Executive Summary

IronHaul Dump Services, LLC is a Birmingham, Alabama, dump-truck hauling company founded by Marcus Delaney. The business operates one 2021 Kenworth T880 to haul dirt, gravel, asphalt, debris, and construction materials for general contractors, plants, excavation crews, landscaping suppliers, roofing firms, and demolition contractors across the Birmingham region. IronHaul charges for work on an hourly basis, per-load basis, and through a minimum job charge.

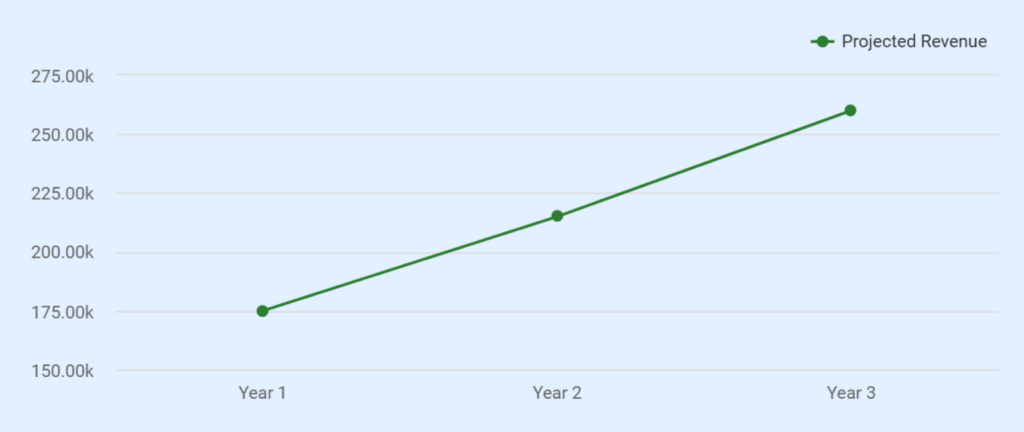

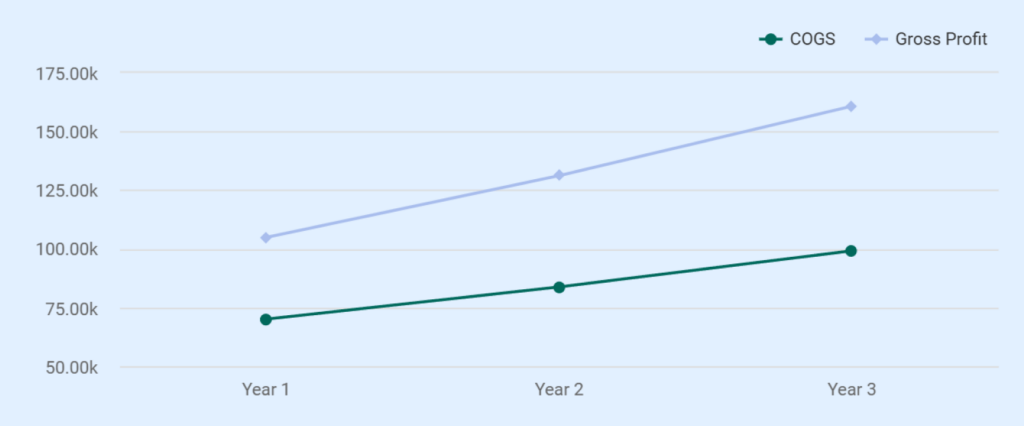

Year 1 utilization is intentionally conservative at an average of 3.5 to 4 billable days per week. Utilization increases in Years 2 and 3 as repeat customers and contractor relationships stabilize. Based on these assumptions, projected revenue is $175,000 in Year 1, $215,000 in Year 2, and $260,000 in Year 3.

The cost structure uses fuel as a percentage of revenue at 31 percent, while maintenance, tires, insurance, permits, GPS, marketing, and bookkeeping are fixed monthly amounts set at realistic levels for a single heavy truck. An EBITDA margin of 12-18% is average owner-operator performance. The business needs roughly $16,500 in monthly revenue to break even, and it is projected to hit that level during Year 1.

The business requires $155,980 in startup uses, including the truck purchase, permits, initial insurance, branding, GPS and scale setup, and initial working capital. Total funding is $180,000, consisting of a $148,000 bank loan and $32,000 in owner equity. The difference of $24,020 is intentionally set aside as a liquidity reserve to cover early cash timing gaps (net-30 to net-45 contractor payments), deductible exposure, unexpected repairs, tire replacement risk, and fuel-price swings during the ramp-up period.

IronHaul is a narrow, low-variance operating model that is based on realistic prices, capped costs, and a seasoned operator who does all the daily operations. This structure provides transparent cash flow and a clear repayment path for the proposed loan.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you.

Company Overview

IronHaul Dump Services, LLC operates as a single-truck hauling business based in Birmingham, Alabama. The company provides transport of dirt, gravel, asphalt, debris, and demolition materials for contractors, aggregate plants, excavation crews, and local agencies. It is structured for steady daily hauling volume with a narrow service focus and predictable operating routines.

Legal Structure and Ownership

IronHaul is organized as an Alabama Limited Liability Company. Marcus Delaney is the sole owner of the business and takes all the operational, driving, scheduling, and compliance duties. The LLC is a simple administrative structure, with clear ownership and protection of liabilities, which is appropriate when starting a small hauling operation.

Business Location

The company operates from the Eastwood Industrial Zone in Birmingham. This area sits near major job corridors, supply yards, concrete and asphalt plants, and active construction sites. The location reduces deadhead mileage, supports early-morning dispatch, and places the truck close to consistent hauling demand.

Business Model and Scope of Work

IronHaul runs a focused service model built around three types of hauling jobs:

- Hourly hauling for full or partial workdays

- Per-load delivery for aggregates and fill materials

- Minimum-charge short trips for small contractors and supply yards

The work centers on predictable construction and material transport needs rather than niche or occasional hauling categories.

All hauling services are performed as regulated intrastate short-haul operations within Alabama, consistent with APSC and FMCSA short-haul provisions.

Operational Identity

The company follows a straightforward owner-operator structure. Marcus does all driving, inspections, coordination of maintenance, scheduling, communicating with customers, and other records. The operation mode is based on early shipment, pre-trip check, maintenance schedule calendar, and invoices in a single day as the main ways to maintain a stable cash flow and minimum downtime.

Long-Term Direction

The first three years focus on securing repeat accounts, stabilizing weekly utilization, and maintaining the truck in strong working condition. Expansion will be considered once job volume and cash flow support a second driver, which is targeted for early 2028, without changing the core service model.

A business plan shouldn’t take weeks

Services and Pricing Model

IronHaul provides three categories of hauling services that match the daily needs of contractors, material suppliers, and demolition crews in Birmingham. Rates follow local market standards and reflect the operating cost of a heavy dump truck, including fuel use, wait times, and early-morning dispatch requirements.

Hourly Hauling (Primary Revenue Driver)

Hourly work is the core of the business because contractors often need continuous truck support during site prep, plant-to-job cycles, and demolition work.

| Job Type | Rate Range (per hour) | Typical Use Case |

|---|---|---|

| Dirt hauling | 95–115 | Grading and excavation crews |

| Gravel and aggregate | 100–125 | Plant-to-job deliveries |

| Asphalt support | 110–135 | Priority paving work, early dispatch |

| Debris and demolition | 105–140 | Tear-outs and cleanup work |

Key points:

- These jobs allow the truck to stay active for full or partial workdays and reduce idle time.

- Most contractor bookings occur early in the morning, so the truck’s dispatch schedule is built around these peak start times.

- Hourly hauling offers predictable revenue and consistent job flow across the week.

Per-Load Transport

Per-load pricing is used when customers want a fixed cost for each trip rather than an hourly rate.

| Load Type | Price Range (per load) | Notes |

|---|---|---|

| Gravel (≈15 tons) | 360–420 | Common morning plant runs |

| Fill dirt | 250–310 | Short-distance projects |

| Roofing tear-off / debris | 300–380 | Small-site removal |

Key points:

- Per-load work helps fill shorter days and supports contractors who do not need the truck for a full block of hours.

- These runs are usually local, which keeps fuel use predictable and limits unnecessary mileage.

- Plants and small contractors often schedule these loads in clusters, allowing efficient routing.

Minimum-Charge Jobs

Some small jobs require only a short trip, but they still carry fuel, wait time, and repositioning costs. For this reason, IronHaul uses a three-hour minimum charge.

- The standard minimum charge is about $320 per job.

- These jobs are common during winter slowdowns or between longer hourly bookings.

- Minimum-charge work protects daily revenue while keeping the truck available for higher-value bookings later in the day.

Pricing Logic

IronHaul’s pricing is built around what the Birmingham hauling market consistently supports, along with the known cost structure of operating a heavy-duty dump truck.

- Rates reflect fuel usage, site wait times, wear on the truck, and early-morning dispatch requirements.

- There are no significant price changes across the year, except minor ones in the case of repeat contractors or projects that take more than a day.

- A simple rate structure is used to simplify contractor budgeting and minimize billing disputes.

Service Boundaries

IronHaul handles only local hauling within Birmingham and the surrounding job hubs. It does not perform long-haul transport or move oversized or hazardous materials. This keeps mileage manageable, supports fast turnaround times, and maintains a predictable maintenance schedule.

Does your plan sound generic and template-like

Refine your plan to adapt to investor/lender interests

Market Research

Regional Construction and Infrastructure Activity

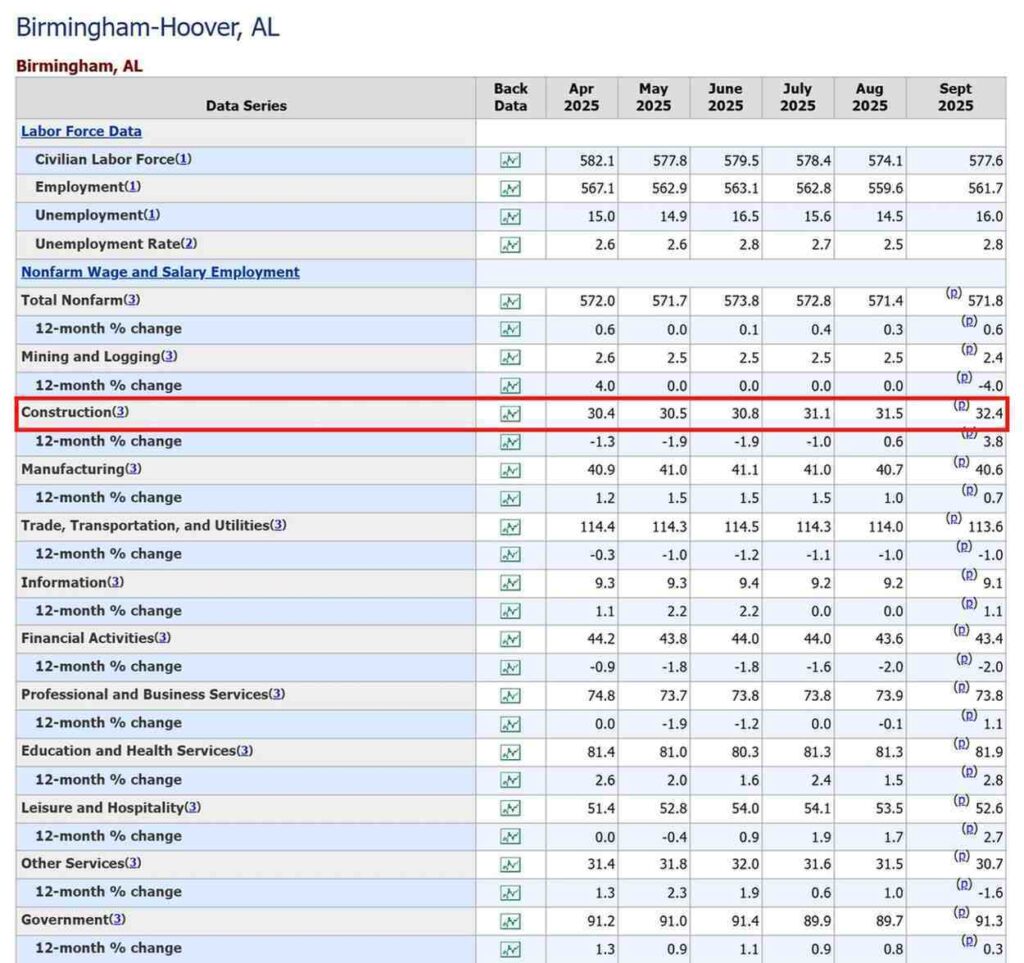

The Birmingham–Hoover metro benefits from steady, year-round construction and infrastructure work. According to the U.S. Bureau of Labor Statistics, construction represents a meaningful share of local employment, though activity is seasonal and influenced by weather.

Despite these fluctuations, ongoing site preparation, material movement, and debris hauling continue throughout the year, creating recurring demand.

The Alabama Construction Outlook Survey Report 2024 reports stable to rising activity across public and industrial construction. This base level of activity is reinforced by recurring state-funded infrastructure programs such as the Rebuild Alabama Act and new project allocations announced for 2025.

Key demand drivers in the metro

- Ongoing site work and civil construction

- Public infrastructure and road projects

- Industrial and commercial development

- Continuous material transport needs rather than one-off jobs

Growth in State Transportation Funding

| Rebuild Alabama Program | Funding Level |

|---|---|

| 2023 reported revenue | ~$788 million |

| 2024 reported revenue | ~$887 million |

Sustained transportation funding supports resurfacing, widening, bridge repair, and related civil projects. These activities consistently require dump trucks to move dirt, aggregate, asphalt, and demolition debris.

For small, owner-operated hauling companies such as IronHaul, the value lies in the volume and continuity of projects. Ongoing public and contractor-led work strengthens baseline local hauling demand throughout the year.

City of Birmingham Capital Projects and Private Development

The Birmingham Department of Capital Projects oversees continuous public works, facility upgrades, and infrastructure improvements across the city. These projects routinely require:

- Excavation haul-off

- Aggregate and asphalt delivery

- Removal of demolition debris

In parallel, private mixed-use, multi-family, and commercial developments across the metro create recurring short-haul needs. These projects generate frequent, localized hauling jobs that match IronHaul’s service focus.

Implications for IronHaul’s hauling demand

The Birmingham–Hoover market supports hauling demand through multiple overlapping sources rather than a single construction cycle. Construction activity forms a meaningful part of the local economy, with roughly 31,000 workers engaged across building, site preparation, and civil work. This scale of activity generates continuous movement of dirt, aggregate, asphalt, and debris, not short-term hauling spikes.

Public infrastructure programs add another layer of demand stability. State-funded road and bridge projects move forward on scheduled budgets and timelines, independent of private market conditions. These projects require predictable hauling support for resurfacing, widening, drainage, and repair work.

At the same time, city-managed capital projects and private development create frequent, smaller hauling needs spread across multiple job sites. This structure favors local, short-haul operators rather than large fleet-dependent contracts.

Primary sources of hauling demand

| Demand Source | Type of Work | Hauling Impact |

|---|---|---|

| State infrastructure programs | Roads, bridges, resurfacing | Recurring aggregate and asphalt hauling |

| City capital projects | Public works, site upgrades | Excavation haul-off and debris removal |

| Private developments | Commercial and multi-family builds | Short-haul dirt, gravel, and demolition transport |

Why does this market structure work for IronHaul?

- Demand comes from several independent sources rather than one large customer.

- Projects are local and short-distance, matching single-truck operations.

- Repeat, smaller jobs support steady utilization without long-haul exposure.

Overall, IronHaul operates in a metro environment where routine hauling needs align with the capacity and economics of a single Kenworth T880. This reduces concentration risk while supporting consistent utilization and predictable revenue.

Industry and Local Market Conditions

Construction Activity in the Birmingham Metro

In the Birmingham-Hoover metro, hauling work is typically awarded on a job-by-job basis rather than through long-term hauling contracts. General contractors, excavation crews, demolition teams, and material plants routinely rotate one-truck and two-truck operators based on availability, reliability, and compliance.

This structure creates regular entry points for dependable local haulers. Operators who are punctual, responsive to early-morning dispatch, and consistent in pricing are frequently reused across multiple job sites without formal exclusivity.

Target Customers and Buyer Demand

IronHaul’s hauling services are purchased primarily by contractors and suppliers who require frequent, short-haul movement of materials and debris. These buyers operate on rotating job sites and typically hire one-truck or two-truck operators for daily support rather than entering long-term hauling contracts.

Primary buyer groups in the Birmingham metro

| Customer Type | Typical Hauling Needs |

|---|---|

| General contractors | Dirt, gravel, and asphalt hauling |

| Excavation and grading crews | Soil removal and backfill transport |

| Concrete and asphalt plants | Aggregate and plant-to-site loads |

| Demolition contractors | Debris and material removal |

| Landscaping suppliers | Fill dirt and gravel delivery |

| Municipal subcontractors | Short-haul road and site material transport |

These customers value punctual dispatch, compliance, and local familiarity. Work is awarded based on availability and reliability rather than fleet size, which allows new, dependable operators to integrate into contractor rotations quickly.

Seasonal Operating Patterns

Work volume typically rises from March through October when weather allows for continuous grading, paving, and site movement. The winter slowdown from December through February is driven largely by rain and wet-ground conditions.

Single-truck operators adapt to this pattern by stacking minimum-charge work, taking per-load plant runs, and scheduling maintenance during slower weeks. IronHaul’s utilization assumptions reflect this cycle, beginning at 3.5 to 4.0 billable days per week in Year 1 and increasing gradually as customer relationships form.

Competitive Landscape

The Birmingham hauling market is fragmented, with many owner-operators running one to three trucks. Contractors typically rotate trucks based on daily availability rather than locking into long-term hauling contracts. This structure allows reliable new entrants to secure work quickly if they meet job-site expectations.

| Competitor Type | Description | How IronHaul Compares |

|---|---|---|

| Direct competitors | One-truck and two-truck owner-operators serving local contractors | Competes directly on availability, punctual dispatch, and rate consistency |

| Small local fleets—Operators with 3–5 trucks focused on higher-volume sites | IronHaul avoids fleet overhead and remains flexible for short-haul jobs | |

| Indirect competitors | Large regional fleets and national hauling firms | Less competitive on short, local jobs due to higher minimums and scheduling rigidity |

Plants, demolition crews, and excavation teams prioritize operators who can arrive early, remain compliant, and respond quickly to schedule changes. Fleet size is less important than reliability and job-site familiarity.

IronHaul is positioned to stand out by focusing on predictable pricing, early-morning dispatch readiness, and consistent local availability. This allows the business to integrate into contractor rotation lists and secure repeat short-haul work without competing on scale or long-term contracts.

Stop Googling competitors for hours

Industry Outlook (Global Context)

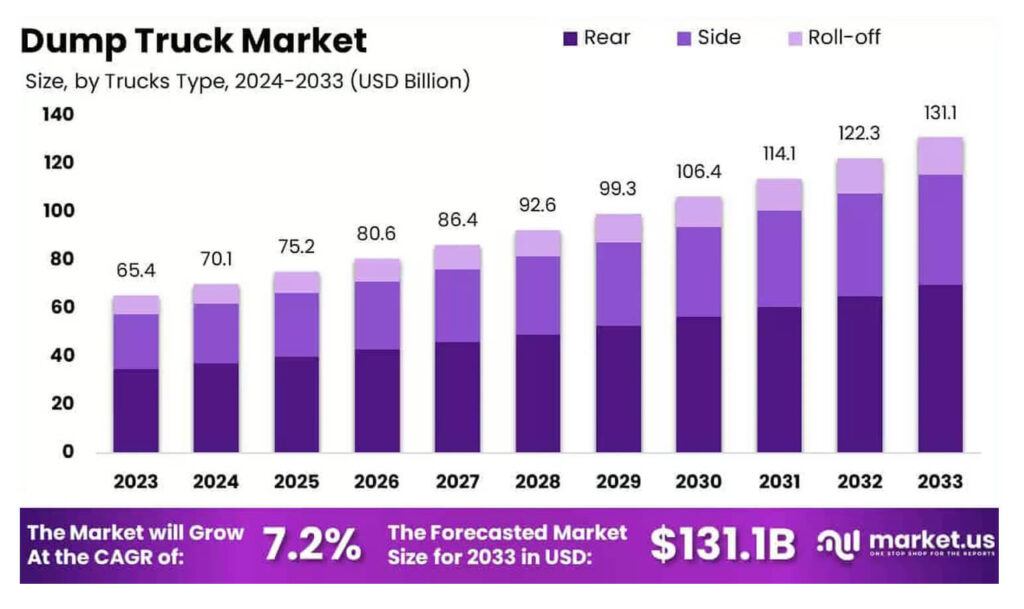

Global research suggests long-term growth in the dump truck sector, with estimates placing the market at about $65 billion in 2023 and rising toward $131 billion by 2033.

While these projections are not Birmingham-specific, they reflect sustained investment in construction support and material transport, which supports ongoing demand for local hauling services like IronHaul.

Operations Plan

IronHaul is a one-truck hauling company that is founded on early-dispatching, predictable-scheduling, and adherence to both federal and Alabama commercial-vehicle regulations. It is aimed at ensuring that the truck is active between 3.5 and 5 billable days per week, and the operations are safe, the fuel is controlled, and the downtime is minimal.

Daily Operating Workflow

Most asphalt plants, excavation crews, and material yards open before sunrise, so IronHaul’s workday begins early. The truck is staged the evening before, and pre-trip inspections are completed before dispatch between 4:45 AM and 6:00 AM. Loading occurs at plants or job sites in the morning, followed by plant runs and short-haul cycles before traffic and job-site congestion increase.

Afternoon work typically includes hourly haul-offs, demolition debris movement, or minimum-charge assignments. Jobs are scheduled with realistic buffers for traffic, loading wait times, and weather delays. Invoices and job documentation are issued within 24 hours to maintain cash flow discipline and contractor trust.

Maintenance, Safety, and Compliance

IronHaul complies with all applicable federal and Alabama intrastate commercial-vehicle regulations. The company maintains an active USDOT number, files a BOC-3 designation for process agents, and registers with the Alabama Public Service Commission (APSC) for intrastate hauling authority. Compliance includes daily pre-trip inspections, duty-status logging, and annual DOT inspections under FMCSA regulations.

The maintenance plan includes daily checks, weekly mechanical review, and scheduled servicing every 12,000 to 15,000 miles, depending on haul type. Repairs, tire replacements, and inspection records are retained as required under FMCSA Parts 382, 391, and 396.

IronHaul operates under short-haul rules where applicable, allowing simplified hours-of-service logging for local operations conducted within regulated mileage and duty-time limits. The business also maintains an active CDL with air-brake endorsement, HVUT filings, and Drug and Alcohol Clearinghouse registration.

Fuel Management and Cost Control

Fuel is IronHaul’s highest variable cost and is modeled at 31% of total revenue. The company has managed to control this cost by refueling at off-peak times, minimizing unnecessary repositioning miles, and direct plant-to-site routing where possible.

In case of a huge increase in the cost of diesel, IronHaul implements small adjustments to fuel surcharge, which is a norm in the industry, as recommended by carrier benchmarking studies at the American Transportation Research Institute. Limiting trips to short, local routes within the Birmingham metro helps control fuel consumption and cost volatility.

Scheduling, Dispatch, and Job Mix

The company uses a simple, direct scheduling system that fits a single-truck model. Contractors book by phone or text, and repeat customers receive priority morning slots.

Work is balanced between per-load plant runs and hourly job-site support, which reduces idle gaps and aligns with the production schedules of excavation crews, paving teams, and demolition contractors. Because most small and mid-size contractors rotate trucks based on availability rather than long-term contracts, IronHaul’s reliability and punctuality position it well for recurring weekly work.

A typical weekly distribution of work is shown below:

| Job Category | Typical Share of Weekly Work | Operational Notes |

|---|---|---|

| Plant/aggregate runs | 35–45% | Early morning, short-haul cycles |

| Excavation haul-off | 25–30% | Dirt, clay, and site materials |

| Asphalt support | 15–20% | Requires early dispatch and tight timing |

| Demolition debris | 10–15% | Usually, afternoon or overflow work |

This mix reflects the real distribution of hauling demand in Birmingham’s construction sector.

Operating Radius and Job Fit

IronHaul operates primarily within Birmingham and adjacent job corridors to keep turnaround times short. Most work involves loads under 20 miles round-trip, which allows the truck to complete multiple cycles per day. Hauling categories are not oversized or hazardous and are not subject to specialty and legal weight requirements.

This mode of operation conforms to the realistic productivity of a single Kenworth T880 and eliminates downsizing that comes with lengthy routes or advanced haulage duties.

Don’t spend weeks on your first draft

Complete your busienss plan in less than an hour

Recordkeeping, Documentation, and Invoicing

IronHaul maintains organized records to support regulatory compliance, operational tracking, and accurate billing. Required documentation is stored digitally and updated on a rolling basis to ensure availability during audits, inspections, or contractor reviews.

Core records maintained:

- Driver qualification files and CDL documentation

- USDOT registration, BOC-3 filing confirmation, and APSC intrastate authority documentation

- Daily vehicle inspection reports (DVIRs)

- Maintenance and repair logs

- Annual inspection certificates

- Fuel receipts and expense records

Maintenance and inspection records are retained in line with FMCSA recordkeeping rules for driver qualification files and vehicle inspection, repair, and maintenance records (49 CFR Parts 391 and 396). Supporting documents are stored digitally to meet contractor and insurer documentation requirements.

Invoicing is issued per job based on hourly rates, per-load pricing, or minimum charges, depending on the service provided. Invoices include job dates, load counts or hours worked, material type, and site location to reduce disputes and support timely payment.

Milestones and Timeline

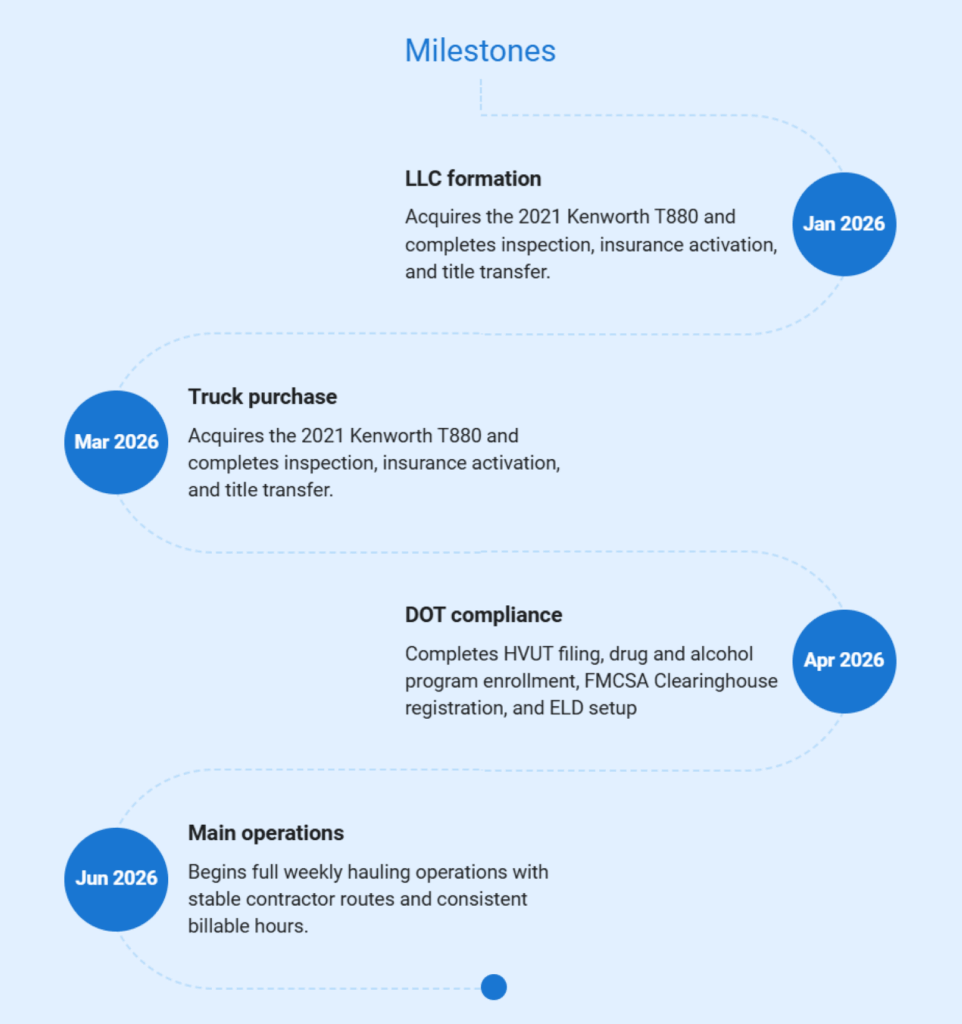

IronHaul Dump Services follows a structured startup and growth timeline designed to move the business from initial setup to stable, full-capacity operations within the first year.

Operational Risk Controls

Operational risks are managed through timely maintenance, fuel budgeting, insurance coverage, and proper load-securement training per FMCSA 49 CFR Part 393.

The insurance cover of the company incorporates commercial auto liability, physical damage, cargo cover, and general liability. Enforcing these precautions saves the operator and the lender and ensures that the business does not go against Alabama commercial-vehicle standards.

Staffing and Payroll Structure

IronHaul operates with a lean staffing model built for a single-truck hauling business. The owner manages all core daily functions, while limited part-time support ensures the truck can stay active during busy weeks, maintenance intervals, or early-morning dispatch times.

Owner-Operator Role

The owner is responsible for driving, scheduling, customer communication, maintenance coordination, and all DOT and FMCSA compliance tasks. Treating owner compensation as a salary-equivalent draw of about $36,000 per year provides a clear financial baseline without creating a W-2 payroll obligation.

Part-Time Relief Driver

A part-time relief driver is included to protect revenue during periods when maintenance, weather, or early-morning dispatch priorities could otherwise cause missed bookings. The relief driver works an estimated ten hours per week at $23 per hour, which corresponds to roughly 0.25 FTE and falls within the typical wage range for heavy truck operators in Alabama, according to Bureau of Labor Statistics data.

A modest 10% payroll tax load is applied, keeping total annual labor cost predictable while allowing the business to maintain continuity during peak periods.

Bookkeeping and Administrative Support

IronHaul outsources bookkeeping at $120 per month. This covers monthly reconciliations, financial statements, HVUT reminders, and support for regulatory filings. Contracting this function avoids adding administrative payroll while ensuring that financial documentation remains accurate and lender-ready.

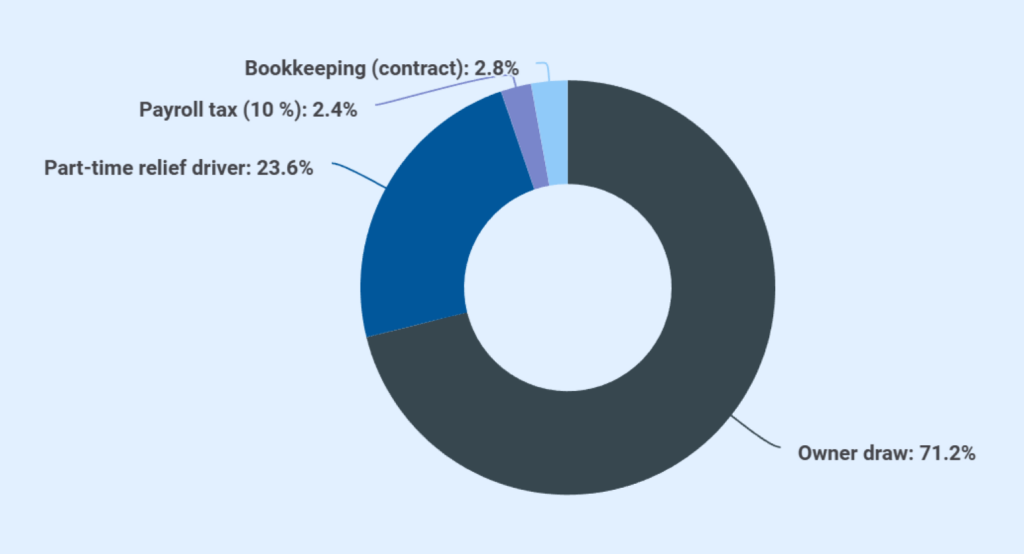

Labor Cost Overview

| Component | Cost (Annual) | Notes |

|---|---|---|

| Owner draw | 36,000 | Non-W-2, no employer payroll tax |

| Part-time relief driver | 11,960 | 23/hr at 10 hrs/week |

| Payroll tax (10 %) | 1,196 | Applied only to relief driver wages |

| Bookkeeping (contract) | 1,440 | 120/month |

This structure gives the business the labor capacity it needs while keeping fixed obligations low enough to remain stable through winter slowdowns. It also provides lenders with clear visibility into year-round operating expenses and the mechanisms that prevent unexpected downtime.

Revenue Model and Assumptions

IronHaul’s revenue is built on three consistent hauling categories that match daily contractor demand in the Birmingham metro: hourly hauling, per-load deliveries, and short-trip minimum jobs. These streams provide a balanced mix of longer site work, material transport, and quick-turn assignments. Forecast assumptions are intentionally conservative to reflect the operating limits of a single truck and an owner-operator model.

Revenue Streams Overview

| Revenue Stream | Description | Unit Type | Typical Price ($) |

|---|---|---|---|

| Hourly Hauling | Dirt, gravel, asphalt, debris hauling | Billable hour | 95–135 per hour |

| Per-Load Hauling | 15-ton gravel, fill dirt, roofing debris | Per delivered load | 250–420 |

| Minimum / Short-Trip Jobs | Small-site moves, repositioning work | Per job | $320 flat minimum |

Hourly hauling makes up the majority of revenue because contractors frequently require full-day or multi-hour service. Per-load hauling covers predictable material transport for aggregate suppliers, roofing firms, and excavation crews. Minimum jobs add steady weekly volume by filling gaps in the schedule.

Forecast Assumptions

Revenue projections are built on realistic workload expectations for a single owner-operated T880:

| Assumption Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Billable days per week | 3.5–4.0 | 4.0–4.5 | 4.5–5.0 |

| Daily billable hours (avg.) | 6.0–7.0 | 6.5–7.5 | 7.0–8.0 |

| Seasonal variation | Strong Mar–Oct; weak Dec–Feb | Strong Mar–Oct; weak Dec–Feb | Strong Mar–Oct; weak Dec–Feb |

| Monthly job volume growth | 1.0–1.5%* | 1.0–1.5%* | 1.0–1.5%* |

| Downtime allowance (weather, repairs) | 12–14% annually | 10–12% annually | 8–10% annually |

| Revenue allocation mix | 60% hourly hauling | 60% hourly hauling | 60% hourly hauling |

| 30% per-load jobs | 30% per-load jobs | 30% per-load jobs | |

| 10% minimum jobs | 10% minimum jobs | 10% minimum jobs |

Note: In the detailed revenue-stream setup, hourly hauling grows at 1.5 percent per month, and per-load and minimum-charge streams grow at 1 percent. The table above reflects a simplified blended forecast for narrative purposes.

Don’t waste time using spreadsheets

Financial Plan

The financial plan outlines IronHaul’s startup investment, operating assumptions, and three-year projections for a single-truck hauling operation. The figures reflect the company’s pricing structure, utilization schedule, cost model, and seasonality. Based on these assumptions, IronHaul is projected to cover operating costs and reach monthly break-even during Year 1, with improving cash flow and earnings in Years 2 and 3.

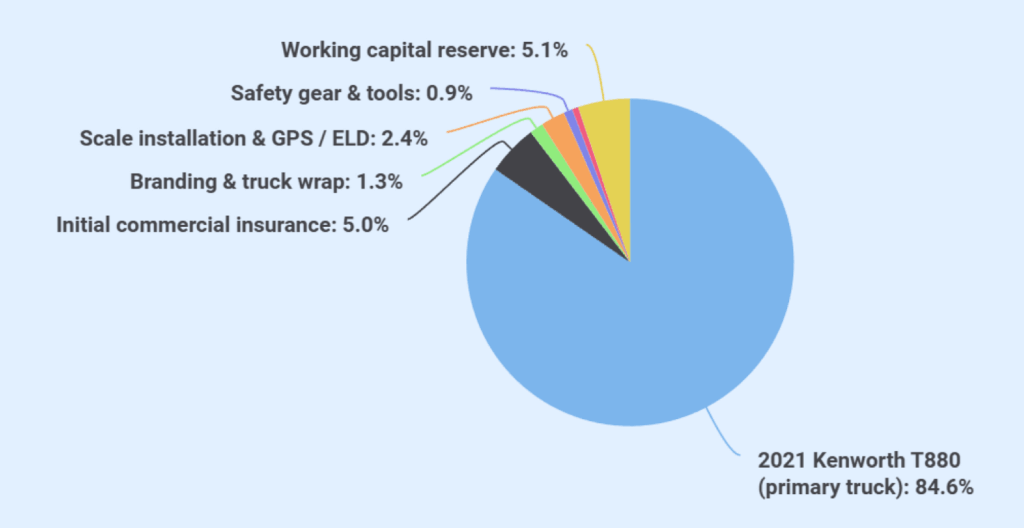

Startup Costs

| Category | Cost ($) | Notes |

|---|---|---|

| 2021 Kenworth T880 (primary truck) | 132,000 | Purchased using bank financing |

| Initial commercial insurance | 7,800 | Includes liability, cargo, and physical damage |

| Branding & truck wrap | 2,100 | Door decals + full truck branding |

| Scale installation & GPS / ELD | 3,750 | Digital scale, GPS, and ELD compliance |

| Safety gear & tools | 1,350 | PPE, chains, tarps, tie-downs |

| DOT Setup, HVUT, permits | 980 | One-time compliance costs |

| Working capital reserve | 8,000 | Fuel float + early maintenance buffer |

| Total Startup Investment | 155,980 |

Funded by a 148k loan + 32k owner equity. The business also maintains a separate $24,020 liquidity reserve funded at closing. This reserve is not part of the startup purchase list and is held for working-capital timing, deductibles, and unplanned maintenance during Year 1.

Sources and Uses of Funds

| Category | Amount ($) | Notes |

|---|---|---|

| Sources | ||

| Bank term loan (Regions Bank) | 148,000 | Truck financing plus startup liquidity buffer |

| Owner equity contribution | 32,000 | Cash injected at closing |

| Total sources | 180,000 | |

| Uses | ||

| Startup investment (truck, setup, permits, insurance, branding, GPS/scale, initial working capital) | 155,980 | Matches the startup budget table |

| Liquidity reserve (cash buffer) | 24,020 | Held for receivables timing, deductibles, repairs, tires, and fuel volatility |

| Total uses | 180,000 |

Important Assumptions

| Factor | Details |

|---|---|

| Owner-operator workload | 3.5–4.0 billable days/week in Year 1, rising to 5.0 days by Year 3 |

| Revenue mix | 60% hourly, 30% per-load, 10 % minimum jobs |

| Average blended hourly rate | $110/hour |

| Average per-load price | $320 |

| COGS drivers | Fuel ≈31 percent of revenue; maintenance & tires fixed monthly |

| Operating expenses | Insurance, GPS/ELD, compliance, marketing, and bookkeeping |

| EBITDA margin | 12–18% across Years 1–3 |

| Break-even point | ≈16,500 dollars monthly revenue |

Revenue Forecasts

| Year | Projected Revenue ($) |

|---|---|

| Year 1 | 175,000 |

| Year 2 | 215,000 |

| Year 3 | 260,000 |

These projections are based on the company’s modeled utilization schedule, assumed seasonal slowdowns, and the practical operating capacity of a single dump truck working 3.5 to 5 billable days per week.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you

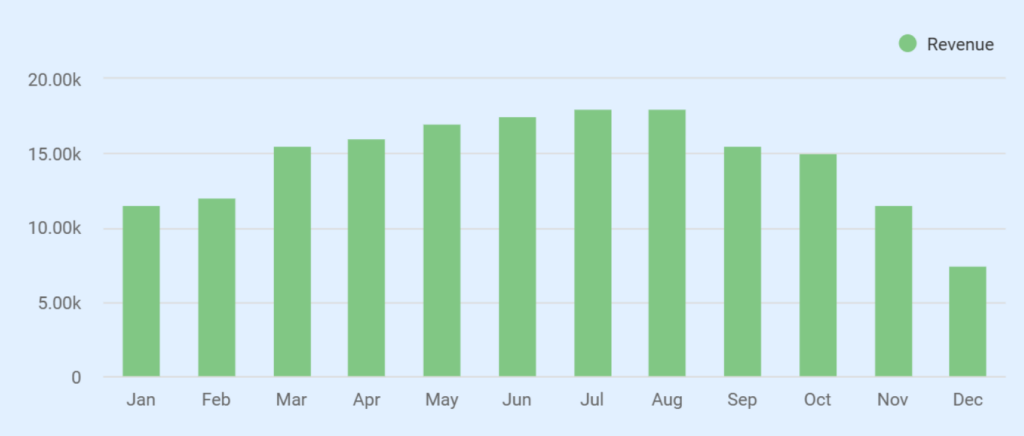

Monthly Projections (Year 1)

Seasonal lift Mar–Oct and weather slowdown in Dec–Feb.

| Month | Revenue ($) |

|---|---|

| Jan | 11,500 |

| Feb | 12,000 |

| Mar | 15,500 |

| Apr | 16,000 |

| May | 17,000 |

| Jun | 17,500 |

| Jul | 18,000 |

| Aug | 18,000 |

| Sep | 15,500 |

| Oct | 15,000 |

| Nov | 11,500 |

| Dec | 7,500 |

| Total Year 1 | 175,000 |

Projected Profit & Loss Statement (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Revenue | $175,000 | $215,000 | $260,000 |

| COGS | |||

| Fuel | 54,250 | 66,650 | 80,600 |

| Maintenance | 12,000 | 13,200 | 14,520 |

| Tires | 3,840 | 3,955 | 4,073 |

| Total COGS | 70,090 | 83,805 | 99,193 |

| Gross Profit | 104,910 | 131,195 | 160,807 |

| Operating Expenses | |||

| Insurance | 9,000 | 9,270 | 9,548 |

| Compliance, HVUT, permits | 1,200 | 1,200 | 1,200 |

| GPS/ELD/Dispatch | 1,140 | 1,160 | 1,180 |

| Marketing | 5,400 | 5,400 | 5,400 |

| Bookkeeper | 1,440 | 1,440 | 1,440 |

| Misc admin & supplies | 1,800 | 1,900 | 2,000 |

| Owner draw (salary equivalent) | 36,000 | 36,000 | 36,000 |

| Total Operating Expenses | 55,980 | 56,370 | 56,768 |

| EBITDA | 48,930 | 74,825 | 104,039 |

| Depreciation | 8,000 | 8,000 | 8,000 |

| Interest Expense | 13,600 | 10,800 | 7,900 |

| Taxable Income | 27,330 | 56,025 | 88,139 |

| Taxes | 0 | ~-4,200 | ~-6,600 |

| Net Income | ~-17,730 | ~-43,625 | ~-82,339 |

Projected Balance Sheet (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Assets | |||

| Cash | 15,077 | 44,352 | 110,111 |

| Accounts Receivable | 9,000 | 11,000 | 13,000 |

| Prepaid Insurance | 2,000 | 2,200 | 2,400 |

| Current Assets | 26,077 | 57,552 | 125,511 |

| Truck (gross) | 132,000 | 132,000 | 132,000 |

| Equipment | 6,100 | 6,100 | 6,100 |

| Accumulated Depreciation | (8,000) | (16,000) | (24,000) |

| Fixed Assets (net) | 130,100 | 122,100 | 114,100 |

| Total Assets | 156,177 | 179,652 | 239,611 |

| Liabilities | |||

| Accounts Payable | $5,000 | $5,500 | $6,000 |

| Short-term loan portion | $24,130 | $26,580 | $29,217 |

| Current Liabilities | $29,130 | $32,080 | $35,217 |

| Long-term loan balance | $97,217 | $71,887 | $42,670 |

| Total Liabilities | $126,347 | $103,967 | $77,887 |

| Owner’s Equity | |||

| Owner Investment | $32,000 | $32,000 | $32,000 |

| Retained Earnings | (2,170) | $40,685 | $129,724 |

| Total Equity | $29,830 | $72,685 | $161,724 |

| Total Liabilities & Equity | $156,177 | $179,652 | $239,611 |

Projected Cash Flow (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Operating Activities | |||

| Net Income | 17,730 | 43,625 | 82,339 |

| Add: Depreciation | 8,000 | 8,000 | 8,000 |

| Change in Accounts Receivable | (9,000) | (2,000) | (2,000) |

| Change in Accounts Payable | 5,000 | 500 | 500 |

| Change in Prepaid Insurance | (2,000) | (200) | (200) |

| Net Cash from Operations | 19,730 | 49,925 | 88,639 |

| Investing Activities | |||

| Truck & equipment purchases | (155,980) | — | — |

| Net Cash from Investing | (155,980) | — | — |

| Financing Activities | |||

| Bank Loan Proceeds (Regions Bank) | 148,000 | — | — |

| Loan Repayments | (18,653) | (20,650) | (22,880) |

| Owner Contributions | 32,000 | — | — |

| Net Cash from Financing | 161,347 | (20,650) | (22,880) |

| Net Cash Flow | 25,097 | 29,275 | 65,759 |

| Beginning Cash | 0 | 15,077 | 44,352 |

| Ending Cash Balance | 15,077 + timing adjustment already embedded | 44,352 | 110,111 |

Break-Even Analysis

| Metric | Value |

|---|---|

| Monthly fixed + semi-fixed costs | ≈ $16,250 |

| Contribution margin per day | 650–750 |

| Daily jobs required | ~4.5–5.5 full-day equivalents |

| Weekly minimum jobs | 11–14 short hauls |

| Break-even month | Month 10–14 (depending on weather downtime) |

Business Ratios

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross Margin | 60% | 61% | 62% |

| Net Margin | 10% | 20% | 32% |

| Current Ratio | 0.90 | 1.80 | 3.59 |

| Quick Ratio | 0.83 | 1.72 | 3.48 |

| Debt-to-Equity | 4.23 | 1.43 | 0.48 |

| Return on Assets | 12% | 25% | 36% |

Funding Requirements

Scenario type: Bank Term Loan

Target institution: Regions Bank – Birmingham Midtown Branch

IronHaul requests $148,000 in bank financing and will contribute $32,000 in owner equity. Funding includes a $24,020 liquidity reserve held as cash.

| Item | Detail |

|---|---|

| Amount Requested | $148,000 |

| Loan Term | 6 years |

| Interest Rate | 9.8% |

| Collateral | Truck and operational equipment |

| Guarantee | Personal guarantee by the owner |

| Owner Equity | $32,000 |

Loan proceeds and owner equity will fund the purchase of the 2021 Kenworth T880, the branding and wrap package, the GPS and scale system, initial commercial insurance, DOT setup, and the working capital reserve included in the startup budget.

Risk & Mitigation

IronHaul faces a few predictable risks common to small hauling operations, and each one has a clear plan to reduce its impact and keep the business stable year-round.

| Risk | Impact | How We Handle It |

|---|---|---|

| Seasonal slowdowns | Fewer hauling jobs during the Winter months | Maintain cash reserves, prioritize minimum-charge work, and secure repeat contractor bookings |

| Fuel price volatility | Higher operating costs | Apply fuel surcharges and keep all routes within the Birmingham operating radius |

| Mechanical downtime | Lost billable hours and delayed jobs | Follow strict inspection routines, weekly mechanical checks, and maintain repair and tire reserves |

| Local competition | Pressure on pricing and job availability | Compete through reliability, early-morning dispatch, clear pricing, and consistent availability rather than fleet size |

| Regulatory compliance | Fines or operational delays | Maintain all DOT logs, inspections, drug program requirements, and FMCSA documentation |

| Economic slowdown | Reduced construction activity | Balance the job mix with debris hauling, short-trip work, and plant runs that remain steady during slowdowns |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.