Investors care about one thing—money. What comes in, what goes out, and what stays as profit.

They aren’t interested in the full detailed story. All they want is your business’s bottom line.

Present them with a detailed business plan and they’ll flip straight to your financial section. A quick glance over your income statement and they would decide if your plan is worth their time.

That’s what an income statement can do!

It goes beyond numbers to showcase your business’s ability to generate revenue, control costs, and deliver sustainable profits.

It definitely is an important part of your business plan. But how do you prepare one?

Let’s figure that out in this blog post.

What is an income statement?

An income statement, also called a profit and loss statement, is a financial document that shows how much money a business earns (revenue), spends (expenses), and keeps as profit (net income) over a specific period.

It’s one of the three key financial statements you add to your business plan. It provides a clear overview of your business’s financial health highlighting its ability to generate revenue and manage costs effectively.

Key components of a business plan income statement

An income statement covers crucial financial details that reflect your business’s profitability over a specific period. However, to truly grasp what an income statement shows, it’s essential to understand the key components it’s built on.

- Revenue: It’s the total amount generated by selling goods/services

- COGS (Cost of goods sold): Direct costs associated with producing or acquiring the goods or services

- Gross profit: Revenue less COGS gives gross profit also known as sales profit or gross income

- Operating expenses: Costs incurred to run the company’s operations, i.e. general and administrative expenses (SG&A) and marketing

- Operating income: Represents income earned from regular business operations also known as EBIT (Earnings before interest and taxes)

- Earnings before tax (EBT): Company’s profit after accounting for all operating and non-operating income and expenses (excluding taxes), also known as pre-tax income

- Depreciation and amortization: Non-cash expenses to spread the cost of capital assets (tangible and intangible) over their useful life

- EBITDA (Earnings before income, tax, depreciation, and amortization): Demonstrates company’s profitability by excluding non-cash (depreciation, amortization) and financing costs (interest, taxes) from EBIT

- Net income: Earnings after deducting all the expenses, including operating costs, interest, taxes, depreciation, and amortization, from total revenue

Excel vs. financial planning software

Excel and spreadsheets have been around for a long time. While we have all used it at least once—be it for college assignments, vacation planning, or financial forecasting—we never really got the hang of it.

(I can at least speak for myself)

Spreadsheets can be incredibly useful to create financial forecasts, but they’re overwhelming, time consuming, and frustrating at the same time.

While spreadsheets can help you achieve great results, they ask for—hours of your time, manual number crunching & calculations, and making and fixing inevitable errors.

AI-powered financial forecasting tools like Upmetrics. Simply create your revenue and expense streams (using built-in AI), put in your numbers, and see your reports coming through.

Simply put, a task Excel took a couple of hours to finish can be achieved in minutes using Upmetrics.

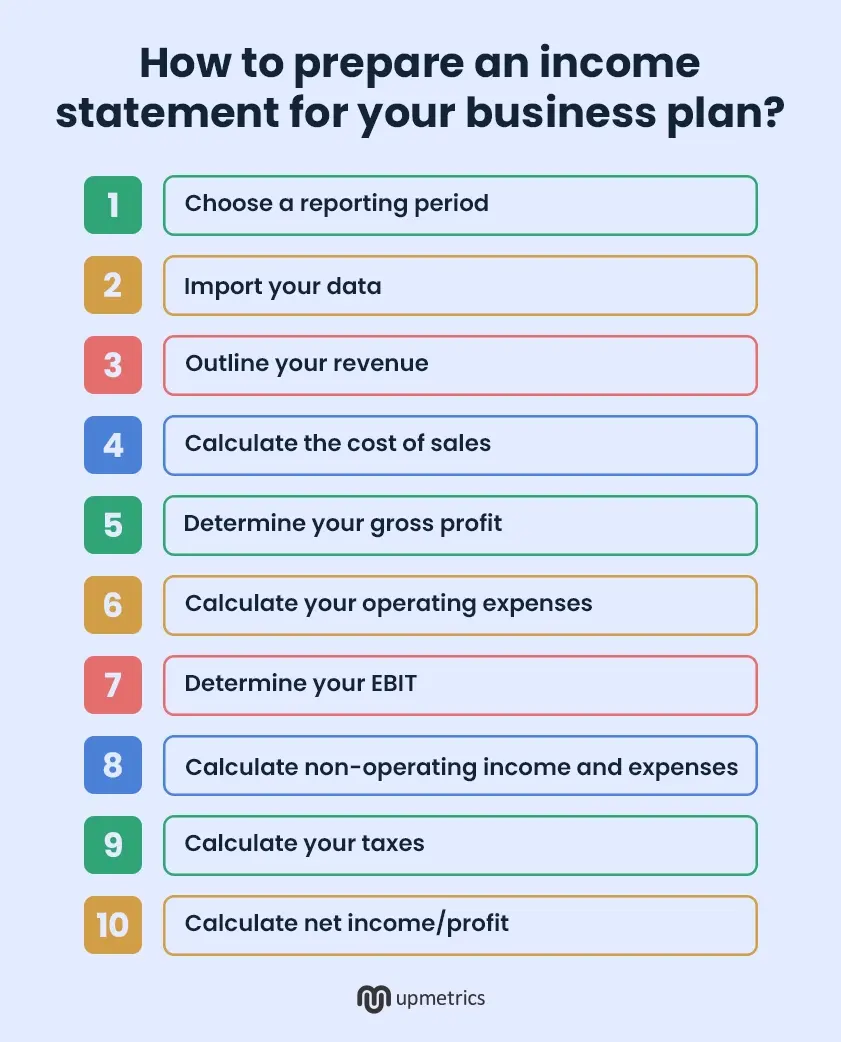

How to prepare an income statement for your business plan?

Let’s now walk through a quick, step-by-step guide to building an income statement.

1. Choose a reporting period

Before you gather data and make complex calculations, decide the time frame for your projections. Does your business plan demand monthly projections or do you prefer quarterly and annual projections?

Generally, startups preparing a business plan for investors would add income statements with projections for at least 2-3 years. However, make sure that the reporting period aligns with your overall business plan’s timeline and goals.

2. Import your data

If you’ve historical financial data for your business, import it to the forecasting or ERP (enterprise resource planning) tool. This will simplify calculations and cut short the process for you.

3. Outline your revenue

List down the revenue generated by your business during a given period. Make sure that you include all sorts of revenue, i.e. revenue from products/ services, rental income, interests, royalties, etc.

Now, if you’re building an income forecast, you need to forecast your sales for each revenue stream. Consider the existing data, market research, and industrial trends to forecast precise sales.

Next, determine the pricing for your products/services and multiply it with the sales to get your revenue.

Pro-tip

Upmetrics’ AI offers a quick list of revenue stream suggestions relevant to your business. You can double-check with this list while preparing your income statement to ensure you don’t overlook any important revenue aspects.

4. Calculate the cost of sales

Determine the direct costs associated with producing and acquiring the products/services your company sells. This includes costs for labor, materials, distribution, and other manufacturing expenses.

For a service-based business, COGS is also called cost of sales. This includes costs related to software, personnel, hosting and infrastructure, and others.

List down the direct costs for your business and calculate your COGS for the reporting period.

Pro-tip

Upmetrics’s AI offers suggestions for direct and indirect costs associated with producing the products/service. This way you won’t add expenses that shouldn’t be included in your COGS.

5. Determine your gross profit

Simply deduct your COGS from revenue to get gross profit. This metric will help evaluate the health of different revenue streams and their ability to generate revenue. The higher the gross profit margin, the better the cost management and pricing.

With an ERP and forecasting tool, you won’t have to do this manually. Most of these tools will prepare an income statement on the backend as you add details about expenses and income.

6. Calculate your operating expenses

List down all the ongoing expenses your business will incur to keep it operational. This includes SG&A (general and administrative) and marketing expenses such as

- Marketing & advertisement expenses

- Travel expenses (business)

- Professional expenses

- Office expenses

- Utilities

- Salaries

- Rent

If you’re projecting the expenses for say next quarter or year, make sure that you account for inflation and market shifts to maintain its relevance. Also, refer to your historical data and industrial benchmarks while basing your assumptions.

Again, with Upmetrics you can get detailed expense stream suggestions for your business. This will make sure that you don’t leave behind even the tiniest of expenses that may make your projections faulty.

7. Determine your EBIT

Simply deduct your operating expenses from the gross profit to get your EBIT, i.e. operating income. The EBIT demonstrates the profit generated from your core business operations.

At this stage, also account for the depreciation and amortization adjustments you will be making against the long-term value of the assets.

8. Calculate non-operating income and expenses

Now, comes the non-operating income and expenses that might not keep your business operational but still contribute to the business’s bottom line.

This includes interest income, investment gains, loan payments, impairment charges, loss/profit on asset sales, and much more.

Create a list of such income and expenses and account for their values for the projected period.

Calculate your pre-tax income after accounting for all operating and non-operating income and expenses (excluding taxes).

9. Calculate your taxes

Account for state, federal, and local taxes your business is liable to pay during the accounting period.

10. Calculate net income/profit

Now, deduct all the expenses, or simply deduct non-operating income/expenses and income taxes from your EBIT to get your net profit. Net income is the bottom line of your business’s profitability. It’s an opening cash balance, i.e. the amount of funds available with you to grow business or pay shareholders.

That’s your step-by-step guide to building an income statement. In the simplest terms, deduct all your expenses from revenue systematically to get your net profit.

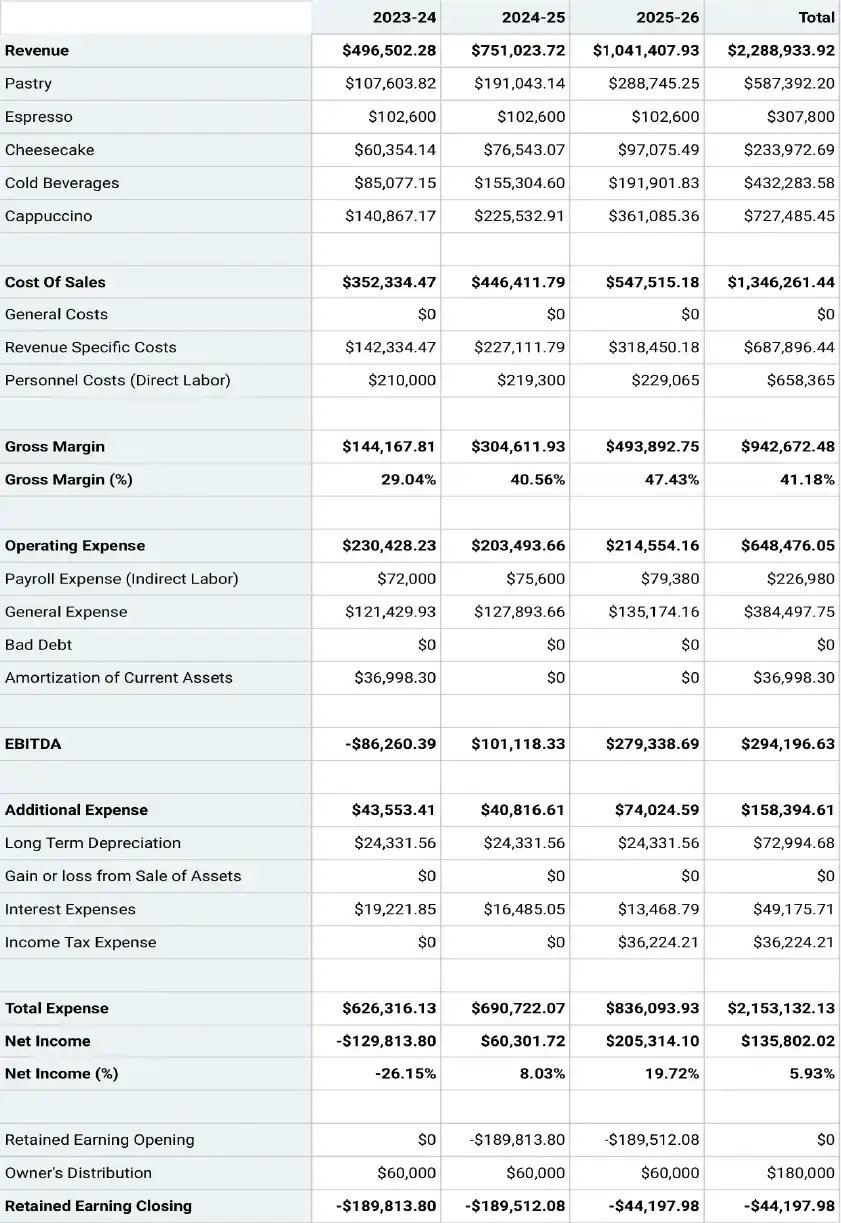

Sample business plan income statement

Let’s quickly glance through a sample income statement to understand how it will fit into your business plan.

Build your income statement with Upmetrics

The fundamentals and building blocks of an income statement are quite easy to grasp. However, building income statements for your entire projection period is still a time-intensive task.

Besides, your financial plan is not just an income statement. It includes other key statements (balance sheet and CFS), a funding plan, visual reports, and much more. Having a tool like Upmetrics is essential to make your financial planning process manageable and easier.

Its financial forecasting feature automates the calculations, builds visual reports, and offers AI stream suggestions relevant to your business. It builds detailed financial statements for your business without requiring you to deal with complex computations.

Build your income statements with Upmetrics now.