Most new dispensary owners fail—not because of their products, but because they don’t plan well.

Even it’s easy to get stuck with rules, high costs, finding good suppliers, and earning customer trust. Without a clear plan, running and growing your dispensary is much harder.

That’s why we created this dispensary business plan template. It helps you organize your ideas, plan your budget, and make a clear plan to grow. With it, you can focus on running a dispensary that customers trust and that succeeds.

Keep reading for tips on creating an investor-ready plan.

Why do you need a dispensary business plan?

Starting a dispensary isn’t just about selling cannabis products—it’s about running a legal, profitable, and well-organized business.

That’s why you need a business plan to guide you through important things like:

- How to follow all the laws and rules?

- How to get good suppliers and keep products in stock?

- How to set fair prices and still make a profit?

It’s exciting to open a dispensary, but without a plan, you risk compliance mistakes, financial losses, or falling behind competitors. With a clear plan, you can stay organized, avoid costly errors, and focus on growth.

If you’re applying for a license, a loan, or looking for investors, they’ll want to see a solid plan. This shows you understand the business, the market, and are serious about running a profitable dispensary.

Now that you understand why a dispensary business plan is important, let’s look at how to write one step by step.

How to write a dispensary business plan?

When writing a business plan for your dispensary business, it’s important to focus on the key parts that clearly share your vision and how you plan to succeed.

Here’s a simple guide to help you build a strong and effective dispensary business plan:

1. Executive Summary

The executive summary is your dispensary’s high-level introduction to readers. It gives them a quick idea of what your business is about. Even though it comes first, it’s easier to write after finishing the rest of your business plan because you’ll know all the details you want to highlight.

Start with your dispensary’s name and location. Then explain who your main customers are and how your dispensary will serve them.

Next, make sure to cover these important points:

- Products you’ll sell: List things like cannabis flower, edibles, concentrates, and smoking accessories.

- What makes your dispensary special: Maybe it’s high-quality products, friendly and knowledgeable staff, or excellent customer service.

- Money you’ll need: Explain how much funding is required for licenses, inventory, equipment, rent, and marketing.

- Your main goals: Share your financial goals and short-term plans to grow the dispensary.

Keep this section short and clear, using simple words. The goal is to grab attention and make readers want to learn more about your dispensary.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Business Description

The business description section gives more details about your dispensary. It explains the basics and helps people understand what your business is all about.

Start by writing your dispensary’s name and where it is. Do you have a physical store, sell online, or both? Say if you run the dispensary alone, with partners, or as a registered company like an LLC.

Next, write a short mission statement that explains what your dispensary wants to do. Then, write a vision statement that explains what you aim to achieve in the future.

If you’ve already sold products or worked in the industry, mention it. For example: “GreenLeaf Dispensary has been selling wellness and herbal products online and at local events for one year.”

Finally, add your short-term and long-term goals.

Short-term goals could be attracting local customers and offering delivery. Long-term objectives might be adding new products or building an online store.

Overall, keep this section engaging and clear. It should give readers a good idea of what your dispensary does, your plans, and who you are.

3. Market Analysis

Before opening a dispensary, it’s important to understand the industry and what customers want. The market analysis section shows that you know your target market and customers.

Here’s what you should cover in this section:

Industry overview

Start with the overall industry. How big is it? Is it growing? Share a fact to show opportunities. For example: “The global cannabis market is expected to earn about $70.71 billion in 2025 and grow around 3.4% each year, reaching $83.56 billion by 2030.”

Target market

Think about who will buy your products and what they need:

- Adults using cannabis for wellness: Herbal oils, supplements, or edibles

- Recreational users: Safe and legal products

- Local businesses: Wellness products for employees or customers

- Health-conscious community: Natural or organic products

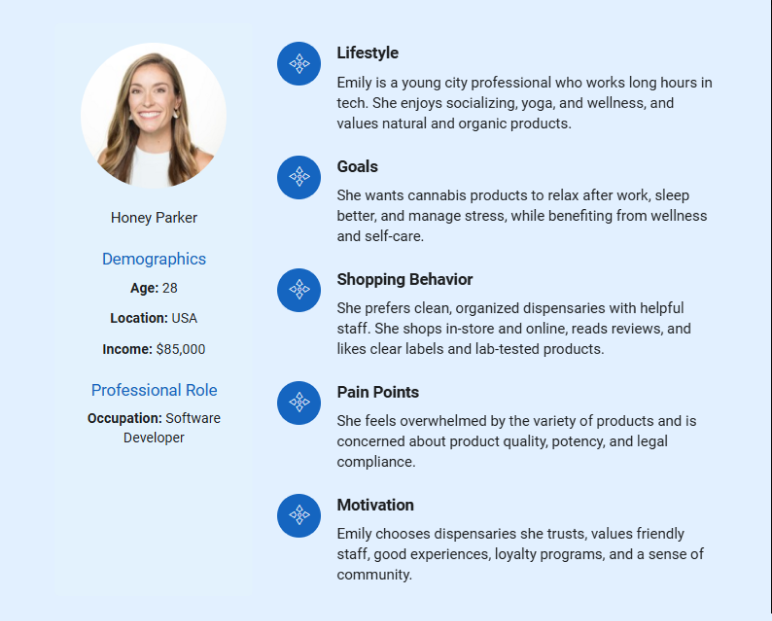

Creating a customer profile helps you understand and serve them better. For example:

Market trends

Note trends or gaps in the market. For example:

- Some people like online orders or home delivery.

- Customers want safe and easy ways to buy cannabis products.

- Many customers like eco-friendly or natural products.

Show how your dispensary helps, like with good products, friendly staff, delivery, or special items.

Regulations

To run a dispensary, you need to follow the rules and get the right licenses and permits. These usually include:

- State license

- Local permits

- Health and safety permits

Following these rules shows your dispensary is legal, safe, and trustworthy.

In simple words, this section shows that you understand the market and are ready to open a dispensary that meets real customer needs.

4. Competitor Analysis

Before starting your dispensary, it’s important to know who your competitors are. Understanding other businesses in the market helps you see what they do well, what they do poorly, and how your dispensary can do better and attract more customers.

Start by listing your competitors (direct and indirect, both).

Your direct competitors might be other dispensaries nearby. And indirect competitors could be online cannabis stores, herbal shops, wellness stores, or any place selling similar products.

Next, think about how your dispensary is different. This could be your competitive advantage. For example, you can offer:

- Better prices than others

- More variety of products and wellness options

- Delivery service for customers’ convenience

- Friendly staff to help customers

You can also do a simple SWOT analysis to check your strengths, weaknesses, opportunities, and threats. This helps you see what your dispensary is good at, what needs work, where you can grow, and what problems to watch out for.

The competitor analysis section shows that you understand your competition and have a clear plan to grow your dispensary successfully.

5. Products Offered

This section describes the products your dispensary will offer and how you’ll provide value to customers. It also shows how your business will make money.

Begin with the main products you’ll sell. For example:

- Wellness and Cannabidiol (CBD) products

- Cannabis-related products (if legal in your area)

- Accessories like vaporizers or storage items

- Edibles, oils, or tinctures

Next, talk about product quality. Mention if items are organic, locally made, or lab-tested, as this helps customers trust your dispensary.

Also, describe the packaging. Using gift-ready, eco-friendly, or discreet packaging makes products look appealing, professional, and can attract more customers.

Lastly, explain your pricing strategy. Say if products are sold by piece, grams, bottles, or in bundles.

Use clear pricing for customers.

In short, this section shows what products your dispensary sells, what makes them special, and why customers will want to buy from you.

6. Marketing and Sales Strategies

This section explains how you’ll attract customers and grow your dispensary. A good marketing and sales plan helps people know about your products and choose your store.

The following are some marketing tactics and sales strategies you may consider including in your plan:

Marketing strategies

- Create a simple website and use local SEO so nearby customers can find your dispensary

- Use social media platforms like Instagram and Facebook to share products, offers, and wellness tips

- Partner up with local wellness centers, gyms, or cafes to reach more customers

- Use flyers, posters, and vehicle branding to promote locally

- Run online ads to reach more customers

Sales strategies

- Respond to customer questions quickly

- Help customers pick the right cannabis or wellness products

- Follow up with customers who don’t buy right away

- Explain product benefits to customers

- Give discounts to new customers

A clear marketing and sales plan shows you know how to reach customers, promote your products, and encourage them to revisit your dispensary over others.

7. Management Team

Investors and lenders want to know who is running your dispensary and if they have the skills to make it successful.

In this section, introduce the key people involved in running your dispensary and highlight their relevant experience.

Start by introducing the owners or founders. Briefly describe their background and experience. For example, one founder may have experience in retail or wellness products, while another has knowledge of the cannabis industry and customer service.

Next, describe the people who will help you run the dispensary. This can include a store manager, sales staff, and inventory or stock manager. Explain what each person does and what experience they bring.

It’s also helpful to show an organizational structure to explain how roles are divided. This gives a clear idea of how the dispensary will run smoothly.

If you have mentors or advisors, include them too to show support and guidance for your business.

8. Operations Plan

As the name indicates, this section explains how your dispensary will run on a daily basis and how you’ll keep everything organized and working smoothly.

Here are the important aspects to cover in your dispensary operations plan:

Location & setup

Write where your dispensary is, like in a busy street or shopping area. Explain why this is a good place.

Daily operations

Describe what happens every day, for example:

- Open and close the dispensary

- Help customers and answer questions

- Restock and organize products

- Take payments

- Keep the store clean and tidy

Suppliers & partners

Say who provides your products and how often you order. Include any delivery services or partners that help your business.

Equipment & tools

Note down the main equipment you need, like shelves, a cash register, security cameras, and a computer. Include any programs or software you use to keep track of sales and stock. Here’s an example of how you can mention your tools and software:

Team & staff

Shed light on who works in your dispensary and what they do, like a cashier, sales helper, or manager. Say if you’ll hire more people as your business grows.

Hence, drafting a well-thought-out operations plan shows potential investors or lenders that your dispensary can run well, help customers, and grow over time.

9. Financial Plan

The financial plan is one of the most important parts of your dispensary business plan. It shows how your dispensary is expected to perform over the next few (3-5) years.

Begin by listing the money you need to start your dispensary, for example:

| Item | Estimated Cost (USD) |

|---|---|

| Store setup and furniture | $5,000 – $15,000 |

| Licensing and permits | $1,000 – $5,000 |

| Business registration and legal costs | $500 – $2,000 |

| POS system, computer, and security | $2,000 – $5,000 |

| Initial product inventory | $30,000 – $150,000 |

| Marketing materials | $500 – $2,000 |

| Total Estimated Cost | $39,000 – $179,000 |

Explain how you’ll pay for these costs—using your own money, a loan, or investors.

Then, explain how your dispensary will make money. You’ll earn from selling products like wellness items, cannabis products, and accessories.

Next, estimate how many customers you’ll have, how much each customer will spend on average, and how your sales might grow over the next 3–5 years.

Also, list your ongoing costs.

Fixed costs (stay the same each month): Rent, salaries, insurance, utilities, licenses

Variable costs (change based on sales): Inventory, packaging, marketing, delivery

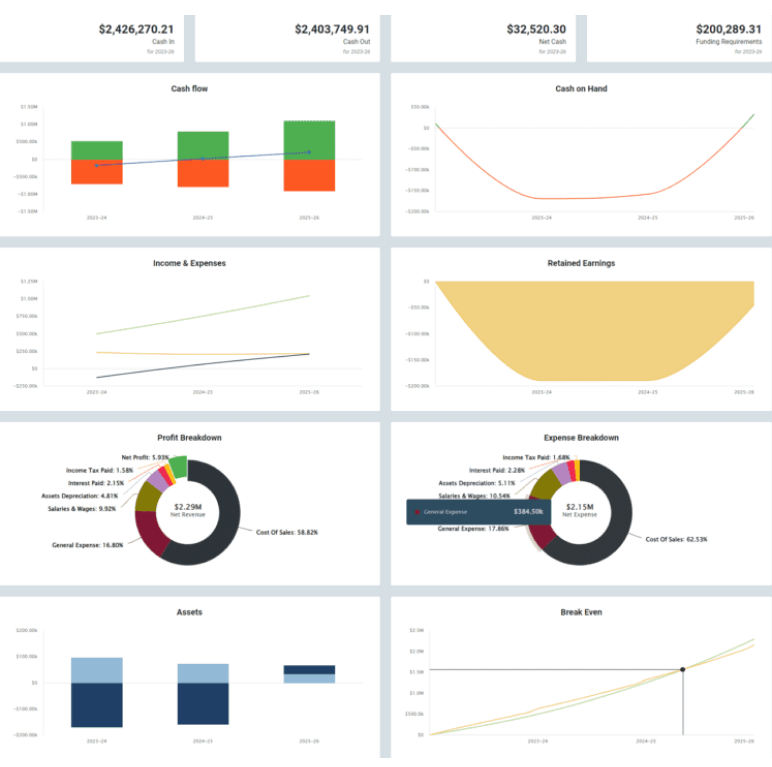

Include these 3 key financial reports to show your business’s monetary health and viability:

- Profit & loss statement

- Cash flow statement

- Balance sheet

From these, calculate your break-even point—how many customers or sales you need to cover all costs. Adding visuals like charts, graphs, or tables can make these numbers easier to understand. For instance:

If applicable, list key assumptions behind your numbers, such as:

- 50 customers per week in Year 1

- Average sale per customer is $50

- Marketing costs grow 10% each year

Lastly, if you’re asking for a loan or investors, explain how much you need, how you’ll use it, and when you expect to start making a profit.

With clear and realistic financial projections, you show that your dispensary is a smart and profitable business idea.

Download a free dispensary business plan template

Ready to make your own dispensary business plan, but not sure how to start? We’ve got you covered. Download our free dispensary business plan template PDF to get started right away.

This easy-to-use template has examples and a full outline, so you don’t have to begin from scratch. Just edit it to match your products and goals. It’s quick, simple, and helps you create a clear, professional plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Conclusion

Now that you’ve gone through this guide and have a free template in hand, creating a business plan for your dispensary should feel much easier.

But if you still need help with the details or want a faster way to put your plan together, Upmetrics can make it simple. With its smart AI tools, it streamlines the planning process and saves you time.

You’ll also get accurate financial forecasts, market research tools, and business planning resources to help you build a strong plan that wins over investors.

So, why wait? Start planning your dispensary today!