You need funding for your business. The question is: Do you borrow it and pay it back, or bring in someone who owns part of your business? That’s the core idea of debt vs equity financing.

One puts pressure on your bank account, and the other puts people in your business.

Both give you money. Both expect something in return. And both options sound fine when explained by someone who doesn’t have anything on the line.

The best choice depends on what you’re more comfortable giving up. In this blog, we’re going to make the decision way easier. Let us first explain what both of them are.

What is debt financing?

Debt financing means borrowing money for your business and agreeing to repay it over time, usually with interest. It’s a way to secure funding loans for your business, whether for covering expenses, buying equipment, or expanding, without giving up any ownership.

The money often comes from banks, SBA programs, online lenders, or even business credit cards. Since you’re not giving away equity, you stay in full control of your company.

But repayment is non-negotiable. Fixed payments kick in whether business is booming or slow, so this option works best when your cash flow is steady and predictable.

What is equity financing?

Equity financing means raising money by offering a share of your business to investors. Instead of taking out a loan, you sell part of your ownership in exchange for capital. There’s no repayment schedule or interest, but you do give up a slice of control and future profits.

It’s common among fast-growing startups that need large funding and don’t have steady revenue yet.

Typical sources include angel investors, venture capital firms, and even equity crowdfunding. Since investors now have a stake, they’ll expect updates, influence, and a return when your business grows or eventually exits.

Equity financing is common among fast-growing startups that need large funding and don’t have steady revenue yet. A classic example is Facebook’s early growth. That was fueled by multiple rounds of equity funding from venture capitalists and angel investors.

So far, that was the theory. Let’s break down how debt and equity stack up where the decisions get real.

Debt vs. equity financing at a glance

Debt and equity are key startup financing or funding options, but the cost, control, and expectations look completely different. Before picking a side, it helps to see the tradeoffs in one place.

| Factor | Debt Financing | Equity Financing |

|---|---|---|

| Ownership & Control | You keep full ownership. Lenders don’t get a say in how you run the business. | You give up a portion of ownership. Investors usually want a say in big decisions. |

| Repayment Obligation | Yes. You repay the loan with interest, usually on a fixed schedule. | No scheduled repayments. Investors get paid if the business does well. |

| Cash Flow Impact | Fixed payments can strain cash flow, especially during slower months. | No regular payouts, so you can reinvest more into the business early on. |

| Cost of Capital | You owe principal + interest. Interest may be tax-deductible. | You share future profits. If you grow big, equity can end up costing a lot more. |

| Time Commitment | Ends when the loan is fully paid off. | No fixed end. Investors stay on unless they sell their shares or get bought out. |

| Involvement Level | Minimal. Lenders care about payments, not how you operate. | High. Investors often expect updates, influence, and a return on their money. |

So far, it all looks neat. But funding choices rarely stay neat once they play out. Let’s see how each option holds up when real business pressure kicks in.

Pros and cons: Debt vs. Equity financing

Understanding the tradeoffs in debt financing vs equity financing is the only way to make an informed decision. We’ll dig into how each option plays out, starting with debt financing and then covering equity financing. These aren’t pros and cons written to sound clever. They’re written to help you actually decide.

Debt financing

| Pros | Cons |

|---|---|

| You keep full ownership and control | Repayments are due regardless of profits |

| Once repaid, all profits are yours | Loan interest can get expensive |

| On-time payments build business credit | Cash flow takes a hit from regular payments |

| Interest is usually tax-deductible | Some loans require personal guarantees or collateral |

Equity financing

| Pros | Cons |

|---|---|

| No monthly repayments, so less pressure early on | You give up ownership and control over time |

| More cash available for hiring and growth | Investors share long-term profits |

| Investors often offer bigger checks than banks | Major decisions may need investor approval |

| Strategic support: advice, intros, and experience | Fundraising takes time and focus away from operations |

The pros and cons paint a clear picture, but choosing comes down to your goals, risk tolerance, and stage. Let’s look at how to decide between the two.

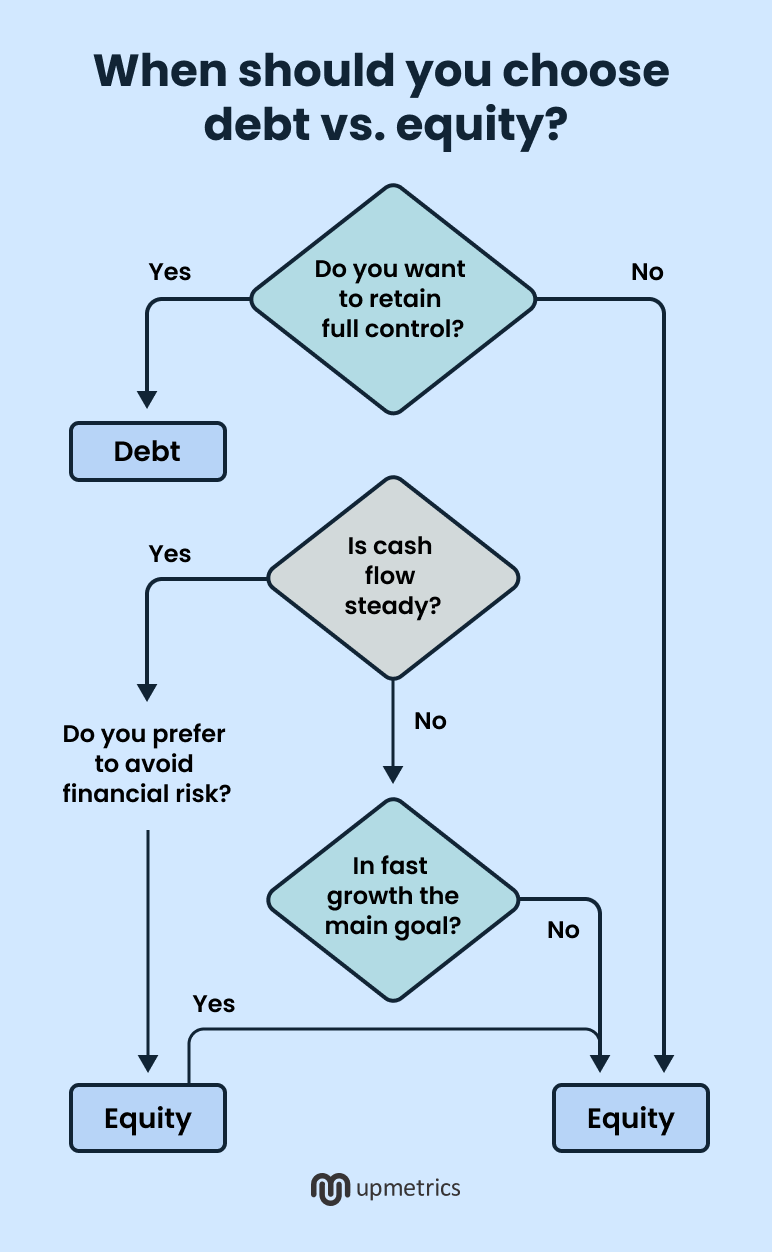

When should you choose debt vs. equity?

Maybe one option already stands out. Still, it’s smart to pause and ask:

Does it really fit the stage, the plan, and the weight this business can carry right now?

Here’s where each path tends to work best.

Debt financing is ideal if…

- You want full decision-making power with no investors weighing in or taking equity.

- The business brings in enough predictable income to handle repayments without strain.

- You’re covering a specific, time-bound need like inventory, equipment, or a working capital gap.

- You have strong credit, solid revenue, or assets to secure a loan with fair terms.

- You’d rather pay fixed interest now than give up future profits or ownership later.

- You need funds fast and don’t have months to pitch, negotiate, and close equity deals.

Equity financing is ideal if…

- You can’t afford loan repayments right now and need funding without monthly pressure.

- You’re raising more than banks will lend, and fast growth demands deep pockets.

- You don’t want to carry the downside alone if the business fails, with repayments owed.

- You value mentorship, strategy, and investor networks, and a sharp business plan for investors can help open those doors.

- You need time to build without debt, draining your operating cash every month.

- You’re okay trading some ownership for growth, and your plan includes future exit or scale.

Key factors to consider when choosing debt vs. equity financing

Before you make any funding decision, zoom out. The smart move is to match the funding to your stage, revenue, and pressure tolerance. These factors will help:

1. Stage of business

Is your business pre-revenue, just launched, or gearing up for growth? Equity usually makes more sense early on when cash is tight, and you’re investing ahead of revenue. Debt often suits more mature businesses that can show income, profits, or assets lenders want to see.

2. Revenue consistency

Do your financial projections show enough cash coming in to cover fixed monthly payments? If income keeps changing wildly or you’re still building a customer base, debt may stretch you too thin. Equity frees up your cash to reinvest while you grow.

3. Risk appetite

Are you comfortable betting on future earnings or sharing upside to reduce pressure now? Debt means risk sits squarely on your shoulders, so missed payments can hurt. Equity spreads risk but comes at the cost of shared ownership and future profits.

4. Control preferences

Is staying in full control important to you, or are you open to shared decision-making? Loans let you call every shot. Equity brings partners who may want a say in strategy, spending, or hiring. That can be helpful or frustrating, depending on your leadership style.

5. Vision for the business

Is this a fast-growth, investor-backed rocket ship or a lean company you want to run long-term? If you plan to scale quickly and eventually exit, equity capital and investor networks can help. If you’re going to stay private, debt may give you growth without the strings.

Still unsure about equity vs debt financing? Honestly, sometimes the best funding strategy isn’t either-or; it’s a smart mix. If debt feels too risky and equity too expensive, there’s a middle ground worth exploring.

Confused? Consider hybrid financing options

Choosing between debt and equity doesn’t have to be all or nothing. Hybrid models offer softer landings for founders who want funding without extremes.

A handful of hybrid funding tools offer flexibility without locking you into a rigid loan or giving up control too soon. That’s exactly what early-stage founders need.

Convertible Notes

This is a short-term loan that might turn into equity down the line. You raise money now, defer the hassle of deciding what your company is worth, and convert the debt into shares during your next funding round, usually at a discount.

You don’t give investors any shares right now, so they don’t own part of your business today. But later, if your business grows and raises more money, the loan they gave you (the convertible note) can turn into equity. That gives them a share of your success without needing ownership from day one.

In its early stages, Uber raised $1.6 million through a convertible note in 2010. This strategic move allowed the company to expand rapidly and revolutionize the transportation industry.

SAFE Agreements (Simple Agreement for Future Equity)

Popular among startups, a SAFE gives investors the right to receive equity later without interest or repayment schedules. It’s not a loan, and it’s not a traditional equity sale.

You don’t owe anything monthly, but the investor still gets a stake once you raise your next big round. It’s fast, founder-friendly, and avoids early valuation fights.

Revenue-based Financing

Instead of fixed monthly payments, this model lets you repay a percentage of your actual revenue. The more you earn, the more you pay. If business is slow, payments drop. There’s no rigid schedule and no pressure to hit a set number every month. That makes it less risky for companies with uneven cash flow.

It also doesn’t involve giving up equity. You keep full ownership while still accessing capital. Lenders get repaid based on your performance, not a deadline. It’s a good fit for companies that expect revenue but want to avoid both the pressure of debt and the dilution of equity.

Each of these sits in the middle ground. If debt feels too rigid and equity feels too permanent, hybrid financing gives you room to breathe and raise capital on terms that match your growth.

The bottom line

Equity financing vs debt financing is one of the first decisions founders face when raising capital.

If you’re leaning toward debt financing, make sure your business plan stands up to lender scrutiny. Upmetrics can help with full SBA loan assistance, complete with lender-approved templates, step-by-step guidance, and financial forecasting that makes your plan bank-ready.

If you prefer equity instead, you’ll need a sharp pitch deck that shows investors you mean business. Our AI-powered Pitch Deck Creator helps you build one fast, with smart prompts and clean slides that do the talking.

No matter which funding path you choose, preparation is important. Upmetrics gives you the tools to prepare, impress, and raise capital with confidence. Let’s get you funded.

Say goodbye to old-school Excel and spreadsheets

Make realistic financial projections in minutes!

Plans starting from $14/month