Preparing an ice cream shop financial plan can be a bit tricky, especially if you are not used to dealing with numbers, budgets, or Excel. But it is an important part of the business.

Whether you are starting an ice cream shop or already have one, understanding your finances is crucial for success.

Don’t worry, here is our guide that breaks down creating a financial plan into simple steps, with easy explanations and practical examples.

So, if you want to take control of your finances and grow your business, this guide is a must-read!

What is an Ice Cream Shop Financial Plan?

An ice cream shop’s financial plan reflects the current monetary position of the business and outlines its long-term financial goals, objectives, and strategies to achieve the desired outcomes.

It is the last but the most important part of a business plan that can convince investors to invest in your business.

A financial plan consists of key financial reports like income statement, break-even analysis, balance sheet, and investment plan. These reports help investors assess the revenue potential, risks, and rewards that a particular ice cream shop can bring.

Instead of paragraphs, the financial section of a business plan is presented best with figures, diagrams, graphs, and charts.

Key Takeaways

- Develop a practical financial plan for your ice cream shop by evaluating your current financial situation and projecting the initial expenses.

- Determine the profitability of your ice cream shop with key financial reports.

- Improve the precision of the plan by verifying assumptions and performing sensitivity analysis.

- Get a financial snapshot of your business and pique investors’ interest.

- Consider using user-friendly financial planning software.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

How to Prepare an Ice Cream Shop Financial Plan?

Preparing a financial plan can feel overwhelming. However, this step-by-step procedure can help you prepare a financial document for the ice cream shop by making sure you have every detail.

1. Identify Your Funding Requirements

Before making the financial plan for your ice cream shop, you need to know the startup costs of your ice cream shop. Because, after that, only you will get an exact idea of a financial plan.

From location rent, interior needed, and equipment to licenses & permits, count every expense in the startup costs.

Additionally, make sure to consider your marketing costs, salary costs, and other unpredictable expenses. This way, you will get practical financial requirements for your ice cream shop.

After knowing the capital needs, assess how much capital you need from outside funding for your ice cream shop.

2. Determine Your Funding Strategy

To start an ice cream shop, you will need money. If you don’t have it, then you need to ask it from potential investors or someone else. Here are a few funding sources you can consider for starting your ice cream shop:

- Bank loans

- SBA loans

- Investors

- Crowdfunding

- Franchise financing

Evaluate different funding sources and their costs before you consider selecting one.

3. Select a Business & Financial Planning Software

Being an entrepreneur, you will have a lot more responsibilities than you think. So instead of drowning in such responsibilities, it is better to do smart work.

Yes, you can do smart financial planning and forecasting for your ice cream shop with the help of a financial tool.

But too many options are there, right? Consider a tool that is easy to use, allows integration with Excel, and has a wide range of services.

Pro-tip

Create an Ice Cream Shop Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

4. Pre-Assumptions & Market Analysis

You need to have basic knowledge of your target market, competitors, historical data, and market trends before you start financial projections. Here are some things to consider:

Pricing strategy

Remember, the pricing strategy of your ice cream shop sets the tone of your business. It reflects in which category (premium, average) your ice cream shop comes in.

Also, analyze factors like menu, customer preferences, spending habits, and competition to determine the ideal pricing strategy. Keep in mind, that the prices of raw materials and staff salaries will increase every year, but you can not do the price hike every year like that.

Revenue stream

Apart from the sales of your ice cream shop, you should also consider different revenue streams, like merchandise of your brand, catering, or partnership with any local brands.

Sales forecast

Consider seating capacity, average customer orders, sales channels, and menu when forecasting.

Break everything down to daily, weekly, monthly, and yearly figures. Also, consider the fluctuations and changes in demand according to the seasons or trends.

This way, you will get to know the sales forecast and the way your ice cream shop will thrive.

Overheads budget

These are the day-to-day expenses that keep your ice cream shop running smoothly. To project these accurately, gather precise estimates from your suppliers and account for various costs like payroll, rent, administrative ice cream shop monthly expenses, and more. An accurate overhead estimate ensures your ice cream shop’s budget is on point.

5. Prepare Financial Projections

Figures speak more than any person in case of proving the viability of your business. One look at the reports and investors will decide whether to invest in your ice cream shop.

Let’s check the key components and statements of financial projection:

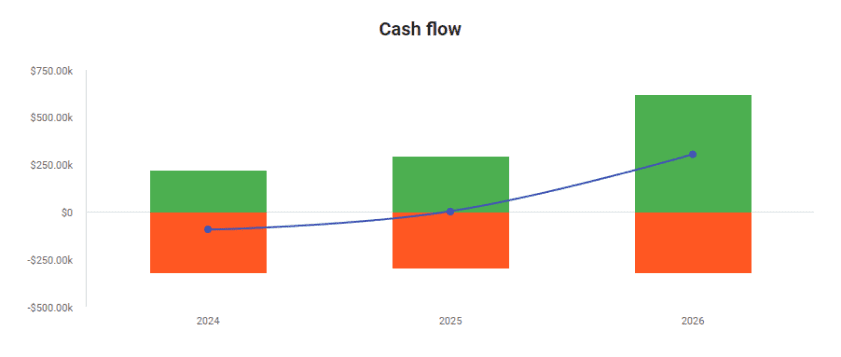

Cash flow statement

A cash flow statement is necessary to assess the liquidity, financial health, and operational efficiency of the ice cream shop. It provides a detailed view of cash inflows and outflows over a specific period.

Investors generally rely on the cash flow statement to evaluate a business’s ability to generate cash and meet financial obligations, inducing confidence in its financial stability. Below is an example of cash flow:

Income Statement

The income statement, also known as the profit & loss statement, showcases the profitability of your ice cream shop. Apart from that, it also shows the anticipated growth for the next 2-3 years. It helps investors and audiences in measuring the health of an ice cream shop.

By removing the cost of goods sold from revenue, you get the gross margin. Further, subtract the operating expenses and earnings before interest, taxes, depreciation, and amortization (EBITDA) to get net profit for your ice cream shop.

Balance sheet

A balance sheet displays everything your ice cream shop had, and it owes. It is a summary of the money your ice cream shop owes to others; the money invested in it, and the assets of the ice cream shop.

Investors, lenders, and stakeholders analyze the balance sheet to assess the business’s solvency, leverage, and liquidity. Additionally, the balance sheet facilitates financial decision-making by highlighting areas of strength or weakness in the company’s capital structure and resource allocation.

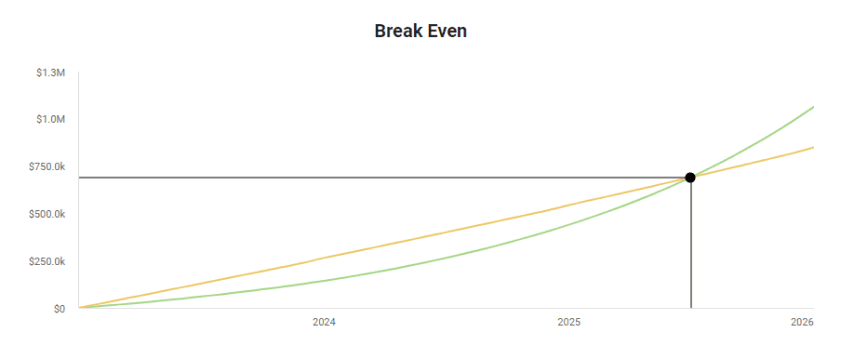

Break-even Analysis

Profit is the ultimate goal for any ice cream shop operator. But when do you start generating the profits?

Break-even analysis helps determine how much sales volume is essential to reach the break-even point.

It answers an important question for investors: How long before the ice cream shop turns profitable?

It can take years to reach a break-even if there are loans to settle. However, you can keep the ice cream shop afloat and profitable with an appropriate understanding of fixed costs. Here is an example of a break-even analysis for an ice cream shop:

6. Test Assumptions

One approach to test assumptions is sensitivity analysis, which involves assessing how changes in key assumptions affect financial outcomes.

Start by identifying the essential digits in your financial plan, such as sales volume, pricing, cost of goods sold, and operating expenses. Then, vary these assumptions within a range of reasonable values to simulate different scenarios.

Next, evaluate the sensitivity of your financial projections to these variations. Determine which assumptions have the most significant influence on profitability, cash flow, and overall financial performance.

Additionally, consider stress testing your financial plan by simulating extreme scenarios or adverse conditions, such as economic downturns or unexpected disruptions. This helps assess the resilience of your business model and its ability to withstand adverse events.

By testing assumptions through sensitivity analysis and stress testing, you can refine your financial plan, mitigate risks, and make more informed decisions to ensure the success of your ice cream shop.

7. Monitor & Update Your Plan

Creating a financial plan is only the beginning. To make it work, you need to revisit and alter it according to the current scenarios.

Remember, your financial plan is based on assumptions and market analysis. Real-world conditions will be way different from what you thought.

Thus, regularly monitoring your business’s financial performance is crucial. Compare both the financial plan & actual digits and take note of it.

If you find that some metrics are significantly different from what you predicted, try to understand why. Once you identify the reasons, take action to correct the situation and update your plans accordingly.

Keep in mind that your plan should be flexible and adaptable to changing circumstances. It is not only about the financial plan, but the whole ice cream shop business plan should be flexible.

Download Free Ice Cream Shop Financial Plan Example

Crafting a financial plan from the base can get confusing and overwhelming. After all, Excel sheets are not that exciting. Don’t worry, download this free ice cream shop financial plan example prepared using Upmetrics to get started with yours.

It includes all the key components of a business’s financial projections, including the balance sheet, cash flow statement, P&L or income statement, and break-even statement, simplifying ice cream shop financial planning.

Related Ice Cream Shop Resources

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Start Preparing Your Ice Cream Shop Financial Plan

And there you have it – we’ve covered the essentials of financial planning for your ice cream shop.

But now it’s time to put that knowledge into action. Feeling overwhelmed by the thought of creating a financial plan? Don’t worry; we’ve got you covered.

Upmetrics’ financial planning tool is here to make the process a cakewalk. Just input your projected assumptions, and we’ll handle the rest.

So, don’t delay any longer. It’s time to get started on your financial plan now.