Growing your business is not an easy feat.

One day, you’re deciding whether to hire a new employee and the next, you’re debating if it’s time to raise prices or finally let go of that underperforming product you’ve been holding onto.

Every choice feels like a domino, ready to topple your bottom line—or maybe shape your future in ways you didn’t expect.

Real talk? You can’t rely on gut instincts and wishful thinking hoping it turns into a winning strategy. You need data-backed insights to see what’s coming and help you make informed decisions.

That’s where financial forecasting comes in. With the right financial forecasting methods, you can leverage the data and accurately predict your business’s state.

Ready to explore the top methods? Let’s dive right in.

What is financial forecasting?

Financial forecasting refers to the process of estimating a company’s future financial performance using historical data, current market trends, and economic conditions. It’s an important aspect of financial planning that helps businesses estimate key metrics like revenue, expenses, cash flow, and future growth.

Financial forecasting provides necessary insights to guide resource allocation, build efficient budgets, and make strategic decisions. By leveraging accurate forecasts, one can secure long-term growth and financial stability for their business.

Spreadsheets vs. financial planning software

Think of forecasting and the never-ending Excel sheets flash before your eyes. It’s dreadful and if I were you, I would even push my forecasting plans to the next day.

Despite how useful spreadsheets are—one needs patience and a lot of it while mastering it for complex calculations. Think of equations where you would be accounting for multiple independent variables. Of course, it’s not an easy learning curve. And even if you master Excel, it will take hours and days to build your financial projections from scratch.

Forecasting tools like Upmetrics, on the other hand, make forecasting much easier. It eliminates the need to recall and use complex formulas. You just enter your predictions for revenue, sales, and expense and this tool will create detailed forecasts in no time.

You’ll get all these (+ visual reports) without making any manual calculations or adjustments.

Doesn’t it make more sense to take an easy road, especially when your business demands your brains elsewhere?

Let’s now understand the structured methods that will help translate the data, and trends into actionable insights about the future.

6 Types of financial forecasting methods

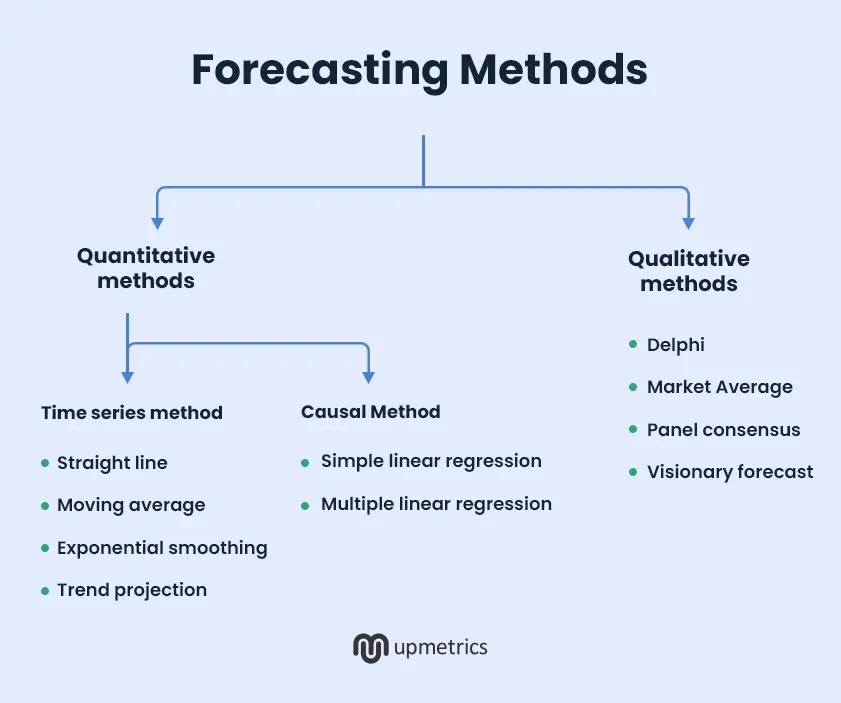

Financial forecasting methods are broadly classified into quantitative and qualitative methods.

To offer a quick overview:

- Quantitative methods: Rely on mathematical and statistical models to analyze historical data and make predictions about future

- Qualitative methods: Focus on qualitative data such as expert opinions, consumer feedback, and market analysis for future forecasts

While quantitative data offers a precise understanding of future performance, qualitative data is useful in scenarios that require subjective judgment.

Both these methods have a series of forecasting methods that can be used by businesses, both small and large, to forecast their growth, revenue, sales, and future trends.

Let’s discuss the 6 important forecasting methods that can be used to predict future revenues, expenses, and growth of the business.

1. Straight-line forecasting: For businesses with consistent growth

The straight-line method is part of a time-series forecasting model that helps businesses predict their future growth. This method is based on the assumption that a company’s historical growth rate will remain constant in the coming years.

Meaning, that if the company has grown at the same pace over the past few years, it might continue to grow at the same pace even in the foreseeable future.

Such a method of forecasting relies on past data and basic mathematical equations to calculate future sales and revenue. It’s particularly effective for businesses with steady growth rates to plan and budget for the short term, i.e. annually.

Example of straight-line forecasting

Elenor, a retail clothing brand, analyzed its past financial statements over the past 36 months and found a consistent revenue growth of 5% per year. Assuming the same growth rate would continue, the company forecasted its revenue for the next two years using the straight-line method.

If Elenor’s current annual revenue is $800,000, the forecasted revenue for the next year would be $840,000, and $882,000 for the year after that.

We used Upmetrics’ forecasting feature to calculate this in seconds! Still, if you’re choosing the spreadsheet way, here’s a formula you can use.

Straight-line forecasting formula

Future Revenue = Previous Period Revenue x (1 + Average Growth Rate)

Pros

- Simple and easy-to-calculate

- Helps set realistic financial and operational goals

- Requires minimal data and mathematical effort

Cons

- Ignores external factors like market trends and competitive changes

- Not suitable for long-term forecasts

- Fails to address unexpected market shifts and supply chain issues

2. Moving average method: To forecast short-term trends

This method is quite similar to straight-line forecasting, except that it’s used to make predictions for extremely short time frames. We’re talking days, weeks, months, and quarters.

Moving average uses evolving average calculations to create an estimate of future values based on past and present data. It identifies underlying patterns and highlights fast-moving trends making it a reliable tool for short-term forecasting.

Moving average is ideally used to analyze the trend movement of stocks. However, businesses can also benefit from this financial forecasting method by predicting sales, revenue, and profits during peak seasons.

It’s particularly helpful for meeting short-term market demands by providing valuable insights to plan inventory and manage resources effectively.

Formula to calculate the moving average:

Forecasted revenue or forecasted sales = A1+A2+A3+….+Aɳ/ɳ

A = Average of given periods

ɳ = Total number of periods

Example of moving average forecasting method

GrowFlow, a SaaS company, is experiencing fluctuating weekly sign-ups for its project management software. With a marketing campaign running, they want to identify the overall trend in sign-ups to plan server capacity and support. To smooth out these fluctuations, they calculate a 4-week moving average based on recent weekly data:

- Week 1: 6000 users

- Week 2: 10,000 users

- Week 3: 9,000 users

- Week 4: 12,000 users

Using the moving average formula, they expect an average of 9250 (6000+10,000+9000+12,000/4) sign-ups each week for the next month. This prediction will help GrowFlow optimize its server capacities to meet increased sign-ins during the campaign period.

Pros

- Helps identify trends in fast-moving markets

- Can evaluate metrics like sales, inventory, and revenue

Cons

- Not suitable for long-term forecasting

- Needs continuous recalculations as new data becomes available

3. Simple linear regression: To forecast the impact of one variable on another

This method belongs to the causal financial forecasting models that examine the relationship between two variables—independent (e.g. advertising spending) and dependent (e.g. revenue).

It’s based on the assumption that a linear relation exists between these two variables. To clarify, any changes in the independent variable will directly influence the dependent variable, proportionally.

With this method, you can forecast future values of dependent variables based on their historical data. The forecasts will help businesses identify trends with minimal complexity.

Formula to calculate simple linear regression:

Y=A+BX

Where,

Y: Predicted value (dependent variable)

X: Independent variable

A: Intercept (value of Y when X = 0)

B: Slope of the line (change in Y for a one-unit change in X)

Example of simple linear regression

GreenTech, a solar panel retailer, wants to predict its monthly revenue based on advertising spend. Before starting their ad campaigns in July, their sales were steady at $35,000 per month. After consistently investing in ads, they noticed a proportionate increase in revenue.

To understand the connection between ad spend and revenue, they used simple linear regression and gathered data from the past five months:

| Month | Advertising spend | Revenue |

|---|---|---|

| July | $5,000 | $50,000 |

| August | $6,000 | $60,000 |

| September | $7,000 | $65,000 |

| October | $8,000 | $75,000 |

| November | $9,000 | $85,000 |

| December | $10,000 | (?) |

Using the formula, a company would earn a revenue of $85,000 if they spent $10,000 on advertisements.

Now if you’re a math wizard you can go on to calculate using the formula. But for the rest, don’t fret, just use a forecasting tool where you can calculate the value of Y dependent simply by entering the data. Just like we did.

Say goodbye to old-school excel sheets & templates

Make accurate financial models faster with AI

Plans starting from $14/month

Pros

- Ease of implementation with an ERP or forecasting tool

- Establish a clear relationship between two variables

- Useful for straightforward and scalable applications, e.g. ad performance

Cons

- Ignores the complex relationship between independent and dependent variables

- Easily influenced by deviations and outliers

4. Multiple linear regression forecasting method: For advanced forecasting

This method of financial forecasting is built on the same approach as simple linear financial modeling, however with multiple independent variables.

Here the variables have a linear relationship that helps in predicting the actual value of the dependent variable using the past data. And although these variables are unrelated to each other they collectively influence the outcome.

When fed with correct financial data, this forecasting method will generate accurate and realistic projections. It’s, in fact, the most suitable method to evaluate the future financial performance of your business.

Formula to calculate multiple linear regression:

y = β₀ + β₁x₁ + β₂x₂ + … + βkxk + ε

where,

y = dependent variable

β₀ = intercept

β₁-βk = regression coefficients for each independent variable (x₁ to xk)

ε = error term

Example of multiple linear financial forecasting model

A retail electronic store wants to forecast its monthly revenue considering multiple variables influencing its sales. This includes factors such as advertising spend, seasonal changes, foot traffic in-store, and a recent change in the pricing model.

Using a multiple regression model, the store can predict how each variable impacts revenue. For instance:

- Increasing advertising spend by $1,000 may lead to a $3,000 rise in revenue.

- Seasonal trends might boost revenue by $5,000 during peak months.

- A 10% increase in foot traffic could raise revenue by $2,000.

Again no brownie points for putting the formula to use (simply use a forecasting tool). What’s important is that you learn to analyze the results that such regression models generate.

For example, if higher advertising spending doesn’t lead to increased revenue, the business must understand that its ads are either ineffective or they’re targeting the wrong audience.

Now, use these insights to make strategic decisions that will aid in achieving your revenue goals.

Pros

- Offers a deeper understanding of how dependent and independent variables interact

- Analyzes multiple factors influencing business metrics

- Provides more precise predictions than simpler models

Cons

- Requires large and accurate datasets

- Complex to interpret the results

- Assumes linear relationships and unbiased data

5. Delphi method: To reach a financial consensus

This is a type of qualitative forecasting method that uses expert opinions to predict future trends and outcomes.

Here the company hires multiple experts, each unknown to the other, to fill out a structured questionnaire about the future financial performance. These experts analyze the market conditions and share their individual insights based on their experience and knowledge.

After every round, the facilitator compiles a consolidated summary of the group’s responses and shares it with the participants. The expert then reviews and refine their input and adjust their forecasts if needed. This iterative process continues until the group reaches a consensus, resulting in a well-rounded and reliable forecast.

Businesses with limited historical financial data benefit from Delphi modeling. However, as this financial forecasting process continues for a series of rounds, it may take time to arrive at results.

Example of Delphi forecast:

A streaming platform plans to forecast subscriber growth for its new regional content. Experts in consumer behavior, regional culture, and digital marketing independently provide their predictions.

Through multiple feedback rounds, the experts align on strategies to attract 100,000 new subscribers in the first quarter, helping the platform plan content investment and marketing efforts.

Pros

- Combines unbiased insights from experts across different fields

- Effective when past data is unavailable

Cons

- Multiple rounds of feedback can take a significant amount of time

6. Market research method: To use consumer insights

The Market Research Method is a qualitative forecasting model that uses consumer feedback to predict future trends and business performance.

Here a company gathers direct insight from their consumers using surveys, interviews, focus groups, and questionnaires. This data helps businesses forecast revenue by identifying potential markets, understanding customer preferences, and uncovering gaps in their offerings.

The insights gathered from market research guide resource allocation, pricing strategies, and market expansion plans of the company.

Example of market research method

A local bakery surveys customers to understand the demand for a new vegan pastry line. Based on the feedback, they forecast a 20% increase in monthly sales if the line is launched.

With that, we have a round-up of 6 commonly used forecasting methods that can guide businesses to make confident financial decisions for future growth.

How to choose the right forecasting method?

Let’s now create a checklist that will help you choose the right forecasting method for your business.

1. Determine the objective of your forecast

As with anything you do, you need to understand the objective, i.e. what you want to gain from this forecast. It could be anything such as,

- Understand peak seasonal demand to optimize inventory

- Determining financial position to make strategic decisions about market entry, exit, and expansion

- Understanding revenue and cash flow situations to plan future hires

- Evaluating the impact of pricing strategies on revenue and profitability

- Gather short-term overview of business finances to plan for the upcoming quarter

- Supporting loan applications or credit approvals with accurate financial projections

When you have a clear objective, you can choose a method that can help you build financial projections for your startup.

2. Availability and nature of data

Now, assess the nature of financial data available to you. Use these parameters for evaluation:

- Seasonality: Does your data show seasonal fluctuations, or is it indicative of consistent growth patterns?

- Relationships: Is there a clear linear relationship between variables, such as advertising spend and sales?

- Volatility: Have there been significant market shifts or volatility in recent times?

- Relevance: Is the data specific to your industry or niche?

If your data indicates steady and predictable growth, methods like straight-line forecasting or moving averages may work well. However, for volatile markets with fluctuating data, more adaptive approaches like exponential smoothing or scenario analysis are better suited.

In the absence of data, qualitative methods can be your only option.

3. Simplicity of the method

Time-series methods (straight line & moving average) are much easier to use requiring no statistical or forecasting expertise. However, their accuracy compared to causal methods (simple linear and multiple linear) is quite low.

Casual methods, on the other hand, are difficult to use but much focused on accuracy.

That doesn’t mean you should always choose the causal method. If yours is a startup with minimum data and consistent growth, time-series methods are just fine for you.

4. Time-frame of the forecast

Again, time-series methods offer quick forecast insights while it takes time to calculate, interpret, and strategize the results of causal forecasting models. If you need quick short-term forecasts with limited data, place your bait on a straight line or moving average methods.

These factors give you a checklist to evaluate and measure your choices, helping you select the most suitable forecasting method for your business objectives.

Conclusion

Choosing the right forecasting method is just the first step. It’s a long process ahead building your projections, interpreting them, and using those insights to make strategic decisions.

No way should you be tackling all of this manually. With forecasting tools that can handle all the complex and repetitive tasks, your time is better spent analyzing the results and applying them to grow your business.

That’s exactly what Upmetrics is here to help with.

With its financial forecasting feature, you can test different scenarios, automate the calculations, and get visual reports highlighting key insights. It integrates with Xero and Quickbooks and assists you in preparing projections for up to 7 years.

So stop waiting. Build your projections and use its insights to strengthen the business’s financial health.