I’ve never pitched to investors myself. But after helping hundreds of founders prepare their decks, rehearse their story, and face real investor questions, I’ve figured out the difference between a pitch that ends the meeting and one that gets you a second call.

One founder I worked with thought they nailed it. Then an investor said, “I don’t get what makes this different,” and passed. That stung… but it turned into the best feedback they ever got.

Since then, I’ve built a simple rule: Never pitch without outside feedback. Not from people who nod politely, but those who ask the hard stuff: “Why you?” “Why now?” “What’s missing?” That kind of feedback reshapes how you pitch.

Today, I’ll walk you through exactly how I’ve helped founders get better feedback—who to ask, what to listen for, and how to decide what to fix or ignore.

Why get feedback on your pitch in the first place?

Because you’re too close to it.

You already know what you’re trying to say, so your brain fills in the gaps, but investors’ brains won’t. So you need outside eyes to spot what’s unclear, what’s dragging, and what doesn’t hit. Without that, you risk walking into meetings with false confidence and walking out with polite rejections.

Good feedback helps you stress-test your story, tighten your logic, and figure out what people actually hear, not just what you meant to say. That clarity makes a real difference when your money’s on the line.

But not all feedback helps. How you ask for it matters just as much as who you ask.

The right approach to getting feedback on your business pitch

Early on, the founders I worked with thought getting feedback meant showing their pitch to everyone they knew. They assumed that more feedback automatically means better feedback.

It doesn’t.

I’ve watched many of them waste weeks chasing random opinions from people who didn’t understand their market, their model, or their vision. All that scattered input just created more confusion and second-guessing.

What actually moves pitches forward is strategic focus: asking fewer people, but asking the right ones. The founders who make real progress are those who get selective about their feedback sources and intentional about what they’re testing.

Let me break it down.

1. Identify the right people to give you feedback

If you ask ten random people for pitch feedback, you’ll get ten random opinions and probably end up more confused than when you started.

What actually works is asking a few people who know how pitches are judged and who’ve either been in the room or pitched in it.

Here’s who I recommend starting with:

- Expert pitch consultants review decks daily and quickly spot what investors will question.

- Mentors who’ve raised capital understand what a fundable pitch looks like because they’ve done it themselves.

- Early-stage investors you trust bring the investor lens and won’t sugarcoat what needs fixing.

- Founders who’ve already raised are close to the process and know what catches attention and what doesn’t.

- Accelerator or incubator coaches see dozens of pitches a week and know what stands out.

If you’re thinking about asking friends or family, keep expectations realistic. Unless they’ve built or backed companies themselves, their feedback often leans polite or generic.

Don’t let conflicting feedback derail your business pitch

Talk to the experts and get real feedback on your pitch

2. Get feedback on both your business pitch and pitch deck

Founders often obsess over their delivery, running mock pitches, practicing their timing, or trimming the script. But when feedback rolls in, it’s rarely about what they said. It’s about the deck.

In reality, the pitch and the deck aren’t separate. They’re two versions of the same story: One spoken and one shown. If the narrative makes sense in your head but falls apart on your slides, it won’t land.

Your pitch deck has to work on its own. An investor should be able to flip through it without you in the room and still understand:

- What you’re building

- Why it matters

- How the numbers hold up

If your slides contradict your business plan or skip what you’re explaining out loud, you lose clarity. And confusion kills momentum.

Most founders overdo pitch prep and underinvest in fixing weak slides. That’s a mistake. If you want to avoid common pitfalls, here’s a breakdown of pitch deck mistakes founders often overlook.

Ditch your old-school pitch deck creation methods

Make compelling pitch decks in minutes with AI

Plans starting from $14/month

3. Choose the right format for review

The way you ask for feedback shapes the kind of feedback you get. Founders don’t realize this until they start pitching in front of real people who aren’t afraid to be blunt.

A group of founders watching you pitch in real-time gives you different insights than someone reviewing your deck quietly over email. Both are useful, but for different reasons.

Here’s what you should use and what each one actually helps with:

Live pitch sessions

It includes startup meetups, founder dinners, or demo days. These help you read the room. You’ll know when people tune out, what makes them nod, and when confusion creeps in.

One-on-one mentor reviews

This is where people get the most useful, blunt feedback. This format always exposes what group sessions don’t, such as misaligned messaging, weak transitions, and slides that confuse instead of clarify.

Recorded pitches sent by email

Asynchronous reviews work best when you record a short Loom and include clear notes on what you want to be reviewed. Specific direction always leads to sharper feedback.

Mock decks posted online

People post their pitch deck on r/startups and the YC forums to get unbiased input from people with no reason to sugarcoat anything. The feedback is usually blunt, often critical, and exactly what they need.

Each one will give you a different lens. Some reveal delivery issues; others expose gaps in logic or flow. The biggest shift happens when you stop treating feedback as a checkbox and start using it to actively rebuild what wasn’t working.

4. Questions to ask when requesting feedback

When founders start asking for feedback, they’d send their deck and say, “Let me know what you think.” Here’s what you need to know: Vague asks lead to vague replies.

The people reviewing your pitch are busy, and unless you guide their attention, they’ll either respond with surface-level reactions or focus on things that aren’t important.

Over time, I have built a short list of questions that get can actually get you useful, actionable input:

- Did the problem and solution feel clear right away, or did it take effort to understand?

- At what point did your attention dip, or did the story lose momentum?

- Was the business model simple to grasp, or did it raise questions?

- Did the funding ask feel realistic based on the rest of the pitch?

- Which slide or section felt weakest, and why?

- What was missing that you expected to see?

- Did the tone and structure build confidence or create doubt?

- Would this pitch make you want to learn more or pass?

Once you’ve worked through feedback, sharpen your delivery with this guide on how to pitch to investors.

Never send all of these at once. Pick three, depending on what you’re trying to improve. That focus makes it easier for the reviewer to respond and easier for you to act on what they say.

5. Share your pitch for public feedback

The clean version of your pitch won’t survive the internet if it’s full of fluff. Public feedback forces clarity because no one there cares about sparing your ego. That kind of input is uncomfortable, but it’s valuable, especially when patterns start to repeat.

Here are a few places I’ve found useful:

YC Startup School

You can share your deck with a community of founders and mentors at YC Startup School. The feedback tends to be fast, practical, and focused on investor expectations.

Reddit – r/startups

Feedback on r/startups isn’t filtered, and that’s the point. If your pitch is unclear, someone will say it. So before posting, tighten your deck and be direct about what kind of feedback you’re looking for. Otherwise, you’ll get comments on things you weren’t trying to test.

IndieHackers

People have posted to IndieHackers when they needed feedback from people who think like builders, not investors. The responses are about whether the product makes sense, whether the business can survive, and whether you’re solving something real.

LinkedIn startup communities

Post in relevant groups or message experienced founders you trust. Keep it short, share context, and ask for specific feedback. Responses can vary, but when they hit, they hit.

Before posting publicly, remove anything sensitive (IP, exact projections, personal emails). Then focus on the ask: Highlight what you want reviewed and what kind of feedback you’re ready for.

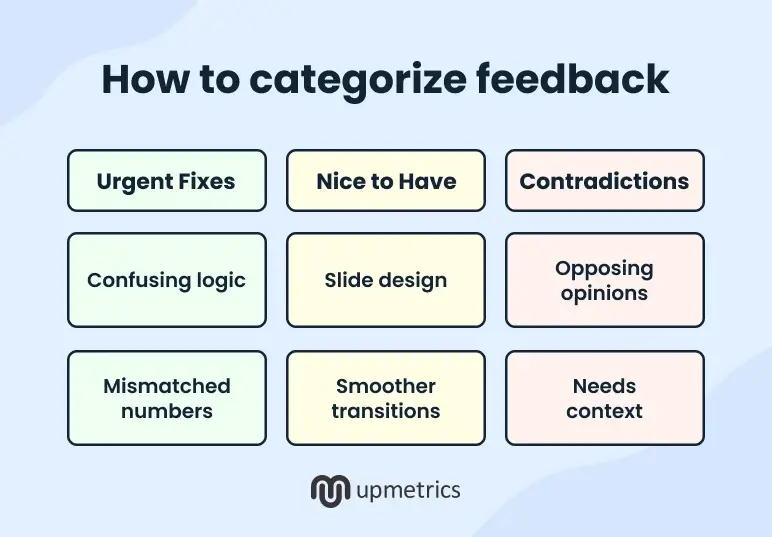

6. Analyze and categorize the feedback

The biggest mistake founders make early on is trying to apply every piece of feedback they get. It slows them down and dilutes the pitch. What actually helps is sorting feedback into buckets and then deciding what was worth acting on and what could wait.

Here’s how you should break it down now:

- Urgent fixes: Anything that makes the pitch confusing or unreliable, such as mismatched numbers, unclear financials, unrealistic traction, or a poorly defined target market.

- Nice to have: Suggestions that improve delivery or design, like cleaner visuals, tighter language, or better slide flow, but don’t change how the pitch is understood.

- Contradictions: Feedback that points in opposite directions, which should be reviewed by looking at who gave it, what context they bring, and whether it actually fits your pitch.

The point of feedback isn’t universal approval. It’s clarity. Cut what weakens the pitch, protect what defines it, and move on.

7. Effectively incorporating the feedback

Sorting feedback is only the start. And one of the most common mistakes founders do is treating every comment like a task on a checklist. That kills clarity.

You don’t have to act on everything. Some feedback reveals confusion while some reflects personal preference. The real skill is knowing the difference. Spot the comments that point to a deeper issue.

A good pitch doesn’t try to please everyone. It gets sharper, more logical, and harder to question. That only happens when you revise with intention.

Here’s a workflow that might help:

- Group similar suggestions: Collect repeated comments on the same issue and treat them as clear signals that something needs to change.

- Prioritize based on impact: Address feedback that affects trust, clarity, or logic before making cosmetic or stylistic adjustments.

- Apply changes in focused rounds: Tackle one category of fixes at a time to avoid overcorrecting or introducing new inconsistencies.

- Test subjective feedback with variations: Create A/B versions of slides or taglines when opinions differ, and review both with fresh eyes to see what lands better.

The goal is to build a pitch that holds up under pressure, tells a clear story, and makes investors take you seriously.

Need additional help?

When founders I work with are deep in their pitch, one week, their story makes sense, and the next, it doesn’t. They revise the slides, tweak the numbers, cut a section, and then bring it back. And honestly, they often don’t know what they’re doing wrong.

That’s exactly why they should start using Upmetrics for the business founders. Instead of the endless cycle of confusion and revision, it provides a clear, focused set of tools and services that make the process less overwhelming.

The AI pitch deck creator generates a pitch that actually makes sense fast. More importantly, the structure helps connect the pitch to the business plan, so everything tells one clear story. Along the way, the guidance surfaces mistakes one usually wouldn’t catch on their own.

And when you need more support, holistic business planning services are always there.