If you’re starting a coffee shop or working on a business plan for one, you’re probably wondering how to create a strong coffee shop financial plan.

If you need funding or want a business partner, a solid financial plan is essential to show the potential of your coffee shop. You simply cannot afford to be negligent with this aspect of your business plan.

All of these require you to work on endless and tiring Excel sheets. However, only if you plan to do everything traditionally.

Need help writing the financial aspect of a business plan? Well, let us help you out.

What is a Coffee Shop Financial Plan?

A coffee shop’s financial plan reflects the current monetary position of a business and outlines its long-term financial goals, objectives, and strategies to achieve the desired outcomes.

It is the last but most important part of a business plan that can convince investors to invest in your business.

A financial plan consists of key financial reports like an income statement, break-even analysis, balance sheet, and investment plan. These reports help investors assess the revenue potential, risks, and rewards that a particular coffee shop can bring.

Instead of paragraphs, the financial section of a business plan is presented best with figures, diagrams, graphs, and charts.

Key Takeaways

- Develop a practical financial plan for your coffee shop by evaluating your current financial situation and projecting the initial expenses.

- Determine the profitability of your coffee shop with key financial reports.

- Improve the precision of the plan by verifying assumptions and performing sensitivity analysis.

- Get a financial snapshot of your business and pique investors’ interest.

- Consider using user-friendly financial planning software.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $14/month

How to Prepare a Coffee Shop Financial Plan?

1. Identify Your Funding Requirements

You need money to open the doors of your coffee shop in the actual world. The first step here is to accurately estimate your coffee shop startup costs.

From location rent, renovations, interior, equipment, furniture & fixtures, to licenses and permits, count each expense before you actually start your coffee shop.

Ensure that startup costs also include the operating costs or the coffee shop’s monthly expenses for the first few months. This will help you have adequate working capital to run the coffee shop before it turns into a profitable business.

After knowing the capital needs, assess how much capital you need from outside funding for your coffee shop.

2. Determine Your Funding Strategy

Not everyone has a pile of money ready to start a business. Sometimes, people have to ask for help from potential lenders to get the money they need to start their coffee shops.

Here are a few funding sources you can consider for your coffee shop:

- Lendings from friends and family

- Bank loans

- SBA loans

- Angel Investors

- Real Estate loans

Before you seek credit from banks and investors, evaluate different funding sources, their costs, and benefits to pick the most desirable ones.

3. Select a Business & Financial Planning Software

We don’t mean to scare you off, but starting and running a coffee shop will swamp you with responsibilities. Unless you plan to run around like a headless chicken, a planning tool can support you in making different financial plans and reports.

If you are struggling to create a financial plan for the coffee shop, you need a planning and forecasting tool right away.

Too many options to confuse you? Consider a tool that is easy to use, offers a range of functions, and allows seamless integration of Excel data.

Pro-tip

Create a Coffe Shop Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

4. Pre-Assumptions & Market Analysis

To build a foundation for your financial projections, go through your target audience, historical data, and current market trends. Here are other things to consider:

Pricing strategy

Analyze factors like your menu, customer preferences, spending habits, and the competitive landscape to determine the ideal pricing.

Remember, your pricing sets the tone for your coffee shop in the market. It should reflect the perceived value your coffee shop offers the customers. Don’t forget to consider potential increases in food costs throughout the year.

Sales forecast

Sales forecasts help determine whether your coffee shop can thrive. When crafting these projections, take into account seating capacity, average customer orders, sales channels, and menu.

Break it down into daily, weekly, monthly, quarterly, and yearly figures. Account for fluctuations and changes in demand to create accurate sales projections.

Overheads budget

These are the day-to-day expenses that keep your coffee shop running smoothly. To project these accurately, gather precise estimates from your suppliers and account for various costs like payroll, rent, administrative coffee shop monthly expenses, and more. An accurate overhead estimate ensures your coffee shop’s budget is on point.

5. Prepare Financial Projections

Figures are definitive and can act as a decisive point for investors. One look at the key reports and they will decide whether or not to invest in your coffee shop.

Let’s check these key components of financial projection:

Cash flow statement

A cash flow statement provides valuable insights into whether your coffee shop has sufficient funds to keep operations running smoothly.

To create an accurate cash flow statement for your coffee shop, you need to consider several critical factors. These include your sales figures, the cost of goods sold, and the budget for overhead costs, such as rent, staff salaries, and utilities.

When crafting your cash flow statement, it’s essential to be realistic with your assumptions. Consider industry standards and the current market situation.

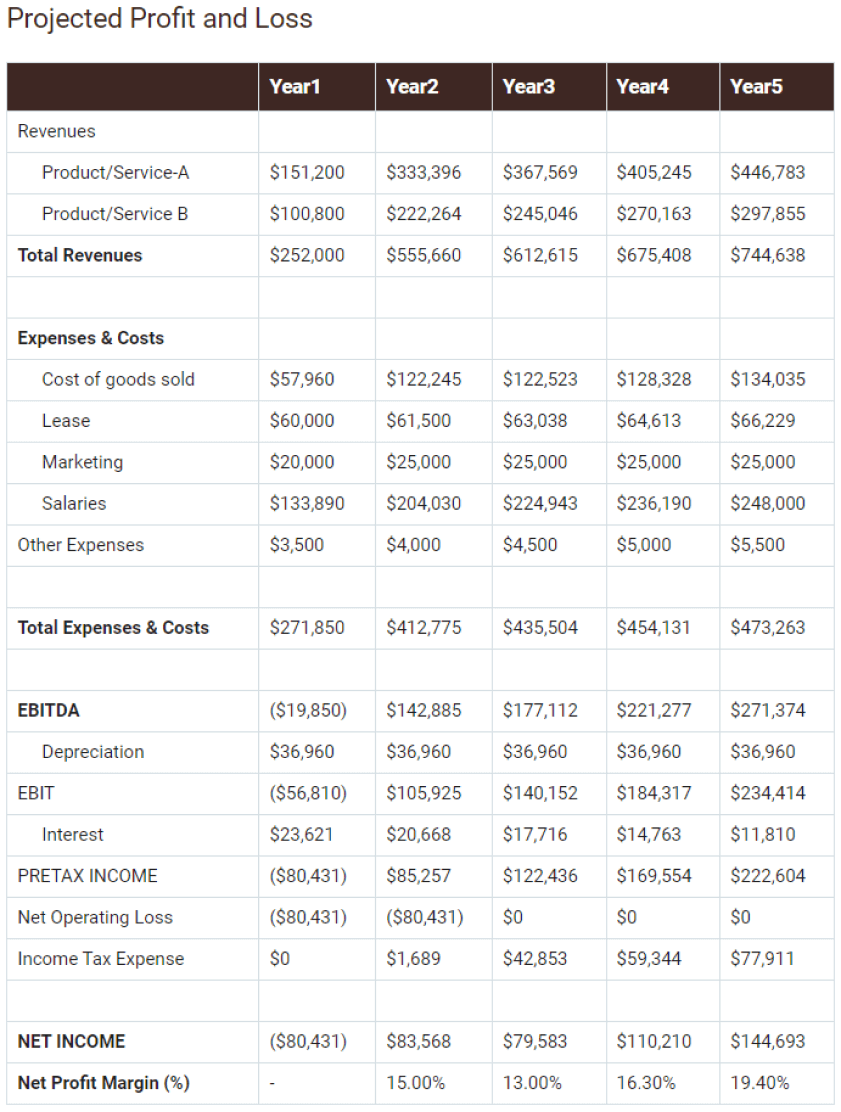

Income Statement

The income statement, also known as the profit and loss statement, offers insight into a coffee shop’s profitability, long-term financial goals, and business growth over the next 2-3 years.

Profit and loss measures the health of a coffee shop. By deducting the cost of goods sold from revenue, you get the gross margin.

Further, deduct the operating expenses and EBITDA to calculate the net profit of your coffee shop business. This is what interests investors the most.

The profit and loss statement overall gauges a business’s feasibility in the long term. Here is the projected income statement for 5 years using Upmetrics:

Balance sheet

A balance sheet is like a picture of everything your coffee shop has and what it owes. It’s a summary of the money your coffee shop owes to others, the money invested in it, and all the things it owns.

Investors pay attention to the balance sheet because it helps them understand how your coffee shop’s money is organized and how much profit it’s making. It’s also the starting point for figuring out different financial numbers that tell you more about your coffee shop’s financial health.

Break-even Analysis

Profit is the ultimate goal for any coffee shop operator. But when do you start generating the profits?

Break-even analysis helps determine how much sales volume is essential to reach the break-even point.

It answers an important question for investors: How long before the coffee shop turns profitable?

It can take years to reach break-even if there are loans to settle. However, you can still keep the coffee shop afloat and profitable with an appropriate understanding of fixed costs.

6. Test Assumptions

Your whole financial plan is built on predictions. Even if you’ve planned every detail carefully, unexpected challenges can still arise.

During this stage, it’s crucial to think about various “what-if” situations. Imagine different scenarios, where things go well, and others where they don’t.

For example, think about what happens if your coffee shop’s sales drop when the weather gets extremely cold or if the cost of your menu items increases unexpectedly due to rising inventory costs. These are extreme examples. You should also consider the in-between possibilities and adjust your financial projections accordingly.

To implement this kind of analysis, you can test your projected numbers with real data from similar coffee shops. Look at the financial reports of companies that are similar to what you’re planning.

It will help you check if your assumptions make sense and allow you to make changes where needed.

In simpler terms, it’s like trying out different “what if” scenarios to make sure your financial plan is robust and can handle unexpected twists and turns.

7. Monitor & Update Your Plan

Creating a financial plan is only the beginning. To make it work, you need to follow and alter it as required.

Remember, your financial plan is based on assumptions and market analysis. Real-world conditions can impact your coffee shop differently than you expected.

That’s why it’s crucial to monitor your business’s financial performance regularly. Compare the numbers in your financial plan with the actual numbers, and take note of any differences.

If you find that some metrics are significantly different from what you predicted, try to understand why. Once you identify the reasons, take action to correct the situation and update your plans accordingly.

Now that you have all the information to create a solid coffee shop financial plan, it’s time to start making projections and doing the necessary calculations.

Keep in mind that your plan should be flexible and adaptable to changing circumstances. It is not only about financial plan, but the whole coffee shop business plan should be flexible.

Download Free Coffee Shop Financial Plan Example

Creating a financial plan from scratch can get overwhelming. After all, Excel sheets are tiring and endlessly long. Worry not. Download this free coffee shop financial plan example prepared using Upmetrics to help you get started.

It includes all the key components of a business’s financial projection, including the balance sheet, cash flow statement, P&L or income statement, and break-even statement, simplifying coffee shop financial planning.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Start Preparing Your Coffee Shop Financial Plan

And there you have it – we’ve covered the essentials of financial planning for your coffee shop.

But now it’s time to put that knowledge into action. Feeling overwhelmed by the thought of creating a financial plan? Don’t worry; we’ve got you covered.

Upmetrics’ financial planning tool is here to make the process a cakewalk. Just input your projected assumptions, and we’ll handle the rest.

So, don’t delay any longer. It’s time to get started on your coffee shop’s financial plan now.