Starting a dance studio is an exciting venture—it lets you turn your passion for dance into a thriving business.

But to make your studio successful, you need more than great dance skills. You need a roadmap for your business, which is exactly what a dance studio business plan provides.

Not sure how to draft one?

This dance studio business plan template will walk you through everything you need to create a complete plan, step by step.

Why do you need a dance studio business plan?

A business plan is essential because it turns your idea into a structured strategy. Writing a plan forces you to research and think through every aspect of running a dance studio, from the market you’ll serve to the way you’ll operate day-to-day.

In fact, if you’re planning to start a new dance studio, the first thing you’ll need is a business plan. It helps you deal with all the business aspects of running a studio and ensures your strategies are foolproof and effective.

Here are a few key reasons to keep a dance studio business plan:

- Giving clarity & direction: It defines your studio’s mission, target market, and goals, acting as a roadmap for growth.

- Letting you check feasibility: Researching for the plan lets you validate that there is demand for your classes in your area and that your financial model is sound.

- Attracting investors or loans: A well-written plan showcases your studio’s potential, giving lenders or investors confidence in your concept.

- Organizing your strategy: By covering everything from marketing to operations, the plan ensures you have a cohesive strategy and aren’t “winging it” in any area.

- Measuring progress: It helps set benchmarks that you can later use to track your studio’s progress and adjust plans as needed.

In short, a business plan is your studio’s blueprint for success. It’s easier to change and refine a plan on paper than to make costly mistakes in real life. Investing time in a plan now can save time, money, and stress later.

How to draft a business plan for a dance studio?

Drafting a business plan might sound daunting, but not to worry! Here’s a simple approach to drafting your plan:

1. Executive Summary

The executive summary is an overview of your entire dance studio business plan, distilled into a few key points. Think of it as the “elevator pitch” for your dance studio. A reader should get the gist of your whole plan after reading this section.

This section comes first in the plan, but it’s often easiest to write it last since it’s a summary.

In 1–2 pages, touch on the most important aspects of your dance studio:

- Business concept

- Target market and niche

- Competitive advantage

- Summary of services

- Brief financial highlights

- Funding needs (if applicable)

Remember, the tone of the executive summary should be enthusiastic, confident, and clear. Avoid going into too much detail—the goal is to entice the reader to keep reading the rest of your plan.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Company Description

The company description introduces the basic details or fundamentals of your dance studio. Think of it as an expanded elevator pitch. By the end of this section, the reader should clearly understand who you are, what your studio does, and what you plan to accomplish.

This section comes right after the executive summary and sets the stage for the details that follow.

Key elements to cover in your company description:

- Basic company details: State your studio’s name, location(s), and what type of legal entity it is. If you have a specific start date in mind or your studio is already operational, mention that too.

- Mission and vision: Include your mission statement and your vision statement. These help readers connect with your studio’s values and long-term aspirations.

- History and current status: If your dance studio is a new startup, you might instead share the background of the idea: what inspired you to start this studio?

- Management and ownership: Introduce the founder(s) or key owner(s) of the studio. You can mention your name and any co-founders, along with a one-liner about your background in dance or business. Also, clarify the ownership structure.

- Legal structure and status: Note if you’ve formally registered the business and any licenses or permits acquired or pending.

The company description should give a captivating snapshot of your business and where it’s headed, enough to keep readers hooked.

By providing essential information about what you do and who you are, you win the reader’s trust in your business idea and encourage them to continue through the plan.

3. Industry and Market Research

This section demonstrates your understanding of the dance studio industry and the market you plan to operate in. You’re answering: What is the broader industry like, and what is my target market within it?

Industry overview

Start by describing the dance studio industry at a high level, including market size, growth trends, and relevant insights.

According to a Statista report, the US dance studio industry was valued at a whopping 4.4 billion dollars in 2024, with a CAGR increase of 2.6%.

This highlights the significant activity in the sector. Trends include the rise of dance for fitness, with styles like Zumba and dance cardio boosting adult participation, and pop culture continuing to drive interest in dance classes. Mention any local industry specifics as well.

Target Market

Next, zoom in on the specific market you plan to serve. Who are your ideal customers? Be as specific as possible. For a dance studio, your market can often be segmented by age, skill level, or dance interest.

If you have multiple segments, you can list them out. For clarity, you might break your target market into categories such as:

Here’s a table based on the categories you provided:

| Age Group | Target Audience Description |

|---|---|

| Children (ages 3–12) | Parents of young children seeking beginner dance classes (creative movement, ballet basics, etc.) |

| Teens (13–18) | Youth dancers aiming for high school dance teams or competitions, needing intermediate/advanced training in specific styles |

| Young Adults (19–30) | College students or professionals interested in dance as a hobby or fitness activity (e.g., hip-hop, salsa nights, etc.) |

| Adults (30+) | Adults and seniors wanting to dance for exercise, fun, or social reasons (e.g., ballroom dance classes, dance fitness) |

Customer Behavior

Touch on how your customers make decisions. Do parents prioritize qualifications, cost, or quality? For adults, is it fitness, skill, or social connection? Understanding your customers helps guide your marketing.

A solid market analysis shows you understand the environment. This research shapes your marketing and sales strategies, ensuring your services meet customer needs. It demonstrates that there is a viable opportunity for your dance studio in the community.

4. Competitive Analysis

Even if you’re passionately convinced that your studio will be unique, you can’t ignore the competition.

In the competitive analysis, you’ll identify who you’re up against in the dance studio market and analyze their strengths and weaknesses.

A competitive analysis is not just about understanding others—it’s a fundamental component of your business plan. Here’s how to approach this section:

- Identify your competitors: Start by listing existing dance studios and dance instruction providers in your area. These are your direct competitors—businesses that offer similar dance classes to the same audience you’re targeting.

- Detail competitor profiles: For each major competitor, provide a brief description. Key things to note: what styles of dance they teach, what age groups they serve, their pricing, their location, how long they’ve been around, and any reputation or brand image they have. You might write it out or use a comparison table.

- Analyze strengths and weaknesses: Look at what each competitor does well and where they might fall short. This can come from online reviews, talking to community members, or personal observations.

- Perform a SWOT analysis: A helpful tool here is a SWOT analysis charting the strengths, weaknesses, opportunities, and threats related to your business.

- Your competitive advantage: After studying your competitors, explain how your business will be different. This is the key to competitive analysis—using what you’ve learned to improve your own plan. Maybe you found a gap in the market or a need that others aren’t meeting.

By demonstrating knowledge of your competition and articulating your plan to differentiate, you build credibility. It shows you’re not entering the market blindly. You know who you’re up against and have a plan to attract students despite the competitive landscape.

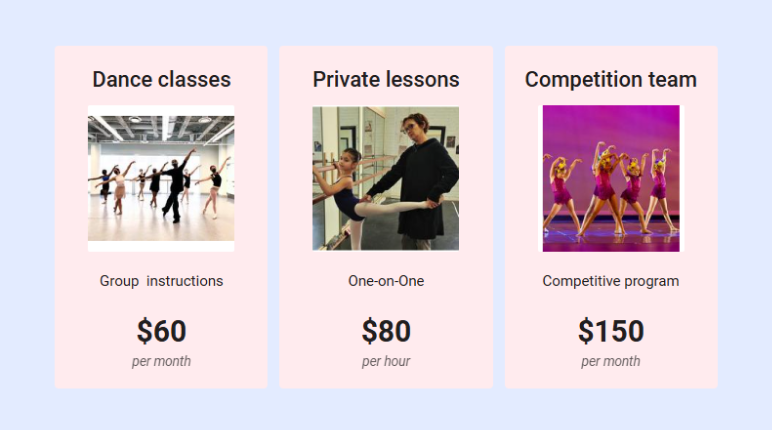

5. Services and Pricing

This section dives into the heart of what your dance studio offers—your services—and how you price them. Essentially, you’re answering: What exactly will customers pay you for, and how much will it cost them?

Services offered

Describe the services your dance studio will provide. For most studios, the core service is dance instruction, but break it down further:

- Dance classes

- Private lessons

- Competitive team or troupe

- Workshops and events

- Studio rental

- Merchandise or other sales

Make sure to emphasize anything unique in your services.

Pricing strategy

Dance studios often use a mix of pricing models to meet student needs and support financial goals. The sample pricing breakdown for core dance studio services.

Clearly stating how payments are collected (monthly auto-pay or upfront) builds trust and ensures smooth operations.

6. Sales and Marketing Strategies

Now that you’ve described what you’re selling, it’s time to explain how you’ll attract customers and get them to enroll. Build it and they will come” doesn’t always work—you need clear marketing and sales strategies. Break this into:

Marketing Strategy

A mix of online and local marketing will be used to attract students and build the studio’s presence.

- Launch a website with class info, schedule, pricing, bios, and online registration.

- Use Instagram, Facebook, and TikTok to post class photos, short videos, and announcements. Engage current and new students.

- Distribute flyers at schools, cafés, and community centers. Place a banner near the studio. Use community newsletters.

- Use a clear theme like “Dance for Everyone” or “Unleash Your Potential.” Match this in logo, slogan, and tone.

Sales Strategy

The process for turning interest into enrollments and keeping students engaged includes:

- Allow students to sign up online or in person. Offer a free trial. Follow up with an email and an enrollment packet.

- Respond to inquiries quickly. Provide studio tours. Ensure the process is easy and welcoming.

- Communicate clearly with parents. Provide progress updates and resolve concerns quickly.

- Offer rewards, “Student of the Month,” or recital milestones.

- Recommend extra or complementary classes. Offer private lessons to support student growth.

By detailing robust marketing and sales strategies, you reassure that you have a plan to get students in the door, which is one of the biggest challenges for any new studio.

With this section, you connect the dots from identifying your customers to actually reaching them and serving them.

7. Operations Plan

The operations plan explains the how of your business: How will you run the dance studio on a day-to-day basis and deliver your services? While earlier sections covered the vision and marketing, this part gets into the practical details of running the studio efficiently.

Here’s how to approach your operations plan:

Step 1: Choose a suitable location

Pick a space with proper flooring, mirrors, a sound system, a waiting area, and restrooms. Make sure it’s visible, has parking, and is safe for families. Mention build-outs if needed.

Step 2: Set your studio schedule

Plan weekday afternoon/evening classes and weekend mornings. Stagger class times to avoid crowding. List your daily operating hours.

Step 3: Prepare your equipment

Get mirrors, barres, dance flooring, sound system, and check-in tools. Use dance studio software to manage attendance, payments, and schedules.

Step 4: Define roles and hire staff

Assign teaching and admin duties. The owner might teach and manage. Hire part-time instructors and a receptionist. Outsource cleaning or bookkeeping if needed.

Step 5: Set up key processes

Decide how students register, how you track attendance, enforce safety, manage class sizes, and handle makeups or weather closures. Use software for admin tasks.

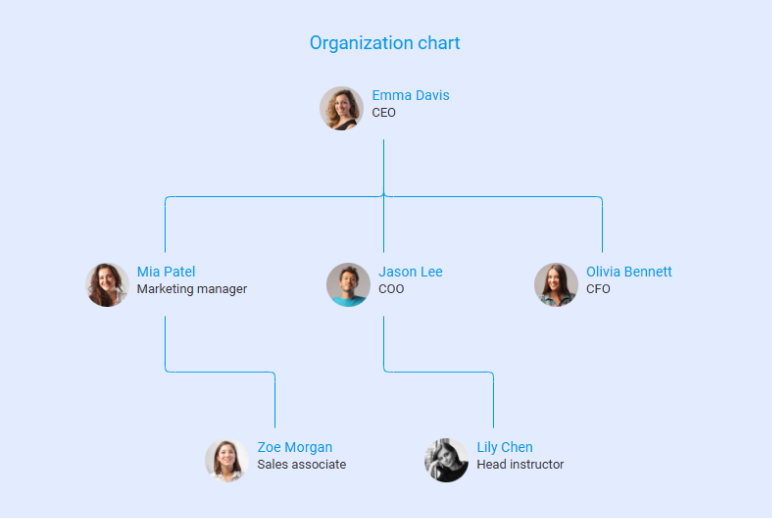

8. Management Team and Organization

Even the best business idea needs the right people to execute it. In this section, you will introduce the management team and the organizational structure of your dance studio.

Essentially, who is running the show, and why are they capable of making this studio a success?

A strong management team not only contributes to business success but also helps secure funding by inspiring confidence in stakeholders.

First, list the key individuals involved in managing and operating the studio. This usually includes the owner(s), any co-founders, and high-level staff like a studio manager or lead instructors, especially if they have a notable role beyond just teaching.

For each person, provide a brief bio highlighting their relevant experience, skills, and role at the studio.

If required, illustrate a simple organizational chart here to visually show team structure and reporting lines. For instance:

By clearly outlining your team’s qualifications and structure, you’re addressing a critical question: Can these people execute this plan? You want the answer to be a resounding yes.

The reader should come away thinking, “This team knows dance and knows business—they have what it takes to run a successful studio.”

9. Financial Plan

The financial plan is where you translate all the ambitious ideas and strategies from the rest of your business plan into concrete numbers. It demonstrates the viability of your dance studio in terms of revenue, expenses, profitability, and funding needs.

A well-thought-out financial plan shows that you have done the math and your studio can be a sustainable venture. This section often includes projections for at least the first 3-5 years of business and is crucial for convincing investors or lenders of the soundness of your business model.

The following are the key components to include in your financial plan:

- Startup costs

- Revenue projections

- Profit & loss projection

- Cash flow considerations

- Balance sheet

- Break-even analysis

- Funding requirement

In short, the financial plan is showing feasibility in numbers. It should reassure potential investors that you know how to make money and manage money.

10. Appendix

The appendix is the final part of your dance studio business plan. It includes supporting documents that are too detailed for the main sections but still important for due diligence.

Start with detailed financials. Include projected income statements, cash flow statements, balance sheets, and a break-even analysis or month-by-month cash flow if available.

Include a full class schedule with pricing and any startup cost breakdowns.

If you have a lease or letter of intent for your studio space, include them here. Also, add legal documents like your business registration or insurance summary.

Show marketing readiness with sample flyers, social posts, or branding visuals. These help readers see that your business is real and well-prepared.

Finally, include letters of support or testimonials from parents, students, or community leaders. They show early interest and strengthen your plan’s credibility.

Download a free dance studio business plan template

Are you ready to create your dance studio business plan but need a bit of help getting started? Don’t worry, we’ve got you covered. Download our free dance studio business plan template PDF to kickstart your planning process.

This template provides a structured format with helpful prompts, ensuring you don’t miss any important details. Just fill in the specifics for your studio, make adjustments as needed, and you’ll have a professional business plan ready in no time.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Summary

With this detailed guide and the free template, you’ll find drafting your dance studio business plan much easier.

However, if you still need assistance or want a more streamlined approach, Upmetrics can help. It’s a modern business planning tool that simplifies the process with its advanced AI features.

Upmetrics also offers tools for accurate financial forecasting, market analysis, as well as hundreds of business resources, making it easier to create a detailed, investor-ready plan.

So, why wait? Start your dance studio business planning today!