Planning your finances isn’t really exciting. You know what’s worse, though? Knowing that your company is losing money and not knowing where it all went. You can only avoid financial reality for so long until it catches up with you.

Wouldn’t it be nice to know what lies ahead and avoid the anxiety? With financial forecasting it is possible. You can plan resources, foresee costs, and make decisions.

Accountants vouch for it, investors adore it, and companies that genuinely wish to expand take it seriously. It’s time for a better strategy if you’re still making financial decisions by winging it.

In this blog, we have laid out all the information you need to know about financial forecasting and make smart business choices.

What is financial forecasting?

Financial forecasting is a financial planning process that involves estimating future revenue, expenses, and monetary flow of a company, based on its historical financial data, statistical models, and market research.

It’s the foundation for smart corporate budgeting, investment strategies, and risk management. By using forecasting, businesses can predict revenue, optimize financial statements, and prepare for projected fiscal period financial conditions, giving them the confidence to plan, grow, and navigate challenges effectively.

Investors love seeing strong financial projections, but ultimately, this is for you. Knowing how much money is coming in and going out means you can make better business decisions, avoid unnecessary risks, and keep your business stable, at least financially.

Understanding financial forecasting is step one, but how does it compare to financial modeling?

Financial forecasting vs. modeling

Financial forecasting predicts future revenue and expenses based on historical data, market analysis, and expected economic conditions, helping with budgeting and long-term financial planning.

On the other hand, financial modeling is the process of simulating various financial “what-if” scenarios to understand how specific decisions may impact projected fiscal period conditions, financial statements, and business performance. It evaluates the potential outcomes of strategies, investments, or operational changes.

So, now that you know what financial modeling and forecasting are, let’s clear up a common confusion—how is it different from the budgeting process? Before you start like they mean the same thing, let’s break it down properly.

Financial forecasting vs. budgeting

The budgeting process is about setting financial expectations and goals by creating a structured plan that outlines how a company intends to allocate its resources over a specific period, such as a fiscal year.

However, businesses conduct financial forecasting processes to analyze historical financial data, market trends, and economic conditions to estimate future financial outcomes.

The budgeting vs forecasting comparison is natural since they are important aspects of a financial plan. But why does forecasting even matter? Can’t businesses just roll with the punches? Well, not if they want to stay profitable.

Why do businesses need financial forecasting for planning?

Here’s why financial forecasting is a must for businesses:

Budgeting and resource allocation

Forecasting aligns your budgets with historical revenue data, so your company’s future financial outcomes aren’t hit with unnecessary cutbacks or overspending sprees.

Plus, incorporating cash flow forecasting helps you anticipate future expenses, manage revenue streams, and stay financially stable—even when the market throws you curveballs. A strong annual budget process also ensures that financial plans are realistic and adaptable.

Sets achievable financial goals

“Let’s double revenue this year!” Sure, it sounds great, but is it realistic? Financial forecasting ensures your goals are SMART (Specific, Measurable, Achievable, Relevant, Time-bound). By analyzing market trends and income statements, you can set goals that actually match what’s possible.

And when things don’t go as planned, tracking financial performance against forecasts lets you adjust strategies before small issues become big problems.

Helps navigate capital risks

Financial risks are a given, but they don’t have to catch you off guard. Forecasting lets you identify potential risks like economic downturns or business cycles before they happen.

Running scenario analyses will help you stay ready whether the market booms or busts. The better your forecast, the fewer unpleasant financial surprises.

Supports business expansion and investments

Market dips, unexpected future expenses, or financial setbacks—these things happen. A strong financial forecasting process prepares businesses to adjust before expected financial conditions deteriorate.

Companies that analyze three financial statements—the balance sheet, income statement, and cash flow statement—can determine whether they have the funds to scale operations, expand production cycles, or invest in new products.

Improves investor and stakeholder trust

Investors don’t fund businesses based on your enthusiasm. They like data-driven insights. More importantly, they like accurate forecasts and risk assessments.

Clear financial statements, accurate projections, and well-thought-out risk evaluations make them feel confident about backing you. Businesses that leverage pro forma financial statements and address financial forecasting FAQs are far more likely to secure investments.

Knowing why financial forecasting is important is only half the battle. Choosing the right forecasting method for your business is the other half.

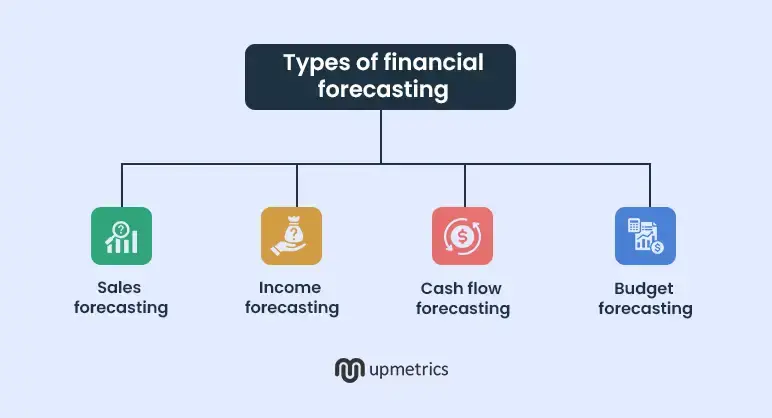

Types of financial forecasting you must know

No single financial forecasting type works for everything, which is why companies use hybrid forecasting techniques to stay on top of their financial statements. By analyzing historical data, market conditions, and statistical data, businesses can develop forecasts that align with their future growth goals.

Here’s a breakdown of the most common forecasting approaches.

1) Sales forecasting

Sales forecasting methodologies help businesses predict how many products or services they will sell in a given period. It ensures that hiring, inventory management, and marketing budgets are aligned with realistic revenue expectations. Finance teams rely on it for budgeting, sales teams use it to set SMART goals, and management teams depend on it for strategic planning.

A well-structured sales forecasting model considers independent and dependent variables, demographic trends, and consumer behavior to anticipate fluctuations in demand and revenue cycles.

Companies that forecast properly stay prepared for market changes and seasonal variations. When revenue projections are inaccurate, everything from payroll expenses to operational budgets is thrown into confusion.

2) Income forecasting

Income forecasting predicts how much revenue a company will generate before making future spending decisions. It ensures businesses budget wisely, avoid monetary flow shortages, and make data-driven hiring or investment decisions.

Beyond analyzing previous sales data, companies assess business capacity, competitive landscape, and relevant economic conditions to set realistic business goals.

Since gross profit, cash flow forecasts, and pro forma statements depend on accurate revenue estimates, advanced financial forecasting software helps businesses track variance analysis, fiscal environment changes, and financial performance trends to stay ahead.

3) Cash flow forecasting

It predicts how much money a business will have in the next 30, 60, or 90 days, ensuring liquidity and financial stability. Companies use cash flow statements to track immediate funding needs, projected financial conditions, and future costs.

Without this, unexpected expenses can lead to last-minute budget cuts and financial stress. Businesses that conduct knowledge-based forecasting for planning production cycles, debt reduction strategies, and operating costs avoid cash shortages and ensure smarter financial choices.

A strong cash flow financial forecasting model enables businesses to remain financially stable and proactive rather than scrambling to react when money runs low..

4) Budget forecasting

Budget forecasting predicts what a budget will achieve if all planned financial activities go as expected. It ensures that companies align spending with realistic business goals, measure financial accomplishments, and adjust budgets accordingly.

Since budget forecasting plays a significant role in variance analysis and financial decision-making, businesses use it to assess resource allocation, set financial priorities, and evaluate pro forma statements before finalizing long-term budgeting plans.

A well-structured annual budget process also ensures that financial goals align with the company’s fiscal year objectives.

Without it, businesses risk making costly financial miscalculations that could affect forecasts and disrupt business stability.

Alright, so you now know the different types of financial forecasting, but how do you actually apply them? Especially if you’re running a startup where revenue is unpredictable? Let’s find out.

How to predict revenue for your startup?

Budgeting for a startup is important, but so is knowing what’s financially realistic and sustainable. Financial forecasting helps businesses identify trends and risks, plan for future income, and maintain financial stability.

Start by defining your revenue streams by asking a few key questions:

- What are you selling?

- How much do you expect to sell?

- What will be the price of each product/service?

- What will be your total revenue when you multiply the estimated sales volume by the price?

- How much does it cost to produce and sell each product or service?

- What are the total costs when you multiply COGS with the expected sales volume?

- How much profit will you make when you subtract total costs from total revenue?

Estimating this helps set clear sales projections and ensures that your balance sheet reflects realistic expectations. If you’re barely breaking even, it’s time to adjust. Maybe your pricing needs tweaking, or you need to cut unnecessary expenses.

Don’t forget about external factors. Competition, customer demand, market conditions, and seasonal trends impact sales numbers and revenue streams.

Financial forecasting isn’t about being right 100% of the time—it’s about making informed decisions. Keep adjusting as new financial data comes in, and you’ll save yourself from avoidable financial surprises while keeping your business performance and long-term growth on track.

There are structured financial forecasting methods, and each serves a different purpose. Let’s break them down.

What are different methods of financial forecasting?

Picking the right financial forecasting method is the difference between guessing and making smart financial decisions.

1. Quantitative Forecasting

This method uses historical trends, sales data, and financial reports to make structured, numbers-driven predictions. It’s great for businesses with consistent revenue and growth patterns.

Popular ones include:

- Percent of sales model: Assumes costs scale with revenue, providing an easy financial projection.

- Straight line forecasting: Uses past growth rates to predict future performance.

- Moving average Applies averages or weighted calculations to recent sales data for short-term projections.

- Simple linear regression: Uses one key factor (like ad spend) to predict revenue outcomes.

- Multiple linear regression: Considers several financial variables to create detailed revenue projections.

2. Qualitative Forecasting

This approach is ideal for startups, new product launches, or unpredictable markets where past financial data doesn’t help. It relies on industry knowledge, expert opinions, and market analysis.

Some common ones include:

- Industry expert analysis: Combines insights from professionals to develop a realistic market outlook.

- Market surveys: Collects direct feedback from target customers to predict demand and guide pricing strategies.

You now know different financial forecasting methods and how each of them works, but are you still planning to do it all manually? The right financial forecasting tools can automate the process, improve accuracy, and save you hours of work. Let’s look at the best tools to help you forecast smarter.

Best AI-powered financial forecasting tools you need

If your forecasting method involves gut feelings and a bit of luck, it’s time for an upgrade. A financial forecasting tool takes the uncertainty out of the equation, using historical data, market conditions, and advanced analytics to predict revenue, expenses, and cash flow.

Instead of manually calculating spreadsheets, these tools provide real-time insights, automate calculations, and prevent you from making expensive financial projection mistakes.

The right financial forecasting tools take data, trends, and actual logic to help you plan smarter. Here are two that actually work (and won’t make you regret every financial decision).

Upmetrics

Upmetrics is a modern business and financial planning software that helps entrepreneurs create winning business plans and correct forecasts. With AI-powered tools, seamless integrations, and automated financial insights, it simplifies forecasting, budgeting, and strategic planning.

Some of the key features of Upmetrics include:

- AI business plan generator

- Financial forecasting

- AI financial assist

- QuickBooks and Xero integration

- AI pitch deck generator

- Strategic planning

Forecastia

Forecastia is one of the leading financial forecasting software that helps businesses create accurate, AI-driven projections without spreadsheets, formulas, or endless manual updates. Whether you’re planning next quarter’s budget or tracking actual performance, Forecastia gives you real-time insights to help your business grow smarter.

Here is what you get with Forecastia:

- Financial forecasting

- Sales forecasting

- Actual vs. forecast analysis

- QuickBooks and Xero integration

Start preparing your financial forecast

Sure, investors love a solid financial forecast, but you know who needs it even more? You. A forecast is a realistic roadmap for your startup. Whether it’s big-picture estimates or detailed number crunching, the key is making it work for your business.

However, the manual forecasting process can be a nightmare. An AI-powered financial forecasting software automates projections, tracks market trends, and updates forecasts in real time so you don’t have to burn your brain in spreadsheets.