Executive Summary

SeniorCare Companions is a non-medical home care facility agency that helps seniors in the county of Springfield. Sarah Matthews is the owner and operator of the business and a certified nursing assistant who has more than 5 years of experience in senior care and care coordination within assisted living as well as in-home settings. With an owner-managed operation, the company is organized in a way that care quality, timetable, and relationships with clients are directly monitored.

SeniorCare Companions offers hourly, privately paid, in-home services that cater to the needs of seniors aged 65+ who do not want to leave their homes and move to institutions. Core services include:

- Companionship and supervision

- Non-medical personal care

- Meal preparation

- Light housekeeping

- Transportation support

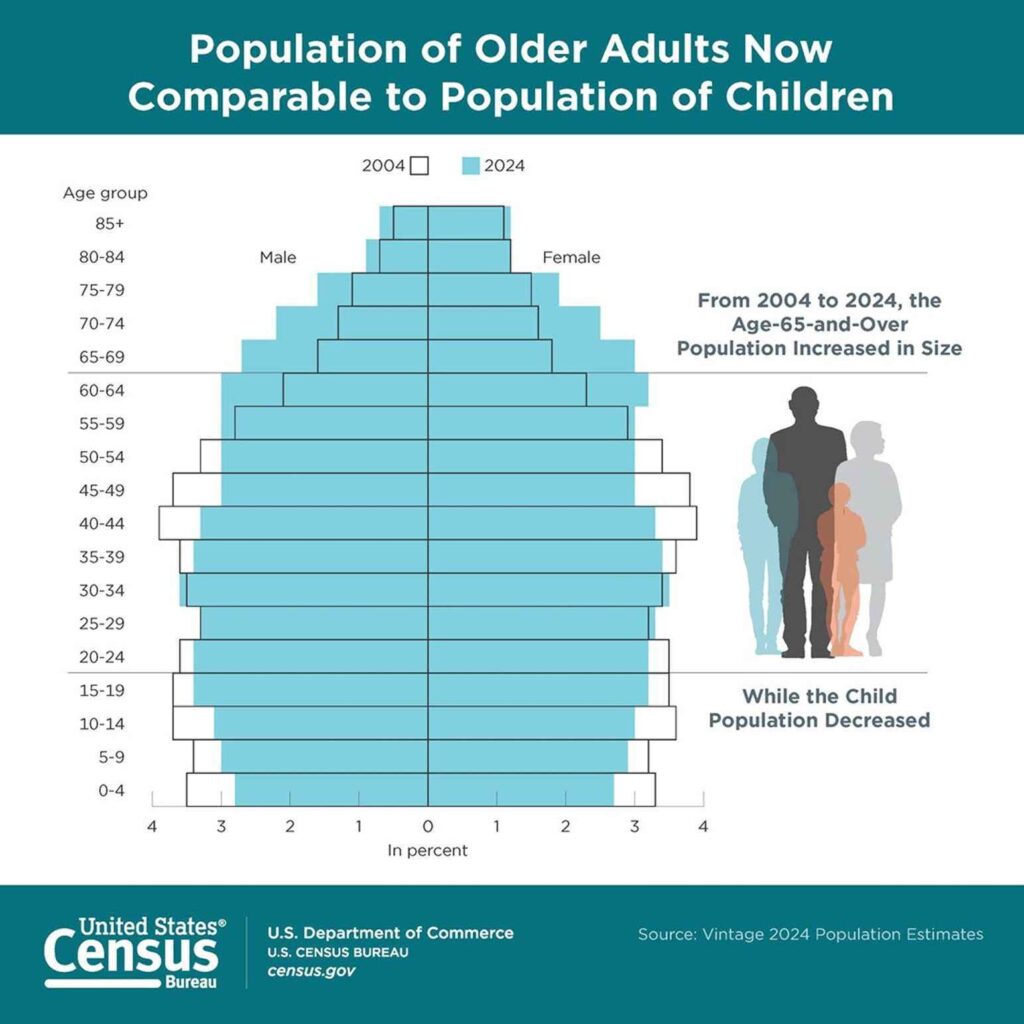

This service offering is in line with existing national demographic and care delivery trends. The U.S Census Bureau released numbers in 2025 that showed that adults aged 65 and older had increased 3.1% (to 61.2 million), validating the long-term rise of the population most prone to non-medical home care.

At the same time, hospital discharge practices and limited availability of family caregivers increasingly shift recovery and ongoing support into the home. This creates a clear need for flexible, hourly non-medical care that bridges the gap between independent living and institutional care.

SeniorCare Companions responds to this demand using a controlled owner-managed operating model. The owner is directly involved in all client intake, scheduling, and care coordination, which helps in maintaining consistency of the services and avoids overextension in the initial years of operation. The first service delivery is purposely limited to a capacity of about 60 service hours per week, which is in line with caregiver capacity and planned growth conservatively.

The only source of revenue is hourly services, ranging between $15-30 per hour, with a blended planning rate of $22 per hour applied in the financial modelling. The company prefers to grow through incremental growth in service hours, as opposed to aggressive acquisition of clients.

| Financial Snapshot | Amount |

|---|---|

| Year 1 Revenue | $68,640 |

| Year 2 Revenue | $78,936 |

| Year 3 Revenue | $90,376 |

| Break-even Volume | ~1,326 service hours per month |

SeniorCare Companions is launching with $80,000 in startup capital, consisting of $30,000 in owner equity and a $50,000 loan from Local Community Bank at a 6% interest rate. During the projection period, the business services interest-only payments, with no principal repayment reflected in Years 1–3, and the outstanding loan balance remains $50,000 throughout this period.

Due to intentionally limited staffing during the initial years, the business is not expected to reach break-even within the first three years. Service hours are capped to align with caregiver availability and service quality standards. Break-even is expected once additional caregivers are added and service capacity increases beyond the pilot-stage operating model.

A business plan shouldn’t take weeks

Company Description

Business Overview

SeniorCare Companions is a non-medical and home care business that provides services to seniors in Springfield County and is a private-pay business. The company offers home-based services to people who would like to stay at home, but they need some support to carry out their daily chores. The services are provided in a non-medical scope only and do not involve skilled nursing or clinical treatment.

The care is offered in scheduled and hourly visits of at least two hours, to all-day cover. The owner is directly involved with all client intake, matchmaking, scheduling of caregivers, and continuous communication with the family.

Legally and operationally, SeniorCare Companions has been set up as a limited liability company (LLC), which offers both the protection of liabilities and the separation of personal and business assets.

Location and Operating Base

SeniorCare Companions is based at 6058 Oak Wood Lane, Suite 100, Springfield, USA. The office will serve as the administrative and coordination centre of the client intake, caregiver scheduling, documentation, and referral management. The care is provided in the homes of the clients, but having a dedicated office upholds professionalism, regulatory compliance, and accessibility to referral partners and families.

The site was chosen because it was close to the Springfield Regional Hospital, several senior communities, and physicians specializing in geriatric care. This position will help in acquiring clients through referrals, especially to the seniors who have been discharged by the hospitals and need short-term or long-term non-medical support services at home.

Ownership

SeniorCare Companions is a 100% owned company of Sarah Matthews, who is the owner and care coordinator. Sarah Matthews possesses more than 5 years of practical experience in senior care. She was a certified nursing assistant (CNA) who had worked in assisted living facilities before, giving personal care and building long-term relationships with residents.

She then joined a local home health agency as a care coordinator, where she worked on care plans, as a caregiver, and also had direct contact with families.

She is actively certified by the state of Texas as a CNA and has completed additional training in dementia care, fall prevention, and medication reminder assistance. Her experience in the field of both institutional and in-home care helps her evaluate the needs of the client correctly, train the caregivers properly, and determine when care needs are beyond the boundaries of non-medical care.

Business Goals

SeniorCare Companions’ primary objective is to establish a financially controlled, owner-managed non-medical home care operation with service volume directly aligned to caregiver availability and cash flow capacity.

During the initial operating period, the business will intentionally limit service delivery to available staffing levels rather than pursuing full market penetration. Client intake will be paced to maintain consistent caregiver coverage, predictable scheduling, and manageable labor costs.

Short-term goals focus on operational stability, including maintaining service continuity, controlling payroll expenses, and meeting monthly fixed cost obligations without reliance on additional external funding. The business will prioritize service reliability and compliance over rapid expansion.

Long-term growth will occur gradually through measured increases in service hours and selective caregiver hiring, driven primarily by referral demand rather than broad-based advertising. Expansion decisions will be based on demonstrated service utilization, caregiver availability, and the ability to sustain positive contribution margins without compromising service quality or working capital discipline.

Keys to Success

SeniorCare Companions’ operating model is built around three core success factors:

- Quality of caregivers: Hiring, training, and client-caregiver matching were done by the owner himself.

- Referral relationships: Hospitals, physicians, and senior centres refer to us consistently, not because of paid lead generation.

- Lean operations: Direct owner participation in the process of care coordination to regulate costs and ensure the stability of the services.

Sarah Matthews’ clinical background strengthens caregiver oversight and client satisfaction, while the referral-driven model supports credibility and cost-efficient growth.

Services & Pricing

SeniorCare Companions is a non-medical in-home care company that offers services to the older generation, who desire to stay independent but require some help in their day-to-day lives. The services are all strictly within the scope of non-medical and do not necessitate any skilled nursing licensure.

Core Service Lines

The business delivers the following hourly services based on individual client care plans:

1) Companionship Care Service

This service supports seniors who live alone or need regular supervision and social interaction to remain safe and engaged at home.

2) Non-Medical Personal Care

Personal care services assist clients who require physical support with everyday activities (such as bathing assistance, dressing, grooming, toileting support, and mobility help) while remaining within a non-medical scope of care.

3) Meal Preparation & Light Housekeeping

This service helps clients maintain a functional living environment and regular meals without the burden of daily household tasks.

4) Transportation & Errand Support

Transportation services support client mobility and independence while ensuring safe travel and accompaniment.

Pricing Structure

All services are billed hourly, with rates ranging from $15 to $30 per hour, depending on the level of assistance required. For financial planning purposes, a blended average billing rate of $22 per hour is used. This blended rate reflects the expected service mix and supports coverage of direct labour costs while allowing for controlled, capacity-based growth.

Caregivers are compensated on a per-hour basis at an average wage of $17.00 per hour, with payroll-related costs bringing the blended caregiver cost to approximately $18.70 per service hour. Pricing is structured to maintain a positive contribution margin while prioritizing service quality over volume expansion.

Service Tiers

To ease the process of care planning among families, services will be categorized into two viable levels:

- Standard Tier: The level addresses companionship and general home care of clients who require minimal daily care and frequent visitation.

- Premium Tier: This tier will cover all standard tier services with the addition of non-medical personal care and transportation services to clients who require higher assistance or post discharge services.

Equipment and Operating Systems

SeniorCare Companions operates with minimal but essential equipment to support safe and reliable service delivery. This includes:

- Communication devices (smartphone and tablet) used for caregiver coordination, scheduling updates, and client communication

- Transportation support primarily using the owner’s vehicle or approved caregiver vehicles, subject to insurance verification

- Caregiver scheduling and management system to track service hours, assignments, and documentation

This lean system approach supports operational efficiency without adding unnecessary fixed costs.

Payment Terms

Clients are billed once a month based on the actual hours of care provided. Payment is due within 15 days of receiving the invoice.

Payments can be made using:

- Personal or family funds

- Reimbursement from private long-term care insurance

Invoices clearly list service dates, hours worked, types of services provided, and caregiver information. This makes them easy to use for insurance reimbursement when needed.

Clients are not locked into long-term contracts. Services can be adjusted or stopped with reasonable advance notice.

At this time, SeniorCare Companions does not participate in Medicaid waiver programs or other government payment systems. These programs often involve complex paperwork and slow payments. Participation may be considered in the future once the business is stable and cash flow is consistent, likely after the first year of operations.

Market Analysis

Demand for non-medical home care in the Springfield area is driven by a growing senior population that prefers to remain at home rather than move into assisted living or nursing facilities. Many older adults need help with daily activities but do not require medical care, creating a steady demand for hourly, in-home support services.

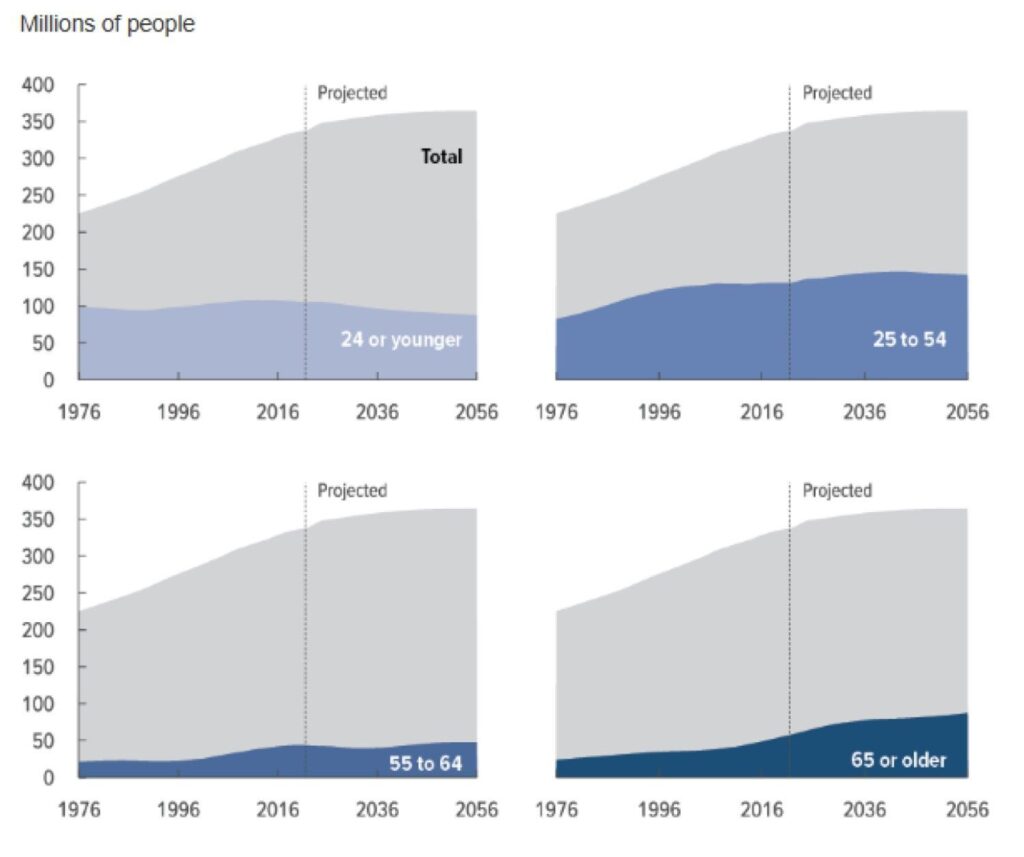

At the national level, long-term population trends support this demand. The Congressional Budget Office projects that the U.S. population will continue to age over the 2026 to 2056 period. The number of people age 65 and older is expected to grow through 2036 at an average annual rate of 1.6%, faster than younger age groups.

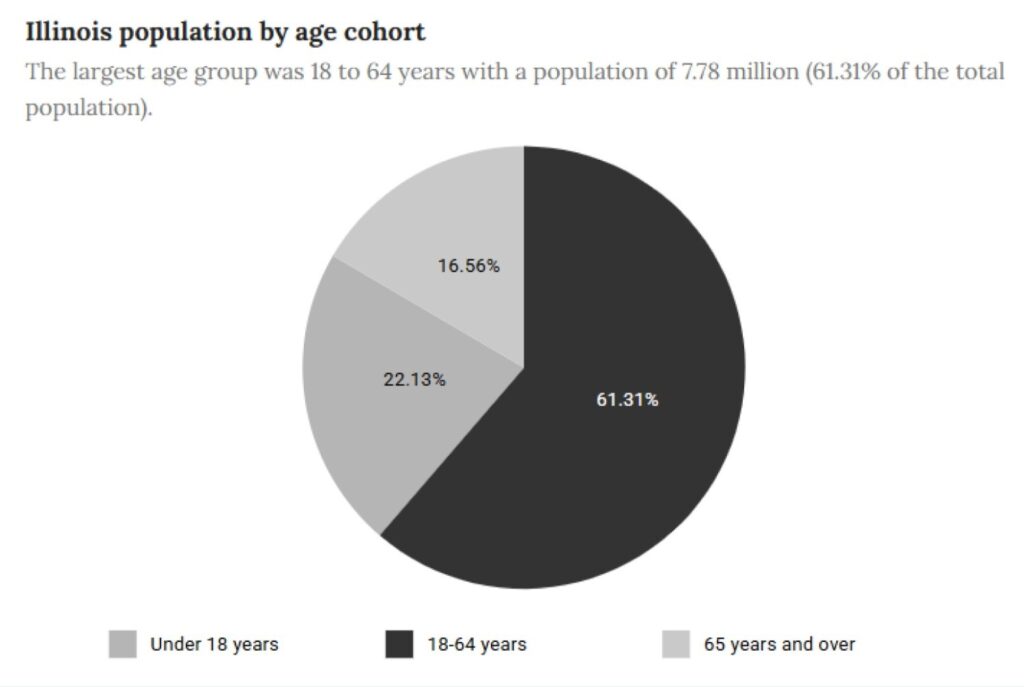

This national trend is reflected clearly in Illinois. The state has an estimated 2.1 million residents aged 65 and older, many of whom live independently in residential communities rather than institutional settings.

As this population grows, reliance on in-home, non-medical care continues to increase, especially for seniors who need assistance during the day or after hospital discharge.

This environment directly supports SeniorCare Companions’ target audience. The business serves seniors aged 65 and older who live independently and require help with personal care, companionship, household tasks, and transportation. Demand also comes from families seeking reliable, non-medical support to help loved ones remain safely at home.

Market Risk Considerations

SeniorCare Companions faces a few common risks for a non-medical home care business. These risks are managed by keeping operations small and closely monitored.

- Caregiver availability: Services depend on having enough caregivers. Client intake is limited early on and expanded only when staffing is in place.

- Client start timing: New clients may not start each month. Referrals from hospitals, doctors, and community groups help bring in clients with clear care needs.

- Pricing sensitivity: Families pay by the hour and can reduce hours if needed instead of ending services altogether.

- Owner oversight: The owner manages intake, scheduling, and staffing, allowing quick action if issues arise.

Stop searching the internet for industry & market data

Get AI to bring curated insights to your workspace

Competitive Landscape

The non-medical home care market in Springfield County is comprised of both national franchise providers and locally based agencies. Industry statistics have shown that the home care industry is very fragmented in the U.S., with none of the providers holding a 5% of the local markets. It enables the smaller agencies to be able to compete based on service quality and relationship, as opposed to scale.

Direct Competitors

These providers are similar to SeniorCare Companions in service provision, such as companionship services and personal and household support services. Nevertheless, the agencies that use the franchise structure are usually characterized by centralized scheduling, uniform allocation of caregivers, and an increased administrative overhead that may decrease flexibility and continuity at the client level.

| Provider | Type | Service Model | Market Characteristics |

|---|---|---|---|

|

Local / Regional | Non-medical hourly care | Relationship-based, limited owner visibility |

|

National franchise | Non-medical home care | Higher overhead, standardized processes |

|

National franchise | Non-medical companionship & personal care | Brand recognition, rotating caregivers |

Indirect Competitors

| Alternative | Why Families Consider Them | Limitations |

|---|---|---|

| Assisted living facilities | Full-service care environment | High monthly cost, reduced independence |

| Family caregivers | No direct cost | Time constraints, burnout risk |

| Independent caregivers | Lower hourly rates | Limited oversight, compliance risk |

Indirect alternatives often fail to provide the balance of professional oversight, scheduling flexibility, and service reliability that licensed non-medical home care agencies offer.

Competitive Positioning

SeniorCare Companions is positioned as a small, owner-operated agency emphasizing service consistency and relationship-based care rather than scale.

What sets the business apart:

- The owner is directly involved in client intake and scheduling

- A small caregiver team allows for better matching and familiar faces

- Most growth comes from referrals through hospitals, doctors, and senior centers

- A lean setup helps keep prices reasonable

Rather than competing on volume or brand reach, the business focuses on reliability, continuity, and local trust, which are primary decision factors for families selecting home care providers.

Stop Googling competitors for hours

Marketing & Client Acquisition

SeniorCare Companions uses a relationship-driven client acquisition model aligned with its owner-operated structure, limited initial staffing, and emphasis on service consistency. The business does not pursue high-volume advertising or lead-generation platforms, as these models often create intake levels that exceed caregiver capacity and increase service disruption risk.

Instead, client acquisition is built around local referral relationships with organizations that regularly encounter seniors who require non-medical assistance.

Marketing Channels

The total monthly marketing budget is $1,000.

| Marketing Channel | How It Will Be Used |

|---|---|

| Local referrals (hospitals, physicians, senior centers, local community centers) | Visiting local partners, sharing service details, and staying in touch regularly |

| Social media (Facebook, Instagram) | Posting updates, reminders, and photos to stay visible locally |

| Local SEO | Keeping the Google Business profile updated and managing reviews |

| Referral outreach | Regular check-ins with referral partners and sharing updates |

| Online ads | Running local search and social ads during busy periods |

| Print media | Handing out flyers and placing ads in local publications |

| Community events | Attending local events to introduce the business and meet residents |

Client Intake and Conversion

All initial inquiries are handled directly by the owner. This ensures that client needs, service scope, and scheduling requirements are confirmed before services begin.

Care plans are matched to caregiver availability, and pricing is communicated upfront. This process reduces cancellations, improves service continuity, and supports predictable scheduling.

Alignment With Operating Model

This acquisition strategy aligns with the company’s:

- Owner-managed structure

- Limited initial caregiver pool

- Emphasis on consistency and relationship-based care

- Conservative growth and cash flow assumptions

By pacing growth through referrals rather than volume advertising, SeniorCare Companions maintains service quality while scaling in line with staffing capacity.

Does your plan sound generic?

Refine your plan to adapt to investor/lender interests

Operational Plan

SeniorCare Companions operates as a licensed, non-medical home care agency and provides in-home support services that do not involve skilled nursing or medical treatment. The business is regulated by the Illinois Department of Public Health (IDPH) and complies with all applicable state requirements governing non-medical home care operations, employment practices, client privacy, and service documentation.

By operating strictly within a non-medical scope, the company avoids the regulatory complexity associated with medical home health providers while maintaining full compliance with licensing and oversight requirements.

Services are delivered on a private-pay basis only. The business does not bill Medicare, Medicaid, or other government programs, which limits administrative burden, reduces payment delays, and supports predictable operating cash flow during early growth.

Operating Hours

SeniorCare Companions operates primarily during standard daytime hours aligned with client demand and caregiver availability.

Our operating hours are 8:00 AM to 6:00 PM (Monday–Friday).

On-call availability is maintained outside standard hours for urgent client needs and short-notice schedule adjustments. This structure supports consistent scheduling while preserving flexibility for families requiring time-sensitive assistance.

Service Scheduling and Delivery

Care services are delivered in clients’ homes through scheduled hourly shifts, with a minimum of two hours per visit. Most services occur during weekday daytime hours, aligning with client demand and caregiver availability. Service volume is paced deliberately to match staffing capacity.

Core delivery characteristics:

- Hourly, scheduled care

- Consistent caregiver assignments

- Owner-managed intake and scheduling

- Flexible care plans adjusted as needs change

Transportation support is provided as a non-medical service for appointments and errands. Caregivers may use client vehicles or approved personal cars, subject to insurance verification and documentation.

Quality Control and Documentation

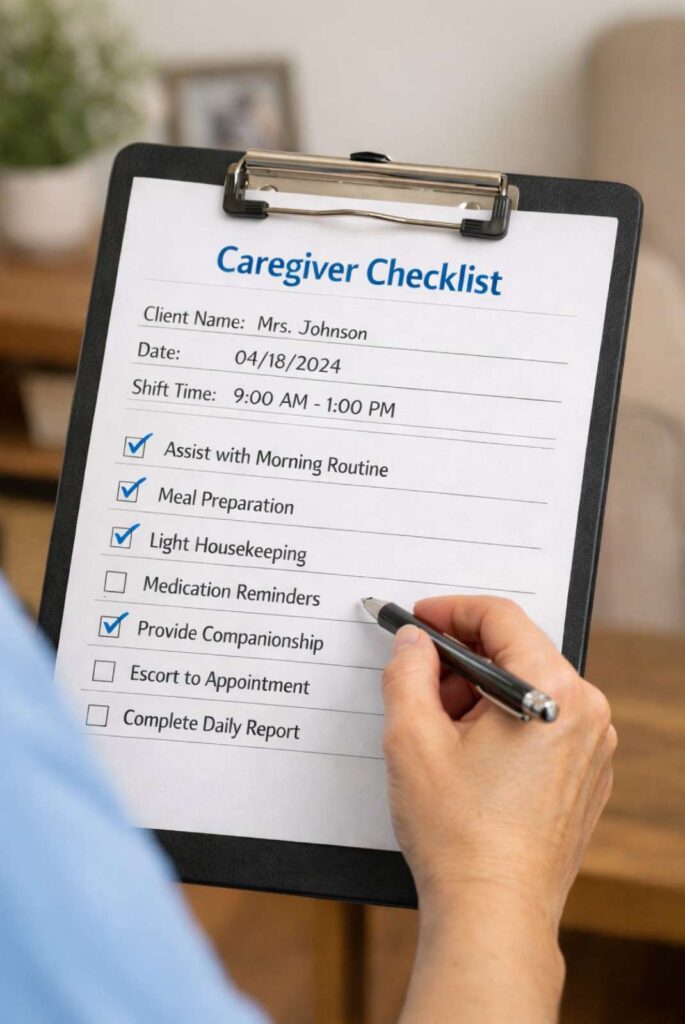

Before service begins, client needs are assessed and documented, and care plans are adjusted as those needs change over time. To ensure consistency in daily service delivery, caregivers follow standardized service checklists that outline approved tasks, visit scope, and reporting requirements for each client.

Ongoing communication with clients and families supports service continuity and allows issues to be identified and addressed at an early stage.

The business maintains general liability, professional liability, workers’ compensation, and non-owned auto insurance coverage to support in-home service delivery and transportation-related activities

Operational Risk Management

The chief causes of operational risks are caregiver availability, coordination in scheduling, and the speed of onboarding. These risks are addressed by the use of conservative growth assumptions, keeping the number of caregivers small, and the direct ownership control of intake and scheduling decisions.

| Risk Area | Mitigation |

|---|---|

| Staffing constraints | Gradual service expansion |

| Scheduling conflicts | Owner-managed coordination |

| Scope creep | Strict non-medical boundaries |

| Compliance exposure | Standardised documentation |

Management & Staffing

SeniorCare Companions will be an owner-managed organization at the beginning of its operations, permitting straightforward control over scheduling, care coordination, and staffing choices. This helps maintain uniformity in service delivery, cost management, and client intake and caregiver availability congruency.

Management Structure

The owner serves as the primary decision-maker for:

- Client intake and service authorization

- Care scheduling and caregiver assignment

- Quality oversight and issue resolution

- Referral relationship management

Administrative tasks such as billing and recordkeeping are supported through part-time administrative assistance, allowing management to focus on operations and service delivery.

Staffing Model

Staffing is intentionally lean at launch and designed to scale with demand.

| Role | Status | Function |

|---|---|---|

| Owner & Care Coordinator | Full-time | Intake, scheduling, oversight |

| Administrative Support | Part-time | Billing and documentation |

| Caregivers (2) | Part-time | In-home service delivery |

Caregivers are engaged on a part-time basis to maintain flexibility and limit fixed payroll obligations during early operations. Staffing is intentionally lean at launch and designed to scale in line with client demand.

Caregiver Hiring and Standards

Hiring of caregivers is conducted under state non-medical home care regulations, such as background testing, documentation, and client privacy guidelines. Each one of them is paid on an hourly basis and works within the limits of non-medical services.

This recruitment strategy promotes the quality of the services provided at a reasonable cost and adherence to regulations.

Staffing Capacity and Expansion

The two part-time caregivers with 30 hours each in their workweek initially support the operations, which translates to 60 service hours a week. During the pilot phase, service volume is intentionally limited to control overhead costs and to maintain service quality.

With the growing demand via referral, new caregivers will be sought in terms of incremental hiring to ensure service capacity is scalable without going beyond the break-even estimates.

Recruitment is done on the basis of:

- Sustained increases in weekly service hours

- Limits on existing caregiver availability

- Service quality considerations

This will help avoid over-staffing and at the same time not to be understaffed.

Staff Training and Oversight

Before the caregivers give care, they are given a structured orientation that includes approved service boundaries, expectations of client safety, and the documentation needs. Constant monitoring is directly managed by the owner, including scheduled check-ins, quarterly performance evaluations, and frequent client and family feedback, to diagnose and address any service problems in time.

Caregiver availability and turnover are the main staffing risks. The management of these risks includes flexible scheduling, a gradual intensity of service growth based on the verified demand, and a small number of trained caregivers instead of excessive staffing. This strategy restricts fixed labour exposure and continuity of care.

As a whole, the management and personnel organization makes possible controlled growth, predictable labour expenses, and consistent service delivery, all in line with the conservative business financial assumptions and the step-by-step expansion plan.

Financial Plan

Financial projections are based on a conservative pilot-stage operating model with limited initial staffing and service volume intentionally capped by caregiver availability rather than rapid expansion.

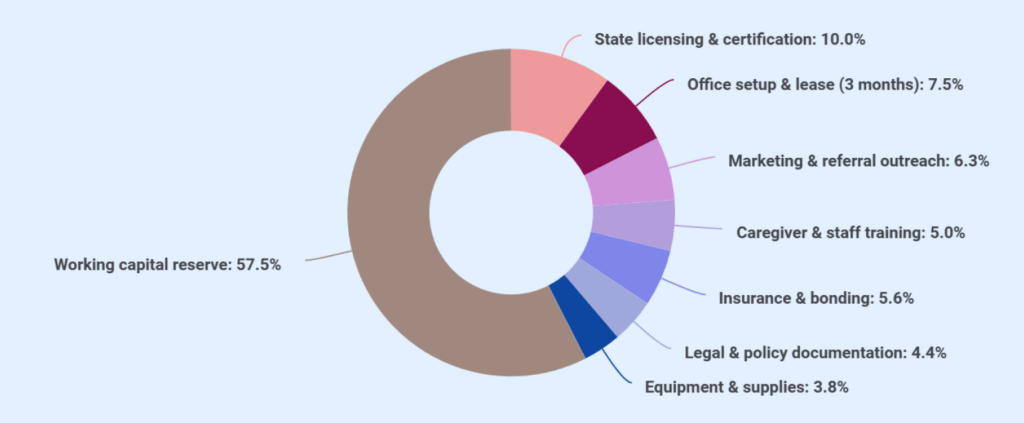

Startup Costs

The business requires $80,000 in total startup funding to complete licensing, establish operations, and support working capital needs during the initial operating phase.

| Category | Cost |

|---|---|

| State Licensing & Certification | $8,000 |

| Office Setup & Lease (3 months) | $6,000 |

| Marketing & Referral Outreach | $5,000 |

| Caregiver & Staff Training | $4,000 |

| Insurance & Bonding | $4,500 |

| Legal & Policy Documentation | $3,500 |

| Equipment & Supplies | $3,000 |

| Working Capital Reserve | $46,000 |

| Total Startup Costs | $80,000 |

Funding Sources

| Source | Amount ($) |

|---|---|

| Owner equity contribution | 30,000 |

| Bank loan (6% interest) | 50,000 |

| Total Funding | 80,000 |

Key Financial Assumptions

| Item | Assumption |

|---|---|

| Forecast Period | 3 years (2026–2028) |

| Revenue Streams | Companionship: $20/hr; Personal Care: $25/hr; Meal Prep & Housekeeping: $15/hr; Transportation: $30/hr |

| Revenue Mix | Companionship: 30%; Personal Care: 35%; Meal Prep & Housekeeping: 20%; Transportation: 15% |

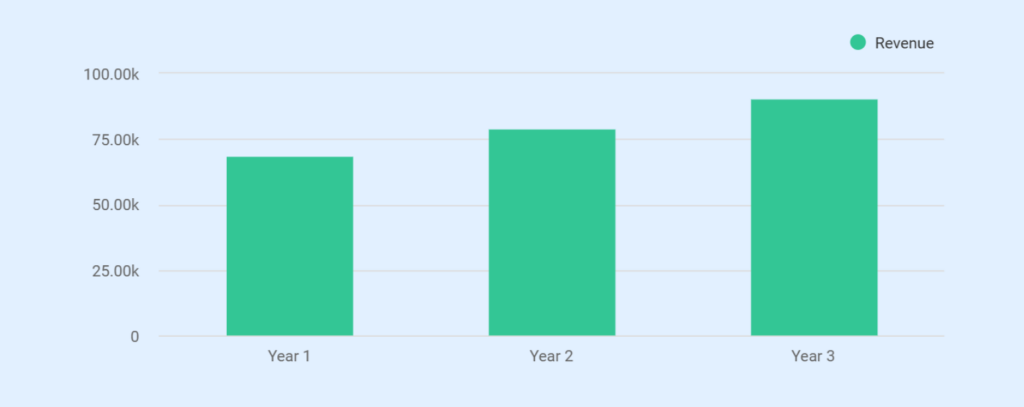

| Revenue Growth | 15% annual growth in clients and service hours starting Year 2 |

| Service Volume | Year 1: 60 hrs/week; Year 2: 69 hrs/week; Year 3: 79 hrs/week |

| Staffing Capacity | 2 part-time caregivers, 30 hrs/week each |

| Cost of Services (COGS) | Caregiver wages, transportation costs, and care supplies |

| Operating Expenses | Fixed: $4,375/month (office lease, insurance, admin, marketing); Variable: caregiver wages, fuel, supplies |

| Staffing & Wages | Owner: no salary (first 5 years); Caregivers: $17/hr; Admin support: $1,000/month |

| Marketing Spend | $1,000/month (referrals, online ads, print media, events) |

| Collection Timing | Monthly billing, minimal receivable delays |

| Capital Expenditures | Office setup: $6,000 (5–6 year depreciation); Equipment & supplies: $3,000 (3-year depreciation) |

| Tax Treatment | Pre-tax projections; 21% federal corporate tax |

| Funding Sources | Loan: $50,000 at 6% interest, interest-only through Year 3; Owner equity: $30,000 |

Forecast (3 Years)

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Service Hours (Annual) | 3,120 | 3,588 | 4,108 |

| Revenue ($) | 68,640 | 78,936 | 90,376 |

Projected Profit & Loss Statement (3 Years)

| Category | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Service hours (annual) | 3,120 | 3,588 | 4,108 |

| Average billing rate | $22 | $22 | $22 |

| Total Revenue | 68,640 | 78,936 | 90,376 |

| Caregiver wages | 53,040 | 60,996 | 69,836 |

| Supplies & transportation | 5,304 | 6,100 | 6,984 |

| Total COGS | 58,344 | 67,096 | 76,820 |

| Gross Profit | 10,296 | 11,840 | 13,556 |

| Operating Expenses | |||

| Office lease | 24,000 | 24,000 | 24,000 |

| Marketing & outreach | 12,000 | 12,000 | 12,000 |

| Insurance & bonding | 4,500 | 4,500 | 4,500 |

| Administrative support | 12,000 | 12,000 | 12,000 |

| Total Operating Expenses | 52,500 | 52,500 | 52,500 |

| EBITDA | (42,204) | (40,660) | (38,944) |

| Depreciation | 2,200 | 2,200 | 2,200 |

| Interest Expense | 3,000 | 3,000 | 3,000 |

| Net Income (Loss) | (47,404) | (45,860) | (44,144) |

Net Income:

The business experiences losses in Year 1, Year 2, and Year 3, but these losses reduce over time as revenue grows and costs stabilize.

Projected Cash Flow (3 Years)

| Cash Flow | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Net Income | -47,404 | -45,860 | -44,144 |

| Add: Depreciation | 2,200 | 2,200 | 2,200 |

| Operating Cash Flow | -45,204 | -43,660 | -41,944 |

| Capital Expenditures | -9,000 | — | — |

| Loan Proceeds | 50,000 | — | — |

| Owner Equity Contribution | 30,000 | — | — |

| Net Cash Flow | 25,796 | -43,660 | -41,944 |

| Beginning Cash Balance | 0 | 25,796 | -17,864 |

| Ending Cash Balance | 25,796 | -17,864 | -59,808 |

*Negative cash balances in Years 2–3 indicate the need for additional service volume, pricing adjustments, or continued owner support during the growth phase.

Projected Balance Sheet

| Balance Sheet | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash | 25,796 | -17,864 | -59,808 |

| Net Fixed Assets | 6,800 | 4,600 | 2,400 |

| Total Assets | 32,596 | -13,264 | -57,408 |

| Liabilities | |||

| Loan Balance | 50,000 | 50,000 | 50,000 |

| Equity | |||

| Owner Paid-in Capital | 30,000 | 30,000 | 30,000 |

| Retained Earnings | -47,404 | -93,264 | -137,408 |

| Total Liabilities & Equity | 32,596 | -13,264 | -57,408 |

Break-Even Analysis

| Break-Even Item | Amount |

|---|---|

| Average billing rate per hour | $22.00 |

| Caregiver wage per hour | $17.00 |

| Supplies, payroll related cost & transportation per hour | $1.70 |

| Total variable cost per hour | $18.70 |

| Contribution margin per hour | $3.30 (15.0%) |

| Monthly fixed operating costs | $4,375 |

| Break-even service hours per month | 1,326 hours |

| Break-even service hours per week | ~332 hours |

| Break-even service hours per day (5 days) | ~66 hours/day |

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features