Launching a successful insurance agency takes more than just knowing how to sell policies—it requires strategic planning and a clear roadmap from day one.

That’s where an insurance agent business plan comes in. A well-crafted business plan helps you build, run, and grow your business with focus.

Wondering how to draft a plan?

Don’t worry! This insurance agent business plan template walks you through everything.

What is an insurance agent business plan?

Simply put, an insurance agent business plan is a strategic blueprint of how your agency will operate and grow. It outlines your mission, target market, insurance services, marketing approaches, team structure, and financial projections.

Whether you’re launching a new agency or expanding an existing one, this document acts as your roadmap for customer acquisition, service distribution, and sustainable development.

Why is a business plan important for an insurance agent?

Developing a business plan may seem like additional work, but this is an important step for any insurance agent to start an agency.

Here are some major reasons that a solid business plan is very valuable for an insurance agent:

- Provides direction and focus: A business plan acts like a compass for your insurance agency, defines your goals, and outlines strategies and milestones to achieve them.

- Attracts investors and partners: If you’re demanding money or co-operation, a well-structured business plan is required. This shows potential stakeholders that you’ve thought through your vision and created a growth plan.

- Helps identify challenges: Each business faces obstacles, and an insurance agency is no exception. A solid business plan helps you to estimate these challenges and prepare a strategy to overcome them.

- Installs benchmarks for success: A business plan sets a clear performance indicator (KPI), allowing you to track progress and evaluate success over time.

- Improves operational efficiency: Workflows, team responsibilities, and in advance by planning for daily operations, your business can run more smoothly and efficiently.

A business plan is more than only one document; it’s a powerful tool that guides your decision-making, attracts investors, and puts your insurance agency concentrated and placed on track.

How to create an effective insurance agency business plan?

Now, let’s dive into the step-by-step process of creating your insurance agent business plan. Here, we’ve broken down the key sections your plan should include and what to cover in each.

1. Executive Summary

The executive summary is the opening snapshot of your insurance company business plan, essentially a concise overview of your entire plan.

In this section, you’ll provide the highlights of your agency’s mission, goals, target market, and competitive advantage, as well as a glimpse of your financial outlook. Think of it as your agency’s elevator pitch in written form.

Since this is the first section readers might see, it needs to grab their attention and quickly convey what your insurance business is all about. Hence, keep your executive summary brief and engaging.

Here are the key elements to include in your executive summary:

- Business overview

- Mission statement

- Services and products

- Target market

- Competitive advantage

- Financial highlights

Even though this section comes first, many experts recommend writing it last, after you’ve worked out the details in the rest of your plan. That’s how your summary truly captures all the key points.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Company Description

In the company description section, you’ll tell the story of your insurance agency and explain what makes it special. This is where you provide the background story of your business and set the stage for why it will succeed.

This section underlines the major aspects of your insurance agency, who you are, what you provide, and how you plan to serve your customers effectively.

Here’s how to approach your business description section:

- Start with the basics of your agency, including the business name, legal structure, location, and either the established date or intended launch date.

- Next, underline your mission and long-term vision. What does your agency do to fit in the insurance industry, and how do you plan to grow?

- If your agency is already in operation or you have prior experience, then highlight the major milestones, such as when and how the business started and any major achievements to date.

- Define the types of insurance policies or products that your agency will offer. Be specific; it helps you bring your agency into a position within the market.

- Describe your target market. Who are your ideal customers in terms of age, place, profession, or needs? This shows a clear understanding of your customer base.

- Highlight your unique sales proposal. What does your agency separate? This may be individual service, flexible hours, or strong community engagement.

Finally, if you have a team or plan to create one, share a brief description of your company’s culture and values. In the world of insurance, trust and service matter—clarify your perspective.

Overall, the company’s details should portray the picture of the identity and purpose of your agency.

By the end of this section, the reader should understand the background of your agency, what you’re planning to do, and why you believe that there is an opportunity for success.

3. Market Analysis

The market analysis section demonstrates that you have a deep understanding of the insurance market you’ll operate in.

As an insurance agent, it’s crucial to know your industry landscape, your target customers, and your competition. This section will typically cover:

Industry Overview

Start with a brief overview of the insurance industry relevant to your niche. You might include the size of the market and growth trends. Focus on the segments you’ll operate in.

Target Market Analysis

Dive deeper into your target customer segments identified in the company description. Provide data or estimates of the number of potential customers in your area or niche.

Customer Needs and Preferences

What do customers in your target market typically look for in insurance? Do they value face-to-face consultation, or are they moving toward online services?

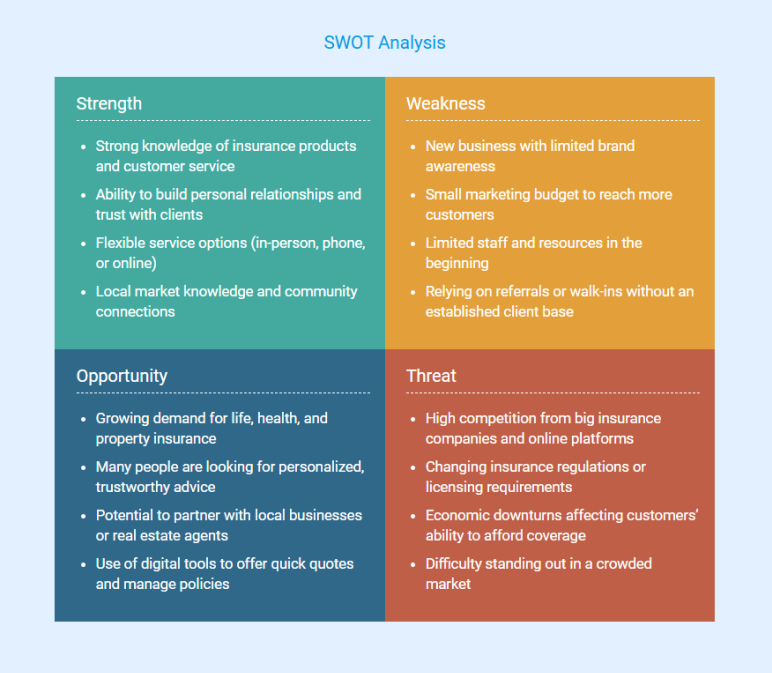

SWOT Analysis

To better understand the business’s position in the market, a SWOT analysis is conducted. It highlights internal strengths and weaknesses, as well as external opportunities and threats. These factors help you plan for future growth and stay competitive.

Regulatory Environment

If there are key regulations or licensing requirements that impact your business, mention them briefly. This shows you’re aware of compliance issues.

Market Trends and Opportunities

Discuss any trends that affect your business. Is the local population growing? Are there new insurance needs emerging? Mention how these trends create opportunities for your agency.

By the end of the market analysis, you should convince the reader that there is a viable market for your insurance services and that you understand the landscape thoroughly.

4. Competitive Research

While conducting the market analysis, you should delve deeply into your competitive research and clearly outline how you’ll stand strong among other insurance providers.

Knowing your competition is important to carve your niche and define your unique value offer in a crowded insurance market.

In your competitive research section, include the following:

- List of key competitors: Identify the main (direct & indirect) competitors in your region or niche.

- Competitor offerings: Summarize what each competitor offers. Note the lines of insurance they sell, any specialty areas, and what client segments they target.

- Strengths and weaknesses: Assess each competitor’s strengths and weaknesses.

- Your competitive advantage: Based on the above, clearly state how your agency will differentiate itself.

- Competitor comparison table (optional): You might include a simple table comparing your agency to others based on key factors.

Remember to stay professional and factual. This section isn’t about bashing competitors, but rather showing you’ve done your homework on the competition and have a plan to offer something better or different.

5. Services Offered

In this section, you’ll need to detail the insurance products and services your agency will provide. This is essentially your “menu” of offerings, and it’s important to be clear and specific so readers know exactly what you’re selling.

Here’s how to approach this section:

- List the insurance products your agency will offer, such as auto, home, life, health, commercial, and specialty lines.

- Be specific by naming the exact types of policies you’ll provide under each category.

- Explain the key features and client benefits of each product without going into full policy details.

- Include any insurance carrier partnerships you have or plan to establish to deliver these policies.

- Describe how you’ll deliver services, like consultations, policy reviews, or claims assistance.

- Outline any plans for expanding services in the future to show a long-term vision.

- Highlight any offerings that fill gaps in the local market to reinforce your competitive edge.

By clearly outlining what you’re selling and why it’s beneficial, you not only clarify your business model for readers but you also set the stage for your marketing and sales strategy.

6. Marketing and Sales Strategy

Having great insurance products is one thing, but you also need a plan to attract and retain clients.

The marketing and sales strategy section explains how you’ll promote your services, acquire customers, and achieve sales goals.

Here’s what to cover in this section:

- Brand positioning: Define your agency’s identity and the image you want to project in the market.

- Marketing channels: Identify and underline the specific channels that you will use to reach potential customers.

- Unique marketing strategy: Highlight any specific strategies that separate your agency.

- Sales strategy: Explain the sales process you’ll use to turn leads into clients.

- Pricing and commission: While premium rates are set by carriers, the agency adds value through personalized service and client support that enhances the overall experience.

- Customer retention strategy: Emphasis on the importance of maintaining customer relationships after the sale.

Finally, make sure your marketing plan matches your current capabilities. If you’re starting out as a solo agent, you may not have a large advertising budget, so it’s smart to focus on affordable, high-impact tactics.

7. Operations Plan

The operations plan outlines the day-to-day operational setup of your insurance agency—essentially, how you’ll deliver your services and run your business on an operational level.

The following are the key points to include:

Business Location & Office Setup

Describe your office location and why it’s suitable. Will you have a physical storefront or office space where clients can walk in? If so, provide the location and any advantages.

Office Hours and Availability

State when your agency will be open for business and how clients can reach you. This assures that you have a plan to be accessible to customers.

Team and Staffing Plan

If you’re a one-person operation initially, say so and mention any plans to hire support staff once you hit certain growth milestones. If you have a team, outline roles and responsibilities.

Processes and Workflow

Describe the typical workflow for serving a client. Outlining this shows you have a systematic approach for efficiency. Also, cover processes for policy renewals, claims support, and any cross-selling or upselling processes.

Growth and Scalability

Explain how your operations will scale as you grow. This shows foresight in managing an increasing workload without sacrificing service quality.

By covering these points, your operations plan will show that you’ve planned out the practical aspects of running your agency efficiently and effectively.

8. Management Team

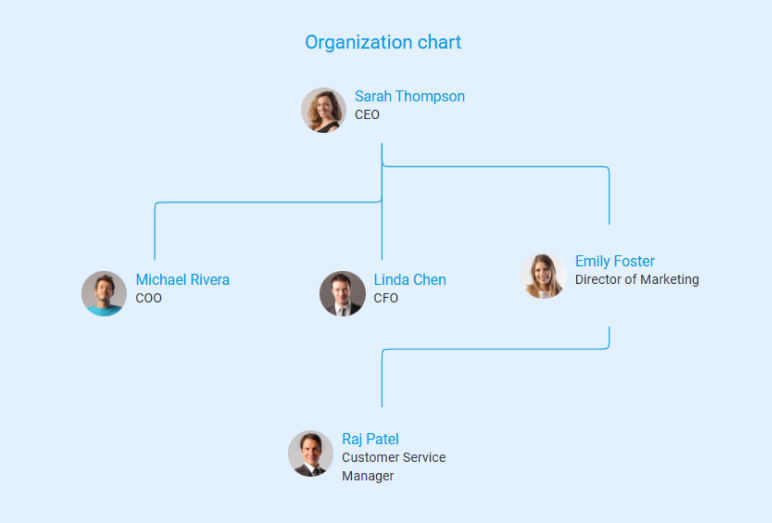

In the management team section, describe the people responsible for the operations of your insurance agency. It’s important for you to outline the important people who are doing significant work and contributing value to your business, whether you’re doing it alone or are on a team.

Start by providing a summary of each person’s qualifications and professional experience. Include licenses, certifications, education, and other formal qualifications or specific skills that provide strength to your agency.

Clearly identify each person’s title, role, and contribution in the business. Even if some of this information is within their biographies, make it obvious as to who is doing what.

Operating an insurance agency will likely have you collaborating with other professionals outside of the agency, including accountants, or providing advice from lawyers, or marketing consultants.

Identify other essential support roles that contribute to the operational functioning of the business.

Once you have introduced the key team members, provide a summary of your agency’s organizational structure.

This allows the reader to envision what the hierarchical structure of your agency looks like and how roles are interconnected. For instance:

9. Financial Projections

This section is where you translate your business plan into numbers. It’s a critical part of your plan, especially if you’re seeking a loan or investment, because it shows the expected financial outcomes and viability of your insurance agency.

While planning this section, consider including these important financial projections:

- Revenue model

- Sales projections

- Operating expenses

- Profit & loss projection

- Cash flow estimates

- Balance sheet

- Break-even analysis

- Financial assumptions

Your financial plan section should be grounded in the details of your plan and should demonstrate a path to profitability.

Keep in mind that existing agencies often show profit from renewals, but as a new agency, the first year might even be a loss or just breaking even—that’s okay if the growth trajectory is solid.

10. Funding Request (if applicable)

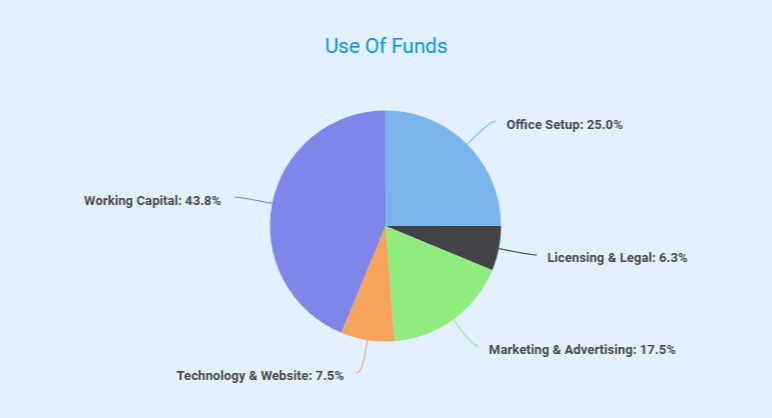

This section is required only when you’re demanding external funding to start or develop your insurance agency, such as debt, investor capital, or perhaps a line of credit.

If required, give a simple breakdown of the use of funds. Here’s a sample of how the requested funding will be used to support the startup and long-term development of the insurance agency.

Remember to keep this section brief and factual. It should create the belief that you know how much you need and will use it wisely to do business.

Download a free insurance agent business plan template

Writing a business plan can feel like a big task, but you don’t need to start from zero. Download our free insurance agent business plan template in PDF to get started.

This customizable template follows the structure outlined in this guide and comes with pre-written content and financial examples specifically designed for an insurance agency. It saves you time and helps make sure you cover every important section.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Conclusion

We’ve covered all the key elements of an insurance agency business plan, from your services and operations to marketing and financial projections. You also have access to a free sample plan to help guide you through the writing process.

However, if you’d prefer to skip the formatting and focus on your business, Upmetrics can help.

It’s an AI-powered tool that simplifies business planning, from financial forecasts to market research. It helps you generate an investor-ready plan in just a few minutes.

Don’t wait! Try Upmetrics today and turn your insurance agency vision into a successful business.