A business owner might see $50,000 in monthly sales and think, “We’re crushing it.” But once rent, payroll, taxes, loan repayments, and those sneaky hidden costs pile in, that number can shrink fast, sometimes to just a fraction of what you expected.

In fact, small businesses typically see net margins of only 7–10%, which means most of that top-line revenue never makes it to your pocket.

That’s why it’s important to separate revenue, gross income, and net income. However, net income isn’t calculated the same way for everyone.

A freelancer, an e-commerce store, and a growing startup all have different factors eating into their bottom line.

In this blog, we’ll break down exactly how to calculate your net income in different situations.

What is net income?

Net income (NI), also called net earnings or the “bottom line,” is what remains after subtracting all expenses (operating costs, interest, taxes, and other deductions) from total revenue. It’s the clearest signal of whether a business is truly profitable and how efficiently it converts sales into real profit.

For investors, lenders, and business owners, this figure is important because it shows what’s actually available to reinvest, distribute, or save.

And while it’s often confused with cash flow, gross profit, or even pre-deduction paycheck income, net income is different; it reflects the actual amount left once every cost is accounted for.

The net income formulas: Comprehensive & simplified

There are actually two formulas and methods to calculate net income. While they both help you reach the same final destination, the first one is often used for detailed financial analysis, and the latter for quick check-ins.

Let’s have a look at both of these formulas, how they’re different, and which one should you consider.

I) Comprehensive method

This is the standard accounting approach; the kind you’ll find in audited financial statements, investor reports, or accounting tools like QuickBooks. It breaks costs into separate buckets so you can see exactly where money is going:

- COGS (Cost of goods sold): Direct costs of producing or delivering your product (materials, labor, shipping).

- Operating expenses: Day-to-day costs like salaries, rent, utilities, software, and marketing.

- Interest: Loan interest, credit lines, or financing costs.

- Taxes: Federal, state, and local taxes.

Why use it?

This method gives the clearest picture of profitability. You’re not just looking at what’s left; you can see which cost categories are dragging profits down and where you might cut or optimize. That’s why lenders, investors, and tax authorities rely on this version.

This is also the figure people call net profit, net earnings, or “the bottom line.”

II) Simplified method

Sometimes you don’t need that level of detail. If you just want a quick sense of profit after expenses, you can use the shortcut:

Formula:

Net Income = Gross Income – Total Expenses

or

Net Income = Total Income – Total Expenses

Here, “total expenses” can cover everything from rent to software subscriptions to one-off bills. You don’t need to split them into categories. This version works well for:

- Freelancers or contractors without inventory.

- Service businesses with few overhead costs.

- Side hustles or early-stage ventures where speed matters more than precision.

It’s faster, lighter, and still directionally correct as long as you include every expense.

Which method should you use?

| Comprehensive: Best if you need accurate records for investors, lenders, or taxes. | Simplified: Handy for quick checks, freelancers, or small operations tracking profit casually. |

And remember, net income isn’t always positive. Many startups, seasonal businesses, or growth-focused companies run at a net loss for a while — and that’s not unusual.

In fact, only about 40% of startups turn a profit, while 30% just break even, and the rest operate at a loss. What matters isn’t just whether the number is positive today, but that you’re tracking it and using it to guide decisions on pricing, spending, or scaling.

Tired of manual number crunching?

Handle your financial projections like a pro

Plans starting from Starts at $14/month

How to calculate net income (formulas + examples)

Let’s walk through an example using both methods so you can see exactly how the numbers come together. We’ll use a simple small business scenario with round numbers for clarity.

1) Using the comprehensive formula

Net Income = Revenue – COGS – Operating Expenses – Interest – Taxes

Example:

- Revenue: $85,000

- COGS (Cost of goods sold): $33,000

→ Subtotal: $85,000 – $33,000 = $52,000 - Operating Expenses: $24,000

→ Subtotal: $52,000 – $24,000 = $28,000 - Interest: $1,100

- Taxes: $1,000

→ Net Income: $28,000 – $1,100 – $1,000 = $25,900

What this means:

This $25,900 is the business’s actual profit after covering inventory costs, operating overhead, interest on debt, and taxes. It’s the real “bottom line” number; the one that tells you how much your business actually kept.

2) Using the simplified formula

Net Income = Gross Income – Total Expenses

Example:

- Revenue: $85,000

- COGS (Cost of goods sold): $33,000

- Operating Expenses: $24,000

- Interest: $1,100

- Taxes: $1,000

- Gross Income (Revenue – COGS): $85,000 – $33,000 = $52,000

- Total Expenses (Operating Expenses + Interest + Taxes): $24,000 + $1,100 + $1,000 = $26,100

Net Income: $52,000 – $26,100 = $25,900

What this means:

This $25,900 is the simplified calculation of your business’s profit after covering expenses. While less detailed, it provides a quick look at your bottom line: How much your business actually made after costs, without breaking down the individual expense categories

Both methods give the same result; they just start from different places. The comprehensive method breaks down each cost category, while the simplified method groups them together.

Whether you use the full breakdown or the simplified version, the goal is the same: To understand what your business actually earned after covering all costs.

How detailed does this calculation need to be?

Plenty of people put off figuring out their net income because they don’t have every single expense recorded to the last cent. The truth is, you don’t need perfect data to get started; you just need enough to get a clear picture.

If you’re missing a few details, that’s fine. You can use:

- Monthly averages based on recent spending.

- Last year’s tax data is a baseline.

- Bank statements, receipts, and invoices you already have on hand.

A rough calculation is still far better than doing nothing at all. Once you see the big picture, you can always go back and refine the numbers. The aim is to understand where you stand now so you can start making decisions based on reality.

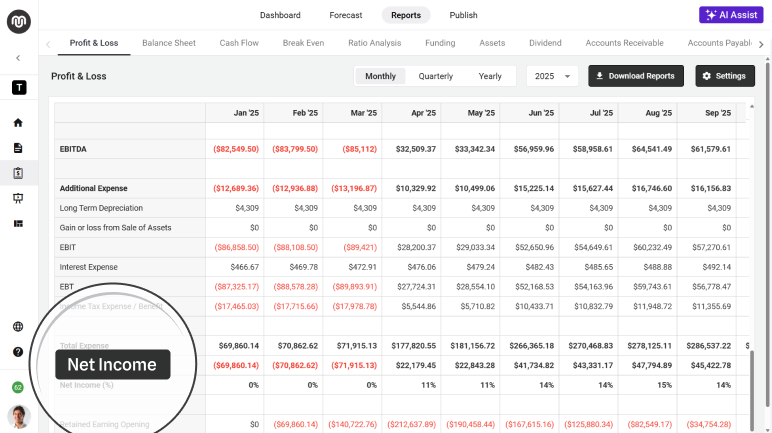

Where to find your net income in financial statements?

For businesses, net income is typically located at the very bottom of the Profit & Loss (P&L) statement. This figure shows the company’s profitability after all expenses, including operating costs, taxes, and interest, have been deducted from total revenue.

While the P&L statement is the most common place to find net income, you can also look for it in other financial documents, such as the cash flow statement or balance sheet, where it may be adjusted to account for certain non-operating items or retained earnings.

In short, the P&L statement is your main resource for net income, but understanding how it connects to other financial statements is crucial for a holistic view of your business’s financial standing.

Don’t know if your business is profitable?

Simplify financial planning & reporting using Upmetrics

Plans starting from Starts at $14/month

Now that you know where to find net income in your financial statements, it’s important to understand that there is often confusion around what this figure represents, which is: Is the net income shown in the financial documents before or after taxes? Let’s clear up this confusion.

Is net income before or after taxes?

Net income is calculated after taxes. It represents what’s left once all expenses (operating costs, interest, and taxes) are deducted from total revenue.

For businesses, the figure shown on the Profit & Loss (P&L) statement already reflects tax obligations. For individuals, net income (often called “take-home pay”) is the amount left on your paycheck after federal, state, and local taxes, along with deductions like insurance or retirement contributions, have been subtracted.

Try Upmetrics for financial planning & reporting

At the end of the day, net income isn’t just a number you calculate once and forget about. It’s the figure that decides how much you can reinvest, pay yourself, or set aside for growth, and it changes as your business does.

You could keep running calculations in spreadsheets or reading guides like this every time you need answers. But that eats up hours and leaves plenty of room for mistakes.

With Upmetrics, you don’t have to stress over formulas. Just enter your revenue, expenses, and a few important details, and the platform generates accurate financial statements and forecasts automatically.

Even better, you can test “what if” scenarios like a dip in sales or a rise in costs and instantly see how they impact your bottom line.

Instead of letting net income stay as a static figure in a report, Upmetrics helps you turn it into a planning tool. That means sharper decisions, fewer surprises, and a business plan investors will actually take seriously.