Got an amazing idea to establish your own crypto business? Great call!

Well, it can be an exciting venture with big earning potential. But before you dive into the crypto world, you’ll need a well-thought-out business plan to guide your way.

I understand—writing a business plan can be a bit overwhelming and a daunting task, especially when you’re new to this game. But trust me, it’s worth keeping one for your cryptocurrency business.

Need a hand with your plan? Not to worry!

Explore this crypto business plan template that guides you through the process of crafting a business plan, including why it works best for your crypto startup.

Free Business Plan Template

Download our free crypto business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

Why do you need a cryptocurrency business plan?

A cryptocurrency business plan isn’t just a professional document—it’s your roadmap to success. If you’re looking to break into the crypto space, a business plan is a must-have tool. Here’s why:

Gives you clear direction

Writing a business plan instills you to organize your business ideas on paper and outline your business goals.

It also lets you clearly define your specific goals, offerings, target audience, potential customers, marketing efforts, and financial projections. It serves as your guide to stay focused when there are a million other things to do.

Attracts investors and builds trust

Many investors are still cautious about jumping into the crypto businesses, especially when they’ve been burned before.

However, a solid crypto business plan in your hands shows potential investors that you’ve done thorough research and built a clear financial plan to earn profits. This is very important if you’re looking to raise funds.

Helps navigate crypto regulations

Well, the crypto industry is known for its complex regulatory environment. But a cryptocurrency business plan allows you to outline how you’ll comply with laws and regulations.

Whether it’s getting specific licenses or addressing anti-money laundering (AML) & KYC (know your customer) requirements.

Prepares you for challenges

If you’ve been in crypto for a while, you will know the market can swing wildly—One day, Bitcoin is up, and the next, it’s taking a nosedive!

At that time, having a crypto business plan enables you to think about those market dips and spikes, giving you strategies for managing these fluctuations. So, it prepares you for good times and tough times as well.

Now, without further ado; let’s proceed to the sections of the crypto business plan.

How to write a crypto business plan?

Writing a crypto business plan involves several actionable steps and key elements to encapsulate your business idea, goals, and strategies. Here’s a step-by-step guide to help you draft a successful crypto business plan:

1. Executive summary

An executive summary is the first section that anyone reads. So, think of it like your sales pitch, providing a quick, high-level overview of the complete crypto business plan.

If your executive summary is interesting, it helps you capture readers’ or potential investors’ attention and convince them to learn more about your crypto business. That’s why keep it clear and concise yet informative—outline what your crypto business is all about.

To plan this section, consider including:

- Crypto business name and concept

- The problem you’re solving

- Your target market

- Sales and marketing strategies

- Key success factors

- Financial goals and projections

- Funding needs

Though it’s an introductory part, writing your plan summary would be more convenient at the end once the entire doc is ready. Why? Because it lets you summarize all the essential points more effectively.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Business overview

Now, it’s time to go into more detail as the business overview section is a detailed description of your crypto business.

It sheds light on the foundational facts of your crypto business, starting from its legal structure and location to future goals and growth strategies that potential investors need to understand.

Also, give a clear explanation of your crypto business idea. Whether it’s an exchange, a wallet service, a Decentralized Finance (DeFi) platform, or a blockchain consulting firm.

After that, tell your background story, why you started this company, and what makes it special. Plus, mention the problem you aim to solve in the crypto market.

Lastly, don’t forget to emphasize your vision and mission statement to let you showcase how your business stands out in the crowded marketplace. For example:

Vision statement

“To make digital finance easy, secure, and accessible for everyone, no matter where they are in the world. We see a future where crypto and blockchain tech are as common as sending a text, giving people more control over their money and opportunities.”

Mission statement

“We’re building a simple, secure crypto platform with all the tools people need to buy, trade, and grow their assets. Our goal is to create a space where users can manage their crypto confidently, supported by strong security and transparency. We’re committed to pushing blockchain’s limits while always keeping our community at the heart of everything we do.”

3. Market analysis

Conduct a thorough market analysis to build a strong foundation for your cryptocurrency business.

It will help you get valuable insights into the external crypto industry, along with the specific market niche, target audience, market trends, and primary competitors.

While drafting this section, answer the following kind of questions:

- What’s currently happening in the crypto world?

- How big is the size of the crypto market (in dollars)? Is it growing or declining?

- What are the emerging market trends (like the rise of DeFi, or NFTs)?

- Who’s your target market? Who’s your ideal customer? Beginners, tech-savvy traders, businesses looking for blockchain solutions?

- Who else is doing a similar type of crypto business? What they’re good at, and where they’re missing the mark?

For example, if you’re starting a new exchange, explore platforms like Coinbase, Binance, or Kraken. What do they do well, and where can you do better?

Ensure you identify the market gaps and devise strategies to fill those gaps, allowing you to get a competitive advantage in the market.

4. Product and service offerings

In this section, describe the main products or services your crypto business is going to offer.

Also, explain how it solves a problem and benefits your customers, like making crypto more accessible or giving top-notch security.

Will you provide a crypto trading platform, a secure digital wallet, a DeFi app, or perhaps blockchain consulting services?

Highlight the unique features of your business offerings and specify what makes them different. Maybe you’ve got a user-friendly interface, lower fees, or educational resources for beginners.

If you plan to offer any additional services —premium user support, educational webinars, or custom consulting packages, mention them as well. (Think about how you can diversify your income streams.)

5. Marketing strategy

Well, the crypto industry is highly competitive. So, you’ll require a solid marketing plan to reach your target audience and bring in new users. Here’s what to include in your marketing strategy for crypto businesses:

Promotion channels

Where will you promote or market your services? Social media platforms like Twitter and Reddit are great for reaching crypto influencers, while YouTube can help you share educational content.

Community building

Crypto is all about community. Engage with users on Discord, Telegram, or even host AMAs (Ask Me Anything) sessions to build trust and transparency.

Sales funnel

How will you convert a curious visitor into a paying user? Map out your user journey, from discovering your brand to signing up and making their first trade.

Pricing strategy

Explain how you’ll price your services—like transaction fees, subscription tiers, or premium features. Make sure your pricing makes sense compared to competitors.

6. Management team

A strong team is essential for strategic planning and informed decision-making. So here, introduce your management team in this section.

First, share a bit about yourself (or other business owners, if any) and highlight why you’re passionate about crypto. If you have relevant industry experience, mention it too.

After that, include short resume-styled bios for the key team members, including their educational qualifications, expertise, work experience, and how they add value to your business.

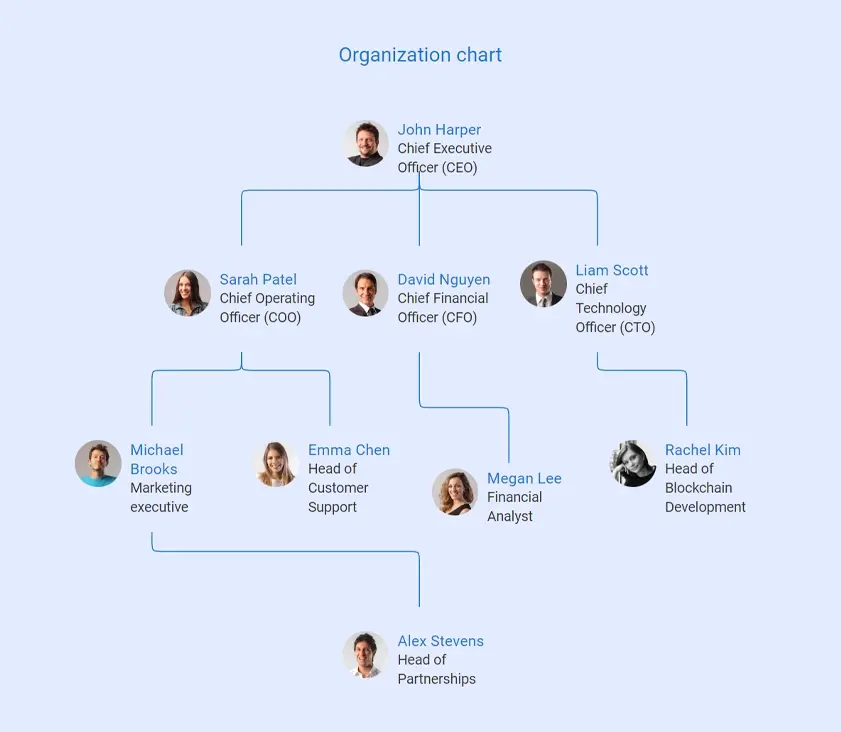

Plus, illustrate the organizational chart that defines the hierarchical structure and explains how key roles are interconnected. Here’s an example:

By clearly defining the authority, investors will get to know that you’ve got the right people to drive the company’s vision and manage your crypto business operations.

7. Operations plan

Next, provide a detailed overview of the day-to-day business activities and operations. Clarify how everything will run behind the scenes.

Try to cover all the following operational intricacies in your plan:

- What technology will you use for your platform? Think blockchain protocols, security measures, and user interfaces.

- How will you handle security, like encryption and multi-factor authentication, to protect users’ funds?

- How will you stay compliant with local regulations, such as obtaining licenses or working with legal advisors to stay updated?

- What will be your hiring plan, if your team is lacking? Need developers, customer support, or a security expert?

By detailing all these operational aspects, you show financial packers that your crypto business runs smoothly and is managed effectively. So keep this section more practical.

8. Financial plan

Crypto businesses might be digital, but the bills are real! And the financial plan is all about how your business will generate revenue and manage costs.

Typically, the startup financial plan involves the comprehensive analysis of your financial projections for the next few (5-7) years.

Here’s a list of the critical financial statements and reports that you must include in your crypto financial plan:

- Profit and loss statement

- Cash flow statement

- Balance sheet

- Break-even analysis

- Funding needs (if applicable)

Besides that, outline your expected startup costs, including tech development, marketing, and legal fees. Then, estimate your revenue projections, like how much you expect to make from transaction fees or premium services.

While presenting your financial data, try to develop tables, graphs, and charts that are clear and easy to read. This will help potential investors or lenders make informed decisions wisely.

For example, you may consider formulating the financial forecasts as shown below:

Profit and loss statement (income statement)

| Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

| Revenue | |||

| Trading Fees | $300,000 | $450,000 | $675,000 |

| Staking Rewards | $50,000 | $75,000 | $100,000 |

| Consulting Services | $50,000 | $75,000 | $125,000 |

| Total Revenue | $400,000 | $600,000 | $900,000 |

| Cost of Goods Sold (COGS) | |||

| Network Fees | $100,000 | $150,000 | $225,000 |

| Transaction Costs | $20,000 | $30,000 | $45,000 |

| Total COGS | $120,000 | $180,000 | $270,000 |

| Gross Profit | $280,000 | $420,000 | $630,000 |

| Operating Expenses | |||

| Salaries and Benefits | $120,000 | $130,000 | $150,000 |

| Marketing & PR | $50,000 | $40,000 | $50,000 |

| Compliance and Legal Fees | $20,000 | $20,000 | $25,000 |

| Technology & Security | $10,000 | $10,000 | $15,000 |

| Total Operating Expenses | $200,000 | $200,000 | $250,000 |

| Net Income | $80,000 | $220,000 | $380,000 |

Cash flow statement

| Year | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Beginning Cash Balance | $100,000 | $180,000 | $380,000 |

| Cash Inflows | |||

| Sales Collections (90% of Revenue) | $360,000 | $540,000 | $810,000 |

| Loan Proceeds | $50,000 | – | – |

| Total Cash Inflows | $410,000 | $540,000 | $810,000 |

| Cash Outflows | |||

| Operating Expenses | $230,000 | $253,000 | $278,250 |

| Loan Payments (Principal & Interest) | $10,000 | $10,000 | $10,000 |

| Capital Expenditure (Tech Upgrades) | $10,000 | $10,000 | $20,000 |

| Total Cash Outflows | $250,000 | $273,000 | $308,250 |

| Net Cash Flow | $160,000 | $267,000 | $501,750 |

| Ending Cash Balance | $180,000 | $380,000 | $881,750 |

Balance sheet

| Year | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash | $180,000 | $380,000 | $881,750 |

| Digital Assets (Crypto Holdings) | $100,000 | $150,000 | $300,000 |

| Accounts Receivable | $30,000 | $60,000 | $70,000 |

| Technology & Equipment | $70,000 | $135,000 | $280,000 |

| Total Assets | $380,000 | $725,000 | $1,531,750 |

| Liabilities | |||

| Accounts Payable | $20,000 | $30,000 | $35,000 |

| Deferred Revenue | $15,000 | $20,000 | $25,000 |

| Loan Payable | $50,000 | $40,000 | $30,000 |

| Total Liabilities | $85,000 | $90,000 | $90,000 |

| Equity | |||

| Owner’s Equity | $100,000 | $100,000 | $100,000 |

| Retained Earnings | $195,000 | $535,000 | $1,341,750 |

| Total Equity | $295,000 | $635,000 | $1,441,750 |

| Total Liabilities & Equity | $380,000 | $725,000 | $1,531,750 |

Moreover, be sure to account for potential risks or market volatility and how it might impact your income. This will let you plan for those ups and downs, showing you’re well-prepared for emergencies.

Download our free crypto business plan template

Ready to kickstart your crypto business plan writing from scratch? But need more assistance? No worries; we’ve got you covered. Download our free crypto business plan template to get started.

This sample plan covers a real-world example of what a polished business plan looks like. You can use it as a reference while writing your own plan. Just remember to modify it to fit your unique business idea and needs!

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Conclusion

Now, that’s a wrap! We’ve discussed all the key sections of a crypto business plan and how to draft each of them. So, it’s much easier for you to draft a professional-looking business plan for your crypto venture.

But if you need extra help or are seeking an easy way to develop your plan, try using Upmetrics. It’s an AI-powered business plan software that will simplify the entire planning process for you and generate an actionable plan quickly and efficiently.

So, wait no longer; start preparing your plan with us!