Executive Summary

Oakline Residential Investments is a small startup real estate investment company in Raleigh, North Carolina. The firm purchases, renovates, and rents residential properties, providing monthly rental incomes.

Daniel Harper owns and manages the business, overseeing acquisitions, financing, tenant management, and long-term asset management. The company will specialize in small multi-unit residential homes that will cater to the working professionals and families that are interested in long, stable residences.

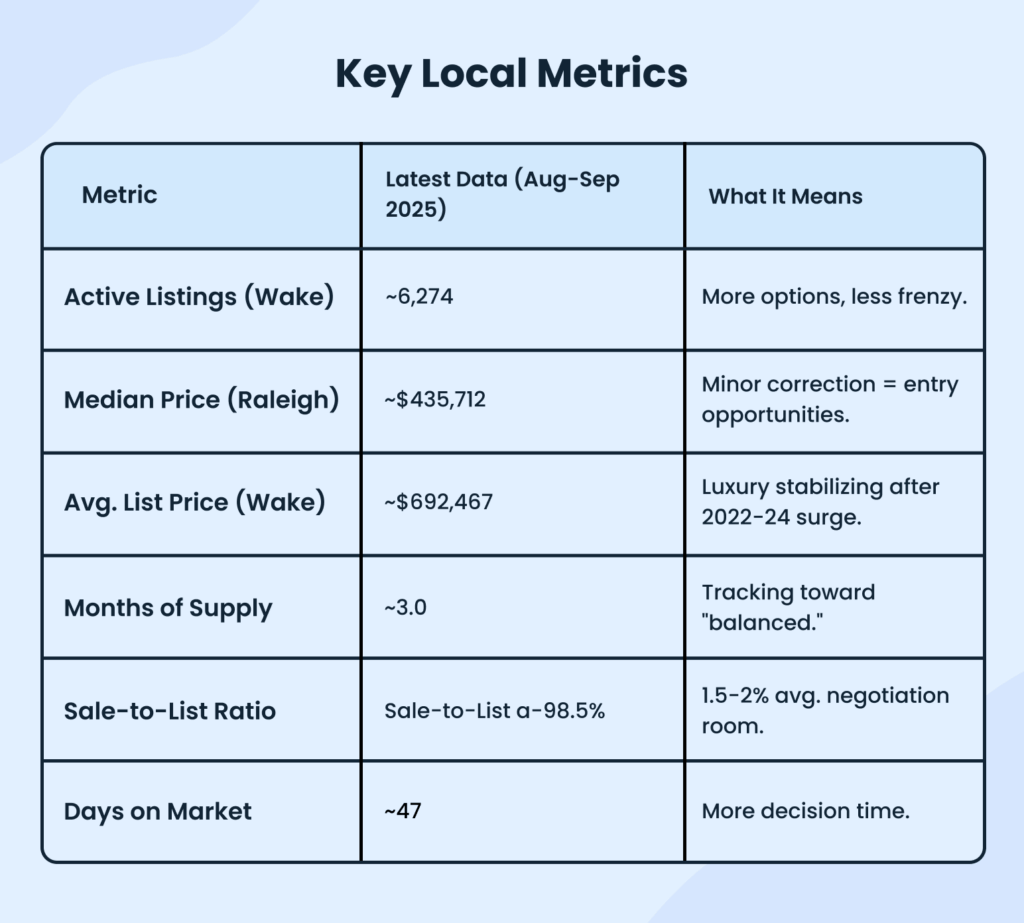

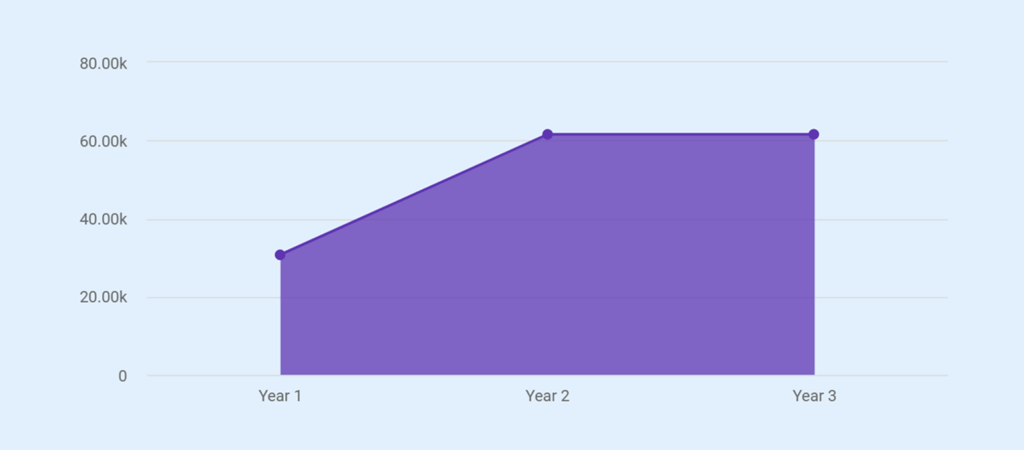

Late-2025 housing data for Wake County and Raleigh indicate a stable market, with home prices holding near historic highs. Buyer competition has eased, as the months’ supply has increased to approximately 3.0, and the average days on market have risen to about 47 days year-over-year.

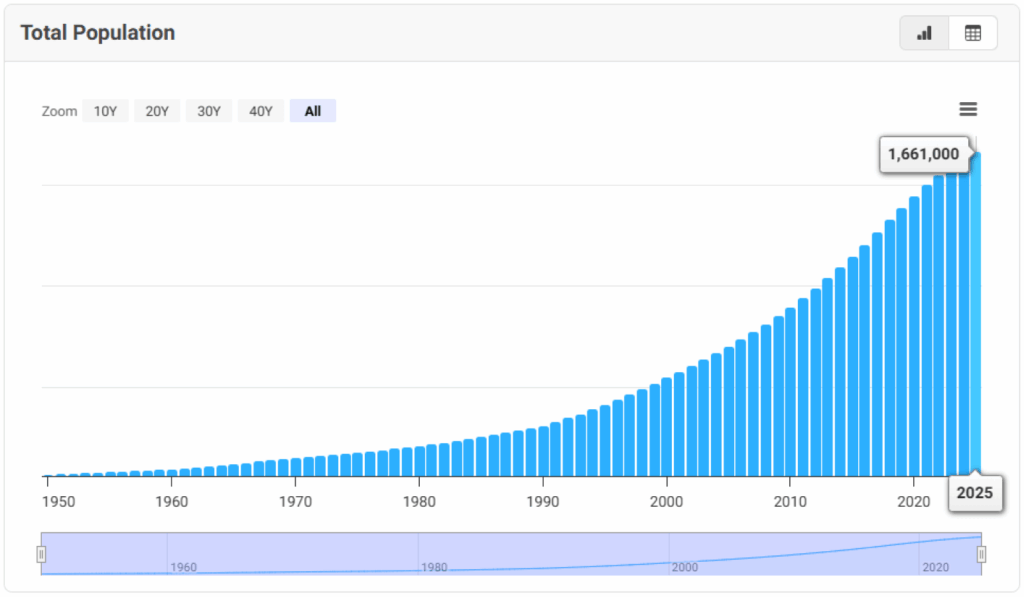

The demand for well-maintained rental property remained high due to the rapid population growth in Raleigh and the lack of housing stock. According to the latest study, the Raleigh metro area population reached approximately 1,688,000 in 2026, reflecting a 1.63% increase over 2025.

The graph below illustrates the continuous population growth in the Raleigh region since 2020 and prior years. This growth increases rental demand, supports stable occupancy, and reduces vacancy risk for Oakline’s residential rental property.

The business purpose is to have a predictable cash flow, manageable spending, and acceptable debt coverage by commercial lenders. Oakline Residential Investments focused on the stability of income and equity growth rather than the short-term resale or speculative assumptions of a price.

Target Audience

Target audiences of Oakline Residential Investments will be as follows:

- Working professionals who would like to rent a house close to the workplace.

- Small families that like long-term residential leases.

- Renters focus on well-maintained houses.

- Tenants who have a stable income.

Mission

Oakline Residential Investments focuses on providing safe and well-maintained rental homes for families and working professionals while generating stable cash flow. The company emphasizes responsible management, fair pricing, and long-term tenant relationships. The goal is to create housing where tenants feel respected and choose to stay in the long term.

Our Ask

We are seeking a $380,000 commercial real estate loan from First Citizens Bank for a 30-year term. This loan will cover both the property acquisition and necessary improvements for a 4-unit residential multifamily property.

The property details are as follows:

| Property Type | 4-unit residential multifamily |

| Building Size | Approximately 3,600 square feet total |

| Average Unit Size | 900 square feet per unit |

| Unit Mix | Four 2-bedroom, 1-bath units |

| Total project cost | $520,000 |

| Purchase price | $480,000 |

| Renovation budget | $40,000 |

The financing supports long-term ownership, and refinancing is planned only after the property stabilizes, not as an immediate need. Loan repayment will be supported solely by the recurring rental income from these units. Owner equity will cover the down payment and closing costs, reducing lender risk and ensuring reliable debt service.

Financials

Oakline Residential Investments was capitalized with a $140,000 owner equity contribution applied toward the down payment and closing costs. The business generated revenue exclusively from residential rental operations across four units.

Effective rental revenue reached approximately $30,780 in Year 1 after vacancy adjustments, reflecting stabilized occupancy.

Revenue remains the same in Years 2 and 3, as no rent increases or operational changes are assumed during the early stabilization period. The financial structure supported consistent operating income, controlled expenses, and reliable debt coverage, demonstrating overall financial health.

Still staring at a blank document?

Turn your business idea into a complete plan within minutes

Company Overview

Oakline Residential Investments will operate as a residential real estate investment company based in Raleigh, North Carolina. The company is structured as a limited liability company (LLC) and is owned and managed by Daniel Harper.

Moreover, the company will focus on owning and operating small multi-unit residential properties designed to support long-term rental occupancy. Currently, the operations will be owner-managed with no full-time employees.

However, Oakline Residential Investments will make selective use of third-party services when required. The company could be reached at (214) 555-4820 or by email at [email protected]. Additional information is available at www.oakresidential.com.

Location

Oakline Residential Investments is based in Raleigh, North Carolina, and is headquartered at 1421 Willow Creek Drive, Suite 220, Raleigh, North Carolina 27607.

The neighborhood consists mostly of single-family houses and small multi-unit dwellings. Most homes in the area were built between 1985 and 2005. The neighborhood is quiet, well-maintained, and affordable for long-term tenants.

The area has a stable rental business owing to the increase in the population of Raleigh. The large job centers, such as NC State University, WakeMed Health, and Duke University Health System, are within a 15-25 minute drive. The site provides a stable occupancy and stable rental incomes.

Values and Philosophy

Oakline Residential Investments has a solid sense of integrity, transparency, and community impact. Our values influence all the decisions that we make:

- Integrity: Act with honesty and fairness in every part of the business, from how properties are acquired to how tenants are treated and supported.

- Quality: Trust in keeping high standards in property maintenance and management, and offering clean and safe places to live.

- Sustainability: Aim to achieve sustainable business practices to add value to our investors as well as the communities.

- Responsibility: Become responsible in financial management and ethical investments to be stable in the long run.

Company History

Oakline Residential Investments is a startup that was established by Daniel Harper based on more than 10 years of experience in the real estate business. After gaining experience through various jobs and small projects, Daniel saw an opportunity to build a more practical and effective real estate investment business. He wanted to offer quality rental properties that contribute to the local communities and, at the same time, have a stable cash flow.

Ownership and Management

The Oakline Residential Investments, based in Raleigh, is 100% owned and operated by Daniel Harper. With a strong background in real estate investment, Daniel oversees all aspects of the company, from property acquisition to day-to-day management.

The company’s ownership structure ensures streamlined decision-making, with a clear focus on maintaining high standards for property quality, tenant relations, and financial performance.

Short-Term Goals

- Complete renovations on the 4-unit property within the planned timeline and budget.

- Achieve full occupancy and stabilize rental income by the end of Year 2.

- Maintain rent collection discipline and timely response to tenant requests.

- Control operating costs while keeping the property in good condition.

- Build and preserve operating and debt service reserves.

Long-Term Objectives

- Maintain stable cash flow and consistent debt service coverage over the loan term.

- Grow the portfolio gradually to reach eight total units within five years.

- Increase equity through loan paydown and disciplined property operations.

- Retain long-term tenants through fair pricing and reliable property upkeep.

- Strengthen relationships with lenders to support future acquisitions.

A business plan shouldn’t take weeks

Industry Analysis

Oakline Residential Investments will purchase and maintain residential properties that generate monthly returns by having tenants occupying the homes on a long-term basis.

The firm involves renting homes to working professionals and families in the Raleigh, North Carolina region in order to address the high demands of quality and affordable housing.

Market Size and Opportunity

In the period between Oct and Dec 2025, 30% of U.S. homebuyers ran a search on relocating to another metro area, with Florida, Arizona, North Carolina, Tennessee, and South Carolina being the leading places.

Furthermore, North Carolina State has a booming economy, and it is estimated that over 300,000 new jobs will be generated by 2028, which will cause an increase in-migration, households, and long-term rentals. This employment expansion helps advance the occupancy and secure more rental revenue for business organizations such as Oakline Residential Investments.

The demand in short-term vacation rentals, as well as long-term residential properties, is also stimulated by the record-breaking tourism income of the state, which is anticipated to be estimated at $36.7 billion in 2024.

The state has a very attractive rental market due to the existence of landlord-friendly laws, the ease with which eviction is achieved, and tax incentives like depreciation. The factors offer a sound investment in real estate, as there are numerous opportunities available to meet the demands of every tenant, as well as to optimize the returns.

Market Trends

The rental real estate market in North Carolina is dynamic and investor-friendly, as it is supported by a continuous population increase and promising employment opportunities in the technological/financing/research centres. The market trends of real estate investments in North Carolina are as follows:

Reasonable Rent Levels

In North Carolina, the average monthly rent for a one-bedroom home is $1,334. It is approximately 10-15% lower than the national average. The cheap rent prices are encouraging housing by making it cheaper and encouraging individuals to migrate, in case they are moving to states where housing is more expensive.

Moderate Vacancy Rates

Rental vacancy rates range between 6% and 6.4%, indicating a balanced market rather than oversupply. As new construction slows, vacancy levels are expected to decline further in 2026.

Improving Rent Outlook

In some areas during 2025, rents softened slightly due to new supply entering the market. As construction slows and demand remains steady, rents are expected to rise again in 2026.

Strong Job and Economic Base

Cities such as Charlotte and Raleigh-Durham will keep on growing and bringing in more employers. A stable labor market will ensure that there is a consistent rental demand even when there is a temporary increase in the supply of housing.

Multiple Rental Opportunities

The state of North Carolina provides demand both in single-family and in small multifamily rentals. The high occupancy is especially high and steady in university towns and tech-driven regions.

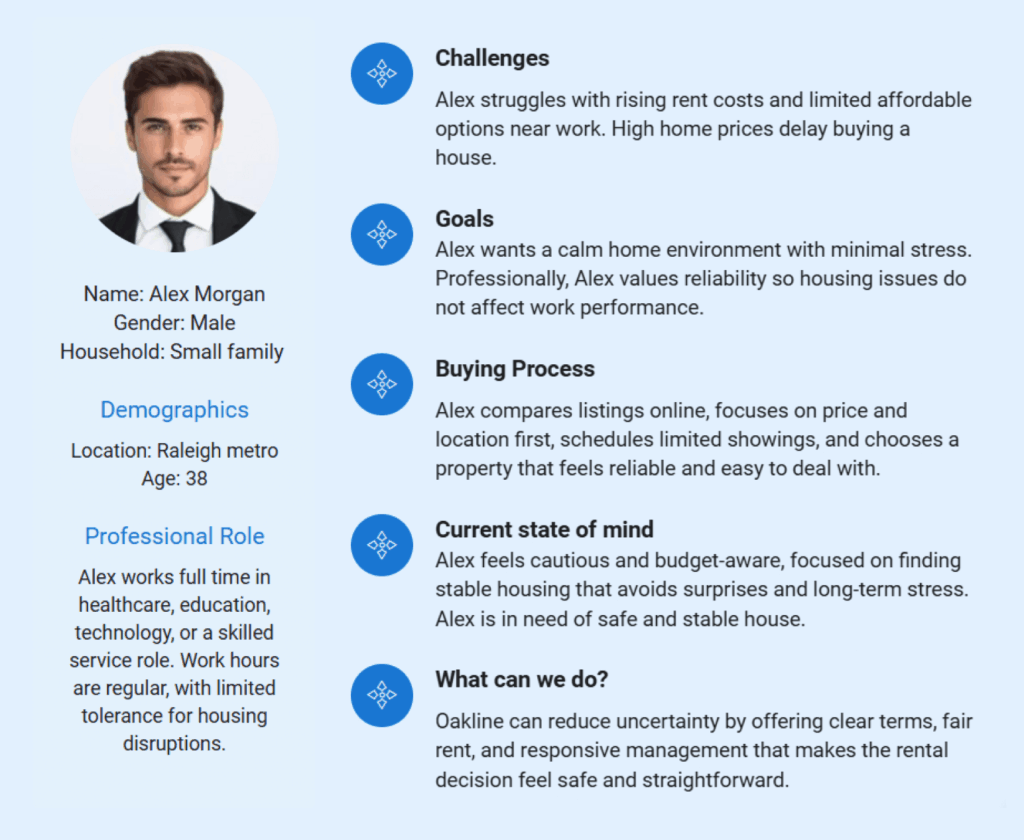

Target Audience

Oakline chooses the target group to facilitate consistent occupancy, fund stability in renting, and long-term property performance. The company targets tenants with an appropriate housing demand by the type of units, location, and price scheme.

| Target Clients | Details | Why We Are Targeting Them |

|---|---|---|

| Working Professionals | Full-time employees in healthcare, education, technology, and service industries | Provide stable income, consistent rent payments, and lower turnover risk |

| Small Families | Households with one to two dependents seeking long-term housing | Prefer longer leases and value safe, well-maintained neighborhoods |

| Renters Priced Out of Homeownership | Individuals affected by rising home prices and mortgage rates | Increased demand for quality rentals without ownership costs |

| Long-Term Renters | Tenants planning to stay multiple years | Reduce vacancy, turnover costs, and leasing expenses |

| Local Workforce Commuters | Employees working near Raleigh’s employment centers | Value proximity to work, supporting steady occupancy and retention |

Client Persona

Barrier to Entry

Investment in real estate in North Carolina is not easy. There are a number of factors that restrict the ability to compete.

1) High Upfront Costs

Single-family rental homes typically cost between $200,000 and $400,000. Most lenders require a 20–25% down payment, which means $40,000 to $100,000 in cash per property.

2) Strict Loan Rules

The typical credit score and debt ratio that are required by the banks is above 680 and less than 43% of income. New entrants are likely to have a higher down payment or loan refusal because of poor rental history.

3) Local Market Knowledge

Effective investors have to know which neighborhoods appeal to tenants and which are not doing so successfully. Unwise pricing decisions or the inability to estimate the cost of repair purchases in time can wipe down profits.

4) Established Networks Matter

Renowned investors have been trusting realtors, contractors, and managers. Such relationships offer greater bargains and reduce expenses. New investors receive more expensive prices and competition.

5) Hands-On Operating Skills

Rental management entails proper leasing, clear screening of tenants, and speedy repairs. Errors cause legal issues, increased expenditure,s and revenue loss.

Competitors

| Company | Strengths | Weaknesses |

|---|---|---|

| Oak City Properties |

|

|

| Block & Associates Realty |

|

|

| KeyRenter Raleigh |

|

|

Stop Googling competitors for hours

Differentiation

Oakline will be competing on stability and discipline in the execution instead of aggressive leverage or luxury positioning.

Small Multifamily Focus (2–4 Units)

Small multifamily properties allow direct owner control and faster decision-making. This structure avoids the risk of relying on a single tenant, which is common in single-family rentals.

Conservative Renovation Strategy

Renovations focus on necessary improvements that support durability and tenant comfort rather than luxury finishes. This keeps costs predictable and limits renovation spending to under $40,000 per property.

Direct Owner Management

The business avoids third-party management fees and delays. Daniel Harper directly manages tenant communication, maintenance coordination, and financial oversight.

Six-Month Operating Reserve Policy

Cash reserves cover operating expenses and debt service during vacancy periods or unexpected repairs. This reduces financial stress and lowers forced-sale risk during market downturns.

Workforce Housing Positioning

Units are priced 10–15% below Class A apartments and serve long-term tenants employed in healthcare, education, and local services rather than short-term renters.

Services

Oakline Residential Investments is a conservative buy-and-hold investment model of acquiring rental property. The company buys small multifamily buildings, does specific renovations, and holds property to generate the cash flow in the long term.

What We Do?

Oakline targets the purchase of small residential homes with two to four units within the stable areas near Raleigh. The choice of property is determined by the location, the physical condition of a property, and the earnings of consistent rental income instead of a temporary rise in prices. The company does not choose to rent out buildings with significant structural problems and focuses on the ones that require only moderate renovation.

Renovation activities focus on the practical enhancements, which have a direct impact on the comfort of tenants and the appeal of rentals. Common upgrades would be interior paint, floor changeover, new fixtures, and simple repairs to the systems.

Each project will have a 6 to 9-month schedule, and units will be leased when work is done. This gradual solution enables the rental revenues to start early, and renovation risk and holding costs are kept low.

Pricing Strategy

Compared with other Class A apartments in the region, Oakline provides rental prices at 5-10% below its competitors. Considering the example, the property under consideration costs $1,350 per unit per month, which is a little higher than older and not renovated units, which rent at $1,250-$1,300.

This is cheaper than more recent luxury apartments that charge between $1,500 and $1,800, and therefore, tenants receive modern living spaces without high rent.

The strategy retains loyal and long-term tenants and ensures occupancy rates of more than 90%. Oakline does not focus on pushing rents to the limit but on high occupancy.

At Oakline, we do not increase rent on an annual basis, but the projections at the start of the year are that there will be no increase in rent to make the forecast conservative. Rent growth is normally maintained at a moderate amount after stabilization to facilitate renewal and minimize the cost of turnover.

A strict acquisition rule is also used by us. Monthly, the gross rent per property should be a minimum of 1% of the total cost of the project (purchase and renovation).

To take a case, a property whose project cost is a total of $520,000 should generate at least $5,200 in one month at full occupancy. This is to ensure that it does not overpay, but every purchase is backed by a consistent cash flow.

Service Model

Oakline has a conservative BRRRR business model: Buy, Rehab, Rent, Refinance, Repeat. Every step has a set of processes that place more emphasis on cash flow stability and risk management instead of speedy growth.

Acquisition Phase

The properties are obtained through MLS listings and direct outreach to brokers and small multifamily owners. Oakline aims at 2-4 unit buildings located in mature neighborhoods that have reliable rental rates, such that the monthly rent is more than 1% of the overall cost of acquisition and renovation.

Renovation Approach

Renovations are aimed at tenant-facing work like painting, flooring, and updating fixtures, but the budget is limited to $10,000 per unit. All this work is supervised personally by Daniel Harper, who does not introduce markup fees to the contractors and makes sure his project is completed on time.

Leasing Operations

Marketing also commences 30-45 days prior to the completion of the unit, and listings are placed in sites such as Zillow and Apartments.com, where Daniel Harper does the showings and screening of tenants to qualify them.

Property Management

Oakline follows a hands-on management approach to maintain control over property performance and tenant experience. Daniel Harper manages tenant communication, rent collection, and maintenance coordination directly, which allows faster decisions and consistent oversight.

Refinancing Strategy

The refinancing of the property occurs 12-18 months after the stabilization, after the value of the property has been evaluated. The funds raised in the process of refinancing are paid out to settle the current debt, and the rest of the equity is invested in future acquisitions.

Portfolio Expansion

Oakline plans to grow gradually, with a goal of owning 8 total units within 5 years. Every new property is purchased according to the same underwriting standards, which makes it consistent and stable in terms of finances.

Marketing Strategy

At Oakline Residential Investments, our marketing strategy focuses on keeping units occupied with reliable, long-term tenants while controlling marketing costs. The approach relies on competitive pricing, clear property positioning, and direct tenant engagement. Marketing efforts prioritize steady demand and low turnover rather than high-volume promotion.

Marketing Channels

Oakline markets its rental units through platforms where serious renters actively search.

| Channel | How It Is Used | How It Helps the Business |

|---|---|---|

| Zillow | Listings are posted with clear photos, pricing, and unit details | Reaches a large pool of serious renters actively searching for housing |

| Apartments.com | Units are listed with full descriptions and availability dates | Attracts working professionals and families, comparing long-term rental options |

| Local Online Groups | Listings are shared in neighborhood and community groups | Reaches local renters who prefer nearby housing and shorter commute times |

| Referral Network | Current tenants and local contacts refer potential renters | Brings in pre-qualified leads and reduces marketing time and cost |

| Direct Inquiries | Calls, emails, and messages are handled quickly | Converts interest into scheduled showings and faster lease signings |

Retention Approach

Oakline will be keen on retaining loyal tenants to reduce vacancy, turnover costs and loss of revenues. The tenants on a long-term basis encourage consistent cash flow and operating risk minimization.

Key Retention Practices:

- Competitive Rent Positioning: Rents are determined at a reasonable market rate to allow affordability and renewal on a long-term basis.

- Managed Growth in Rents: When there is a lease-up, rent growth is implemented at a slow pace to strike a balance between a gradual increase in income and the stability of tenants.

- Reactive Maintenance: Maintenance orders are also addressed in a timely manner in order to avoid small problems, which may lead to tenant dissatisfaction or move-outs.

- Standards of Property Condition: Units and communal space are fairly clean, safe, and functional so as to promote long-term occupancy.

- Effective Communication with tenants: The tenants are always informed and maintained in communication with the tenants, in a respectful and straightforward manner.

Showing and Leasing Process

Oakline follows a simple and controlled process to convert inquiries into signed leases efficiently.

All inquiries received through listing platforms, email, or phone are reviewed promptly. Qualified prospects are contacted to schedule showings by appointment only, which helps filter serious renters and avoid unnecessary traffic.

Showings are conducted directly by the owner to answer questions clearly and assess tenant fit. This allows better screening early in the process.

After the showing, interested applicants complete a rental application. Screening includes income verification, credit review, background checks, and prior landlord references.

Approved tenants receive a standard 12-month lease. Lease terms, rent amount, and move-in requirements are explained clearly before signing to avoid misunderstandings.

Operations Plan

Oakline runs on direct owner involvement and streamlined systems. Daniel Harper manages all property operations without employees. This structure minimizes overhead and maintains direct control over tenant relationships and property condition.

Operation Hours

| Category | Working Days | Working Time |

|---|---|---|

| Administrative & Tenant Communication | Monday to Friday | 9:00 AM – 5:00 PM (calls until 6:00 PM) |

| Maintenance & Emergency Response | Routine: Monday to Friday Emergency: All days |

Routine: 8:00 AM – 5:00 PM Emergency: 24/7 |

| Property Showings & Inspections | Tuesday to Saturday | 10:00 AM – 6:00 PM |

Property Acquisition & Improvement Plan

Oakline is focused on small residential housing with two to four units situated on very secure regions in the Raleigh metro region.

The ongoing purchase is a 4-unit residential multifamily house, and the overall size of the house is nearly 3,600 square feet, which is 900 square feet on average per unit. All units will have a 2-bedroom, 1-bath floor plan which is in line with the local renter demand.

The maximum amount that can be spent on the renovation is $40,000, or 8% to 10% of the purchase price. The expenditure is concentrated on the things that tenants observe and utilize on a daily basis.

Scheduled improvements are interior painting, replacement of flooring, replacement of fixtures, and minor repair of systems. These modifications take units to readiness in the market without overbuilding.

The timetable of renovation work is 6-9 months. Work is done by completing and renting units as it moves along. This minimizes wasted time and initiates rent collection in time.

Once improvements are done, the individual units are projected to rent $1,350 monthly, which is between the older units and the luxury apartments in the locality. This price will sustain a consistent demand and occupancy.

The plan is cost-controlled, attractive in terms of rental, and stable in terms of long-term incomes.

Daily Operations

Oakline’s daily operations focus on rent monitoring, tenant requests, and property condition checks. Here’s how Oakline’s daily operations work:

Technology and Systems

Oakline uses simple digital tools to manage daily operations and keep records organized. The list of different systems and technologies used at Oakline is as follows:

1) Property Management Software

Used for rent collection, expense tracking, maintenance requests, and storing lease documents. Tenants and owners can access their portals 24/7.

2) Online Banking

All financial transactions, including security deposits and cash payments, are processed through online banking with mobile check deposits. Weekly reviews ensure accuracy.

3) Communication Tools

A dedicated business phone line, professional email address, and text messaging are used for tenant communication. Voicemail is checked twice a day.

4) Document Storage

Documents such as leases, inspection reports, and financial records are stored digitally in the cloud with automatic backups. Physical files are kept for original signed leases and closing documents.

Licensing and Permits

No state-level landlord license is required in North Carolina for owning and renting residential property. Oakline operates in compliance with the North Carolina Landlord-Tenant Act (Chapter 42), which governs leases, security deposits, habitability standards, disclosures, and eviction procedures.

Entity and Tax Registration

The company is properly formed as a North Carolina limited liability company and is registered with the North Carolina Secretary of State.

Local Rental and Property Compliance

Each acquired property is registered with the appropriate county and municipal authorities as a residential rental asset, where required.

Renovation and Improvement Permits

All renovation work is limited, non-structural, and code-compliant. Required building, electrical, or plumbing permits are obtained prior to commencement of work.

Safety and Habitability Standards

Properties meet applicable fire safety, health, and habitability requirements, including smoke detectors, carbon monoxide alarms, handrails, lighting, and safe egress.

Don’t waste time using spreadsheets

Financial Plan

The financial plan outlines clear assumptions, realistic revenue expectations, and conservative expense estimates for Oakline residential investments. The projections focus on cash flow stability, adequate reserves, and steady loan repayment. The plan will help lenders understand how the property performs during lease-up and after stabilization.

Revenue Projection

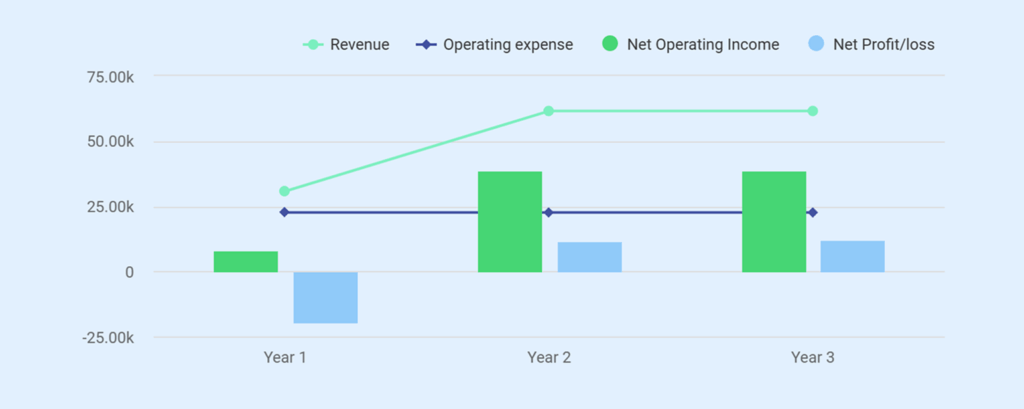

| Particulars | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Average Occupied Units | 2 | 4 | 4 |

| Monthly Rent per Unit | $1,350 | $1,350 | $1,350 |

| Gross Rental Income | $32,400 | $64,800 | $64,800 |

| Less: Vacancy (5%) | -$1,620 | -$3,240 | -$3,240 |

| Effective Rental Revenue | $30,780 | $61,560 | $61,560 |

Note: Revenue in Years 2 and 3 remains the same because the projections assume full occupancy with no rent increases during the early stabilization period. This conservative approach avoids relying on growth assumptions and focuses on stable operations.

Profit & Loss Statement

| Particulars | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | |||

| Effective Rental Revenue | $30,780 | $61,560 | $61,560 |

| Operating Expenses | |||

| Property Taxes | $7,200 | $7,200 | $7,200 |

| Insurance | $2,200 | $2,200 | $2,200 |

| Repairs & Maintenance | $6,500 | $6,500 | $6,500 |

| Management / Admin Equivalent | $3,200 | $3,200 | $3,200 |

| Utilities (Owner Paid) | $2,000 | $2,000 | $2,000 |

| Miscellaneous | $1,500 | $1,500 | $1,500 |

| Total Operating Expenses | $22,600 | $22,600 | $22,600 |

| Net Operating Income (NOI) | $8,180 | $38,960 | $38,960 |

| Non-Operating Expenses | |||

| Interest Expense | $27,426 | $27,143 | $26,839 |

| Net Income (Loss) | -$19,246 | $11,817 | $12,121 |

Note: The property size, unit count, and service level do not change across the projection period. Since operations remain unchanged, operating costs remain flat.

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features

Operating and Debt Service Reserves

The owner has contributed $45,000 in operating and debt service reserves at closing. This is in addition to the $140,000 equity used toward the project cost and is held in a separate reserve account. These reserves are not included in the purchase price or renovation budget.

The reserves are intended to cover operating expenses and loan payments during the first year of lease-up. As shown in the Year 1 projections, these reserves will fully cushion any cash flow deficits during this period. The property is expected to stabilize and achieve full occupancy by Year 2, generating sufficient cash flow to meet operating expenses and debt service without needing reserve assistance.

These owner-funded reserves are reflected in the opening cash balance in the Cash Flow Statement.

Cash Flow Statement

| Particulars | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Operating Cash Flow | |||

| Net Operating Income (NOI) | $8,180 | $38,960 | $38,960 |

| Debt Service | |||

| Principal Repayment | -$3,774 | -$4,057 | -$4,361 |

| Interest Expense | -$27,426 | -$27,143 | -$26,839 |

| Total Debt Service (Principal + Interest) | -$31,200 | -$31,200 | -$31,200 |

| Net Cash Flow (After Debt Service) | -$23,020 | $7,760 | $7,760 |

| Cash Position | |||

| Opening Cash Balance | $45,000 | $21,980 | $29,740 |

| Add / (Less): Net Cash Flow | -$23,020 | $7,760 | $7,760 |

| Ending Cash Balance | $21,980 | $29,740 | $37,500 |

Note: Opening cash balance represents owner-funded operating and debt service reserves held at closing. Cash balances reflect operating activity only and exclude any lender-required restricted reserves, if applicable.

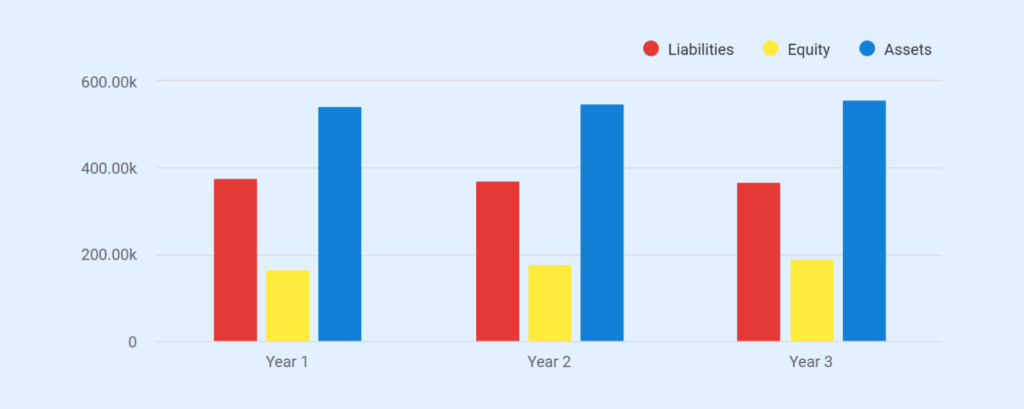

Balance Sheet

| Particulars | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| ASSETS | |||

| Cash & Bank Balance | $21,980 | $29,740 | $37,500 |

| Rental Property (Cost) | $520,000 | $520,000 | $520,000 |

| Total Assets | $541,980 | $549,740 | $557,500 |

| LIABILITIES | |||

| Mortgage Loan Balance | $376,226 | $372,169 | $367,808 |

| Total Liabilities | $376,226 | $372,169 | $367,808 |

| EQUITY | |||

| Owner Capital (Project Equity) | $140,000 | $140,000 | $140,000 |

| Owner-Funded Reserves (Unrestricted Cash) | $45,000 | $45,000 | $45,000 |

| Retained Earnings (Cumulative NI) | -$19,246 | -$7,429 | $4,692 |

| Total Equity | $165,754 | $177,571 | $189,692 |

| Total Liabilities & Equity | $541,980 | $549,740 | $557,500 |

Note: The owner has contributed $45,000 in reserves at closing. This is in addition to the $140,000 equity used toward the project cost.

DSCR (Lender View)

| Particulars | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Net Operating Income (NOI) | $8,180 | $38,960 | $38,960 |

| Annual Debt Service | $31,200 | $31,200 | $31,200 |

| DSCR | 0.26 | 1.25 | 1.25 |

Note: Stabilized DSCR reflects conservative rent assumptions with no rent growth and above-market maintenance reserves; DSCR is expected to improve modestly over time through operational efficiencies.

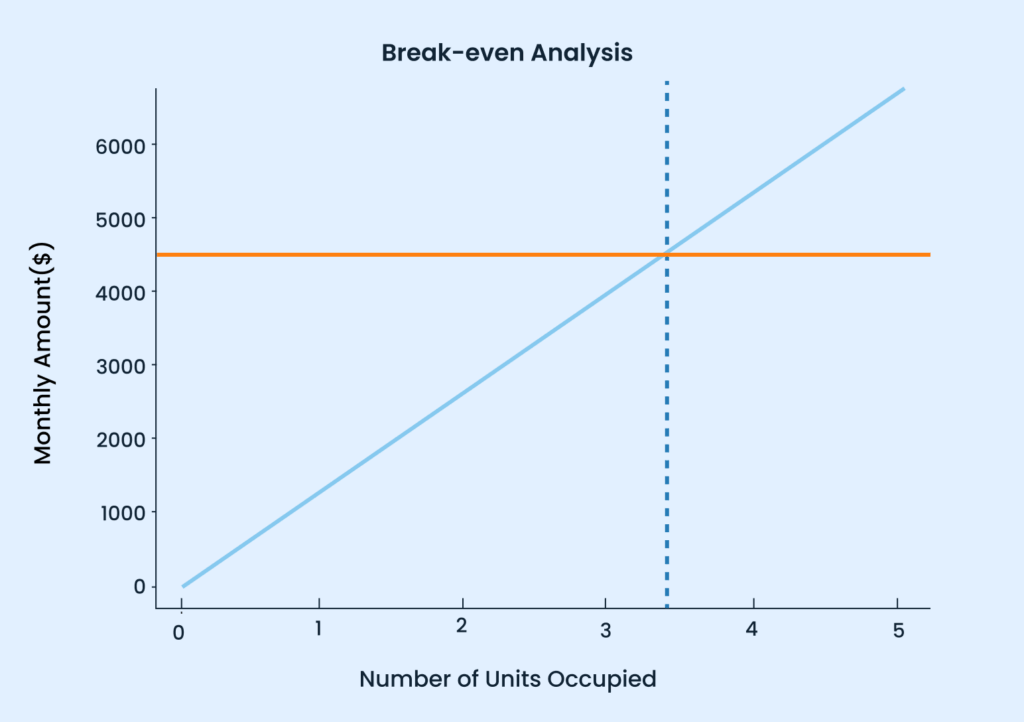

Break-Even Analysis

| Item | Monthly Amount |

|---|---|

| Operating Expenses | $22,600 ÷ 12 ≈ $1,883 |

| Debt Service | $2,600 |

| Total Monthly Requirement | $4,483 |

Break-even Calculation

- Average rent per unit: $1,350 per month

- Units required to break even: $4,483 ÷ $1,350 ≈ 3.32 units

Loan Repayment Plan

| Item | Value |

|---|---|

| Loan Amount | $380,000 |

| Interest Rate | 7.25% fixed |

| Term | 30 years |

| Amortization | Fully amortizing |

| Annual Debt Service | $31,200 |

| Monthly Payment (rounded) | $2,600 |

Loan Repayment Schedule

| Particulars | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Beginning Loan Balance | $380,000 | $376,226 | $372,169 | $367,808 | $363,132 |

| Annual Debt Service (P+I) | $31,200 | $31,200 | $31,200 | $31,200 | $31,200 |

| Interest Paid | $27,426 | $27,143 | $26,839 | $26,524 | $26,196 |

| Principal Paid | $3,774 | $4,057 | $4,361 | $4,676 | $5,004 |

| Ending Loan Balance | $376,226 | $372,169 | $367,808 | $363,132 | $358,128 |

Long-Term Loan Outlook (Rough Illustrative)

| Milestone | Approx. Loan Balance |

|---|---|

| End of Year 5 | ~$358,000 |

| End of Year 10 | ~$325,000 |

| End of Year 15 | ~$275,000 |

| End of Year 20 | ~$210,000 |

| End of Year 25 | ~$125,000 |

| End of Year 30 | $0 |

Note: The long-term loan balances above are illustrative and rounded, based on annual debt service of $31,200. Exact balances will vary slightly under a month-by-month amortization schedule. Underwriting is based on stabilized NOI and annual debt service for DSCR; the lender’s amortization schedule should be used for exact long-term balances.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.