If there’s one lesson I wish every founder learned early, it’s this: Working capital isn’t just a number.

I got this wrong, too. Once I peeled back the layers, I saw the truth—companies that looked solid on paper were scrambling to pay staff by Friday.

That’s the trap. Truth be told, working capital is mostly about cash parked in 90-day receivables, inventory eating liquidity, and even short-term payables knocking on the door. I’ve reviewed countless plans where the figure looked fine, but the business was anything but fine.

It’s no surprise 68% of small businesses still hit cash flow squeezes.

In this guide, I’ll walk you through how to calculate working capital and, more importantly, how to read it like an investor (and maybe spare you a Thursday afternoon payroll panic). Let’s clear up the basics first…

What is working capital?

Working capital is a measure of how much short-term liquidity a business has to run its daily operations. It is calculated by taking current assets (like cash, unpaid invoices, and inventory) and subtracting current liabilities (such as bills, wages, or short-term loans).

In simple terms, this is the number that shows whether a business has enough readily available resources to pay its near-term obligations and still operate smoothly.

A positive figure means there’s a financial cushion to cover upcoming expenses. A negative figure suggests cash flow is tight, and meeting short-term commitments could be a struggle.

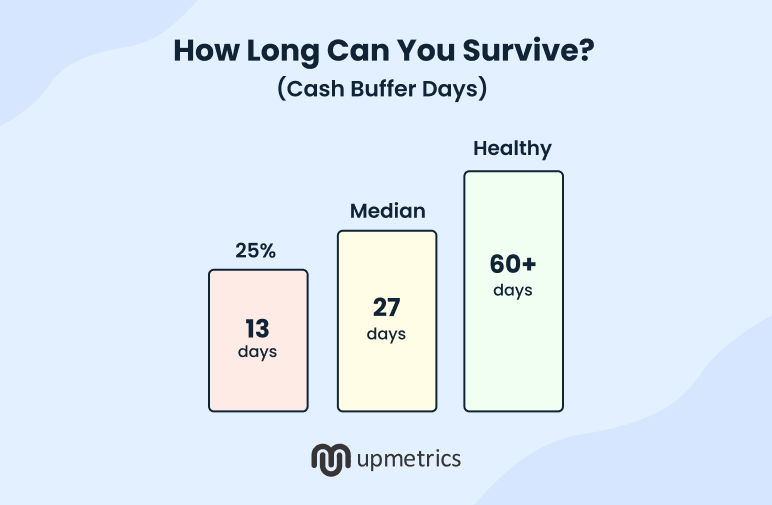

In fact, a JP Morgan Chase study found that the average small business holds only 27 days of cash buffer to survive if revenue stops. That shows why understanding your working capital isn’t just accounting; it’s about knowing how long your business can realistically keep the lights on.

The working capital formula

Working capital measures the difference between what a business owns and what it owes in the short term. Both numbers come from the balance sheet: current assets on one side, current liabilities on the other.

To calculate working capital, you subtract current liabilities from current assets:

Current assets typically include cash, accounts receivable, and inventory (anything you expect to convert into cash within a year). Current liabilities include short-term obligations such as supplier invoices, wages, and loan payments due within a year.

For example, if a company has $100,000 in assets and $30,000 in liabilities, it has $70,000 ($100,000-$30,000) of working capital available to run operations.

Positive vs. negative working capital

Positive working capital: This occurs when current assets are greater than current liabilities. It usually signals good short-term financial health: The business has enough liquidity to pay its bills, support operations, and even invest in growth.

Negative working capital: This happens when liabilities exceed assets. It can indicate cash flow pressure and difficulty meeting short-term obligations.. It may point to poor liquidity management, over-reliance on debt, or deeper financial strain.

Now that we’ve covered the formula and what the results indicate, let’s walk through how to calculate working capital in practice and, just as importantly, how to interpret it.

How do you calculate working capital?

Working capital might sound like a formula you just plug numbers into, but the real value comes from understanding what those numbers mean for your business. Here’s a simple way to calculate it without getting lost in accounting language.

Step 1: Pull your most recent balance sheet for financial data

The first place you should start when talking about working capital is the balance sheet. Now, I know balance sheets can feel overwhelming.

You’ll find rows of numbers and headings in the sheet. Here’s the thing: For working capital, you can ignore 90% of it. I like to zero in on just those two sections, because they tell me what’s most important, that is, current assets and current liabilities.

Current assets usually cover cash, unpaid invoices (accounts receivable), and inventory that will be sold within a year. Current liabilities are the bills, wages, taxes, and short-term loans that need to be paid in the same timeframe.

If I were to explain this to founders, I’d tell them not to get stuck in the weeds. Just pull the latest month-end balance sheet and circle those two totals.

That’s your starting point. Everything else on that page might be useful later, but it’s not essential for calculating working capital.

This is exactly why, when drafting a balance sheet for your business plan, I highlight current assets and current liabilities first. They give the clearest snapshot of liquidity and provide the numbers you need to calculate working capital.

For example, let’s say my current assets add up to $80,000 and my current liabilities total $55,000. That’s all I need to move forward.

Step 2: Apply the working capital formula

You’ve already pulled the two numbers you need—current assets and current liabilities. Step 2 is where you run the actual calculation. This part is simply about subtracting one from the other, so you can see the number in black and white.

Let’s calculate that with an example:

Current assets (things you’ll use or turn into cash within a year):

- Cash in the bank: $30,000

- Customer invoices (accounts receivable): $25,000

- Inventory (products ready to sell): $20,000

- Prepaid expenses (like rent you’ve already paid in advance): $5,000

Total current assets = $80,000

Current liabilities (bills and obligations due within a year):

- Supplier bills (accounts payable): $20,000

- Wages owed to employees: $15,000

- Short-term loan payments: $10,000

- Taxes payable: $10,000

Total current liabilities = $55,000

Now subtract:

$80,000 – $55,000 = $25,000 working capital

That’s your working capital.

That number means that, on paper, your business has $25,000 left after covering everything due in the near term. It’s your margin of safety, the extra runway before you run out of cash.

New entrepreneurs usually get tripped up here because they’re not sure how exact this calculation needs to be. I suggest sticking to your most recent month-end balance sheet.

That way, you’re working off a clean snapshot. If you pull numbers mid-month, you risk timing issues like invoices that haven’t been posted yet or bills that are still sitting in draft. Those little gaps can throw the math off.

Another thing founders often ask is…

Should I factor in seasonality while calculating working capital?

Yes, if your business changes with the calendar.

A retailer heading into the holidays or a caterer in the wedding season is going to look very different than in the off-season. In cases like that, I suggest calculating working capital across several months and then comparing. One number on its own doesn’t tell the entire story.

And here’s something I always emphasize: Working capital is a point-in-time metric. It’s like a snapshot, showing where you stand today, not what’s going to happen in 30 days. That’s why analysts (myself included) rarely look at one calculation in isolation. The real insight comes from watching how it moves over time.

Step 3: Check and interpret the result

You might not think of this step much, but it’s actually the most important one. After the calculation, the real work begins. Sure, you now have a number on paper, but that number is only important if you understand what it’s telling you about your business.

Otherwise, it’s like stepping on the scale, seeing a number, and having no idea if it’s good news or not.

Let’s go back to the example from Step 2. We calculated $25,000 in working capital. That’s positive. It means that after paying off all your short-term obligations, you still have $25,000 left to work with.

That cushion could cover a surprise repair, help you fund a small project without borrowing, or simply let you sleep better at night knowing payroll is covered.

But here’s where I’d add a warning.

Positive doesn’t always equal healthy.

If $25,000 of your “assets” are sitting in customer invoices that won’t be paid for 90 days, your liquidity is more fragile than it looks. Inventory has the same issue. It counts as an asset, but unless it’s being actively traded, it’s essentially just cash sitting in storage.

And then you’ve got liabilities—suppliers may give you 60 days to pay, which actually stretches your cushion further than the formula alone shows.

Now imagine the reverse. If liabilities are higher than assets—say, $85,000 versus $80,000—you’ve got –$5,000 working capital. That’s negative. In real life, it looks like juggling supplier payments, pushing payroll onto a credit card, or waiting nervously for a big customer check to clear.

Negative working capital usually raises eyebrows, but it’s not automatically doom. Retailers, restaurants, and subscription models often run this way because their customers pay up front and fast. The red flag is when it happens across several months without a clear operating reason.

And then there’s zero working capital.

Assets and liabilities perfectly cancel out. On paper, that means you can cover every bill. But with one late-paying client or one surprise expense, you’re instantly in the red.

So, is it good or bad if you have a working capital of $25,000?

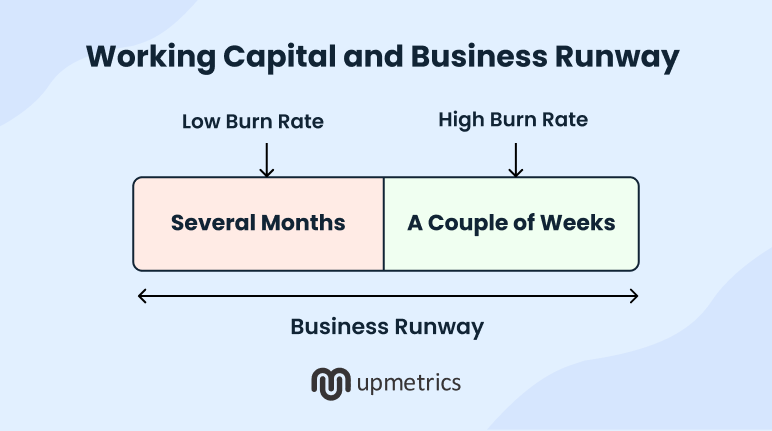

Honestly, it depends on your monthly burn. If you’re spending $20,000 a month, then $25,000 buys you breathing room. If you’re spending $50,000, it barely covers two weeks.

The formula gives you a number, but that won’t pay your bills; cash does. You need to ask if that working capital figure reflects true liquidity. So always look at what’s actually collectible, what’s tied up, and what obligations are really pressing.

That’s the part investors care about, and it’s what separates a founder who’s just “doing the math” from one who’s running with a clear financial map.

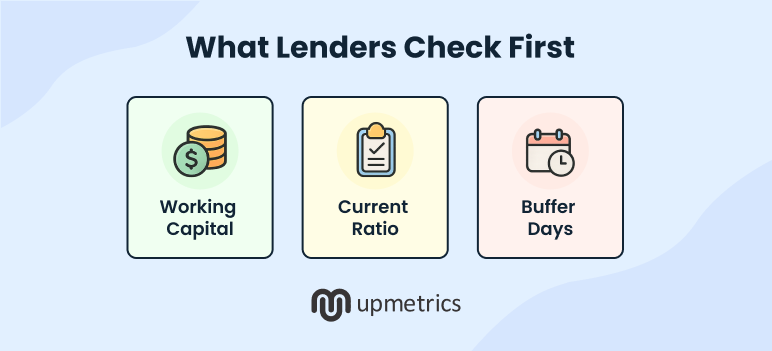

Step 4: Double-check with the current ratio

Calculating working capital in Step 2 gave us $25,000 left over after paying short-term bills. That’s helpful, it’s just a dollar amount. On its own, it doesn’t scale. A tiny business and a company ten times bigger could both show $25,000, yet the implications for each are completely different.

That’s why analysts, bankers, and investors often go one step further. They look at the current ratio. While working capital answers “what’s left over?”, the current ratio answers “how well can you actually cover your obligations relative to your size?”

The formula for the current ratio:

Let’s apply it to our numbers:

- Current assets = $80,000

- Current liabilities = $55,000

$80,000 ÷ $55,000 = 1.45

Now, what does 1.45 mean in practice? It means for every $1 of obligations, the business has $1.45 available. That’s a solid margin, enough cushion to show stability without hoarding too much in underutilized assets.

The ratio normalizes the scale. You can compare businesses of different sizes, track yourself over time, and give lenders a quick snapshot of whether you’re solvent. Banks love this number because it instantly tells them if you can pay your bills without needing to read every line of your balance sheet.

Of course, context matters:

- In retail, where cash comes in daily and inventory turns quickly, a ratio as low as 1.2 might still be fine.

- In manufacturing, where money is tied up in raw materials and production cycles, investors often want to see closer to 1.5–2.0.

- In SaaS businesses, the ratio can appear weaker because deferred revenue (subscriptions paid in advance) sits on the liability side, even though the cash is already in the bank.

This is why I always look at working capital and the current ratio together. The dollar figure tells me the size of the buffer. The ratio tells me how strong that buffer is relative to what’s owed. Together, they give a much more accurate read on financial health than either one can provide alone.

The power of the current ratio is that it normalizes scale. You can use it to compare companies of very different sizes, track your own business across time, and give lenders a quick read on solvency. Banks love it because it instantly answers the question: “Can this company reliably pay its bills?”

Now, there are a few points I always emphasize here.

First, working capital and the current ratio are not either/or. The dollar figure tells you the size of your cushion; the ratio shows how strong that cushion is relative to what you owe. Both are important.

Second, yes, the ratio can be too high. If you’re sitting at 3.0 or above, it usually means you’ve got too much capital tied up in receivables or inventory that isn’t moving. Though it’s safe on paper, it’s inefficient in practice.

Third, frequency is important too. Don’t wait for year-end reports. Monthly or quarterly checks are far better, especially if your business is seasonal or cash inflows are lumpy. Liquidity can swing quickly, and you want to catch those shifts before they become problems.

And finally, context. A 1.2 ratio might be fine for a retailer with cash coming in daily. A manufacturer, with money locked in production cycles, is safer at 1.5–2.0. SaaS companies often look weaker on paper because deferred revenue is booked as a liability, even when the cash is already in hand.

This is the way I think about it: Working capital tells you how much room you have. The current ratio tells you how strong your footing is. Look at both, and you’ll understand whether you’re standing on solid ground or balancing on a tightrope.

Now that you know how to calculate it, let’s talk about why this single number influences how smoothly your business runs, whether you’re ready to grow, and how credible you look to lenders and investors.

Why is working capital important?

When I’m reviewing financials, working capital is where I start. Not revenue, not profit projections—this. Why? Because it tells me whether the business can handle today before we even talk about tomorrow. If it looks solid, the pitch gets easier. But, if it looks shaky, the rest of the plan gets picked apart…rather quickly.

Let’s discuss it in detail:

1. It reveals the quality of your liquidity (not just the quantity)

When a banker, investor, or analyst reviews your business, this is often the very first number they check. Positive working capital reassures them that you can meet short-term obligations. Thin or negative working capital raises doubts about stability.

I’ve seen review meetings where a weak number here set the tone for the entire conversation, even before we touched revenue or profit.

2. It defines your room for growth

Working capital quietly tells reviewers whether you can absorb the risks of expansion. If the cushion is strong, they see the capacity to hire, open new locations, or invest in growth. If it’s thin, the advice (and sometimes the funding decision) is simple: Strengthen liquidity first.

Personally, I like to think of it as the “green light” or “yellow light” for scaling, and that’s exactly how most lenders and investors use it, too.

3. It reflects discipline in daily operations

Numbers on a balance sheet show how you actually run the business day to day. Strong working capital signals you’re collecting invoices on time, managing supplier terms smartly, and keeping inventory in check. Weak working capital suggests the opposite (late collections, strained payables, or bloated stock).

When I see those patterns, I know I’m not just looking at liquidity; I’m looking at how disciplined (or improvised) your operations are.

Using working capital in business planning

When you calculate working capital, the point isn’t just to see if you can cover this month’s bills. You should also know whether you’ll have enough to hire next quarter, expand next year, or take on that big customer order without extra stress.

If I were building a cash flow forecast, I’d always start by checking working capital. Why? Because the balance tells me what kind of moves are realistic:

- Strong balance: I can weather a few months of uneven income.

- Weak balance: I need to plan ahead by cutting costs, collecting faster, or arranging credit.

That’s why you should always treat working capital as more than just a number. It won’t be wrong to call it a planning tool that shapes forecasts, funding conversations, and growth decisions.

The same logic applies to bigger moves. Imagine a startup planning to open a second location. On paper, the idea looks great. But before signing a lease, they run the numbers. With $20,000 in working capital after covering current bills, they know they can handle payroll and supplier costs while the new store ramps up. Without that cushion, the risk would be far higher.

And if you’d like to go one step further, Upmetrics makes the process more practical. Its Financial Assistant can calculate your working capital for you, while the forecasting features let you model scenarios like hiring, expansion, or large customer orders before you commit.

That way, you can see where your business stands today and build clarity about the road ahead.