Starting a business is a big bite to take on. To no surprise, adding state laws doesn’t make it any simpler. But that’s not Montana.

The state has no statewide sales tax. Usually has low startup costs (average, LLC forming cost is just $35). Has supportive local communities. In short, it’s ready to welcome you and your Montana dream if you start lean, plan smart, and connect locally.

But of course, you can have numerous doubts regarding the local permits, where to get funds, which town or county to begin your venture, etc. And this is probably delaying your start.

The doubts are endless, am I right? But having answers to these questions is what makes starting a business in Montana a breeze. In fact, Montana is one of the few places where small businesses actually have room to breathe (you’ll know why in a bit).

So today, I will show you how to start a business in Montana in a not-so-complex manner. Shall we?

But first…

Top reasons to start a business in Montana

If you’ve already done some research, you’re probably excited about the no statewide sales tax. As you should! It immediately lowers operating costs for small business owners.

But hold your horses.

There’s more Montana has to offer.

1. Simple and affordable LLC formation

If you’re forming an LLC, the setup is simple and affordable. It costs just $35 to file online, and the annual report fee is only $20. Go on and check out the Secretary of State’s website. You can handle nearly every step digitally through it, making the entire process quick and paper-free.

2. No general state business license requirement

Unlike many other states, Montana doesn’t require a general state business license. You’ll only need to check for local or industry-specific permits in your city or county. Isn’t that nice? You can avoid an extra statewide licensing fee that other states charge annually.

3. Growing and diverse state economy

Moreover, from a broader perspective, Montana’s economy is consistently rising across key sectors, including tourism, outdoor recreation, agriculture, and renewable energy. This implies two major details. One, these industries are driving new job growth. And two, they’re creating opportunities for startups to plug into expanding markets.

4. Business-friendly tax environment

Add to that ‘no inventory tax’ and ‘low property tax rates’, and you get a state where your business can start lean, scale sustainably, and keep more of what it earns.

To understand Montana and business further, let’s explore…

Montana’s business climate in 2026

The climate seems perfect for your first rodeo. That’s not me saying it. According to research, as of 2024, there are 136,968 small businesses in Montana. That’s 99.3% of Montana businesses.

I’m pretty sure that means your startup will get a real chance to taste success. In fact, small businesses in Montana pay 39% of all wages, compared to 21% in the whole of the U.S. That shows scope.

Furthermore, the Secretary of State released the Montana Business Economic Report, which shows that 63,808 new businesses were created in Montana in 2024. And as of 2024, 324,000+ businesses in Montana are standing strong.

In short, Montana’s businesses may be small, especially when compared to other states. But these small businesses provide more jobs and wages than many other states. This implies that Montana has a higher reliance on small businesses than elsewhere.

It’s not very difficult to decipher that this higher reliance is partially because of Montana’s rural nature and widely dispersed population. And of course, partially due to Montanans’ high level of entrepreneurialism.

That said, let’s jump right to the…

10 Steps to start a business in Montana

Here are 10 easy-to-follow steps (I promise):

Step 1: Define your business model

This really isn’t just Montana-specific. Before you file anything for any business, you should get clear on what kind of business you want to run, who you’ll serve, and how you’ll make money.

Why? Because it’s only going to guide every later decision, like location, pricing, staffing, and funding.

In the case of Montana, the most populated city is Billings with 121,483 people. So, you’re dealing with small towns where your customer base will depend heavily on your local community. Meaning? Markets can be small, but deeply loyal if you meet a real need.

For instance, a dependable mechanic in a rural county or a quality donut shop in a tourist corridor can thrive year-round from repeat customers.

How do you know if your idea will work in a small Montana town?

Talk! Observe! Test!

In small towns, people talk amongst each other a lot and know the ins and outs of their neighbourhoods. So, talk to the residents. Ask around in public communities like churches or college campuses. You can even join local Facebook groups or check what services people travel out of town for.

If you discover that town members have unmet needs, like no reliable daycare, no door-to-door pet groomer, or no local farm-to-table food option, you’ve found a viable niche.

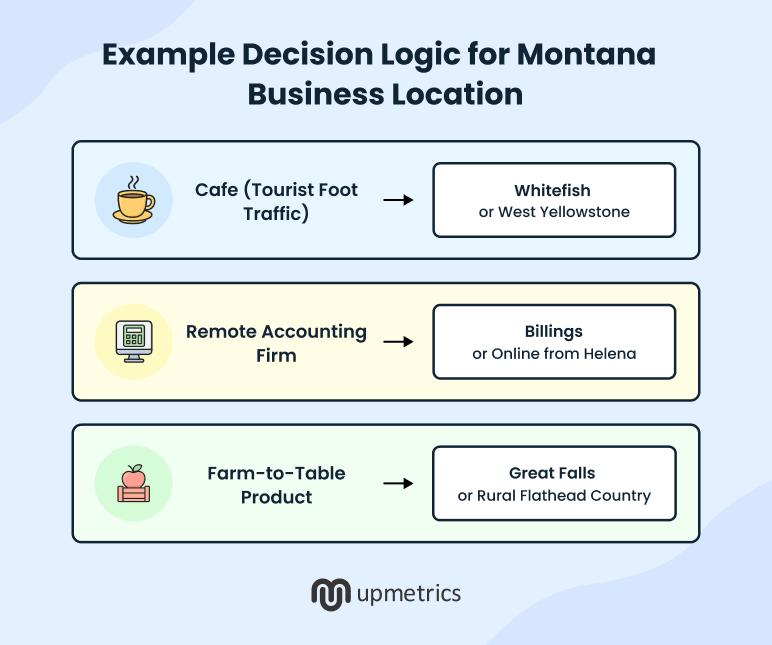

Step 2: Choose where in Montana to start

Montana’s geography shapes its business opportunities. Every town or county has its own business climate. Let’s take a look-

Bozeman and Missoula are fast-growing cities with active startup, tech, remote professionals, and tourism scenes. Billings and Great Falls are industrial, healthcare, and logistics hubs with solid infrastructure. Kalispell and Whitefish? Tourism-driven economies tied to Glacier National Park.

And the smaller towns like Livingston, Havre, and Miles City are great for community-based retail or service businesses.

Confused? Then, let’s make it simple. When choosing your location, ask:

- Does your business depend on locals, tourists, or through-traffic?

- Can you easily reach suppliers, delivery routes, or skilled workers?

- Are there zoning limits or incentives for small businesses?

- What’s the cost of permits, utilities, labour, and rent in that city or county?

Some Montana cities offer local grants, tax breaks, or small-business development incentives, while others have minimal local licensing rules. The “best” location for you isn’t necessarily the busiest one. It’s actually where your business model fits the local economy, community, and lifestyle.

Here’s an example decision logic for your Montana venture.

Step 3: Write a simple business plan

Obviously, you need one. It’s your roadmap. It forces you to test whether your Montana dream makes sense while keeping your spending realistic.

So when you write a business plan, at a minimum, include the sections:

- Executive summary

- Business description

- Market analysis

- Services offered

- Business structure

- Sales and marketing strategy

- Financial projections

- Risk management plan

- Exit strategy

These details ensure that you’re able to explain your idea, mission, and why it fits Montana’s market. It’s important you share whether that’s tourism, outdoor recreation, or local services. It will also clarify your company structure (LLC, sole proprietorship, etc.) and ownership, as well as other important details like:

- Financials

- Marketing plans

- Team and vendors

- And other business strategies

Keep the plan practical and concise. Something you’ll actually use, not just a document for lenders.

Do you really need a business plan if you’re starting small? (H4)

Yes! For small Montana businesses, the plan doesn’t have to be long or formal. The purpose is often clarity and survival, and not pitching.

It keeps things realistic and helps avoid costly surprises. Also brings a sense of accountability because writing down your plan keeps you from guessing what to sell, how much to stock, and when to expand.

Want to get started? Use Upmetrics or your local Montana Small Business Development Center (SBDC) for free templates and planning support.

Note: Montana investors and lenders look for resilience (seasonality), realism (logistics), local fit (community), and sustainability (environmental awareness). If your plan proves you understand those four levers, it will read as Montana-ready.

Step 4: Register and set up legally

With your business plan ready, you can now look at ways to make your venture legal in Montana. It’s straightforward:

- Check name availability on the official Montana Secretary of State’s website. If no results appear, it means your name is unique and available.

- File your Articles of Organization online for $35 (standard processing). You can pay more for “24 Hour Processing” (an extra $20) or “1 Hour Processing” (an extra $100). You’ll find the filing option under “Register A Business” on the same website.

- List a registered agent. It can be a commercial registered agent, or you can serve as your own if you live in-state.

- Lastly, wait for approval, typically 5–6 business days (unless you paid extra for expediting the process).

Remember to be precise. Your filing can be rejected for mismatched addresses, missing agent details, or invalid name formats.

Step 5: Get the local licenses and permits

Now that you’re registered, you can get your permits.

The best news? Montana has no general statewide business license, which simplifies things. However, local or industry-specific requirements still apply:

| Industry | Licenses/Permits Required | Where to Obtain |

|---|---|---|

| Food and beverage | Health and safety permits | The county health department and the Montana Department of Public Health and Human Services (DPHHS). |

| Construction and trades | Contractor registration and state occupational licenses. |

Montana Department of Labor & Industry (DLI) |

| Lodging and tourism | Lodging facility license and state bed tax registration. Plus local inspection. |

Montana Department of Public Health and Human Services (DPHHS) |

| Retail | Local city license (if required) and signage permits. |

City or county business licensing office |

| Childcare, beauty, or healthcare services | May require both state professional licensing and local health approval. |

DPHHS, Montana Board of Medical Examiners |

Of course, always verify with your county clerk or city business office to avoid fines or delays. Contact the City Clerk’s Office if your business is inside city limits. Contact the County Clerk & Recorder if you operate in an unincorporated area.

Ask specifically for:

- A general business license or registration (some cities require one, some don’t).

- Zoning clearance to ensure your business type is allowed at your location.

- Home occupation permit if you’re running the business from home.

- Sign permit if you’ll display exterior signage.

Examples: Bozeman, Billings, Missoula, and Great Falls require local business licenses. Whereas many smaller towns and counties, such as Fergus County, Broadwater County, only require zoning approval or registration.

Step 6: Open a business bank account and track finances

Next, you want a separate business bank account to protect your personal assets, track expenses, and simplify taxes. To open one, bring:

- Your Employer Identification Number (EIN) from the Internal Revenue Service (IRS)

- Your business registration documents

- Photo ID

- A physical mailing address (PO boxes are often not accepted)

But which bank should you trust? Remember, when in Rome…

So start with local options like First Interstate Bank, Glacier Bank, or Opportunity Bank of Montana. They often cater to small businesses and are good for local service, flexible underwriting, and SBA support. So definitely check them out.

With a separate bank account, tracking finances should become simple. Use cloud storage for receipts and invoices, bank feeds to automatically sync transactions, and categories for income, expenses, mileage, and taxes.

Can you open a business bank account if you’re operating as a sole proprietor?

Yes. You’ll just need a DBA and an EIN (even if you don’t have employees). In fact, it matters most because:

- It simplifies bookkeeping and income tracking

- Builds a financial history if you later form an LLC or seek funding

- Protects personal privacy when accepting payments or issuing invoices.

For managing money, tools like QuickBooks, Wave, or FreshBooks can help you track income, expenses, and prepare for tax season.

Step 7: Understand Montana taxes and compliance

No statewide sales tax has its own benefits. One of them is simpler pricing and no collection hassles for most businesses.

Still, you should stay compliant with:

- State income tax (through the Montana Department of Revenue or DOR)

- Employer withholding tax (if hiring)

- Federal taxes like if you’re self-employed, pay self-employment tax (Social Security and Medicare). Or make quarterly estimated payments to the IRS and Montana DOR if you expect to owe over $500 for the year.

- Industry-specific taxes, like the 4% lodging facility tax or alcohol and tobacco excise taxes

- Annual report filing by April 15, with a $20 fee

Do you need to collect sales tax in Montana?

No, you don’t. Of course, unless your business falls under a specific taxed category like accommodations or certain regulated goods. Each town sets its own rate (usually 3–5%) and has its own remittance process.

Step 8: Find funding options in Montana

Sure, Montana has fewer venture capital firms. But it’s not a dead end for you. Strong local and state funding programs exist.

Start with Montana-based programs

The Montana Department of Commerce runs several funding initiatives that support small businesses statewide:

| Funding Source | Description |

|---|---|

| Big Sky Economic Development Trust Fund (BSTF) | Offers grants and job-creation incentives for startups and expanding businesses. |

| Native American Business Advisors (NABA) Grant | Provides funding and technical support for tribally owned or Native-led businesses. |

| Incumbent Worker Training Program | Covers up to 50% of employee training costs for Montana employers. |

| Montana Microbusiness Finance Program | Low-interest loans for small and rural ventures. |

You also want to check your local economic development authority (LEDA)—every county has one. They manage microloans, small business grants, and gap financing.

Try federal and SBA options

You can always use SBA-backed loans available in Montana through local banks and credit unions. For example, the SBA 7(a) Loan Program provides up to $5 million, ideal for working capital or expansion. If you’re a small business but in a traditionally large funds-requiring industry like mining or farming, this can be a good option.

But you’ll likely want to check out the SBA Microloan Program. It provides up to $50,000 for new or early-stage businesses. Especially if they need funds for inventory, supplies, or smaller equipment. Warning: They can’t be used for real estate or to pay off other debts.

Another option is the USDA Rural Development Loans and Grants. It’s great for rural facilities, renewable energy, and agriculture-based ventures.

These programs often partner with Montana lenders like Stockman Bank, Opportunity Bank, or Glacier Bank.

Check out rural and minority-owned business programs

Another beneficial option is checking out women-owned or minority-owned business programs. You can access tailored support through the Montana Women’s Business Center (if you’re a woman-owned business) and the Montana Community Development Corporation (MoFi).

Step 9: Build your network and team

I personally think businesses in Montana thrive on relationships. You know how small towns operate. Your morning newspaper delivery man, to your corner cafe owner, to your church minister, everyone is often well versed with you and other neighbors.

What does that mean for you? It means networking is less about conferences and more about showing up locally.

Join your chamber of commerce. Attend local business breakfasts or farmers’ markets. And connect with SBDC events. Word-of-mouth partnerships go a long way here.

Are you hiring? The Montana Job Service and Department of Labor & Industry can help you find employees or seasonal workers. Seasonal hiring is common in tourism-heavy towns like Whitefish or West Yellowstone, where visitors number falls sharply during winter.

Step 10: Develop your marketing plan and launch

Marketing in Montana? It’s easy if you’ve cracked networking. Because word-of-mouth is still the most powerful marketing tool in small Montana communities.

So what should you do? Focus on reliability, service quality, and community involvement. Start small, collect feedback from the community members, and refine your approach over time.

But does that mean you don’t tap into the modern marketing tactics? Of course not. Just keep in mind that Montana depends on credibility and consistency. That said, here’s everything you can do to reach Montanans:

- A Google Business Profile with photos, hours, and location.

- Listings on local directories and Facebook community pages.

- Mentions in local newspapers or radio shows for affordable awareness.

- Website optimized for “near me” and town-specific searches (e.g., “coffee shop in Whitefish, MT”)

- Listings on the Chamber of Commerce and the tourism board

- Flyers and posters at community hubs

- Sponsored school, rodeo, or community events

You should most definitely use more than one of these marketing tactics. Local + digital mix works best.

Coming to the launch, being strategic is the best way to go. Why not treat opening week as a community event? That’s very on-the-nose Montana!

Hear me out:

Host a soft launch or open house with local partners ➡️Builds relations.

Offer limited-time local discounts or collaborations (e.g., a brewery and food truck pairing) ➡️Brings in the numbers.

Capture testimonials and photos to reuse in future promotions ➡️Improves trust and awareness amongst the community.

Thank local supporters publicly ➡️Montanans value authenticity.

All of these steps will not only market your business, but they will also please the ‘people’, the essence of Montana.

With that said, I conclude my guide. But I feel a few handy resources will do you some good as a new Montana business owner. Let’s take a look…

Helpful resources for entrepreneurs in Montana

Here’s a quick directory of websites for you, so you don’t have to scavenge the internet for Montana business needs:

- Montana Secretary of State: Use this site to register your business, file your annual report, access official documents, and stay compliant. It’s where every new business in Montana begins.

- Montana SBDC Network: This is the small business department center that offers free help with business plans, funding, and marketing. Excellent for first-time business owners who want expert advice.

- Montana Department of Revenue: You’ll need this website to handle state taxes and employer registration. It helps you understand what taxes apply to your business and how to pay them.

- Accelerate Montana: This website will be your holy grail when it comes to training, mentorship, and online growth support for small businesses and startups.

- Big Sky Economic Development: This website provides local funding programs, business loans, and growth resources, especially for businesses in and around Billings.

- SBA Montana District Office: Here you can connect with federal loan programs, grants, and small-business training available across the state.

Conclusion

I hope I was able to live up to my promise to offer easy-to-follow. By now, you should have clarity as to where to start and how far you’re to go regarding your Montana business.

But the success of your Montana venture? Now that depends on your understanding of the local regulations and careful planning. With low taxes, affordable registration, and a strong community spirit, it’s a state that rewards founders like you who keep things practical, grounded, and community-focused.

Ready for some community love while making bank? That’s the Montana dream. Good luck!

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks, AI-assistance, and automatic financials make it easy.