It’s important to understand the company’s future cash flows because nearly every critical decision hinges on it.

Can you hire? Can you invest?

Can you handle a delay in receivables or surprise capital expenditures in the next quarter?

Without visibility into projected cash inflows and outflows, you’re making strategic calls on shaky ground—and that’s a risky approach to cash management.

And in most cases, that’s what breaks a business—not the lack of growth, but the lack of liquidity at the wrong moment.

This blog isn’t going to walk you through the basics of building an accurate forecast or why it matters. You already know that.

Here, you’ll find the real-world, practical cash-forecasting practices that actually move the needle.

Let’s dive right in.

8 Cash flow forecasting practices for small businesses

Let’s explore different tactics and practices to make your cash management and forecasts accurate.

1. Build a data-driven cash flow forecasting process

Forecasts without data are nothing but your attempt at building best guesses.

Whether you’re projecting into the next quarter or next year, having a clean and structured sizable data set is non-negotiable.

Now, many organizations think pulling data from the last quarter makes their cash forecasting process data-driven. However, that’s just historical reporting in disguise. Not forecasting.

True data-driven forecasting doesn’t stop at last quarter’s actuals. It pulls real-time department-level data, i.e., sales, procurement, accounts receivables, and others, to create a more accurate cash flow forecast.

It factors in seasonality, macroeconomic shifts, and operational nuances affecting cash position in the real world.

So, how do you build layered forecasts that evolve with reality?

Start with historical data as the baseline, then layer in known variables like seasonal trends and macroeconomic shifts for granular-level detailing. Just like P.E. Schweicher at MSadvisory does.

According to him, his team also factors future uncertain events into forecasts after weighing their probability. That is, if they are 70% sure a client will renew their contract, they include 70% of that expected revenue in their forecasts rather than all-or-nothing.

This way, your forecast doesn’t just look right—it behaves the way your cash actually moves.

2. Automate data collection for accuracy

Nearly 88% of spreadsheets have significant errors in them.

More shocking? The majority of them are human errors—meaning they could have been completely avoidable mistakes.

If you’re still manually updating data into spreadsheets, you’re likely building on top of flawed inputs without even realizing it.

Not to mention the valuable hours—sometimes days—wasted on tasks that could be easily automated without sacrificing accuracy.

Another caveat? The data is already stale when you go from data entry to analysis and building cash flow projections in spreadsheets.

What you’re forecasting isn’t your current cash position—it’s a snapshot from days ago.

Something that’s not supporting your business objective of leveraging real-time cash visibility to make faster, smarter decisions.

The solution?

It’s obvious. Invest in cash flow forecasting software that can fetch real-time data from your ERP, payroll, banks, and accounting systems.

And not just any tool—a system that adapts to changing formats and structures without breaking the model or introducing new errors.

3. Model scenarios for all-round planning

Things never remain consistent in a business.

For example:

- A strong quarter might be followed by a sudden regulatory change that cuts into margins or stalls future sales.

- A supplier might raise prices.

- A new competitor could enter the market.

- A top client might churn. And, in rare cases, an unpredictable event—like COVID-19—can throw everything off track.

While you can’t control every scenario, staying prepared will keep your business afloat when the tides change.

Considering historical data, seasonal trends, and present market conditions, prepare a base case scenario—one that reflects the most likely cash position (projected cash balances) if things unfold as expected.

But don’t stop there.

The real value comes from modeling what happens when things go better—or worse—than expected. Scenario modeling it is.

But how do you decide which situations to model for?

Well, look out for pressure points by asking these questions:

- Where is your forecast most sensitive?

- What assumptions are you making that could easily shift?

- Which cash inflows or cash outflows are based on hope, not certainty?

The idea is to plan for the realistic risks and meaningful upside that impact your cash position the most.

4. Segment cash flow for a clear understanding

Remember how we segment cash flow statements into investing, operating, and financing activities? Well, that segmentation isn’t just useful for calculation—it’s critical for analysis.

It helps you go beyond net income and understand the real movement of cash. Sometimes, your net income might look healthy, but that doesn’t always mean you have enough cash for business operations and debt repayment.

The direct and indirect cash flow helps you answer questions that can’t be captured from net cash flows alone:

- Is our positive cash position coming from operations, or are we just delaying vendor payments?

- Are we funding growth through internal cash generation or burning through investor money?

- Are we paying accounts payable too aggressively and risking short-term liquidity?

- Is our cash flow from operations being dragged down by slow-paying clients or bloated expenses?

When your cash forecasts are segmented into proper inflows and outflows, it becomes much easier to spot red flags, surface hidden inefficiencies, and identify what’s actually working.

You shift from reaction mode to diagnostic mode, working on gray aspects before it gets late.

Want to Take Control of Your Business Cash Flow?

Quickly analyze your income and expenses with our free Cash Flow Calculator. Get clear financial insights in minutes!

5. Always document your assumptions

Most assumptions look clean and logical on the surface. But dig deep, and you won’t remember why certain numbers were used in the first place.

That’s problematic, right?

Because when reality shifts and it most certainly will, you need to know which assumptions to revisit and tweak.

Whether you’re expecting a 5% increase in monthly revenue because of a new product launch or a dip in costs based on a vendor renegotiation, you need to know where that number came from.

The easiest way is to keep a simple log of all the assumptions you build along the way.

Nothing complex—just a clear list of what you assumed, why you assumed it, and what it was tied to. This way, you will have a reference point whenever things go wrong or better in the future.

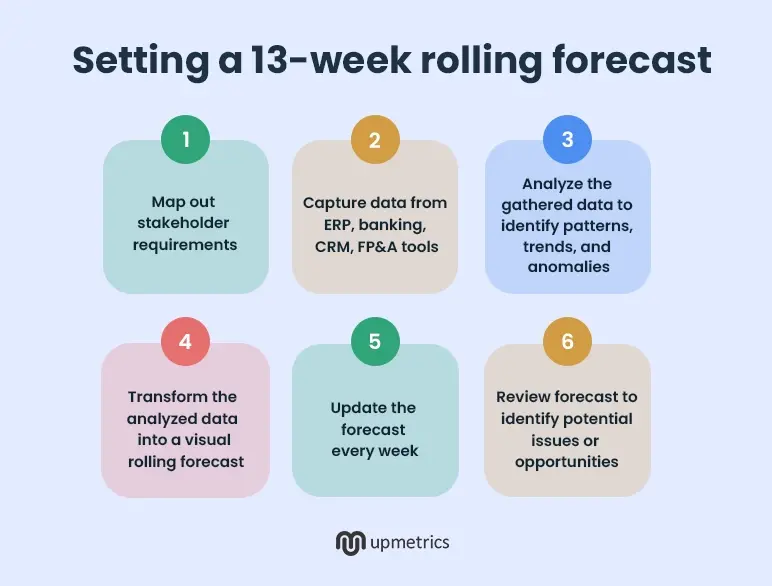

6. Implement 13-week rolling forecasts

Cash flow forecast is, after all, an assumption made on your best guesses.

Predict too far into the future, and the projections become irrelevant. Predict too little, and you’re constantly reacting instead of planning.

For most businesses, 13-week rolling forecasts offer a practical sweet spot.

They give just enough visibility to improve liquidity management and decision-making so that you can manage short-term decisions without falling into long-range guesswork.

You’re still making assumptions, but they’re tied to real inputs, not baseless guesses. And since it rolls forward every week, the forecast keeps pace with reality and doesn’t dry your working capital.

Speaking of, here’s an interesting insight shared by Andrew Lokenauth, the writer of thefinancenewsletter with over 100,000 subscribers.

7. Align short-term forecasts with long-term strategic vision

While 13-week forecasts are helpful, they won’t take you far unless they’re grounded in long-term strategic vision.

The best way to align your short-term actions with long-term goals?

Start with an annual forecast. Map out your revenue targets, hiring plans, product launches, capital investments, and financing needs across the next 12 months.

Then layer in your monthly or 13-week forecasts—not as separate exercises but as live tools tied to that larger plan.

For instance, if your annual plan includes financing a new asset or repaying a loan, your short-term forecast should show exactly when those outflows will occur—and whether the business can absorb them without disrupting operations.

With reliable long-term forecasting, leaders can make better decisions about multiyear capital investments and can track their financial performance more readily.

That said, when short-term and long-term forecasting move in the same direction, every cash decision becomes more intentional and far less risky.

8. Compare and review the actual cash flow

The variances will occur even in the seemingly accurate forecasts. And it’s absolutely normal.

However, not tracking your forecasts against actuals will make you blind to the gaps in your assumptions.

An automated forecasting tool with intuitive dashboard features and real-time analysis has the ability to instantly flags discrepancies as and when they occur.

Some even allow you to color-code variances based on thresholds or impact, helping you quickly spot which gaps need attention now and which can wait.

Jeffrey Zhou, the founder of Figloans, shares how he changes variance thresholds depending on seasonal trends.

As he mentions, their variance during tax season is lower than 1%. Since the volume is high during that time, errors tend to multiply quickly. For the remaining part of the year, they allow a 3-4% variance before digging in. Such flexible thresholds give them better control over cash flow positioning.

That said, depending on the variability of your industry, you may even afford variances up to 15% without immediate action.

Those were some of the best cash flow forecasting practices we had for you. Test what works for you, modify the approach, and be flexible enough to make changes on the go.

Build cash flow forecasts that align with your business strategy

Managing a healthy cash flow is crucial for the survival of your business.

But building cash flow forecasts that are isolated from your core business strategies won’t cut it—especially when the stakes are as high as investor conversations, funding decisions, or major growth moves.

With Upmetrics, you go from step 0 to building realistic and accurate forecasts without the spreadsheet chaos. You get an AI financial assistant, a tool that integrates with Quickbooks and Xero, and automated calculations to speed up everything from cash flow projections to scenario modeling.

What’s more?

Connect the dots with your business plan, long-term strategies, operations, and everything fundamental—all with one app.

Try now.