We often hear about the tough questions investors ask entrepreneurs before they decide to invest. But did you know founders should ask questions, too?

Yes, as a founder, you have every right to question your potential investors. Because this isn’t just about getting money and giving returns, it’s about building a partnership, one that’s aligned with your mission and committed to helping you achieve it.

Hence, in this blog, we’ll arm you with the questions to ask investors in the first meeting to find that perfect match, ensuring your startup doesn’t just launch but soars.

Let’s get started.

Why does asking questions to investors matter?

Here are the 5 reasons why asking questions to investors is non-negotiable, especially if you’re serious about building something that lasts.

1) It shows you’re a leader, not just a pitcher

Any startup founders can memorize a deck and talk about traction. But when you start asking the potential investor thoughtful questions, it shows you’re not just chasing money—you’re choosing a partner.

2) You’re building a relationship, not closing a sale

Raising capital isn’t like selling a product. It’s like starting a long-term relationship. You will work with this person for years, through wins, losses, pivots, maybe even crises. Hence, asking the right questions helps you understand their style, values, and expectations.

3) It helps you spot red flags early

Not every investor is the right fit for your company. By asking the right questions, you can quickly understand if your vision, values, and working style align with theirs. Remember, asking early helps you avoid surprises later and ensures you bring on a partner who truly supports your direction.

4) Tells you what value they bring

Apart from being an angel investor who will invest money in your business, asking questions will let you know what else they are bringing to the table.

- Do they have industry connections?

- Can they help with future fundraising?

- Will they mentor you or just monitor you?

Remember, you only find out if you ask.

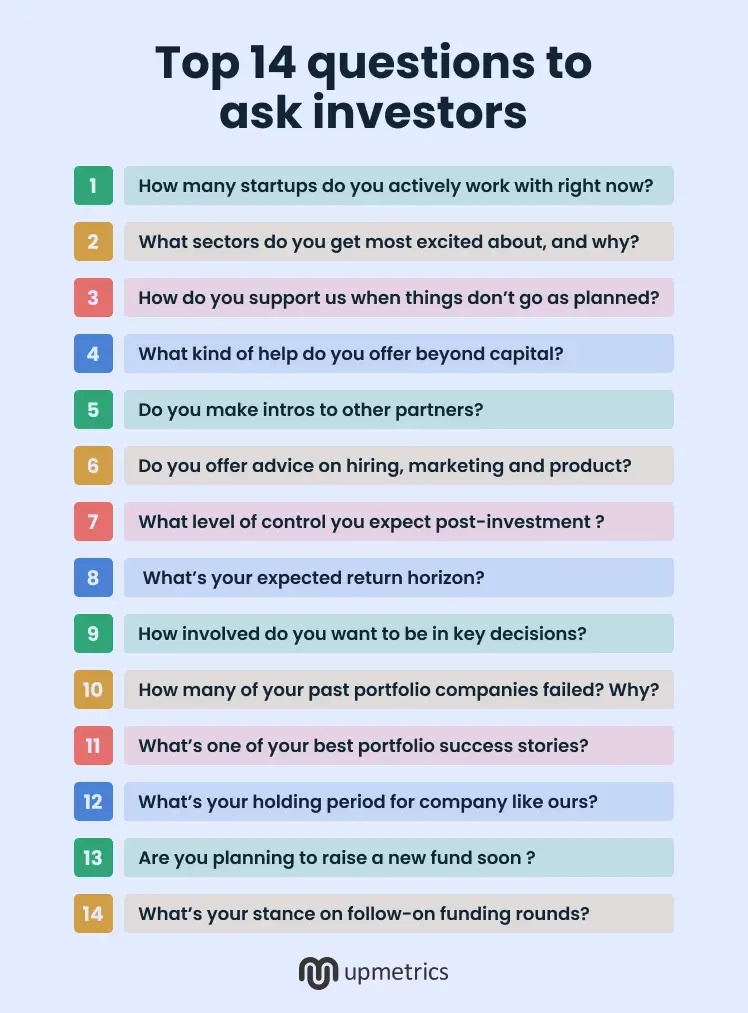

Top 14 questions to ask investors

Investing money is one thing, but running a venture successfully in the long term requires strong relationships, clear communication, and the right partnership.

If you want to know whether an investor truly brings these qualities, you must ask the right questions.

The answers will help you understand their mindset, values, and help you choose the right investor.

So, let’s dive in and know what questions you should ask your investors:

Questions to understand their investing style

Here’s a list of questions that will help you understand how involved they are, what kind of startups they typically back, and whether they’re a good fit to be your lead investor.

1) How many startups do you actively work with right now?

Today, there are 1,245 startups around the world valued at over a billion dollars. By asking this question, you can understand how much time they can realistically give you.

If they’re overloaded, they might not be able to support you when you need it most. Hence, it’s better to know now than be disappointed later when you’re counting on their help.

2) What sectors do you get most excited about, and why?

This question tells you if your startup matches their passion and expertise. An investor excited about your space is more likely to stay committed through ups and downs.

3) How do you support startups when things don’t go as planned?

You’re not here just for raising money, but to build a long-term relationship. Ask this to see how they handle challenges — do they step up, or step away? You want someone who’ll be in your corner, not just when things are good.

Questions to understand their value beyond money

Now, it’s time to find out what they bring to the table besides funding—ask these questions during your investor meetings to uncover the support, connections, and expertise:

4) What kind of help do you offer beyond capital?

Most investors say they’re “value-add,” but this question helps you find out how they actually help. Ask this to understand if they’ll be hands-on or hands-off after the investment. You want someone who adds value, not just one who wires funds and disappears.

5) Do you make introductions to other investors or partners?

Asking whether an investor makes introductions to other investors or partners reveals their willingness to leverage their network for your success. Investors aren’t just wallets; they’re connectors with access to industry players, potential co-investors, and strategic partners who can accelerate your growth.

6) Do you offer strategic advice on hiring, marketing, or product?

A startup’s success doesn’t just rely on a brilliant idea or big investment—it also depends on having the right partnership to grow and thrive. If you need a piece of advice, marketing tactics, or even to hire an employee, your investor should be someone you can turn to without hesitation. Ask this to see if they’ll help you make smarter decisions in key areas. Their past experience could save you time, money, and costly mistakes.

Question about funding terms and expectations

Now, it’s important to ask questions that clarify their funding terms, expectations after your pitch deck, and whether they’re open to follow-on investments as you grow. These insights will help you avoid surprises and build a funding path that supports your long-term vision.

7) What level of control or influence do you expect post-investment?

Some investors may want a board seat, approval rights, or a say in major business moves. It’s important to understand their expectations up front so you’re not caught off guard later. Clear boundaries now will save you from conflicts and confusion down the road.

8) What’s your expected return horizon?

You should ask this to understand how quickly the investor expects to see returns. Some may aim for a 3–5 year exit, while others are open to a longer journey. This tells you how much pressure you’ll face to grow fast or exit early.

9) How involved do you want to be in key decisions (hires, pivots, etc.)?

Some investors like to stay hands-off, while others want regular input on major moves like hiring or changing direction. Ask this question to know how much autonomy you’ll have after the investment. Understanding their involvement level helps you set the right expectations and avoid micromanagement.

Questions to understand their track record

These questions help you assess their past performance, deal flow, and whether they truly support founders beyond the first cheque. During due diligence, this info tells you if they’re likely to invest more money later or disappear after the initial deal.

10) How many of your past portfolio companies failed? Why?

Before you dive into a deal, understanding how they handle failure is important to gauge their maturity. Their answer reveals honesty, experience, and whether they stick around when things get tough.

But remember, a transparent investor with lessons learned is far more valuable than one who only talks about wins.

11) What’s one of your best portfolio success stories?

This question helps you understand the kind of startups they back and how they support them. It gives you a clear picture of what success looks like to them and the value they bring beyond funding.

Questions to understand their long-term intentions

Now, before you shake hands, it’s wise to know if your investor thinks like a Silicon Valley legend or just wants a quick exit. These questions will reveal their long-term thinking, commitment level, and how they approach decision-making during tough or critical phases.

12) What’s your typical holding period for a company like ours?

This tells you how long they usually stay invested. If you’re in it for the long haul, but they prefer quick exits, it could lead to misaligned expectations down the road.

13) Are you planning to raise a new fund soon (can impact support)?

An investor raising a new fund might shift focus to courting new LPs. This question helps you judge how much time and attention they’ll realistically have for you post-investment.

14) What’s your stance on follow-on funding rounds?

Not all investors write a second cheque. Ask this to find out if they typically participate in future rounds—it can signal long-term confidence and reduce funding pressure later.

Conclusion

One thing is clear—investors aren’t just for raising money, they’re partners in building your vision. So by asking these 14 questions, you’re not just getting to know your investors, you’re choosing a long-term partner who shares your mission.

Keep these questions in your arsenal and never skip them during any investor meeting, because the right partnership can decide the future of your firm.

Further, if you need assistance in raising funds or need an investor-ready business plan that helps you get funded, you may get in touch with Upmetrics. We’re here to support your journey.