Executive Summary

Alder & Axis Furniture Manufacturing is a mid-scale furniture company based in Huntersville, North Carolina. The company produces solid wood dining tables, restaurant tables, office desks, boutique hotel bedroom sets, and custom pieces for hospitality and commercial projects. Its setup combines CNC machining for accuracy with hand finishing for detail, which supports both batch runs and custom orders.

The business serves restaurants, boutique hotels, interior designers, commercial contractors, and mid to high-end furniture retailers across the Charlotte region. Demand for local production has grown as overseas lead times remain slow, and North Carolina continues to be one of the strongest furniture-producing states in the country.

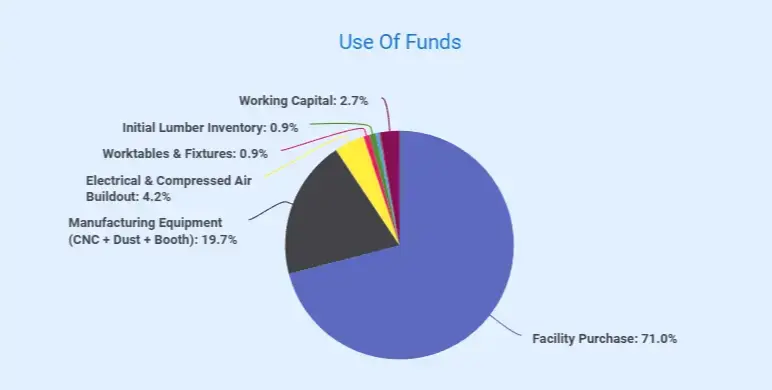

Alder & Axis is completing a $2,311,000 capital plan under the SBA 504 program. The plan includes buying an 18,700 sq ft facility, adding CNC equipment, an edge bander, a dust collection system, and a finish room. It also covers upgrades to electrical and compressed air lines, fixtures, starting inventory, and working capital.

The project follows the standard SBA 504 structure with a 50% bank loan, a 40% CDC loan, and a 10% owner contribution. These funds increase production capacity, improve workflow, and support long-term stability.

Mission Statement

Alder & Axis aims to produce well-built, design-focused furniture using dependable regional sourcing, predictable lead times, and a workflow that supports both commercial batches and custom orders.

Market Opportunity

North Carolina is widely recognized as the furniture capital of the world. The state has over 850 furniture makers. It also has more than 2,000 suppliers. Local businesses get a steady supply of materials and skilled workers. The state exports over $296 million in furniture each year. This shows how active the market is.

Facility Acquisition & Capital Project

The company is completing a full capital project funded through the SBA 504 program, covering:

- Purchase of an 18,700 sq ft facility

- CNC router, edge bander, dust system, and finishing booth

- Electrical upgrades and compressed-air infrastructure

- Machinery installation and logistics tooling

- Working capital

Total Project Cost: $2,311,000

Facility ownership ensures long-term operational stability, supports OSHA-compliant workflow design, and protects production continuity.

Management Team

- Marcus Ellington – CEO & Lead Designer

Oversees product development, model design, and client-side concept work. Experienced in hospitality furniture design for national brands. - Dana Ellington – COO & Supply Chain Lead

Manages procurement, production scheduling, staffing, and logistics. Experienced in manufacturing-sector supply workflows and vendor coordination.

Their combined experience supports predictable operations, stable supply cycles, and a structured production environment.

Financial Projections

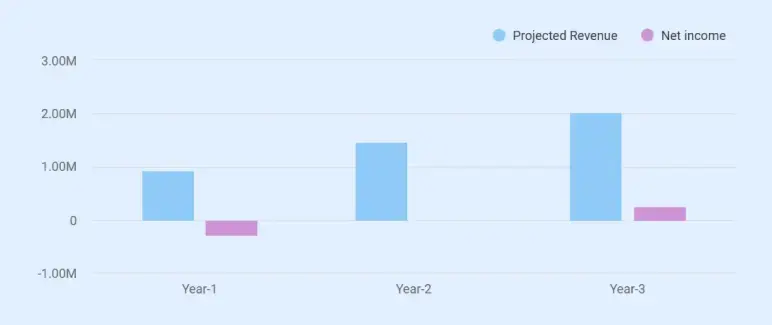

The business expects to make revenue of $940,000 in Year 1, $1,460,000 in Year 2, and $2,020,000 in Year 3 from furniture orders and project work. The shop will still be in the loss stage in Year 1 (–$275,240) and Year 2 (–$6,726) because the new factory is still getting up to speed. By Year 3, the shop reaches a profit of $245,220 as production runs smoothly and more furniture is going out the door.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you

Business Overview

Company Identity

Alder & Axis Furniture Manufacturing is a local furniture maker based at 11904 Statesville Road, Building 3, Huntersville, North Carolina 28078, USA. The company builds commercial wood furniture and custom pieces for hospitality groups, contractors, and designers. Alder & Axis is a North Carolina LLC, giving the owners legal protection and flexibility to run the business.

The shop works from an 18,700 sq. ft. light-industrial building near I-77. The area is mostly used for production and trucking, which makes it a good fit for a full shop. From here, the company can reach contractors and designers who need steady millwork and furniture in the Charlotte region.

Alder & Axis runs as a purpose-built shop with clear stations for CNC cutting, assembly, sanding, finishing, and quality checks. This setup keeps the work steady and consistent, unlike small custom shops that often slow down.

History

Alder & Axis started after Marcus Ellington and Dana Ellington saw a steady need for local, commercial-grade wood furniture in North Carolina. Marcus had spent years designing products at a furniture shop in Hickory, and he wanted to bring the same craft quality to small and mid-size businesses.

Dana had worked in manufacturing logistics, where she handled supply planning and vendor coordination. Their combined experience showed them how local buyers struggled with long lead times, inconsistent imports, and limited custom options.

Alder & Axis was formed to fill that gap by offering steady production, custom work, and faster delivery for restaurants, hotels, and commercial clients.

Goals

The company has clear goals that guide how it plans to grow over the next few years.

- Become a steady, go-to supplier for restaurants, boutique hotels, office projects, and designers.

- Add more items to the product list to serve a wider range of B2B buyers.

- Build stronger B2B relationships in the Charlotte area.

- Bring in 4–6 hospitality projects per month by Year 2.

- Achieve break-even in Q1 of Year 3.

These goals help the company stay focused, support steady growth, and make sure production stays consistent as demand increases.

Vision Statement

Alder & Axis wants to be the shop that architects, designers, and hospitality groups return to again and again. The company plans to keep selling both standard models and custom pieces without slow or unpredictable schedules.

Over time, the company will expand its catalog, offer more finishes and style choices, and strengthen ties with North Carolina-based suppliers. This will help the business reach more customers across the Southeast.

Business Model

Alder & Axis uses a mix of production methods that support both standard furniture lines and project-based work.

- Furniture Production

The company builds solid wood dining tables, restaurant tables, office desks, hotel bedroom sets, and other commercial pieces. CNC cutting keeps parts consistent. Hand finishing gives the final surface needed for commercial use.

- Custom Work

Designers and contractors often need custom sizes, finishes, or layouts. The team provides CAD drawings, adjusts designs to fit project needs, and keeps CNC files ready for repeat orders.

- Service Revenue

Alder & Axis earns added income through drafting, CNC-only work, FF&E items for hospitality jobs, and delivery with installation. These services help balance revenue when order volume shifts.

Market Analysis

Industry Overview

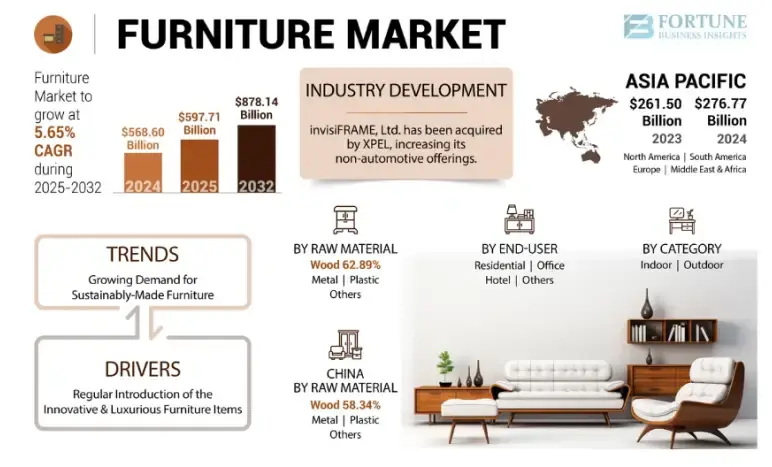

According to a report, the global furniture market was worth about $568.6 billion in 2024, and it may reach around $878.1 billion by 2032. That works out to a yearly growth rate of roughly 5.6%.

In the United States, the furniture market is expected to reach about $130.2 billion by 2032. This growth is supported by higher home sales and steady demand for new and well-designed furniture pieces.

The household furniture manufacturing industry in North Carolina is valued at roughly $4.9 billion in 2025.

The market is still growing because buyers want strong, well-made furniture and quicker delivery than imports. Many companies also like working with local makers who can handle small orders and custom jobs. This gives steady room for Alder & Axis to gain more work each year.

Target Market

Alder and Axis serve buyers who need strong, commercial-grade wood furniture with short lead times.

The main target groups are:

- Hospitality Clients

- Restaurants

- Cafés

- Boutique hotels

- Small hotel groups that need repeatable FF&E items

These buyers need strong pieces that can handle daily use.

- Residential Furniture Retailers

Mid- to high-end stores that sell solid-wood dining tables, bedroom sets, and shelving.

- Commercial and Office Designers

These stores look for local sellers who can offer steady batches and custom options.

- Independent Interior Designers

They want local production, fast changes, and the option to reorder matching pieces.

Market Growth Drivers

Urban Growth

More people are moving into cities. This leads to new homes and apartments being built. The demand stays steady for small furniture. People want pieces that can do more than one job. Simple designs fit fancy rooms well. People who move often, mostly renters, replace their furniture more often.

Rising Material Costs

Furniture prices stay high because wood, metal, and fabric now cost more. This makes many buyers choose well-made, lower-cost pieces instead of pricey imports. This creates steady demand for makers who can offer simple, durable pieces at a fair price, which is where Alder & Axis fits well.

Demand for Custom Furniture

Many buyers now want furniture that matches their style, room size, or layout needs. Custom work lets companies offer higher-value products and build stronger repeat business. This trend keeps growing as customers look for more choice and flexibility when they shop for furniture.

Latest Industry Trends

The furniture market is changing. Businesses want suppliers who give steady quality, short lead times, and reliable service. Key trends in the market include:

- More restaurants and hotels are upgrading interiors. This increases demand for strong, custom wood furniture.

- Commercial builders and office designers want small local batches. They want to avoid long overseas delays.

- Hospitality buyers now choose domestic makers. They need faster delivery for phased projects.

- Businesses want vendors who offer design help. This includes CAD files, samples, and custom sizes.

- Companies also want furniture that lasts. Easy-to-maintain pieces matter for busy and high-traffic spaces.

These trends show buyers need a stable supply, good lead times, and commercial-grade furniture. Alder & Axis fits this by offering local production, quick turnaround, and project-ready designs.

Competitor Analysis

In North Carolina, Alder & Axis competes with both direct and indirect furniture makers. Each competitor serves different buyers and has its own strengths and weaknesses.

| Competitor | Type | Strength | Weaknesses |

|---|---|---|---|

| Vanguard Furniture Manufacturing (Hickory) | Direct | Solid-wood furniture, strong craftsmanship, steady production | Higher prices, slow for small or rush orders |

| Gat Creek (Regional Distributor Network) | Direct | Quality wood furniture, consistent finishing, wide retail reach | Limited custom sizes, longer lead times during busy seasons |

| Woodwright Co. (Mooresville) | Direct | Custom millwork, solid craftsmanship, and good project work | A smaller team leads to slower output and limited batch volume |

| Piedmont Millworks (Concord) | Direct | Millwork for contractors, steady repeat work | Focuses more on millwork than furniture, not ideal for large custom runs |

| Imported Furniture Suppliers | Indirect | Low-priced imported pieces, many ready-made styles | 10-14 week delivery, not durable for hotels, restaurants, or offices |

| Big-Box Retailers (Walmart, Target, etc.) | Indirect | Affordable, ready-made furniture available instantly | Weak durability, no custom work or installation |

| Online Flat-Pack Brands | Indirect | Low-cost flat-pack items, easy online ordering | Not built for heavy use, no custom sizes, no on-site help |

Competitive Advantage

Alder & Axis sits between high-volume factories and small custom shops. It can produce steady batch runs while still offering custom sizes, finishes, and project-specific work.

What Sets Alder & Axis Apart

Alder & Axis stands out through:

- Shorter lead times of about 4 to 6 weeks

- Local hardwood sourcing from North Carolina sawmills

- CNC accuracy paired with hand finishing

- Durability testing for hospitality use

- In-house design support for custom drawings

This mix allows the company to serve restaurants, boutique hotels, office designers, and residential retailers who want domestic production with predictable timelines.

Stop searching the internet for industry & market data

Get AI to bring curated insights to your workspace

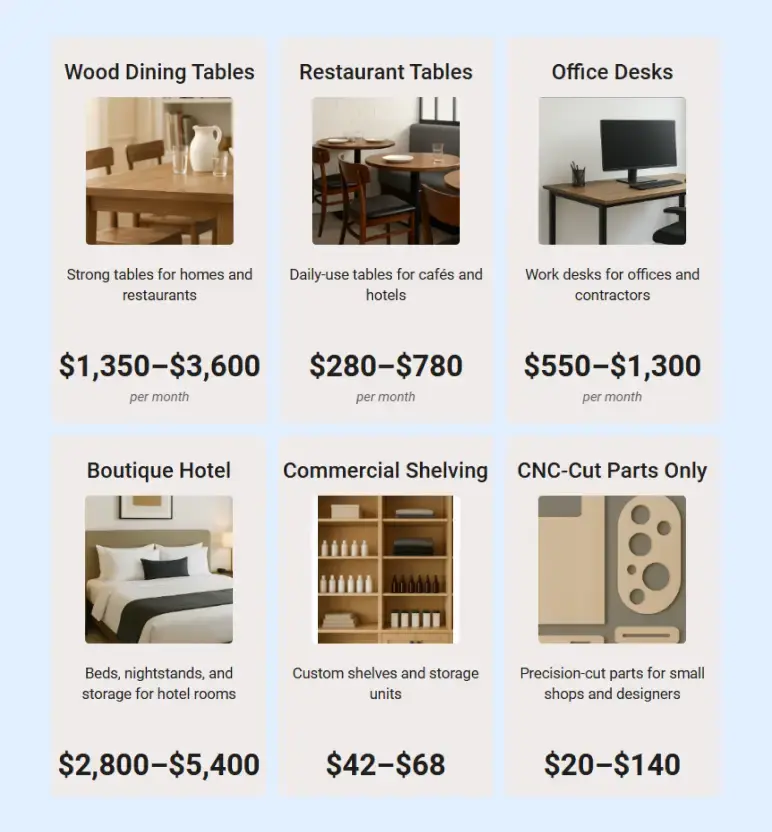

Products & Services

Alder & Axis makes furniture for restaurants, hotels, offices, and designers who need steady quality and clear timelines. The company also offers a few service options that support custom projects and commercial buildouts.

Product Line Overview

The company focuses on a small group of product types that stay in steady demand in the Charlotte region. Each item is built with CNC-cut parts and finished by hand for consistency.

Additional Services

Some clients need more than finished furniture. Alder & Axis offers a set of services that support custom projects, commercial buildouts, and hospitality work.

1. CAD Design

Rate: $95 per hour

CAD Design helps clients turn early ideas into clear drawings that the shop can use for production. Many designers bring sketches that are not ready for cutting, so this service cleans up the design, checks measurements, and creates files that match the exact build. It makes sure every part fits and reduces guesswork during the job.

2. CNC Cutting Services

Rate: $70 per hour

This service is meant for clients who already know what parts they need and only want the cutting done. The CNC machine produces clean, accurate pieces that match the design, which is useful for custom orders, repeated parts, or small projects. It lets clients get professional-quality cuts without owning or setting up a machine themselves.

3. Hospitality FF&E Builds

Rate: Project-based pricing

Hotels and restaurants often need booths, wall panels, casework, and reception units made to match their layout and branding. Alder & Axis builds these pieces using wood, laminate, and selected finishes so the space has a coordinated look. Pricing depends on size, materials, and installation needs.

4. Delivery and Installation

Rate: $95 per hour + mileage

Commercial spaces often need items installed for the first time. This service ensures furniture is placed, leveled, and adjusted as required. It saves clients from hiring extra labor and helps protect finished surfaces during placement.

Equipment Overview

Alder & Axis uses a set of machines that support steady, accurate, and safe production. These tools help the company cut parts, finish surfaces, and maintain quality across both batch runs and custom projects.

Operations Plan

Alder & Axis focuses on delivering steady, high-quality production for restaurants, hotels, offices, and designers. The team follows a clear workflow inside the shop so material enters one side, moves through production in order, and leaves as finished furniture without delay. Defined roles, routine checks, and a consistent daily rhythm help maintain quality and timelines for every client.

Business Location and Facilities

Alder & Axis operates from an 18,700 sq. ft. light-industrial facility in Huntersville, North Carolina.

The building includes:

Lumber intake and storage, CNC machining zone, Assembly bays, Sanding area, Sealed finishing room, Quality-check station, Packaging and loading area

The layout keeps dusty, noisy, and clean processes separated. This reduces safety risks, prevents cross-contamination, and keeps production flowing from raw wood to finished goods.

Hours of Operation

- Working Days: Monday to Friday

- Time: 7:00 a.m. to 5:00 p.m

- Weekend Overtime: Used only when hospitality or contractor deadlines require faster output.

Daily Working Process

The daily working process keeps the shop organized and helps the team move each job from cutting to finishing without delays.

| Time | Activity | What Happens |

|---|---|---|

| 8:00–9:00 AM | Material Intake | Receive lumber, moisture-check, prep CNC files, and assign job tickets. |

| 9:00 AM–12:00 PM | Production Block 1 | CNC cutting of hardwood and sheet goods, edge-banding panels, and preparing parts for assembly. |

| 12:00–1:00 PM | Assembly | Build frames, bases, and units from cut parts. |

| 1:00–3:00 PM | Sanding + Prep | Smooth surfaces by hand and orbital tools to prepare pieces for finishing. |

| 3:00–4:30 PM | Finishing Block | Apply stains, sealers, and clear coats inside the controlled finish booth. |

| 4:30–5:00 PM | QC + Packaging | Inspect each piece, correct defects, wrap items, and stage products for shipment. |

This structure ensures predictable lead times and prevents bottlenecks during busy seasons.

Customer Support

Alder & Axis keeps communication simple and predictable. Clients primarily communicate via email for order updates, drawings, and approvals. For fast coordination on commercial projects, the team uses phone calls and scheduled meetings. This prevents delays and ensures decisions are made quickly.

Each client receives:

- A defined point of contact

- Updates during business hours

- Clear timelines for production and delivery

- Review of drawings or mockups before fabrication

This process helps clients stay confident about their orders and reduces revision cycles.

Risk Mitigation Plan

Alder & Axis prepares for operational risks by using clear, practical steps.

| Risk | How We Mitigate It |

|---|---|

| Lumber price changes | Maintain multiple NC suppliers; use short-term pricing agreements; keep a buffer stock of oak, ash, and walnut. |

| CNC downtime | Annual service contracts; preventive maintenance during slow weeks; train backup operators; keep essential spare parts ready. |

| Skilled labor gaps | Build training pipeline with technical colleges; maintain vetted contractors; cross-train internal staff. |

| Freight or handling damage | Use reinforced packaging and corner guards; partner with furniture-experienced carriers. |

| Seasonal demand drops | Fill slow periods with small custom runs; rely on hospitality contracts; keep inventory lean. |

| Compliance issues (OSHA, finish chemicals) | Follow OSHA woodworking standards; maintain dust-collection systems; update chemical-handling procedures; keep staff certified. |

Regulatory and Compliance

Alder & Axis follows core federal, state, and safety requirements:

Business License

Register the business through the state and renew annually.

State Requirements

Operate as a North Carolina LLC and comply with local zoning for manufacturing facilities. Maintain finish-room permits and ventilation compliance.

Federal Requirements

Obtain an EIN for payroll and taxes, follow IRS rules for contractor payments and reporting, and comply with federal air-quality and waste-disposal rules for finishing materials.

Workplace Safety

Follow OSHA woodworking standards, ventilation, dust-collection, and combustible-dust rules, forklift training, and annual safety reviews.

Insurance Coverage

- General Liability

- Property & Equipment Insurance

- Workers’ Compensation

- Professional Liability (for design drawings)

Industry Compliance

Meet hospitality and commercial durability standards. Follow fire-safety coating requirements, safe chemical-handling, and labeling practices

Implementation Timeline

The following timeline shows the complete sequence of steps Alder & Axis will take from facility acquisition to full production, based entirely on the project schedule.

| Phase | Milestone | Date |

|---|---|---|

| Acquisition | Facility offer accepted | March 2026 |

| Financing | SBA 504 application submitted | April 2026 |

| Closing | Keys received | July 2026 |

| Buildout | Machinery and setup completed | July–September 2026 |

| Launch | Official opening | November 2026 |

This timeline provides lenders with a clear view of how the company moves from closing to stable operations while keeping all steps within the defined 2026–2027 schedule.

Does your plan sound generic?

Refine your plan to adapt to investor/lender interests

Management and Organization

Alder & Axis uses a clear team structure so production stays steady and every order moves through the shop without delays. Each role supports daily operations while keeping lead times predictable.

Leadership Team

Staff Planning and Compensation

| Role | Compensation | Core Responsibility |

|---|---|---|

| CEO / Lead Designer (Marcus Ellington) | $78,000/year | Creates drawings, oversees product design, and builds prototypes. |

| COO / Supply Chain Lead (Dana Ellington) | $62,000/year | Manages schedules, buying, logistics, and daily operations. |

| Plant Manager (1) | $68,000/year | Supervises the shop floor, ensures workflow, and handles production issues. |

| CNC Operators (2) | $23/hour | Runs CNC equipment and prepares parts for assembly. |

| Finishers (2) | $21/hour | Applies stains, sealers, and coatings inside the finish room. |

| Assembly Technicians (3) | $19/hour | Builds frames, table bases, and units from machined parts. |

| Driver / Installer (1) | $20/hour | Handles delivery and on-site installation. |

| Office Administrator (1) | $38,000/year | Manages intake, communication, and project coordination. |

| Bookkeeper (Contractor) | $300/month | Handles accounting tasks and monthly financial updates. |

| Maintenance Technician (Contractor) | $650/month | Performs repairs and equipment upkeep. |

This staffing plan gives Alder & Axis the right balance of leadership, skilled labor, and support roles. The mix helps the company maintain steady output and keep lead times within the usual 4–6 weeks, even when order volume rises.

Marketing and Sales Strategy

The company’s marketing and sales strategy focuses on business-to-business buyers who need predictable lead times, consistent finishing, and regionally sourced furniture. The plan uses a mix of hospitality outreach, designer relationships, contractor partnerships, trade-show visibility, and steady digital presence. A monthly marketing budget of $2,400 supports these efforts.

Hospitality Outreach (40%)

Restaurants, boutique hotels, and multi-location hospitality groups need suppliers who can deliver dependable schedules. Alder & Axis will focus on:

- Direct outreach to local restaurant groups and hotel operators

- Getting listed as an approved vendor with hospitality purchasing teams

- Coordinating with general contractors during build-outs and remodels

This channel brings in larger repeat orders and FF&E packages that stabilize production.

Trade Shows (High Point Market) (20%)

High Point Market allows the company to meet buyers early and show finished quality in person. Displays will include dining tables, restaurant sets, shelving, and finish samples. This helps the company build visibility and form long-term relationships with commercial buyers.

Designer & Architect Referrals (20%)

Designers often need custom sizes, coordinated finishes, and repeatable production. The company supports them by offering CAD drawings, sample kits, finishing selections, and optional installation services. This channel leads to steady, project-driven custom work.

Local SEO + Google Local (15%)

Regional buyers often search for furniture manufacturers who can respond quickly. The company will maintain its Google Business Profile, publish local landing pages, and share project photos to help capture searches from contractors, retailers, and small hospitality groups.

Instagram & LinkedIn (5%)

These platforms provide visual proof of craftsmanship rather than high lead volume. The company will post CNC clips, finish-room photos, installation examples, and new product showcases to build trust with designers, contractors, and commercial clients.

Customer Acquisition Plan

To strengthen this plan and bring in more projects, we will also:

- Send out a quarterly design catalog

- Mail sample kits to interior designers

- Hire a dedicated hospitality sales rep in Year 2

- Work with Charlotte general contractors on commercial millwork

- Use 3D renders when bidding on larger projects

Together, these steps help us attract steady project work, repeat orders, and more commercial clients over time.

Launch Promotion

To build early traction in the first six months, the company will offer a set of simple launch promotions. New hospitality clients will receive a 5% discount on their first order, and projects above $12,000 will include free design mockups. The first ten B2B clients will receive priority lead times, and designers and architects will be provided with complimentary sample kits.

These early offers help shorten sales cycles and give the company an effective way to introduce its capabilities to high-value buyers.

Sales Process

Alder & Axis keeps the sales process simple so every client knows what’s happening at each step. The goal is to make the work easy to understand, easy to follow, and smooth from start to finish.

| Step | What We Do |

|---|---|

| 1. Customers Contact Us | People find us through designers, contractors, events, social media, or local search. When they reach out, we note their basic details. |

| 2. We Understand Their Needs | We make a short outline of what they want—items, materials, rough pricing, and timeline. For big projects, we also share a simple 3D view. |

| 3. We Create the Build Plan | Once the customer says yes, our design team makes clear drawings with exact sizes, hardware, and finishes. |

| 4. We Schedule the Work | The COO checks our workload and chooses the best time to start based on machine time, finishing, and assembly. This helps us deliver in 4–6 weeks. |

| 5. Delivery & Installation | We pack everything safely, check the quality, and deliver. For commercial jobs, we also install the furniture on-site. |

Account Management

Alder & Axis keeps things easy for clients even after delivery. The company focuses on staying in touch, handling warranty requests, and making reorders simple.

- Staying in Touch

Clients get updates during production so they always know what stage the job is in. This is especially important for hospitality groups and contractors who work with tight schedules.

- Warranty Support

If a client finds a problem with structure or finish during the covered period, the company will fix it.

- Making Reorders Easy

Many clients, especially designers and hotels, order matching pieces later.

To make reorders quick and accurate, the company keeps records of all build details. This makes it simple to reproduce an identical item months after the original project.

Financial Plan

Alder & Axis’s financial plan provides a clear view of how the company will use startup funding, cover its operating costs, and grow production volume in a steady and controlled way. The plan focuses on predictable output, manageable labor costs, and stable margins while maintaining enough cash on hand to handle material price changes and seasonal demand shifts.

Startup Costs

| Category | Cost ($) |

|---|---|

| Facility Purchase | 1,640,000 |

| CNC Router + Edge Bander | 342,000 |

| Dust Collection System | 62,000 |

| Finishing Booth | 51,000 |

| Electrical + Compressed Air Install | 98,000 |

| Worktables + Fixtures | 19,800 |

| Initial Lumber Inventory | 21,000 |

| Office + Design Equipment | 8,800 |

| Insurance + Permits | 5,600 |

| Working Capital | 62,800 |

| TOTAL PROJECT COST | 2,311,000 |

Revenue Forecast

| Revenue Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Dining Tables (Solid Wood) | 240,000 | 365,000 | 505,000 |

| Restaurant Table Sets | 150,000 | 230,000 | 315,000 |

| Office Desks & Workstations | 180,000 | 295,000 | 400,000 |

| Hotel Bedroom Sets | 170,000 | 270,000 | 380,000 |

| Commercial Shelving & Millwork | 130,000 | 200,000 | 280,000 |

| CNC Contract Machining | 45,000 | 55,000 | 70,000 |

| CAD Design Services | 25,000 | 30,000 | 40,000 |

| Delivery + Installation | 30,000 | 45,000 | 55,000 |

| TOTAL REVENUE | 940,000 | 1,460,000 | 2,020,000 |

| EBITDA | -69,500 | 194,274 | 477,220 |

Operating Expenses

| Expense Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Utilities | 28,200 | 43,800 | 60,600 |

| Insurance & Property | 14,100 | 21,900 | 30,300 |

| Marketing | 18,800 | 29,200 | 40,400 |

| Maintenance & Repairs | 9,400 | 14,600 | 20,200 |

| Freight & Delivery | 20,680 | 32,120 | 45,320 |

| Supplies & Consumables | 21,620 | 33,580 | 47,460 |

| Admin & Back Office | 14,100 | 21,900 | 30,300 |

| Total OPEX | 126,900 | 197,100 | 274,580 |

Profit & Loss Statement (3 Years)

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | 940,000 | 1,460,000 | 2,020,000 |

| COGS (30 percent) | 282,000 | 438,000 | 606,000 |

| Gross Profit | 658,000 | 1,022,000 | 1,414,000 |

| Operating Expenses | 126,900 | 197,100 | 274,580 |

| Labor Costs | 600,600 | 630,626 | 662,200 |

| EBITDA | -69,500 | 194,274 | 477,220 |

| Depreciation | 65,000 | 65,000 | 65,000 |

| EBIT | -134,500 | 129,274 | 412,220 |

| Interest Expense | 140,740 | 136,000 | 130,000 |

| Taxes | 0 | 0 | 37,000 |

| Net Profit | -275,240 | -6,726 | 245,220 |

Monthly Financial Breakdown (Year 1)

| Month | Revenue | COGS | Gross Profit |

|---|---|---|---|

| Jan | 62,000 | 18,600 | 43,400 |

| Feb | 65,000 | 19,500 | 45,500 |

| Mar | 90,000 | 27,000 | 63,000 |

| Apr | 92,000 | 27,600 | 64,400 |

| May | 95,000 | 28,500 | 66,500 |

| Jun | 88,000 | 26,400 | 61,600 |

| Jul | 70,000 | 21,000 | 49,000 |

| Aug | 72,000 | 21,600 | 50,400 |

| Sep | 92,000 | 27,600 | 64,400 |

| Oct | 94,000 | 28,200 | 65,800 |

| Nov | 90,000 | 27,000 | 63,000 |

| Dec | 70,000 | 21,000 | 49,000 |

| Total | 940,000 | 282,000 | 658,000 |

Cash Flow Statement

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| EBITDA | -69,500 | 194,274 | 477,220 |

| Change in Working Capital | -20,000 | -30,000 | -35,000 |

| Interest Expense | -140,740 | -136,000 | -130,000 |

| Debt Principal Payments | -62,000 | -64,000 | -66,000 |

| Taxes | 0 | 0 | -37,000 |

| Net Cash Flow | -292,240 | -35,726 | 209,220 |

Balance Sheet (Opening + End of Year 1)

| Category | Opening Amount | End of Year 1 |

|---|---|---|

| ASSETS | ||

| Building | 1,640,000 | 1,640,000 |

| Equipment (Net) | 455,000 | 390,000 |

| Inventory | 21,000 | 21,000 |

| Cash | 62,800 | -229,440 |

| Total Assets | 2,178,800 | 1,821,560 |

| LIABILITIES | ||

| Bank Loan | 1,155,500 | 1,124,000 |

| CDC Loan | 924,400 | 893,900 |

| Total Liabilities | 2,079,900 | 2,017,900 |

| EQUITY | ||

| Owner Equity | 231,100 | 231,100 |

| Retained Earnings | -132,200 | -427,440 |

| Total Equity | 98,900 | -196,340 |

| Balance Check | 2,178,800 | 1,821,560 |

Don’t waste time using spreadsheets

Break-Even Analysis

| Metric | Value |

|---|---|

| Monthly Fixed Costs | 60,625 |

| Contribution Margin | 70% |

| Monthly Break-Even Revenue | 86,600 |

| Commercial Units Needed per Month | 28–40 |

| Hospitality Projects Needed per Month | 4–5 |

Funding Requirements

To fully launch the facility and cover all startup costs, the business requires $2,311,000 in combined financing from lenders and owner investment. The loans are secured by the building, the new manufacturing equipment, and personal guarantees from the owners.

| Funding Source | Amount ($) | % of Total | Terms | Monthly Payment |

|---|---|---|---|---|

| Bank Loan (Wells Fargo) | 1,155,500 | 50% | 20 years, ~7.3% | 9,171 |

| CDC Loan (NC Rural Center) | 924,400 | 40% | 25 years, ~6.1% | 6,024 |

| Owner Equity | 231,100 | 10% | — | |

| TOTAL FUNDING | 2,311,000 | 100% | — |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.