It’s strange how often I hear the same story from founders.

The idea was solid. The team was good. The early numbers looked promising. And yet, somewhere along the way, things stopped working.

When I dig deeper, the reasons sound somewhat similar every time. That’s what made me curious. Why do startups fail even when they seem to do most things right?

So, I reached out to founders, other consultants, and dug through post-mortems to find the real answers. Turns out, failure isn’t random. It’s a set of repeatable mistakes—around 18 to 20, if you track them long enough. I’ve broken them down, so you can spot the early signs and course-correct before it’s too late.

1. Solving a problem that sounded important, but customers never felt urgent enough to pay for

On paper, sure, a problem might look big. But the truth will only surface when you talk to customers. More often than not, the response sounds something like this: “Yes, it’s an issue…but not urgent enough to spend money on.”

A classic example of this was Google Glass. It looked revolutionary with wearable tech that promised a new way to experience information. But when it launched, customers didn’t feel an urgent need for it. Privacy worries, limited use, and a high price meant it solved an interesting problem, not an immediate one.

This gap between “important in theory” and “urgent in reality” is dangerous. CB Insights and the pattern isn’t limited to tech; many small businesses fail for the same reason.

Beta users say nice things. Friends call it “brilliant.” But you have to know that compliments don’t equal commitment. If nobody is willing to pay, you don’t have a business.

2. Launching into a market that looked large on paper but was too fragmented to monetize

At first glance, a big market feels like a safety net. “If it’s worth billions, surely I can capture a slice,” right? That’s the trap. Large numbers on paper don’t always translate into real opportunity.

I came across this pattern a lot in local service startups. Cleaning, tutoring, home delivery…they look huge because everyone needs them. But demand is scattered across thousands of small providers, and every city plays by different rules.

Now, some founders have got this balance right too. In a recent LinkedIn post, Shripal Gandhi explained how Indian unicorns like Paytm, OYO, and Ather scaled only after mastering hyperlocal markets and unit economics first.

The post shows how India’s top unicorns focused locally, proved their model in one market, and only then scaled successfully, avoiding the “big-on-paper” trap that kills many startups.

Now, you might think: “But can’t I just consolidate or scale with tech?” That’s exactly what many startups believed. The problem is, fragmentation keeps costs high and margins razor-thin. Customer acquisition doesn’t get cheaper with scale, and retention is shaky because users often treat these services as optional.

The way I frame it now is simple: “Is this market big enough for me to capture in practice, or is it just big on paper?” If the opportunity is too fragmented, even great execution won’t add up to a viable business.

3. Relying on early adopter praise instead of testing willingness to pay

In the first point, I spoke about urgency. This one’s connected. Even when the problem feels real, you can still get misled by how people talk about your solution.

Founders told me they heard the same lines again and again: “This is amazing,” or “I’d definitely use this.” It gave them confidence that they were building something people wanted. But when they finally asked for payment, those same users vanished.

I came across a post from @ThePeelPod a few weeks ago that perfectly captured this pattern. They cited a study shared by @credistick, showing that nearly 70% of startups raised too much money before proving product–market fit. They poured funds into growth and hiring based on excitement, not validation—and when things didn’t click, everything unraveled.

Now, you might be wondering: “But isn’t positive feedback a good sign?” Yes, it shows there’s some interest. What it doesn’t show is commitment. Compliments cost nothing. Real validation shows up when people keep using the product without being nudged, or better, when they pay.

4. Targeting an audience that had enthusiasm but no purchasing power

This one came up a lot in my conversations with founders. They built something people genuinely loved. The app got downloads, the community was buzzing, and engagement looked great. But revenue was zero.

Student-focused apps are the clearest example. Students are eager to try new things, quick to give feedback, and happy to spread the word. But they didn’t have the budget or the habit of paying for products. The enthusiasm was real, but the purchasing power wasn’t.

And I can already hear the question: “But can’t you just monetize later with ads or partnerships?” Sure, some try that. But the truth is, if your core users can’t or won’t pay, you’re building on weak ground.

Ads don’t magically fix bad unit economics, and partnerships are hard to land without traction that converts. These patterns repeat so often that the startup failure rate has stayed stubbornly high for years, even as funding and tools improve.

5. Expanding into new geographies before proving repeatable traction at home

This is a mistake I’ve seen repeated across industries. A startup finds traction in one city and assumes it can copy the playbook everywhere. But every market plays by its own rules.

Wilbur Labs’ 2023 report also highlights this pattern: Founders expanding too early without a repeatable model. New cities brought new habits, higher costs, and unexpected competition. The same strategy that worked once suddenly stopped working.

You might think, “But isn’t scaling fast the goal?” It is, but only when the playbook’s proven. Until retention, margins, and acquisition costs make sense in one place, expansion just multiplies your problems. Nail it once before you copy it. These patterns repeat so often that the startup failure rate has stayed stubbornly high for years, even as funding and tools improve.

Even global giants have stumbled here. Airbnb, despite its global success, eventually shut down its operations in China after years of struggling with local competition, cultural mismatches, and regulatory hurdles. The market looked huge on paper, but the model that worked everywhere else just didn’t translate.

6. Overbuilding infrastructure for millions of users when only hundreds had signed up

This one always makes me pause because it comes from good intentions. Founders want to be ready for scale. They picture millions of users and build systems that can handle it. The problem is that those users haven’t arrived yet.

I came across a great post on Reddit that described this perfectly. It talked about how early-stage founders often overengineer their product, trying to cover every use case from day one. There’s always “just one more feature,” and by the time it’s ready, the runway’s gone.

I get the logic—We don’t want things to crash later.” But the truth is, early startups rarely die from scaling too late; they die from running out of time while preparing too early. So always build for what you have, not what you hope for. Growth will test your systems when it’s real.

7. Creating features because investors asked, not because customers demanded them

When I was studying startup post-mortems, this was a recurring mistake. Founders didn’t plan to drift from their users; it just happened slowly. After a few investor meetings, they started tweaking their product to “look stronger” for the next pitch instead of making it better for customers.

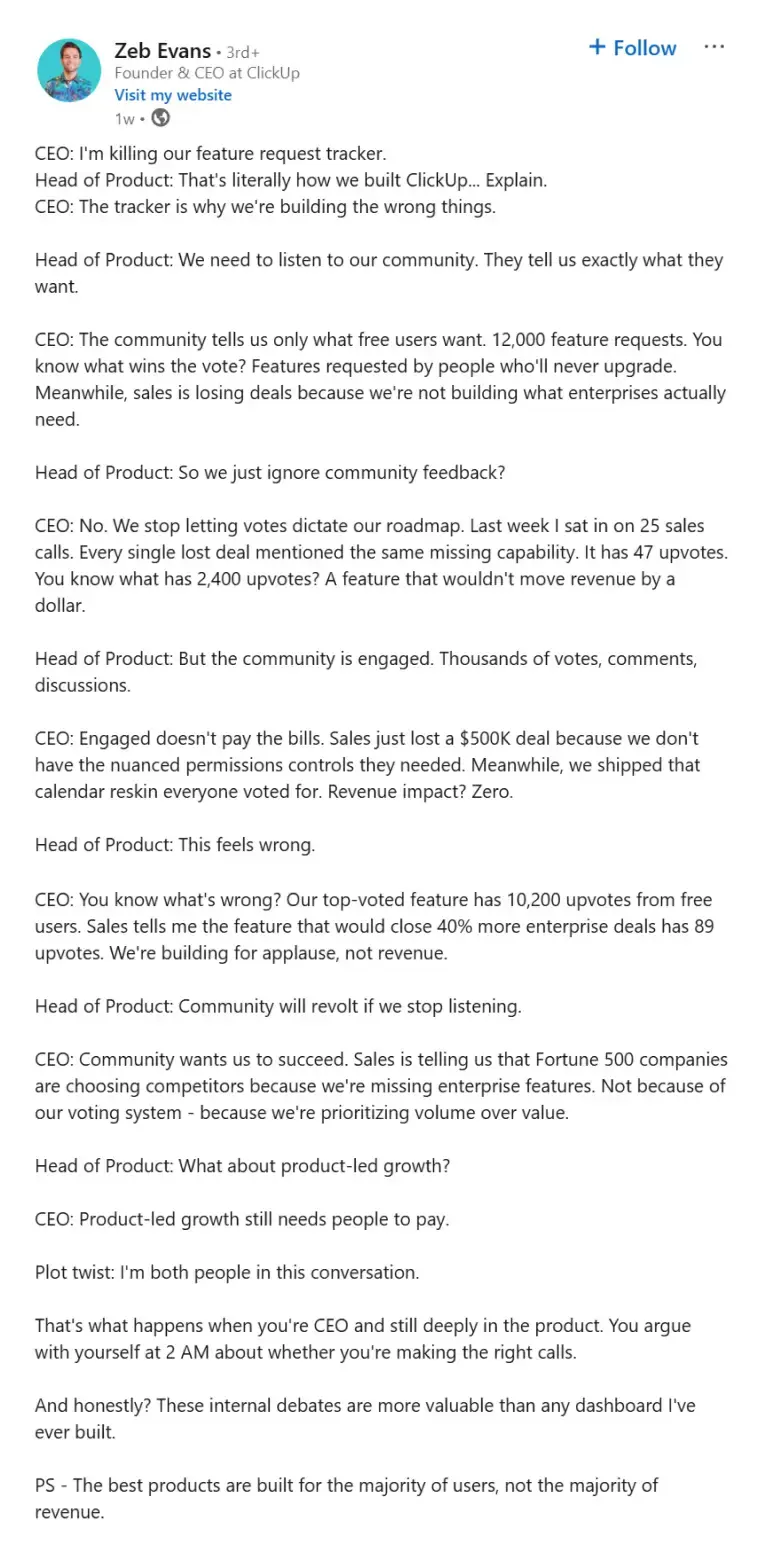

Like most days, I was scrolling through LinkedIn and saw a post by Zeb Evans, CEO of ClickUp. He’d written a mock conversation between his “Head of Product” and “CEO” selves about killing their feature-request tracker.

The problem? They were prioritizing what free users wanted most instead of what paying customers actually needed. His line summed it up perfectly: “We’re building for applause, not revenue.”

And that’s exactly the danger with investor-driven features, too. You start building what looks good in a pitch deck instead of what keeps the business alive. Every founder who followed that path later said it pulled them away from real demand. Learning to write a business plan that’s based on customer insight—not investor pressure can help you stay focused.

You might be thinking, “But what if the investor’s suggestion is actually good?” Sometimes it is, but the test should be the same: Do your users care? If it doesn’t make their life easier or their problem smaller, it’s not a feature.

8. Ignoring user churn because acquisition graphs looked impressive

Growth numbers have a way of blinding founders. When signups rise every week, it feels like validation. But many startups chase new users while quietly losing the ones they already had.

The other day, I was reading a discussion on Reddit where a founder who’d worked with 30+ startups said something that really stuck—most startups build acquisition machines instead of retention machines.

He noticed the same pattern I’ve seen: Teams hit a few hundred thousand in revenue, then plateau. They’re pouring water into a leaky bucket and wondering why the level never rises.

In the beginning, it doesn’t look serious with just a few drop-offs here and there. Teams convince themselves it’s normal and pour more money into ads. But churn compounds fast. Before long, the marketing spend climbed while the active user base barely grew.

In my opinion, if your new user curve looks great but your repeat usage doesn’t, you’re not growing. Sustainable growth means the base sticks before it expands.

9. Depending entirely on a third-party platform (Facebook, App Store) for distribution

I’ve come across startups that looked like they had growth figured out with steady users, consistent sales, and everything tracking up. Then one day, a small change in an algorithm wiped most of it out. Overnight, the same ads stopped performing, or the app slipped off discovery lists.

Even giants aren’t immune to this. Remember when Mark Zuckerberg openly criticized Apple’s control over the App Store in front of 50,000 Meta employees? He called out how Apple’s policies directly affected Facebook’s ability to reach users. If a company like Facebook can feel that pressure, imagine what it does to a startup.

It’s an easy trap to fall into. You might be thinking, “But isn’t that where the audience is?” True, but that audience isn’t really yours. If you can’t reach them without someone else’s algorithm, you’re renting, not owning.

So I always tell founders to start small but build direct channels early—email lists, communities, owned audiences. Growth is easier when no one else controls your access to it.

10. Launching a marketplace without incentives for either side to join first (cold start problem)

The first thing that most founders learn (the hard way, of course) is that nobody wants to go first. You can have the best idea, great designs, a solid business plan, but if buyers log in to buy and see nothing to buy, they obviously leave.

Sellers wait to see proof of buyers, and buyers don’t bother signing up because the selection’s thin. Everyone’s waiting for someone else to blink first. It’s not that people don’t care; they just don’t want to be the first ones standing in an empty room.

If I had to summarize the fix in one line, it’s this: Make the first move irresistible. Give early users something extra (like visibility, revenue share, access) that gets one side moving. Once that side sticks, the other one always follows.

11. Pricing products too low, assuming scale would fix broken margins

Every founder wrestles with pricing. In the early days, charging less feels safe as it gets attention, attracts users, and makes you look competitive. Many say, “We’ll raise prices once we scale.” But scaling won’t fix your already weak margins; if anything, it magnifies them.

A LinkedIn post by Patrick Casey, a fractional CFO who reviews startup pitches, summed this up perfectly. He said most founders could tell him their revenue and burn rate, but froze when he asked a simple question: “What’s your profit per customer?”

He’d seen startups raise millions, scale fast, and implode, all because they never figured out their unit economics. They confused revenue growth with actual business health.

And that’s exactly what Wilbur Labs called the “unit economics blind spot.” When your numbers don’t work at a small scale, growth just makes the hole bigger.

A common question I get is, “But won’t low prices help us grow faster?” Maybe, but if every new user costs you money, what are you really growing? A better way is to test pricing early, even if it scares you. It’s easier to justify your value than to rebuild your model later.

12. Scaling paid ads early without knowing customer lifetime value

I get why founders do this. Ads are one of the few levers that give quick results. You spend, you see traffic, and suddenly there’s momentum. It feels like growth is working.

But most founders don’t yet know what each customer is actually worth. You’re spending $30 to acquire someone who might only bring in $15 over time. Early traction hides that math. You assume the numbers will balance out later. “Let’s just get users first,” right? That’s the line I hear the most.

Even experienced ad strategists warn against this. Chris Marrano, who audited over 90 Meta ad accounts this year, found that most brands scale without knowing their break-even point. They pour money into ads without defining a profitable CPA or ROAS threshold and end up burning through cash they could’ve reinvested in retention.

When you scale before understanding what profitability looks like, you’re not optimizing. So before spending more, test the basics: How long do customers stick, and how much do they really bring in? If you can’t answer that confidently, more spending won’t fix it; it’ll just magnify the leak.

13. Underestimating compliance costs (permits, licenses, legal), which wiped out thin margins

This one catches a lot of founders off guard, especially in food, health, or anything even slightly regulated. You plan your pricing, calculate margins, and it all looks fine…until the paperwork comes up.

Permits, licenses, testing, labeling, renewals—each looks small on its own, but together they slice into margins fast. I once spoke with a founder who realized their “profitable” smoothie business was actually running negative once they added compliance renewals and lab testing.

It’s easy to overlook because compliance doesn’t feel urgent at launch. You’re focused on getting the product out. But the bills come due later, and they don’t scale nicely. If your margins are already thin, treat compliance like rent—it’s not optional, and it’s never one-time.

14. Designing financial projections for pitch decks rather than operational reality

When founders start raising money, projections somehow turn into performance art. The charts always go up, costs magically stay flat, and profits appear right on cue. I get why—it’s what investors expect to see.

But most of those numbers aren’t built to run the business; they’re built to impress. And when the real costs hit—marketing that’s pricier, higher churn—the whole plan stops making sense. It’s one of the common business plan mistakes to avoid.

Former banker and startup advisor Jonathan Mills Patrick talks about this often. In one of his articles, he pointed out that financial slides are the ones founders most often get wrong—they’re polished for storytelling, not grounded in operations. He says investors can spot that instantly.

So if your financials only look good in a deck, they’ll fall apart the moment you start operating from them. Optimism is fine; just back it with logic. A believable forecast isn’t just for investors; it’s your first reality check.

Financial spreadsheets are clunky and boring

Make accurate forecasts without spreadsheets or historical data

Plans starting from $14/month

15. Expanding team headcount right after funding, without tying hires to revenue milestones

The moment the money hits, everything shifts. Founders go from stretching every dollar to finally having breathing room, and that freedom can be dangerous. Even after raising money, funding challenges return quickly when expenses grow faster than revenue. The instinct is to hire fast, build structure, “grow into” the company you want to become.

But growth doesn’t work on intuition. I’ve seen teams triple in size before they had a working sales process or stable revenue. The results in burnout shooting up, culture getting messy, and nobody could tell which hires were actually making an impact.

It’s not that hiring is bad; it’s that the timing is important. Each new role should tie back to a clear milestone: What problem it solves, what number it moves, what risk it reduces.

16. Cofounder misalignment on pace, vision, or equity split leading to breakup

In the early days, everyone’s working toward the same goal, so differences don’t feel like a big deal. But once things start moving, those small gaps in vision or pace become harder to ignore.

I’ve talked to founders who said it started with minor disagreements—one wanted to grow fast, the other wanted to slow down and fix the basics. Neither was wrong, but the gap kept widening until every decision turned into a debate.

And it’s not rare. A psychologist who works with startup founders on LinkedIn mentioned that 70–80% of startup breakups trace back to cofounder misalignment. Not funding, not the market—just people drifting apart because they never learned how to handle conflict when it was still small.

That hit me because it’s true. Most cofounders don’t fall out over one big argument; they just stop having the hard conversations. It’s easy to assume contracts or equity splits will keep things steady. They don’t. What actually keeps things steady is communication that doesn’t shy away from tension.

17. Hiring senior execs from big corporates who couldn’t adapt to the startup pace

It always starts with the best intentions. Things are finally moving, you’ve got funding, and you think, “Let’s bring in someone who’s done this before.” So you hire a senior exec from a big company.

For the first week, you feel like you’ve leveled up. Then the meetings begin. Suddenly, there are strategy decks, approval flows, and talks about “process alignment.” You’re thinking, “Wait, we’re six people… what process?”

It’s not that they’re wrong. They’re just wired for a world where time and budget aren’t constant threats. Startups live in the opposite reality.

18. Founder unwillingness to pivot when data contradicted the original vision

This is one of those mistakes that feels small at first. You run an experiment, the results don’t match your expectations, and you brush it off. Then it happens again. And again. Before long, you’ve collected months of feedback that all point in one direction, which is that you just don’t like where it’s going.

Founders often ask, “But what if the market’s just not ready yet?” Sometimes that’s true. Most of the time, it’s not. The market’s speaking—you’re just not listening.

I’ve seen teams waste runway trying to make the wrong idea work when the right one was sitting in their data all along. Pivoting isn’t abandoning your vision; it’s keeping it alive long enough to find the version that actually works.

19. Lack of transparent communication with investors during downturns

When growth slows, most founders go straight into fix-it mode. You tell yourself, “Let’s turn things around first, then we’ll update investors.” It feels responsible—but that silence often does more harm than the bad numbers themselves.

The longer you wait, the harder it becomes to explain. Investors don’t read silence as focus; they read it as panic. And once that doubt creeps in, it’s tough to rebuild trust.

Most founders stay quiet because they don’t want to look like they’ve lost control. But the truth is, investors have seen downturns before. They don’t expect perfection; they expect honesty. A quick business plan review can uncover issues early and rebuild trust before they escalate.

What I find ironic is when founders finally do share the bad news, help usually follows. But by then, they’ve already spent weeks trying to fix things alone.

Tired of guessing what investors want to see?

Create fund-ready business plans with Upmetrics

20. Overconfidence after early press coverage, mistaking visibility for traction

That first big media mention changes everything for a few days. Traffic spikes, social mentions blow up, and the team feels unstoppable. It’s easy to believe this means the product has finally “clicked.”

But that illusion is dangerous. Press attention often pushes founders to behave like they’ve already found a product–market fit. They hire faster, increase spending, and shift focus from improving the product to maintaining visibility.

That first big media mention changes everything for a few days. Traffic spikes, social mentions blow up, and the team feels unstoppable. It’s easy to believe this means the product has finally “clicked.”

But that illusion is dangerous. Press attention often pushes founders to behave like they’ve already found product–market fit. They hire faster, increase spending, and shift focus from improving the product to maintaining visibility.

PR strategist Brooke Hammerling explained this perfectly in her First Round Review essay, “Why Most Startups Don’t Get Press.” She said most founders chase press too early—before they have real traction to sustain it.

Media visibility can make a company look bigger than it is, drawing in users, investors, and even competitors who expect maturity that simply isn’t there yet. As she puts it,

“Press doesn’t create momentum; it amplifies what’s already there.”

That’s the real trap. The sudden visibility forces startups to act like established brands—launching features faster, spending more, or trying to live up to the narrative the press built for them. When the buzz fades, as it always does, the gap between perception and progress becomes impossible to hide.

The bottom line

Looking back at all these patterns, one thing that stands out is that startups don’t fail because founders stop working hard. They fail when they stop checking their assumptions. Most of these mistakes show up early; you just need a system to catch them.

That’s why having a structured way to plan and track your business matters. Upmetrics makes it easier to test your ideas, project realistically, and see early when something’s drifting off course