CB Insights reports that only 46% of seed-funded companies successfully raise follow-on rounds. This statistic reveals a fundamental disconnect between what founders think fundraising requires and what investors expect.

Many founders skip the crucial step of assessing whether they need more capital or if they’ve hit the milestones that make them attractive to the next tier of investors.

Instead, they jump straight into creating materials and reaching out to investors without understanding the specific requirements of their funding stage.

Well, let me help you gain some clarity about funding rounds and how to prepare for them without making the most common mistakes founders often make.

Spending hours putting together documents for your investor meet?

Build your plan, pitch, projections in minutes with Upmetrics

Plans starting from $14/month

What is a funding round (for a startup)?

A funding round is a formal event where startups raise a specific amount of capital from investors in exchange for equity (ownership shares) or debt. Instead of taking a huge lump sum amount, startups typically raise money in stages or rounds as they grow.

These rounds are directly related to your company’s stage, i.e., seed funding (early stage), Series A (for growth), and Series B, C, or beyond (for further expansion). You will be attracting different types of investors based on your company’s maturity and funding needs.

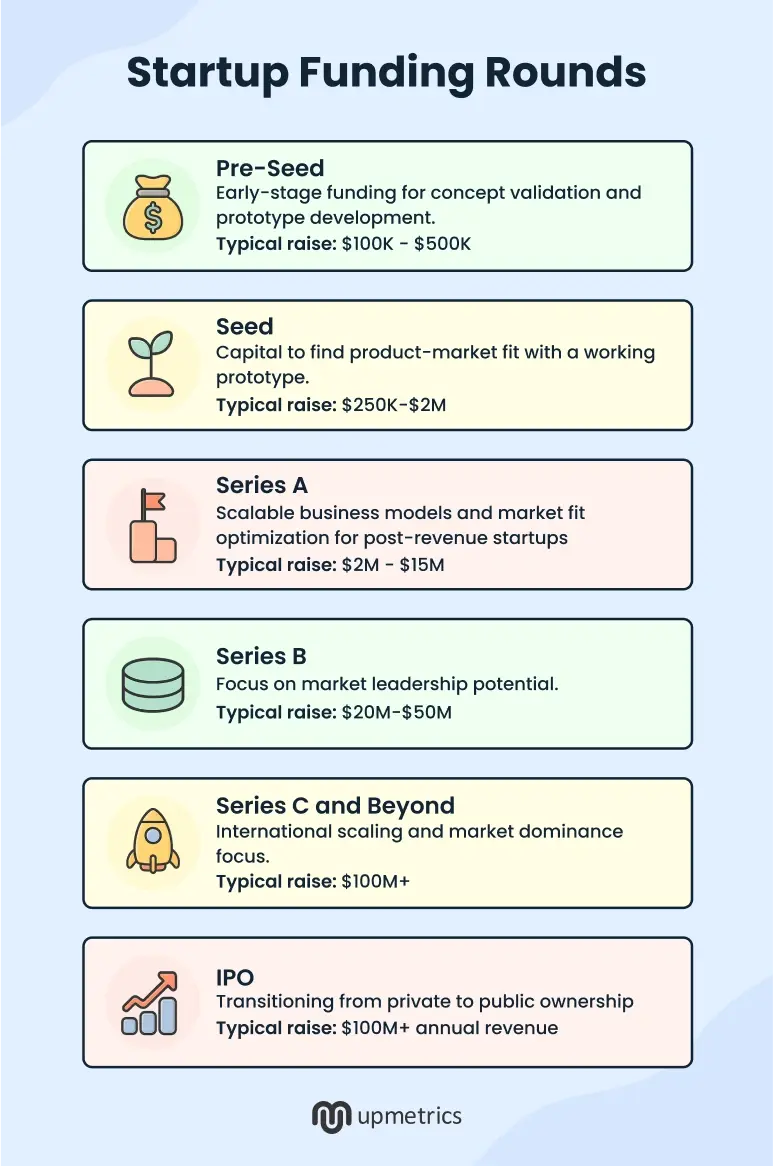

The six funding rounds (or stages) explained

Each funding stage serves a distinct purpose in your startup’s journey. Let me show what investors expect at each round, so you can prepare efficiently:

1. Pre-seed

Pre-seed funding comes before founders have a product or customers. At this stage, founders are working with a very small team (or even by themselves) and are developing a prototype or proof-of-concept. They’re essentially selling their vision and ability to execute to convince investors to invest.

The money to fund a pre-seed stage typically comes from an angel investor or an incubator. However, founders themselves or their families and friends can also be the primary investors at this stage. They’re typically betting on your ability to execute, not your current metrics.

Take Comp AI, the San Francisco-based startup that secured $2.6M in pre-seed funding while still developing its AI-powered compliance platform. Investors like OSS Capital and Grand Ventures weren’t investing in proven revenue streams, but rather in the founding team’s vision to automate SOC 2 compliance and their ability to execute on that concept.

2. Seed round

Seed funding happens when you have a working prototype but need capital to find product-market fit. Investors at this stage are usually angel investors and early-stage venture capital firms, who are more likely to invest in the product, the market, and the team.

These investors would expect to see early traction, i.e., actual users, revenue (even if small), and a clear path to product-market fit to gain confidence in your proposal. They want to see that you’ve validated your assumptions and have a repeatable way to acquire customers.

Take Elion, for instance.

This New York-based healthcare AI platform raised $9.3M in seed funding, with its working research and intelligence platform already serving healthcare organizations. Investors saw early traction in the health tech market, with the funding specifically targeted to achieve stronger product-market fit in the healthcare technology space

3. Series A

Series A focuses on optimizing the product and market fit for post-revenue (yet early-stage) startups. This is for businesses with a scalable business model and predictable revenue growth.

Series A investors want to see consistent growth metrics and a clear path to consistent profitability. You should have established revenue streams, a growing customer base, and a clear expansion strategy to convince them to invest.

For instance, Capsule.

This AI video editing platform raised $12M in Series A funding. With established clients like HubSpot, Instacart, and Ramp, plus a third of their revenue coming from expansion, Capsule showed the consistent growth metrics and clear path to profitability that Series A investors require before writing larger checks.

4. Series B

Series B aims to scale the business that needs capital to expand operations, enter new markets, or develop additional products. Such businesses need to demonstrate a market leadership potential with strong competitive positioning.

Investors will seek evidence that you can capture a significant market share to provide you with the institutional money. Due diligence processes and formal deal terms become tighter and more rigorous.

Take Cortex, for instance.

This internal developer portal startup raised $35M in Series B funding, showcasing the market leadership potential that Series B investors demand. With 400% year-over-year revenue growth and enterprise clients, Cortex demonstrated the strong competitive positioning needed to justify the larger funding round for market expansion

5. Series C and beyond

Series C is about preparing for major expansion or acquisition, i.e., scaling internationally, acquiring competitors, or preparing for public offerings.

Investors at this stage want to see clear paths to liquidity events. These investors are generally late-stage venture capital firms, private equity firms, and strategic investors willing to invest $50 million and so money in a business.

Take Ambience Healthcare, for instance.

The AI platform raised $243M in Series C led by Oak HC/FT and Andreessen Horowitz. With clients like the Cleveland Clinic and UCSF Health already using their platform, they’ve proved the market dominance required by Series C investors. The funding targets international scaling and broader healthcare deployment.

6. IPO

An Initial Public Offering (IPO) transitions your company from private to public ownership. This isn’t technically a funding round but rather a liquidity event where early investors can sell their shares.

Companies going public typically have revenues exceeding $100 million annually, established market positions, and predictable growth trajectories. The IPO process involves significant regulatory compliance, financial transparency, and ongoing public market obligations.

Look at Firefly Aerospace in this space.

This Texas-based space technology company recently completed its IPO, pricing shares at $45 each after raising the range multiple times. With over $176 million in cash and established operations in rocket manufacturing, Firefly met the revenue requirements and market position needed for public market investors.

That said, here’s a quick overview of what each funding stage looks like:

| Round | Average Raise | Typical Investor | What to Prove |

|---|---|---|---|

| Pre-seed | $100K – $500K | Friends, family, angel investors, incubators | Market opportunity exists, and you can build something people want |

| Seed | $250,000- $2 Million | Angel investors, early-stage VCs | Product-market fit potential with clear user engagement |

| Series A | $2 Million- $15 Million | Venture capitalists | Scalable business model with predictable revenue growth |

| Series B | $20 Million-$50 Million+ | Late-stage VCs, growth equity firms | Market leadership potential with strong competitive positioning |

| Series C and beyond | $100 Million + | Late-stage VCs, private equity, and strategic investors | Market dominance with clear exit opportunities |

| IPO | 10-20% of the company’s shares are raised in an IPO | Public market investors | Sustainable business model with transparent financials |

How to prepare for a funding round?

Preparation is what separates successful fundraising from rejection letters. When you approach an investor with a funding request, they would need certain documents to assess both your business potential and your ability to execute.

Well, here are the 3 essential documents you should be building to have a successful funding round:

Business plan

Your business plan for investors acts as your startup’s strategic blueprint that investors scrutinize before writing checks. It demonstrates whether you understand your market and have a go-to-market strategy that leads to profitability. Think of it as a document that would convince investors of your business’s potential.

Investors often request detailed business plans after initial pitch meetings to validate the claims you made during presentations.

And while your business plan can include multiple details, investors do expect to find information about these key components:

- Business model: Explain how you plan to make money, revenue streams, and unit economics to turn your business profitable

- Go-to-market strategy: Map out exactly how you’ll reach customers and scale your sales efforts

- Competitive analysis: A thorough analysis of your direct and indirect competition and the edge (competitive advantage) you have over those competitors

- Use of funds: A precise breakdown of how you’ll deploy investor capital to achieve specific milestones

Financial projections

Investors use financial projections to understand whether your business can generate meaningful returns on their investment. And trust me, they don’t expect perfect accuracy with your numbers.

They just need numbers that are grounded and backed by realistic assumptions. Numbers that align with the growth and scale you promise in your business plan.

For instance, if you project 50% year-over-year growth, explain the specific initiatives that will drive it.

Projecting financials isn’t hard if you follow this simple approach:

- Analyze historical data: Gather bits and pieces of data accumulated over the past few months and years to analyze seasonal trends, dips, soars, and many such nuances that affect your business performance

- Analyze competitors: Analyze historical patterns from similar companies in your industry. Study how competitors grew their revenue, what their customer acquisition costs looked like, and how long it took them to reach profitability

Use this market intelligence combined with your specific business insights to build projections for the next 3-5 years.

Next, you model scenarios, i.e., what will happen to your finances in various aggressive and progressive situations.

Show investors you’ve thought through different possibilities and have contingency plans. This will demonstrate strategic thinking and, more importantly, keep you prepared for all sorts of situations, financially.

Investor pitch deck

While your business plan provides comprehensive details, investors need something digestible for initial meetings. A pitch deck with its visual storytelling provides exactly that.

A pitch deck is a high-value overview of your business plan covering every detail that would compel the investor to learn more.

After analyzing over hundreds of pitches, here are some essentials your deck should include:

| Slide | Purpose | What do investors look for? |

|---|---|---|

| Problem | Establish the market pain point significance | Large, growing pain point affecting many potential customers |

| Solution | Present your unique approach to solving the problem | Clear differentiation from existing alternatives and switching incentives |

| Market | Quantify the size of the business opportunity | Realistic market size that can support venture-scale returns |

| Traction | Demonstrate customer validation and momentum | Real usage metrics and revenue growth, not vanity metrics |

| Business model | Show how you make money sustainably | Clear revenue streams with proven or realistic unit economics |

| Team | Prove execution capability | Relevant experience and domain expertise for this specific challenge |

| Financials | Project a realistic growth trajectory | Ambitious yet achievable projections based on actual performance data |

| Competition | Position against alternatives | Honest competitive analysis with clear competitive advantages |

| Funding ask | Specify investment terms and deployment | Specific funding amount with a clear milestone timeline and use of funds |

Need help building your business funding documents?

Develop Funding-ready Plans and Pitch Decks with Upmetrics

Plans starting from $14/month

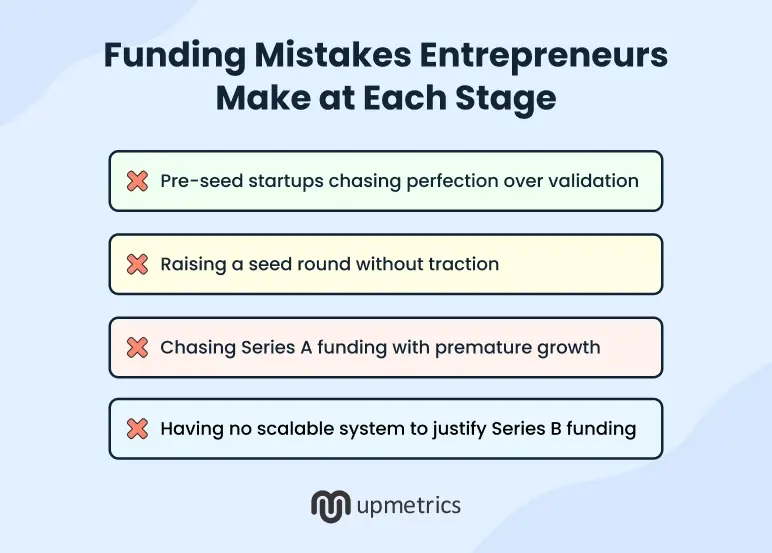

What do most founders get wrong about funding rounds?

Founders treat every investor the same, not realizing that a seed investor’s risk tolerance and timeline expectations are completely different from a Series B investor’s.

This expectation mismatch is the reason why you may find it difficult to close the funding round.

So, I’ve created a roundup of mistakes founders make (in different stages of their funding rounds):

Pre-seed: Chasing perfection over validation

The perfectionist mindset in the initial stage can lead to timing and resource mistakes. There’s a problem if you’re:

- Building in isolation: Spending months developing features without involving potential users, then discovering the market wants something completely different

- Overengineering solutions: Creating complex technical architectures when simple prototypes would prove the core concept faster and cheaper

Seed: Raising without traction

Seed-stage companies have some product momentum, but founders frequently misinterpret what investors consider real traction signals.

- Confusing vanity metrics with growth: Presenting app downloads and social media followers instead of user retention and engagement rates

- Raising without repeatability: Showing revenue spikes from one-time events rather than sustainable customer acquisition systems

Series A: Premature scaling

These founders have proven some product-market fit but often rush to expand before solidifying their foundation.

- Lack of local expertise: Entering new markets before dominating their initial territory or understanding expansion mechanics

- Feature bloat over core strength: Adding multiple product lines instead of perfecting the core offering that drives most revenue

Series B: No scalable team or systems

These companies have proven their business model works, but founders often hire aggressively without creating the operational foundation to support growth.

- Scaling headcount before processes: Adding dozens of employees without documented workflows, leading to chaos and inefficiency as the team grows

- Missing leadership infrastructure: Hiring individual contributors without building management layers and accountability systems needed to coordinate larger teams

Alternate funding sources for startups

Venture capital isn’t the only way to fund a startup. I have seen many founders either augment VC money with other sources or bypass VC altogether.

That’s why, you should consider some of these alternate sources:

- Bootstrapping: Fund the business using your savings or early revenue while keeping full control

- Friends and family: Raise small, early-stage capital from people who trust you enough to back the idea

- Loans: Try bank loans, government-backed loans (SBA loans), or revenue-based financing that doesn’t require you to give up equity

- Angel investors: Bring in experienced individuals who invest personally at the early stage

- Equity crowdfunding: Raise money online from a large group of small investors through regulated platforms

- Accelerators and incubators: Join programs that offer funding, mentorship, and investor access in exchange for equity

- Grants and government funding: If your business fits specific sectors or innovation criteria, apply for non-dilutive capital

- Strategic partnerships: Get capital or resources from companies interested in your product or market

How to know you’re ready to raise your next round?

Timing a fundraise is crucial. If you go out too early, you risk taking a low valuation, but if you wait too long, you might run out of cash or miss the market window.

So, how do you know when your startup is truly ready to raise the next round?

Here’s a quick checklist to help you decide:

| Funding round | Signs that you’re ready | Signs that you’re not ready |

|---|---|---|

| Pre-Seed |

|

|

| Seed |

|

|

| Series A |

|

|

| Series B |

|

|

Get funding ready with Upmetrics

The difference between successful and unsuccessful fundraising often comes down to preparation and timing. Companies that secure funding know their numbers inside out, have documented processes, and approach the right investors at the right stage.

These founders also understand that fundraising is a process, not a single event, which means having your documents ready before you need them.

If you need help (and you will) to prepare for your funding rounds, Upmetrics and its AI-powered business planning resources are what you need. You get business plan samples, strategic planning templates, an AI pitch deck generator, and an intuitive financial plan builder (with AI assistance)—all in one place.

Sign up and get funding ready today.