California is an amazing place to set up your business, be it a headquarters for your tech startup, first food or coffee shop outlet, or even a manufacturing unit.

But, starting a business is more than the idea and finalizing your location. There are these questions that often feel out of your area of expertise.

- How do I register my business?

- What licenses and permits do I need?

- Should I hire an agent, or can I do it myself?

And a dozen other questions like these.

Answer: This blog post.

While I can’t potentially cover everything on setting up a business in California, I’m sure this blog post will help you at least figure out the basics.

Here’s my quick, yet complete guide on starting a business in California.

What makes California different from other states for business?

California is the economic powerhouse of the USA, where new opportunities emerge every day. Starting a business here is like: You’re stepping into one of the biggest and boldest markets in the world, with access to over 50% of U.S. venture capital.

Moreover, a constant wave of innovation in tech, food, fashion, and green energy gives you opportunities to explore in different fields.

Here are a few stats that prove California is different from other states:

- Massive market: 39M people, currently living in California.

- Huge economy: 4th largest in the world if it were its own country.

- Higher costs & rules: Corporate tax is 8.84% + strict labor laws.

- Funding hub: Over 48.79% of U.S. venture capital flows here.

- Innovation hotspot: Tech, food, fashion, green energy—trends often start in CA.

Now that you have a clear overview of California’s stats and market dynamics, it’s time to focus on the practical steps to start your business in California. Let’s dive in.

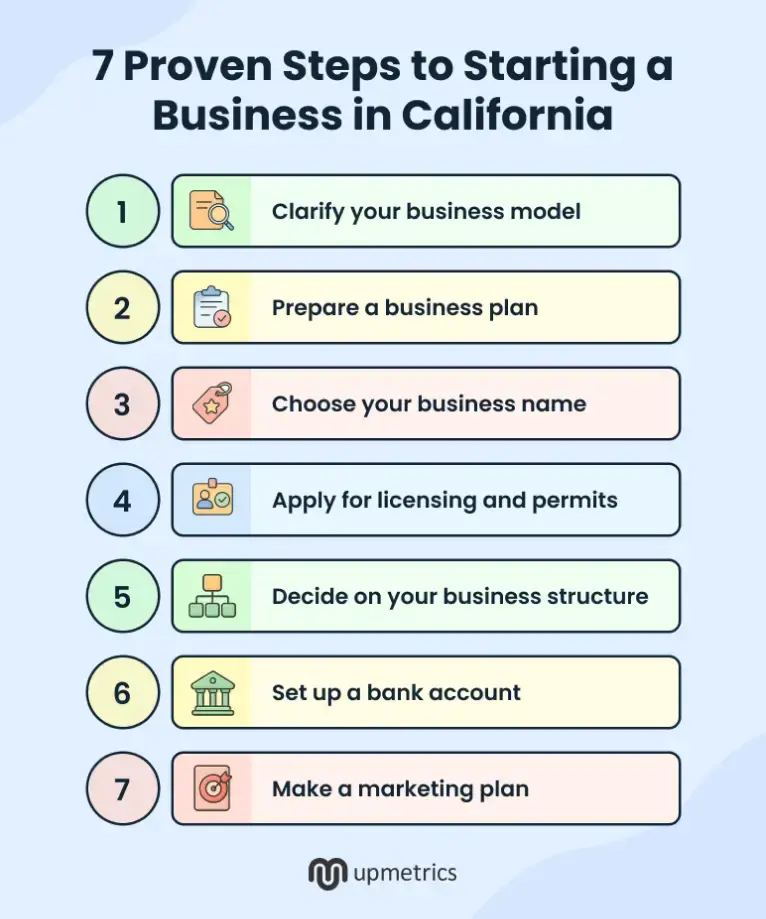

7 Proven steps to starting a business in California

Here are 8 simple steps. I promise not to complicate it.

Step 1: Clarify your business model

Jumping in without a clear business model is a NO. So, before you spend a single dollar, start by mapping out the mechanics of how your business will run. These questions should help:

- Who exactly are you serving? Write a clear profile of the exact person you want to serve. Note their age, lifestyle, buying habits, and preferences.

- What problem are you solving for them, and why is your solution better than what’s out there?

- How will you earn revenue? List your revenue streams like sales, subscriptions, and add-ons, and estimate the costs tied to each.

Remember: It’s essential to find a way to differentiate yourself.

For a coffee shop, don’t just brew coffee, create a cozy corner, offer delivery, or unique blends that keep customers coming back. For a boutique, think beyond just clothes; personal styling, online ordering, or curated collections can set you apart.

And voila! That’s your business model. You’re not just another shop but a shop people remember.

Step 2: Prepare a business plan

I know a business plan requires effort, time, and deep research. But a business plan isn’t about a 30-page document; a one-page business plan also works if it’s prepared with precision.

The key is that it should answer these three questions:

- What to do first?

- Where to invest your money?

- How to grow without burning out?

Our founder, Vinay, has made great efforts to document the steps to write a business plan, making life easier for founders like you.

To get you started quickly, here are the key elements you should include in your business plan:

- Executive summary

- Business description

- Market analysis

- Services offered

- Business structure

- Sales and marketing strategy

- Financial projections

- Risk management plan

- Exit strategy

Remember: A solid business plan may take effort and time, but calm seas never made a skilled sailor. That hard work prepares you to navigate challenges and steer your business toward real success.

Not very good at writing? Need help with your plan?

Write your business plan 10X faster

with Upmetrics AI

Plans starting from $14/month

Step 3: Choose your business name

This step may sound simple, but trust me, it’s where many business owners get stuck. Picking the right business name isn’t just about creativity; it’s about legality, availability, and branding.

Let’s break it down.

When you’re just starting, especially as a sole proprietor, you can operate under your own legal name, like “Sarah Johnson Consulting” or “Mike’s Auto Repairs.”

But if you want your business to sound different from your personal name, say “Blue Horizon Consulting” or “Sunset Auto Care,” you’ll need to file a DBA (Doing Business As), also known as a fictitious business name in California.

Filing a DBA doesn’t create a separate legal entity, but it allows you to legally operate under that business name, open a bank account, and market your services without confusion.

Here’s how you can do it right:

| Step | What to Do | Where / How |

|---|---|---|

| Check Name Availability | Ensure your business name isn’t already taken. | Use the California Secretary of State’s Business Name Search. |

| Check Trademark Conflicts | Avoid legal issues by checking trademarks. | Search on the USPTO website. |

| Register Your DBA | File a DBA if using a name other than your own. | Apply at county clerk’s office; publish in local newspaper if required. |

| Secure Domain & Social Handles | Lock consistent online presence. | Check domain registrars and social media platforms. |

Step 4: Apply for licensing and permits

Running a business without the proper license or permit? That can quickly lead to hefty fines, legal trouble, or even a forced shutdown.

However, if you want to know which licenses or permits you need and where to get them in California.

Here’s a quick answer:

| License/Permit | Who Needs It | Where to Apply |

|---|---|---|

| General Business License | Almost every business (retail, service, consulting, home-based) | City or county clerk where you operate |

| Seller’s Permit | Anyone selling or leasing tangible goods (retail, online shops, wholesalers) | California Department of Tax and Fee Administration (CDTFA) |

| Health Permit | Food-related businesses (restaurants, cafés, bakeries, food trucks) | Local County Environmental Health Department |

| Alcohol License | Bars, restaurants, wineries, and breweries | California Department of Alcoholic Beverage Control (ABC) |

| Professional License | Accountants, lawyers, contractors, cosmetologists, real estate agents, medical pros | California Department of Consumer Affairs (DCA) boards |

| Home Occupation Permit | Home-based businesses with clients or inventory | Local planning/zoning office |

| Environmental Permits | Manufacturing, auto shops, businesses with waste/emissions | CalEPA or local Air Quality/Water Boards |

| Sign Permit | Any business installing exterior signage | Local city/county planning department |

The table above lists where to apply, along with the official websites. If you only need a general business license, the process is straightforward:

- Visit the local office where your business will operate. (Most counties allow online app)

- Provide details like business name, address, ownership type, and nature of business.

- Pay licence fee (Fees vary by city or county, usually $50)

- Wait for approval (Can take a few days to a couple of weeks)

- Once approved, keep a copy of your license at your business location (Required by Law)

Step 5: Decide on your business structure

I’ve watched founders sign leases or hire staff before setting this up, only to spend months (and money) untangling the mess later. Remember, starting your business without a formal business structure will result in extra taxes, complicated paperwork, and difficulties in raising funds.

Thus, choosing your business structure isn’t just ticking a box; it’s one of the most important calls you’ll make early on.

Now, how to choose your business structure in California? Let’s break down each business structure and understand which works best for you:

1) Sole proprietorship

It’s the simplest business structure, which means you’re the only owner who runs the business. No paperwork, no cost. Good for freelancers, consultants, or testing an idea.

However, remember sole proprietorship comes with no liability protection. Which means your personal assets, like your house, car, or savings, can be used to pay for business debts or legal claims if something goes wrong.

2) Partnership

This business structure is the same as a sole proprietorship, but with two or more people. Similarly, there will be no protection on liability, but responsibilities and profits are shared among the partners.

3) LLC (Limited Liability Company)

LLCs are among the most popular business structures chosen by entrepreneurs in California. Why? Because it gives you liability protection and flexible taxes. Perfect for cafés, salons, and online stores.

4) Corporation (C-Corp or S-Corp)

It’s a separate legal entity that provides liability protection, good for enterprises and business owners who want to protect their personal assets. A corporation also makes raising funds, signing contracts, and scaling the business much easier compared to a sole proprietorship or partnership.

Alright then, if you’re a small or medium-sized business owner, an LLC can be the best choice to get started. Here’s how you set it up in California:

However, before applying for a business structure, ensure you have the following documents ready:

- Chosen business name (and a Name Reservation if needed)

- Articles of Organization (LLC) or Articles of Incorporation (Corporation)

- Statement of Information

- Operating Agreement (LLC) or Bylaws (Corporation)

- Business License from your city or county

- Federal EIN (Employer Identification Number)

All you need to start is picking a unique name for your LLC; ensure no one else is already using it. Next, appoint a Registered Agent. This is the person who will receive official legal documents for your business.

However, you can act as your own agent if you have a physical address in California, or hire a service.

After that, file your Articles of Organization on the California Secretary of State website. This officially registers your LLC.

Next, get an EIN from the IRS. EIN acts as the social security number of your business. You’ll need this to open a bank account, pay taxes, and hire employees. Finally, check with your city or county for any licenses or permits your business might need.

Step 6: Set up a bank account

Opening a business bank account in California is pretty straightforward; you can do it online or walk into your local branch. But honestly, I suggest visiting in person, especially if it’s your first business account.

You’ll get to ask questions, compare fees directly, and understand what really fits your business needs..

Make sure the bank you select for your business needs provides applications, online banking tools, and other crucial financial services. Additionally, remember to carry the following documents when opening a bank account in California:

- Your business formation papers

- Federal EIN (Employer Identification Number)

- A valid photo ID of all owners/signers

- Your business license or permit (if applicable)

- Partnership agreement or operating agreement (for LLCs/partnerships)

Step 7: Make a marketing plan

Even the best product in the world won’t sell itself. I’ve watched talented people pour everything into building a brilliant business, only to sit back and hope customers will magically find them.

They rarely do. A solid marketing plan isn’t fluff; it’s how you ensure all your hard work actually reaches the people who need it.

So get clarity on three things:

- Who are your customers?

- Where do they hang out?

- Why should they choose you?

Without that, you’re just throwing spaghetti at the wall.

The best ways to market your business are as follows:

| Way | Why Use It | Key Benefit |

|---|---|---|

| Social Media | 31M Californians scroll daily; meet them where they are. | Build visibility and connect fast with your audience. |

| Local SEO & Google Business | People search locally before buying. | Show up in ‘near me’ results and drive foot traffic. |

| Email Marketing | Direct line to your audience’s inbox. | Keep customers engaged and boost repeat sales. |

| Community Events & Pop-Ups | Californians love supporting local at markets & fairs. | Build trust and attract loyal customers. |

| Paid Ads | Instant reach if you target wisely. | Quick traffic and brand awareness. |

| Partnerships & Collabs | Share customers with complementary brands. | Expand reach without big ad spend. |

Although it doesn’t have to be intricate, a successful marketing strategy must be deliberate. Find out where your clients already hang out and arrange to meet them there.

Step 8: Fund your startup

Money isn’t just helpful when you’re starting out; it’s what keeps the lights on and the doors open. Rent, equipment, inventory, licenses, marketing… it all adds up quickly. That’s why it pays to sort out your finances before you launch.

Take time to map out what you’ll need and where it will come from, whether that’s savings, loans, grants, or outside investors. The upside? California offers many grants and programs to support small businesses, so you don’t have to do it all alone.

Here is the list of grants and programs offered in California:

- California Small Business COVID-19 Relief Grant (now broader support)

- California Dream Fund

- GO-Biz Incentives

- Small Business Technical Assistance Centers

Visit these websites and choose any grants that may fit your needs. The required documents, process, and time period are provided on the website itself.

Funding comes from more than just government grants. Here’s a quick look at the different ways you can secure money, how long it usually takes, and the easiest way to get started.

| Funding Type | What It Is | Time to Access | How to Apply |

|---|---|---|---|

| Personal Savings | Using your own money to start | Immediate | Just transfer or allocate funds to your business account |

| Friends & Family | Borrowed funds or investments from people you know | 1–4 weeks | Discuss terms, draft agreement, and receive funds |

| Bank Loans | Traditional small business loans | 2–8 weeks | Apply through a bank or credit union; provide the necessary info |

| Grants | Non-repayable funds from government or private programs | 4–12 weeks | Apply to the program website or the designated portal |

| Angel Investors | Wealthy individuals investing in early-stage businesses | 4–12 weeks | Network or use platforms to pitch; negotiate terms |

| Venture Capital | Investment from firms in exchange for equity | 1–6 months | Submit pitch deck to VC firms; attend meetings |

| Microloans | Smaller loans from nonprofit lenders | 2–6 weeks | Apply through nonprofit lenders or microloan programs |

| Crowdfunding | Raising small amounts from many people online | 1–8 weeks | Launch campaign on platforms like Kickstarter, GoFundMe |

Additionally, my team has put together a handy list of California’s current small business grants. Make sure to check it out before you start hunting for private loans.

Conclusion

You’ve now got a clear picture of what it takes to launch a business in California, from the prep work and paperwork to funding and landing your first clients.

Yes, the list can feel long, but with the right tools, like an AI business plan generator or guidance from a planning consultant, it’s absolutely doable.

Take a breath, trust your idea, and start building. California rewards founders who show up prepared and ready to grow. Good luck turning your vision into reality.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks, AI-assistance, and automatic financials make it easy.