Many new loan officers work hard but struggle to land clients because they don’t have a clear plan to prove their value.

Lenders want to see you know the market and have a strategy—but figuring out how to show that is confusing. Without a solid business plan, getting started feels impossible.

That’s why we created this template. It guides you step by step through licensing, marketing, finances, and operations—so you don’t miss any key details.

Download this free loan officer business plan template and get closer to launching your loan officer business.

Keep reading for tips on how to use the template and draft a plan with ease.

How to write a loan officer business plan?

An effective loan officer business plan explains what your business does and how it plans to succeed.

Here’s a simple 9-step guide to help you put together a strong plan for your loan officer business:

1. Executive Summary

Every great business plan begins with a strong executive summary. This section gives a quick snapshot of your loan officer business and why it will succeed.

It’s best to write this part after you finish the full plan. Keep it short—about one page—and make it interesting because many readers only see this section.

While drafting your plan summary, include these key points:

- Business introduction: What’s your business name, and where is it located? What loan services do you offer?

- Market opportunity: Why is this a good time to start a loan officer business? Is there a growing demand for loans in your area?

- Services and value: What loan services will you provide? How are you different from others?

- Marketing and sales plan: How will you get clients and make money? Will you earn commission, charge fees, or both?

- Financial highlights: What are your expected earnings for the first year? Do you need funding to get started?

This summary should quickly show readers what your business is about and why it’s a good opportunity. Keep the tone clear and confident.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Business Overview

As a loan officer, you can’t just say, “I help people get loans.” You need to show that you understand the business side, industry rules, and how you fit into the market.

Here’s what to include in this section:

Business type – Say if you are a sole owner, LLC, or corporation. This is important for licensing and taxes.

Location – Share where your office is and if it’s easy for clients to visit. If you also work online, mention that too.

Mission statement – Keep it short and real. For example:

“To guide clients through the loan process with honesty, expertise, and excellent customer service, ensuring they get the best possible financing.”

Company history (if any) – If you have past experience in banking, finance, or real estate, include it here. If you’ve already helped clients secure loans in another role, mention that too.

Goals – Show how you’ll grow your business. Add your short-term and long-term goals. For example:

- Short-term goals might be getting a license, closing your first loan, or building client referrals.

- Long-term goals might be offering more loan types, hiring staff, or expanding your business.

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

To succeed in this business, it’s important to understand how the loan industry works and how much people need these services.

The market analysis section explains what’s happening in the loan industry, who your target customers are, and how you can stand out from competitors.

Here’s what you need to include in this section:

Industry Overview

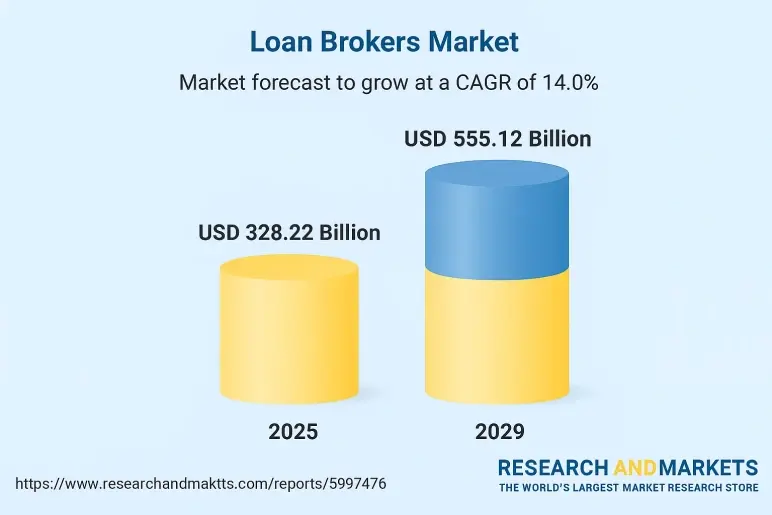

Start by understanding how the mortgage and loan industry is performing. This shows lenders, partners, or investors that you’re stepping into a market with strong demand and real potential.

The mortgage market is large and still increasing. More people are buying homes, refinancing, and investing in property, so loan officers are in demand.

You can also add a simple chart to show how the market is growing. For example:

This shows the market is getting bigger, giving you more chances to get clients.

Target Market

Think about who needs your services most. Here are some common types of customers and what they usually want:

| Customer Type | What They Need |

|---|---|

| First-time homebuyers | Help understanding the process and finding low-down payment options |

| Homeowners refinancing | Lower interest rates or smaller monthly payments |

| Real estate investors | Loans for rental or commercial properties |

| Self-employed people | Help getting approved with non-traditional income |

Market Gaps & Trends

Look for things missing in the market or new trends. For example:

- Many people want faster, online-friendly loan applications.

- Some borrowers need loan options that banks don’t offer.

- Growing interest in government-backed loans like Federal Housing Administration (FHA) or Veterans Affairs (VA) loans.

Your business can stand out by offering personal service, different loan options, and quick approvals.

Regulatory Environment

You need to follow certain rules and get proper licenses. For example:

- A loan officer license in your state.

- Following federal lending rules like the Truth in Lending Act (TILA).

- Protecting customer information and privacy.

In short, this section shows you understand the loan industry, the customers you want to help, and how your services will meet real needs in the market.

4. Competitor Analysis

Before starting your loan officer business, it’s important to know who else is offering similar services. This section explains who your competitors are and how you’ll be different.

First, list other loan officers, mortgage brokers, and banks in your area. Write a short note on each—what loans they offer, how fast they work, what they charge, and what people like about them.

Also, think about indirect competition, like online lenders, credit unions, or real estate agents who send clients to certain loan officers.

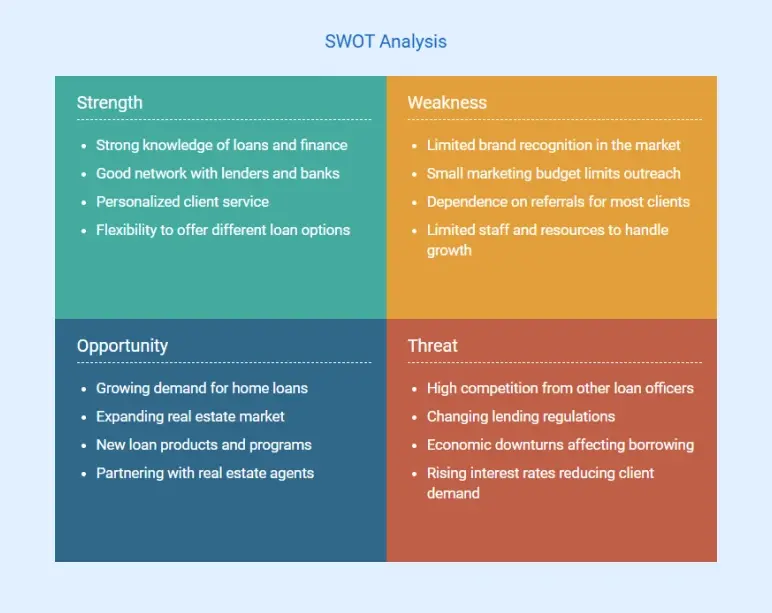

If possible, you can also add a simple SWOT analysis. This means writing down your strengths, weaknesses, opportunities, and threats. It shows where you are strong and what challenges you should watch out for.

Finally, explain what makes you special—faster loan approvals, better options, friendly service, or clear communication. Show why people should choose you instead of others.

By the end, it should be clear that you understand your competitors and know how to stand out.

5. Services Offered

In this section, you explain what services your loan officer business will provide and how you’ll charge for them.

Start by listing your main services. This may include:

- Home purchase loans

- Refinancing

- First-time homebuyer programs

- Investment property loans

- Loan pre-approval

- Credit improvement guidance

You can also give extra help, like free loan workshops or online tools to calculate payments, so clients see you have more than one way to help.

To make it easy for clients, you can add a table that shows each service, a short description, and how you charge for it. This helps them quickly understand what you offer.

| Service | Description | Pricing Method | Estimated Price (USD) |

|---|---|---|---|

| Home Purchase Loans | Arrange loans for buying a home. | Commission from lender / flat fee | $500–$1,500 or 1% of loan |

| Refinancing | Replace an old loan with better terms. | Commission from lender / flat fee | $400–$1,200 |

| First-Time Homebuyer Programs | Guide first-time buyers to special programs. | Commission from lender | $0–$800 |

| Investment Property Loans | Loans for rental or investment properties. | Percentage of loan / commission | 0.5%–1% of loan |

| Loan Pre-Approval | Provide letters showing borrowing limit. | Flat fee or free service | $0–$200 |

| Credit Improvement Guidance | Tips to improve credit for better loans. | Hourly rate / flat fee | $50–$150 per hour |

When you talk about pricing, be clear and open. Some loan officers get paid a commission from the lender, some charge a flat fee, and some take a percentage of the loan amount. Let clients know this from the start.

Keep your services and pricing simple so people understand exactly what you do and how you make money.

6. Marketing Strategies

The marketing section of your plan explains how you’ll find clients, turn them into borrowers, and keep them coming back for future loans.

Here are some ways to market your loan officer business:

- Social media: Share tips about home loans, buying houses, and refinancing on Facebook, Instagram, and LinkedIn.

- Networking and referrals: Work with real estate agents, builders, and financial advisors who can send you clients.

- Paid ads: Use Facebook, Google, or LinkedIn ads to reach people looking for a loan.

- Website: Make a simple, professional website that covers mortgage calculators, client reviews, and easy ways to contact you.

- Helpful content: Write short blogs, post videos, or send emails about loan options and credit tips.

After that, discuss your sales process. Explain how the client onboarding process works:

- Give a free consultation

- Suggest the best loan options

- Follow up within a few days

- Keep client details and loan progress in a tracking system

If you have a unique marketing hook, like “Fast 7-Day Pre-Approval” or “Zero Closing Cost Options,” mention it here.

In short, this section shows that you know how to find your audience, build trust, and turn them into happy, long-term clients.

7. Management Team

A strong business starts with a strong team. This section shows who is behind your loan officer business and why they can help it succeed.

Start with yourself, the founder. Share your work experience in lending, mortgages, or finance, along with any certifications or training. Mention any big achievements, like helping many clients get approved for loans or building strong lender connections.

Then, introduce other key team members if you have, such as a loan processor, marketing specialist, or office assistant. For each person, include:

- What they do in the business

- Their education or certifications

- Skills they bring

- Experience in the lending industry

Even if you don’t have employees, you might have an advisory board or mentors. Listing their names and expertise can add credibility and show that you have expert guidance.

If relevant, talk about your business values—like providing excellent customer service, being honest, and keeping clear communication.

This section proves that your team is skilled, reliable, and ready to grow the business.

8. Operations Plan

This section explains how your loan officer business will run each day and how you’ll serve clients efficiently while staying compliant with all regulations.

A clear operations plan shows you can handle client needs, process loans smoothly, and maintain high service standards.

When writing this section, break down the entire client process—from the first contact to loan approval and closing. Be specific about tools, systems, and staffing.

Here’s what to include in this section:

- Office setup – Home office or rented office with furniture and equipment

- Tools and software – CRM, loan processing systems, e-sign tools

- Client process – Taking applications, collecting documents, and getting loans approved

- Partners – Lenders, banks, credit agencies, and title companies you work with

- Staffing – Loan processors, assistants, or marketing support

- Compliance – Licenses, data safety, and legal record-keeping

- Growth plan – More clients, more partners, and stronger marketing

In short, your operations plan proves you can meet client needs on time, maintain compliance, and grow your business successfully.

9. Financial Projections

The financial projection is where you turn your business plan into numbers. It shows if your loan officer’s business is financially sound and how it’s expected to perform over the next few years.

Start by listing how much money you’ll need to launch your business. Break this into categories so it’s clear where your money is going:

| Item | Estimated Cost (USD) |

|---|---|

| Office space or home office setup | $500–$2,000 |

| Licensing and certification fees | $300–$1,000 |

| Business registration and legal costs | $200–$800 |

| Computer, printer, and phone setup | $1,000–$2,000 |

| Website development | $500–$1,500 |

| Marketing materials | $300–$1,000 |

| Total Estimated Cost | $2,800–$8,300 |

Explain how you’ll pay for these costs. Will you use your own money, take a loan, or get investors? If you’re asking for money, say how much you need and what you’ll use it for.

Next, explain how your business will earn income. As a loan officer, you can make money from:

- Commissions from lenders

- Origination fees from clients

- Consulting or service fees

Give a sales forecast for the next 3–5 years. Estimate how many clients you’ll serve, your average income per client, and how that grows over time.

Then, list your main business costs. These include:

Fixed costs (stay the same each month):

- Office rent or utilities

- Software or tools

- Insurance and licenses

- Staff salaries (if any)

- Loan payments

Variable costs (change based on your work):

- Advertising and marketing

- Office supplies

- Travel or client meeting costs

You can also include your break-even point—the number of clients you need to cover your costs.

Also, add these 3 simple financial reports to show how your business will do:

- Profit and loss statement

- Cash flow statement

- Balance sheet

These help readers see the full financial picture.

Don’t forget to list the key things you’re assuming in your plan. For example:

- You’ll get 3 new clients per month in Year 1

- Average income per client is $2,000

- Marketing costs will grow 10% each year

This helps show that your numbers are based on real thinking, not guesses.

Finally, if you’re asking for funding, say when you expect to pay it back or when your business will start making a profit. Show how the money will help your business grow.

With a clear and realistic financial plan, you show that your loan officer business is not just a good idea—but a smart investment too.

Download a free loan officer business plan template

Want to start your loan officer business but not sure how to begin? Don’t worry—we’re here to help! Download our free loan officer business plan template PDF and take the first step toward your business journey.

This easy-to-use template is made for new loan officers and small lending business owners. It includes real examples and a simple layout to help you fill out each section. Whether you’re just starting or planning to grow, the template will help you stay organized, focused, and ready to get funding.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Conclusion

Having a business plan puts you on the right track to building a successful loan officer business. It helps you stay clear about your goals, make smart decisions, and show others—like lenders or investors—that you’re serious about your business.

If you still feel unsure or want an easier way to create your plan, try Upmetrics. It has an advanced AI assistant, financial forecasting features, market research tools, and 400+ customizable templates to guide you through everything.

So go ahead—start planning today and bring your loan officer business idea to life!