Executive Summary

Keystone Medical Supply, LLC is a new medical equipment distributor based in Philadelphia, Pennsylvania. The company will sell and deliver durable medical equipment (DME) and home healthcare supplies to patients, families, and care providers. Our office will be located at 1628 Market Street in Center City, close to Jefferson Health and Penn Medicine.

The company is co-owned by two professionals with complementary skills. Dr. Lauren Mitchell, a physical therapist with more than 12 years of hospital experience, owns 60 percent of the business. She has seen firsthand how delays in getting basic medical equipment can slow down recovery for patients leaving the hospital.

Daniel Foster owns 40 percent of the business. He has an MBA in healthcare administration and years of experience in medical supply operations and finance. Together, they combine clinical knowledge with operational expertise.

Problem

Philadelphia has a large and growing senior population. More than 282,000 residents are over the age of 65, and more than 210,000 patients are discharged from hospitals in the region every year. Many of these people need medical equipment at home—wheelchairs, hospital beds, oxygen machines, CPAP devices, walkers, and more.

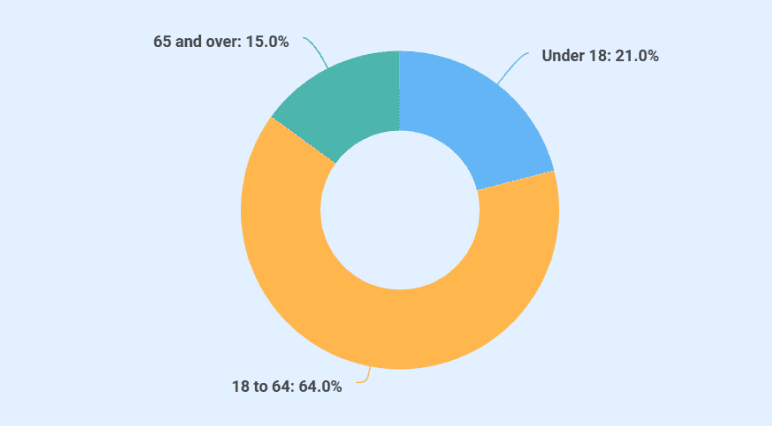

The chart below shows Philadelphia’s population by age, with seniors making up nearly 15% of residents and representing a major share of equipment demand.

Today, most patients rely on large national suppliers, like McKesson or insurance-affiliated providers. These companies are big and established, but they often struggle to respond quickly. Patients and families sometimes wait days for delivery, face difficulties communicating in their language, or deal with rigid schedules. Keystone aims to fill this gap by focusing on speed, service, and accessibility.

Our Solution

Keystone’s promise is simple: Same-day delivery of essential medical equipment within a 25-mile radius of Philadelphia. We will also offer a 24/7 hotline for urgent requests and bilingual support in English and Spanish. This personal, community-based service will make it easier for patients and families to get the equipment they need without delay.

Our catalog will include durable products such as wheelchairs ($325), hospital beds with mattresses ($1,050), CPAP (Continuous Positive Airway Pressure) machines ($1,200), and portable oxygen concentrators ($2,800). We will also sell everyday supplies like disposable gloves ($8.95 per box) and wound care kits.

Seasonal demand will be anticipated, with extra oxygen machines stocked for winter months and sports injury kits available during summer. All products will be sourced from trusted suppliers, including Cardinal Health, ResMed, Invacare, and McKesson.

Revenue Model

Keystone’s revenue will come from two channels:

- Direct-to-Consumer (B2C) – Patients and families paying directly or through insurance.

- Business-to-Business (B2B) – Clinics, therapy centers, and long-term care facilities with regular supply contracts.

In the long term, Keystone expects about 60% of revenue from consumer sales and 40% from provider contracts. This balance will give the business a steady cash flow while still capturing the larger consumer market.

Marketing Efforts

Keystone will use both digital marketing and direct outreach to reach customers. We will invest about $14,300 each month in Google ads, LinkedIn ads, Spanish-language TV and radio spots, and partnerships with hospital discharge planners. A $40,000 launch campaign will introduce our brand to the community. We will also run promotions such as “first month free” rentals on select equipment and $50 referral credits. Our Year 1 goal is to bring in 30 new consumer customers every month and secure 10 institutional contracts by the end of Year 2.

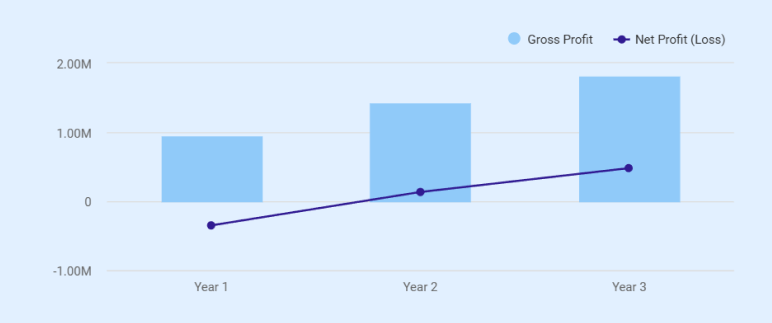

Financial Overview

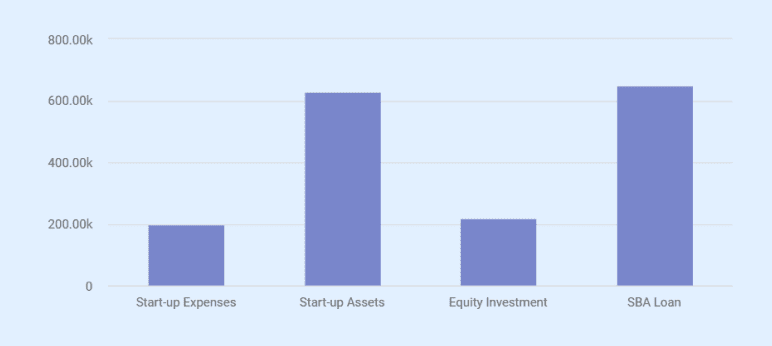

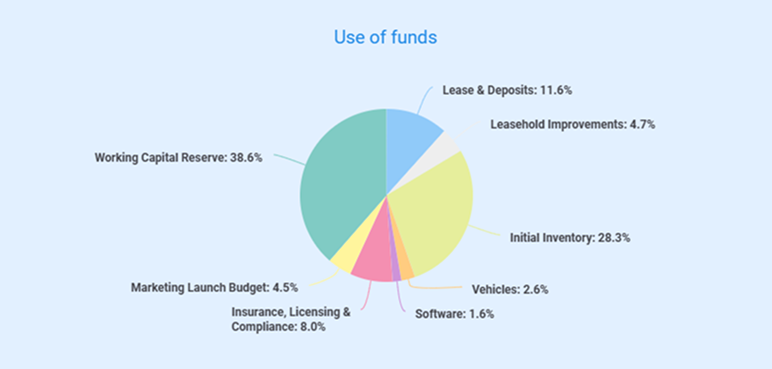

The business requires $870,000 in funding. This amount includes startup costs for leasehold improvements, inventory, software, vehicles, and licensing, plus working capital reserves to cover payroll and cash flow delays. Funding will come from a $650,000 SBA 7(a) loan and $220,000 in owner equity.

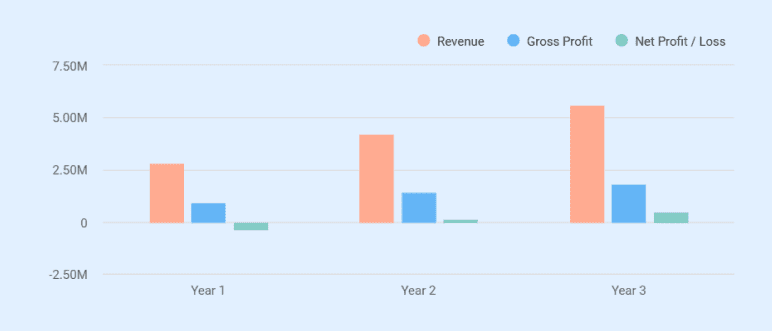

Monthly fixed costs are expected to be around $102,000, including payroll, rent, insurance, marketing, and overhead. With a gross margin of 32 to 35 percent, Keystone will need about $306,000 in monthly revenue (or $3.7 million per year) to break even.

| Year | Revenue | Gross Profit | Total Operating Expenses | Net Profit (Loss) | Break-even Status |

|---|---|---|---|---|---|

| 1 | $2,800,000 | $950,000 | $1,210,600 | -$348,600 | Below break-even |

| 2 | $4,200,000 | $1,428,000 | $1,211,300 | $134,700 | Break-even reached (mid-year) |

| 3 | $5,600,000 | $1,820,000 | $1,263,400 | $480,600 | Above break-even |

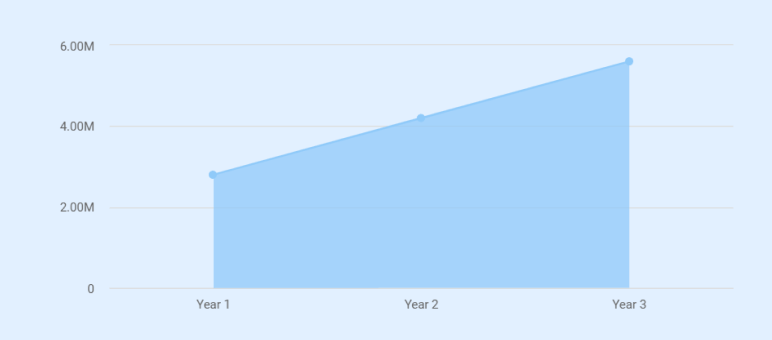

Year 1 revenue is projected at $2.8 million, which falls short of this break-even point. However, the working capital reserve is designed to cover the gap until revenues grow. By June 2027, midway through Year 2, Keystone expects to reach break-even and move toward net margins of 8 to 12 percent by Year 3.

Looking for an easy way to draft your plan?

Download our free medical equipment business plan template to guide your planning. Just enter your business details step by step and create a professional plan in minutes.

- Investor-ready layout

- Built-in financial tables

Company Overview

Keystone Medical Supply, LLC is a Pennsylvania-based company that will distribute durable medical equipment (DME) and home healthcare supplies. The business will operate from a central office and warehouse in Philadelphia and focus on providing fast, reliable service to patients, families, and healthcare providers. The company’s mission is to improve patient recovery at home by removing delays in equipment delivery and offering a more personal, community-focused approach than large national suppliers.

Business Identity

The business is officially registered as a Pennsylvania Limited Liability Company (LLC). Its office and showroom will be located at 1628 Market Street, Suite 1100, Philadelphia, PA 19103. The company will also operate a 5,500-square-foot warehouse in the East Falls area to store inventory and manage deliveries. This two-location setup allows Keystone to stay close to hospital referral sources in Center City while maintaining the warehouse space needed to stock and distribute equipment efficiently.

Ownership

Keystone is co-owned by two individuals with complementary strengths:

| Owner | % Ownership | Role | Background & Expertise |

|---|---|---|---|

| Dr. Lauren Mitchell | 60% | Founder & Chief Executive Officer (CEO) | Physical therapist, 12+ years at Jefferson Health; brings clinical insight and patient-focused leadership. |

| Daniel Foster | 40% | Chief Operating Officer & Finance Partner | MBA in Healthcare Administration; ex-Medline operations lead with expertise in logistics and finance. |

This leadership team provides a strong balance of patient-centered healthcare experience and proven business management skills.

Values and Culture

Keystone’s values focus on service, reliability, and community. The company’s culture will be patient-first, emphasizing clear communication, compassion, and responsiveness. Hiring will prioritize not only skills but also empathy and cultural awareness, so patients and families feel supported during what is often a stressful time.

Start-up Summary

| Start-up Requirements | Amount ($) |

|---|---|

| Start-up Expenses | |

| Legal & Professional Fees | 5,000 |

| Licensing & Compliance | 52,500 |

| Insurance (General, Professional, Property, Vehicles) | 18,500 |

| Marketing & Branding | 40,000 |

| Leasehold Improvements | 42,000 |

| Office & Warehouse Deposits | 15,000 |

| Furniture & Equipment | 10,000 |

| Telecommunications & IT | 5,000 |

| Miscellaneous / Contingency | 10,000 |

| Total Start-up Expenses | 198,000 |

| Start-up Assets | |

| Initial Inventory | 250,000 |

| Vehicles (2 leased vans) | 22,800 |

| Software (Brightree DME) | 14,400 |

| Cash / Working Capital Reserve | 341,200 |

| Total Start-up Assets | 628,400 |

| Total Funding Required | 870,000 |

Long-Term Goals

In the first three years, Keystone aims to:

- Establish itself as the go-to local supplier for patients leaving Philadelphia hospitals.

- Build referral relationships with Jefferson Health, Penn Medicine, and local clinics.

- Reach profitability by Year 2 with net margins of 8–12% by Year 3.

- Expand the product catalog to include more home rehab and chronic-care solutions.

- Explore future regional expansion once the Philadelphia operation is stable and profitable.

Want a professional plan like this sample?

Let Upmetrics AI generate a complete, investor-ready plan for you.

Plans starting from $14/month

Products

Keystone Medical Supply will provide a wide range of durable medical equipment (DME) and home healthcare supplies to patients and providers across Philadelphia.

Our goal is simple: To make sure that anyone who needs medical equipment at home can receive it quickly, affordably, and with the right support.

The durable medical equipment (DME) and home healthcare supply industry supports patients who need medical products outside of hospital settings. These include wheelchairs, hospital beds, CPAP machines, oxygen concentrators, walkers, and everyday supplies like gloves and wound care kits. And the U.S. DME market is growing.

Keystone will participate in this growing market by stocking the most commonly used equipment and consumables, sourced from established vendors, and offering delivery models that emphasize speed and service.

Core Product Categories

| Category | Product/Item | Price | Notes / Use Case |

|---|---|---|---|

| Mobility Equipment | Standard Wheelchair | $325 each | For patients needing mobility support post-surgery or long-term. |

| Walker with Seat | $110 each | Lightweight mobility aid for seniors and rehab patients. | |

| Hospital Bed with Mattress | $1,050 per set | Essential for home recovery and chronic care management. | |

| Respiratory Care | CPAP Machine (ResMed AirSense 11) | $1,200 each | Treats sleep apnea; growing demand among older adults. |

| Portable Oxygen Concentrator | $2,800 each | Supports respiratory illness; demand spikes in winter months. | |

| Consumable Supplies | Disposable Gloves (Box of 100) | $8.95/box | Everyday medical use; high turnover consumable. |

| Wound Care Supplies (via McKesson) | Varies | Kits for post-discharge care and clinical use. | |

| Braces, Supports, Cold Therapy Kits | Varies | For rehab and sports injury recovery; steady recurring demand. |

Seasonal and Niche Products

Keystone will adjust its catalog to match seasonal demand patterns:

- Winter – Additional stock of portable oxygen concentrators and CPAP machines to meet higher respiratory care needs.

- Summer – Sports injury kits, braces, and mobility supports for increased recreational injuries.

This flexible stocking strategy helps reduce the risk of overstocking slow-moving items while making sure high-demand products are always available.

Supplier Partnerships

Keystone will purchase products directly from trusted manufacturers and distributors:

- Cardinal Health for consumables and wound care supplies.

- ResMed for CPAP and respiratory devices.

- Invacare for wheelchairs, walkers, and hospital beds.

- McKesson for consumables and specialty items.

These vendors are established national suppliers with proven reliability. By maintaining multiple supplier relationships, Keystone reduces the risk of shortages and ensures competitive pricing.

Service Model

Products are only part of the offering. Keystone will combine its inventory with services that make the customer experience better than competitors:

- Same-Day Delivery – All products will be delivered within 25 miles of Philadelphia on the same day the order is placed.

- 24/7 Hotline – Urgent requests will be handled at any time of day.

- Bilingual Support – Customer service will be available in both English and Spanish.

- Training and Setup – Staff will explain how to use the equipment and follow up with patients to confirm safe operation.

This service-first approach is what differentiates Keystone from large national providers, who often deliver on a slower schedule and leave patients to figure out equipment to use themselves.

Market Analysis

Industry Overview

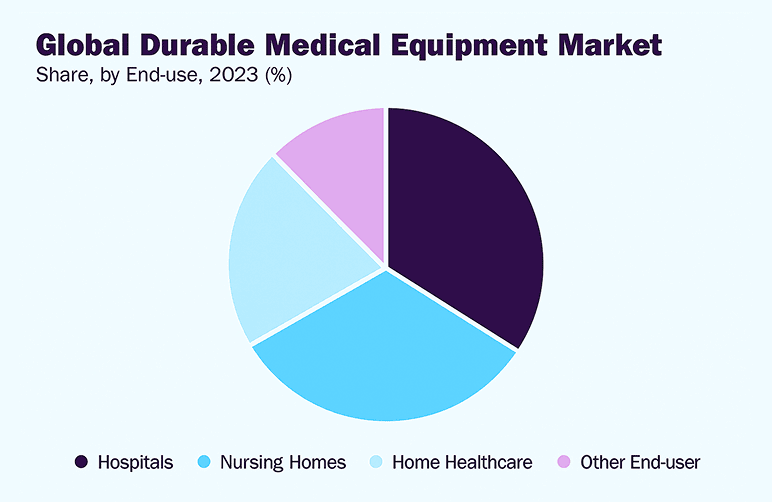

According to a report from Grand View Research, the global DME market was estimated at $221.35 billion in 2023 and is projected to reach $331.14 billion by 2030, with a growing CAGR of 5.90% (2024 – 2030). This is expected to continue expanding as the senior population grows.

Even the demand for this industry is growing nationwide as the population ages and hospitals discharge patients sooner to continue recovery at home. For suppliers, the key success factor is reliability—patients and providers expect equipment to arrive quickly and in good condition.

The chart above shows the global DME market by end use in 2023. Hospitals and nursing homes hold the largest share, while home healthcare is emerging as a key growth driver.

Local Market Size

Philadelphia is a strong market for DME providers because of its demographics and healthcare activity. The city has a population of about 1.55 million, and according to Census-based estimates, 12.7% are aged 65 to 84, and another 1.6% are 85 or older. That equals more than 200,000 residents over the age of 65. A report from Axios confirms the senior population in the Philadelphia region is rising, with a 9.3% increase between 2020 and 2023. This means demand for medical equipment will only increase.

Healthcare usage also drives demand. Data from the Pennsylvania Department of Health shows high volumes of inpatient discharges from general acute care hospitals every year (PA DOH Hospital Reports). Each discharge represents a potential need for home medical equipment. For example, patients leaving after surgery often require walkers or hospital beds at home, and those with respiratory issues may need oxygen concentrators or CPAP devices. Taken together, Philadelphia’s growing senior population and heavy hospital discharge volume create a consistent and expanding customer base.

Barriers to Entry

Barriers include licensing, Medicare/Medicaid approval, and capital needed for inventory. Keystone is prepared with the required licenses, financial reserves, and vendor relationships. These barriers also protect the company once established, making it more difficult for casual new entrants to compete.

Emerging Trends

Several trends strengthen Keystone’s position:

- Aging Population – As more people in Philadelphia move into the 65+ age group, the demand for reliable home medical equipment will keep rising.

- Shift to Home-Based Care – Hospitals reduce length of stay to save costs, pushing patients to rely on equipment at home.

- Language and Accessibility – Philadelphia has large Spanish-speaking communities. Many suppliers do not offer bilingual support, but Keystone will.

- Tech Integration – Providers expect accurate billing and fast claim submissions. Keystone’s use of Brightree DME software meets this need.

Market Potential

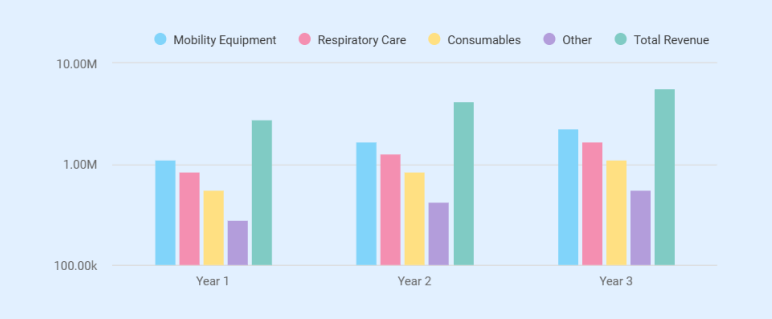

Keystone projects revenues of $2.8 million in Year 1, $4.2 million in Year 2, and $5.6 million in Year 3. Compared to the size of Philadelphia’s senior population and hospital discharge base, this represents only a small fraction of potential demand. Even capturing 2–3% of discharge-driven equipment needs would allow Keystone to exceed its projections.

Customer Segments

Keystone will serve two main groups:

1) Patients and Families (B2C)

This includes seniors (55+) and their caregivers who often need equipment quickly after hospital discharge. Families value same-day delivery, clear instructions, and support in their preferred language.

2) Healthcare Providers (B2B)

This group includes physical therapy centers, outpatient clinics, and long-term care facilities. These organizations purchase equipment on contract, looking for dependable supply, insurance claim accuracy, and responsive customer service.

Both segments present recurring opportunities, but the consumer market will drive faster growth at launch, while provider contracts will stabilize revenues over time.

Competitive Landscape

Current competitors include:

Beyond these major players, smaller regional suppliers also serve Philadelphia, but they share similar gaps in speed, flexibility, and personalized service. Keystone’s focus on same-day delivery, bilingual support, and strong hospital relationships positions it to win referrals where larger and smaller competitors fall short.

Differentiation Strategy

Keystone’s key advantages will be:

- Same-day delivery within a 25-mile radius.

- English and Spanish language support.

- Local presence near major hospitals.

- A 24/7 hotline and follow-up service to ensure patients know how to use equipment safely.

This combination is not offered by large suppliers and will build trust with both patients and hospital staff.

Marketing and Sales Strategy

Keystone Medical Supply will grow its customer base through a balanced mix of digital marketing, hospital partnerships, community outreach, and referral programs. The approach is practical, measurable, and aligned with the needs of both patients and providers. The sales plan emphasizes trust—building long-term relationships with hospitals while also serving individual patients quickly and reliably.

Market Challenge

Most families do not think about medical equipment until it’s urgently needed—often after a hospital discharge. This means Keystone must be highly visible at the right moment. The most effective channels for this are:

- Digital Ads that show up immediately when patients or families search online.

- Hospital Referral Partnerships with case managers and discharge planners.

Branding and Messaging

Keystone’s brand will be built around three promises:

- Fast Service – Same-day delivery when needed.

- Accessible Support – English and Spanish staff, with a 24/7 hotline.

- Community Connection – A local Philadelphia supplier, not a distant chain.

This dual message appeals to both families (who want care and trust) and hospitals (who want reliability).

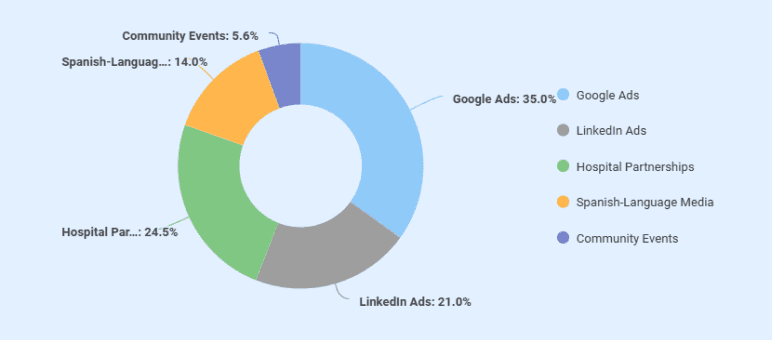

Marketing Channels

| Channel | Budget (Monthly) | Purpose / Approach |

|---|---|---|

| Google Ads | $5,000 | Search keywords like “Philadelphia medical supply” or “CPAP near me.” CPC ranges $2.50–$3.00. Delivers ~1,600–2,000 high-intent clicks/month. |

| LinkedIn Ads | $3,000 | Targets rehab administrators, PT centers, and clinic managers. Precise B2B outreach by role and industry. |

| Hospital Partnerships | $3,500 | Sponsorships, workshops, and relationship-building with Jefferson Health and Penn Medicine case managers. |

| Spanish-Language Media | $2,000 | Ads on Univision & local radio. Reaches 15% of Philadelphia households that speak Spanish at home. |

| Community Events | $800 | Senior fairs, rehab workshops, and wellness events. Creates personal, local trust. |

Sales Strategy

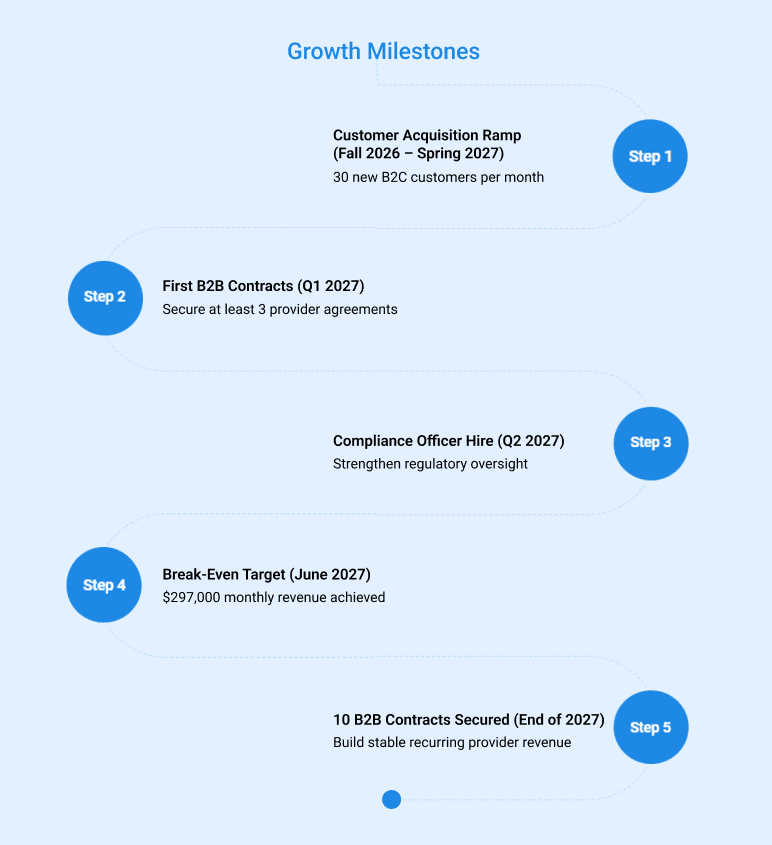

1) Customer Acquisition Goals

- Year 1: 30 new consumer customers/month (~360 for the year).

- Year 2: 10 new institutional contracts on top of consumer growth.

2) Promotions

- First Month Free Rentals – Beds and wheelchairs for new patients.

- Referral Credits – $50 reward for each new customer referral. Proven to increase retention in healthcare (PubMed).

3) Sales Process

- Inbound Leads – Driven by digital ads and hospital referrals.

- Customer Service Team – Answers within one hour during business hours.

- Sales Reps – Focus on closing provider contracts (rehab centers, LTC facilities).

- Follow-Up – Calls after delivery to boost satisfaction and encourage repeat business.

Measurement and Metrics

Success will be tracked with clear performance indicators:

- Cost per lead (Google Ads).

- Conversion rates from hospital referrals.

- Customer acquisition cost (CAC) vs. lifetime value (LTV).

- Repeat purchases and referral volume.

Brightree DME software will integrate marketing and sales data with billing, giving management real-time insight into ROI.

Operations

Keystone Medical Supply’s operations are designed around one clear goal: fast and reliable service for patients and healthcare providers. The company will combine a well-located warehouse, efficient delivery systems, trained staff, and compliance controls to make sure equipment reaches customers quickly and safely. This section explains how Keystone will operate day to day, how staffing will be organized, and how compliance will be maintained.

Business Location and Facilities

The company will have two main sites:

1) Headquarters and Showroom

Keystone’s main office and showroom is at 1628 Market Street in Center City, Philadelphia. The spot is close to Jefferson Health and Penn Medicine, which are key referral partners. Families and patients can also stop by the showroom to look at equipment before making a purchase.

2) Warehouse

The warehouse is a 5,500-square-foot leased space in East Falls, Philadelphia. It’s used to store inventory, handle logistics, and serve as the main hub for deliveries. Rent is $16 per square foot, or about $88,000 a year. This setup keeps us close to the medical district while giving us enough space for storage and order fulfillment.

Hours of Operation

Keystone will maintain extended hours to meet patient and provider needs:

- Monday–Friday: 8:00 a.m. to 7:00 p.m.

- Saturday: 9:00 a.m. to 5:00 p.m.

- 24/7 Hotline: Urgent calls will be answered around the clock, with staff on call for emergency deliveries.

Having longer hours and a 24/7 hotline ensures customers never feel stranded when equipment is urgently needed.

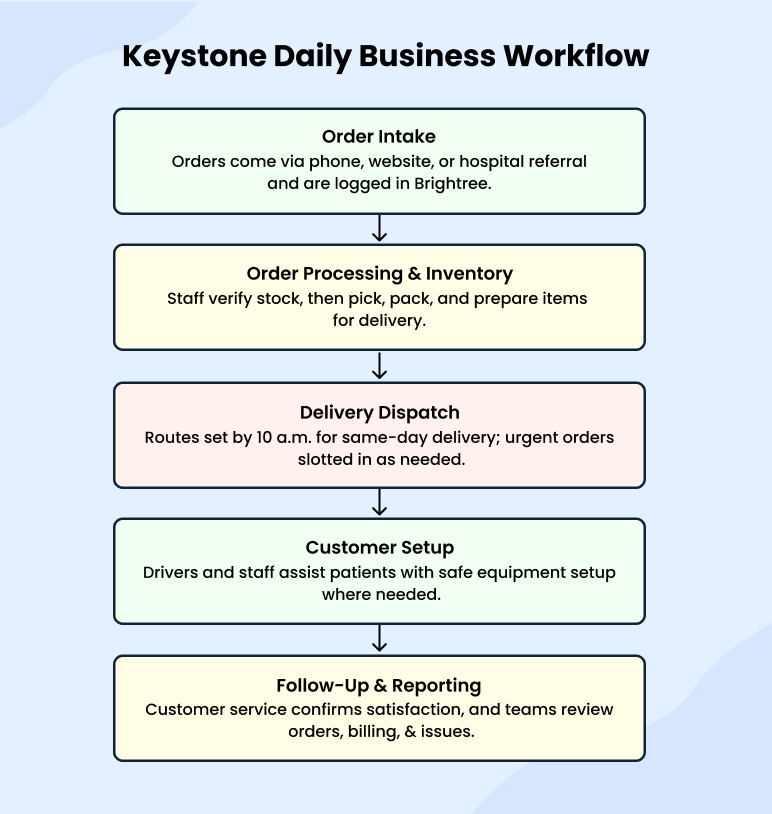

Daily Business Processes

To deliver equipment quickly and keep service consistent, Keystone will follow a clear daily routine. Each day follows the same sequence—from taking orders in the morning to completing deliveries and checking in with patients.

This cycle ensures Keystone maintains speed, accuracy, and high-quality service daily.

Vendor and Logistics Partnerships

Keystone will use a mix of owned and third-party logistics to keep costs efficient:

- Enterprise Fleet Leasing – Two delivery vans at $950/month each. These vans will be branded with Keystone’s logo for visibility.

- UPS Healthcare – For deliveries outside the 25-mile radius. UPS offers healthcare-focused shipping solutions with temperature and handling controls (UPS Healthcare).

- Brightree DME Software – A subscription system ($1,200/month) to handle billing, order management, and insurance claims. This ensures accuracy and compliance.

Customer Support and Service

Customer service is a central part of operations. Keystone will provide:

- Bilingual Support – Our front desk team will be trained to take calls in both English and Spanish, so every customer feels comfortable.

- Follow-up Calls – After we deliver equipment, our staff will call patients to check if everything is working fine and if they need help.

- Emergency Response – We’ll have staff on call for urgent repairs or equipment changes, so patients don’t have to wait.

This approach helps patients feel supported and also builds trust with hospitals and clinics that refer us.

Risk Mitigation Strategies

Like any healthcare business, Keystone faces financial, operational, and compliance risks. The table below shows the key risks and how we plan to handle them.

| Risk | Impact | Mitigation |

|---|---|---|

| Reimbursement Delays | 30–90 day Medicare/Medicaid payments strain cash flow. | $393k reserve, BofA credit line, diversify with private-pay customers. |

| Large Competitors | McKesson and others have scale and budgets. | Same-day delivery, bilingual service (15% Spanish-speaking Census Reporter), local relationships. |

| Compliance Failures | CMS/FDA audit issues could stop billing. | Medicare bond, DMEPOS accreditation, compliance officer by Year 2, audits, HIPAA training, Brightree system. |

| Staffing Turnover | Service gaps if drivers or warehouse staff leave. | Competitive wages, training, patient-focused culture. |

| Supply Chain Issues | Shortages of CPAP/oxygen units. | Multiple suppliers, seasonal safety stock, flexible contracts. |

| Economic Downturn | Lower demand or delayed payments. | Focus on essential equipment, strong provider contracts, lean costs + reserves. |

Regulatory and Compliance

State Licensing Requirements

In Pennsylvania, all companies that sell or rent durable medical equipment must hold a DME license issued by the state. This license confirms that the company meets standards for facility safety, record-keeping, and customer service. Keystone will apply for and maintain its Pennsylvania DME license as part of its launch.

The warehouse in East Falls and the office in Center City will be inspected to ensure they meet state requirements for equipment storage, accessibility, and security. Keystone will keep all licenses up to date with renewals tracked by the compliance officer.

Federal Compliance – Medicare and Medicaid

Since many patients rely on federal programs to pay for equipment, Keystone must be an approved supplier under the Centers for Medicare & Medicaid Services (CMS). This requires obtaining a Medicare Supplier Number. To qualify, Keystone must meet CMS supplier standards, including:

- Maintaining a physical facility with at least 200 square feet of space.

- Posting hours of operation that are clearly displayed and accessible to patients.

- Carrying liability insurance of at least $300,000.

- Maintaining a $50,000 Medicare surety bond to protect against potential billing errors or fraud.

- Completing DMEPOS (Durable Medical Equipment, Prosthetics, and Orthotics supplies) accreditation with a CMS-approved body

- Complying with billing and claims submission rules.

These rules are detailed on the CMS website (CMS Supplier Standards). Keystone will build its operations around these requirements from the start to avoid delays in reimbursement.

FDA Registration

Since Keystone will be distributing medical devices like CPAP machines and oxygen concentrators, it needs to register as an FDA distributor. This step is required for any U.S. business that sells or distributes medical devices. The FDA may also review records and product tracking to make sure everything is in compliance.

Insurance and Liability

Keystone will carry multiple layers of insurance coverage:

- General liability insurance that covers accidents or injuries linked to equipment use.

- Professional liability insurance to protect against claims tied to advice or training given to patients.

- Property and vehicle insurance for the East Falls warehouse, office space, and leased vans.

Having proper insurance not only meets CMS rules but also protects the business financially if something goes wrong.

HIPAA and Data Protection

Keystone may not be a hospital, but it still works with patient information when handling insurance and records. That’s why it follows HIPAA rules. Staff will be trained on how to protect data, and Brightree software will keep billing and records secure. Only the people who need access will get it. This way, patients and hospitals can feel confident that their information is safe.

Internal Compliance Program

Keystone will appoint a Compliance Officer by the end of Year 1. This person will oversee:

- Staff training on state, federal, and insurance rules.

- Internal audits of billing and claims.

- Vendor checks to make sure only FDA-approved devices are stocked.

- Annual outside audits for extra review.

This approach lowers the risk of mistakes and shows hospitals and lenders that Keystone takes compliance seriously.

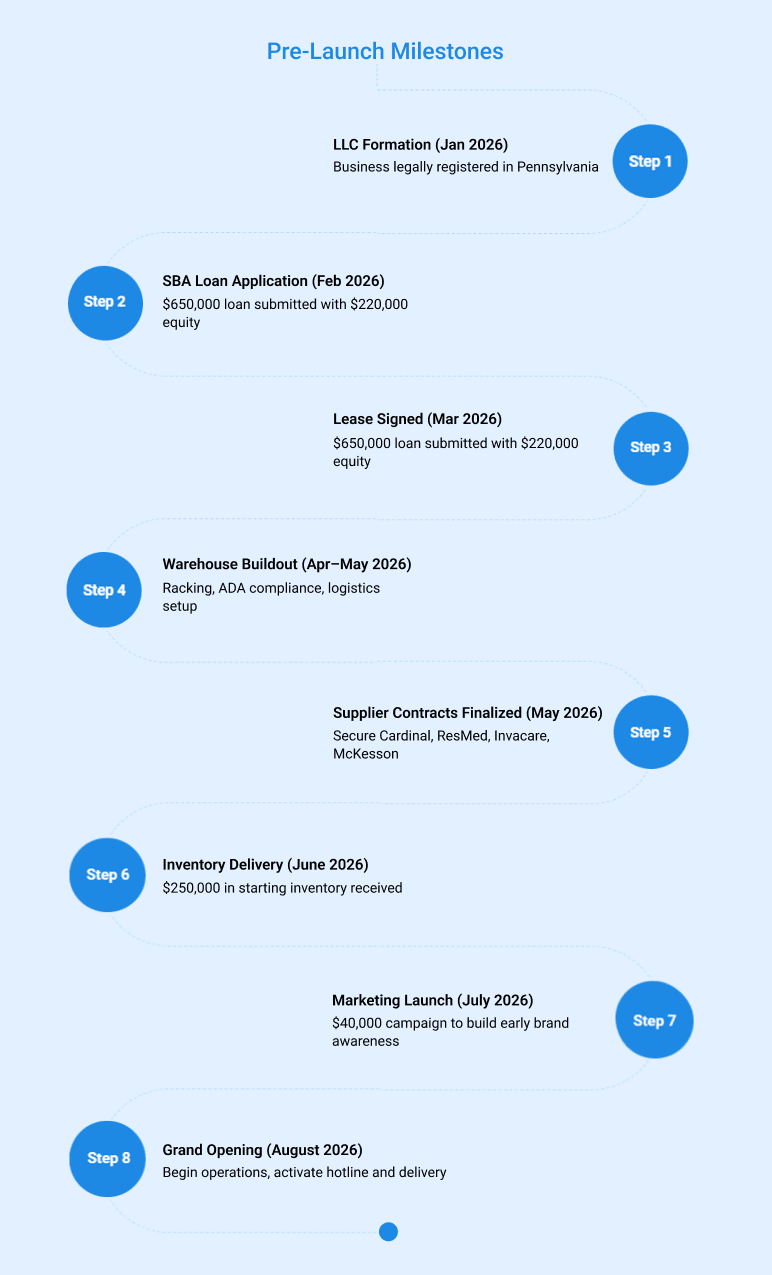

Milestone & Timeline

Launching Keystone Medical Supply requires a series of well-planned steps. Each milestone builds on the previous one, moving from setup to full operations. The timeline covers the first 18–24 months and points out the key actions needed to hit break-even by the middle of Year 2.

Leadership Team

Keystone’s leadership combines deep clinical experience with operational and financial expertise.

1) Dr. Lauren Mitchell (Chief Executive Officer, 60% owner)

A licensed physical therapist with more than 12 years at Jefferson Health. Lauren has seen how equipment delays slow recovery and designed Keystone to keep patient needs at the center of operations. She will lead strategy, clinical oversight, and key hospital relationships.

2) Daniel Foster (Chief Operating Officer & Finance Partner, 40% owner)

Daniel holds an MBA in healthcare administration and previously served as operations lead at Medline Industries. He brings expertise in logistics, vendor contracts, and financial management. Daniel will oversee day-to-day operations, compliance systems, and long-term financial planning.

Staffing Plan and Compensation

From launch, Keystone will operate with a lean but capable team. The structure ensures full coverage for deliveries, warehouse operations, sales, and customer support.

| Role | Headcount | Pay Level / Compensation | Notes / Responsibilities |

|---|---|---|---|

| Warehouse Manager | 1 | $55,000/year | Oversees inventory and logistics. |

| Warehouse Associates | 3 | $18/hour (~$37,440/year each) | Order picking, packing, and restocking. |

| Medical Equipment Technician | 1 | $22/hour (~$45,760/year) | Licensed to install & service medical equipment, ensure compliance with safety standards. |

| Delivery Drivers | 2 | $20/hour + mileage (~$41,600/year) | Same-day deliveries and urgent dispatch. |

| Sales Representatives | 2 | $50,000 base + commission | Build B2B contracts, manage referrals. |

| Customer Service Reps | 2 | $17/hour (~$35,360/year each) | Hotline coverage, bilingual support, follow-ups. |

Wage Benchmarks: The U.S. Bureau of Labor Statistics reports that the average hourly wage for “Medical Equipment Preparers” is about $19.55/hour nationally (BLS), confirming Keystone’s wage levels are competitive.

Training and Development

At Keystone, every new hire will get hands-on training right away. They’ll learn how to use equipment safely, talk clearly with patients and families, and follow HIPAA rules to keep information safe.

Because Philadelphia is so diverse, our team will also be trained to help customers in both English and Spanish. This way, everyone feels understood and supported.

Training won’t end after the first week. Staff will keep getting updates on new products, changes in healthcare rules, and better ways to care for patients. Keeping the team sharp means customers get reliable service, and employees feel confident and valued in their jobs.

Shift Structure

Keystone will run two shifts to keep operations efficient:

- Day Shift – Three warehouse associates, two delivery drivers, and office staff (customer service + sales reps). This is the busiest shift, handling most orders and deliveries.

- Evening Shift – One warehouse associate and one delivery driver to handle late deliveries and urgent calls.

This shift structure ensures patients who need equipment in the evening are not left waiting until the next day.

Financial Plan

Keystone Medical Supply’s financial plan shows how the company will use startup funding, manage expenses, and grow revenues over the first three years. The plan is built on conservative estimates and includes a working capital reserve to handle the cash flow delays common in the medical equipment industry.

Funding Requirement

The company requires a total of $870,000 to launch. This will come from two sources:

- SBA 7(a) Loan – $650,000, 10-year term at Prime + 2.75% (~11.25%).

- Owner Equity – $220,000 from personal savings and family contributions.

Collateral for the loan will include discounted inventory, warehouse equipment, and Daniel Foster’s residence in Cherry Hill, NJ (appraised at $525,000, with ~70% considered, or $368,000).

Use of Funds

| Category | Amount | Purpose |

|---|---|---|

| Lease & Deposits | $103,000 | $88,000/year lease + $15,000 deposit for warehouse |

| Leasehold Improvements | $42,000 | Racking, ADA compliance |

| Initial Inventory | $250,000 | Wheelchairs, hospital beds, CPAPs, consumables |

| Vehicles | $22,800 | Two leased delivery vans ($950/month each) |

| Software | $14,400 | Brightree DME software ($1,200/month) |

| Insurance, Licensing & Compliance | $71,000 | Liability insurance, permits, Medicare bond, DMEPOS accreditation |

| Marketing Launch Budget | $40,000 | Initial advertising and outreach |

| Working Capital Reserve | $341,200 | Payroll, inventory replenishment, A/R delays |

| Total | $870,000 |

Operating Expenses

Fixed monthly costs are estimated at $102,000, broken down as:

- Payroll (base + taxes/benefits/commissions): ~$66,000

- Lease: $7,300

- Vehicles: $1,900

- Software: $1,200

- Insurance & Compliance: $1,800

- Marketing: $14,300

- Miscellaneous & Overhead: $9,500

This structure reflects the true cost of running a licensed medical equipment distributor in Philadelphia.

Personnel Plan

The personnel plan shows projected payroll costs over the first three years of operations. It includes leadership salaries, staff wages, commissions, and estimated increases as the company grows.

| Role Group | Year 1 | Year 2 | Year 3 | Notes |

|---|---|---|---|---|

| Leadership (CEO + COO) | $180,000 | $185,400 | $190,962 | 3% annual increase for cost-of-living. |

| Warehouse Staff (Mgr + 3 associates) | $167,320 | $172,340 | $177,510 | Includes 3 full-time associates + manager. |

| Medical Equipment Technician (1) | $45,760 | $47,130 | $48,540 | Licensed/qualified installer; 3% annual increase. |

| Delivery Drivers (2) | $83,200 | $85,700 | $88,300 | Base $20/hr + mileage allowance. |

| Sales Representatives (2) | $100,000 base + $20,000 commission | $105,000 base + $25,000 commission | $110,000 base + $30,000 commission | Commission grows with revenue. |

| Customer Service Reps (2) | $70,720 | $72,840 | $75,030 | $17/hr with modest annual raises. |

| Compliance Officer (added Year 2) | – | $75,000 | $77,250 | Hired in Year 2 to oversee audits and CMS requirements. |

| Total Payroll | $621,240 | $721,280 | $749,352 | Covers all staff compensation. |

Revenue Forecasts (by Product Category)

| Year | Mobility Equipment | Respiratory Care | Consumables | Other | Total Revenue |

|---|---|---|---|---|---|

| 1 | $1,120,000 | $840,000 | $560,000 | $280,000 | $2,800,000 |

| 2 | $1,680,000 | $1,260,000 | $840,000 | $420,000 | $4,200,000 |

| 3 | $2,240,000 | $1,680,000 | $1,120,000 | $560,000 | $5,600,000 |

Annual Revenue Projections

| Year | Revenue | Avg Monthly Revenue | Gross Margin (32–35%) | Net Margin Target |

|---|---|---|---|---|

| Year 1 | $2,800,000 | $233,000 | $896,000 – $980,000 | Negative (loss covered by reserves) |

| Year 2 | $4,200,000 | $350,000 | $1.34M – $1.47M | 5–8% |

| Year 3 | $5,600,000 | $467,000 | $1.79M – $1.96M | 8–12% |

Profit & Loss Statement

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | $2,800,000 | $4,200,000 | $5,600,000 |

| COGS (65–68%) | $1,850,000 | $2,772,000 | $3,780,000 |

| Gross Profit | $950,000 | $1,428,000 | $1,820,000 |

| Operating Expenses | |||

| Payroll (incl. new tech role) | $792,000 | $816,000 | $840,000 |

| Lease & Utilities | $88,000 | $90,000 | $92,000 |

| Vehicles (2 vans) | $22,800 | $23,400 | $24,000 |

| Software (Brightree) | $14,400 | $14,400 | $14,400 |

| Insurance & Compliance (incl. bond + DMEPOS) | $21,800 | $22,500 | $23,000 |

| Marketing | $211,600 | $180,000 | $200,000 |

| Misc/Overhead | $60,000 | $65,000 | $70,000 |

| Total OPEX | $1,210,600 | $1,211,300 | $1,265,400 |

| EBITDA | ($260,600) | $216,700 | $556,600 |

| Depreciation / Amort. | $15,000 | $15,000 | $15,000 |

| Loan Interest Expense | $73,000 | $67,000 | $61,000 |

| Net Profit (Loss) | ($348,600) | $134,700 | $480,600 |

| Net Margin | -12% | -3% | -9% |

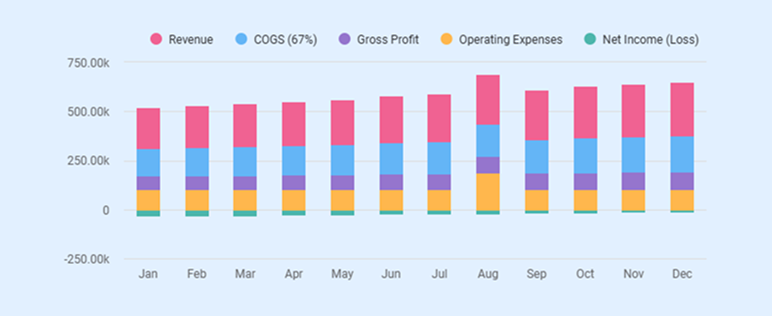

Monthly Financial Breakdown (Year 1)

| Month | Revenue | COGS (67%) | Gross Profit | Operating Expenses | Net Income (Loss) |

|---|---|---|---|---|---|

| Jan | $210,000 | $140,700 | $69,300 | $102,000 | -$32,700 |

| Feb | $215,000 | $144,100 | $70,900 | $102,000 | -$31,100 |

| Mar | $220,000 | $147,400 | $72,600 | $102,000 | -$29,400 |

| Apr | $225,000 | $150,800 | $74,200 | $102,000 | -$27,800 |

| May | $230,000 | $154,100 | $75,900 | $102,000 | -$26,100 |

| Jun | $240,000 | $160,800 | $79,200 | $102,000 | -$22,800 |

| Jul | $245,000 | $164,200 | $80,800 | $102,000 | -$21,200 |

| Aug | $250,000 | $167,500 | $82,500 | $102,000 | -$19,500 |

| Sep | $255,000 | $170,900 | $84,100 | $102,000 | -$17,900 |

| Oct | $265,000 | $177,600 | $87,400 | $102,000 | -$14,600 |

| Nov | $270,000 | $181,000 | $89,000 | $102,000 | -$13,000 |

| Dec | $275,000 | $184,300 | $90,700 | $102,000 | -$11,300 |

| Total | $2,860,000 | $1,935,900 | $926,100 | $1,224,000 | -$297,900 |

Cash Flow Projections

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Cash Inflows | |||

| Revenue (Collections, net 90-day delay) | $2,400,000 | $4,000,000 | $5,200,000 |

| SBA Loan Proceeds | $650,000 | – | – |

| Owner Equity | $220,000 | – | – |

| Other (Line of Credit, if tapped) | $50,000 | – | – |

| Total Inflows | $3,320,000 | $4,000,000 | $5,200,000 |

| Cash Outflows | |||

| COGS (Inventory Purchases) | $1,850,000 | $2,772,000 | $3,780,000 |

| Payroll & Benefits | $792,000 | $816,000 | $840,000 |

| Lease & Utilities | $88,000 | $90,000 | $92,000 |

| Vehicles (Lease & Fuel) | $28,000 | $29,000 | $30,000 |

| Software | $14,400 | $14,400 | $14,400 |

| Insurance & Compliance | $71,000 | $22,500 | $23,000 |

| Marketing | $251,600 | $180,000 | $200,000 |

| Misc/Overhead | $60,000 | $65,000 | $70,000 |

| Loan Payments (Principal + Interest) | $128,000 | $122,000 | $116,000 |

| Total Outflows | $3,283,000 | $4,110,900 | $5,165,400 |

| Net Cash Flow | $37,000 | ($110,900) | $34,600 |

| Opening Cash Balance | $341,200 | $378,200 | $267,300 |

| Closing Cash Balance | $378,200 | $267,300 | $301,900 |

Balance Sheet

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Current Assets | |||

| Cash | $378,200 | $267,300 | $301,900 |

| Accounts Receivable (90 days avg) | $600,000 | $900,000 | $1,200,000 |

| Inventory (avg on-hand) | $400,000 | $500,000 | $600,000 |

| Total Current Assets | $1,378,200 | $1,667,300 | $2,101,900 |

| Fixed Assets | |||

| Leasehold Improvements (net) | $40,000 | $35,000 | $30,000 |

| Vehicles & Equipment (net) | $18,000 | $15,000 | $12,000 |

| Total Assets | $1,436,200 | $1,717,300 | $2,143,900 |

| Liabilities | |||

| SBA Loan Balance | $595,000 | $540,000 | $485,000 |

| Accounts Payable | $120,000 | $180,000 | $250,000 |

| Other Liabilities (Taxes, Accruals) | $30,000 | $35,000 | $40,000 |

| Total Liabilities | $745,000 | $755,000 | $775,000 |

| Equity | |||

| Owner Equity (initial) | $220,000 | $220,000 | $220,000 |

| Retained Earnings (loss/profit) | $471,200 | $742,300 | $1,148,900 |

| Total Equity | $691,200 | $962,300 | $1,368,900 |

Break-Even Analysis

| Item | Amount |

|---|---|

| Fixed Monthly Costs | $102,000 |

| Average Gross Margin | 33% |

| Break-even Monthly Revenue | $306,000 |

| Break-even Annual Revenue | $3.67M |

| Expected Break-even Date | Mid-Year 2 (June 2027) |

Loan Repayment Plan

Keystone Medical Supply is applying for a $650,000 SBA 7(a) loan with a 10-year term. The interest rate is about 11.25% (Prime + 2.75%). Payments are set so that a little more goes toward the loan each year, while the interest part slowly goes down.

In the first year, payments will total about $128,000—roughly $55,000 toward the loan and $73,000 in interest. By Year 3, the annual payment drops to about $116,000, since less is owed in interest. By Year 10, the loan will be fully repaid, with the last year requiring a larger principal adjustment of ~$155,000.

| Year | Opening Balance | Principal Payment | Interest Payment | Total Payment | Ending Balance |

|---|---|---|---|---|---|

| 1 | $650,000 | $55,000 | $73,000 | $128,000 | $595,000 |

| 2 | $595,000 | $55,000 | $67,000 | $122,000 | $540,000 |

| 3 | $540,000 | $55,000 | $61,000 | $116,000 | $485,000 |

| 4 | $485,000 | $55,000 | $55,000 | $110,000 | $430,000 |

| 5 | $430,000 | $55,000 | $48,000 | $103,000 | $375,000 |

| 6 | $375,000 | $55,000 | $42,000 | $97,000 | $320,000 |

| 7 | $320,000 | $55,000 | $36,000 | $91,000 | $265,000 |

| 8 | $265,000 | $55,000 | $29,000 | $84,000 | $210,000 |

| 9 | $210,000 | $55,000 | $23,000 | $78,000 | $155,000 |

| 10 | $155,000 | $155,000 | $17,000 | $172,000 | $0 |

This steady repayment schedule gives lenders confidence that Keystone can handle its debt while still growing the business. By Year 3, the company expects a Debt Service Coverage Ratio (DSCR) of over 1.25x, meaning cash flow will be more than enough to cover loan payments.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.