Executive Summary

In Dayton, Ohio, roughly 14.1% of residents are age 65 or older, and many in this group need daily supervision and routine support without requiring skilled medical care, creating steady demand for residential group homes. For small providers, this demand comes with fixed licensing and staffing requirements that keep operating costs steady regardless of occupancy.

The Safe Harbor Residential Services is established to work in this reality. It is a one-member limited liability company operating a five-resident licensed residential group home in Dayton, Ohio, offering referral-based placements in Dayton.

Safe Harbor provides residential services within an organized home care setting to offer non-medical care to people who need day-to-day care, routine help, and a stable place to live. The services are provided in accordance with the Ohio residential care regulations and are aimed at regular supervision, routines, and intake control instead of service delivery based on volume.

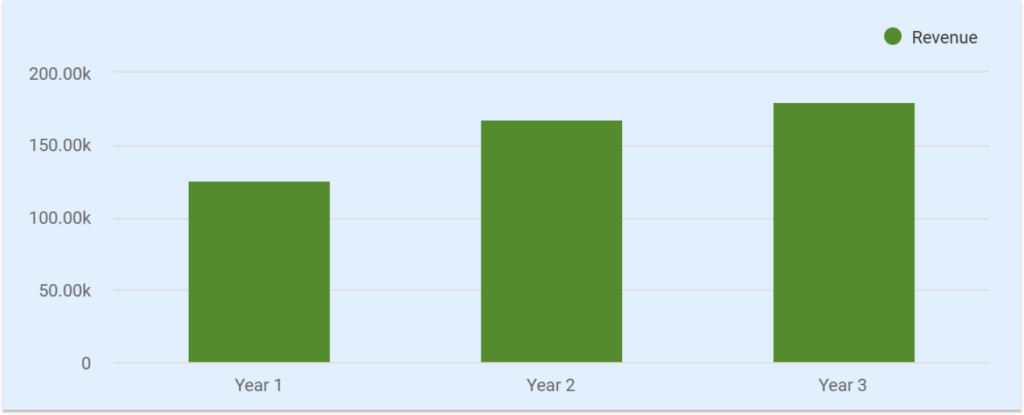

The revenue is earned based on the number of occupied beds through monthly per-resident care fees, at an average of $4,200 per resident. Since the home has a maximum licensed capacity of five residents, revenue is limited by definition. Occupancy increases gradually through referral channels as licensing requirements are met and resident fit is confirmed. No year assumes full occupancy, resulting in predictable but modest revenue growth.

Based on these assumptions, projected annual revenue is approximately:

- $126,000 in Year 1

- $168,000 in Year 2

- $180,000 in Year 3

Occupancy does not change operating costs at the same rate. Ohio laws demand that at all times, there must be on-site supervision of the caregiver, irrespective of the number of residents present, which poses a significant fixed labor base during the ramp-up period. Because staffing availability is the primary operational risk in small residential care homes, the business is structured with fixed schedules, backup coverage, and direct owner escalation to prevent supervision gaps.

Safe Harbor is funded to cover both startup costs and early operating expenses, including staffing, before revenue fully stabilizes. The business requires $165,000 in total startup and initial operating capital. The structure of the funding is as follows.

| Funding source | Type | Amount (in $) | Purpose |

|---|---|---|---|

| Owner Equity | Equity | 30,000 | Initial capitalization |

| Bank Term Loan | Debt | 45,000 | Startup and facility setup costs |

| Owner Working-Capital Loans | Debt | Up to 90,000 | Cash flow support during occupancy ramp-up |

| Total Funding | 165,000 |

The business uses owner working-capital loans to manage short-term cash needs and keep all payments current during operations. Until Year 3, the owner’s compensation is deferred to maintain liquidity in the initial operations.

The business reaches break-even at approximately 4 residents, which is slightly below the licensed maximum of five. Like most small residential care homes, profitability remains modest even after stabilization, reflecting a model built for steady operation.

Malik Turner, the owner and operator of Safe Harbor Residential Services, offers administration, staffing coordination, intake approvals, and regulatory compliance management. The business is organized as a realistic, owner-supported residential group home where regulatory compliance, staff stability, and strict cash management are of higher priority than growth or ambitious margin goals.

A business plan shouldn’t take weeks

Business Overview

Legal Structure and Business Location

Safe Harbor Residential Services is structured as a single-member LLC. The owner chose this structure to protect personal assets while maintaining full control over regulatory compliance, staffing decisions, and intake approvals. The structure also provides accountability, and this is necessary in a licensed residential care business that is under constant supervision.

The business is located at 214 Willow Crest Drive in Dayton, Ohio. The owner chose this site because it is properly zoned for residential care use and meets Ohio’s licensing, inspection, and safety requirements for small residential group homes.

Mission and Vision

Safe Harbor Residential Services’ mission is to operate a licensed residential group home that provides consistent supervision, meets all regulatory requirements, and maintains a stable daily living environment for residents.

The business vision is to continue operations within licensed capacity in the long run, with steady occupancy and manageable staffing levels without expansion of more than one facility.

Ownership

Safe Harbor Residential Services is fully owned and managed by Malik Turner. He is responsible for regulatory compliance, staffing oversight, resident intake approvals, and overall day-to-day operations.

The business has no outside partners or investors, allowing the owner to maintain clear decision-making authority and consistent control over licensing and operational standards.

Business Model

Safe Harbor Residential Services operates within a license-defined structure that determines both revenue and service delivery based on approved resident capacity.

The business earns revenue through flat monthly care fees charged per resident. Pricing is based on supervision needs and household operating costs and does not change with short-term occupancy fluctuations.

Operating Goals

The operating objectives of the business include:

- Ensure complete licensing and regulatory compliance, such as staff-to-patient ratios, documentation, inspections, and safety measures.

- Maintain uninterrupted caregiver coverage through fixed schedules, planned backup staffing, and direct owner escalation to prevent supervision gaps.

- Manage occupancy and intake, receive placements on fit, and staffing, but not speed or volume.

- Deliver stable and predictable daily services, using structured routines to support resident safety and reduce operational risk.

- Preserve financial stability during early operations, funding expected cash shortfalls without reducing staffing or delaying obligations.

These goals define how the business operates day to day and ensure care delivery remains compliant, stable, and financially controlled.

Market Analysis

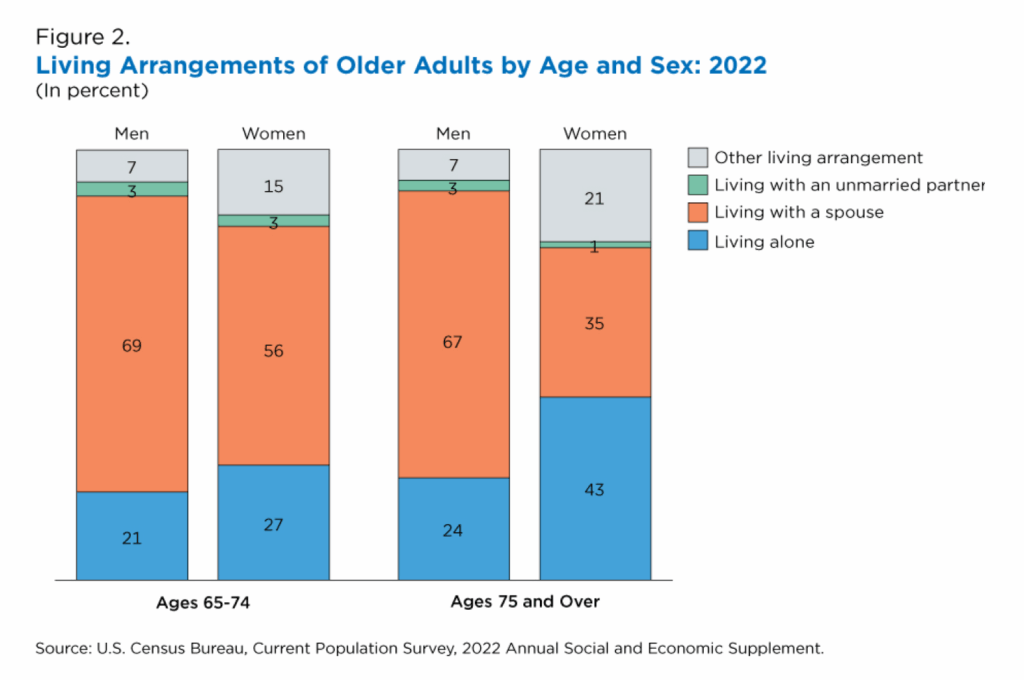

Across the United States, conditions that drive demand for supervised residential care are already in place. In 2022, nearly 3 in 10 adults aged 65 and older lived alone.

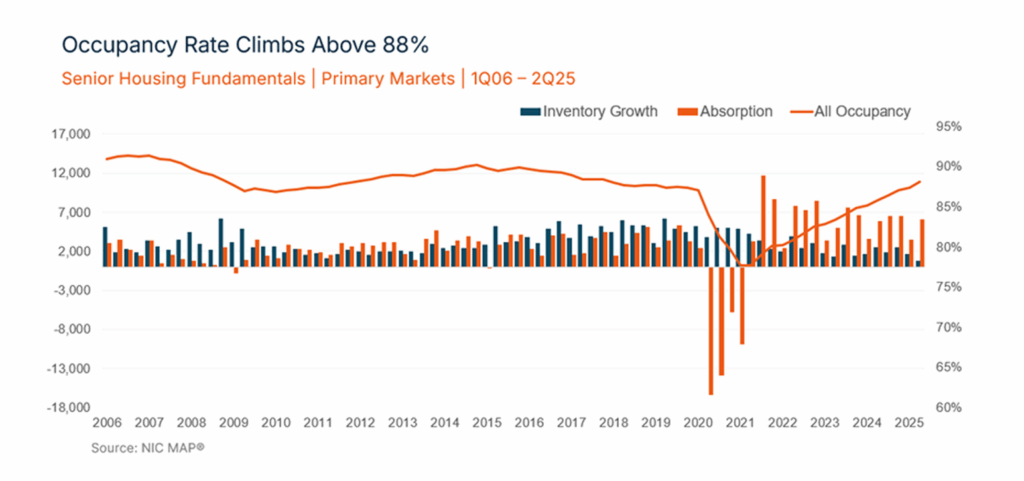

Among those living alone, almost 4 in 10 had limitations such as vision or hearing loss, difficulty managing daily activities, cognitive issues, or other disabilities. As a result, many older adults need daily supervision and routine assistance even when medical nursing care is not required. This demand is reflected in utilization trends, with senior housing occupancy in the United States exceeding 88% by the first half of 2025 due to sustained demand and limited new supply.

Ohio reflects this trend. More than 2.2 million residents are aged 65 or older, and in over one quarter of Ohio counties, older adults outnumber children. This shows growing demand for residential care driven by aging in place, increasing reliance on small, licensed residential homes.

Dayton shows the same pattern locally. The city has a population of about 136,346, with roughly 14.1 percent aged 65 and older. Many residents in this group need daily supervision and routine support, but not skilled nursing care. Together, these factors support the need for a small, licensed residential group home in Dayton serving referral-based placements.

Stop searching the internet for industry & market data

Get AI to bring curated insights to your workspace

Target Market

Safe Harbor’s primary target market consists of older adults and referral populations in the Dayton area who require supervised, non-medical residential care. This includes:

- The elderly (65 and above) who no longer live independently

- Individuals who do not qualify for skilled nursing but cannot safely live independently

The target market consists of individuals who need regular supervision but minimal clinical care. This makes small residential group homes an appropriate placement.

Competitive Analysis

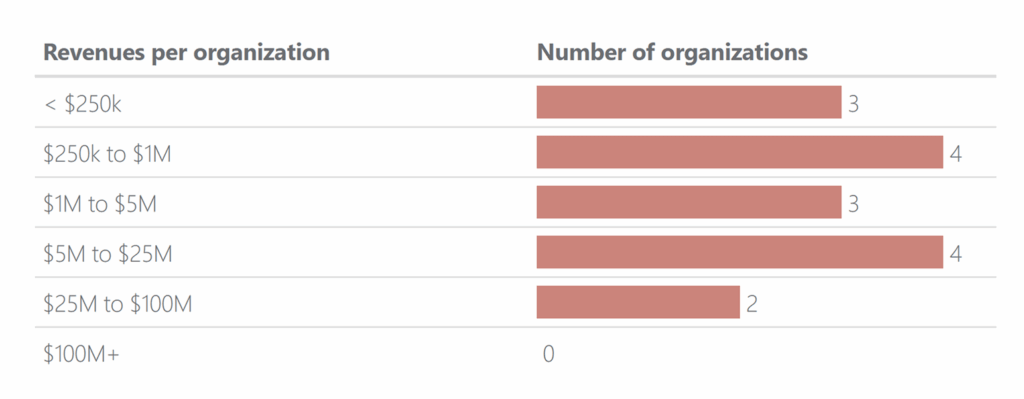

The metro Dayton, Ohio, has an estimated 26 residential care and group homes, with thousands of employees and more than $212 million of collective revenue in the sector. This is a dynamic, yet competitive, care provider ecosystem.

These competitors are large organizations (such as hospice and aged care networks) to small group home operators within respective communities.

| Logo | Name | Type | Strengths | Weaknesses |

|---|---|---|---|---|

|

Graceworks Lutheran Services | Direct | Large nonprofit with strong referral networks and financial scale | Operates at a larger scale with broader programs; less personalized, higher cost |

|

Resident Home Association of Greater Dayton | Direct | Established residential care provider with community-based housing | Serves specific populations; limited flexibility in placements |

|

Choices in Community Living | Direct | Focus on community-based residential support | Primarily serves the developmental disability population, with a narrower intake fit |

|

Sunrise Center for Adults | Direct | Senior-focused residential care | Limited public data on capacity and staffing depth |

Competitor Advantage

Safe Harbor’s Competitive Advantages include

- Targeted capacity focus: A five-resident licensed home offers a personalized environment compared with larger facilities, appealing to people seeking community-like settings.

- Referral-linked intake: Referral-based intake relies on formal placement channels, supporting compliance and steady occupancy without aggressive marketing.

- Stable pricing model: Flat monthly fees tied directly to supervision and care needs provide predictability for families and payers.

- Consistent staffing model: Fixed schedules and owner oversight reduce caregiver turnover and provide residents with stable, familiar supervision, which is often preferred over rotating staff in larger facilities.

Although bigger assisted living facilities and retirement communities offer more services or clinical care capacity, the system at Safe Harbor is based on monitored daily living, but not on clinical complexity. This is best suited to residents who require supervision but not advanced medical care.

Services & Care Offerings

Safe Harbor Residential Services provides non-medical residential care focused on daily supervision, safety, and routine within a licensed home environment. Core services are designed to meet supervision needs while remaining fully within Ohio Residential Care Facility regulations.

Across all care levels, residents receive continuous on-site supervision, assistance with permitted daily activities, regular household meals, and upkeep of their living areas. Caregivers work in scheduled shifts to maintain consistent oversight, structured routines, and continuity of care throughout the day and night. The average monthly fee is approximately $4,200 per resident, reflecting the supervised residential setting and bundled daily support services.

Core Services

Standard Residential Care

This service is provided to residents who need constant supervision and organized daily schedules but are not in need of medical or clinical assistance.

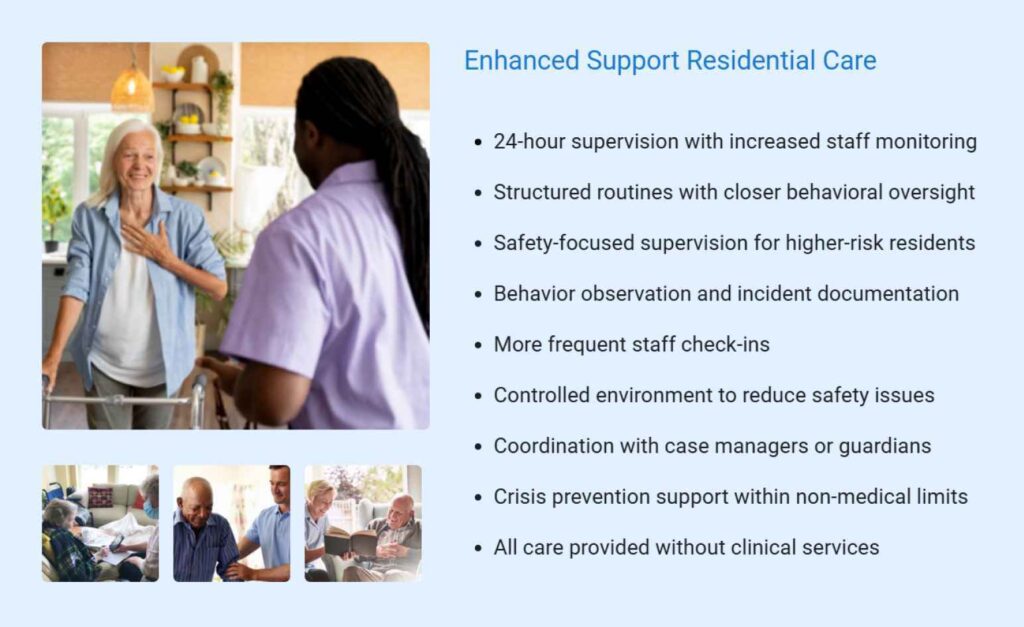

Enhanced Support Residential Care

This service is targeted at residents who need closer supervision because of behavioral, safety, or monitoring issues.

Short-Term Placement Care

This service accommodates temporary residential stays for evaluation, transition, or placement assessment.

Service Scope and License Boundaries

All services operate strictly within the scope of Ohio’s residential care licensing rules. The license limits the home to five residents and sets the required staffing and service levels. Intake decisions and service levels align with these regulatory constraints at all times.

Excluded Services and Medical Limitations

Safe Harbor Residential Services does not offer any medical treatment, skilled nursing, clinical therapy, or emergency medical care. In case it is offered, the medication assistance is limited to what the license permits. External licensed providers deliver all medical and therapeutic services, with staff coordinating logistics only.

Investors hate amateur writing errors

Instantly improve your plan w/ our AI writing assistant

Operational Plan

The operations of Safe Harbor are not based upon flexibility or volume-based service delivery but instead on the fixed requirements of supervision, controlled intake, and constant compliance.

Daily Operating Workflow

Day-to-day operations follow a consistent routine to support resident stability and reduce supervision risk. Core daily activities include continuous supervision, assistance with permitted daily living activities, scheduled meals, household upkeep, and documentation of resident status. Standardized routines reduce variability in staff decisions and help maintain predictable care delivery regardless of occupancy level.

Supervision standards do not change during ramp-up or periods of underutilization. The same staffing coverage, monitoring practices, and documentation requirements apply whether the home is partially or fully occupied.

Staffing Structure

Safe Harbor Residential Services maintains 24/7 on-site caregiver coverage through a fixed shift schedule. The staffing model consists of three to four rotating caregivers, set according to Ohio licensing requirements and not adjusted based on short-term occupancy.

Each shift designates a lead caregiver responsible for:

- Direct supervision of residents

- Coordinating daily routines and household activities

- Monitoring resident behavior and safety

- Responding to incidents and escalating issues when required

- Completing supervision logs and shift documentation

Caregivers provide hands-on supervision and daily living support strictly within the scope of the residential care license. No medical or clinical services are provided.

They also have a standard handover process to ensure a seamless transition between shifts. The departing lead caregiver hands over to the new employee everything about the residents, supervision, incidents, and follow-ups. This ensures continuity and prevents miscommunication.

During nights, weekends, and holidays, staff escalate urgent issues directly to the owner or a designated backup to ensure uninterrupted oversight and compliance.

Staffing Continuity and Backup Coverage

If a scheduled caregiver is unavailable, coverage is maintained through pre-identified backup staff or direct owner involvement. Malik Turner remains on call outside standard hours and steps in to coordinate coverage immediately to ensure supervision is never interrupted. New resident placements are paused if staffing coverage cannot be maintained at licensed standards.

Owner Role and Management Oversight

Malik Turner has direct managerial control over Safe Harbor Residential Services. Instead of working in regular caregiver shifts, he handles administration, staffing, and regulatory compliance.

His responsibilities involve:

- Approval of staffing

- Review of resident intakes

- Regulatory communication

- Incident response

Facility Layout

The residential facility will be able to receive a maximum of five residents as per the capacity and supervision requirements. The design facilitates round-the-clock monitoring, routine activities, and safe movement within the household.

The facility includes:

- Private resident bedrooms furnished with a bed, dresser, chair, and personal storage

- Shared living and dining areas used for supervised meals, daily activities, and social interaction

- Common bathrooms that meet safety and basic accessibility requirements

Furniture and layout focus on resident safety, durability, and easy supervision. The layout helps caregivers have a clear view of the main living areas and lets them respond to the needs of residents promptly.

Safety and accessibility considerations include sufficient lighting around all communal areas, well-labeled exits, non-slip flooring in busy zones, and grab bars in the bathrooms when they are needed.

Equipment, Supplies, and Vendor Management

The company has a small stock of household appliances, safety items, and resident supplies that are required to run the business on a daily basis. Local suppliers provide food, household products, and consumables on a consistent basis.

The owner manages vendor relationships to manage costs, ensure consistency of supply, and comply with safety and quality standards. No medical equipment is kept or used in the facility.

Licensing, Insurance, and Safety Standards

The business maintains required insurance coverage, including:

- General liability insurance

- Professional liability coverage

- Property and casualty coverage as applicable

Safety standards include fire safety systems, controlled access, incident reporting, and regular facility inspections. The business maintains up-to-date documentation to support both scheduled and unannounced regulatory inspections.

Intake, Placement, and Referral Controls

Residents are accepted exclusively through referral-based placement channels. Each referral is reviewed to confirm:

- License eligibility

- Supervision requirements

- Compatibility with existing residents

- Staffing capacity at the time of placement

Intake decisions prioritize safe, sustainable placements over speed or occupancy targets. New placements are paused if staffing coverage or compliance conditions cannot be maintained.

Marketing Strategy

Safe Harbor Residential Services does not admit residents without a referral. Since it’s operated under the capacity limits and constant supervision requirements, the business does not use public advertising, digital marketing, or demand-generation efforts.

All placements are managed by professional referral partners. This approach supports controlled intake, regulatory compliance, and staffing stability.

Referral Intake Sources

Safe Harbor takes placements done by qualified professionals and agencies that arrange supervised residential care, including:

- Hospital discharge planners for post-discharge and transitional placements

- Ongoing residential placement case managers and care agencies

- Local placement coordinators who match residents to licensed residential homes

These partners place residents based on care needs, license fit, and available capacity.

Provider Listings and Professional Visibility

Safe Harbor maintains accurate and current listings in state and local provider directories. These listings support referral partners by allowing them to:

- Confirm active licensing and compliance

- Check availability

- Verify provider eligibility

Listings support intake readiness and verification, not lead generation or promotion.

Marketing Cost Control

The business does not maintain a separate marketing or advertising budget. Referral coordination and listing maintenance occur as part of routine administrative operations and are included in general operating expenses.

This approach avoids unnecessary overhead and prevents intake pressure beyond licensed capacity or staffing limits.

Does your plan sound generic?

Refine your plan to adapt to investor/lender interests

Financial Plan

The financial forecast of Safe Harbor is based on conservative expectations, regulated occupancy, and adequate capital to fund initial operations.

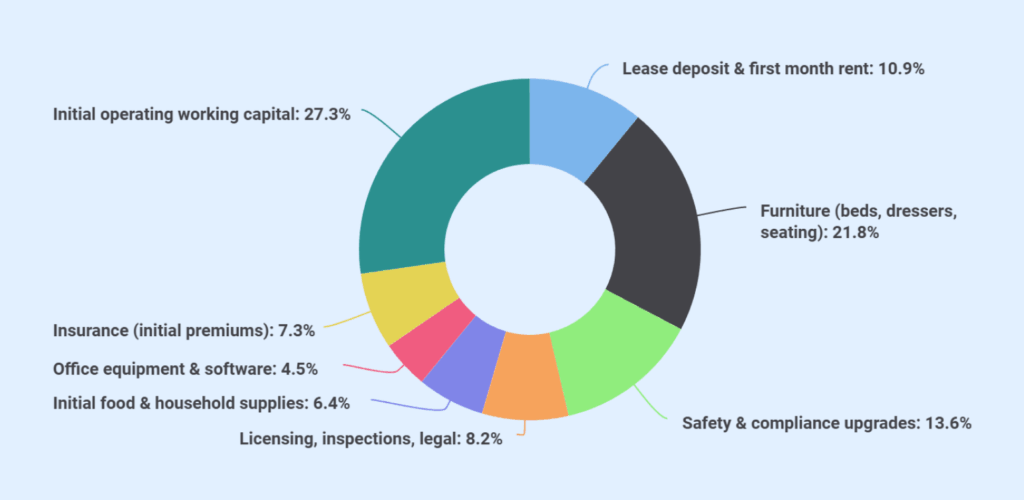

Startup Costs

| Category | Amount (USD) | Justification |

|---|---|---|

| Lease deposit & first month rent | 6,000 | Typical 1–1.5 months for a small residential lease |

| Furniture (beds, dressers, seating) | 12,000 | 5-resident capacity, durable but basic furnishings |

| Safety & compliance upgrades | 7,500 | Fire safety, locks, alarms, ADA-related adjustments |

| Licensing, inspections, legal | 4,500 | State licensing, inspections, and application fees |

| Initial food & household supplies | 3,500 | First 30–45 days of resident supplies |

| Office equipment & software | 2,500 | Laptop, printer, scheduling, documentation tools |

| Insurance (initial premiums) | 4,000 | General + professional liability upfront |

| Initial operating working capital | 15,000 | Covers early payroll timing and vendor lag |

| Total Startup Costs | 54,500 | Funded via owner capital + bank loan |

Sources of Funding

Total funding is structured to cover both startup costs and the operating cash deficits expected during the early ramp-up period. In addition to owner equity and a bank term loan used for initial setup, the plan includes documented owner working-capital loans, recorded as debt, to fund operating losses created by fixed staffing requirements during under-occupancy.

Owner working-capital loans are a planned financing mechanism rather than contingency support. These funds are drawn only to cover identified cash shortfalls and ensure that payroll, rent, and vendor obligations remain current while occupancy stabilizes. Owner compensation is deferred to preserve liquidity, and all funding sources are fully reflected in the financial statements.

| Source | Type | Amount (USD) | Treatment in Financials | Notes |

|---|---|---|---|---|

| Owner Capital Contribution | Equity | 30,000 | Equity (Balance Sheet) | Permanent capital at formation |

| Bank Term Loan | Debt | 45,000 | Long-term liability | Used for startup costs and equipment |

| Owner Working-Capital Loan (Initial) | Debt | 60,000 | Long-term liability | Covers early operating losses |

| Owner Working-Capital Loan (Additional) | Debt | 30,000 | Long-term liability | Draw as needed in Years 2–3 |

| Total Funding Available | 165,000 | |||

| Total Startup & Operating Needs Covered | 165,000 | Matches uses + cumulative cash deficits |

Revenue Forecast

Revenue is based on the licensed bed limit of five residents, a fixed average monthly care fee of approximately $4,200 per resident, and a gradual increase in occupancy through referral-based placements. The business does not assume full occupancy in any year. Revenue grows only as additional residents are placed, not through price increases or added services.

| Year | Licensed Capacity | Avg. Residents | Avg. Monthly Fee | Annual Revenue |

|---|---|---|---|---|

| Year 1 | 5 | ~2.5 | $4,200 | $126,000 |

| Year 2 | 5 | ~3.3 | $4,200 | $168,000 |

| Year 3 | 5 | ~3.6 | $4,200 | $180,000 |

Income statement

| Line Item | Year 1 | Year 2 | Year 3 | Total |

|---|---|---|---|---|

| Revenue | 126,000 | 168,000 | 180,000 | 474,000 |

| 1 | ||||

| Cost of Care (COGS) | ||||

| Caregiver Wages | (92,400) | (96,600) | (99,000) | (288,000) |

| Payroll Taxes & Benefits | (7,400) | (7,700) | (8,000) | (23,100) |

| Food & Resident Supplies | (9,600) | (11,400) | (12,000) | (33,000) |

| Transportation & Activities | (4,800) | (5,400) | (6,000) | (16,200) |

| Total COGS | (114,200) | (121,100) | (125,000) | (360,300) |

| Gross Profit | 11,800 | 46,900 | 55,000 | 113,700 |

| Gross Margin | 9.4% | 27.9% | 30.6% | 24.0% |

| Operating Expenses (OPEX) | ||||

| Rent & Utilities | (18,000) | (18,600) | (19,200) | (55,800) |

| Insurance | (6,000) | (6,200) | (6,400) | (18,600) |

| Licensing & Compliance | (4,200) | (4,400) | (4,600) | (13,200) |

| Admin, Software, Misc | (3,600) | (3,800) | (4,000) | (11,400) |

| Owner Compensation | 0 | 0 | (12,000) | (12,000) |

| Total Operating Expenses | (31,800) | (33,000) | (46,200) | (111,000) |

| EBITDA | (20,000) | 13,900 | 8,800 | 2,700 |

| Depreciation | (4,000) | (4,000) | (4,000) | (12,000) |

| EBIT | (24,000) | 9,900 | 4,800 | (9,300) |

| Interest Expense | (6,500) | (6,200) | (5,800) | (18,500) |

| Net Income (Pre-Tax) | (30,500) | 3,700 | (1,000) | (27,800) |

Liquidity and Cash Flow Management

The business expects to experience negative operating cash flow in the initial operations because of fixed staff costs and incremental occupancy build-up. The financial plan addresses this through explicitly modeled owner working-capital loans, not informal funding or delayed payments.

The owner’s working-capital loans fund identified cash shortfalls and is recorded as a liability. Payroll, rent, and vendor obligations remain current at all times.

Owner compensation is deferred until Year 3 to preserve liquidity and align cash usage with operating performance.

Cash flow statement

| Line Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Net Income (Pre-Tax) | (30,500) | 3,700 | (1,000) |

| Depreciation (Non-Cash) | 4,000 | 4,000 | 4,000 |

| Cash from Operations | (26,500) | 7,700 | 3,000 |

| Initial Capex | (25,000) | 0 | 0 |

| Owner Working Capital Loan | 60,000 | 20,000 | 10,000 |

| Loan Principal Repayment | (6,500) | (6,800) | (7,200) |

| Net Change in Cash | 2,000 | 20,900 | 5,800 |

| Beginning Cash | 15,000 | 17,000 | 37,900 |

| Ending Cash | 17,000 | 37,900 | 43,700 |

Balance sheet

| Line Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash | 17,000 | 37,900 | 43,700 |

| Equipment (Net) | 17,000 | 13,000 | 9,000 |

| Total Assets | 34,000 | 50,900 | 52,700 |

| Liabilities | |||

| Bank Loan | 43,500 | 36,700 | 29,500 |

| Owner Loan (Working Capital) | 60,000 | 80,000 | 90,000 |

| Total Liabilities | 103,500 | 116,700 | 119,500 |

| Equity | |||

| Owner Capital | 30,000 | 30,000 | 30,000 |

| Retained Earnings | (99,500) | (95,800) | (96,800) |

| Total Equity | (69,500) | (65,800) | (66,800) |

| Liabilities + Equity | 34,000 | 50,900 | 52,700 |

Don’t waste time figuring out Excel

Simplify financial forecasting & reporting w/ Upmetrics

Break-even analysis

The break-even analysis reflects the fixed-cost nature of a licensed residential group home, where staffing and facility costs remain largely unchanged at low occupancy levels. Because revenue is limited by licensed capacity, the analysis focuses on the number of residents needed to cover operating costs rather than growth-based profitability.

| Item | Amount |

|---|---|

| Monthly Fixed Costs | ~$5,600 |

| Variable Cost Ratio | ~72% |

| Contribution Margin | ~28% |

| Monthly Break-Even Revenue | ~$20,000 |

| Residents Needed | ~4.1 |

| Licensed Capacity | 5 residents |