As a consultant, I’ve relied on SWOT analyses for years, especially during those first discovery calls with clients.

It’s one of the simplest ways to get a true sense of how a business operates.

Four questions (1) what’s working, (2) what’s not, (3) what’s possible, and (4) what could go wrong can reveal more about a company than a dozen spreadsheets.

While AI tools can generate a SWOT analysis in minutes, the real value still comes from human inputs. Your understanding of the business, your team’s brainstorming, and the context only you can provide.

I’ve put together this guide to help you understand how to utilize AI tools effectively and do your SWOT analysis thoughtfully. So you don’t just develop a 4-grid box, but also a better understanding of your business and your potential next steps.

What is a SWOT analysis?

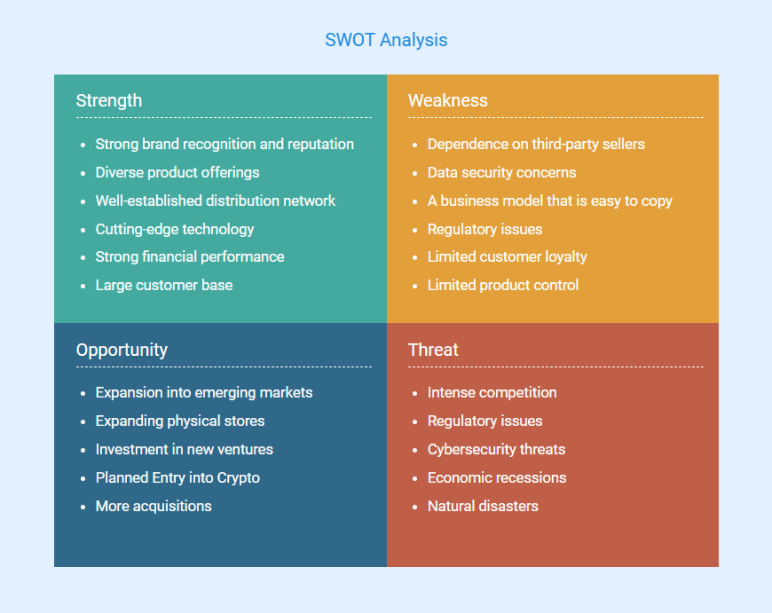

A SWOT analysis is a strategic planning tool used by businesses to evaluate their strengths, weaknesses, opportunities, and threats.

It helps organizations make informed decisions, reduce risks, and identify areas of growth by breaking down both internal and external factors.

The goal is to manage internal elements, such as strengths and weaknesses that are within your control, while also preparing for external factors, such as opportunities and threats that you cannot control but must navigate.

A SWOT analysis gives you a clear, structured view of your business environment and a solid foundation for building a strategy.

Before we get into how to do a SWOT analysis, it’s important to clear up what SWOT is not.

What it’s “not”?

I’ve seen people confusing SWOT analysis with some formal, boardroom-level exercise reserved for big corporations, consultants, or strategic off-sites. They imagine

- Long PowerPoint decks,

- Months of research, and

- Complex data models.

Some even assume it’s a tool only relevant when drafting an investor presentation or a five-year plan, while others treat it like an academic framework filled with jargon.

In reality, a SWOT analysis is neither corporate nor complex. It’s simply a structured way to pause and think: what’s working for me, what’s holding me back, what opportunities exist, and what could go wrong.

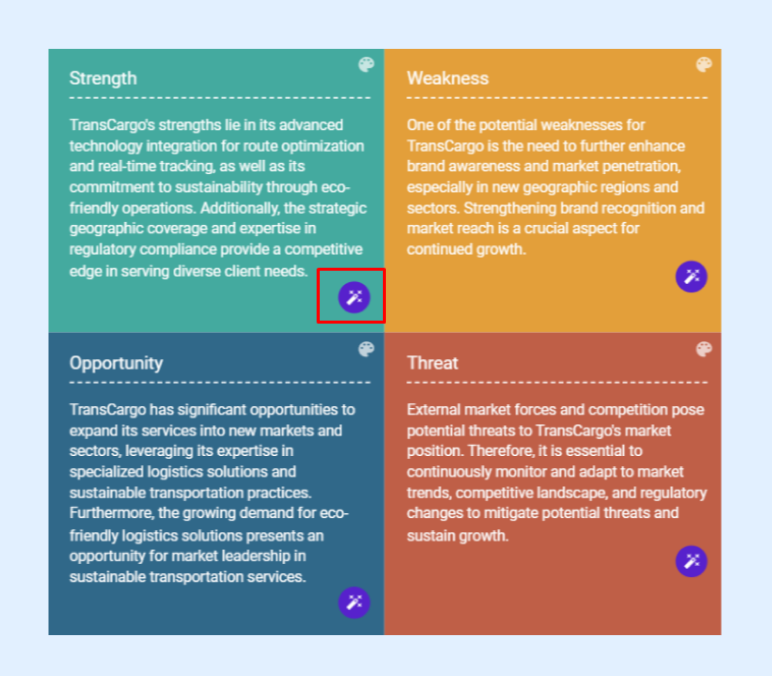

If you’ve seen SWOT analysis examples from companies like Starbucks or Netflix, you’ll notice they all follow this same logic: Simple, visual, and focused on decisions.

At its core, SWOT is a clear, simple habit of thinking critically about the good and bad around a choice—something anyone can use.

SWOT: Strengths, Weaknesses, Opportunities, Threats

You’ve got four quadrants to work with: Two that assess your internal capabilities (strengths and weaknesses) and two that examine external conditions (opportunities and threats). Here’s what you need to know about each.

1. Strengths

Strengths are internal advantages that give you an edge. I’m talking about things like a product that’s genuinely faster than competitors, a team that responds to customer issues in minutes instead of days, or a reputation that brings referrals without you asking.

2. Weaknesses

Weaknesses are the places where your business is vulnerable. I suggest that you get specific here. What’s the thing you hope competitors don’t notice? What’s the constraint that keeps showing up when you try to scale? That’s what belongs in this quadrant.

3. Opportunities

Opportunities are external conditions working in your favor—market shifts, emerging trends, or competitor moves creating openings. When you have more than one option, ranking them by impact and feasibility (and even doing a quick competitive analysis to see how rivals are moving) helps you avoid spreading resources too thin.

4. Threats

Threats are the outside factors that could cause trouble if you’re not prepared. These aren’t things you control, but you need to be aware of them. It could be a strong competitor, new government rules, supply chain problems, or an economic downturn.

Want to create a SWOT Analysis for your Business?

Craft a powerful SWOT Analysis in just minutes using our user-friendly and free online SWOT Analysis Generator Tool!

How to do a SWOT analysis for your business (w/ real-life examples)

I narrowed this down to six practical steps, the way consultants run it; simple enough to follow and detailed enough to make your SWOT analysis useful.

1) Define the objective (why are you doing it?)

A SWOT analysis can only be as good as the purpose behind it. If you sit down to “do a SWOT” without a reason, you’ll likely end up with four boxes filled with vague points. So always link the exercise to a specific decision you’re trying to make.

That’s why I always start by asking clients: What decision are you trying to make right now?

- If you’re writing a business plan for funding, your SWOT should focus on what an investor wants to see: Your market position, growth potential, and financial stability.

- If you’re testing a new product idea, the questions change: Is there enough customer demand? Do you have the resources to produce at scale? What could delay or derail the launch?

- If you’re rethinking strategy after a tough quarter, the focus may be on identifying bottlenecks, competitive pressures, or new areas to invest in.

“But what if I don’t know what to focus on?”

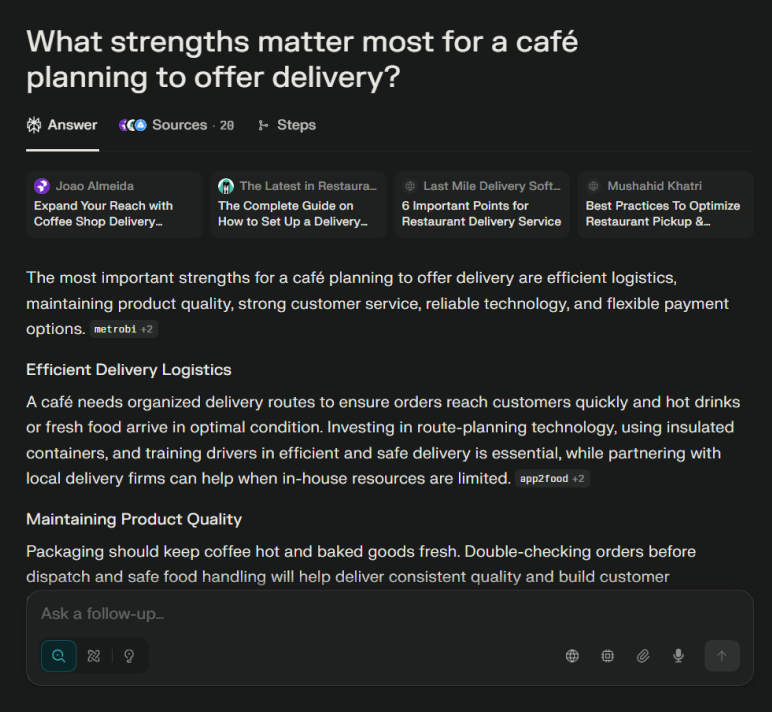

AI assistants like ChatGPT and Perplexity, or Upmetrics’ own AI, can help you frame sharper questions.

You can type in something like, “What strengths matter most for a café planning to offer delivery?” This gives you a starter list that you can then refine with your actual data.

When you start with a clear objective, every point you add will tie back to the outcome you care about.

2) List strengths (internal, positive factors)

When I ask founders to list their strengths, most start with vague answers: good customer service, strong brand, loyal customers. I get why—you’re proud of what you’ve built. But here’s the truth: vague strengths don’t guide strategy.

What makes this part of SWOT valuable is specificity backed by evidence. Numbers, proof points, and tangible assets tell a stronger story.

- A café shouldn’t write “good coffee.” A better strength is “80% of customers return at least twice a week.”

- A SaaS startup shouldn’t write “reliable product.” Instead, note “95% uptime over three years.”

- A retailer shouldn’t stop at “great location.” Say“average daily foot traffic of 2,000+ customers.”

At this point, founders usually push back: “But my strengths don’t look unique.” That’s fine. They don’t need to be. Even small operational edges—like faster response times or healthier margins—can influence decisions.

Others ask: “What if I don’t have numbers?” In that case, use what you do have. Repeat purchase rates, testimonials, or staff expertise can be just as credible. A specific strength, however modest, will always be more useful than a polished but vague one.

3) List weaknesses (internal, limiting factors)

When I sit with founders on this step, most of them hesitate. No one likes putting their weaknesses on paper. I usually hear: “Won’t this make me look bad to investors?” My answer is always the same—it doesn’t make you look weak, it makes you look serious.

People trust a plan more when you show you understand the gaps and already have ideas to fix them.

I recommend only listing weaknesses that truly affect performance. If it slows growth, hurts customer experience, or makes you less stable than competitors, it’s worth writing down.

The key is being specific. “Small team” won’t be enough. Rather, “30% of revenue depends on one client” or “our website converts at 1% when the industry average is 3%” gives you something concrete to act on.

Even the biggest companies do this. Apple, for example, has called out “dependence on iPhone sales” and “exposure to supply chain risks in China.” If a global brand can be upfront about weaknesses, so can you.

4) Identify opportunities (external, growth levers)

Usually, when I ask about opportunities, founders start listing every new trend they’ve heard of. AI, sustainability, subscriptions—you name it. But not every trend is your opportunity.

A common question I hear is: “How do I know which opportunities actually matter for my business?” My answer to that is to filter them. Ask yourself two things:

- Does this build on a strength we already have?

- Do we have the resources to act on it?

If you can’t say yes to at least one, it’s not an opportunity.

Another worry is: “What if we see too many opportunities at once?” That’s where prioritization becomes important. So rank them by impact and feasibility. A café might see delivery, catering, and e-commerce as options. With a small staff, delivery is the logical first step.

Even global brands apply the same logic. Starbucks focused on entering new markets and diversifying products, but only where it had the infrastructure to succeed.

5) Identify threats (external risks)

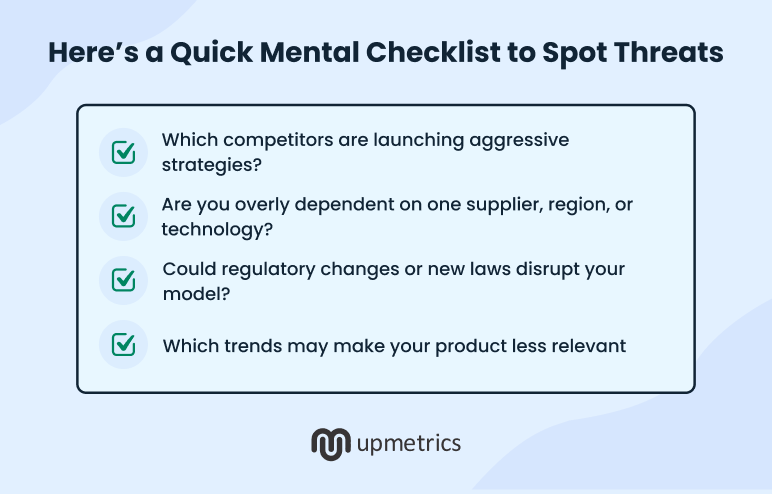

When I ask founders about threats, the first reaction is usually: “But how do I know what really counts as a threat?” It’s a fair question. Threats can be anything from a new competitor to stricter regulations, shifting customer behavior, or supply chain disruptions. You can’t control them, but you can prepare for them.

The way I approach this is through scenario thinking. Ask yourself: “What happens if a well-funded competitor launches tomorrow?” or “What if a key supplier fails or a new regulation rolls out next year?” If the outcome hurts your growth or costs you customers, it’s a threat worth listing.

Another hesitation I hear a lot: “Should I list every possible risk?” No. If you do, you’ll drown in hypotheticals. Focus only on threats that are both likely and impactful.

Big companies do this too. When Disney+ launched in 2019, Netflix immediately flagged it as a major threat—Disney had Marvel, Pixar, and Star Wars content plus deep pockets. Netflix responded by pouring billions into original content and international expansion.

That’s the point of this step: Recognize the risks early, and then build a plan to counter them.

6) Prioritize and analyze results

By this point, you’ll probably have a SWOT full of notes. That’s normal. The temptation is to act on everything at once. That’s a mistake. You’ll stretch yourself thin and make little progress.

Here’s how I approach it with clients. I ask four simple questions:

- Which strengths can you lean on immediately to drive growth?

- Which weaknesses, if ignored, will cause the most damage?

- Which opportunities are realistic given your resources?

- Which threats need a plan right now, not later?

These questions strip away the noise. To make it even clearer, I usually plot everything on an impact vs. urgency grid. High-impact and urgent items rise to the top. The rest stay noted, but we don’t waste energy on them today.

Amazon is a great example I point to. Its strength in logistics turned into Amazon Prime. Its weakness in physical retail led to the Whole Foods acquisition. And when competition in e-commerce became a serious threat, Amazon built AWS and Prime Video to diversify. Each of their SWOT point turned into a concrete business strategy

That’s what you should aim for— a focused set of actions that move your business forward.

How should you use the findings of the SWOT analysis?

Treat your SWOT as a decision-making guide, not a one-time exercise that lives in a drawer. Here are three ways to put it to work.

1) Using SWOT results in your business plan

I tell founders all the time: Don’t park your SWOT in one corner of the plan and forget it. It should shape your strategy, your financials, even your go-to-market story. That’s where it earns its keep.

Think about it this way. A strength like “80% customer retention” can also support your traction and marketing section. A weakness like “30% of revenue tied to one client” can be used in your financial plan.

It’s not much, but investors are impressed with these smallest of details. Tesla does it well in its public reports: They admit weaknesses like supply chain risks and production delays, while also emphasizing their strength as the leader in electric vehicles.

That’s the model to follow. Use your SWOT to explain why your plan looks the way it does. That integration is what convinces investors you’ve thought things through.

2) Guiding your strategic decisions

A list of boxes isn’t a strategy. The real work is turning connections between quadrants into choices. Here’s how I guide founders through it:

- Strengths + Opportunities → Where can you use what you’re already good at to ride a trend or close a market gap?

- Weaknesses + Threats → Which external risks become more dangerous because of your internal gaps, and what do you need to fix first?

- Opportunities + Weaknesses → Which growth areas tempt you, but you can’t pursue yet because you lack skills or resources? That’s where you know to invest.

At this stage, I introduce the idea of sequencing. Not all actions need to happen now. High-impact strength–opportunity pairs go into this year’s plan. Weakness–threat risks get addressed right away, before they cause damage. And opportunity–weakness gaps shape the medium-term investments we plan for down the road.

When you frame your SWOT this way, you will look like someone who knows how to prioritize, where to double down, and how to de-risk growth. That’s how a SWOT analysis becomes the first draft of your strategic business planning.

3) Shaping forecasts and resource allocation

You can write “We’ll grow 20% next year” in a forecast, but unless you back it up, no one’s going to believe it. This is where your SWOT gives you credibility.

Here’s how I use it when building forecasts with clients:

- Strengths → Support growth assumptions

If customer loyalty is a strength, steady retention rates justify reliable revenue projections. - Weaknesses → Adjust forecasts and budgets

If churn is a weakness, I expect to see resources set aside for retention campaigns or product upgrades. - Opportunities → Model the upside

Spotting a new market? Build “what if” scenarios—best case, worst case, most likely—so growth projections feel grounded. - Threats → Stress-test your plan

Supply chain risks? Budget in a buffer for costs. Regulatory changes? Allow compliance before it hits.

That’s how I look at it: Your SWOT shouldn’t sit in isolation; it should explain why your forecasts and budgets look the way they do.

The bottom line

If you’ve made it this far, you know a SWOT is about seeing your business clearly. It shows you what to lean on, what to fix, where to grow, and what to prepare for. Simple, but powerful when you actually use it.

The next step is taking those insights and turning them into a plan you can act on. Upmetrics helps you connect the dots—building forecasts, setting priorities, and pulling everything into a business plan that’s ready to share with investors or your team.

You can think of SWOT as the clarity, and planning as the action. Together, they move your business forward.