Executive Summary

Oak and Iron Furniture Co. is a local retail furniture enterprise that will be managed locally in Columbus, Ohio. The owner of the business is David Keller, who has seven years of experience in selling furniture and three years of working experience in the sphere of woodworking.

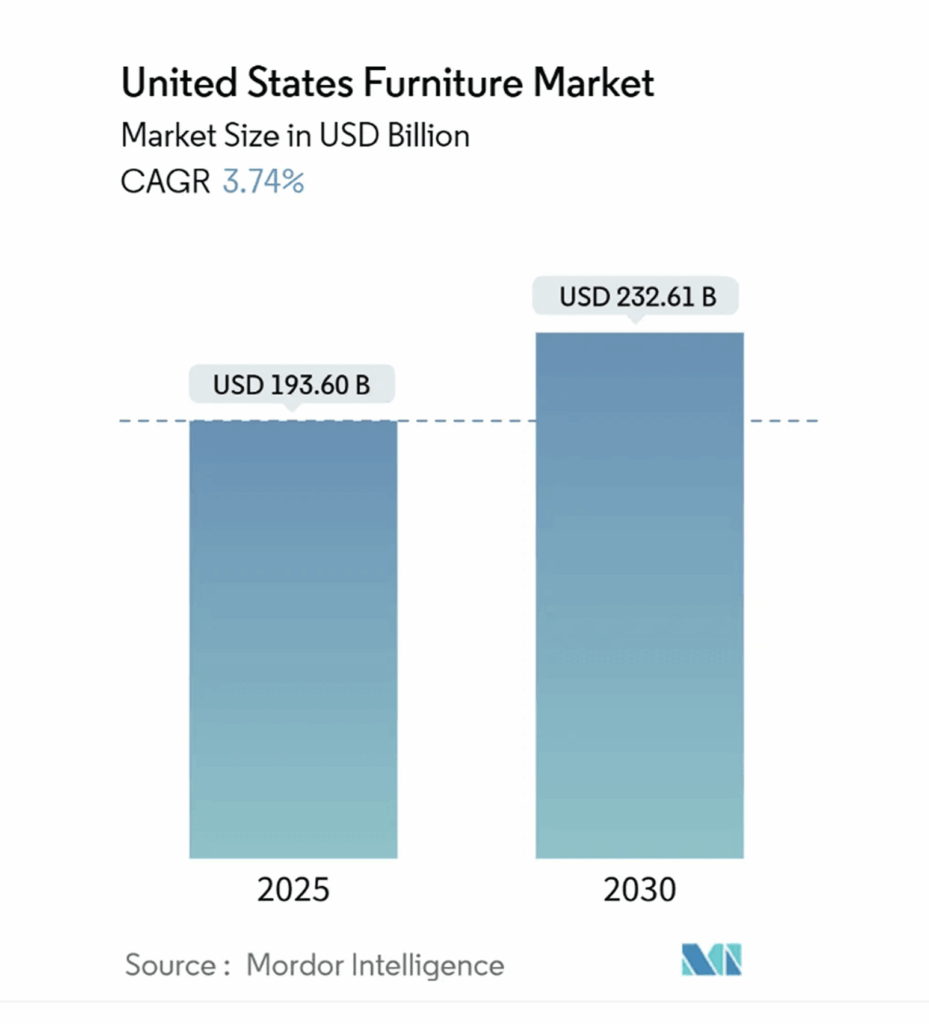

The American furniture market is a large and profitable opportunity, whose total market size is valued at $193.6 billion in 2025 and is projected to reach $232.61 billion by 2030. This is being fuelled by a greater number of homes being owned, remodeling work, and the need for high-quality, long-lasting furniture that is neither mass-produced nor in high-end luxury products- a void part of the market that Oak and Iron are set to fill.

Oak and Iron is a home furnishing company that specializes in high-end residential furniture with a tailor-made and curated showroom approach. The product line entails sofas, dining sets, bedroom furnishings, office desks, storage, chairs, and some of the decor items. With the pricing strategy of placing itself in between national furniture stores and high-end luxury studios, the company captures customer needs of high-quality craftsmanship, practical design, and not being too high-end.

The target market of the business is mostly homeowners between the ages of 28 and 60 in the Columbus metropolitan region, while also involving renters, small office, real estate professionals, and interior designers. The customers receive one-on-one, in-store customer experience with clear pricing, reliable local delivery service, and an easy online catalog to browse and place orders.

Mission

The Oak and Iron Furniture Co.’s mission is to offer quality, mid-range furniture that is affordable, without sacrificing style or becoming excessively expensive. The company also seeks to enable customers to furnish their homes confidentially by providing truthful advice, stable product quality, and reliable local services. Oak and Iron Furniture Co. also puts emphasis on long-term customer relationships by ensuring that their pricing, product choice, and delivery are transparent as opposed to the high-pressure sales and one-off promotions.

Vision

The vision of the Oak and Iron Furniture Co. is to be a reliable local furniture store in Columbus with a reputation for quality, reliability, reasonable prices, and reliable service. The company will focus on establishing a stable, profitable retail business with predictable cash flows, good repeat business, and strict growth control. In the long term, Oak and Iron Furniture Co. will increase its custom-order capacity and delivery effectiveness and ensure strict control over inventory, operating costs, and delivery to the clients.

Finance

Oak and Iron Furniture Co. is undertaking a debt financing program of $90,000 with KeyBank Business Banking through the Small Business Equipment and Working Capital Loan Program. The owner will be making a personal contribution of $25,000 from his personal savings, bringing the total startup capital to $115,000. The loan will be utilized mainly for initial inventory, store build-out, fixtures, and working capital to support upfront operations.

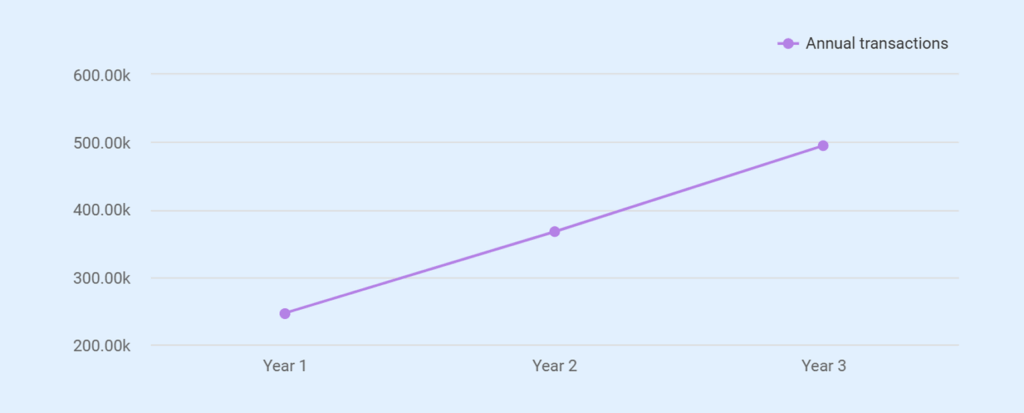

The business plans to repay the loan through operating cash flow generated from in-store furniture sales, custom orders, and delivery services. Based on conservative sales assumptions, the company projects annual revenue of approximately $246,750 in Year 1, increasing to $367,200 in Year 2 and $495,000 in Year 3. Inventory turnover of 45–60 days and steady daily transaction volume support consistent monthly revenue generation.

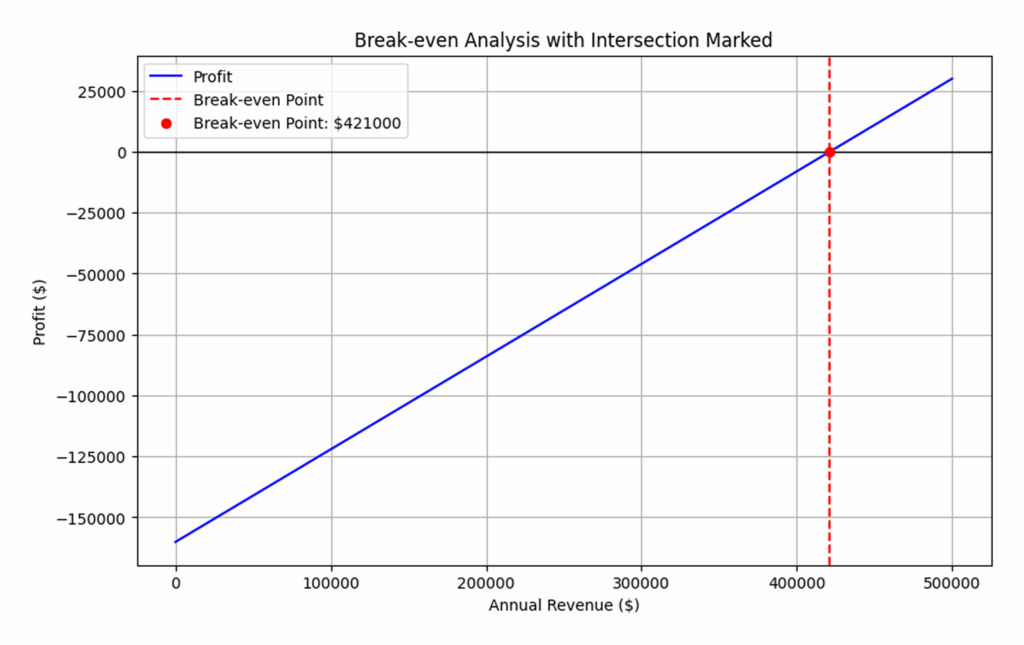

Based on the finalized cost structure and gross margin of 38%, the business requires approximately $32,110 in monthly revenue to cover fixed operating costs, including payroll, rent, operating expenses, depreciation, and interest. This break-even level corresponds to roughly 150 transactions per month, or about 5 transactions per day at the current average ticket size.

Given the projected sales ramp and margin improvement over time, the business is expected to approach break-even in late Year 2 and achieve sustained profitability in Year 3, once sales volume stabilizes and fixed costs are absorbed more efficiently.

At launch, the company has no existing business debt. Startup costs are fully accounted for, and the owner’s capital injection reduces reliance on borrowed funds. Collateral offered includes store fixtures, tools, initial inventory, and business assets, providing additional security for the lender.

Company Overview

Oak and Iron Furniture Co. is a furniture retail company that is privately owned and organized as a Limited Liability Company (LLC) based in the state of Ohio. The LLC form has been chosen because it offers flexibility in operations, pass-through taxation, and protection of personal liability without making the level of administration burdensome at this formative stage of the business.

David Keller is the founder and managing owner of the company, as well as its 100% owner. Mr. Keller has complete decision-making authority, and he will be in charge of the day-to-day running of the company, relationships with suppliers, sales, and financial control. His ownership structure enables clear accountability, facilitates quicker operational decisions, and allows for the consistent execution of the firm’s business strategy.

Oak and Iron Furniture Co. is a brick-and-mortar retail furniture outlet that offers some custom-order options. The company purchases mid-range furniture from regional wholesalers and local producers and sells directly to consumers using an in-store showroom format.

The company also offers custom-built and refurbished furniture in limited quantities based on individual customer requests, in addition to standard inventory. This approach helps satisfy customer needs while maintaining controlled inventory levels and predictable cash flow.

Business Location

Oak and Iron Furniture Co. will be located in Northside Plaza, 4110 Brookview Road, Columbus, Ohio, a mid-density suburban retail location in an existing residential shopping area. The plaza can be characterized by a good mix of neighborhood-based businesses and the advantage of the local traffic, instead of seasonal or tourist-based demand.

Single-family houses, apartment complexes, and small office buildings are located in the surrounding environment, which forms a steady customer base in home furnishings and replacement furniture. The neighborhood has a stable housing turnover, renovation, and renter flow that contributes to the continuous demand for furniture purchases all year round.

Northside Plaza has convenient car access, surface-level parking, and easily visible stores, all of which are essential in the context of furniture retail business where the customers are most of the time via car and need convenient loading and delivery logistics. The location also offers good delivery routes within a 10-12 mile service radius, which saves on fuel costs and delivery time.

The lease offers sufficient showroom display and backroom storage square footage without high rent overheads that would sustain the operations and allowable fixed expenditure in the initial years of business.

Company Positioning

The firm is situated between the large mass-market retail furniture stores and designers’ showrooms. The company is not in competition on the basis of the lowest price; rather, it competes based on product reliability and selected and customized service. As opposed to the national chain with large inventory levels and a low level of flexibility, Oak and Iron has a controlled level of inventory and changes its product mix according to the local demand. This will enable the business to capture those customers who desire higher quality and services than those offered in big-box stores without paying the high prices of the studio furniture.

Operating Model Overview

Oak and Iron Furniture Co. is a lean retailing business with owner management. Fixed costs are kept within the line of a narrow sales force, small backroom stocking, and a narrow product line. The main process of sales is in-store, and it is supported by a simplified online catalog, which gives customers access to the products to browse and place inquiries.

Local delivery and installations are done so that the quality of service provided and the low cost of the third-party logistics can be achieved. In this operating model, priority is given to the stability of cash flows, discipline of inventory, and uniformity of customer experience.

Startup Summary

The startup costs required to launch Oak and Iron Furniture Co. are outlined in the following table. These costs represent realistic, one-time expenses needed to secure the location, purchase initial inventory, prepare the retail space for operations, and maintain sufficient working capital to support the business during its initial months of operation.

| Startup Expense Category | Amount (USD) |

|---|---|

| Lease deposit | $2,900 |

| Initial inventory | $65,000 |

| Store build-out | $12,000 |

| Display fixtures & lighting | $8,500 |

| POS system | $2,300 |

| Website & product catalog | $1,800 |

| Initial marketing | $2,000 |

| Insurance (first year prepaid) | $1,600 |

| Initial working capital reserve (startup) | $18,900 |

| Total Startup Costs | $115,000 |

In addition to startup costs, the owner will contribute $50,000 in working capital equity at launch to support inventory ramp-up and operating losses during the initial growth phase.

Long-Term Goal

Here’s what we aim for Oak and Iron Furniture Co. in the next 3 to 5 years:

- Make Oak and Iron Furniture Co. a reputable local retailer of furniture with efficient repeat and referral buyers.

- Over time, augment the proportion of custom and semi-custom orders of higher margin.

- Attain long-term profitability and cash inflow during all months of operation.

- Create a special delivery vehicle to enhance logistics efficiency and customer service.

- Add a storage or annex area to assist in the expansion of inventory, but not to expand the showroom rent.

- Establish long-term relationships with local wholesalers, local manufacturers, and business associates, including real estate agents and interior designers.

Products Offering

Oak & Iron Furniture Co. focuses on offering furniture that customers can rely on for everyday use, not a showroom-only display. The product selection emphasizes durability, clean design, and practical sizing suited for modern homes, apartments, and small offices.

Rather than carrying excessive inventory, the store curates a balanced mix of core furniture categories that meet the most common furnishing needs while allowing flexibility for custom requests. This approach keeps inventory fresh, controls cash flow, and ensures that each item on the showroom floor serves a clear customer purpose.

Our Products and Pricing

Customize services

- Custom-built furniture: Priced at approximately 15% above standard retail due to material selection, labor, and customization.

- Refurbished and restored pieces: Priced 15–30% below new inventory, depending on condition, style, and demand.

Vendors and Suppliers

Oak & Iron Furniture Co. sources its products through a balanced vendor mix consisting of four regional furniture wholesalers and two local furniture makers. This approach allows the business to maintain consistent product availability while also offering differentiated pieces that are not commonly found in national chain stores.

The regional wholesalers supply the company’s core inventory, including sofas, dining sets, bedroom furniture, office desks, and storage units. These vendors provide reliable lead times, standardized quality, and volume-based pricing, which support predictable inventory turnover and stable gross margins.

The local furniture makers support the company’s custom and limited-run offerings. They produce made-to-order tables, shelving, and small décor items, allowing Oak & Iron Furniture Co. to accommodate customization requests without carrying excess inventory. Working with local makers also reduces transportation costs and lead times for custom pieces.

Inventory Management

The company follows a controlled inventory management approach designed to balance product availability with cash flow protection. The business maintains a focused showroom selection of approximately 30–40 furniture pieces, allowing customers to view representative models while avoiding excessive capital tied up in unsold stock.

Inventory is reviewed on a 45–60 day rotation cycle. Items that do not meet sales expectations within this window are either discounted through a designated clearance section or replaced with higher-performing products. This practice keeps the showroom fresh, reduces aging inventory, and improves cash conversion.

Core furniture items are reordered based on historical sales patterns, seasonal demand, and vendor lead times. Custom and locally made pieces are produced primarily on a made-to-order basis, which minimizes inventory risk while supporting higher-margin sales. Refurbished items are acquired selectively and priced to move quickly.

All inventory is tracked through the point-of-sale system, allowing the owner to monitor sell-through rates, margin performance, and reorder timing. This disciplined approach ensures predictable inventory turnover, supports steady cash flow, and reduces the risk of overstocking.

Don’t spend weeks on your first draft

Complete your business plan in less than an hour

Market Analysis

Industry Overview

The American furniture market is huge and is increasing steadily due to constant housing turnover, remodeling, and demand by the consumer who is in search of quality residential furnishings. The U.S. furniture market is forecasted to be about $193.6 billion in the year 2025, though this is expected to increase to $232.61 billion by the year 2030 at a compound annual growth rate of approximately 3.74%.

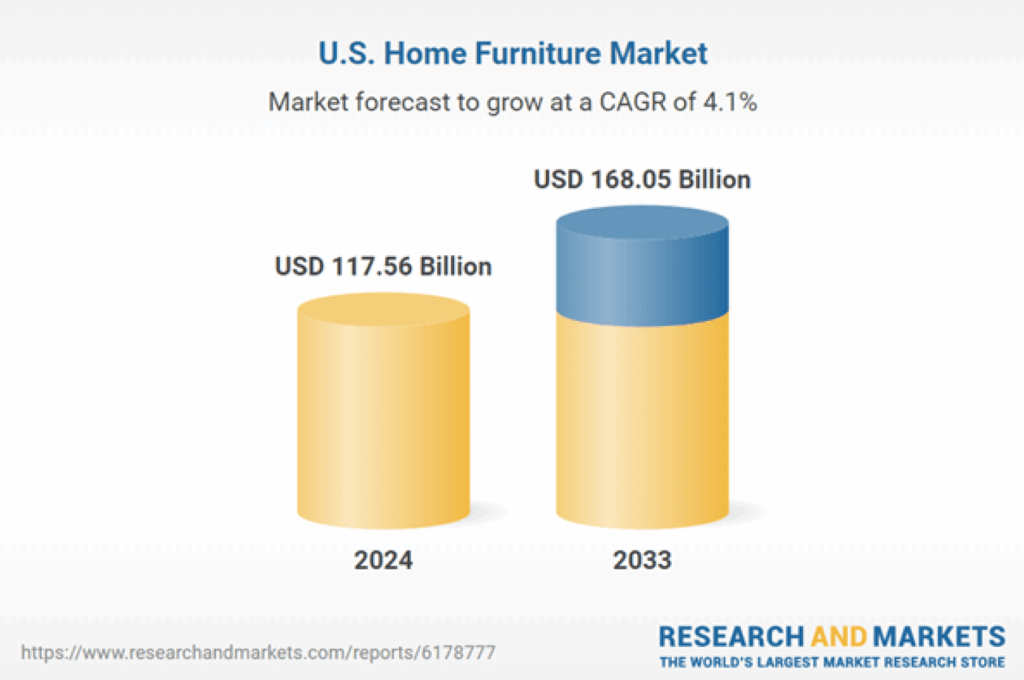

Home furniture is a huge part of this market, encompassing sofas, dining sets, bedroom furniture, storage units, and office furniture; the main items of the core products of Oak and Iron Furniture Co. The American home furniture market alone is expected to reach $168.05 billion by 2033.

The State of Ohio represents a strong and stable furniture retail market within the broader U.S. industry. In 2025, the Ohio Furniture Stores industry is estimated at approximately $5.2 billion, driven by the state’s large population base, consistent housing turnover, and ongoing demand for household furnishings.

Barriers to Entry

Getting into the furniture retail business is not easy, which helps existing stores stay strong.

A new furniture store needs a lot of money up front. Inventory is expensive, and money is also needed for the showroom, displays, and daily expenses before the business starts making a steady income.

Supplier access is another challenge. Better prices and reliable product supply usually go to retailers with a proven sales history. New stores often pay more and have fewer product options.

Running a furniture store also takes experience. Managing large items, handling deliveries, and dealing with damaged products requires good systems. Poor inventory choices can quickly create cash flow problems.

Finally, customers want to buy from stores they trust. Furniture is a big purchase, and people prefer retailers with a good reputation and reliable service. New stores take time to earn that trust.

These factors help Oak and Iron Furniture Co. compete and remain stable in the market.

Emerging Trends

The emerging trends in the furniture business are as follows:

- Personalization & Customization: Customers are moving towards customized furniture that is made to order, is modular, and should fit individual spaces and personal style.

- Sustainable / Eco-Friendly Products: The demand increases in the products made with the use of sustainable materials, re-used wood, and the low-VOC (Volatile Organic Compounds) finishes, which influence the purchase decision and the brand loyalty.

- Omnichannel and Virtual Shopping: As the combination of physical and online shopping, including online shopping, AR/VR visualization, and mobile apps, they give the retailer a competitive edge.

- Modular/Multifunctional Furniture: The urban lifestyle and home work are driving the need to have versatile furniture that can be utilised in a small space.

- Local and Resilient Supply Chains: Brands are transitioning to local and regional suppliers in order to increase reliability, shorten lead times, and minimize the supply chain risk.

- Second-Hand and Refurbished Furniture: The refurbished and used furniture is expected to become even more popular due to the fact that it encourages sustainable purchases and purchases based on value.

Competitor Landscape

| Competitor | Strengths | Weaknesses |

|---|---|---|

| Havertys Furniture | Well-known brand with strong reputation and quality inventory; broad product selection; robust customer service | Higher price points that may deter mid-range buyers; larger store overhead limits pricing flexibility |

| Big Sandy Superstore | Large selection and competitive pricing; strong local following and high review counts | Big-box feel with less personalized service; inventory can be overwhelming for customers seeking curated options |

| IKEA | Recognized national brand; affordable modern designs; strong logistics and self-service efficiency | Requires customer assembly; less appeal to buyers seeking in-store, hands-on assistance and custom options |

| Furniture Land Ohio | Local presence with generally good reviews; mid-range pricing appeal | Smaller showroom and inconsistent brand identity limit perceived reliability compared to larger retailers |

| TY Fine Furniture | High review ratings and personalized service; strong local reputation | Limited scale; narrower product range than larger chains |

| Signature Furniture | Good customer ratings; established local store | Less brand recognition than national competitors; may struggle with price and inventory breadth |

| The Furniture Vault | Boutique feel with carefully selected pieces; personalized service appeal | Small footprint; limited inventory and marketing reach |

Differentiation Strategy

Oak & Iron Furniture Co. differentiates itself through curated products, local service, and operational discipline.

- Curated mid-range furniture selection that avoids big-box overload and designer-level pricing.

- Limited custom-order capability without carrying excess made-to-measure inventory.

- Faster local delivery through owner-managed logistics and regional vendor relationships.

- Refurbished furniture options priced below new inventory to attract value-driven buyers.

- Personalized, no-pressure in-store guidance instead of commission-driven sales tactics.

- Controlled inventory rotation to keep styles current and cash flow predictable.

- Strong local focus with partnerships involving real estate agents and interior decorators.

Stop Googling competitors for hours

Marketing & Sales Strategy

Oak & Iron Furniture Co. focuses on practical, local marketing and relationship-driven sales to convert foot traffic into repeat customers while keeping acquisition costs controlled.

Marketing Channel

Oak & Iron Furniture Co. allocates a monthly marketing budget of $1,200, which is distributed across a mix of digital, local, and relationship-driven channels. This allocation prioritizes high-intent customer acquisition, local brand visibility, and repeat business while keeping overall marketing costs controlled.

| Marketing Channel | Approx. Share (%) | Purpose / Notes |

|---|---|---|

| Digital Advertising | 35% | Includes Google Ads, Google Shopping, and paid search to capture intent-driven buyers online. |

| Social Media Advertising | 20% | Paid campaigns on Facebook, Instagram, and Pinterest to build awareness and engagement. |

| SEO & Website / Online Catalog | 10% | Organic search optimization and content to drive discovery and product browsing. |

| Email Marketing | 10% | Personalized campaigns for nurturing leads and repeat customers. |

| Local Print & Flyers | 5% | Community print ads and store mailers for local awareness and promotions. |

| In-Store Marketing & Displays | 10% | Signage, point-of-sale promos, and experiential in-store displays to convert walk-ins. |

| Partnerships & Referrals | 7% | Collaboration with real estate agents, decorators, and referral networks. |

| Local Events & Sponsorships | 3% | Community events, local shows, and local sponsorships to build brand presence. |

Sales Process

The company uses a well-planned but consultative sales process that aims at converting walk-in and referred customers into actual purchases. The sales process involves customer entry and the discovery of the needs. The sales personnel meet the customer, ask practical questions related to room size, usage, budgetary range, and time, so as to guide the customer into appropriate choices, other than promoting a particular product.

Then, customers visit the furnishing on the showroom floor, and staff will provide information on materials, quality of construction, cost, and delivery schedule. In the case of a customer with special needs, they negotiate the custom or refurbished options at this point.

After making a choice of a product, the sales associate ensures that pricing, availability, delivery, and payment terms are checked. Orders are placed in the point-of-sale system, and the deposits are received when the need arises.

The process ends with delivery arrangement and after-sales services. The store also organizes local delivery, ensures a time slot with the customer, and provides a solution to any problem on time to stimulate the idea of returning business and recommendations.

Customer Retention Strategy

The company can maintain its customers through the quality of services, follow-ups to the buyer, and repeat business based on relationships.

- Pay attention to the continuity of the service and reliability of products to create long-term customer trust.

- Carry out after-sales follow-ups to ensure satisfaction and address any problems as soon as possible.

- Keep the records of the customers using the POS to communicate in the future and make repeat contacts.

- Promote recurring purchases with match sets, accessories, and room suggestions.

- Seasonal refresh promotions should be used as opposed to mass discounting to maintain margins.

- Use the leverage of referral programs and provide collaborations with real estate agents and interior decorators.

- Focus more on word-of-mouth and returning customers so that the expenses of long-term marketing will be minimized.

Measurement and Metrics

Oak and Iron Furniture Co. follows the key performance indicators (KPIs) to observe the effectiveness of sales, the effectiveness of operations, and the satisfaction of customers. Metrics include:

Monthly Sales Revenue: Checks the sales in-store and custom orders against estimates.

Average Transaction Value (ATV): Measures the amount of revenue per sale to find the opportunity to upsell.

Inventory Turnover Rate: It is used to determine the rate at which the inventory is sold and replenished, and this should be 45–60 days.

Customer Acquisition Cost (CAC): Measures the amount spent on marketing as compared to the number of new customers converted.

Repeat Purchase Rate: Assesses customer retention and success of follow-up efforts.

Customer Satisfaction and Reviews: Keeps track of customer feedback, online reviews, and post-delivery surveys so the service delivery can be highly rated.

Break-even Tracking: Involves a monthly revenue that is equivalent to or greater than the break-even level of 28,000-30,000.

Such metrics will enable the owner to make informed choices, change the marketing and inventory plans, and remain financially sound in favor of long-term development.

A business plan shouldn’t take weeks

Operations Plan

The company will operate with a lean owner-managed operating model, which focuses on efficiency, inventory management, and regular execution in stores. The business is more about routines that can be predicted and not complex systems, and this enables the management to retain the quality of the services and, at the same time, keep the overhead to a low amount in the initial years of operation.

Working Hours

The store is open six days per week, with extended hours on weekends when furniture shopping activity is highest.

Proposed operating hours:

- Monday – Friday: 10:00 AM to 7:00 PM

- Saturday: 10:00 AM to 6:00 PM

- Sunday: Closed

Administrative tasks such as inventory ordering, vendor coordination, and financial reviews are handled by the owner outside of store hours to ensure uninterrupted customer service during business hours.

Staffing Plan

Oak & Iron Furniture Co. follows a lean staffing model designed to support daily store operations, customer service, and deliveries while keeping payroll aligned with revenue growth. Hiring is phased to match store traffic and seasonal demand, avoiding unnecessary fixed labor costs in the early months.

| Role | Type | Hourly / Salary | Avg Hours / Week | Weeks / Year | Annual Wages |

|---|---|---|---|---|---|

| Owner (David Keller) | Full-time | Salary | — | — | $30,000 |

| Sales Associate | Full-time | $17/hour | 35 | 52 | $30,940 |

| Weekend Sales Associate | Part-time | $15/hour | 15 | 52 | $11,700 |

| Delivery Helper | Contract (seasonal) | $20/hour | 10 | 26 | $5,200 |

| Total Wages | $77,840 |

Payroll Taxes & Burden

Payroll taxes applied only to employee wages, not owner draws, and not contractors.

| Item | Amount |

|---|---|

| Taxable employee wages | $42,640 |

| Payroll tax rate | 10% |

| Payroll taxes | 4,264 |

Total Payroll Cost – Year 1

| Category | Amount |

|---|---|

| Employee wages (incl. owner) | $72,640 |

| Payroll taxes | $4,264 |

| Total payroll expense | $76,904 |

| Contract delivery labor | $5,200 |

| Total labor-related cost | $82,104 |

Daily In-Store Process

The store follows a structured daily workflow to ensure consistent customer service, accurate inventory control, and smooth store operations.

Store Opening

- Open the store, inspect the showroom, and ensure all displays are clean and properly staged

- Power on the POS system and review the prior-day sales

- Confirm scheduled deliveries and customer appointments

Sales & Customer Service

- Greet walk-in customers and assess furnishing needs

- Provide product recommendations, pricing, and customization options

- Process sales through the POS system and collect deposits for custom orders

Inventory & Vendor Coordination

- Update inventory status in the POS system

- Flag low-stock or slow-moving items

- Place replenishment or custom orders as required

Delivery & Fulfillment

- Coordinate delivery schedules with contract helpers

- Verify items before dispatch

- Confirm delivery completion and address any issues

End-of-Day Close

- Reconcile cash and card transactions

- Review daily sales performance and foot traffic

- Secure the store and prepare the next day’s task list

Such a structured process allows the business to operate efficiently with minimal staff while maintaining a consistent customer experience.

Delivery & Logistics

We manage our delivery and logistics through a flexible, cost-controlled model that supports reliable customer fulfillment without heavy capital investment.

The owner oversees delivery scheduling and coordination to ensure orders are fulfilled on time and in proper condition. For most deliveries, the business uses a contract delivery helper during peak seasons, which allows capacity to scale with demand while avoiding year-round payroll costs.

Furniture is inspected and secured before dispatch to reduce damage and returns. Deliveries are scheduled in grouped routes to minimize fuel expenses and time on the road. Customers receive delivery windows in advance, along with clear handling and setup expectations.

Custom-built and locally sourced items are coordinated directly with makers to align production completion with delivery timing. This reduces storage needs and improves cash flow.

This logistics approach balances reliability, customer satisfaction, and operating cost control while supporting future expansion into a dedicated delivery vehicle as sales volume increases.

Risk Mitigation Strategies

| Risk Area | Potential Risk | Mitigation Strategy |

|---|---|---|

| Inventory Risk | Slow-moving or overstocked furniture tying up cash | Maintain 45–60 day inventory turnover, rotate underperforming items, and use targeted clearance pricing |

| Demand Fluctuation | Seasonal sales dips impacting cash flow | Build a working capital reserve, increase promotions during slow months, and push custom orders |

| Supplier Dependency | Delays or pricing changes from vendors | Use multiple regional wholesalers and local makers to diversify supply sources |

| Delivery Issues | Product damage or missed delivery timelines | Inspect items before dispatch, schedule grouped routes, and use experienced contract helpers |

| Competitive Pressure | Price competition from big-box retailers | Focus on service, curated selection, and custom options rather than price matching |

| Cash Flow Risk | Mismatch between expenses and sales cycles | Monitor weekly cash flow, control fixed costs, and adjust purchasing based on sales velocity |

| Operational Risk | Owner dependency in early-stage operations | Standardize daily processes and gradually delegate routine tasks as revenue grows |

Regulatory and Compliance

The following licenses, permits, and insurance policies ensure Oak & Iron Furniture Co. operates legally, safely, and in full compliance with state and local regulations.

- Ohio Business Registration (LLC): Establishes the company as a legal entity and limits the owner’s personal liability.

Ohio Vendor’s License: Allows the business to collect and remit state sales tax on furniture sales. - City of Columbus Business License: Authorizes retail operations within the city limits.

- Zoning & Certificate of Occupancy: Confirms the location is approved and safe for retail furniture use.

- Fire Safety Certificate: Verifies compliance with local fire and safety regulations.

- Signage Permit: Approves exterior business signage under city guidelines.

- Workers’ Compensation Coverage: Covers employee injuries as required by Ohio law.

- General Liability Insurance: Protects against customer injury, property damage, and related claims.

Financial Plan

The financial plan outlines Oak & Iron Furniture Co.’s revenue model, cost structure, and funding strategy over the first three years of operation. Projections are based on realistic sales volume, conservative margins, and disciplined expense control to support stable cash flow and timely loan repayment.

Core Assumptions (3 Year)

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| COGS (% of revenue) | 62% | 60% | 58% |

| Gross margin | 38% | 40% | 42% |

| Monthly non-payroll expenses | $5,360 | $5,530 | $5,700 |

| Loan amount | $90,000 | — | — |

| Interest rate | 8.5% fixed | 8.50% | 8.50% |

| Loan term | 5 years | — | — |

| Annual debt service | $22,600 | $22,600 | $22,600 |

Revenue Projection (3 Year)

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Annual revenue ($) | $246,750 | $367,200 | $495,000 |

Operating Expenses (3 Year)

| Expense Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

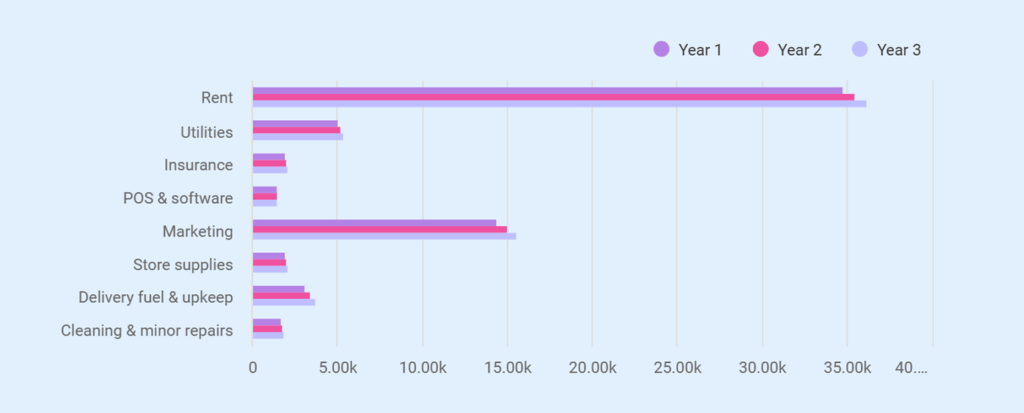

| Rent | $34,800 | $35,500 | $36,200 |

| Utilities | $5,040 | $5,200 | $5,400 |

| Insurance | $1,920 | $2,000 | $2,080 |

| POS & software | $1,440 | $1,440 | $1,440 |

| Marketing | $14,400 | $15,000 | $15,600 |

| Store supplies | $1,920 | $2,000 | $2,100 |

| Delivery fuel & upkeep | $3,120 | $3,400 | $3,700 |

| Cleaning & minor repairs | $1,680 | $1,800 | $1,900 |

| Total Operating Expenses | $64,320 | $66,340 | $68,420 |

Payroll (3 Year)

| Payroll Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Owner salary | $30,000 | $32,000 | $34,000 |

| Full-time sales associate (W-2) | $30,940 | $32,500 | $34,100 |

| Part-time sales associate (W-2) | $11,700 | $12,300 | $12,900 |

| Total W-2 wages | $72,640 | $76,800.00 | 81,000 |

| Payroll taxes (10% on employee wages only) | 4,264 | 4,480 | 4,700 |

| Contract delivery labor | $5,200 | $5,700.00 | 6,200 |

| Total payroll & labor cost | $82,104 | $86,980.00 | 91,900 |

Profit & Loss Statement (3 Year)

| P&L Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Revenue | |||

| Sofas & seating | $91,300 | $134,000 | $180,000 |

| Dining & bedroom sets | $93,800 | $147,000 | $195,000 |

| Office & storage furniture | $52,400 | $72,500 | $97,000 |

| Custom & add-ons | $9,250 | $13,700 | $23,000 |

| Total Revenue | $246,750 | $367,200 | $495,000 |

| Cost of Goods Sold (COGS) | $152,985 | $220,320 | $287,100 |

| Gross Profit | $93,765 | $146,880 | $207,900 |

| Gross Margin (%) | 38.00% | 40.00% | 42.00% |

| Operating Expenses | |||

| Payroll & labor cost | $82,104 | $86,980 | $91,900 |

| Operating expenses (non-payroll) | $64,320 | $66,340 | $68,420 |

| Total Operating Expenses | $146,424 | $153,320 | $160,320 |

| EBITDA | -$52,659 | -$6,440 | $47,580 |

| Depreciation | $6,000 | $6,000 | $6,000 |

| EBIT | -$58,659 | -$12,440 | $41,580 |

| Interest Expense | $7,650 | $6,380 | $5,000 |

| Net Income | -$66,309 | -$18,820 | $36,580 |

Don’t waste time figuring out Excel

Simplify financial forecasting & reporting w/ Upmetrics

Cash Flow Statement (3 Year)

| Cash Flow Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| CASH FLOW FROM OPERATIONS | |||

| Net income | -$26,114 | -$37,960 | -$17,810 |

| Depreciation | $6,000 | $6,000 | $6,000 |

| Change in inventory | -$48,000 | -$7,000 | -$7,000 |

| Change in prepaid expenses | -$1,200 | $0 | $0 |

| Change in accounts payable | $9,500 | $1,500 | $1,500 |

| Change in accrued expenses | $3,200 | $300 | $300 |

| Net Cash from Operations | -$56,614 | -$37,160 | -$16,010 |

| CASH FLOW FROM INVESTING | |||

| Store build-out & fixtures | -$20,500 | $0 | $0 |

| Equipment additions | -$4,000 | -$6,000 | -$6,000 |

| Net Cash from Investing | -$24,500 | -$6,000 | -$6,000 |

| CASH FLOW FROM FINANCING | |||

| Owner equity contribution | $25,000 | $0 | $0 |

| Loan proceeds | $90,000 | $0 | $0 |

| Loan principal repayment | -$14,950 | -$16,220 | -$17,600 |

| Net Cash from Financing | $100,050 | -$16,220 | -$17,600 |

| Net Cash Movement | $18,936 | -$59,380 | -$39,610 |

| Opening cash balance | $19,554 | $38,490 | -$20,890 |

| Closing cash balance | $38,490 | -$20,890 | -$60,500 |

Balance Sheet (3 Year)

| Balance Sheet Item | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| ASSETS | |||

| Cash & bank | $38,490 | -$20,890 | -$60,500 |

| Inventory | $48,000 | $55,000 | $62,000 |

| Prepaid expenses | $1,200 | $1,200 | $1,200 |

| Furniture, fixtures & equipment (net) | $18,500 | $12,500 | $6,500 |

| Total Assets | $106,190 | $47,810 | $9,200 |

| LIABILITIES | |||

| Accounts payable | $9,500 | $11,000 | $12,500 |

| Accrued expenses | $3,200 | $3,500 | $3,800 |

| Loan balance (ending) | $75,050 | $58,830 | $41,230 |

| Total Liabilities | $87,750 | $73,330 | $57,530 |

| EQUITY | |||

| Owner capital | $25,000 | $25,000 | $25,000 |

| Retained earnings (cumulative) | -$6,560 | -$44,520 | -$62,330 |

| Total Equity | $18,440 | -$19,520 | -$37,330 |

| Liabilities + Equity | $106,190 | $47,810 | $9,200 |

Break-even Analysis

| Item | Amount |

|---|---|

| Annual Revenue (Year 1) | $246,750 |

| Cost of Goods Sold (62%) | $152,985 |

| Gross Margin (%) | 38% |

| Total Fixed Costs (Annual) | $160,074 |

| Total Fixed Costs (Monthly) | $13,340 |

| Monthly Break-Even Revenue | -$35,100 |

| Annual Break-Even Revenue | -$421,000 |

Loan Repayment

- Loan amount: $90,000

- Interest rate: 8.5% fixed

- Term: 5 years

- Annual payment: 22,600

| Loan Item | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Opening balance | $90,000 | $75,050 | $58,830 | $41,230 | $22,140 |

| Annual payment | $22,600 | $22,600 | $22,600 | $22,600 | $22,600 |

| Interest | $7,650 | $6,380 | $5,000 | $3,510 | $460 |

| Principal | $14,950 | $16,220 | $17,600 | $19,090 | $22,140 |

| Ending balance | $75,050 | $58,830 | $41,230 | $22,140 | $0 |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.