Founders love asking, “What is a fair percentage for an investor?”

Before they’ve even figured out if the new company is even worth funding. The blunt answer is: It depends on how early you are.

It depends on:

- The risk you’re asking someone else to take.

- What that investor is offering besides the money.

- Are they writing a check and disappearing?

- Or are they showing up with real help like introductions, support, future capital?

It sounds like the smart thing to ask. But it’s the wrong place to start.

The better question is: “What am I actually giving away?”

Let’s break down what “fair” actually means when it comes to equity and why the answer isn’t simple, fixed, or found in someone else’s funding round.

What is a fair percentage for an investor (quick answer)

You’ll hear people throw out numbers—10%, 20%, 30%. But “fair” can’t be boiled down to a clean range. Every deal shows the risk on the table, the help the investor offers, and how much you’re asking for. Don’t start with numbers. Start with understanding the full cost of giving up a piece of your company.

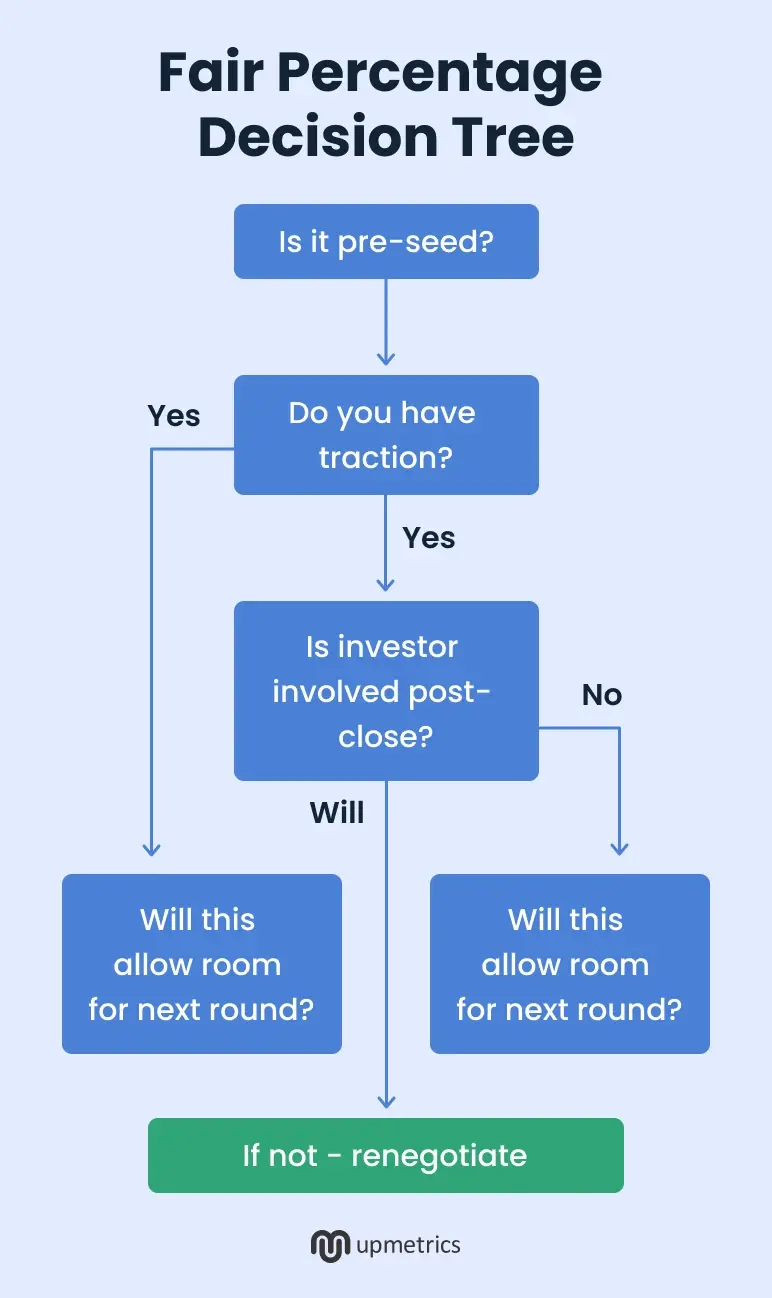

You still want a quick answer; I get it. So here it is: At pre-seed, it’s common to give away 10–20% of your equity. But there are lots of ifs and buts, so make sure to stick around for the full picture.

Equity isn’t just a percentage

Equity is ownership. It’s money. It’s also leverage, voice, and a piece of everything your business might become.

You’re not just trading shares. You’re handing over a slice of your future. That means a piece of every win, every raise, every possible exit—even your business returns years down the line.

A lot of small businesses trade a big chunk of equity just to keep the lights on. What can I say? It is expensive. Most startups treat it like a number on a cap table. But it’s not a number. It’s a decision that follows you for years.

Angel investors and venture capitalists look ahead. They care less about the present and more about the equity growth potential—what their equity stake might be worth when you hit real traction.

Ask yourself: Does the ownership you’re offering reflect what you’re getting back? Will it still feel like a fair deal at your next stage of growth? Does it align with your market value and not just your desperation?

If you’re not clear on that, investors will be. They’ll price your uncertainty with confidence because…

You’re selling risk, not profit, in the early stages

There’s no polite way to say it: Most startups don’t offer much to hang onto.

No revenue. No traction. Just a dream, a pitch, and a LinkedIn post saying you’re “building something exciting.”

But potential investors still show up—especially if they see something in you.

That’s because sometimes, it’s about the founder more than the idea.

Angel investors might place a bet based on a personal connection, grit, or a gut feeling. If they think you’ll figure it out under pressure, they’ll write the check. It’s instinct. And honestly, sometimes it’s just to stay in the loop if things take off.

VCs are a different story. They want signs that something’s already working. It doesn’t have to be huge; maybe some early users, customer feedback, or signs of product-market fit.

But there has to be movement. If there’s no momentum yet, they’re probably not getting involved. They’ll wait until it looks like you’ve already started to prove the idea.

So yeah, pre-seed can feel rough. You’re raising money on a story, not stats.

And because the risk is on their side, equity asks tend to go up fast.

Giving up 20% for your first $200K might be okay. Or it might box you in two rounds from now. It really depends on how the investor negotiates, what they bring, and the nature of the particular deal.

This is knowing your value and understanding your leverage comes down to…

Cash flow

It’s the money coming in and going out of your business. You can have the cleanest pitch deck in the world, but if your cash flow is a mess, investors will move on.

Investors want to know what happens after the wire hits. How long can you run? What’s your burn rate? When will revenue cover costs?

They will dig into your business plan, financials, assumptions, and how efficiently you plan to use their capital. If you’re raising money with no clear milestones, no projections, and no timeline, it’s not a great look.

Often, a smaller raise with solid planning gets more interest than a big number with no roadmap.

The money needed doesn’t matter if the plan to spend it doesn’t hold up. Investors back founders who can manage money—not just ask for it.

If your cash flow isn’t real, your pitch won’t be either. And investors aren’t the only ones doing the evaluating.

Due diligence goes both ways… Are they the right investor for you?

Founders make one common mistake. They often forget they have power, too. It’s not just about getting a “yes.” You’re choosing a business partner, not just accepting an investment. Once they’re on your cap table, they’re part of your company, and you can’t easily undo that.

That’s why due diligence goes both ways.

Start by looking at their track record. Who have they backed? Don’t just glance at the logos. Check if they’ve supported other startups like yours, especially at the pre-seed or early stages. Talk to founders they’ve worked with. Ask what actually happened when things got hard.

You want to know if they offer real help when business slows down or if they push for risky changes to protect their capital.

Every venture capitalist and angel investor claims to be “founder-friendly.” But what’s important is how they act when your business returns drop or growth stalls.

Also, consider what else they bring. Do they just write checks, or do they offer investors connections, hiring support, and follow-on help?

The value of an investor isn’t just in the money. It’s in how they shape your equity growth and your next funding round.

The wrong investor doesn’t just slow you down. They make your next move harder and the future of your company smaller.

What is a fair percentage for an investor? (Now we can talk)

A fair percentage isn’t fixed. It depends on your valuation of your company, the stage of your raise, the type of investor, and how much value they bring beyond the wire transfer.

At pre-seed, it’s common to give away 10–20% of your equity. That’s the ballpark. But what’s “common” isn’t always what makes sense. It’s only fair if the investment lines up with the risk you’re taking and the support they’re offering in return.

Are they helping you build? Do they bring a proven record? Do they show up after the transfer or disappear until the next board meeting?

Angel investors, venture capital firms, and professional investors play by different rules. So do new investors vs. seasoned ones. Don’t treat all startup investors the same way.

You also have to think ahead. What will this deal mean for the next funding round? Will your company still have room to breathe?

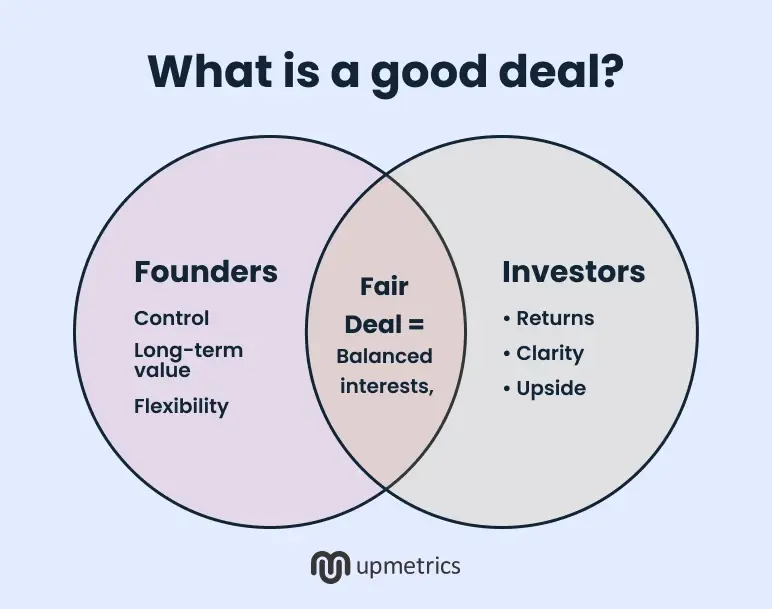

Most investors are focused on returns. You should be focused on control and long-term equity growth.

The goal shouldn’t be to raise as much money as possible. It must be to raise what you need from someone who brings actual capital, not just cash.

And remember: in the public market, the price of a share reflects the business today. In private markets, you’re pricing risk, potential, and fit.

So what is a good deal?

It’s one where the money needed is matched by the value received. Where you’re not giving up more than the moment requires. And where the ownership you keep gives you room to grow.

That’s the only kind of fair percentage worth talking about.

Founders spend hours worrying about the fair percentage. Fair. Smart. But none of that matters if you can’t negotiate. Most investors will smile while offering terms that quietly take a bite out of your company. And most startups say yes just to move forward.

If you want to protect your business, especially early on, focus less on the number and more on the conversation. So, let’s talk about what really gets you a fair outcome.

Negotiating with investors: Tips for getting a fair deal

A fair percentage might sound simple. But in the real world, you negotiate for it, and how you handle that conversation matters just as much as the terms themselves.

Start here: Know your business better than anyone else in the room.

Before you talk terms, ask yourself: Can I explain how my business makes money—clearly and quickly? Do I know my burn rate, runway, margins? Can I explain why now is the right time to invest?

If you can’t answer these, the investor will fill in the blanks for you. And you probably won’t like the assumptions they make.

Tools like Upmetrics can help sharpen your pitch, clarify your financials, and build a story that holds up under pressure, especially when the questions get specific.

Common mistake: Rushing the first deal❗

At pre-seed, this happens a lot: Founders feel pressure to close fast. They agree to deals without asking hard questions.

But early equity decisions shape every round that follows.

You can’t afford to wing it.

Not all investors are the same🤝

And don’t treat all investors the same. Different investors bring different things to the table. Some bring just money. Some bring real value: talent access, follow-on support, or operational help. If you’re giving up equity, make sure it reflects what you’re actually getting—not just what you hope they’ll offer.

Push back (Yes, you should)

Also, let’s be clear: Most deals aren’t handed out fairly. Most investors aren’t offering their best terms first. They expect pushback. If you treat the negotiation like a one-way process, you’ll either overpay in equity or walk away from a deal that could’ve worked if you’d just spoken up.

Don’t fake it⚠️

Confidence is important, but don’t bluff. Be honest about what you know and real about what you’re still figuring out. Investors have seen enough pitches to know when something doesn’t add up. They’d rather work with a founder who’s grounded than one who’s trying too hard to impress.

And if you’re unsure? Get help.

Bringing in someone experienced isn’t a weakness—it’s a way to protect your business from long-term damage. Founders usually don’t lose control of their company in year five. They lose it during that first investment conversation when they are too unsure to ask the right questions.

An impartial deal is one you still believe in at your next round. Not one that leaves you wondering if you gave up too much, too early, to the wrong investor.

A good deal is one you won’t regret when things get real

The easiest part of the raise is signing. The hardest part is living with it.

If you’re asking what a fair percentage for an investor is, that’s good. Keep asking. But also ask: Did the investor actually help you build something? Did that investment push your company forward? Or are you now working twice as hard with half the ownership?

If the answer’s yes, you made a smart call. That’s what a good deal actually looks like. A smart investment leaves you with ownership, breathing room, and someone in your corner.