Executive Summary

HarborSpirits Liquor & Fine Beverages, LLC will operate a retail liquor store at 1937 Harbor Avenue, Suite C, in St. Petersburg, Florida. The business will sell spirits, craft beer, wine, ready-to-drink cocktails, and party bundles to residents within a 2-3 mile radius. The location serves approximately 30,000 people in the:`

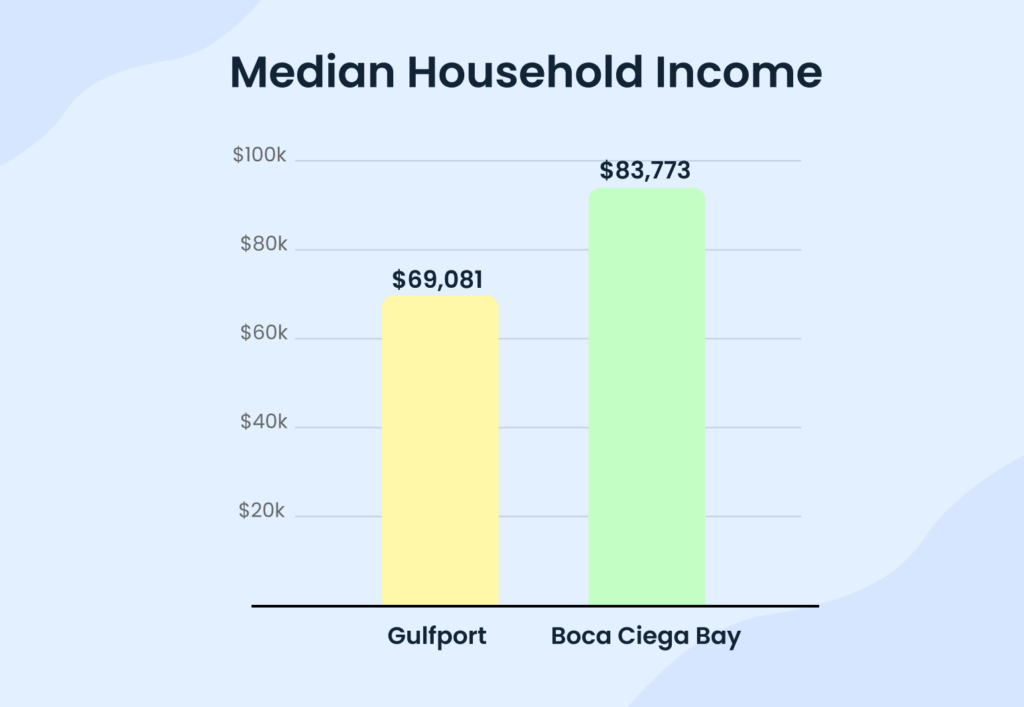

- Gulfport area (median household income: $69,080/year)

- And the Boca Ciega Bay area (median household income: $83,773/year).

Management

Derek Langford owns 100% of the company. He has 11 years of experience managing beverage purchasing and inventory control in restaurant operations. He has experience in vendor negotiations, order planning, and direct customer service in alcohol sales.

Products

We’ll offer a mix of familiar favorites and high-end options to suit all tastes. Our selection will include:

- Vodka

- Whiskey

- Bourbon

- Rum

- Tequila

- Craft beer

- Wine

This will cover both everyday and premium price ranges. We’ll also have ready-to-drink cocktails and curated party bundles, which will set us apart from the bigger, less personal stores. Wine will start at just $9, with premium tequila priced up to $60. We’ll feature chilled beer and ready-to-drink cocktails in refrigerated displays to make shopping and access easier.

Market Opportunity

The Gulfport and Boca Ciega Bay area supports year-round alcohol demand driven by residents, hospitality workers, and beach-area tourists. Weekend and holiday periods generate peak sales. Several independent liquor stores operate in the area, but focus on discount pricing over selection depth and convenience.

Operations & Licensing

The store will operate 7 days/week. 10 AM to 10 PM Monday through Thursday, 10 AM to 11 PM Friday and Saturday, and 12 PM to 7 PM Sunday. Derek will manage daily operations full-time. Two part-time cashiers and one part-time stocker will support peak hours and weekend traffic.

The Florida Division of Alcoholic Beverages and Tobacco licensing will be completed before lease execution. The license cost is included in startup expenses. Operations are contingent on final ABT approval.

Primary suppliers include Southern Glazer’s Wine & Spirits and Breakthru Beverage Florida. Both distributors offer net 15-day terms after initial credit establishment. Inventory will turn quickly on beer, mixers, and RTD products. Spirits generate the highest gross margin but turn more slowly.

Financial Highlights

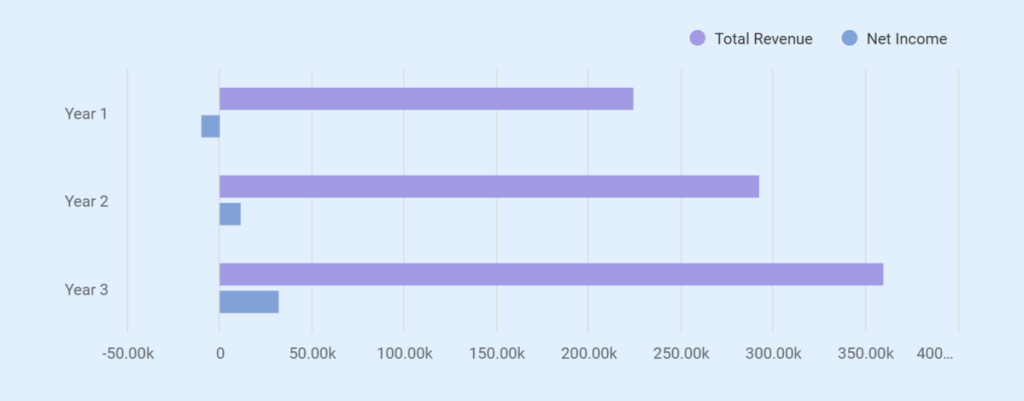

For the first year, revenue is projected at $225,000. Based on how the business is structured, the store reaches break-even at about $18,800 in monthly sales. That works out to roughly 750 transactions a month with an average ticket around $25. This level is achievable given a blended gross margin of about 35% and fixed monthly operating costs of roughly $6,500, with the owner actively involved in day-to-day operations.

Annual debt service totals approximately $10,800. During the first year of operation, the debt service coverage ratio is tight and approaches 1.0, consistent with a startup retail profile. To protect liquidity, owner compensation will be deferred or reduced as needed during the early months of operation. Cash flow is expected to remain constrained during the ramp-up phase and stabilize once consistent monthly sales exceed the break-even threshold.

Funding Request

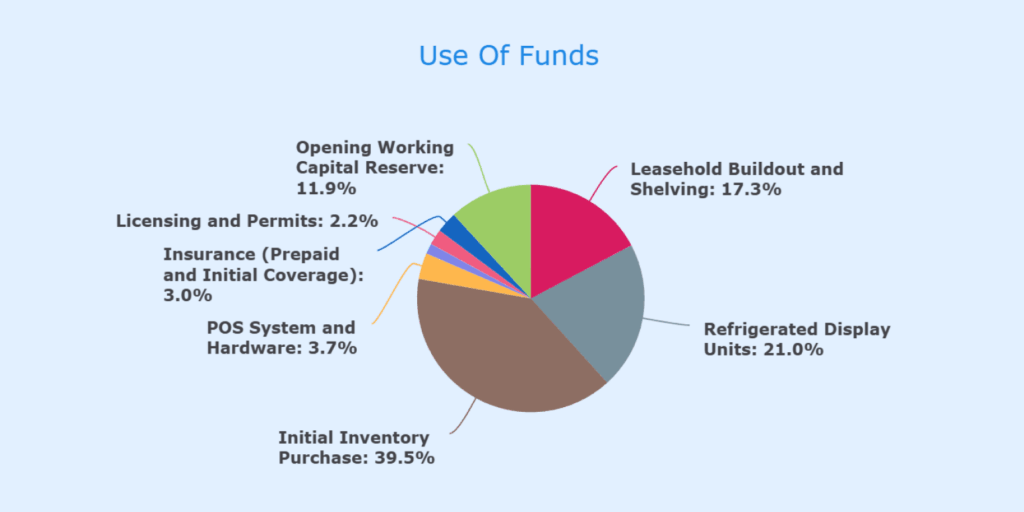

Total startup costs equal $81,000. This includes leasehold buildout, refrigeration units, initial inventory, POS hardware, security installation, Florida ABT licensing, insurance, and working capital. Funding combines a $48,000 SBA microloan from ACCION Opportunity Fund and $33,000 in owner equity.

The loan carries a 10.75% interest rate over 6 years with estimated monthly payments of $900. Collateral includes refrigeration units, shelving, POS hardware, and opening inventory. The loan will be repaid through operating cash flow supported by high-turnover inventory and controlled operating expenses. Secondary repayment capacity includes the liquidation value of refrigeration equipment and inventory.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you

Company Description

Legal Structure and Ownership

HarborSpirits Liquor & Fine Beverages, LLC is a Florida limited liability company that will be formed in March 2026. Derek Langford holds 100% ownership. The LLC structure provides liability protection while remaining a disregarded entity for federal tax purposes.

The business will file federal taxes as a single-member LLC. Florida state registration includes the Division of Corporations filing, sales tax permit, and employer identification number.

Location and Facilities

Our store will occupy 1,200 square feet at 1937 Harbor Avenue, Suite C, St. Petersburg, Florida 33707. This space will sit in a small retail strip near the intersection of Harbor Avenue and 19th Street South. Parking accommodates 12 vehicles directly in front of the unit.

The Gulfport and Boca Ciega Bay area includes single-family homes, small apartment buildings, and a mix of long-term residents and short-term vacation rentals. The neighborhood attracts tourists visiting St. Pete Beach and Pass-a-Grille. Hospitality workers from nearby hotels and restaurants live within two miles of the store.

Harbor Avenue carries consistent vehicle and foot traffic. The store benefits from visibility to southbound traffic heading toward the beach. Several restaurants, a fitness center, and a convenience store operate within 300 feet.

Monthly rent is $2,400 with annual increases capped at 3%. The lease runs 5 years with one 5-year renewal option. The landlord approved alcohol retail use before lease negotiation. Lease execution is contingent on Florida ABT license approval.

Owner Background

Derek Langford has 11 years of experience in restaurant beverage operations. He managed purchasing, inventory control, and vendor relationships at two full-service restaurants in Tampa and St. Petersburg. His responsibilities included weekly ordering, cost tracking, inventory reconciliation, and staff training on responsible alcohol service.

Derek negotiated pricing and payment terms with Southern Glazer’s, Breakthru Beverage, and local craft distributors. He understands product margins, seasonal demand shifts, and how to balance slow-moving premium inventory against fast-turning everyday products.

His background doesn’t include retail management. He hasn’t operated a POS system in a liquor store setting. These gaps will be addressed through system training and early reliance on distributor sales representatives for category guidance.

Florida ABT Licensing

Florida requires a Series 2-COP package store license issued by the Division of Alcoholic Beverages and Tobacco. This quota license permits off-premise sales of beer, wine, and spirits. The license will be obtained through transfer from an existing license holder in Pinellas County.

License transfer costs include a $1,200 state transfer fee, approximately $600 in local fees, and transfer processing costs included in the $1,800 licensing budget. The application process includes background checks, fingerprinting, zoning verification, and proof of lease. Processing typically takes 60 to 90 days after submission.

License approval is contingent on clean background checks and no conflicts with local zoning or distance restrictions from schools or churches. No such conflicts exist at the Harbor Avenue location.

Keys to Success

HarborSpirits will succeed by controlling four operational priorities.

- First, maintain inventory turnover at 5-6 times/year on average across all categories to avoid cash lockup. High-velocity items, like beer and mixers, will turn faster while premium spirits turn more slowly.

- Second, keep operating expenses under 22% of revenue through lean staffing and controlled rent.

- Third, build repeat customer traffic through consistent product availability and fast checkout.

- Fourth, limit theft and shrinkage through camera coverage and disciplined cash handling.

Products

| Category | Key Products | Price Range | Gross Margin | Turnover (Annual) |

|---|---|---|---|---|

| Spirits | Vodka, whiskey, bourbon, rum, tequila | $16 – $22 (value vodka) $28 – $38 (mid-tier whiskey) $45 – $60 (premium tequila) |

25 – 32% | 5 – 6x (value/mid-tier) 2 – 3x (premium) |

| Craft Beer | Six-packs, local and seasonal releases | $10 – $18 per six-pack | 22 – 28% | 10 – 12x |

| Wine | Every day, mid-range, limited premium | $9 – $18 (everyday) $20 – $35 (mid-range) $40+ (premium, limited) |

~30% (mid-range) | 4 – 5x (everyday) 2 – 3x (premium) |

| Ready-to-Drink Canned Cocktails (RTDs) | Canned cocktails, hard seltzers | $12 – $18 per four-pack | 28 – 32% | 8 – 10x |

| Mixers & Syrups | Tonic, syrups, bitters, lime juice | $4 – $9 | 35%+ | Low unit volume |

| Party Bundles | Margarita kits, old-fashioned kits | $42 – $48 per bundle | Blended by item | N/A (assembled at sale) |

Vendor Relationships and Terms

Southern Glazer’s Wine & Spirits serves as the primary distributor for major spirit brands. The company supplies Diageo, Beam Suntory, and Brown-Forman products. Payment terms begin with cash on delivery for new accounts. Net 15-day terms become available after three months of consistent payment history.

Breakthru Beverage Florida distributes Bacardi and regional craft spirits. Payment terms mirror Southern Glazer’s structure. Both distributors deliver twice weekly to Pinellas County accounts.

Local craft beer and spirits come through smaller distributors, including Florida Beer Company and independent brokers. These vendors require cash payment but offer higher margins on niche products that differentiate the store.

Inventory Management Strategy

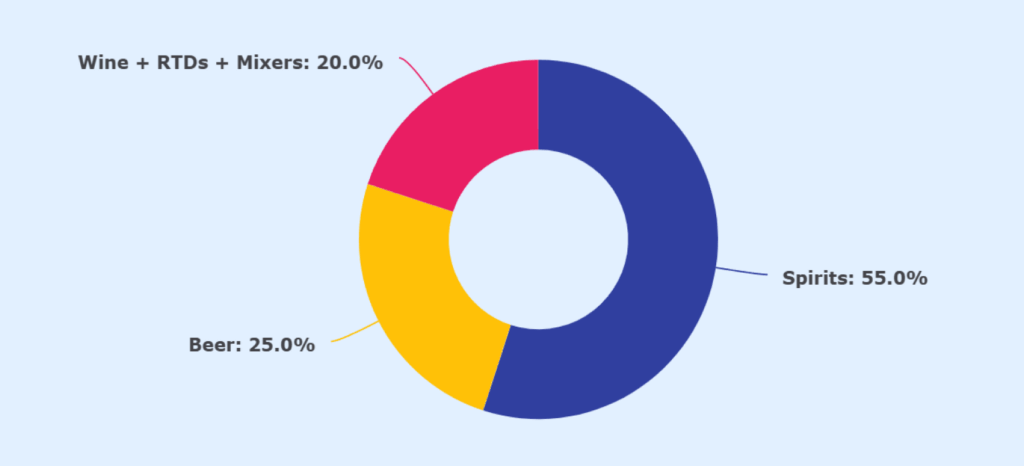

Initial inventory will total $32,000 at cost. Category allocation is based on projected sales mix and turnover rates. Spirits receive 55% of inventory dollars. Beer takes 25%. Wine, RTDs, and mixers split the remaining 20%.

Within the spirits allocation, premium bottles above $50 won’t exceed 15% of the total spirits inventory. This cap prevents excessive cash lockup in slow-moving high-end products. The majority of spirits dollars will stock everyday and mid-tier brands that turn 5-6 times annually.

Reorders occur weekly for beer and RTDs. Spirits restock every 2 weeks based on sales velocity. Slow-moving premium bottles won’t be automatically replaced. Each reorder requires manual review to prevent cash from sitting in inventory that does not move.

The target is 6-7 inventory turns/year across all categories. Beer and RTDs driving higher velocity will offset slower spirits and wine turnover. This blended rate balances cash efficiency with adequate selection depth.

Inventory shrinkage is controlled through locked cases for bottles above $50, camera coverage of all aisles, and daily register reconciliation. Expected shrinkage is budgeted at 2% of revenue.

Point of Sale and Technology

Clover Retail Pro will manage transactions, inventory tracking, and sales reporting. The system generates automatic reorder alerts when stock falls below preset thresholds. Daily sales data feeds directly to the bookkeeper for weekly cash flow review.

True GDM-series glass door coolers provide refrigerated display space for beer and RTDs. These units maintain consistent temperature and improve product visibility compared to reach-in coolers.

Market Analysis

Local Demographics and Trade Area

HarborSpirits serves a 2-3 mile radius centered on the Gulfport and Boca Ciega Bay area of St. Petersburg. This trade area includes approximately 30,000 residents across several distinct neighborhoods. The immediate area around Harbor Avenue consists of single-family homes built primarily between 1950 and 1980, smaller apartment complexes, and a growing number of short-term vacation rentals.

Median household income in the trade area is approximately $70,000. The population skews slightly older than Pinellas County overall, with concentrations in the 35-55 and 60+ age groups. Year-round residents include retirees, service industry workers, and professionals commuting to downtown St. Petersburg or Tampa.

Tourism activity intensifies during the winter months and summer weekends. St. Pete Beach, Pass-a-Grille, and Treasure Island attract visitors who rent homes and condos within the trade area. These guests generate incremental alcohol demand beyond the resident base.

The immediate neighborhood includes multiple full-service restaurants, fitness centers, and specialty retail businesses that have operated profitably for several years. This operational stability suggests consistent local spending capacity. Alcohol consumption is culturally normalized and year-round, not limited to seasonal peaks.

Target Customer Segments

Four customer groups will generate the majority of revenue. They are ranked here by contribution to operating cash flow, not by transaction count.

| Customer Segment | Typical Age/Profile | Purchase Behavior | Average Ticket | Visit Frequency |

|---|---|---|---|---|

| Local Residents | Ages 30–65, nearby households | Buy 1–3 bottles per visit, every day spirits and wine | $15–$30/visit | Weekly or biweekly |

| Hospitality Workers | Bartenders, servers, hotel staff | Spirits, mixers, and beer for personal use or small gatherings | Moderate | High frequency, especially on weekdays |

| Vacation Rental Guests | Short-term visitors and tourists | Stock rentals for the duration of stay | Larger baskets | One-time per stay |

| Event Hosts & Party Planners | Individuals hosting social events | Multiple bottles, mixers, party bundles | High per transaction | Occasional |

| Corporate Gift Buyers & Collectors | Businesses, premium buyers | High-touch, premium, or rare items | High but inconsistent | Low |

Industry Context and Alcohol Retail Trends

Alcohol retail in the U.S. is still a mix of different store types. Grocery stores, big-box retailers, independent liquor stores, and convenience stores all play a role, but they don’t compete on equal terms.

In Florida, grocery stores can sell beer and wine, but spirits are limited to licensed package stores. That rule matters. It keeps independent liquor stores from being completely squeezed out by large grocery chains.

What customers buy has been changing, though not overnight.

- Ready-to-drink cocktails have picked up a lot of interest in recent years, especially for casual and beach-oriented occasions.

- Craft beer hasn’t disappeared, even with softer demand in the broader beer category.

- Premium spirits priced above $40 a bottle continue to sell as well, but they remain a smaller slice of overall volume rather than the main driver.

For neighborhood liquor stores, price competition isn’t the battle to win. Customers who care most about saving a few dollars will drive across town to a big-box store and always will. The customers that matter are the ones who value speed, convenience, and proximity. Being close to home and easy to stop into is what keeps those customers coming back, and that’s the segment HarborSpirits is built to serve.

Competitive Landscape

Three direct competitors operate within the trade area.

Large-format chain stores operate approximately 2 miles north on major commercial corridors. These locations offer an extensive selection across all categories and competitive pricing on popular brands. Customers seeking the lowest price or the widest variety will shop there. HarborSpirits won’t attempt to match their breadth or pricing.

- Gulfport Package Store sits approximately 1.2 miles southeast on Gulfport Boulevard. This independent store has operated for over 20 years and focuses on discount pricing for value-tier spirits and beer. The store does not emphasize craft beer, RTDs, or premium products. Its customer base skews toward price-conscious buyers.

- Beach-area liquor stores operate 2-3 miles south near Treasure Island. These stores cater primarily to tourist traffic with higher prices and beach-convenient packaging. Selection emphasizes RTDs, wine, and mixers for vacation rentals.

- HarborSpirits won’t compete directly with any of these stores. Large chains own the broad selection and low price position. Gulfport Package owns the deep discount segment. Beach stores own the tourist convenience premium.

The gap HarborSpirits fills is the proximity and speed for Harbor Avenue residents. Customers who live within 1 mile of the store will choose convenience over driving 2 miles for a $2 savings on vodka. Customers who value curated party bundles and local craft selection will choose HarborSpirits over Gulfport Package’s discount focus.

Competitive Response and Pricing Discipline

Price matching isn’t required to survive. The business model assumes customers will pay a 5-10% premium over big-box pricing in exchange for location convenience and faster checkout. This is a deliberate tradeoff.

If a competitor opens closer to Harbor Avenue or if large chains expand promotional activity, HarborSpirits will not respond with across-the-board price cuts. Margin erosion would undermine cash flow faster than modest volume loss. Instead, competitive pressure would trigger adjustments to product mix, party bundle emphasis, or operating hours.

Some customer loss due to price competition is accepted as unavoidable. The store is not built to serve every liquor buyer in the trade area. It serves the subset that prioritizes convenience and is willing to pay for it.

Stop Googling competitors for hours

Marketing & Sales Strategy

Customer Acquisition Approach

HarborSpirits will acquire customers through proximity, visibility, and word-of-mouth referrals. The store relies on foot and vehicle traffic passing Harbor Avenue daily. Marketing will support awareness, but won’t drive the business. Location convenience drives the business.

If initial walk-in traffic underperforms, the fallback is direct outreach to nearby apartment complexes and targeted social media posts highlighting specific products and convenience factors. The business can’t pivot to paid advertising or complex campaigns without undermining cash flow.

Marketing capacity is limited by the fact that Derek will be on the floor most days. Time allocated to social media or outreach comes at the expense of serving customers or managing inventory. This tradeoff is accepted. Marketing activities will be kept simple enough to execute consistently during busy periods.

The business grows through repeat customers, not through broad reach campaigns. Some marketing channels will be intentionally underused in year 1 because inconsistent execution would do more harm than good.

Digital Presence

A Google Business Profile will be claimed and optimized within the first 2 weeks of operation. This listing will include accurate hours, phone number, location photos, and product categories. Google Maps visibility matters more than a website for neighborhood retail.

The business will maintain basic profiles on Instagram and Facebook. Posting cadence will be set at two to three times/week during the first 90 days, then reduced to once weekly. Posts will feature new arrivals, weekend specials, and party bundle examples. No paid advertising will run on these platforms.

Online review management will be handled manually. Customers will be passively encouraged to leave Google reviews after positive interactions, but reviews won’t be solicited aggressively or tied to discounts. Response to negative reviews will occur within 48 hours.

No website will be built in year 1. The cost and maintenance time don’t justify the return for a single-location liquor store where customers make purchase decisions at the point of sale.

Local Partnerships and Referrals

Vacation rental property managers and apartment complex leasing offices within 1 mile will receive outreach during the first 60 days. Derek will introduce the business, provide business cards, and offer a one-time 10% discount for new residents or guests referred during the first 30 days. This discount is time-limited and applies only to initial referrals to avoid training customers to expect ongoing price breaks.

Flyers will be distributed to restaurants, bars, and fitness centers within walking distance. The flyers will include store hours, location, and a first-visit discount. Distribution will occur once, not repeatedly. Restaurants and bars are potential referral sources, not advertising partners.

No formal affiliate or commission structure will be created. Referral activity will remain informal and relationship-based.

In-Store Tactics

1) Weekly Product Feature

Weekly featured products will rotate across spirit categories to drive repeat visits. A chalkboard near the entrance will display the current week’s selections. These items will be photographed and posted to Instagram. Pricing remains standard with no loss-leader discounting.

2) Cocktail Recipes

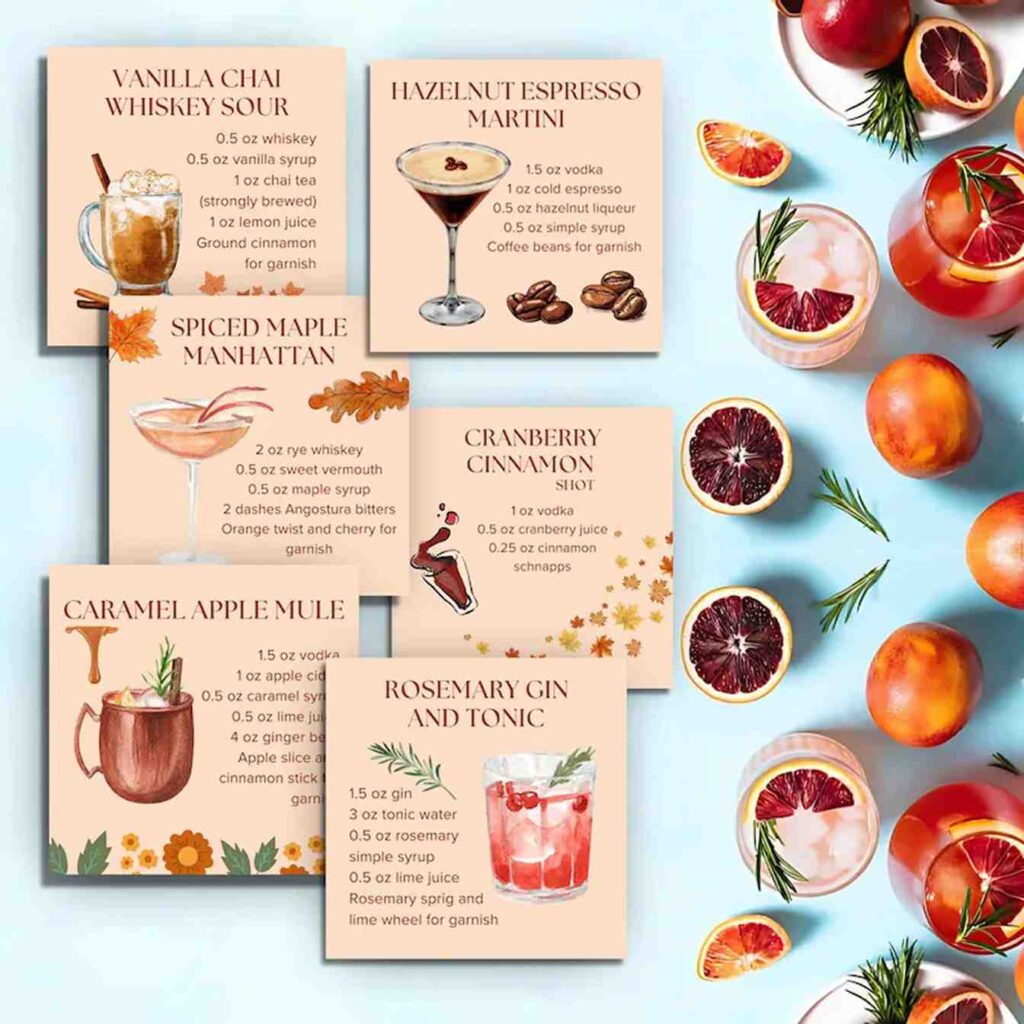

Cocktail recipe cards will be placed near mixers and spirits. Cards will list ingredients, proportions, and suggested brands. This encourages basket building and reduces decision fatigue for customers unfamiliar with cocktail preparation.

3) Loyalty Program

A loyalty program will launch during month 2. Customers receive a punch card offering a free mixer after ten purchases. The program is manual and requires no software or technology investment. Punch cards cost approximately $40 to print and will be kept at the register.

4) Party Bundles

Party bundles will be displayed near the front counter with suggested combinations listed on signage. Bundles are assembled at checkout with each item rung separately to maintain pricing transparency and comply with Florida alcohol sales regulations. Preset suggestions reduce decision time and increase average transaction size.

Launch Promotions

Three promotions will run during the first 30 days, but customers may use only one per transaction. First, customers receive 10% off purchases over $20. Second, bottle purchases over $25 include a free mixer. Third-party bundles receive a 15% discount when three or more items are purchased together.

Promotions are non-stackable to protect margins during the cash-sensitive ramp-up period. Even with discounts, blended gross margin will remain above 26% during the promotional window.

These promotions will be advertised through Google Business Profile posts, in-store signage, and Instagram. No paid media will support the launch.

Marketing Budget

Marketing spend will total $1,200/month for the first 90 days. This budget covers exterior signage installation ($1,800), printing for business cards and flyers ($450), Instagram photography equipment ($300), in-store promotional materials ($600), and promotional mixer giveaways ($450). After 90 days, the monthly marketing spend will drop to $400-$500 for ongoing materials and social media tools.

The budget assumes no paid advertising, no website development, and no contracted marketing services. All execution is handled by Derek or part-time staff during slow periods.

Operations & Compliance

Operating Hours and Workflow

HarborSpirits will operate 7 days/week. Monday through Thursday hours run from 10 AM to 10 PM. Friday and Saturday extend to 11 PM. Sunday hours are 12 PM to 7 PM. These hours capture weekday convenience shopping, weekend entertainment purchases, and post-church Sunday traffic.

Derek will open the store each morning and manage the first shift. Part-time cashiers will cover evening hours and weekend peaks. One part-time stocker will handle deliveries and restocking during slower afternoon periods.

Morning workflow begins with register setup, cash drawer verification, and a walk-through to check for overnight issues. Cooler temperatures are logged daily. Shelves are faced and restocked before opening. Deliveries arrive between 10 AM and 2 PM on Tuesdays and Fridays.

Evening workflow includes sales reconciliation, deposit preparation, and closing checklists. Cash is removed nightly and deposited the following morning. No cash remains on-site overnight beyond a minimal register float.

Florida ABT Licensing Process

The Florida Division of Alcoholic Beverages and Tobacco issues Series 2-COP quota licenses for package stores selling spirits. The license will be transferred from an existing quota holder in Pinellas County. Transfer applications require submission of ownership documents, fingerprints, background checks, lease verification, and zoning approval.

Processing takes 60 to 90 days from application submission. The application will be submitted in April 2026 with an expected approval date in June or July 2026. Lease execution occurred in May 2026 with a contingency clause allowing termination if the license transfer is denied.

License denial risk is low. Derek has no criminal history, no prior license violations, and no disqualifying factors. The location meets all distance requirements from schools, churches, and other restricted zones.

If the license transfer is delayed beyond 90 days, buildout work will pause to avoid carrying rent without revenue. No inventory will be purchased until final ABT approval is received.

A business plan shouldn’t take weeks

Inventory Receiving and Storage

Supplier deliveries arrive twice weekly. Southern Glazer’s delivers on Tuesdays. Breakthru Beverage delivers on Fridays. Deliveries are received during the late morning when foot traffic is slower.

All deliveries are checked against invoices at the receiving door. Quantities, product codes, and damage are verified before signing. Discrepancies are photographed and reported to the distributor immediately.

Spirits are stored on wall shelving, organized by category and price point. Beer and RTDs are stocked directly into refrigerated coolers. Wine is shelved separately with everyday bottles at eye level and premium bottles on higher shelves. Inventory over $50/bottle is placed in locked display cases near the register.

Backstock is minimized. The storage area holds one week of backup inventory for fast-moving beer and RTDs. Spirits backstock is limited to promotional items purchased in bulk. Excessive backstock ties up cash and creates theft risk.

Age Verification and Compliance

Every customer purchasing alcohol will be carded regardless of apparent age. This policy is non-negotiable. Acceptable identification includes a Florida driver’s license, state ID, passport, or military ID. Expired IDs aren’t accepted.

The Clover POS system prompts cashiers to verify age at every alcohol transaction. The prompt cannot be bypassed without entering a birthdate. Cashiers receive written training on ID verification during onboarding and sign acknowledgment forms.

Derek will conduct random ID compliance checks by observing transactions during peak hours. Any violation results in immediate retraining. Repeated violations result in termination.

Third-party delivery services won’t be used in year 1. All sales occur in-store with direct ID verification.

Security and Theft Prevention

A 6-camera security system covers the sales floor, register area, entrance, and rear door. Cameras record continuously to a cloud-based system accessible remotely. Footage is retained for 30 days.

Bottles priced above $50 are stored in locked display cases. Customers request these items at the register. High-theft items like premium vodka and small bottles are placed behind the counter or in visible high-traffic areas.

Cash handling procedures require two-person counts for deposits over $500. Register tills are balanced at every shift change. Discrepancies over $10 trigger a written incident report.

No alcohol leaves the store without payment. Customers may not carry products to their vehicle and return to pay. This eliminates walkout theft opportunities.

Security presence during peak hours is managed by scheduling two staff members on Friday and Saturday evenings. Visible staffing reduces theft attempts more effectively than cameras alone.

Technology and Systems

Clover Retail Pro manages all transactions, inventory tracking, and sales reporting. The system integrates with QuickBooks for automated accounting. Sales data is exported daily to the contract bookkeeper for cash flow monitoring.

True GDM-series refrigerated coolers maintain temperatures between 35 and 38 degrees. Temperature logs are recorded each morning manually. Equipment failure triggers immediate service calls to avoid inventory loss.

Internet connectivity runs through a dedicated business line with backup cellular failover. POS downtime is unacceptable during operating hours. A manual backup system allows cash transactions if the POS fails, with entries reconciled once the system is restored.

Does your plan sound generic?

Refine your plan to adapt to investor/lender interests

Management & Staffing

Owner Background and Role

Derek Langford brings 11 years of beverage purchasing and inventory management experience from full-service restaurant operations. He managed weekly ordering, vendor negotiations, cost tracking, and staff training at 2 restaurants in the Tampa Bay area. His responsibilities included maintaining PAR (Periodic Automatic Replacement) levels, reconciling inventory, and controlling pour costs across beer, wine, and spirits programs.

Derek built direct relationships with Southern Glazer’s and Breakthru Beverage representatives. He understands distributor pricing structures, payment term negotiations, and product placement dynamics. Restaurant-side promotional programs differ from retail allowances, but the core vendor relationship skills transfer directly.

His background doesn’t include independent business ownership or retail management. He hasn’t managed a standalone P&L or handled commercial lease obligations. These gaps represent real learning curves during the first year.

Derek will work full-time in the store. He will open 6 days/week, manage vendor relationships, handle purchasing decisions, train staff, and oversee daily cash reconciliation. His presence on the floor is not optional in year 1. The business can’t afford management salaries or outsourced supervision.

Staffing Plan

Two part-time cashiers will cover evening and weekend shifts. Each cashier will work 20-24 hours/week at $14/hour. Responsibilities include customer checkout, ID verification, restocking displays, and closing procedures. Cashiers must pass background checks and complete responsible vendor training.

One part-time stocker will handle deliveries and backstock management. This role works 15-20 hours/week at $13/hour during midday periods when foot traffic is lighter. The stocker receives deliveries, verifies invoices, organizes storage areas, and rotates inventory.

Total labor cost for part-time staff runs approximately $3,900-$4,200/month, including payroll taxes. This assumes consistent scheduling without seasonal reductions.

A contract bookkeeper will handle monthly financials, sales tax filing, and QuickBooks reconciliation. Monthly bookkeeping costs run $250-$300. The bookkeeper provides weekly cash flow reports during the first 6 months.

Compensation Structure and Owner Downside Protection

Derek will draw $2,500/month during the first year. This represents approximately 50% of a market-rate salary for an owner-operator. The reduced draw protects cash flow and prioritizes debt service over owner income.

If monthly revenue falls below $18,000 for two consecutive months, Derek’s draw will be reduced to $1,500 or deferred entirely. This threshold is below the $18,800 break-even point and signals a cash strain that requires an immediate response. Owner compensation adjusts before any other expense reductions. Loan payments, rent, and supplier obligations take priority over owner income.

Derek will absorb the increased workload during low-revenue periods. If part-time staff hours must be cut, Derek will cover additional shifts rather than hiring replacement labor. This workload substitution is the primary owner downside protection mechanism.

Year 2 compensation will increase only if the business generates sufficient cash flow to support both debt service and higher owner draws. Compensation increases are earned, not automatic.

Financial Plan

Here’s an overview of HarborSpirits Liquor & Fine Beverages, LLC’s financial projections for the next three years. We’ve included detailed revenue forecasts, cost breakdowns, cash flow projections, and funding requirements necessary to achieve the company’s growth targets. It outlines the expected revenue streams, cost of sales, operating expenses, and debt service obligations. These financials are based on conservative, well-supported assumptions reflecting the store’s inventory strategy, local market conditions, and operational efficiency.

Startup Costs

| Startup Cost Category | Amount ($) |

|---|---|

| Leasehold Buildout and Shelving | 14,000 |

| Refrigerated Display Units | 17,000 |

| Initial Inventory (Opening Stock) | 32,000 |

| POS System and Hardware | 3,000 |

| Security System Installation | 1,200 |

| Licensing and Permits | 1,800 |

| Insurance (Initial Coverage) | 2,400 |

| Opening Working Capital | 9,600 |

| Total Startup Costs | 81,000 |

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features

Use of Funds

HarborSpirits Liquor & Fine Beverages, LLC will be financed through a combination of debt and owner equity contributions. The total startup costs amount to $81,000, with funding provided by the following sources:

- SBA Microloan: $48,000

The business will secure an SBA microloan through the ACCION Opportunity Fund. This loan carries an interest rate of 10.75% over a six-year term. The loan is backed by collateral, including refrigeration units, shelving, POS hardware, and initial inventory.

- Owner Equity Injection: $33,000

The owner, Derek Langford, will contribute $33,000 in personal equity to fund the remaining portion of the startup costs. This investment ensures strong owner commitment to the business and aligns financial interests between the lender and the business owner.

These combined funding sources will cover all initial expenses, including leasehold buildout, equipment purchases, initial inventory, licensing, and working capital. The loan will be repaid through operating cash flow, with a focus on inventory turnover and maintaining disciplined operating expenses.

Projected Profit and Loss Statement — Years 1 to 3

| Revenue Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Spirits sales | $110,000 | $145,000 | $180,000 |

| Wine sales | $55,000 | $70,000 | $85,000 |

| Beer & RTD sales | $45,000 | $60,000 | $75,000 |

| Mixers & accessories | $15,000 | $17,500 | $20,000 |

| Total Revenue | $225,000 | $292,500 | $360,000 |

| Cost of Goods Sold | |||

| Spirits product cost | $66,000 | $87,000 | $108,000 |

| Wine product cost | $38,500 | $49,000 | $59,500 |

| Beer & RTD product cost | $33,750 | $45,000 | $56,250 |

| Mixers & accessories cost | $8,000 | $9,125 | $10,250 |

| Total COGS | $146,250 | $190,125 | $234,000 |

| Gross Profit | |||

| Gross Profit | $78,750 | $102,375 | $126,000 |

| Gross Margin | 35% | 35% | 35% |

| Operating Expenses | |||

| Part-time cashiers | $28,000 | $30,000 | $32,000 |

| Stocker/receiver | $10,500 | $11,000 | $11,500 |

| Contract bookkeeping | $3,000 | $3,200 | $3,400 |

| Weekend security | $4,500 | – | – |

| Rent & CAM | $12,000 | $12,600 | $13,200 |

| Utilities | $4,200 | $4,500 | $4,800 |

| Insurance | $2,400 | $2,500 | $2,600 |

| POS fees & software | $2,700 | $2,900 | $3,100 |

| Marketing & promotions | $4,000 | $4,800 | $5,400 |

| Office & misc | $6,700 | $7,500 | $8,000 |

| Total Operating Expenses | $79,000 | $82,000 | $86,000 |

| Earnings | |||

| EBITDA | -$250 | $20,375 | $40,000 |

| Depreciation | $4,500 | $4,500 | $4,500 |

| Interest expense | $4,900 | $4,200 | $3,400 |

| Net Income | -$9,650 | $11,675 | $32,100 |

Projected Cash Flow Statement — Years 1 to 3

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Cash Flow From Operations | |||

| Net income | -$9,650 | $11,675 | $32,100 |

| Depreciation | $4,500 | $4,500 | $4,500 |

| Inventory increase | -$4,000 | -$3,000 | -$3,000 |

| Accounts payable change | $5,000 | $1,000 | $1,000 |

| Net Cash From Operations | -$4,150 | $14,175 | $34,600 |

| Cash Flow From Investing | |||

| Equipment & buildout | -$36,000 | – | – |

| Net Investing Cash Flow | -$36,000 | – | – |

| Cash Flow From Financing | |||

| SBA microloan | $48,000 | – | – |

| Owner equity | $33,000 | – | – |

| Loan principal repayment | -$4,700 | -$5,400 | -$6,200 |

| Net Financing Cash Flow | $76,300 | -$5,400 | -$6,200 |

| Cash Position | |||

| Net Change in Cash | $36,150 | $8,775 | $28,400 |

| Beginning cash | $0 | $36,150 | $44,925 |

| Ending Cash Balance | $36,150 | $44,925 | $73,325 |

Projected Balance Sheet — Years 1 to 3

| Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

| Assets | |||

| Cash | $36,150 | $44,925 | $73,325 |

| Inventory | $36,000 | $39,000 | $42,000 |

| Gross fixed assets | $36,000 | $36,000 | $36,000 |

| Accumulated depreciation | -$4,500 | -$9,000 | -$13,500 |

| Net fixed assets | $31,500 | $27,000 | $22,500 |

| Total Assets | $103,650 | $110,925 | $137,825 |

| Liabilities | |||

| Accounts payable | $5,000 | $6,000 | $7,000 |

| SBA microloan | 43,300 | 37,900 | 31,700 |

| Total Liabilities | $48,300 | $43,900 | $38,700 |

| Owner’s Equity | |||

| Owner capital | $33,000 | $33,000 | $33,000 |

| Retained earnings | -$9,650 | $2,025 | $34,125 |

| Total Equity | $23,350 | $35,025 | $67,125 |

| Liabilities + Equity | $103,650 | $110,925 | $137,825 |

Don’t waste time using spreadsheets

Break-Even Analysis and Cash Discipline

Monthly break-even revenue is estimated at approximately $19,100. This calculation is based on fixed monthly operating costs of roughly $6,700 and a blended gross margin of 35%. This threshold is achievable within the first year of operation once weekly transaction volume stabilizes.

The break-even analysis reinforces the business’s operating philosophy. Survival doesn’t depend on peak-season performance or promotional spikes. Instead, consistent weekday traffic, disciplined inventory management, and controlled labor scheduling are sufficient to sustain operations.

Cash discipline remains a priority throughout the projection period. Inventory growth is capped, expenses scale slowly, and debt service is fully planned from operating cash flow. This approach limits downside risk and supports reliable loan repayment.

| Item | Amount |

|---|---|

| Average order value | ~$25 |

| Annual operating expenses | $79,000 |

| Gross margin | ~35% |

| Monthly fixed costs | ~$6,580 |

| Break-even revenue | ~$18,800/month |

| Break-even transactions | ~750 orders/month |

| Daily average | ~25 orders/day |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.