While competition is a driving force behind innovation and trends, simply acknowledging competition isn’t enough.

Understanding your competition is essential to establish your competitive advantage in the market.

A thorough competitive analysis steps in to help you make an informed strategic decision. However, to conduct an effective analysis you need a competitive analysis framework that allows you to access all the competitive information you need in one place.

However, what is it and what are the different available frameworks to conduct competitors’ analysis? Let’s understand that in this blog post.

What is a competitor’s analysis framework?

A competitor analysis framework is a structured approach used to evaluate the strengths, weaknesses, and strategies of competitors within a specific industry. It enables businesses to develop effective strategies by helping them understand their market position and the opportunities available to them.

Some of the popular frameworks for competitor analysis include SWOT Analysis, Porter’s Five Forces, Growth-Share Matrix, Perceptual Mapping, and Strategic Group Analysis—each offering unique insights into the competitive dynamics of a business.

5 competitive analysis framework for your business

Let’s now understand the 5 prominent analysis methods, the steps to perform those and their benefits.

1. SWOT analysis

This is the first of 5 five frameworks of competitive analysis. It is the easiest and most used framework for competitive analysis. It is suitable for businesses of all sizes including small, medium, and large companies.

SWOT analysis stands for Strengths, Weaknesses, Opportunities, and Threats. It is a strategic planning technique that gives you an idea about your strengths, weaknesses, opportunities, and threats in your business. This framework can be applied to evaluate various aspects of a business, including product/service offerings, sales and marketing strategies, target audiences, and overall market positioning.

When to perform SWOT analysis?

- Before developing a new strategy

- During the making of quarterly performance reports

- While making the business plan for the next quarter/ year

- While assessing your strengths, weaknesses, opportunities, and risk

Want to create a SWOT Analysis for your Business?

Craft a powerful SWOT Analysis in just minutes using our user-friendly and free online SWOT Analysis Generator Tool!

How to perform a SWOT analysis?

- Divide your document into 4 parts and put Strengths, Weaknesses, Opportunities, and Threats in each section.

- At the top of the document, add the parameter for which you’re performing a SWOT analysis. For eg: If you want to perform a SWOT for marketing, put marketing in the title bar. By doing so, you perform this analysis with complete clarity.

- In the section for the strength, note down all your strengths.

- In the section on weaknesses, note down all your weaknesses.

- In the section on opportunities, note down all your opportunities.

- In the section on threats, note down all your threats.

- Repeat this process for all your competitors.

- Analyze your business against theirs in all areas.

Benefits of performing a SWOT analysis

- You get a clear idea about the market position of your business.

- You can use this technique to develop and know your USPs

- You become aware of specific areas where your business is lacking.

- This technique encourages creative thinking helping you come up with new groundbreaking strategies

- You know where your competitors are lagging behind you. So, you can leverage those parts to move ahead.

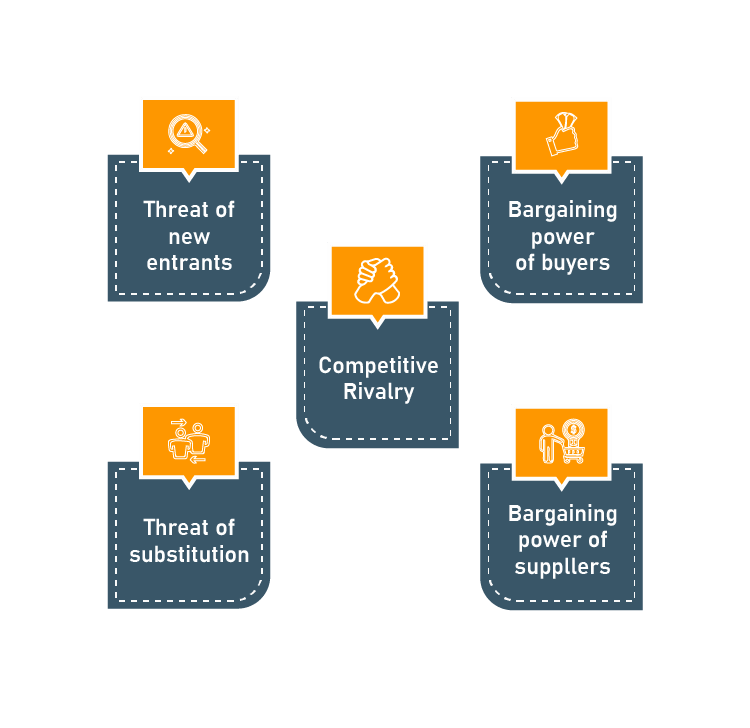

2. Porter’s five forces

The second in the line for the 5 frameworks of a competitive analysis is Porter’s Five Forces. It helps you map competitors and identify your position in the business environment. This can help you understand the strength of your organization’s current and potential competitive position.

Porter’s five forces is a group of analyses wherein you study five different factors:

- Competitive rivalry

- Supplier power

- Buyer power

- Threat of substitution

- Threat of new entry

When to perform porter’s five forces?

- When you want to keep a close watch on your rivals.

- When you want to maximize your profitability.

- For a complete knowledge of the environment and industry.

- To make new business strategies.

- To understand whether new products or services are potentially profitable.

- To identify weaknesses and avoid costly mistakes

How to perform porter’s five forces?

- Draw a circle in the center and extend four arrows from it.

- Put the name and details of rival’s company in the center.

- Now, label the 4 extending arrows as a threat of the new entry, the threat of substitution, the supplier power, and the buyer power respectively.

- Add the details for the comparison under each category based on your research.

- Analyze the information to evaluate your competitive landscape.

Terminology

- Competitive Rivalry: Your competition and their strategies.

- Bargaining Power of Suppliers: The ability of suppliers to drive up the prices of your inputs.

- Bargaining Power of Buyers: The strength of your customers to drive down your prices.

- The Threat of New Entry: The ease with which new competitors can enter the market.

- The Threat of New Substitution: The extent to which different products and services can fulfill the same need as your offerings.

Benefits of porter’s five forces

- Helps you adjust the ongoing business strategies based on competitive pressures.

- Helps you pay attention to the all-round development of your business.

3. Strategic group analysis

Strategic Group Analysis examines players’ positions in a competitive environment. It looks after the underlying factors that affect a company’s profitability and the competitive dynamics of the industry. This framework categorizes companies into strategic groups based on shared characteristics that affect their market behavior and performance.

These dimensions differentiate players into strategic groups and must be chosen considering industry structure, profitability factors, and the project issues being addressed.

When to use strategic group analysis?

- This framework is usually used to analyze sales and marketing strategies.

- To assess your target audience and understand market segments better.

- You can also use this technique when you want to compare your profit margin to theirs.

How to perform strategic group analysis?

- Establish your value proportion by clearly defining your product and service.

- Define your target market outlining specific segments you wish to serve.

- Define your key metrics that will help you measure your performance against competitors.

- Verify your revenue streams and the effectiveness of these channels.

- Accordingly, find your competitors who target the same strategic group.

- Approach your analysis with objectivity and based on real data.

- Evaluate the results to draw meaningful conclusions about your strategic positioning.

Benefits of strategic group analysis

- It helps you make long-term strategic decisions that align with market realities and competitive pressures.

- It helps you to stay aligned with the companies that implement the same business strategies as you.

- Identifies and eliminates competitors that may not be relevant to your strategy, allowing for more focused competitive efforts

4. Growth-Share matrix

The growth-share matrix is an analysis framework that you can use to manage portfolios.

Growth-Share matrix is a table, split into four quadrants, each with its own unique symbol that represents a certain degree of profitability:

- Question marks: High growth and low market share

- Stars: high growth and high market share

- Pets (often represented by a dog): Low growth and high market share

- Cash cows: Low growth and low market share

By assigning each business to one of these four categories, executives can decide where to focus their resources and capital to generate the most value, as well as where to cut their losses.

When to use the Growth-Share matrix?

- To prioritize your action plan based on your current position and market situation.

- To optime the use of capital and resources.

- When you want to have a detailed idea of your and your competitors’ strength and weaknesses.

How to perform Growth-Share matrix?

- Divide your document into four quadrants.

- Put one symbol in each quadrant. Quadrant one: Pet, Quadrant two: cash flow, Quadrant three: Star, Quadrant four: Question Mark

- Put the details in the graphs.

- Pick your competitors’ data and prepare a similar portfolio for comparison.

- Analyze the results to make informed decisions regarding your portfolio.

Benefits of Growth-Share matrix

- It gives you a birds-eye view of your product/service performance, opportunities, and threats.

- Allow optimal allocation of your resources ensuring that investments are made in areas with the highest potential for return.

- Helps analyze your strengths and weaknesses allowing you to strategically position your offerings against competitors.

5. Perceptual mapping

In this framework of competitor analysis, you can figure out where your brand, product, and services stand among competitors. This framework is also known as positional mapping.

It generally consists of two attributes (i.e. price and quality) and requires input from the customer/client to be effective. This visualization helps businesses identify gaps in the market and understand consumer preferences.

When to use perceptual mapping?

- When you want to understand your product/service from the customer’s point of view.

How to perform perceptual mapping?

- Figure out any two attributes you want to compare (i.e. price and quality)

- Gather customers’/clients’ feedback on those attributes

- Research competitors within your industry who are positioned similarly.

- Look out for their customers’/clients’ feedback on their product/services

- Plot the data on a two-dimensional graph to visualize your position relative to competitors and identify market gaps.

Benefits of perceptual mapping

- Helps understand your customer’s expectations and tailor your services accordingly.

- Provides a clear view of your market position from the customer’s perspective.

These are just prominent competitor analysis frameworks we discussed. However, there are many more that businesses can take advantage of to analyze their competition.

Conclusion

Now, choose the frameworks more suited for your business and use them to build your competitive advantage in the market.

Incorporating competitive analysis frameworks into your strategic planning is essential for navigating today’s business environment. These frameworks not only help you understand where you stand in the market but also highlight opportunities for growth and improvement.

By staying informed and adaptable, you can respond effectively to market dynamics.

Now, remember competitor analysis is just a part of broad business planning aspects. For your business to thrive, in-depth business, financial, and strategic planning is essential. With the Upmetrics business planning app, you can streamline this process, ensuring that you have the tools and insights necessary for comprehensive planning and success.