Financial planning is crucial to setting up a successful restaurant business.

A lot goes into financial planning, right from estimating costs to making sales projections, evaluating break even, and much more.

All of these require you to work on endless and tiring Excel sheets. However, only if you plan to do everything traditionally.

The figures in your financial plan will help evaluate the financial feasibility of your restaurant. You simply cannot afford to be negligent with this aspect of your business plan.

Feeling stuck writing the financial aspect of a business plan? Well, let us help you out.

What is a Restaurant Financial Plan?

A restaurant’s financial plan reflects the current monetary position of an eatery and outlines its long-term financial goals, objectives, and strategies to achieve the desired outcomes.

It is the last but most important part of a restaurant’s business plan that can convince investors to invest in your business.

A financial plan consists of key financial reports like an Income statement, break-even analysis, balance sheet, and investment plan. These reports help investors assess the revenue potential, risks, and rewards that a particular restaurant can bring.

Instead of paragraphs, the financial section of a business plan is presented best with figures, diagrams, graphs, and charts.

Key Takeaways

- Plan a realistic funding strategy for your restaurant by assessing the monetary position and estimating start-up costs.

- Determine the profitability of your eatery with key financial reports.

- Enhance the accuracy of the plan by testing assumptions and conducting sensitivity analysis.

- Get a financial snapshot of your business and pique investors’ interest.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $14/month

How to Prepare a Financial Plan for Your Restaurant?

Writing a financial plan can feel overwhelming. However, this step-by-step procedure can help you prepare a financial document for the restaurant by making sure you have accounted for every detail.

1. Identify Your Funding Requirements

Starting a restaurant is a costly affair. You need money, and a loads of it to open the doors of your eatery in the actual world.

The first step here is to accurately estimate your restaurant startup costs.

Account for expenses on lease, construction, licenses and permits, furniture, kitchen equipment, pre-launch marketing, and every expense that goes into starting a restaurant.

Ensure that your cost estimates also include the restaurant’s operating costs for the first few months. This will help you have adequate working capital to run the restaurant before it turns into a profitable business.

Assess your current monetary position and determine how much funding you require to fund your own restaurant.

2. Determine Your Funding Strategy

People don’t always have enough money lying around to fund their business. They need to seek help from potential lenders to acquire the startup capital.

Here are a few funding sources you can consider for your restaurant:

- Lendings from friends and family

- Bank loans

- SBA loans

- Angel Investors

- VC firms

- Real Estate loans

When you seek credit from banks and investors, you will need a neat document projecting the financial modeling of your restaurant.

A financial plan with clear projections and calculations will help potential investors get an accurate idea of your business.

Evaluate different funding sources, their costs, and benefits to pick the most desirable ones.

3. Select a Business & Financial Planning Software

We don’t mean to scare you off, but starting and running a restaurant will swamp you with responsibilities. Unless you plan to run around like a headless chicken, a planning tool can support you in making different financial plans and reports.

If you are struggling to create a financial plan for the restaurant, you definitely need a planning and forecasting tool right away.

Too many options to confuse you? Consider a tool that is easy to use, offers a range of functions, and allows seamless integration of Excel data.

Pro-tip

Create a Restaurant Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

4. Pre-Assumptions & Market Analysis

A successful business always relies on the foundation of good quality market research.

You have already done a deep dive into understanding the target market, customer demography, state of the industry, competition, and restaurant concept when you started writing the business plan.

Now, it’s time to use that market research to create a financial forecast for your eatery.

Let’s have a look at these key essentials that the financial aspect of your business plan should include:

Pricing strategy

There is no fixed rule when it comes to developing a pricing strategy. However, factor in aspects like menu items, potential customers, spending patterns, and competition to determine an ideal pricing strategy for your business.

Generally, the pricing should be in line with the competitors’ pricing to establish yourself in the market. However, you can choose different pricing and still succeed by marketing the eatery wisely.

Remember, that the pricing you choose will set the tone of your eatery in the market. Ideally, it should reflect the restaurant’s perceived value amongst its target customers.

When developing your pricing strategies, account for seasonal, quarterly, or yearly increases in food costs.

Sales forecast

Sales is the ultimate goal for any business. After all, sales are the very basis for company profits and business growth.

A sales projection will help conclude whether or not an eatery can perform as a profitable business.

Now how do you make sales projections?

Well, here are a few things to consider when making sales projections:

- How many customers can an eatery accommodate at a time?

- What are your different sales channels, i.e. dine-in, online orders, takeout?

- How many average customer orders do you receive in a day?

- How much is an average customer spending?

- How many times does a table turn in a particular shift?

- How many menu items are ordered per person?

Project daily sales and then create a chart depicting weekly, monthly, quarterly, and yearly sales. Account for fluctuations and changes in demand to create accurate sales projections.

The sales predictions will help you estimate the cash flow in the business and also the cost of goods sold.

If you are offering services like online orders and takeouts, create separate forecasts for each.

Overheads budget

Overhead costs are basically operating costs or day-to-day business expenses that will keep your eatery running.

To prepare accurate overhead forecasts, get precise estimates of expenses from your suppliers. Account for various fixed costs and variable costs incurred by a business regularly.

These include payroll expenses, occupancy costs, administrative expenses, amortization, depreciation, music and entertainment expenses, etc.

An accurate estimate of overhead costs will help determine a perfect restaurant’s budget.

5. Prepare Financial Projections

Figures are definitive and can act as a decisive point for investors. One look at the key reports and they will decide whether or not to invest in your restaurant.

Let’s check these key components of financial projection:

Cash flow statement

A cash flow statement guides whether or not you have enough funds to run a business.

CFS is formulated taking into account the figures of sales, cost of goods sold, and the eatery’s overhead budget. The precision of your projections in these aspects will determine the accuracy of cash flow.

CFS outlines the amount of cash generated and spent by the business during a particular time. Overall, it’s an indication of how well your restaurant is at generating cash.

Be realistic with the assumptions you make in the cash flow statement. Consider industry standards and market situation while preparing your CFS.

Income statement

The income statement, also known as the profit and loss statement, offers an insight into a business’s profitability, long-term financial goals, and business growth over the next 2-3 years.

Profit and loss measures the health of a restaurant. By deducting the cost of goods sold from revenue, you get the gross margin. The gross profit determines the eatery’s efficiency in utilizing the resources.

Further, deduct the operational expenses and EBITDA to calculate the net profit of your eatery. This is what interests investors the most.

The profit and loss statement overall gauges a restaurant’s feasibility in the long term.

Balance sheet

A balance sheet is a snapshot of what a company owns and what it owes. It is a summation of your restaurant’s liability, equity, and assets.

Investors are keen on the balance sheet as it helps evaluate the company’s capital structure and its ROI. It also forms the base for calculating various financial ratios.

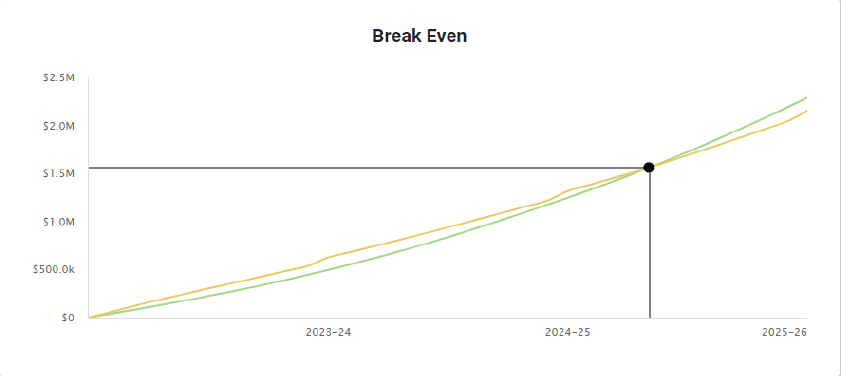

Break-even Analysis

Profit is the ultimate goal for any restaurant operator. But when do you actually start generating the profits?

Break-even analysis helps determine how much sales volume is essential to reach the break-even point.

It answers an important question for investors: How long before the restaurant turns profitable?

It can take years to reach break-even if there are loans to settle. However, you can still keep the restaurant afloat and profitable with an appropriate understanding of fixed costs.

6. Test Assumptions

The entire financial plan is based on projections. Even when you have planned everything to the minutest details, a crisis will arise.

In this stage consider various what-if scenarios. Consider different situations- certain aggressive and certain progressive.

For instance, consider the sales drop when the weather gets extremely chilly or changes in prices of menu items when the inventory cost rises unpredictably.

These are extreme scenarios. Play with the in-betweens and change the inputs of different projections. Review the reports in a different light and check the viability of your projections.

Another way to implement sensitivity analysis is to test your projected calculations with actual metrics of similar restaurants. You can even choose from a listed company operating on the same level as you plan. This will help you validate the assumptions and make tweaks wherever necessary.

7. Monitor & Update Your Plan

Planning is only fruitful when you monitor and revise. Once your financial plan is ready, continue to monitor it closely and note the deviations.

If some metrics are significantly different than anticipated, identify the reason behind it.

All in all, continuously evaluate and update your financial plans when necessary.

Download Free Restaurant Financial Plan Example

Creating a financial plan from scratch can get overwhelming. After all, Excel sheets are tiring and endlessly long. Worry not. Download this free restaurant financial plan example prepared using Upmetrics to help you get started.

It includes all the key components of a restaurant’s financial projection, including the balance sheet, cash flow statement, P&L or income statement, and break-even statement, simplifying restaurant financial planning.

Related Restaurant Resources

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Start Preparing Your Restaurant Financial Plan

And it’s a wrap. This blog has covered almost everything you need to know about financial planning.

But enough of planning. It’s time to nail financial planning for your restaurant now.

Feels like a dreadful task? Well, Upmetrics’ financial forecasting tool can be your savior here.

Simply enter the projected assumptions and let us take care of the rest.

So, what are you waiting for? Create a financial plan for your eatery, NOW!