Want to write an email? Want to learn a topic? Want to analyze your market position?

‘ChatGPT can help.’

Apparently, this has become people’s favorite advice.

On paper, there’s nothing that ChatGPT can’t help with. But is it capable of helping you with something as complicated as market research?

The short answer: Yes

Long answer: In this blog post

I am going to show you how I use ChatGPT for market research, and also share my prompt library that you can tweak and experiment with on the go.

Reminder: ChatGPT is a partner in research, not a substitute for it

Don’t step with an expectation of some magical guide that would help you build your entire market research report in 10 minutes. ChatGPT is a tremendous assistant, but not intelligent enough (yet) to perform entire market research on its own.

It can help you think faster (and more vividly), but it can’t replace your thinking. It can give you new angles to explore, be your brainstorming buddy, synthesize the messy data, and even build reports in seconds—but it still needs your credible data and your insightful judgement.

Play around with ChatGPT and use it to:

- Explore different directions and structures of your research

- Spot gripping insights from messy spreadsheets and reports

- Generate sharper and nuanced summaries for decision-making

But remember, specificity is the key to getting the best of ChatGPT. Tell it what it should do (and what it shouldn’t) and follow up by building on your existing prompts.

How to Use ChatGPT for Market Research (w/ prompts and examples)

The thing with ChatGPT is that you have to build your own direction. It doesn’t offer pre-structured processes or steps that automatically lead to comprehensive analysis.

And I know starting without direction is difficult. But I ran some experiments and mapped a process that you can follow (of course, with your own tweaks) to get the best of ChatGPT’s assistance in your market research.

Step #1: Define your research objectives with/ ChatGPT

Start with a clear objective. That is why you are conducting market research.

- Do you want to test if a new product idea is worth pursuing?

- Or understand what’s driving your ideal customer?

- Do you want to explore entry barriers in a new geographic market?

- Or identify emerging trends that could impact your industry?

Feed GPT your fuzzy details if you are not clear about your why. And even if you are clear, I would still suggest nudging it a bit further.

ChatGPT’s response may help you see the angles you may have missed and sharpen your research objective.

For instance, I knew I wanted to build a market analysis for my coffee shop business plan. But I wasn’t sure what kind of research would convince investors that my idea was financially promising.

I used this simple (but contextual enough) prompt to get a head start.

See how it instantly gives you a structured list of goals to ground your research?

To make it even more useful, I asked ChatGPT to create a step-by-step research process that fulfills those objectives.

Of course, the list was long. But I took what resonated and created an outline I could follow.

Step #2: Conduct secondary research (Desk research)

Now, research should always start with a macro overview, i.e., understanding how your industry is performing and what opportunities exist for your niche to grow.

Without this context, you might overestimate your niche’s potential or miss broader shifts shaping your market.

Thankfully, there’s a ton of industry-specific data available online that can be used to form the basis of your research. This data, collected by agencies like IBIS world, Statista, McKinsey, and GrandViewResearch, can give you insights about:

- Industry size and growth rate

- Factors driving that growth

- State of the industry

- Leading businesses and their market share

- Trends or predictions surrounding your industry

- Regulatory frameworks

Remember to always test the credibility and relevance of data before you use it to form assumptions.

In fact, use ChatGPT to source relevant reports that:

- Cover the right geography (for example, U.S. or state-level data if your business is in Alabama)

- Represent your specific industry segment or niche (cafés or specialty coffee, not the broader “food service industry”)

- Clearly mention data sources and publication date to avoid outdated insights

- Specify research assumptions and methodology, such as whether the data were drawn from surveys or financial filings

For me, a Google search into coffee market reports led to hundreds of results. Naturally, I couldn’t source through all, but ChatGPT gave me 5-ish leads that were (if anything) a great starting point.

Don’t forget to check the tried and tested prompt library in the next section to speed up your secondary research.

Step #3: Gather recent data with deep research

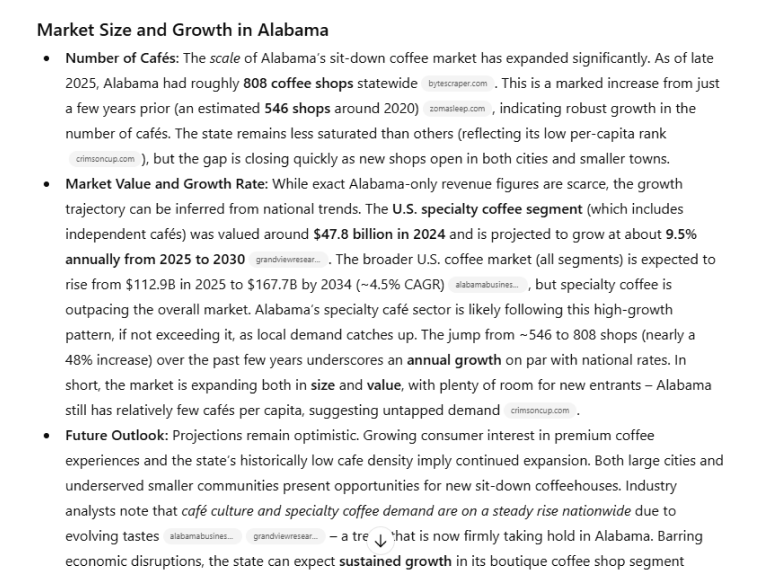

For fetching secondary data at a granular level, I would recommend using ChatGPT’s deep research mode.

This mode can pull real-time information from the web instead of relying on its training data. Meaning you get industry-specific insights and trends captured from the most recent reports and news.

For my coffee shop research analysis, I wanted to know:

- Current market size and growth rate of the specialty coffee shop industry in Alabama

- How is consumer demand for premium or artisanal coffee compared with national averages?

- Pricing strategies that are common among boutique coffee shops in small urban markets

- Lifestyle or behavioral trends that are shaping café culture

- Regulations or licensing requirements affecting café operations in Alabama

A clear prompt and the Deep research mode generated me this beautifully cited report (I could trace back to the source). But be patient, it will take a couple of minutes. Took mine 8.49 minutes to generate a response.

There’s a possibility that reports answering your extremely niche queries may not exist at all. In such cases, instead of hallucinating, Deep Research would clarify how it arrived at a particular data point.

Step #4: Plan and execute primary research

Now, narrow down your research to individual customers and a niche market.

This is where real insights come from. Talk to your prospects, hold focus group discussions, run surveys, interview experts, talk to competitors (if possible), or even post quick polls online—anything that gives you firsthand information about your customers, their preferences, and their unmet needs.

For primary research, ChatGPT can help with the planning, design, and analysis side of things.

It can’t talk to your customers for you, but it can make every other part of the process faster. It can help you identify your target audience, draft interview and survey questions, analyze responses, and give structured summaries of what the data means.

Manually, this kind of research can take months. With ChatGPT, the legwork shrinks to days.

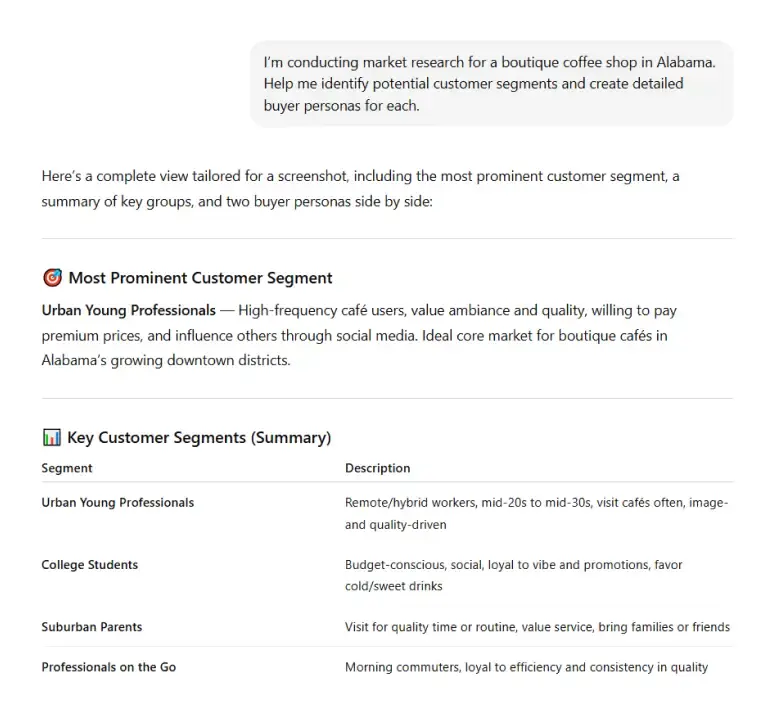

For my Alabama coffee shop, I wanted to understand different market segments and build accurate buyer personas before running surveys. So I asked ChatGPT to map my customer segments and provide an overview of each customer group.

I then used those personas to develop screening questions that helped me select the right participants for my survey.

There are endless possibilities to leverage ChatGPT for primary research.

Here’s what it can do:

- Draft unbiased surveys that align with your goals

- Structure interview and focus group guides

- Create screening questions to filter the right participants

- Generate follow-up questions based on initial responses

- Analyze open-ended feedback for recurring themes

- Summarize qualitative data into concise, actionable insights

Check the detailed prompt library in the next section that covers many of these scenarios.

Step #5: Analyze competitors and market landscape

Next, I analyzed both direct and indirect competitors targeting the same slice of the market as my coffee shop.

I needed to understand how their pricing, product offering, positioning, and strengths compared to mine.

- Were my potential customers loyal to them, or were there gaps I could exploit?

- Did these competitors dominate specific neighborhoods, or was there room for a newcomer?

- What were their distribution channels, market shares, and growth trajectories?

- How did they position their brands, i.e., premium or convenience-driven?

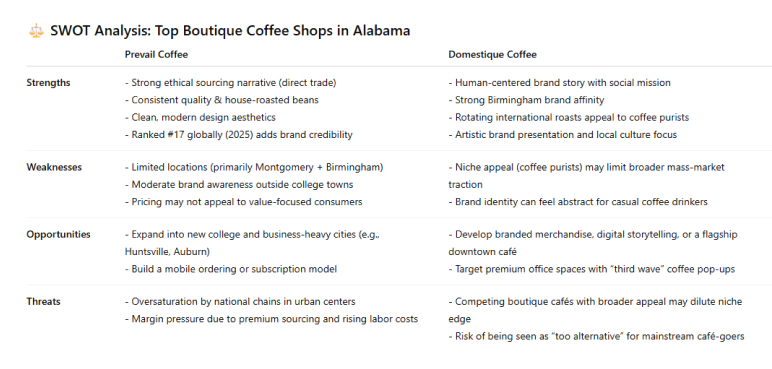

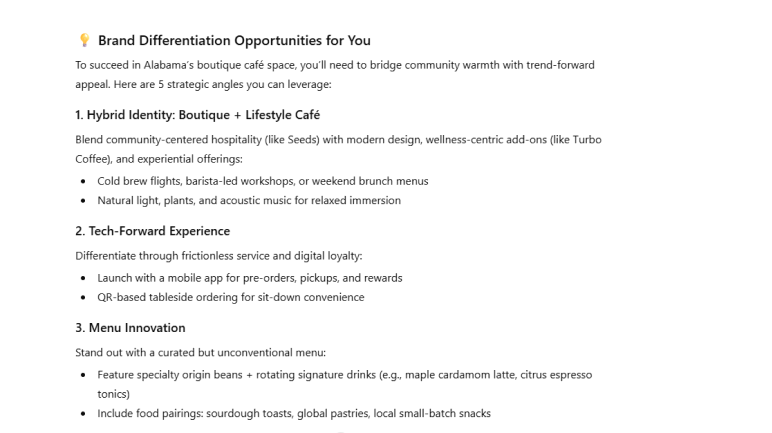

To speed things up, I asked ChatGPT to generate a SWOT analysis for my top three competitors (Prevail Coffee, Domestique Coffee, and Seed Coffee Company) and highlight potential leverage points I could use for differentiation.

In minutes, ChatGPT presented a structured comparison outlining each competitor’s strengths, weaknesses, and positioning gaps.

Its brand differentiation suggestions, like tech-forward experiences, were new to me and honestly something I dug further into.

That said, make sure the advantage you pick is unbeatable. A temporary edge, like a trending flavor or a short-term pricing discount, isn’t a true differentiator. Competitors can copy that within months.

Your advantage should create an irreplaceable space for you in the market.

Step #6: Synthesize findings and create a report

Now use ChatGPT to become your research interpreter.

Feed it all your data points, research notes, competitor’s analysis, and first-hand customer insights. And ask it to organize that messy information into a structured, readable report.

You can also share a preferred report outline or describe the sections you want, i.e., market overview, trends, opportunities, and risks.

ChatGPT can format your findings into clear sections and suggest actionable recommendations by interpreting the data.

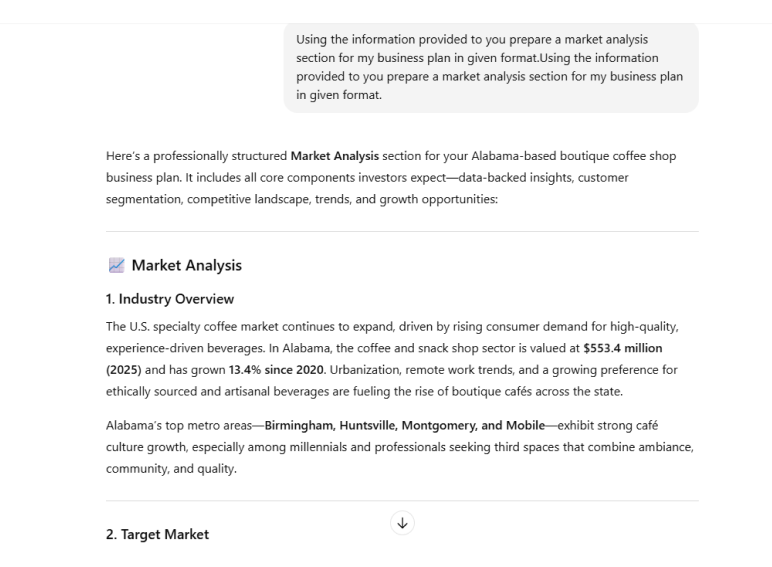

I asked ChatGPT to write the market analysis section for my business plan, and the first draft turned out to be pretty impressive.

I, of course, had to toggle around with citations and visual interpretations, but I didn’t have to stare at a blank page for hours.

That said, see how you can modify this process to help you with market research.

My market research prompts library (copy-paste)

You need to learn prompting if any part of your workflow includes using AI.

But for now, if that sounds like a task to you, start with my tried and tested market research prompts. These prompts are designed to generate detailed, in-depth answers and are highly customizable.

1) Research objective setup

When I first used ChatGPT for research, this prompt changed how I planned things. I used it to set clear objectives for my coffee shop study. And it helped me figure out what to measure, which metrics mattered, and how to decide whether the idea was worth pursuing or needed a pivot.

If you’re new to market research, start with this one. It’s the easiest way to turn your rough ideas into clear, measurable goals.

Act like a senior market research strategist. Write a concise, SMART primary objective that determines market feasibility for an emerging startup by quantifying market size (TAM/SAM/SOM), competitor intensity, demand intent, price acceptance, and go-to-market viability for a defined ICP and geography.

Request minimal inputs (idea, ICP, geography, budget, timeline, key decisions).

Propose methods (desk research, competitive teardown, expert/consumer interviews, survey or smoke tests, pricing tests), KPIs with pass/fail thresholds, sample frame and minimum N, and explicit go/hold/pivot rules.

Deliver a ≤60-word primary objective followed by a compact table or bullet list mapping sub-objectives to KPI, method, sample, threshold, and decision impact.

If you’re exploring a new region or customer segment, use this version instead. It helps you validate market size, demand, competition, and feasibility before you invest too much time or money.

Act like a senior market entry strategist.

Objective: Produce a decision-ready plan to validate expansion into [target market/geography] for an existing business.

Request inputs: current offering, core ICP, target ICP, value prop, pricing, channels, competitors, constraints, budget, and timeline.

Deliver: one SMART primary objective tied to go/hold/pivot, plus a compact list mapping sub-objectives to KPI, method, sample, and threshold.

Include: TAM/SAM/SOM, demand intent, price corridors, competitive intensity (e.g., HHI/share-of-voice), regulatory/operational viability, and GTM fit.

Methods may include desk research, expert/customer interviews, surveys, smoke tests, and pricing tests.

Conclude with explicit decision rules and risks/mitigations.

2) Data source identification

I get it: Finding credible data felt like the toughest part. But the given prompt helped me quickly surface reliable sources, from IBISWorld and Statista to government databases, without hours of manual searching. It’s ideal when you need verified numbers fast.

Act like a senior research librarian and market analyst.

Goal: find credible industry reports and verified databases for [industry] in [geography].

Request inputs: target market, scope, time window, budget, and access limits.

Deliver: a ranked list with Source | Coverage | Use case | Access | Citation.

Include: government stats (e.g., BLS, Census, Eurostat), multilaterals (World Bank, OECD), analyst houses (Gartner, Forrester), paid databases (IBISWorld, Statista, Euromonitor), trade associations, and academic/DOI sources.

Provide query strings (site:, filetype: pdf, NAICS codes), vetting criteria (methodology, recency, provenance), verification steps (triangulate 2+ sources), and citation format.

If you need region-specific insights for your report, switch to the version below. It will help you pull market size, growth, and pricing data across regions, all neatly organized and sourced.

Act as a senior market researcher and quantitative analyst.

Objective: Deliver deep research with comparable regional data points for the topic I provide, suitable for strategy and publication.

Task: Collect, validate, normalize, and present metrics by region. I’ll supply: topic, regions (countries/states/metros), timeframe, KPIs, segments, and preferred sources.

Process & Output:

- Clarify scope, KPI definitions, and geographic hierarchy; list exclusions.

- Build a source plan prioritizing official statistics and reputable industry reports; include titles, URLs, publication dates, and data units.

- Retrieve data; normalize for currency, inflation, and time period; reconcile inconsistencies with a clear rationale.

- Calculate derived metrics and growth rates; mark estimated vs. observed values; document assumptions or imputations.

- Run a quality check across multiple sources and highlight data confidence levels.

Deliverables: concise insights summary, regional comparison table, trend charts, assumptions/methodology note, and a full, dated source list.

Constraints: use markdown tables, a precise and neutral tone, and show reasoning before presenting final numbers. Ensure internal consistency across all regions and timeframes.

3) Competitor comparison

I’ve found competitor analysis to be one of the most revealing parts of research. The right prompts can uncover things you’d otherwise miss—pricing gaps, positioning angles, or overlooked strengths. This prompt will help you identify strategic levers that can strengthen your positioning.

Act like a senior competitive intelligence analyst. Your goal is to produce a decision-ready teardown of [top 5–10 competitors] for [product/category] in [geography/segment].

Inputs to request: my ICPs, core use cases/JTBD, pricing model, core features, target ACV, channels, shortlist of competitors and substitutes, and constraints (budget/time).

Process:

1) Define the competitive set and segments; note buyer personas and jobs-to-be-done.

2) Build a feature inventory with parity, differentiators, and must-haves; score importance vs. satisfaction.

3) Normalize pricing: plans, meters, bundles, discounting, trials; compute effective price per unit value.

4) Map positioning: promises, proof, category narrative, RTBs; create a value curve and perceptual map.

5) Collect evidence: pricing pages, docs, changelogs, blogs, release notes, review sites, G2/Capterra, app stores, job posts, and interviews.

6) Quantify gaps and switching triggers; identify table-stakes vs. wedge features.

7) Propose price tests and packaging hypotheses; outline risks and likely counter moves.

Deliverables: a comparison table (Feature | Our status | Competitor status | Evidence | Priority), pricing ladders with price-to-value ratios, a positioning snapshot per competitor, three strategic moves (focus, fight, avoid), and go/hold/pivot criteria.

If your industry moves fast, use this prompt to track competitor launches, feature rollouts, pricing changes, and new investments. It helps you spot shifts early and adjust your strategy on time.

Act like a competitive intel analyst. Using a simple, low-lift setup, track new launches, feature rollouts, pricing changes, and notable tech investments for [competitor list] in [category/geography] over [timeframe]. Ask me only for: competitor names, ICP, and what would count as “material” news.

Do:

– Monitor 5–7 high-signal sources: product blogs/changelogs, docs/release notes, pricing pages, app stores/marketplaces, press/IR, LinkedIn posts, and job listings.

– Summarize weekly in one table: Company | Update | Date | Evidence link | Why it matters | Quick action.

– Flag only items that may shift demand, differentiation, or CAC.

Deliverable: the table plus 3 recommended responses for the biggest signal.

Take a deep breath and work on this problem step-by-step.

4) Customer persona generation

Understanding your target audience is the starting point for any strong strategy. I use this prompt to segment potential customers and build detailed buyer personas that reveal who they are, what drives them, and how to reach them effectively.

Objective:

Segment potential customers for (product/service) in (market/region) over (timeframe); rank segment attractiveness and create 1–2 buyer personas for top opportunities.

Inputs:

(use cases/JTBD), (firmographics/personas), (behaviors), (pricing), (competitors/alternatives), (data sources), (constraints), (offer), (target customer), (price band), (current users).

Process:

Define candidate segments; size TAM/SAM; score on matrix (Pain, Fit, Differentiation, Velocity, CAC/LTV, Channel Reach, Data, Upside); validate via reviews/forums/search trends; build personas for top segments.

Outputs:

Prioritized table (Segment, Size, Score, Rationale, Priority), ICP + positioning with 3–5 messaging pillars, buyer persona (demographic, psychographic, behavioral, journey, messaging, channels, pricing sensitivity, anti-persona), and channel mix with funnel metrics and Go / Hold / Pivot guidance.

5) Trend summarization

Customer preferences change fast, and staying aware of those shifts is essential. For that, I’ve used the following prompt to track how habits and expectations are evolving, spot new market patterns, and refine your product, messaging, or pricing before trends pass you by.

Act like a consumer insights analyst. Analyze recent shifts in consumer behavior and preferences for [audience] in [category/region] over [timeframe]. Deliver: top 5 changes with evidence, likely drivers, and three actionable implications for product, pricing, messaging, and channels.

If you want to understand regional market shifts, go for the next prompt to spot changes in demand, growing sectors, and regional factors driving or slowing growth.

Analyze how regional and demographic trends influence local sales for [product/category] in [region] over [timeframe]. Use sales by location/segment, census data, mobility/footfall, search intent, and POS/CRM cohorts; control for seasonality and promotions.

Output: top 5 demand drivers, growth and at-risk locations/segments, a simple map or table with lift vs baseline, and 3 prioritized actions with impact and confidence.

6) Report drafting

Turning unstructured research into concise and compelling reports takes time. You can use the below prompt to create executive summaries that highlight key findings, implications, risks, assumptions, and steps forward.

Write a concise executive summary and clear takeaways from [report/article/deck/email thread], tailored for [executive audience] who need a decision on [topic].

Ingest multiple sources if provided and de-duplicate.

Output in this order:

1) TL;DR (3–5 bullets, ≤80 words)

2) Key findings with page/source refs

3) Implications for [company/team] (impact, urgency)

4) Recommended decisions and 3 next steps (owner, deadline, metric)

5) Risks/assumptions and open questions

6) One chart-ready stat and one quotable line

Constraints: plain language, no jargon, neutral tone; highlight unknowns; flag data quality; keep total ≤300 words unless asked. Add a brief appendix: sources used and confidence level.

To synthesize the raw data findings into structured insights, I actually rely on this one. It compiles insights from interviews and surveys to reveal key patterns and how customer opinions connect to broader market trends.

Combine qualitative and quantitative findings for [project/topic] into one clear, decision-ready report. Use datasets, surveys, interviews, and benchmarks; resolve conflicting signals; highlight effect sizes and confidence. Deliver a TL;DR, key insights, implications, and three prioritized actions with owners and metrics.

If you need to generate a ready-to-plug market analysis section of your business plan, use this version. It lets you cover all the necessary sections (market size, competitor analysis, and barriers to entry) in a format that investors appreciate.

Create the market analysis section of a business plan in [industry] and [market]. Include clear visuals and cite sources.

Sections to deliver:

– Market Overview: size (TAM/SAM/SOM), growth, drivers; chart: area/line + assumptions table.

– Target Market Analysis: ICPs, segments, needs, willingness to pay; chart: segmentation bar/treemap.

– Competitor Analysis: 5–8 rivals, features, pricing, positioning; chart: comparison table + 2×2 map.

– Regulatory & Operational Challenges: licenses, compliance costs, timelines; chart: risk heatmap.

– Trends & Opportunities: 3–5 trends with impact; chart: impact vs. timing matrix.

What ChatGPT can’t replace (and how to fill those gaps)

For this experiment, I relied entirely on ChatGPT’s outputs without pairing them with other tools or external databases.

It performed well in organizing ideas, structuring data, and generating analysis. Butttt … as I said, it’s merely an assistant and there are limits to what it can handle on its own.

ChatGPT lags in certain aspects, but I have a workable solution for each of its shortcomings that can make your research process a bit smoother.

1. No real-time or paywalled data

ChatGPT can only pull from publicly available web content and its existing knowledge base. It can’t access proprietary databases that require a subscription or payments.

Solution: Subscribe to reliable data providers and feed key stats or excerpts into ChatGPT for analysis and summarization. Or use ChatGPT alongside market research tools to get access to credible data.

2. Inability to validate actual data

ChatGPT can summarize information, but can’t confirm its accuracy or timeliness.

Solution: Dmitriy Shelepin, the head of SEO at Miromind, suggests treating all output from ChatGPT as testable hypotheses and running verification through multiple checks. While this may be time-consuming, it would ensure that you build your strategies upon verified data.

3. Generic or surface-level outputs

ChatGPT tends to default to its pattern-based writing habits. It often produces long, detailed responses that sound polished but lack real depth or contextual relevance. Without clear direction, it fills gaps with general statements.

Solution: Feed it detailed background information, data, and research notes, and always follow up on prompts to refine its answers. When you push for depth and specificity, you will get sharper, relevant outputs.

4. Hallucinated or fabricated information

ChatGPT tends to present seemingly accurate information with so much conviction that it often sounds credible. This happens when there’s limited or conflicting data, leading it to fill gaps with assumptions.

Solution: Provide detailed prompts that clearly define what kind of data you need. Then, trace every data point back to its source and confirm it fits the right context before using it.

AI Tools that work well with ChatGPT for market research

ChatGPT is a solid assistant. But when paired with the right tools, its impact amplifies.

Here’s how you can use ChatGPT alongside other AI tools to strengthen and validate your research findings:

Perplexity AI: Narayan Prasath, founder at Metaflow, suggests using Perplexity to verify facts and gather source-backed information, then using ChatGPT to reason through and synthesize those data points into insights

Notion AI: When conducting market research, you’ll deal with survey results, research papers, transcripts, and other scattered materials. Notion AI helps organize this information, summarize long documents, and keep your research base searchable and structured

SheetGPT: SheetGPT lets you run ChatGPT directly inside Google Sheets to extract insights and identify trends—without manual sorting

Upmetrics: Upmetrics generates fully cited, ready-to-use market research reports for business plans. It offers comprehensive planning resources (think business plan generator, business plan samples, automated forecasts, and strategic planning templates) to help you plan and grow your business feasibly

When used together, these tools turn your research workflow into a faster, data-backed system.

Bottom line: Use ChatGPT as a thinking partner, not a shortcut

That said, ChatGPT’s almost instantaneous responses are its superpower. But more than that superpower, its real value lies in how it pushes you to think forward.

It’s a solid brainstorming tool. Combined with your logical thinking, argumentative approach, and access to real data, this AI can help you perform quality research without making you take the manual load.

Just stay realistic about its limits. Treat its insights as assumptions that need to be tested, and only when you verify, use that data to shape a strategy or make a decision.