Executive Summary

MileStone Property Management is a Denver-based residential property management start-up that has a business model of serving individual landlords and small residential property owners in the Denver metro area. The company is also a third-party management company that does not own or invest in real estate.

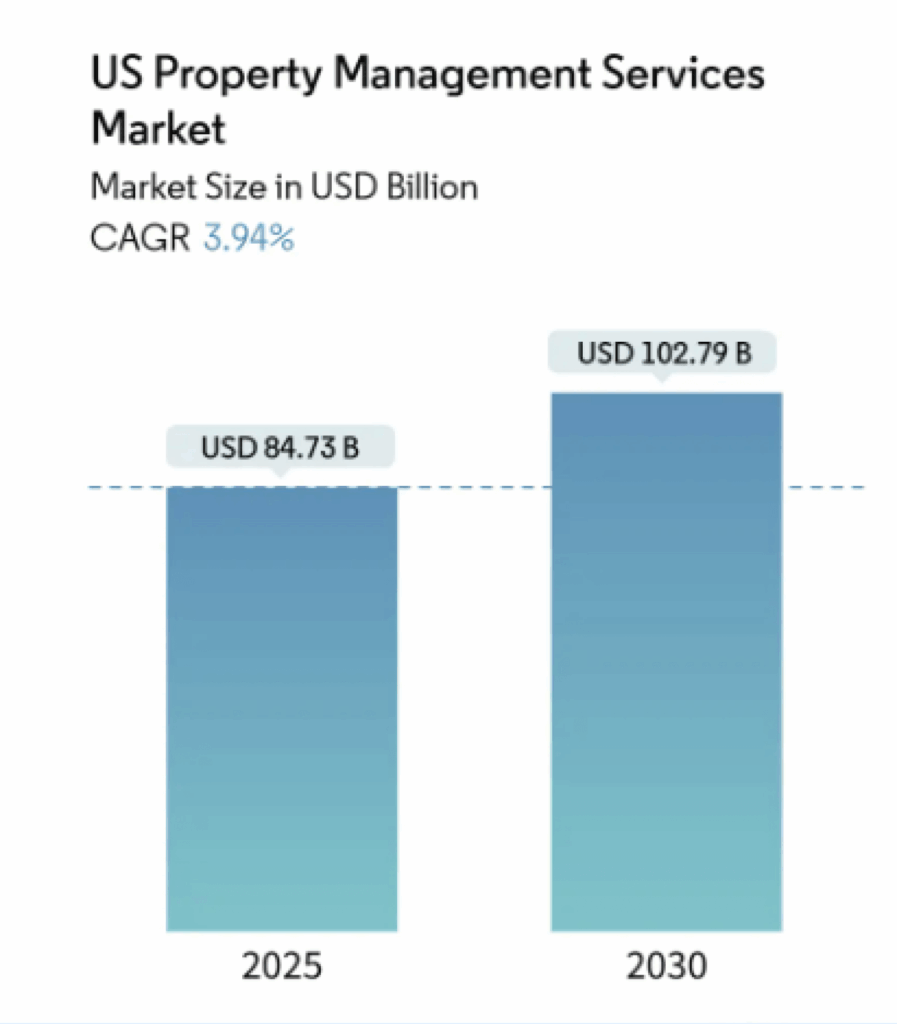

MileStone was established after the founders observed that many small landlords struggle to manage leasing, tenant concerns, and compliance, especially when balancing full-time jobs or living out of state. The U.S. market of property management services is $84.73 billion in 2025, which means that the residential property management services will be in high and continuing demand within the outsourcing framework.

Olivia Carr and Mason Ortega are the co- founders of the business. Olivia Carr and Mason Ortega have practical experience in residential leasing coordination and tenant-facing service positions in the Denver market, and in financial tracking, compliance, and reporting, respectively.

The company operates as a lean, owner-managed business with no W-2 employees and no owner salaries until operating break-even is achieved. Maintenance is coordinated through licensed third-party vendors, limiting fixed costs and operational risk.

MileStone targets individual landlords and small residential property owners with portfolios of one to ten units. Core services include:

- Tenant screening and placement

- Lease administration and renewals

- Rent collection and owner disbursements

- Maintenance coordination through licensed vendors

- Routine property inspections

- Financial reporting and owner communication

The company is proposing to take a local bank term loan of up to 75,000 dollars with FirstBank of Colorado to finance office set-ups, software set-ups, marketing, professional services, and working capital reserves. MileStone projects that will handle an average of 35 units per year in Year 1, an increment of 70 units in Year 2, and 110 units in Year 3. Break-even occurs at an estimated 43 managed units using only management fee revenue to sponsor a modest and lender-consistent repayment plan.

A business plan shouldn’t take weeks

Company Overview

MileStone Property Management is a residential property management company that is designed in such a way that it offers systematic management of long-term rental properties.

MileStone is a company that focuses on the management of private homes and small multifamily residential buildings on behalf of the landlords who prefer to have their rent executed properly, well documented, and under control in case they have to be involved in the daily running of the premises. The business is modeled as an owner-operated lean business model, where dominance is of disciplined processes, adherence, and open reporting, as opposed to portfolio scale.

The business was established because of the typical gap in the local market: small landlords tend to get little attention from the larger management companies, and at the same time, they do not have the time, systems, or local presence to efficiently handle the properties themselves. MileStone is a lean, owner-managed service company with low growth and controlled fixed-overhead.

Business Identity

MileStone Property Management operates as a Colorado limited liability company providing full-service residential property management and tenant placement. Revenue is generated through recurring monthly management fees and leasing services, creating a predictable income base as the managed portfolio grows. The business model is intentionally conservative and designed to reach break-even without owner salaries or staffing in the early stages.

Ownership and Management

Ownership is split between two partners with clearly defined roles.

| Owner | Ownership | Role |

|---|---|---|

| Olivia Carr | 70% | Managing Broker |

| Mason Ortega | 30% | Operations and Finance |

Olivia Carr oversees licensing compliance, leasing coordination, fair housing adherence, and owner communication. Mason Ortega manages financial tracking, reporting, compliance documentation, and vendor coordination.

Mission and Value Proposition

The mission of MileStone is to ensure that small landlords have a good management service to retain the units in rent, preserve the property, and give precise and precise information.

The company prioritizes uniformity of leasing criteria, designed move-in and move-out procedures, rigorous maintenance management by licensed vendors, and elementary and clear pricing. This approach helps owners reduce vacancy time, avoid compliance issues, and maintain steady cash flow

Location and Service Area

The headquarters of the company is located on Capitol Hill at 1478 Clarkson St., Suite 210, Denver. This prime strategic point enables easy access to the proven rental grounds like the Capitol Hill, City Park, Congress Park, Cherry Creek, and other residential neighborhoods. MileStone is used as a service by the clients throughout the Denver metro area, with special attention to properties where the honest local management can bring the most value.

Services and Pricing

MileStone Property Management provides residential long-term rental management services exclusively. The service structure is designed to give small landlords clear pricing, predictable costs, and reliable oversight without unnecessary complexity.

Long-Term Rental Management

MileStone offers full-service management for single-family homes and small residential properties. The monthly management fee covers the core operational responsibilities required to manage a rental property effectively.

| Service Area | Description |

|---|---|

| Tenant Placement | Marketing coordination, screening, and lease execution |

| Lease Administration | Lease setup, renewals, and documentation |

| Rent Collection | Rent tracking, collection, and owner disbursements |

| Maintenance Coordination | Scheduling and oversight through licensed vendors |

| Property Inspections | Routine inspections and issue documentation |

| Owner Reporting | Financial reports and ongoing communication |

Pricing

- Monthly management fee: 8% of collected rent

- Leasing and tenant placement fee: 75% of one month’s rent

There are no minimum unit requirements, and pricing is consistent across managed properties.

Maintenance Coordination

All maintenance work is performed by licensed third-party vendors. MileStone coordinates service requests, schedules repairs, and documents work through its property management system.

- No in-house maintenance staff

- No maintenance markup in Year 1

- Vendor costs are passed through at cost to the property owner

This approach limits payroll exposure and keeps fixed operating costs low.

Administrative Services

Routine administrative activities are included as part of the core management service. No standalone administrative fees are charged outside of leasing services in Year 1.

Software and Systems

Operations are supported by established, cloud-based systems that enable accurate tracking and owner communication.

| System | Purpose |

|---|---|

| Buildium | Property management, reporting, and owner communication |

| Rently | Self-guided showings |

| TransUnion SmartMove | Tenant screening |

| QuickBooks Online | Business-level accounting |

Want a professional plan like this sample?

Let Upmetrics AI generate a complete, investor-ready plan for you.

Plans starting from $14/month

Market Analysis

The demand for professional property management services is increasingly driven by property owners, not renters. Research shows that 51% property owners now rely on third-party management services instead of self-managing their properties.

This shift is particularly notable among small landlords and absentee owners, who often lack the time, local presence, or operational infrastructure to handle leasing, compliance, rent collection, and maintenance themselves.

The U.S. property management market, projected to reach $84.73 billion in 2025, reflects this growing trend of outsourcing.

The complexity of property ownership has increased due to evolving compliance requirements, heightened tenant expectations, and operational challenges. As a result, property owners are increasingly turning to professional services to help them navigate these demands.

This trend directly aligns with MileStone Property Management’s business model: providing system-based, reliable property management services that streamline operations, reduce burdens on landlords, and ensure consistent cash flow. The growing need for outsourced management services presents a significant opportunity for MileStone to deliver the essential services landlords require.

Local Rental Market Conditions

The U.S. property management market is increasingly driven by property owners, specifically, small landlords, absentee owners, and those managing single-family homes or small multifamily properties, who prefer to outsource the complexities of leasing, tenant management, maintenance, and compliance.

In Denver, for example, while renter-occupied households make up 51% of the total, there is a significant portion of owners (49%) who prefer not to self-manage.

As the rental market continues to evolve, small landlords and absentee owners face rising pressure to manage properties efficiently, especially with compliance demands, tenant expectations, and maintenance needs increasing. This creates a growing opportunity for companies like MileStone Property Management to step in, offering professional management services that streamline operations, reduce the burden on owners, and ensure consistent cash flow.

Target Client Segments

MileStone focuses on landlord segments that face the greatest operational and compliance burden in a more competitive rental market. Each segment is defined by a clear problem state and a specific management need.

| Target Segment | What the Client Needs | How MileStone Addresses It |

|---|---|---|

| Small Local Landlords (1–10 units) | Day-to-day leasing and tenant management without disrupting full-time work or personal schedules | Handles leasing, rent collection, maintenance coordination, and tenant communication through structured systems |

| Out-of-State Property Owners | Reliable local presence to manage tenants, vendors, and compliance requirements | Provides on-the-ground oversight, routine inspections, and consistent owner reporting |

| First-Time Rental Owners | Guidance on leasing standards, legal compliance, and ongoing property operations | Delivers full-service management with standardized screening, documentation, and compliance-driven processes |

Demand is strongest in centrally located and established residential neighborhoods where rental turnover is steady, and owners prioritize reliability, responsiveness, and clear reporting over scale-based pricing.

Competitor Overview

Direct Competitors

Denver’s property management market includes local firms, regional operators, and national platforms.

| Competitor Type | Strengths | Weaknesses |

|---|---|---|

| Large Regional Firms (e.g., Evernest, Atlas Real Estate) | Brand recognition, large vendor networks, strong online presence | High portfolio loads per manager, less personalized service |

| Local Mid-Sized Firms (100–400 units) | Market familiarity, local vendor relationships | Often, capacity-constrained, inconsistent service quality |

| Franchise-Based Operators | Standardized systems, marketing support | Rigid pricing, limited flexibility for small owners |

Many competitors are structured to prioritize scale and standardized workflows, which can be inefficient for owners with small portfolios who require hands-on oversight and faster response times.

Indirect Competitors

| Indirect Option | Strengths | Limitations |

|---|---|---|

| Self-Management by Owners | No management fee | Time burden, compliance risk, and slower leasing |

| Real Estate Agents Managing Rentals | Leasing expertise | Limited ongoing management focus |

| Property Management Software Only | Low cost | Requires owner time and operational knowledge |

These alternatives often break down as portfolios grow or when owners live outside the local market.

Stop Googling competitors for hours

Differentiation Strategy

MileStone Property Management is a small, residential-only management company targeted at small property owners as opposed to large-scale operators. The company integrates the already built systems, like Buildium, Rently, SmartMove, and QuickBooks, with direct owner participation and a written workflow.

The major points of distinction are:

- Lower manager-to-unit ratios

- Structured leasing and screening processes

- Outsourced maintenance with no markup in Year 1

- Clear pricing and consistent reporting

In a market where vacancy duration and tenant quality directly impact owner cash flow, MileStone’s emphasis on leasing speed, documentation, and responsiveness provides practical value to small owners who want dependable management without institutional complexity.

Operations Plan

MileStone’s operational rollout is staged to ensure systems, compliance, and controls are fully in place before portfolio growth accelerates. The focus during setup and early operations is readiness and consistency rather than volume.

Pre-Launch Setup

Before onboarding clients, the business completes core setup activities to support compliant, system-based operations. This will involve completing the legal establishment, bank loan funding, office leasing, and basic office furnishing, development of the property management and accounting system, licensing and insurance processing, and the creation of the site and initial local marketing presence.

This stage will make sure that the workflows of leasing, reporting, and documentation are laid down prior to the onboarding of clients.

Staffing and Responsibilities

The business operates as an owner-managed firm with no W-2 employees and no owner salaries prior to reaching break-even. Responsibilities are clearly divided to maintain accountability and avoid operational overlap.

- Olivia Carr oversees leasing coordination, tenant screening, lease execution, fair housing compliance, property inspections, and ongoing owner communication.

- Mason Ortega manages financial tracking, owner reporting, compliance documentation, vendor coordination, and system administration.

Maintenance work is fully outsourced to licensed third-party vendors. No in-house maintenance staff is employed, keeping payroll exposure and fixed costs low.

Transportation

MileStone does not purchase or lease company vehicles. Owners use personal vehicles for property visits, inspections, and vendor coordination as needed. Mileage is reimbursed using standard business reimbursement practices. This approach avoids vehicle-related debt, insurance, and maintenance costs while supporting flexible field operations.

Daily Workflow and Systems

The owners manage operations through a structured, repeatable workflow designed to maintain timely responses, accurate records, and consistent owner communication.

Daily tasks include reviewing rent activity, maintenance requests, leasing inquiries, and owner messages. Rent payments are tracked and posted regularly, with prompt follow-up on delinquencies.

Maintenance requests are reviewed, prioritized, and assigned to licensed vendors. Repair progress is tracked, and owners receive updates once work is scheduled and completed.

Leasing activity is managed on an ongoing basis. This includes responding to inquiries, coordinating self-guided showings, screening applicants using consistent criteria, and preparing lease documentation. Move-ins and move-outs are documented using inspection checklists and photos to support compliance and security deposit handling.

Financial tasks include reviewing expenses, reconciling bank activity, and preparing owner statements to ensure accurate reporting and a clean monthly close.

This workflow supports service quality and operational control as the portfolio grows within an owner-operated model.

Leasing, Screening, and Turnover Process

Leasing follows a defined, repeatable process designed to reduce vacancy time and support compliance.

The process includes marketing properties through major rental platforms, enabling self-guided showings where appropriate, screening applicants using consistent credit and background criteria, and executing standardized lease agreements. Unit condition is documented at move-in and move-out using photos and inspection checklists, supporting clear security deposit handling and dispute reduction.

Compliance and Risk Management

Operations are structured to meet applicable state and local requirements and to reduce regulatory risk through documented processes.

| Area | Requirement |

|---|---|

| Licensing | Colorado Real Estate Broker License |

| Tenant Law | Colorado landlord-tenant statutes |

| Fair Housing | Federal and state fair housing regulations |

| Insurance | E&O and general liability coverage |

Compliance checkpoints are embedded into leasing, documentation, and reporting workflows rather than handled as separate processes.

Scalability

The operating model is designed to support the portfolio through the 35–40 unit range without additional staff. As unit count increases beyond break-even, the company may introduce administrative or leasing support incrementally, funded through operating cash flow rather than upfront payroll commitments.

Investors hate amateur writing errors

Instantly improve your plan w/ our AI writing assistant

Marketing and Sales Plan

The marketing and sales strategy focuses on steady, relationship-based growth while keeping costs controlled. MileStone targets property owners who are actively looking for management services and converts them through clear pricing, defined services, and a simple onboarding process.

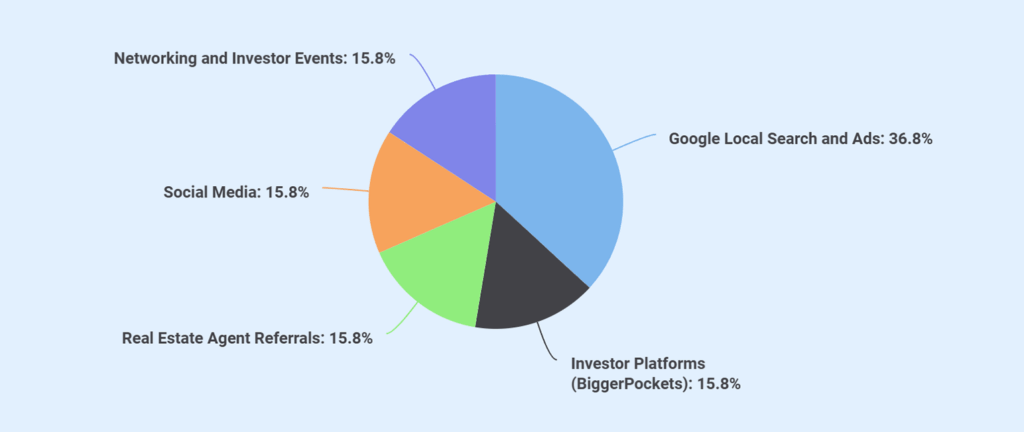

Marketing Channels

MileStone focuses marketing spend on high-intent and referral-driven channels rather than broad brand advertising. All activity is locally focused and managed within a controlled monthly budget of approximately $900 per month.

| Channel | How We Will Use It |

|---|---|

| Google Local Search and Ads | Run local ads and keep the listing updated |

| Real Estate Agent Referrals | Build referral relationships with local agents |

| Networking and Investor Events | Attend local real estate and investor meetups |

| Investor Platforms | Create and maintain business listings |

| Social Media | Post basic updates and company information |

Marketing activity is locally focused and designed to stay within a controlled monthly budget.

Client Acquisition Strategy

Client acquisition focuses on reducing friction for property owners who are deciding whether to hire or change a property manager. MileStone follows a clear and consistent process that emphasizes transparency, fit, and straightforward communication.

The process begins with an initial inquiry through the website, Google listing, or referrals. Each property is then reviewed to assess rental conditions and determine the best management fit. Pricing and service scope are explained clearly before moving forward. Once terms are agreed upon, the management agreement is finalized, and the property is set up in the management systems.

This approach keeps the sales cycle short and supports predictable conversion rates.

Promotions and Intro Offers

Limited-time promotions are used to encourage early adoption without creating long-term pricing pressure.

| Offer | Purpose |

|---|---|

| First Month of Management Free | Reduce hesitation for new clients |

| $99 Tenant Placement (First 10 Clients) | Build early leasing volume |

All promotional offers are capped and time-limited to protect margins.

Customer Retention Systems

Retention is driven by consistent execution rather than incentives. Owners receive regular financial reporting, documented maintenance updates, and clear communication timelines.

Retention is supported through:

- Predictable monthly reporting

- Transparent maintenance coordination

- Consistent point of contact

- Clear renewal and pricing communication

Happy customers will be motivated to recommend other landlords, where increased growth will be organic, and it will reduce the acquisition costs in the long run.

Sales and Marketing Controls

The performance of marketing is checked every month with the help of the lead volume, conversion rates, cost per acquisition, and portfolio growth. Spend is adjusted according to the performance to ensure efficiency and avoid unnecessary growth in the overhead.

Financial Plan

The financial plan for MileStone Property Management reflects a conservative, service-based operating model designed to support predictable cash flow and controlled growth. Revenue is driven primarily by recurring management fees, supported by limited leasing activity, while fixed costs are kept low with no payroll or asset-heavy investments prior to break-even.

The plan emphasizes operating stability, adequate working capital, and realistic assumptions appropriate for a first-time, owner-operated residential property management business funded through a local bank loan.

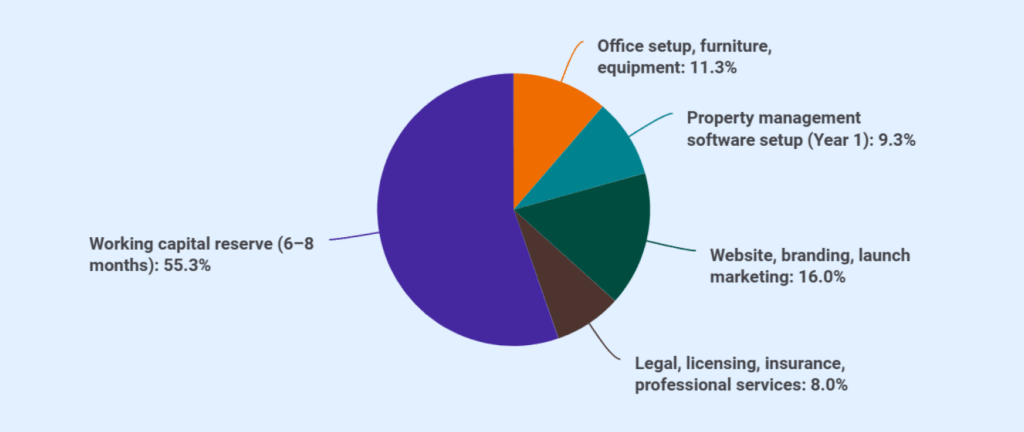

Startup Costs

| Startup Category | Cost ($) |

|---|---|

| Office setup, furniture, equipment | 8,500 |

| Property management software setup (Year 1) | 7,000 |

| Website, branding, launch marketing | 12,000 |

| Legal, licensing, insurance, professional services | 6,000 |

| Working capital reserve (6–8 months) | 41,500 |

| Total Startup Costs | 75,000 |

Key Financial Assumptions

| Item | Assumption |

|---|---|

| Average rent per unit | $1,900 per month |

| Management fee | 8% of collected rent |

| Monthly revenue per unit | $152 |

| Annual revenue per unit | $1,824 |

| Leasing fee | 75% of one month’s rent |

| Maintenance | Coordinated only, no markup |

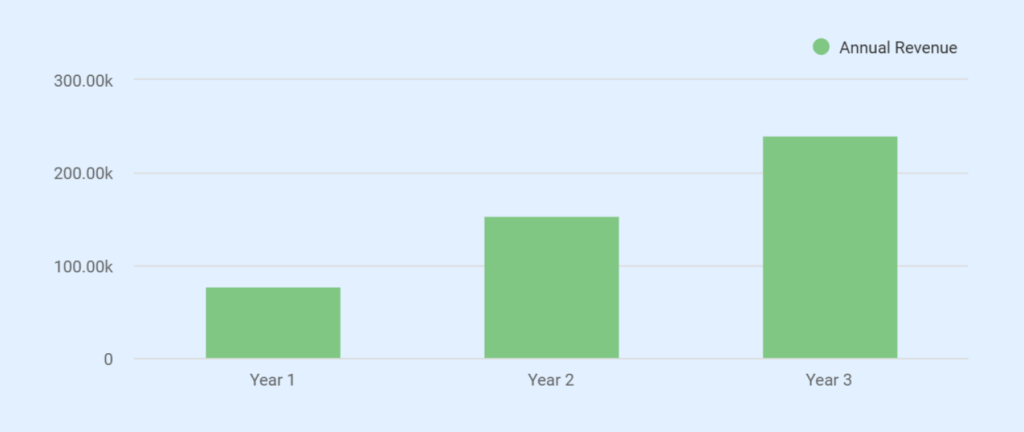

Annual Revenue Forecast

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Average managed units | 35 | 70 | 110 |

| Management fees ($) | 63,840 | 127,680 | 200,640 |

| Leasing & miscellaneous ($) | 14,000 | 26,000 | 40,000 |

| Total revenue ($) | 77,840 | 153,680 | 240,640 |

Notes:

- Unit growth is gradual and relationship-driven

- Revenue sits comfortably within your original stated ranges

- No assumption of aggressive price increases

Monthly Revenue Projections (Year 1)

| Month | Revenue ($) |

|---|---|

| January | 4,900 |

| February | 5,600 |

| March | 6,200 |

| April | 6,800 |

| May | 7,200 |

| June | 7,600 |

| July | 7,800 |

| August | 7,600 |

| September | 6,800 |

| October | 6,200 |

| November | 5,800 |

| December | 5,240 |

| Total Year 1 | 77,840 |

Seasonality reflects higher leasing activity in spring and summer, with stable recurring management fees throughout the year.

Don’t waste time using spreadsheets

Operating Expenses

Costs are structured to remain lean and predictable, with no payroll or asset-heavy commitments before break-even.

| Expense Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Fixed Operating Expenses | |||

| Office rent and utilities | 16,800 | 17,300 | 17,800 |

| Software subscriptions | 7,200 | 7,400 | 7,600 |

| Insurance | 5,400 | 5,600 | 5,800 |

| Marketing and advertising | 10,800 | 11,400 | 12,000 |

| Professional services | 4,200 | 4,400 | 4,600 |

| Loan payments | 18,720 | 18,720 | 18,720 |

| Miscellaneous and contingency | 6,000 | 6,200 | 6,400 |

| Total Fixed Operating Costs | 69,120 | 71,020 | 72,920 |

| Payroll Expenses | |||

| Owner compensation | 0 | 0 | 24,000 |

| Total Payroll Expenses | 0 | 0 | 24,000 |

| Variable Operating Expenses | |||

| Tenant screening fees | 3,600 | 6,200 | 9,200 |

| Listing and showing costs | 2,400 | 3,800 | 5,600 |

| Payment processing fees | 1,800 | 3,000 | 4,400 |

| Total Variable Costs | 7,800 | 13,000 | 19,200 |

| Total Operating Expenses | 76,920 | 84,020 | 116,120 |

Projected Profit & Loss Statement (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Revenue | |||

| Management fees | 63,840 | 127,680 | 200,640 |

| Leasing fees | 14,000 | 26,000 | 40,000 |

| Total Revenue | 77,840 | 153,680 | 240,640 |

| COGS | |||

| Screening and leasing transaction costs | 3,600 | 6,200 | 9,200 |

| Maintenance coordination supplies | 0 | 0 | 0 |

| Payment processing and platform fees | 1,800 | 3,000 | 4,400 |

| Total Cost of Services | 5,400 | 9,200 | 13,600 |

| Gross Profit | |||

| Total Revenue | 77,840 | 153,680 | 240,640 |

| Cost of Services | -5,400 | -9,200 | -13,600 |

| Gross Profit | 72,440 | 144,480 | 227,040 |

| Gross Margin | 93.1% | 94.0% | 94.3% |

| Operating Expenses | |||

| Fixed operating costs | 69,120 | 71,020 | 72,920 |

| Payroll and benefits | 0 | 0 | 24,000 |

| Variable operating expenses | 7,800 | 13,000 | 19,200 |

| Total Operating Expenses | 76,920 | 84,020 | 116,120 |

| EBITDA | -4,480 | 60,460 | 110,920 |

| EBITDA Margin | -5.8% | 39.4% | 46.1% |

| Depreciation, Interest, and Net Income | |||

| Depreciation | 0 | 0 | 0 |

| Interest Expense | 8,580 | 7,260 | 5,940 |

| Pre-Tax Income | -13,060 | 53,200 | 104,980 |

| Income Taxes | — | — | — |

| Net Income | -13,060 | 53,200 | 104,980 |

Projected Balance Sheet

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Assets | |||

| Cash & cash equivalents | 49,020 | 100,740 | 209,860 |

| Accounts receivable | 6,500 | 12,800 | 19,500 |

| Prepaid expenses & deposits | 3,500 | 3,800 | 4,200 |

| Total Current Assets | 59,020 | 117,340 | 233,560 |

| Office & IT equipment (gross) | 8,500 | 8,500 | 8,500 |

| Accumulated depreciation | -1,700 | -3,400 | -5,100 |

| Total Fixed Assets (Net) | 6,800 | 5,100 | 3,400 |

| Total Assets | 65,820 | 122,440 | 236,960 |

| Liabilities | |||

| Accounts payable | 4,800 | 6,200 | 7,800 |

| Accrued expenses | 3,200 | 4,400 | 5,600 |

| Current portion of term loan | 11,920 | 12,180 | 12,460 |

| Total Current Liabilities | 19,920 | 22,780 | 25,860 |

| Long-Term Liabilities | |||

| Bank term loan (long-term portion) | 52,080 | 39,900 | 27,440 |

| Total Long-Term Liabilities | 52,080 | 39,900 | 27,440 |

| Owner’s Equity | |||

| Owner Capital Contribution | 0 | 0 | 0 |

| Retained Earnings | -6,180 | 59,760 | 183,660 |

| Total Owner’s Equity | -6,180 | 59,760 | 183,660 |

| Total Liabilities + Equity | 65,820 | 122,440 | 236,960 |

Projected Cash Flow (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Operating Activities | |||

| Net income | -13,060 | 53,200 | 104,980 |

| Depreciation (non-cash) | 1,700 | 1,700 | 1,700 |

| Change in accounts receivable | -6,500 | -6,300 | -6,700 |

| Change in prepaid expenses & deposits | -3,500 | -300 | -400 |

| Change in accounts payable | 4,800 | 1,400 | 1,600 |

| Change in accrued expenses | 3,200 | 1,200 | 1,200 |

| Net Cash from Operating Activities | -13,360 | 50,900 | 102,380 |

| Investing Activities | |||

| Capital expenditures (office & IT equipment) | -8,500 | — | — |

| Net Cash from Investing Activities | -8,500 | 0 | 0 |

| Financing Activities | |||

| Bank loan proceeds | 75,000 | — | — |

| Loan principal repayments | -11,920 | -12,180 | -12,460 |

| Owner capital contribution | — | — | — |

| Net Cash from Financing Activities | 63,080 | -12,180 | -12,460 |

| Cash Summary | |||

| Net change in cash | 41,220 | 51,720 | 109,120 |

| Beginning cash balance | 7,800 | 49,020 | 100,740 |

| Ending cash balance | 49,020 | 100,740 | 209,860 |

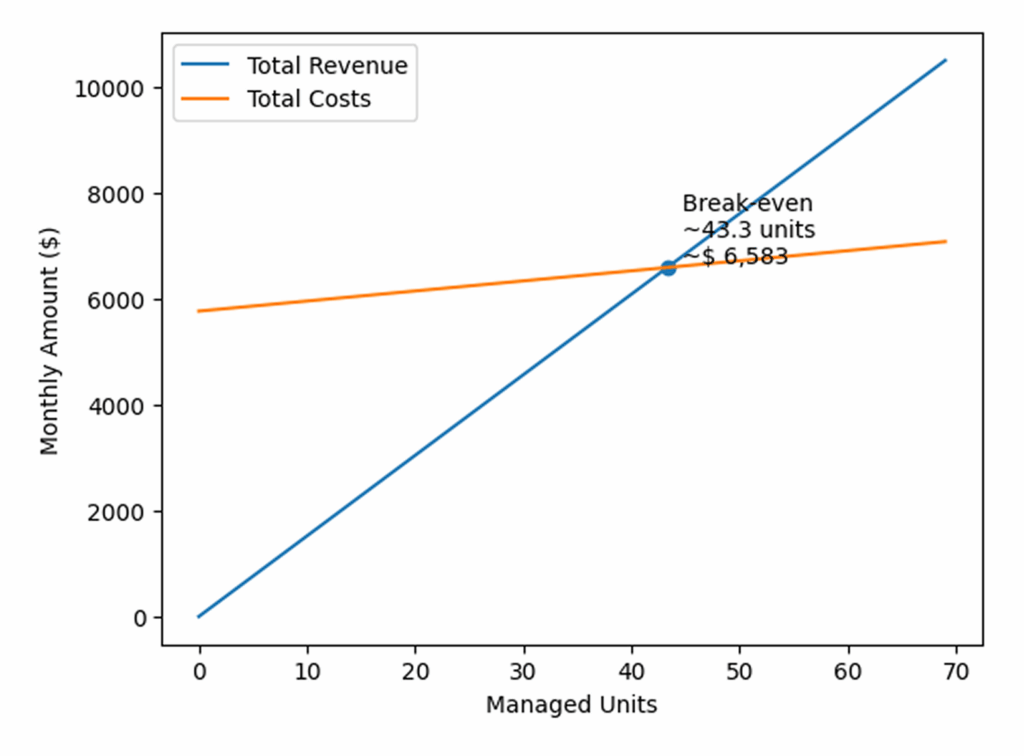

Break-Even Analysis

| Metric | Correct Value |

|---|---|

| Monthly fixed expenses | ~$5,760 |

| Monthly revenue per unit | $152 |

| Monthly variable cost per unit | ~$18–19 |

| Contribution margin per unit | ~$133–134 |

| Break-even units | ~43 units |

| Break-even monthly revenue | ~$6,500 |

Business Ratios

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross Margin | 93.1% | 94.0% | 94.3% |

| Net Margin | (16.8%) | 34.6% | 43.6% |

| Current Ratio | 2.96 | 5.15 | 9.03 |

| Quick Ratio | 2.78 | 4.95 | 8.87 |

| Debt-to-Equity | NM | 1.05 | 0.29 |

*NM = Not Meaningful (due to negative equity in early years)

Funding Requirements

This plan is structured around a local bank service business loan designed for a first-time, owner-operated residential property management startup with low fixed overhead and recurring fee-based revenue.

- Target Institution: FirstBank of Colorado

- Loan Type: Term loan for service business startup

Loan Details

| Item | Detail |

|---|---|

| Loan amount | $75,000 |

| Loan term | 5 years |

| Interest rate | ~9.25% fixed (assumed) |

| Owner injection | None |

| Collateral | Office equipment and business assets |

The owner’s equity contribution is invested at launch and is not financed.

*Note: The requested financing supports startup costs and early working capital needs typical of owner-led service businesses while recurring management revenue builds to sustainable levels.

Use of Funds

Loan proceeds are allocated strictly to business setup, systems, marketing, and working capital. No funds are used for vehicles, payroll, or property acquisition.

| Use of Funds | Purpose |

|---|---|

| Office setup, furniture, and equipment | Prepare leased office space for daily operations |

| Property management software setup | Configuration of management, accounting, and screening systems |

| Website, branding, and launch marketing | Client acquisition and local visibility |

| Legal, licensing, and insurance | Regulatory compliance and required coverage |

| Working capital reserve | Support operating stability during portfolio ramp-up |

Working capital is intentionally included to cover timing differences between onboarding properties and achieving stable monthly management fee income. The reserve reduces early-stage risk and supports consistent loan repayment.

Repayment Considerations

Loan repayment is supported by:

- Recurring monthly management fee income

- Conservative portfolio growth assumptions

- Low fixed operating costs

Leasing income provides additional cash flow but is not relied upon for debt service. The business is structured to reach break-even without owner salaries or staffing additions, supporting early repayment capacity.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.