I consult with business owners on writing clear and effective business plans. And if there’s one place where most of them stumble, it’s when I ask them to differentiate between industry analysis and market analysis.

Some think these terms are interchangeable. Some think they overlap. Others think one is a subset of the other.

There are too many opinions on this topic, but none that bring clarity.

That changes now. In this blog post, I am explaining industry analysis vs market analysis through practical examples so you don’t fumble when you write yours.

Industry vs. market analysis: similarities and differences

There’s a reason why founders confuse industry analysis with market analysis.

Both these approaches focus on understanding your business environment and validating your business opportunity through data and research. Each involves studying trends, competitors, and opportunities.

But that’s the only similarity between the two.

The key difference is scope. Industry analysis looks at the big picture—the size, trends, and growth of your entire sector. On the other hand, market analysis is more specific. It focuses on your customers, location, and main competitors.

For instance, if you’re opening a boutique yoga studio in Austin, an industry analysis would examine the overall U.S. fitness sector. However, your market analysis would focus on Austin’s yoga community and local competition.

More about it as we dig through industry analysis and market analysis in detail.

What is an industry analysis?

Industry analysis examines the current and future state of the industry where your business operates. It’s like gaining a macro perspective of all the forces that shape your business environment.

Here you try finding answers to questions like:

- How big is the industry?

- What are the internal and external forces influencing this industry?

- Who are the major players controlling market share?

- What are the barriers to entry?

- What are the trends affecting everyone in this space?

When you find these answers, you will know whether the industry conditions support your business idea. And if there’s actually a strategic opportunity for your business.

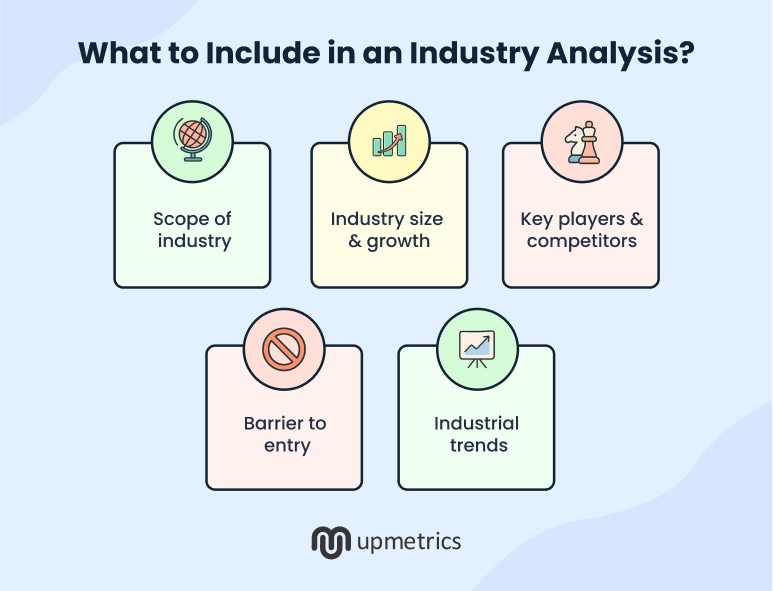

What to include in an industry analysis?

Let’s say you’re writing an industry analysis section for a boutique yoga studio in Austin. Your industry analysis in this case should include:

Industry definition

Always start with the scope. That is:

- What products or services directly or indirectly influence your market? Gyms, fitness clubs, home workout equipment, digital fitness apps, wellness centers?

- What geographical areas constitute your market? Local, national, or international?

Getting this scope right keeps your analysis focused and relevant. Besides, when you start your industry analysis in a business plan with a clear scope, you give readers immediate context about which market forces will actually impact your business.

Growth and size

Is your industry growing or shrinking? Or has it matured? You’ll want to show the industry size in your business plan along with data on where it stood historically and how it’s predicted to grow.

Gather data from reputed publications like IBISWorld, Statista, and McKinsey, but make sure the data you collect focuses on the right market.

For instance,

- There are over 93,874 fitness institutes in the US as of 2025

- The fitness industry revenue is expanding at a CAGR of 7.1% and is estimated to reach the mid-$50 billion range by 2030

- Boutique fitness studios, which provide specialized classes (i.e., cycling, yoga, HIIT) in smaller venues, now command nearly half of U.S. gym memberships and revenue, appealing to consumers seeking community and experience

Boutique studios capturing nearly half the market directly support your yoga studio concept. This kind of data shows whether you’re entering at the right time or fighting against declining momentum.

Industry definition

Always start with the scope. That is:

- What products or services directly or indirectly influence your market? Gyms, fitness clubs, home workout equipment, digital fitness apps, wellness centers?

- What geographical areas constitute your market? Local, national, or international?

Getting this scope right keeps your analysis focused and relevant. Besides, when you start your industry analysis in a business plan with a clear scope, you give readers immediate context about which market forces will actually impact your business.

Growth and size

Is your industry growing or shrinking? Or has it matured? You’ll want to show the industry size in your business plan along with data on where it stood historically and how it’s predicted to grow.

Gather data from reputed publications like IBISWorld, Statista, and McKinsey, but make sure the data you collect focuses on the right market.

For instance,

- There are over 93,874 fitness institutes in the US as of 2025

- The fitness industry revenue is expanding at a CAGR of 7.1% and is estimated to reach the mid-$50 billion range by 2030

- Boutique fitness studios, which provide specialized classes (i.e., cycling, yoga, HIIT) in smaller venues, now command nearly half of U.S. gym memberships and revenue, appealing to consumers seeking community and experience

Boutique studios capturing nearly half the market directly support your yoga studio concept. This kind of data shows whether you’re entering at the right time or fighting against declining momentum.

Key players and competitors

Who are the key players in your industry?

Is there a single player dominating the market, or is it fragmented across multiple competitors?

In the fitness industry, even the largest chain by revenue (24 Hour Fitness) captures only about 5% of the total industry revenue. The market is fragmented, which means there’s room for independent gyms and studios to operate profitably.

That’s exactly what an investor wants to see—proof that new entrants can carve out profitable positions.

How do you analyze the competitive intensity and bargaining power?

Use Porter’s five forces model.

Barrier to entry

Think about the factors that make it difficult for businesses to enter your industry:

- Is your industry heavily regulated?

- Are the startup costs too high?

- Are health and safety regulations too stringent?

- Is certification necessary and too costly?

- Do dominant players control proprietary technology?

- Is brand loyalty strong enough to keep customers from switching?

This analysis creates awareness about the moats created by existing businesses and decides your positioning strategy. It also helps you budget for initial capital requirements and ongoing compliance costs.

Trends

What are the emerging trends and patterns influencing businesses in your industry?

Are you seeing shifts in consumer preferences or the emergence of new technology? Are economic factors changing spending patterns, or is a particular market segment growing rapidly?

Understanding these trends allows you to position your business ahead of shifts.

What is a market analysis?

Market analysis zooms in on your specific customer base and the subset of the industry where you’ll actually compete.

Here you’re finding answers to questions like:

- Who exactly will buy from me?

- How big is my addressable market?

- What do these customers actually want and need?

- Who am I directly competing against for these customers?

- What will make them choose me over alternatives?

- How much are they willing to pay?

These answers are just as important for you as they are for investors evaluating your opportunity. Your market analysis section of your business plan proves whether real customers exist for your product and if demand is strong enough to justify investment.

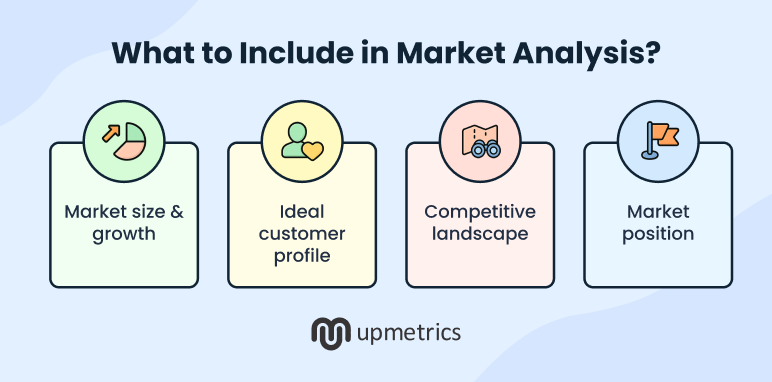

What to include in market analysis?

Continuing our boutique yoga studio example in Austin, here’s what your market analysis should include:

Market size and growth

How many potential customers exist in your target area? What’s their spending capacity? And is this segment growing or stable?

For the boutique yoga studio in Austin, you’d narrow down from the broad fitness industry to answer:

- How many people in Austin actively practice yoga or show interest in starting?

- What’s the local spending on yoga classes and memberships?

- How has this specific market grown over the past few years?

- What’s the projected growth for yoga practitioners in Austin?

Run surveys, analyze the historical data (if available), and conduct interviews to find answers to these questions.

Here, investors would like to see market sizing assumptions about TAM, SAM, and SOM.

Explain your assumptions and show how you can realistically capture a larger slice of SAM over the years.

Ideal customer profile

What are the traits of customers who would buy from you? Do they share similar demographics or pain points? Is there an unmet need or buying pattern that groups them?

You may be targeting multiple customer groups. And while each segment might not be equally prominent, you still want to build buyer personas for each.

For your boutique yoga studio, try finding answers to:

- What is the age, gender, income, and occupation of your ideal customer?

- What are their concerns with current fitness centers and boutique studios?

- How much are they willing to spend each month/ session?

- What gyms or fitness centers are they currently using?

Competitive landscape

Identify the direct and indirect competitors vying for your share of the SAM. This could be direct competitors offering the same services or indirect competitors competing for the same customer spending.

For the competitive analysis, you’d want to map out each competitor’s positioning and spot gaps and opportunities in their offerings. You can also use SWOT analysis to build your own competitive edge.

For your boutique yoga studio, you’d want to look at:

- Yoga studios operating within a 3-5 mile radius

- Fitness centers in the nearby locality

- Online yoga platforms and apps are capturing at-home practitioners

Maybe this analysis could uncover a gap that you could leverage with your offerings.

Market position

How do you plan to position your business? Before you say “as a luxury studio” or “affordable option,” answer these questions as they’ll determine your positioning:

- Is customer loyalty with existing brands strong, or are they choosing competitors because they have no other alternative?

- How severe is the pain point you’re solving?

- Would customers switch brands for a better experience or cheaper pricing?

- What trade-offs are they currently making that frustrate them?

- Where do existing options disappoint them most?

Maybe your analysis may show that the potential customer is already spending $150 a month on yoga classes. They would spend up to $250 for personalized attention and a certified yoga instructor.

These insights will help you customize and curate your market offerings.

Which comes first: industry or market analysis?

In a typical business planning process, market analysis follows industry analysis.

And it makes sense.

Industry analysis overarches market analysis with its broad, zoomed-out perspective. It tells you whether the industry you’re chasing is worth pursuing and if there are regulatory guidelines that will make entry difficult. It stops you from chasing a collapsing sector.

Market analysis is a smaller piece within the umbrella of industry analysis. It narrows down and directs your attention to a specific part of the industry where you will operate. It tells you whether your market will attract paying customers and turn your business profitable.

It’s impractical to analyze your market without understanding the industry first. But you also can’t skip market analysis just because you’ve studied the industry.

In fact, you need industry analysis to confirm the strategic opportunity for your business and market analysis to prove its commercial feasibility.

How do investors/lenders use each in evaluating a plan?

When an investor or lender reads your market opportunity section, they are looking for definite cues that prove your business to be a lucrative investment.

Here’s how they tend to analyze each of these sections:

| What investors evaluate | Through industry analysis | Through market analysis |

|---|---|---|

| Opportunity size | Whether the total industry revenue justifies their investment size and return expectations | Whether your addressable market can generate enough revenue to meet growth projections |

| Timing and momentum | If the industry is in a growth phase or mature/declining based on multi-year trend data | If customer demand in your specific segment is increasing based on local surveys and competitor performance |

| Competitive dynamics | Whether the market is fragmented enough for new players or dominated by a few large corporations | Whether you can realistically win customers from existing alternatives, given your positioning and pricing |

| External threats | If pending regulations, economic factors, or technology shifts could damage all businesses in this sector | If your specific customer segment is price-sensitive, loyal to current options, or too small to sustain your business |

How should you source data for your industry and market research?

The basis of insightful analysis is the quality of data that backs it up. And while you can’t hire expensive consultants or a research team to gather solid data, you can leverage multiple accessible sources to build a convincing case for your business.

Here are a few ways to source reliable data:

- Industry reports and databases: Purchase reports from reputed sites like IBISWorld and Gartner to gather data about growth projections, market size, and competitive landscape

- Government data and statistics: The U.S. Census Bureau and Bureau of Labor Statistics publish free data about the economic census and employment statistics that can be cited in your business plan

- Upmetrics’ industry & market research reports: Upmetrics provides on-demand industry and market research reports built using credible data from Bizminer and DeepResearch—ready to plug into your business plan

- Primary research: Run surveys, customer interviews, and focus groups to validate local demand with firsthand data

- AI research tools: Tools like Perplexity and DeepResearch speed up initial research by aggregating information from multiple sources, helping you find relevant studies and statistics without hours of manual searching

- Social listening and online communities: Reddit, Quora, Facebook groups, and industry forums reveal unfiltered conversations about customer frustrations, exposing gaps that formal research might miss

The bottom line

While industry analysis keeps you from chasing opportunities in sectors that can’t support growth, market analysis keeps you from building products nobody wants to buy. Both protect you from expensive mistakes before you’ve committed resources.

Your business plan needs both perspectives. Together, they form the foundation that will hold up your business plan under investor scrutiny.

That said, if you need help building a complete business plan with solid industry and market analysis, Upmetrics can help.

With over 400 business plan templates, AI business planning assistance, a fully automated financial forecast builder, and on-demand market research, Upmetrics offers comprehensive support to prepare lender-worthy business plans.