Running a car rental business sounds exciting: Managing a fleet, helping travelers on the go, and being part of a high-demand service industry ($278.03 billion by 2030).

But turning that idea into a real, profitable business takes more than just buying a few cars and setting up a website.

You need a proper direction, a clear plan.

One that helps you to determine the number of cars to begin with, how to charge for the rentals, who your target customers are, and how you will run the business in terms of finances.

Feel like you don’t know where to start? Don’t worry.

This car rental business plan template will walk you through everything step by step.

How to write a car rental business plan?

Writing a car rental business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

Your entire car rental business plan is pitched in the executive summary. It provides readers with a concise overview of your company’s mission, target audience, revenue streams, and reasons for success.

It’s best to write this last after you’ve worked out the rest of the plan, even though it comes first.

The following topics should be included in your executive summary:

- What’s the concept? Are you offering self-drive cars, chauffeur-driven services, airport transfers, or business fleet rentals? Will your focus be affordability, convenience, or a premium experience?

- Where will you operate? Are you setting up in a high-traffic tourist city, near an airport, or expanding across multiple locations?

- Who are your customers? Are you targeting tourists, business travelers, local residents who don’t own cars, or companies needing rental fleets?

- How will you make money? Through hourly or daily rentals, monthly contracts, long-term leasing, or value-added services like GPS or insurance add-ons?

- Do you need funding? If yes, how much are you looking for? And what will the funds be used for—buying vehicles, marketing, or setting up your booking system?

Your job here is to hook the reader. Make it easy to understand what your business is all about and why it’s worth paying attention to. Keep it short, sharp, and confident.

1. Executive Summary

An executive summary is the first section of the business plan intended to provide an overview of the whole business plan. Generally, it is written after the entire business plan is ready. Here are some components to add to your summary:

- Start with a brief introduction: Start your executive summary by introducing your idea behind starting a car rental business and explaining what it does. Give a brief overview of the idea of how your car rental will be different.

- Market opportunity: Describe the target market in brief, and explain the demographics, geographic location, and psychographic attributes of your customer. Explain how your car rental business meets its needs. Clearly describe the market that your business will serve.

- Mention your services: Describe in detail the services you provide, like pick-up and drop services, self-drive services, long-term car rental services, or short-term car rental services.

- Management team: Name all the key members of your management team with their duties, responsibilities, and qualifications.

- Financial highlights: Provide a summary of your financial projections for the company’s initial years of operation. Include any capital or investment requirements, startup costs, projected revenues, and profits.

- Call to action: After giving a brief about your business plan, end your summary with a call to action, for example; inviting potential investors or readers to the next meeting if they are interested in your business.

Ensure you keep your executive summary concise and clear, use simple language, and avoid jargon.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Business Overview

This section lays the groundwork for your car rental business. It covers all the basics: what your business is, where it’s based, who’s behind it, and where it’s headed.

Here’s what to include:

| Section | What to include |

|---|---|

| Business name & concept | Your business name and the type of cars/services you offer (luxury, budget, family, etc.). |

| Legal structure | Your business type (LLC, sole proprietorship, partnership, etc.). |

| Location & reason | Where you’re based and why it’s a good spot (e.g., airport, downtown). |

| Ownership & team | Who owns the business and handles what (operations, finance, etc.). |

| Mission statement | One line about what your business stands for and aims to deliver. |

| Background | When and why you started, and any early wins (fleet, bookings, feedback). |

| Future plans | What do you plan to do next (new locations, services, or vehicle types). |

All in all, this part will provide readers with a clear picture of your business and where you are trying to take it next.

3. Market Analysis

Market analysis provides a clear understanding of the market in which your car rental business will operate, including the target market, competitors, and growth opportunities.

Your market analysis should contain the following essential components:

Target market

Start by defining who you’re serving. Are you targeting:

- Tourists who need short-term rentals during their stay?

- Locals who need temporary transportation?

- Business travelers who want fast, reliable, airport pickup & drop?

- Rideshare drivers or gig workers who rent by the week or month?

- Corporate clients needing a long-term fleet solution?

Next, get specific. What’s the typical age range, income level, or travel habits of your ideal customer?

Let’s understand it through a detailed buyer persona:

Knowing exactly who you serve will shape your pricing, fleet choices, and marketing strategy.

Market opportunity and business fit

Start by looking at the size of the car rental market in your region. Is it growing? Are more people choosing to rent instead of owning cars? If you can, include recent data, such as projected market value in the next five years or tourism numbers from local authorities.

Then explain where your business fits. Are you serving a gap in the market? Offering specialty vehicles or a more modern booking experience? Show how you’re solving a real need.

Understanding the competition

To stand out, you need to know who you’re up against. This includes local rental companies and indirect options like rideshare apps or platforms like Turo.

Many competitors have strong points, but also common gaps:

- Easy booking and brand trust

- But poor service, outdated tech, or limited vehicle choices

Your edge could be a newer fleet, cleaner cars, better support, or a smoother booking experience. Focus on what others lack, and show why your service is the better choice.

Regulations & compliance

Understand the regulations to stay ahead of the game, including insurance coverage, driver licensing, vehicle inspections, and local transportation or zoning laws.

Mention any resources or consultants you plan to use to maintain compliance, such as third-party platforms that assist with risk and documentation management, fleet management software, or legal counsel.

4. Products And Services

Your car rental business is all about offering flexible and useful services that fit different customer needs.

Some customers need a car for just an hour, others for a month. Some want luxury, others prefer something more budget-friendly. You’ve got to offer options that fit all kinds of needs.

Vehicle types and rental services

Below is a snapshot of the vehicle types and rental options you can plan to offer:

| Category | Description | Rental options |

|---|---|---|

| Economy cars | Affordable, fuel-efficient, perfect for city use or budget travelers | Hourly, daily, weekly |

| Sedans & compacts | Comfortable for families and professionals, great for long drives | Daily, weekly, monthly |

| SUVs & vans | Spacious options for group travel, off-road trips, or family vacations | Daily, weekly, monthly |

| Luxury cars | Premium vehicles for weddings, events, and executive use | Daily, weekend packages |

| Trucks & pickups | Ideal for moving, delivery, or commercial use | Daily, weekly, monthly |

Rental plans and services

Offer a range of rental durations to keep things flexible:

- Hourly rentals for short-term needs

- Daily and weekend rates for trips or errands

- Weekly/monthly plans with discounted rates for long-term use

Additional services may include:

- Airport pickup and drop-off

- Self-drive or chauffeur options

- Subscription-based rentals for repeat customers

- Mobile app or online portal for quick reservations and payments

Mention any other things as well, such as seasonal offers or bundle deals (e.g., free GPS with weekend rentals). These can be used to gain price-conscious shoppers and to develop repeat customers.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients.

Here are some practical marketing and sales tactics to include in your plan:

- Building a mobile-friendly website with real-time booking and pricing.

- Listing your business on Google Maps and travel aggregator platforms.

- Promoting your fleet on Instagram, Facebook, and Google Ads.

- Running seasonal or limited-time offers (e.g., weekend discounts, free GPS).

- Partnering with hotels, hostels, tour operators, and airports for referrals.

- Using email or SMS to stay in touch with past customers and offer deals.

Word-of-mouth is also powerful in car rental industry. Emphasize delivering renters a convenient experience so that they can tell friends, workmates about your service.

6. Operations Plan

Running a car rental business takes more than handing over keys. From maintaining the fleet to managing bookings and training staff, this section explains how things will run behind the scenes.

Here’s what to include in your operations plan:

Staffing and training

You’ll need the right team to keep things moving. That includes:

- Rental agents to handle bookings, paperwork, and customer questions

- Drivers (if you offer pickup/drop-off services)

- Technicians or a trusted local garage for regular maintenance

All staff should be trained in customer service, booking systems, and basic vehicle safety.

Fleet and sourcing

Decide how many vehicles you need based on expected demand. For example:

- 10–15 cars to start in a city location

- A mix of economy, SUV, and premium vehicles

- Vehicles sourced via purchase, lease, or used inventory

You’ll also need a system to track availability, mileage, insurance, and service history.

Policies and procedures

To keep things smooth and consistent, define your key operating rules, such as:

- Rental eligibility and documentation requirements

- Payment and deposit terms

- Fuel, mileage, and damage policies

- Cleaning and turnaround checklists

You can automate much of this with rental management software.

7. Management Team

The management team section gives a summary of the team that would operate the car rental. Give an account of the experience and qualification of every manager, their duties, and their roles.

Key roles

Start by introducing the founders or owners and their responsibilities. For example:

- Founder/CEO – Oversees operations, growth, and strategy

- Fleet Manager – Handles vehicle acquisition and maintenance

- Sales/Marketing Lead – Manages promotions, partnerships, and customer outreach

- Finance/Accounts Manager – Tracks revenue, expenses, and payroll

Briefly mention each person’s experience, especially if they’ve worked in transportation, logistics, hospitality, or customer service.

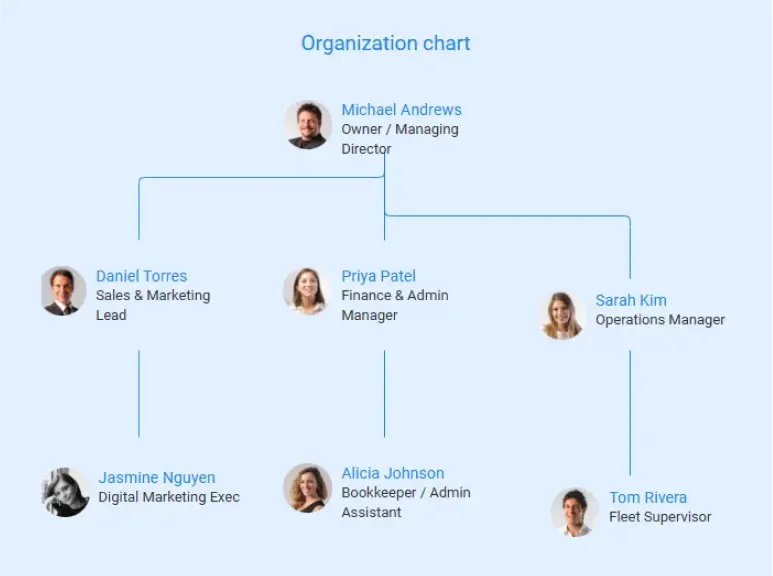

Team structure

Keep your organizational chart simple and easy to understand. For example, a small car rental business would look like:

Compensation (optional)

You can note whether roles are salaried, part-time, or incentive-based. If you plan to use commission or bonuses for staff tied to bookings or reviews, mention that here.

Advisors (If any)

If you have a mentor, advisor, or industry consultant involved, give a quick nod to their name and role. It helps show that you’re not going it alone.

8. Financial Plan

When writing the car rental financial plan section of a business plan, it’s important to provide a comprehensive overview of your financial projections for the first few years of your business.

Here are the key financial projections to include in your plan:

- Startup costs – Vehicle acquisition, office setup, tech tools, insurance, initial marketing

- Revenue forecasts – Estimated earnings based on projected rental bookings and rates

- Operating expenses – Salaries, maintenance, insurance, software, fuel, marketing

- Cash flow estimates – Monthly inflow/outflow expectations for at least the first 12–24 months

- Income statement (Profit & Loss) – Expected net profit or loss after expenses

- Balance sheet – Assets (like vehicles), liabilities (like loans), and equity

- Break-even analysis – How many rentals do you need each month to cover costs

You can present the key financial data using simple tables and charts for better clarity. For example:

Profit & loss statement

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | |||

| Rental Income | $131,400 | $164,250 | $236,250 |

| Add-on Services (GPS, Insurance, etc.) | $15,000 | $20,000 | $28,000 |

| Total Revenue | $146,400 | $184,250 | $264,250 |

| Cost of Goods Sold (COGS) | |||

| Vehicle Maintenance & Cleaning | $12,000 | $15,000 | $20,000 |

| Fuel (if included) | $6,000 | $10,000 | $13,000 |

| Insurance | $12,000 | $14,000 | $16,000 |

| Vehicle Depreciation | $20,000 | $25,000 | $28,000 |

| Total COGS | $52,000 | $64,000 | $77,000 |

| Gross Profit | $94,400 | $120,250 | $187,250 |

| Gross Margin | 65% | 65% | 71% |

| Operating Expenses | |||

| Salaries & Wages | $36,000 | $48,000 | $65,000 |

| Office Rent & Utilities | $12,000 | $13,000 | $14,000 |

| Marketing & Advertising | $8,000 | $10,000 | $12,000 |

| Software & Booking Systems | $2,000 | $2,500 | $3,000 |

| Miscellaneous/Admin | $3,000 | $4,000 | $5,000 |

| Total Operating Expenses | $61,000 | $77,500 | $99,000 |

| Net Profit Before Tax | $33,400 | $42,750 | $88,250 |

| Tax (25%) | $8,350 | $10,688 | $22,063 |

| Net Profit After Tax | $25,050 | $32,063 | $66,188 |

| Net Profit Margin | 17% | 17% | 25% |

Cash flow statement

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Cash Inflows | |||

| Total Revenue | $146,400 | $184,250 | $264,250 |

| Loan/Equity Injection | $60,000 | – | – |

| Total Inflows | $206,400 | $184,250 | $264,250 |

| Cash Outflows | |||

| Vehicle Purchases/Leases | $50,000 | $20,000 | $25,000 |

| Operating Expenses | $61,000 | $77,500 | $99,000 |

| Loan Repayment | $10,000 | $10,000 | $10,000 |

| Taxes Paid | $8,350 | $10,688 | $22,063 |

| Total Outflows | $129,350 | $118,188 | $156,063 |

| Net Cash Flow | $77,050 | $66,062 | $108,187 |

| Opening Cash Balance | $0 | $77,050 | $143,112 |

| Ending Cash Balance | $77,050 | $143,112 | $251,299 |

Balance sheet

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| ASSETS | |||

| Cash | $77,050 | $143,112 | $251,299 |

| Accounts Receivable | $5,000 | $7,000 | $10,000 |

| Inventory (Car Accessories, etc.) | $2,000 | $2,500 | $3,000 |

| Fleet Vehicles (Net of Depreciation) | $90,000 | $105,000 | $120,000 |

| Total Assets | $174,050 | $257,612 | $384,299 |

| LIABILITIES | |||

| Accounts Payable | $4,000 | $5,000 | $6,000 |

| Loan Payable (Balance) | $50,000 | $40,000 | $30,000 |

| Total Liabilities | $54,000 | $45,000 | $36,000 |

| OWNER’S EQUITY | |||

| Owner Capital | $60,000 | $60,000 | $60,000 |

| Retained Earnings | $60,050 | $152,612 | $288,299 |

| Total Equity | $120,050 | $212,612 | $348,299 |

| Total Liabilities + Equity | $174,050 | $257,612 | $384,299 |

You can also include a break-even chart showing the point where your revenue covers all fixed and variable costs.

Risk factors and backup plans

No business is risk-free. Car rentals may face issues like unexpected repairs, demand dips during off-seasons, or insurance delays. To stay ready:

- Keep a reserve fund or line of credit

- Regularly service your fleet to reduce major repair costs

- Track the local demand trends so that you can either change the pricing or level the stock.

Exit strategy

If you’re raising money, briefly describe the exit strategies for investors, such as profit-sharing plans, share buybacks, and business resale. This shows that you have thought about several possible outcomes.

9. Appendix

When writing the appendix section, you should include any additional information that supports the main content of your plan. These may include:

- A table of contents to help readers easily locate specific sections.

- Financial statements (income, balance sheets, and cash flow projections).

- Market research reports showing rental trends, industry size, and target demographics.

- Legal documents like sample rental agreements, licenses, and permits.

- Supporting materials such as brochures, marketing samples, and standard operating procedures.

Also, be sure to use clear headings and labels to keep everything organized and easy to reference.

Download a free car rental business plan template

Ready to write your own car rental business plan without starting from scratch? Download our free car rental business plan PDF to save time and stay organized.

This template includes every section covered above, from the executive summary to the financials, so you can fill in your details and get a polished plan faster.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Summary

There you have it! We’ve walked through all the key sections of a car rental business plan. With this guide and the free template in hand, writing your own plan should feel a lot more doable.

Still want an easier way to build a complete, investor-ready plan?

Try Upmetrics, a modern business planning software that simplifies everything, from writing to financial forecasting with its advanced AI technology.

So, why wait? Start planning with Upmetrics today.