I spoke with over 37 small business owners and startup founders to learn about their biggest financial projection mistakes.

I got plenty of responses.

(People sure do make a lot of mistakes, don’t they? 😆)

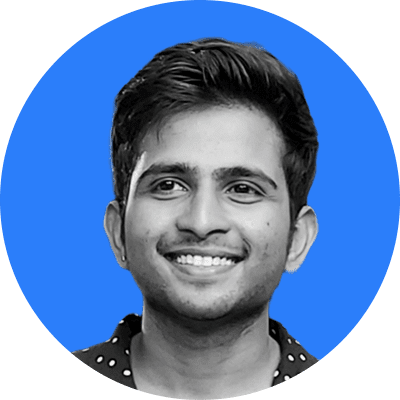

Out of nearly two dozen replies, I narrowed it down to these nine mistakes.

Why these nine? Two main reasons. (1) Many responses overlapped, so I picked on the most common mistakes. (2) I chose mistakes that significantly impacted the businesses.

This article isn’t like others that simply list basic forecasting mistakes to avoid. Instead, it’s a compilation of real-life financial projection mistakes that entrepreneurs have actually made—mistakes you should avoid.

The fact that I’m sharing first-hand experiences makes this guide more practical, relatable, and actionable.

Enough preaching. Let’s get started.

1. Pie-in-the-sky thinking

Most entrepreneurs are “pie-in-the-sky” thinkers; over-optimistic about their financial projections.

They like to believe that they’ll build something and people will come. They’ll project some optimistic financials, and easily achieve them.

Which isn’t often the case.

I spoke with Andrew Clarke, a serial entrepreneur and current founder of Sync-Up bookkeeping, about his “Pie-in-the-sky thinking” mistakes.

“I walked with a naive confidence as a first-time entrepreneur. I assumed everyone would flock to my door. (spoiler alert: they didn’t!) I drastically underestimated my marketing needs, figuring word-of-mouth would be enough. While referrals are great, they take time, and I was in a hurry to generate revenue,” said Andrew.

(He founded his first startup, Millennium Technologies, Inc., a software development company in 1999.)

He further mentioned how he was over-optimistic about startup cost projections, such as the marketing budget, utility bills, and operational costs, which caused him a lot of trouble.

“For example, I allocated $250 a month for Facebook ads, but when business was slow, I needed to double that to get any traction. My budgeting for utilities was equally naive. I’d set aside $300 a month, which worked fine in the spring and fall. But when summer hit and the air conditioning ran nonstop, my electric bill tripled!”

“A few months of that, and I was dipping into my personal savings to keep the lights on.” Andrew further added.

2. Not comparing plan vs. actual

While it may not directly tie to financial projections, not comparing plan vs. actual is often seen as a significant business mistake.

At Upmetrics, we use our financial forecasting tool for plan vs. actual analysis, and I spoke with Vinay Kevadiya, our founder, to get more insights into this process. Here’s what he shared:

Not comparing planned forecasts vs. actuals can lead to several financial and operational inefficiencies that include:

- Overlooked goals and undetected underperformance.

- Risk of overspending and poor budget management.

- Less data-driven insights for strategic adjustments & improvements.

- Delays in identifying & addressing problems, risking bigger setbacks.

3. Underestimating seasonal fluctuations

Almost 6-7 of all the entrepreneurs I spoke with mentioned this as their biggest mistake.

“My biggest financial forecasting mistake was underestimating seasonal fluctuations in demand. For instance, I projected consistent revenue throughout the year, but post-holiday and summer months saw a sharp decline in bookings.”

“This miscalculation led to cash flow issues and unexpected budget shortfalls,” says Mick Jain, operations manager of VMAP cleaning services.

While seasonal businesses like pool cleaning, snow removal, and Christmas retailers get affected the most, almost all businesses experience some level of seasonal impact on their revenue.

For instance, our target audience consists of US-based startup founders, consultants, and business owners. Since everyone enjoys time off during the holiday season, we see our biggest dip in December.

Many entrepreneurs aren’t prepared for these downtimes, making it challenging to cover basic expenses and payroll during low-revenue periods.

The phrase “we must save for the rainy days” fits perfectly in this situation.

What can be done here? Seasonality refers to predictable changes that occur over a one-year period. By analyzing market trends or historical data, you can better anticipate and plan for these variations.

4. Overestimating revenue growth

Overestimating revenue growth is yet again a significantly common financial projection mistake. Overestimating revenue creates a false sense of security which has its own consequences.

The assumption of having perpetual revenue growth may lead to overspending marketing and scaling the business which often results in negative cash flow.

Gabe Garcia of PierrePark, a Healthy Dog Treats seller, once made the same mistake.

“My biggest financial forecasting mistake was overestimating revenue growth. I assumed growth would continue at the same rate without considering market slowdowns. This led to cash flow issues when sales didn’t meet expectations.” — Gabe Garcia, founder of PierrePark

However, in Gabe’s case, she soon realized her mistake and took the necessary countertops.

“The lesson I learned was to build more conservative estimates and always have a backup plan for fluctuating demand. Now, I factor in potential risks and create multiple scenarios to avoid overestimating growth,” she added.

Rongzhong Li also had an interesting story to tell about the same mistake. Rongzhoung is the founder and CEO of Petoi, a robot pet shop.

“I projected aggressive sales increases without accounting for delays in customer acquisition or market saturation. As a result, cash flow got tight, and I had to pivot quickly, cutting expenses and revising targets.”

5. Ignoring small costs

While it’s easy to ignore small expenses when focusing on the bigger picture, these seemingly minor costs can quickly add up and become a significant financial drain.

For example, small costs like accounting fees, website maintenance costs, office supplies and stationery costs, and utility bills often slip through while calculating in big numbers.

However, these smaller expenses can collectively form a big chunk of your startup costs, and missing them could lead to unexpected cash flow issues down the line.

6. Not considering bad debt

Bad debt is a debt, loan, or any outstanding balance that cannot be recovered and must be written off. Technically, “bad debt” is classified as an expense that entrepreneurs, on the high side, often forget to account.

Incurring bad debt is part of the cost of doing business with customers, as there is always some default risk associated with extending credit.

An analysis of Fortune 1000 companies in 2022 showed that the average bad debt-to-sales ratio was 0.16%, with bottom performers experiencing rates as high as 1.10%.

While 1.10% looks like a small number, look from the perspective of a $1 billion company and the amount they lose to bad debt becomes a whopping $11 million.

Although optimizing operations can help minimize bad debt, it’s necessary to account for them while projecting financials.

7. Top-down assumptions

We discussed how entrepreneurs are often optimistic about their business idea, infused with a lot of ambition and expectations from their business.

Considering the top-down approach for financial assumptions is yet another common forecasting mistake related to over-optimism, which often leads to overestimating market share, ignoring customer acquisition challenges, and missing out on cash flow realities.

One fine example of the top-down assumption approach would be to start a fast food outlet and consider “McDonald’s” as your primary competitor.

If a McDonald’s outlet in your locality brings in $1 million in profit, you can’t just say, “Since our food and service are great, we’d at least do half a million.”

This reflects your lack of understanding of your industry and financials.

To realistically aim for $500K in profit, you need to know which products will bring in the most sales for you, how much you’ll sell them for, how you’ll attract initial customers, and more.

Although we’re talking about assumptions here, they must be backed with solid data and industry reports. Your projections shouldn’t look like random, amateur numbers. That’d be an easy way to keep investors and lenders at bay.

8. Unclear financial records

As Nathan Hirsch mentioned in his Twitter post, unclear financial records don’t just cause confusion, but they can cost you money, trust, and growth.

When financial records are unclear, disorganized, or incomplete, it becomes challenging to accurately project future financial performance.

Nathan curated a really great Twitter thread to describe how bad financial records made him miss the best chance to exit his 1st business.

Nathan listed 11 consequences of having unclear financials. According to his post, unclear financials may lead your business to:

- Missed tax deadlines, leading to penalties and interest charges.

- Cash flow problems, difficulty in forecasting cash needs

- Incorrect profit calculations

- Challenges in securing funding

- Stagnant business growth

- And more.

9. Excluding the founder’s salary

Entrepreneurs often don’t include their salary in the forecasts to make their business appear more profitable than it actually is. This gives investors and stakeholders a false impression of a business’s health.

Investors want to see realistic forecasts. Excluding the founder’s salary may lead them to question the accuracy of the projections which may also affect their confidence in the business’s viability.

If your business can’t pay its founder and brags about being profitable, it’s not a business investors or lenders want to invest in.

The bottom line

Financial forecasting isn’t an art that only a few can master. It’s a task that requires following a structured process.

If you avoid these mistakes, use a trusted financial forecasting tool, and follow the step-by-step process; you’ll do just fine.

Keep it simple. Realistic projections are what count; they don’t need to be flawless. Perfect forecasts don’t exist, and if they seem perfect, they probably aren’t realistic.

Hope you found what you were looking for. Start planning today!