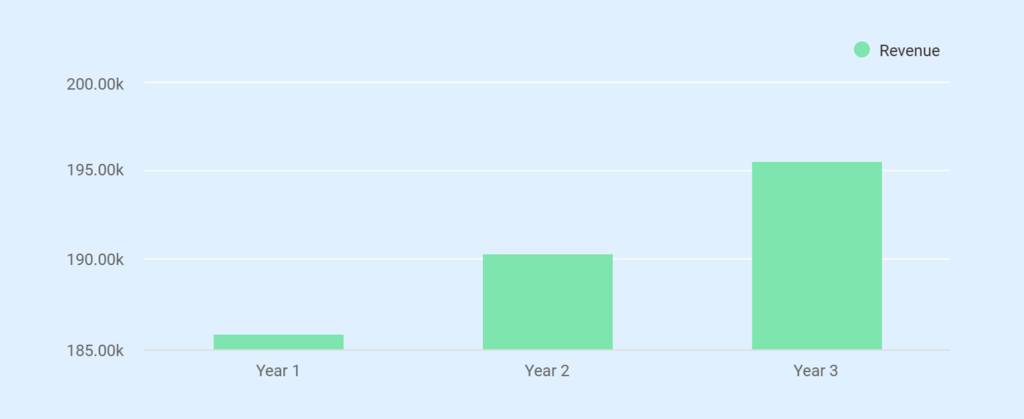

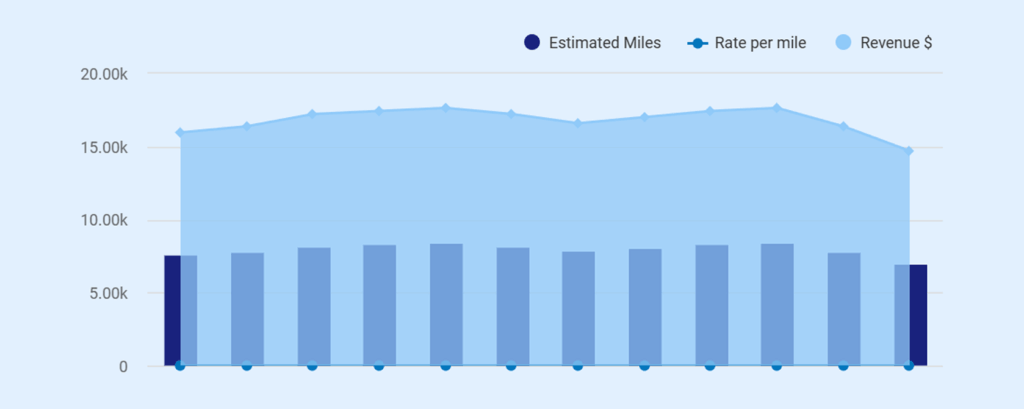

The financial outlook shows a stable, cash-focused operation built around realistic assumptions. Revenue will come from two sources: linehaul freight and fuel surcharge at an all-in average rate of $2.10 per mile. Linehaul revenue will range from $201,600 in Year 1 to $210,000 by Year 3. These figures reflect steady regional miles, not rate spikes or longer hours.

The cost structure keeps pressure low. Monthly fixed operating costs, including the truck loan payment, are expected to total approximately $2,240. This amount includes about $670 in monthly truck debt service. The business also plans for a minimum owner draw of $3,000 per month to cover personal living needs. This puts the total monthly cash requirement at roughly $5,910.

Each revenue mile is expected to contribute about $1.35 toward fixed costs, debt service, and owner income. Cash break-even occurs at roughly 4,770 miles per month. That level sits well below the planned operating range, giving the business room to absorb downtime, slower weeks, or rate softness while still covering obligations.

Spending days structuring a business plan?

Let Upmetrics AI handle the first draft so you can focus on details

Company Overview

The business will operate as a regional freight carrier focused on dry van transportation. Services will center on short- to mid-length Midwest lanes that support predictable scheduling and steady demand. The operation will run as a power-only carrier in the first year, using broker-provided trailers to reduce upfront costs and limit mechanical exposure. The service scope remains narrow by choice, with no specialty freight, no long-haul routes, and no expansion plans tied to volume growth.

Operating Philosophy

The business is built around control and repeatability. One truck and one operator allow full visibility into costs, performance, and cash flow. Freight selection will favor consistency over peak rates. Loads with high deadhead, tight delivery windows, or excessive risk will be avoided. This philosophy supports learning the business at a sustainable pace while protecting equipment life and financial stability.

Legal Structure

The company is organized as a single-member limited liability company to protect the owner’s personal assets while keeping ownership, control, and reporting requirements straightforward. This structure suits a startup trucking operation where ownership, management, and driving responsibilities sit with one individual. It also allows flexibility if future financing or restructuring becomes necessary.

Ownership and Experience

Michael Turner owns and operates the business. His background as a regional company driver provided direct exposure to broker interactions, compliance requirements, and daily route planning. He holds a valid commercial driver’s license (CDL) and maintains a clean motor vehicle record (MVR). That experience informs a cautious operating approach that values discipline over scale. No employees will be hired, and all core functions will remain owner-managed.

Short-term goals

- Launch operations with one truck on the Midwest regional lanes

- Maintain consistent weekly mileage and stable cash flow

- Operate without employees to keep fixed costs low

- Build repeat relationships with reliable regional brokers

- Maintain full compliance and clean operating records

- Establish disciplined maintenance and cost tracking

Long-term goals

- Pay down truck debt and strengthen the balance sheet

- Build retained earnings and operating reserves

- Improve lane efficiency through repeat routes

- Evaluate trailer ownership when financially justified

- Consider adding a second truck only after sustained profitability

- Transition from load boards to relationship-driven freight

Startup Summary

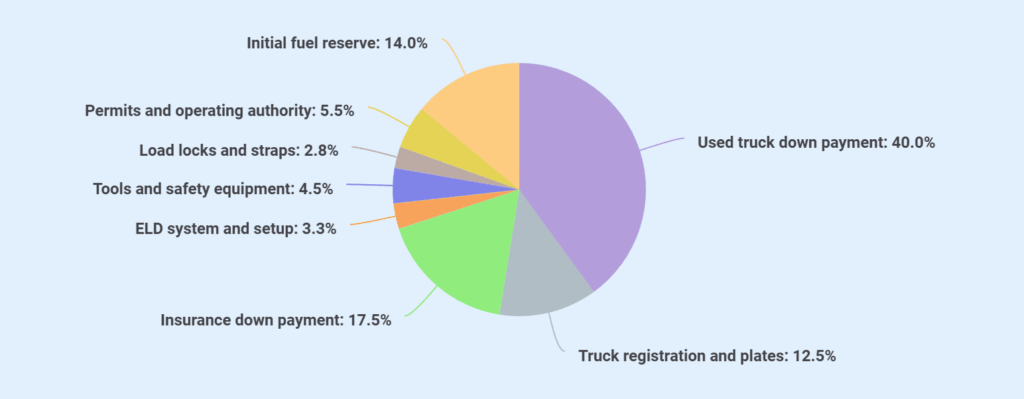

The total startup funding needed is $48,500, which covers the truck purchase, equipment setup, compliance costs, and initial operating reserves. The funding plan supports a measured launch with sufficient liquidity rather than a rapid ramp-up that increases financial risk.

Here’s a breakdown of how the startup funds are allocated to cover required upfront costs and ensure adequate working capital at launch.

| Source | Purpose | Amount ($) |

|---|---|---|

| Owner’s cash investment | Down payment and working capital | 12,000 |

| Kemba Credit Union | Used truck loan | 32,000 |

| Kemba Credit Union | Equipment and setup loan | 4,500 |

| Total Startup Funding Required | 48,500 |

Here’s one thing to note: Total startup funding is $48,500. The table above shows $20,000 in upfront cash startup costs, while the remaining $28,500 covers the financed truck purchase and initial working capital reserves.

Market Overview

The Midwest dry van market supports steady freight movement driven by manufacturing, retail distribution, and regional supply chains. Consistent demand across short and mid-range lanes creates reliable opportunities for owner-operators operating within controlled mileage and pricing assumptions.

Industry Overview

Truck transportation is the backbone of freight movement in North America. Trucks move approximately 72.6% of all freight by weight, making trucking the most relied-upon mode in the logistics system. In the United States alone, the trucking industry generates an estimated $940 billion in annual freight revenue, accounting for roughly 80% of the country’s total freight spending.

For SteadyHaul Transport, this scale matters. The dominance of trucking creates constant demand for capacity, especially in regional dry van lanes that serve manufacturing, retail, and distribution centers.

Because freight volume is spread across thousands of shippers and brokers, small owner-operators can participate without needing contracts or a fleet size. This market structure allows a single-truck operation to secure consistent loads, focus on simple regional routes, and operate profitably without competing directly with large national carriers.

Local Market Overview

The local trucking and freight market around Ohio and the broader Midwest represents a strong opportunity for a regional trucking operator like SteadyHaul Transport LLC. Ohio itself is a major freight hub: The state ranks fourth in the U.S. for total value of inbound and outbound shipments, with roughly $5.2 billion in goods moved annually and a significant logistics presence supporting manufacturing and distribution activity.

Ohio’s transportation and warehousing sector employs many workers and accounts for about $12 billion in economic activity. This positions the state as a strategic base for freight operations.

The wider Midwest corridor (including Ohio, Indiana, Kentucky, Michigan, and Pennsylvania) is a key freight axis in the U.S. due to its dense manufacturing base and connectivity via major interstates.

The region handles a large share of truck freight moving in and out of the industrial heartland and serves as a central distribution point between the East Coast and Midwest markets.

Shorter regional distances and high freight volume allow regional carriers to secure frequent dry van loads with predictable schedules and rates.

Target Customer Profile

The business focuses on customers that require reliable, regional dry van transportation and prefer consistent service over large-scale capacity. As a single-truck owner-operator, SteadyHaul Transport LLC targets freight sources that support steady volume, predictable lanes, and manageable operating risk.

Key target customers include:

- Freight brokers serving Midwest regional lanes

- Small to mid-sized shippers with recurring dry van freight

- Manufacturing facilities shipping raw materials and components

- Retail and distribution centers moving palletized consumer goods

- Customers needing 300–600-mile regional runs

- Brokers offering standard or fast pay terms (7–14 days)

- Shippers that value reliability, communication, and on-time delivery

Market Conditions and Pricing Assumptions

Dry van freight rates in the Midwest typically range around $2 per mile, depending on lane balance, seasonality, and fuel prices. This business plan uses a conservative all-in rate of $2.10 per mile, including fuel surcharge, to avoid overestimating revenue.

Freight demand on Midwest regional lanes remains relatively steady due to year-round manufacturing, retail distribution, and short-haul replenishment needs. These conditions support consistent load availability for regional operators and reduce reliance on volatile long-haul markets.

Competitor Analysis

| Competitor | Strengths | Weaknesses |

|---|---|---|

| Sunway Transport LLC | Mid-sized carrier offering dry van services and regional freight presence in Ohio; established operations and customer base. | Larger fleet means higher overhead and less flexibility on pricing compared to owner-operators. |

| Theo Trucking Inc | Decades in the market with experienced drivers and varied freight handling; established relationships with shippers. | Scale and administrative complexity can slow responsiveness for small, regional loads. |

| Acies Transport LLC | Offers dry van capacity with moderate fleet size and presence in Ohio; competitive pricing possible. | Broker-oriented carriers may prioritize larger loads over small owner-operator segment. |

| Kings Transfer, Inc. | Larger regional carrier with diverse freight types and interstate capacity; reliable service history. | Not focused solely on regional lanes; may underweight short runs compared to specialized operators. |

| Midwest Freight Services LLC | Focus on consistent regional dry van freight and weekly home time; supportive of owner-operators. | Smaller operators still competing for the same Midwest loads as owner-operators. |

Stop Googling competitors for hours

Services

We’ll offer the following services at SteadyHaul Transport:

| Category | Details |

|---|---|

| Services Offered | Dry van transportation only |

| Palletized consumer goods | |

| Retail freight | |

| Manufacturing supplies | |

| Excluded Services | Power-only service using broker-provided trailers |

| No hazmat freight | |

| No oversized loads | |

| No refrigerated freight | |

| No long-haul or coast-to-coast runs |

Freight Types Handled

SteadyHaul Transport LLC handles standard dry van freight that fits a regional, power-only operating model. Freight is limited to palletized and non-specialty loads that can be safely transported without additional equipment.

Moreover, the business primarily hauls:

- Consumer goods

- Retail inventory

- Manufacturing supplies moving between business centers and facilities

We don’t load hazardous materials, oversized freight, and temperature-controlled loads, which reduces our compliance risk and operating complexity.

Lane Profile and Operating Range

The single-truck operation will be done within short to mid-distance regional lanes designed to support consistent scheduling. Typical runs range from 300 to 600 miles, allowing for efficient use of driving hours without extended time away from base.

The operating range is limited to the Midwest, primarily serving lanes between:

This regional focus reduces deadhead miles, simplifies route planning, and supports reliable home time while maintaining steady freight volume.

Service Quality Standards

The firm maintains clear service standards to support reliability and repeat business. Loads are accepted only when pickup and delivery times can be met within planned driving hours.

Communication with brokers is maintained throughout transit, including timely updates at pickup, in route, and delivery. Freight is handled with proper securement and care, and deliveries are completed according to agreed schedules to support consistent performance and long-term broker relationships.

Don’t spend weeks on your first draft

Complete your business plan in less than an hour

Sales and Marketing Plan

SteadyHaul Transport secures steady freight without long-term contracts by using load boards, regional brokers, and lane discipline. The focus is on repeatable regional routes, fast-paying brokers, and load selection strategies that support predictable cash flow and limit exposure to rate swings and downtime.

Freight Acquisition Channels

SteadyHaul Transport LLC sources freight through a mix of digital load boards and direct broker relationships to maintain flexibility and steady access to regional loads.

| Channel | Purpose | How It Works |

|---|---|---|

| DAT Load Board | Primary source for daily freight opportunities | Provides access to a large pool of Midwest dry van loads posted by brokers, allowing rate comparison and lane selection based on distance and payout |

| Truckstop | Secondary load board for regional and short-haul freight | Used to identify nearby loads, reduce deadhead miles, and fill gaps in weekly schedules |

| Small Regional Freight Brokers | Source of repeat and relationship-based freight | Direct communication with regional brokers to secure consistent lanes, negotiate fair rates, and benefit from faster payment terms |

Load Selection Criteria

SteadyHaul Transport LLC adheres to strict load selection guidelines to control costs, mitigate risk, and maintain consistent profitability as a single-truck operation.

- Regional runs are limited to 300–600 miles

- Lanes with low deadhead miles at pickup and delivery

- All-in rate that supports a minimum $2.10 per mile average

- Preference for repeat lanes and familiar pickup locations

- Loads with standard dry van requirements only

- Avoidance of cheap backhauls that weaken weekly averages

- Brokers with clear detention policies and reliable payment history

Broker Relationship Strategy

We will focus on working with a small group of reliable Midwest freight brokers rather than chasing one-time spot loads. The goal is to build repeat business by accepting consistent regional lanes, communicating clearly, and delivering on time.

We’ll prioritize brokers with 7–14 day payment terms or quick-pay options, which help us maintain steady cash flow and gradually reduce dependence on load boards.

Customer Retention Strategy

Customer retention is built through consistent service rather than formal contracts. SteadyHaul Transport LLC focuses on on-time pickups and deliveries, clear communication during transit, and dependable follow-through on agreed lanes.

By running familiar regional routes and working with the same brokers repeatedly, the business:

- Strengthens trust

- Increases repeat load opportunities

- Maintains steady weekly volume without taking on pricing risk

Operations

Our operations are designed to keep the business simple, predictable, and financially controlled. SteadyHaul Transport LLC runs one truck on planned Midwest regional lanes with no employees, no long-haul dispatching, and no complex freight requirements.

This structure limits operational risk, reduces downtime, and allows direct control over scheduling, maintenance timing, and cost decisions. By keeping miles, routes, and daily routines consistent, the business maintains compliance, protects equipment life, and supports stable cash flow from week to week.

Operating Schedule

| Schedule Area | Operating Plan |

|---|---|

| Operating days | 5–6 days per week |

| Daily driving window | Up to 10–11 hours, within HOS limits |

| Weekly rest period | 1–2 days scheduled home time |

| Typical start time | Early morning dispatch and pre-trip |

| End-of-day cutoff | Logs reviewed and secured before rest |

| Overnight driving | Limited, regional-only when required |

| Weekly mileage target | 2,000–2,200 miles |

| Monthly mileage target | Approximately 8,000 miles |

Daily Operating Procedures

Equipment and Cargo

We’ll operate a single sleeper truck suited for regional dry van freight. The truck is a 2014–2016 model Freightliner Cascadia or similar, selected for reliability, fuel efficiency, and ease of maintenance in a regional operating environment. The business runs as a power-only operation, using broker-provided dry van trailers to avoid the cost and risk of trailer ownership in the first year.

Cargo transported is limited to standard dry van freight, including

- Palletized consumer goods

- Retail inventory

- Manufacturing supplies

The business does not handle hazardous materials, oversized loads, or refrigerated freight. This focused approach keeps operations simple, reduces compliance and insurance risk, and supports consistent service on short to mid-range Midwest routes.

Maintenance and Inspection Plan

We’ll follow a preventive maintenance approach to reduce breakdown risk and protect equipment life. The truck is inspected daily through required pre-trip and post-trip checks, with issues addressed immediately when identified.

Weekly inspections cover fluids, tyres, brakes, and visible wear items. A monthly maintenance reserve is set aside to handle routine service and minor repairs, while larger repairs are planned and scheduled to avoid unexpected downtime and cash strain.

Compliance and Licensing

SteadyHaul Transport will operate in full compliance with federal and state trucking regulations required for interstate freight operations. The business holds the required operating authority, registrations, and insurance necessary to legally transport freight across state lines.

- USDOT (The United States Department of Transportation) Number: Will be maintained to meet federal tracking and safety requirements for interstate trucking

- Motor Carrier (MC) Authority: Will allow the business to legally transport freight for hire across state lines

- BOC-3 Filing: Will designate a process agent as required by federal regulations

- Unified Carrier Registration (UCR): Will be filed annually to operate across multiple states

- Commercial Auto and Cargo Insurance: Will be maintained at required coverage levels to meet broker and regulatory standards

- Commercial Driver’s License (CDL): Will be held by the owner-operator to legally operate a commercial vehicle

- DOT Medical Card: Will be maintained to confirm the driver’s medical fitness

- Hours-of-Service Compliance: Will be tracked through an electronic logging device

Investors hate amateur writing errors

Instantly improve your plan w/ our AI writing assistant

Management and Ownership

SteadyHaul Transport LLC is a 100% owner-operated business led by Michael Turner. The business is organized as a single-member limited liability company, allowing the owner-operator to make all operational and financial decisions directly while maintaining a simple and controlled business structure. This ownership structure enables direct oversight of business decisions and operations, while maintaining a simple and efficient organizational structure.

Owner Background

Michael Turner has prior experience as a company driver operating regional dry van routes across Ohio, Indiana, and Kentucky. During this time, he developed a working understanding of day-to-day truck operations, load scheduling, broker coordination, hours-of-service compliance, and equipment handling.

He operates under a valid CDL and maintains an MVR that meets carrier and insurance standards, providing the regulatory and compliance foundation needed to launch SteadyHaul Transport LLC as a single-truck owner-operator business focused on regional lanes.

Roles and Responsibilities

SteadyHaul Transport LLC operates without employees, with all core business functions performed by the owner to maintain control, consistency, and cost discipline. This structure ensures direct oversight, quick decision-making, and tight cost control.

- Driver and vehicle operation

- Load booking and dispatch coordination

- Broker and customer communication

- Maintenance scheduling and oversight

- Compliance and licensing management

- Recordkeeping and basic accounting

Financial Plan

Startup Funding

| Startup Funding Sources | |

|---|---|

| Source | Amount |

| Owner’s cash investment | $12,000 |

| Truck loan | $32,000 |

| Equipment & setup loan | $4,500 |

| Total Startup Funding | $48,500 |

Fixed Operating Expense

| Expense | Monthly | Annual |

|---|---|---|

| Truck loan payment (P+I) | $670 | $8,040 |

| Commercial insurance | $1,050 | $12,600 |

| ELD and software | $75 | $900 |

| Accounting and compliance | $100 | $1,200 |

| Phone and internet | $120 | $1,440 |

| Permits and licenses (amortized) | $125 | $1,500 |

| Total Fixed Costs | $2,240 | $25,680 |

Variable Operating Cost

| Expense | Monthly | Cost per Mile |

|---|---|---|

| Fuel | $4,460 | $0.56 |

| Maintenance reserve | $900 | $0.11 |

| Tire reserve | $300 | $0.04 |

| Tolls and scales | $180 | $0.02 |

| Parking, wash, misc. contingency | $120 | $0.02 |

| Total Variable Costs | $5,960 | $0.75 |

Total Operating Cost

| Category | Amount |

|---|---|

| Fixed costs | $2,240 |

| Variable costs | $5,960 |

| Total Monthly Operating Costs | $8,200 |

Don’t waste time using spreadsheets

Monthly Revenue (Year 1)

| Month | Estimated Miles | Rate per Mile | Monthly Revenue |

|---|---|---|---|

| January | 7,600 | $2.10 | $15,960 |

| February | 7,800 | $2.10 | $16,380 |

| March | 8,200 | $2.10 | $17,220 |

| April | 8,300 | $2.10 | $17,430 |

| May | 8,400 | $2.10 | $17,640 |

| June | 8,200 | $2.10 | $17,220 |

| July | 7,900 | $2.10 | $16,590 |

| August | 8,100 | $2.10 | $17,010 |

| September | 8,300 | $2.10 | $17,430 |

| October | 8,400 | $2.10 | $17,640 |

| November | 7,800 | $2.10 | $16,380 |

| December | 7,000 | $2.10 | $14,700 |

| Total (Year 1) | 96,000 | $201,600 |

Profit and Loss Statement (3 Years)

| P&L Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | $201,600 | $205,800 | $210,000 |

| Variable Costs | |||

| Fuel | $53,520 | $54,640 | $55,760 |

| Maintenance | $10,800 | $11,200 | $11,600 |

| Tires | $3,600 | $3,700 | $3,800 |

| Tolls & scales | $2,160 | $2,200 | $2,240 |

| Misc. supplies | $1,440 | $1,480 | $1,520 |

| Total Variable Costs | $71,520 | $73,220 | $74,920 |

| Gross Margin | $130,080 | $132,580 | $135,080 |

| Fixed Costs | |||

| Truck loan payment | $8,040 | $8,040 | $8,040 |

| Insurance | $12,600 | $12,900 | $13,200 |

| ELD & compliance | $900 | $900 | $900 |

| Accounting | $1,200 | $1,200 | $1,200 |

| Phone & internet | $1,440 | $1,440 | $1,440 |

| Permits & fees | $1,500 | $1,500 | $1,500 |

| Total Fixed Costs | $25,680 | $25,980 | $26,280 |

| Net Operating Income | $104,400 | $106,600 | $108,800 |

| Owner draws | -$90,000 | -$90,000 | -$90,000 |

| Net Retained Earnings | $14,400 | $16,600 | $18,800 |

Cash Flow Statement

| Cash Flow Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Beginning cash | $28,500 | $38,100 | $49,200 |

| Net operating income | $104,400 | $106,600 | $108,800 |

| Owner draws | -$90,000 | -$90,000 | -$90,000 |

| Truck loan principal paid | -$3,500 | -$4,200 | -$4,700 |

| Equipment loan principal paid | -$1,300 | -$3,200 | — |

| Ending cash | $38,100 | $49,200 | $63,300 |

Do spreadsheets slow down financial planning?

Build accurate financial projections w/ AI-assisted features

Balance Sheet

| Balance Sheet Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash | $38,100 | $49,200 | $63,300 |

| Truck (net book value) | $30,400 | $24,800 | $19,200 |

| Equipment | $2,100 | $1,400 | $700 |

| Total Assets | $70,600 | $75,400 | $83,200 |

| Liabilities | |||

| Truck loan balance | $28,500 | $24,300 | $19,600 |

| Equipment loan | $3,200 | — | — |

| Total Liabilities | $31,700 | $24,300 | $19,600 |

| Equity | |||

| Owner capital | $12,000 | $12,000 | $12,000 |

| Retained earnings | $26,900 | $39,100 | $51,600 |

| Total Equity | $38,900 | $51,100 | $63,600 |

| Liabilities + Equity | $70,600 | $75,400 | $83,200 |

Break-even Analysis

| Metric | Value |

|---|---|

| Fixed monthly costs (Year 1) | $2,240 |

| Variable cost per mile (71,520 ÷ 96,000) | $0.75 |

| Revenue per mile | $2.10 |

| Contribution margin per mile ($2.10 – $0.75) | $1.35 |

| Break-even miles/month ($2,240 ÷ $1.35) | 1,660 |

| Break-even revenue/month (1,660 × $2.10) | $3,486 |

Loan Repayment Plan (5-Year Term)

| Item | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Opening Balance | $32,000 | $28,500 | $24,300 | $19,600 | $14,300 |

| Annual Payment | $8,040 | $8,040 | $8,040 | $8,040 | $8,040 |

| Principal Paid | $3,500 | $4,200 | $4,700 | $5,500 | $7,300 |

| Interest Paid | $4,540 | $3,840 | $3,340 | $2,740 | $740 |

| Ending Balance | $28,500 | $24,300 | $19,600 | $14,300 | $7,000 |

The final year reflects an accelerated payoff of the remaining loan balance rather than a fully level amortization schedule.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.