Executive Summary

BlueOak Wealth Advisory, LLC is a small financial planning firm in Charlotte, North Carolina. The firm helps people with personal financial plans, retirement income, smart investing, and business owner strategies. It’s based in the SouthPark area, close to professionals, business owners, and retirees who want honest financial help.

BlueOak was started by Alexander Reid, Certified Financial Planner (CFP), and Natalie Ruiz, Certified Public Accountant (CPA), after they saw that many people were getting financial advice that was confusing, sales-focused, and not really about their goals. They wanted to change that by building a firm that truly puts clients first, explains everything clearly, and creates plans that fit real life. With Alexander’s financial planning skills and Natalie’s tax knowledge, they built BlueOak to give clients honest advice, simple pricing, and peace of mind about their money.

Market Opportunity

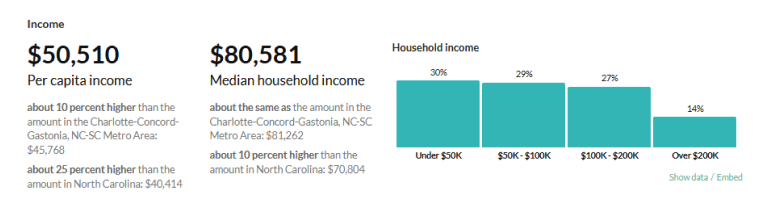

Charlotte’s economy is strong, and many people here have higher incomes and growing investments. The city has a population of 943,476, and around 14% of households make more than $200,000. BlueOak focuses on professionals, small business owners, and retirees who want clear advice and fair pricing.

Target Demographics

BlueOak mainly serves:

- Professionals and executives (ages 35–60) earning $150,000–$400,000

- Retirees with $500,000 or more in investments

- Business owners and doctors planning for retirement or succession

These clients want local advisors who are easy to reach and who give steady, honest support.

Mission and Vision

- Mission: To help clients protect and grow their money with clear and honest financial advice.

- Vision: To become a lifelong partner in our clients’ journeys—from their first savings to a comfortable and worry-free retirement.

Funding Needs

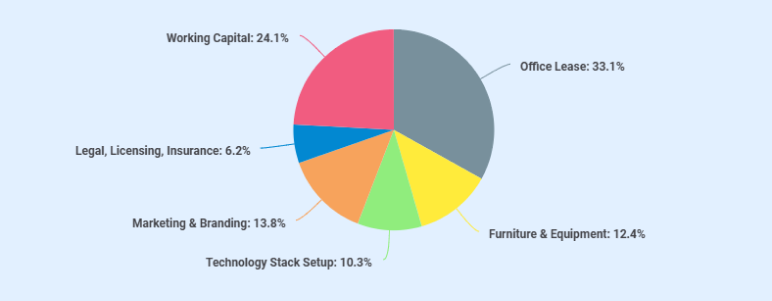

BlueOak is requesting a $210,000 loan from Truist Bank (SouthPark Branch) and adding $70,000 from the owners. The money will go toward:

- Office setup and leasehold improvements

- Technology and compliance systems

- Marketing and launch campaigns

- Working capital and payroll for the first year

This funding will help establish BlueOak as a trusted, tech-enabled advisory firm positioned for long-term success in Charlotte’s growing financial market.

Want a professional plan like this sample?

Upmetrics AI generate a complete, investor-ready plan for you

Business Overview

Location and Legal Structure

BlueOak Wealth Advisory is located at 6120 Fairview Road, Suite 215, Charlotte, North Carolina 28210. The office is in the SouthPark business district, a well-known area filled with banks, law firms, and other professional offices. It’s a good location for reaching professionals, executives, and retirees who live nearby.

The firm is a North Carolina Limited Liability Company (LLC). This setup protects the owners’ personal assets if something happens to the business. It also gives the firm flexible tax options and an easy way to share profits between owners. For a small and growing financial advisory business, an LLC is a simple and smart choice.

Business Model

BlueOak works as a fee-only Registered Investment Advisory (RIA) firm. This means the firm doesn’t earn commissions or take payments from product sales. All income comes directly from client fees, which keeps advice honest and conflict-free.

The firm’s main services include:

- Comprehensive financial planning

- Investment management

- Retirement planning

- Tax-smart investing

- Business owner services

Clients can pay through either flat planning fees or asset-based management fees, depending on what works best for their goals.

Ownership

BlueOak is owned and managed by two partners:

- Alexander Reid, CFP (70%) – Founder and managing partner. He has more than 12 years of experience in private wealth management and previously worked as a vice president at Merrill Lynch. He started BlueOak to give clients unbiased financial advice without pressure from product sales.

- Natalie Ruiz, CPA (30%) – Co-founder and operations director. She is a former EY tax advisor who specializes in helping small business owners with tax and wealth planning. Natalie manages compliance, operations, and client service.

Together, Alexander and Natalie bring financial knowledge, tax expertise, and genuine care for clients.

Business Goals

BlueOak’s main goals for the next few years are simple and clear:

- Build a trusted name in Charlotte for honest, easy-to-understand financial advice.

- Grow to 120 client households and manage about $70 million in assets within three years.

- Reach profitability by Year 2.

- Keep improving client experience through technology, planning tools, and excellent customer service.

- Add corporate 401(k) and tax filing divisions.

Services & Pricing Structure

BlueOak Wealth Advisory operates on a hybrid fee-based model that combines:

- Recurring Assets Under Management (AUM) fees

- Flat-fee and subscription-based financial planning

- Integrated tax advisory services through its in-house CPA division

This model provides consistent cash flow while insulating the firm from market volatility. Clients receive clarity and flexibility, and lenders gain confidence in stable, recurring revenue coverage for debt service.

Advisory Offerings

At BlueOak Wealth Advisory, our services are designed to guide clients through every stage of their financial journey. Each plan is customized to fit individual goals, priorities, and comfort levels.

1. Comprehensive Financial Planning

This service gives each client a full look at their financial situation and a clear plan to reach their goals. It includes:

- Review of income, savings, and spending

- Retirement and investment planning

- Tax and insurance review

- Basic estate and education planning

Each client receives a written plan, a short list of action steps, and follow-up reviews to stay on track. The goal is to make finances simple, organized, and focused on long-term success.

Fee: $2,000–$4,000 (flat fee based on plan complexity)

2. Investment Management (AUM Model)

BlueOak manages each client’s money with a focus on long-term goals. Portfolios are made up of Exchange Traded Funds (ETFs) and mutual funds that give a mix of growth and stability. The goal is to grow wealth steadily while managing risk.

Clients get:

- Regular account reviews and reports

- Portfolio rebalancing when needed

- Tax-efficient investment strategies

- Support through Orion Advisor Tech for tracking and updates

Fee Structure:

| Asset Tier | Annual Fee | Services Included |

|---|---|---|

| First $500,000 | 1.00% | Full portfolio management, reporting, and reviews |

| Next $500,000 | 0.80% | Ongoing monitoring, rebalancing |

| Above $1,000,000 | 0.50% | Continued management and support |

This structure rewards clients with lower fees as their portfolio grows.

3. Retirement Income Planning & Social Security Optimization

This package helps clients create a clear plan for their retirement income. It includes reviewing all income sources such as savings, investments, and pensions. It also estimates monthly expenses to understand future needs. The plan helps decide the best time to start Social Security benefits and shows ways to reduce taxes. Overall, it ensures that clients’ money lasts comfortably through their retirement years.

Fee: $1,200 per plan

4. Tax-Aware Portfolio Construction

This service focuses on helping clients grow their investments while keeping taxes low. It includes choosing the right mix of investments, placing assets in tax-efficient accounts, and managing gains and losses smartly. This approach helps clients keep more of what they earn over time.

This service is included for clients with over $500,000 in managed assets (AUM).

5. Business Owner Services

This service is for business owners who want to manage both their business and personal finances with one simple plan. It helps them set up retirement plans, plan for the future, and make sure their business keeps its value. The goal is to keep everything organized and ready for long-term success.

| Service | What It Includes | Fee |

|---|---|---|

| SEP/SIMPLE/401(k) Setup | We help set up the right retirement plan for the business, guide on how much to contribute, and make sure it follows all rules. | $1,500 (one-time setup) |

| Business Succession Plan | We create a simple plan for transferring or selling the business, covering value, taxes, and ownership changes. | $2,500 (per plan) |

We plan to expand this service over time by adding options like business insurance reviews and exit planning support.

Technology Ecosystem

BlueOak Wealth Advisory uses simple, connected tools to handle all parts of its work. Every system is linked together to make client service smooth, safe, and easy to manage.

| Function | Platform / Vendor | Key Features |

|---|---|---|

| Client Management | Wealthbox | Stores all client details, tracks tasks, and keeps a full record of all activities for compliance. |

| Financial Planning | RightCapital | Builds financial plans, tax reports, and cash flow charts. Saves all plans automatically. |

| Portfolio Management | Orion Advisor Tech | Tracks investments, prepares reports, and handles billing and trade checks. |

| Custody Platform | Schwab Advisor Services | Handles trading, account reports, and protects client money with independent custody. |

| Compliance Tracking | RIA in a Box | Keeps records of advertising, updates, and audits to meet rules and deadlines. |

| Accounting & Payroll | QuickBooks + Gusto | Manages bookkeeping, payroll, and financial reports checked by a CPA. |

| E-Signature & Documents | DocuSign + ShareFile | Lets clients sign forms safely and stores documents in secure folders. |

| Cybersecurity & IT | Ironclad Cyber Solutions | Protects data with monitoring, security tests, and regular updates. |

All tools are cloud-based and secure. This setup helps BlueOak stay organized, follow rules, and give clients full trust that their information is safe and managed properly.

Niche Offerings

BlueOak Wealth Advisory also offers a few special services designed for clients with specific goals and values. Clients who prefer socially responsible investing can choose ESG portfolios built with Dimensional and Avantis ETFs. Those looking to save on taxes benefit from automated tax-loss harvesting through Orion, which helps reduce taxable gains without extra effort.

For mid-career professionals, the firm offers the “Blueprint for 40s” plan—a subscription program priced at $75 per month, including a quarterly financial review. It helps clients in their 40s build wealth, plan ahead for retirement, and stay on track with their goals.

Pricing Strategy

BlueOak’s pricing is anchored in fairness, transparency, and scalability.

- Fees are published on the firm’s website and disclosed in Form ADV Part 2A.

- Clients can choose between AUM or flat-fee engagements depending on preference.

- No performance fees, commissions, or referral compensation accepted.

- All billing is automated through the custodian—eliminating accounts receivable risk.

A business plan shouldn’t take weeks

Market Research

Globally, the financial advisory market is worth around $109.21 billion in 2025 and is expected to grow to $174.33 billion by 2033. More families and business owners now prefer working with real advisors instead of automated tools because they want personal guidance and trust.

In the United States, there are approximately 300,000 financial advisors, but the industry is about to change. According to the 2024 Cerulli report, 109,093 advisors plan to retire in the next decade, representing nearly 41.5% of all managed assets. This creates a big opportunity for new firms like BlueOak Wealth Advisory that focus on modern, transparent, and client-first services.

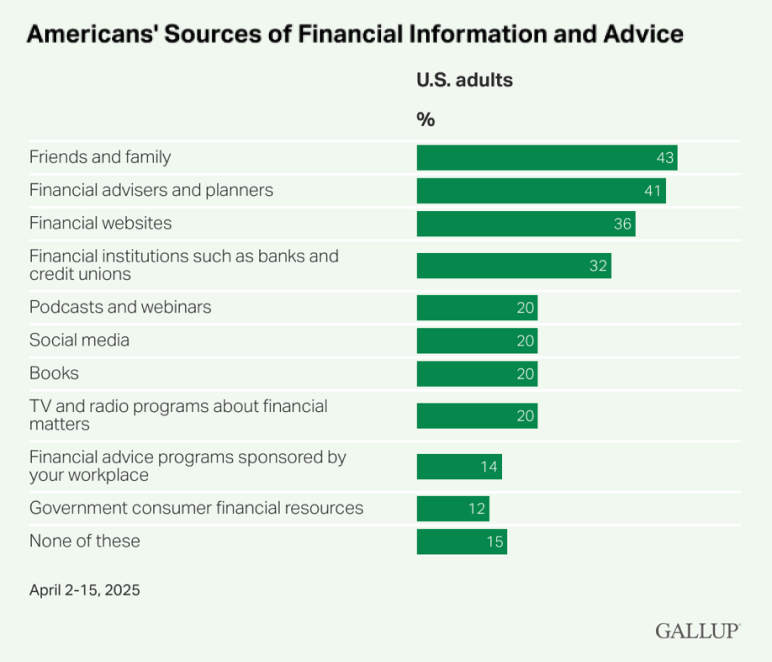

Around 41% of Americans already use a financial advisor, and that number keeps increasing every year.

In Charlotte, North Carolina, the opportunity is even clearer. As said earlier, the city has a population of 943,476 and a median household income of $80,581. About 14% of households earn over $200,000, showing strong potential for wealth management services.

As one of the Southeast’s fastest-growing financial hubs, Charlotte is home to professionals, business owners, and retirees—the very clients who benefit most from honest, personalized advice.

Industry Trends & Alignment

The financial advice field is changing fast. People want both personal help and easy online access, with clear and honest fees. BlueOak Wealth Advisory is built to meet these needs and grow with long-term industry changes.

| Trend | Market Impact | BlueOak’s Approach |

|---|---|---|

| Hybrid Advisory (Human + Digital) | Clients want both personal guidance and easy online access. | Uses Orion, RightCapital, and client dashboards for smooth digital service. |

| Fiduciary Transparency | Investors avoid commission-based models and want clear, honest fees. | Offers a flat fee and a published pricing model to stay fully transparent. |

| Tax-Optimized Investing | Clients focus on keeping more of what they earn after taxes. | Provides in-house CPA support for tax-smart investment planning. |

| Behavioral Finance Focus | Advisors who help clients stay calm during market swings earn long-term trust. | CFP-led coaching builds financial discipline and confidence. |

| Local Boutique Preference | Professionals prefer smaller, local firms over big banks. | Local RIA offering personal service and strong community ties. |

BlueOak’s business model fits these key industry shifts, giving clients a modern, trustworthy, and local choice for financial guidance.

Target Market

BlueOak Wealth Advisory targets a defined set of professionals, retirees, and small-business owners seeking smart financial management.

Unlike traditional brokerages chasing high-net-worth accounts, BlueOak focuses on emerging affluent households—clients with substantial earning power but limited access to institutional-quality advice.

Each client profile is designed to support a diversified, recurring-revenue base with stable AUM retention and cross-service expansion.

Primary Client Segments

1. Corporate Professionals

- Age: 35–55

- Income: $150,000 and $400,000/year

They often have stock options, bonuses, or deferred pay that make taxes complicated. Most don’t have time to plan their finances.

BlueOak helps by building simple, tax-smart investment plans that are updated every year.

2. Small Business Owners and Physicians

- Age: 40–60

They may not have a clear retirement plan or exit strategy. Many also face tax problems and unclear business structures.

BlueOak helps with business continuity planning, tax-efficient exits, and retirement plans like SEPs and 401(k)s.

3. Retirees and Near-Retirees

- Age: 55–75

- Investable assets: $500k+

Their biggest worry is making their savings last through retirement. They also want to manage taxes and protect their legacy.

BlueOak helps by creating detailed retirement income plans, coordinating with estate planners, and preparing for long-term care needs.

4. First-Generation Wealth Builders

- Age: 25–45 (younger couples or professionals building wealth for the first time)

They want to invest but lack structure and confidence. Emotional decisions sometimes lead to financial mistakes.

BlueOak helps through its “Blueprint for 40s” program, which offers simple education, goal tracking, and financial coaching.

Competitor Analysis

The financial advisory space in Charlotte is active and competitive, with both national firms and local advisors serving the same audience of professionals, business owners, and retirees.

Direct Competitors

These are firms that serve similar clients in the Charlotte area and offer wealth management and financial planning services.

1. Merrill Lynch Wealth Management – 6100 Fairview Rd, Charlotte, NC

A major national brand with strong name recognition and resources, but often product-driven and less flexible in pricing.

2. Morgan Stanley – 6101 Carnegie Blvd, Charlotte, NC

Focuses on high-net-worth clients with traditional AUM fees. Offers scale and reputation but limited personalization for mid-tier clients.

3. Vanguard Personal Advisor Services (Remote)

A popular hybrid model combining digital investing tools with virtual advisors. Low cost but lacks the hands-on, local guidance many clients prefer.

BlueOak competes by offering the same fiduciary standards and professional planning quality but with local presence, direct access to advisors, and more transparent pricing.

Indirect Competitors

These include independent RIAs and digital platforms that target similar clients but use different service models.

1. Parsec Financial (Regional RIA)

Based in North Carolina with multiple offices, offering full-service wealth management. Their structure is larger, so clients may not always get direct contact with senior advisors.

2. Local Independent Advisors

Smaller solo firms often provide personal attention but may lack advanced technology or integrated tax planning.

BlueOak positions itself between these extremes—combining the personal touch of a small firm with the professionalism and tools of a larger one. The mix of CFP and CPA leadership helps the firm offer complete planning that goes beyond investment advice.

What Makes BlueOak Different

BlueOak Wealth Advisory is built on trust, clarity, and real financial care.

- Offers both flat-fee and percentage-based pricing for flexibility.

- Works only as a fiduciary, meaning advice always puts the client first.

- Has an in-house CPA for better tax and investment coordination.

- Focuses on building long-term client relationships through education and consistent support.

This approach helps BlueOak give modern, reliable, and personal financial advice to professionals, retirees, and business owners in Charlotte.

Stop searching the internet for industry & market data

Get AI to bring curated insights to your workspace

Marketing & Sales Strategy

BlueOak’s marketing strategy is built around authority, trust, and education rather than volume advertising.

As a fiduciary RIA, every outreach channel reinforces credibility, transparency, and long-term relationships instead of transactional lead generation.

The firm’s marketing framework is designed around three imperatives:

- Build authority through education-driven content and partnerships.

- Generate inbound interest via digital visibility and local credibility.

- Convert and retain clients through transparent, streamlined onboarding.

Marketing Channels

BlueOak Wealth Advisory will spend around $3,500/month focusing on both digital and local marketing channels:

| Channel | Budget % | Monthly Spend | Annual Spend | Description |

|---|---|---|---|---|

| Local SEO & Google Ads | 35% | $1,200 | $14,400 | Targets local searches to attract high-intent clients in the Charlotte area. |

| LinkedIn Content + Paid Thought Leadership | 25% | $850 | $10,200 | Builds brand credibility and engagement with professionals and business owners. |

| Strategic Alliances (CPAs & Attorneys) | 25% | $850 | $10,200 | Creates referral partnerships for steady, high-quality client leads. |

| Email Automation + Nurture Campaigns | 10% | $350 | $4,200 | Sends automated updates to nurture leads and maintain engagement. |

| Events & Educational Webinars | 5% | $250 | $3,000 | Hosts sessions to educate prospects and strengthen local visibility. |

| Total Marketing Budget | 100% | $3,500/month | $42,000/year | — |

This balanced mix of digital outreach and local engagement helps BlueOak connect with the right audience while strengthening its reputation as a trusted local advisory firm.

Customer Acquisition Plan

BlueOak Wealth Advisory plans to grow by building real, long-term relationships with clients. We’ll focus on earning trust through honest advice, clear communication, and excellent service instead of sales pressure.

In the first year, we aim to bring on about 40 households with around $18 million in assets under management (AUM). Most of these clients will come from local referrals, digital marketing, and people who start with our flat-fee financial plans.

By the second year, our goal is to reach 80 households and about $40 million in AUM. We’ll continue growing through word-of-mouth, partnerships with CPAs and attorneys, and steady visibility online and in the Charlotte community.

In the third year, we expect to serve 120 households and manage roughly $70 million in AUM. By then, most new clients will come from referrals and repeat business from satisfied clients.

This steady and personal approach helps us grow while keeping the focus on quality service and lasting client trust.

Promotions

BlueOak Wealth Advisory believes in giving value first. Our promotions help people learn more about their finances and build trust with us before becoming clients.

Our main promotions are:

- Free 30-minute consultation: We talk about each person’s financial goals and share simple advice they can use right away.

- Personal “Wealth Blueprint”: After the consultation, clients receive a short, easy plan with steps to help them move forward.

- Quarterly workshops: Held at the Charlotte Chamber of Commerce, these sessions cover topics like saving, investing, and retirement planning.

These efforts help us meet new clients, share useful knowledge, and build strong, long-term relationships in Charlotte.

Lead Conversion Process

At BlueOak Wealth Advisory, we keep our process simple and easy to follow. Every new lead goes through a few clear steps that help us understand their needs and build trust from the start.

It begins when someone contacts us through our website, social media, or from a referral. We then set up a short 30-minute call to talk about their goals, explain what we do, and share basic information about how we work.

Within two days, we’ll send a short proposal with our services, fees, and next steps. When the person decides to move forward, we send a digital agreement through DocuSign so they can sign quickly and safely.

After the agreement is signed, we send a welcome packet. It includes an overview of their plan, our contact details, and a simple checklist for tax and financial documents. This easy process helps new clients feel confident and supported from the very beginning.

Operations Plan

BlueOak Wealth Advisory operates as a lean, compliance-oriented fiduciary firm with digital infrastructure optimized for efficiency.

All operations are built on three principles:

- Efficiency: Every client process is digitized and trackable.

- Accountability: Every workflow has an assigned owner and documented metric.

- Transparency: Financial and compliance reporting flow directly to both CPA and bank reviewers.

This ensures not only smooth internal coordination but also continuous lender and regulator visibility.

Working Hours & Shift Structure

BlueOak Wealth Advisory is open Monday to Friday from 8:30 AM to 6:00 PM. Client meetings are also available on Saturdays by appointment.

Each day is planned to give the best service to our clients.

- Mornings are used for checking portfolios, reviewing plans, and getting ready for meetings.

- Afternoons are for meeting clients in person or online to go over their plans and make any needed changes.

This schedule helps us stay organized and give every client good service.

Office Location and Space

BlueOak Wealth Advisory is in Suite 215, Charlotte, NC, close to many offices and high-income neighborhoods.

Size: 1,600 sq. ft. Class-A suite (two offices + meeting room)

We plan to add another meeting room in Year 3 as we grow and serve more than 120 clients.

The office is quiet, private, and professional, giving clients a comfortable place to meet and talk about their finances.

Staffing Plan (Year 1)

The following team structure is planned for the first year of BlueOak Wealth Advisory. This setup will help manage daily operations, client service, and marketing as the firm builds its client base.

| Position | Annual Pay | Main Responsibilities |

|---|---|---|

| Managing Partner (Alexander Reid, CFP) | $120,000 | Leads the business and works with clients. |

| Operations & Compliance Director (Natalie Ruiz, CPA) | $85,000 | Manages daily work and keeps the firm in line with rules. |

| Paraplanner (1) | $55,000 | Helps prepare plans, do research, and update client reports. |

| Client Service Associate (1) | $45,000 | Talks with clients and sets up meetings. |

| Marketing Assistant (1) (Part-Time) | $22,000 | Helps with marketing and social media. |

| Total Annual Pay | $327,000 | — |

We plan to hire more staff by Year 3 as the firm grows and the number of clients increases.

Vendor & Partner Management

To extend efficiency, BlueOak engages professional vendors on fixed retainer contracts:

| Vendor | Service | Yearly Cost ($) |

|---|---|---|

| RIA in a Box | Compliance management | $5,400 |

| CPA Reviewer | Quarterly financial reporting | $3,000 |

| Legal Counsel (Soteria Legal Group) | Contract and compliance review | $4,000 |

| IT / Cyber Vendor (Ironclad Cyber Solutions) | Security checks and maintenance | $2,400 |

| Marketing Vendor | Website, SEO, and ad tracking | $6,000 |

| YCharts | Financial data and research tools | $3,600 |

Vendor agreements are reviewed annually for cost efficiency and data compliance.

Legal Compliance & Quality Control

At BlueOak Wealth Advisory, compliance and quality control are a key part of daily operations. The firm follows all rules under North Carolina’s investment laws and Securities and Exchange Commission (SEC) standards to keep everything transparent and secure.

Licensing & Registration:

- BlueOak is registered with the SEC as a Registered Investment Adviser (RIA), with projected assets under management (AUM) of over $100 million within three years.

- It is exempt from Financial Industry Regulatory Authority (FINRA) registration because no brokerage services are offered.

- The firm also holds the North Carolina Investment Adviser License (#IA-02913).

We use a clear process to make sure every part of our business stays compliant. Each quarter, we review all advertising, client communication, and billing records to ensure they meet regulatory standards. Once a year, an outside compliance firm audits our operations and updates our Form ADV filing.

All client files and internal documents are stored securely in digital format for at least five years. Every marketing post or ad we publish goes through a pre-approval review before it goes live.

To protect client data, we only use trusted vendors with SOC 2 Type II certification, including RIA in a Box for compliance tracking and YCharts for financial research and data subscriptions ($3,600 per year).

Every compliance activity is logged automatically through RIA in a Box, so our team can easily show records during any state or SBA audit. This approach keeps our firm transparent, accountable, and ready for continued growth.

Workflow and Daily Operations

At BlueOak Wealth Advisory, our daily operations follow a clear and organized system that keeps every client’s financial plan on track. The workflow is managed through Wealthbox CRM, which connects directly with Orion and RightCapital for smooth coordination between planning, reporting, and compliance.

Workflow Process

Our work moves through five key stages, each handled by the right team member and supported by secure technology tools:

| Stage | Process Owner | System Used | Output / Control Point |

|---|---|---|---|

| Client Intake & Discovery | Paraplanner | Wealthbox + Intake Form | Prospect record and KYC documents |

| Plan Construction | Reid + Ruiz | RightCapital | Full financial plan (PDF) |

| Investment Implementation | Reid | Schwab Advisor Platform | Trade logs and custody verification |

| Tax Integration | Ruiz | QuickBooks + Tax Software | Tax analysis report |

| Ongoing Review | Reid + Paraplanner | Orion + Wealthbox | Quarterly performance dashboard |

Each stage is timestamped and reviewed by another team member or compliance consultant to ensure accuracy and accountability. This cross-checking system keeps data consistent and prevents any oversight.

Daily Operations

Our weekly routine is built to keep a steady balance between client service, planning, and compliance work.

| Day | Main Focus | Core Activities |

|---|---|---|

| Monday | Internal review | Team meeting, compliance check |

| Tuesday | Client work | Planning sessions, portfolio updates |

| Wednesday | Acquisition | Prospect calls, LinkedIn outreach |

| Thursday | Tax coordination | Ruiz handles filings and estimates |

| Friday | Reporting | Performance tracking, data backup |

Automation tools ensure no task is missed. Every deliverable is automatically logged in the CRM with time and date stamps for full transparency.

This structure allows the team to stay organized, deliver consistent results, and maintain excellent client service throughout the week.

Milestones & Timeline

BlueOak Wealth Advisory has a clear plan for its first few years of growth. Each step builds a strong base for the firm’s future.

Does your plan sound generic?

Refine your plan to adapt to investor/lender interests

Financial Plan

Overview

BlueOak Wealth Advisory’s financial plan is built around a realistic ramp-up model typical for boutique RIA firms. The company starts lean, with two partners and a small support team, using a scalable technology stack and predictable fee-based revenue streams.

Initial operations will be funded through owner equity and a local bank term loan, providing sufficient capital for leasehold improvements, compliance, technology, marketing, and early working capital.

Revenue growth is projected through client acquisition and expanding Assets Under Management (AUM), achieving profitability by mid-Year 2 and positive cash flow in Year 3.

Startup Costs

The business will require about $145,000 to start operations. This includes:

| Category | Cost | Notes |

|---|---|---|

| Office Lease (1,600 sq ft @ $30/sq ft) | $48,000 | Annual lease + deposit |

| Furniture & Equipment | $18,000 | Desks, conference setup |

| Technology Stack Setup | $15,000 | Software, compliance systems |

| Marketing & Branding | $20,000 | Website, launch events, ads |

| Legal, Licensing, Insurance | $9,000 | RIA setup, E&O coverage |

| Working Capital | $35,000 | 4-month payroll buffer |

| Total Startup Investment | $145,000 |

Key Financial Assumptions

| Parameter | Assumption |

|---|---|

| Loan Amount | $210,000 at 9.25% fixed for 7 years |

| Owner Equity | $70,000 |

| Average AUM Fee | 0.9% blended |

| Average Household AUM | $450,000–$600,000 |

| COGS | 5% (custodian + tech fees) |

| Client Retention | 96% |

| Break-even Revenue | ~$18,000 per month (~$22M AUM) |

| Total Annual Payroll Outlay | $327,000 |

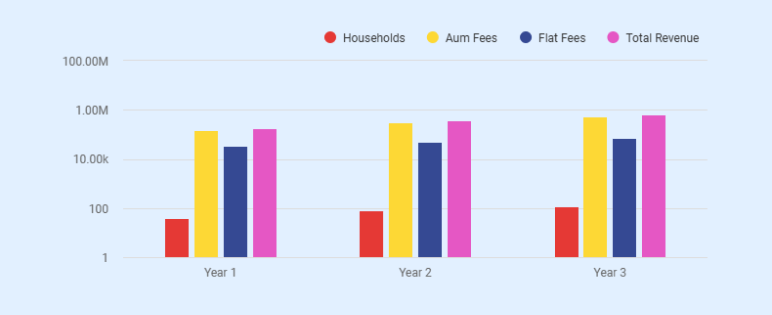

Revenue Forecast

| Year | Households | AUM | AUM Fees | Flat Fees | Total Revenue | EBITDA |

|---|---|---|---|---|---|---|

| 1 | 40 | $18M | $144,000 | $36,000 | $180,000 | -$55,000 |

| 2 | 80 | $40M | $320,000 | $50,000 | $370,000 | +$60,000 |

| 3 | 120 | $70M | $560,000 | $70,000 | $630,000 | +$185,000 |

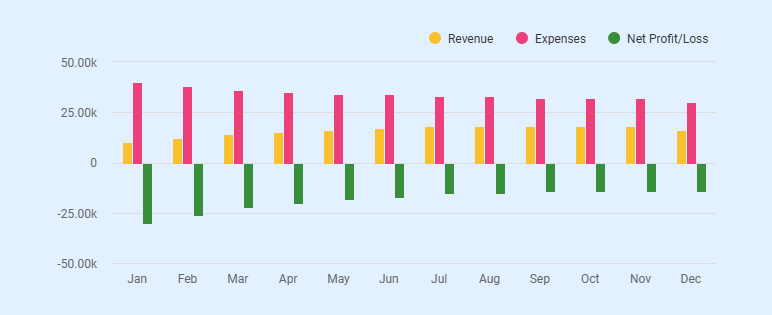

Monthly Projections (Year 1)

| Month | Revenue | Expenses | Net Profit/Loss |

|---|---|---|---|

| Jan | $10,000 | $40,000 | -$30,000 |

| Feb | $12,000 | $38,000 | -$26,000 |

| Mar | $14,000 | $36,000 | -$22,000 |

| Apr | $15,000 | $35,000 | -$20,000 |

| May | $16,000 | $34,000 | -$18,000 |

| Jun | $17,000 | $34,000 | -$17,000 |

| Jul | $18,000 | $33,000 | -$15,000 |

| Aug | $18,000 | $33,000 | -$15,000 |

| Sep | $18,000 | $32,000 | -$14,000 |

| Oct | $18,000 | $32,000 | -$14,000 |

| Nov | $18,000 | $32,000 | -$14,000 |

| Dec | $16,000 | $30,000 | -$14,000 |

| Total (Year 1) | $180,000 | $409,000 | -$55,000 |

Projected Profit & Loss Statement (3 Years)

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | |||

| AUM-Based Fees | $144,000 | $320,000 | $560,000 |

| Flat-Fee Planning | $36,000 | $50,000 | $70,000 |

| Total Revenue | $180,000 | $370,000 | $630,000 |

| Cost of Goods Sold (5%) | -$9,000 | -$18,500 | -$31,500 |

| Gross Profit | $171,000 | $351,500 | $598,500 |

| Operating Expenses | |||

| Salaries & Wages | $327,000 | $327,000 | $327,000 |

| Marketing & Advertising | $42,000 | $42,000 | $42,000 |

| Office Rent | $48,000 | $48,000 | $48,000 |

| Technology & Software | $10,200 | $10,200 | $10,200 |

| Compliance & Insurance | $9,000 | $9,000 | $9,000 |

| IT & Cybersecurity | $7,200 | $7,200 | $7,200 |

| Professional Fees | $6,000 | $6,000 | $6,000 |

| Office & Miscellaneous | $4,000 | $4,000 | $4,000 |

| Total Operating Expenses | $453,400 | $453,400 | $453,400 |

| EBITDA | -$55,000 | $60,000 | $185,000 |

| Loan Interest (9.25%) | -$19,000 | -$16,650 | -$13,350 |

| Depreciation | -$3,000 | -$3,000 | -$3,000 |

| Net Profit Before Tax | -$77,000 | $40,350 | $168,650 |

| Estimated Taxes (24%) | -$0 | -$9,684 | -$40,476 |

| Net Profit After Tax | -$77,000 | $30,666 | $128,174 |

Projected Balance Sheet (3 Years)

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| ASSETS | |||

| Cash & Bank Balance | $25,000 | $55,000 | $130,000 |

| Accounts Receivable | $10,000 | $18,000 | $30,000 |

| Office Equipment & Furniture (Net of Depreciation) | $15,000 | $12,000 | $9,000 |

| Leasehold Improvements | $15,000 | $15,000 | $15,000 |

| Prepaid Expenses & Deposits | $3,000 | $3,000 | $3,000 |

| Total Assets | $68,000 | $103,000 | $187,000 |

| LIABILITIES | |||

| Bank Loan (Truist, 9.25%) | $210,000 | $180,000 | $145,000 |

| Accounts Payable | $5,000 | $6,000 | $7,000 |

| Accrued Expenses | $10,000 | $9,000 | $8,000 |

| Total Liabilities | $225,000 | $195,000 | $160,000 |

| OWNER’S EQUITY | |||

| Owner Capital (Equity Investment) | $70,000 | $70,000 | $70,000 |

| Retained Earnings | -$227,000 | -$162,000 | -$43,000 |

| Total Owner’s Equity | -$157,000 | -$92,000 | -$27,000 |

| TOTAL LIABILITIES & EQUITY | $68,000 | $103,000 | $187,000 |

Don’t waste time using spreadsheets

Projected Cash Flow (3 Years)

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Operating Activities | |||

| Net Profit After Tax | -$77,000 | $30,666 | $128,174 |

| Add Back: Depreciation | $3,000 | $3,000 | $3,000 |

| Add Back: Interest Expense | $19,000 | $16,650 | $13,350 |

| Change in Working Capital | -$5,000 | -$5,000 | -$8,000 |

| Net Cash from Operations | -$60,000 | $45,316 | $136,524 |

| Investing Activities | |||

| Purchase of Furniture & Equipment | -$18,000 | — | — |

| Leasehold Improvements | -$15,000 | — | — |

| Net Cash from Investing | -$33,000 | — | — |

| Financing Activities | |||

| Owner Equity Injection | $70,000 | — | — |

| Loan Proceeds | $210,000 | — | — |

| Loan Repayment | — | -$30,000 | -$35,000 |

| Interest Paid | -$19,000 | -$16,650 | -$13,350 |

| Net Cash from Financing | $261,000 | -$46,650 | -$48,350 |

| Net Change in Cash | $168,000 | -$1,334 | $88,174 |

| Opening Cash Balance | $0 | $168,000 | $166,666 |

| Closing Cash Balance | $168,000 | $166,666 | $254,840 |

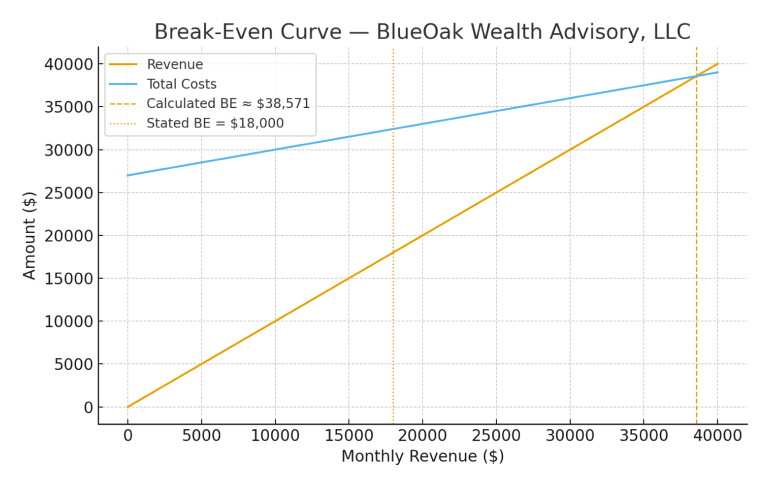

Break-Even Analysis

| Metric | Value |

|---|---|

| Monthly Fixed Costs | $27,000 |

| Average Gross Margin | 70% |

| Break-Even Revenue (Monthly) | $18,000 |

| Equivalent AUM Required | ≈ $22 million |

| Average Client Portfolio Size | $450,000 |

| Clients Needed to Break Even | ~49 |

| Break-Even Point Reached | Q3, Year 2 |

| Safety Margin by Year 3 | 250% of break-even revenue |

Business Ratios

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Gross Margin | 95% | 95% | 95% |

| Operating Margin (EBITDA) | -31% | 16% | 29% |

| Net Profit Margin | -43% | 8% | 20% |

| Current Ratio | 0.30 | 0.53 | 1.17 |

| Debt-to-Equity Ratio | 1.43 | 1.06 | 0.59 |

| Return on Assets (ROA) | -113% | 30% | 68% |

| Return on Equity (ROE) | -110% | 33% | 47% |

| Asset Turnover | 2.65 | 3.59 | 3.37 |

Funding Requirement & Loan Repayment

Funding Requirement

BlueOak Wealth Advisory, LLC is requesting a $210,000 term loan from Truist Bank – SouthPark Branch to help launch and grow the firm. The owners will add $70,000 of their own money from savings and early income.

The total funds will be used for leasehold improvements, technology stack, marketing, and compliance setup.

This funding will help BlueOak set up operations, reach new clients, and grow smoothly in the first year.

Loan Details

- Type: Business Term Loan

- Amount: $210,000

- Term: 7 years

- Rate: 9.25% fixed

- Collateral: Office assets and personal guarantee from both owners

Loan Repayment Plan

Monthly loan payments will be made from the firm’s cash flow, starting immediately after disbursement. BlueOak expects steady revenue from advisory fees and planning retainers to support repayment.

- Year 1: Focus on building clients and cash flow. Working capital will help cover payments.

- Year 2: Revenue improves as AUM grows to $40M, allowing full, consistent payments with positive cash flow.

- Year 3: Business stabilizes with $70M AUM and solid profitability, ensuring comfortable repayment and financial reserves.

The owners plan to keep their salaries low until the firm is stable, ensuring all loan payments are made on time.

Risk & Mitigation

Every business has risks. BlueOak Wealth Advisory plans carefully to avoid problems and stay strong even when things change. The firm’s main goal is to stay stable, follow all rules, and protect client trust.

| Risk | Impact | How We Handle It |

|---|---|---|

| Slow AUM Growth | If we don’t grow client assets fast enough, income could be lower than planned. | We offer both flat-fee plans and AUM services, so money keeps coming in even when growth is slow. |

| Compliance or Audit Issues | Missing a rule or report could cause fines or hurt our reputation. | We follow clear compliance steps, work with a legal advisor, and review everything every few months. |

| Market Volatility | When markets drop, our fees can go down too. | We balance this by offering fixed-fee planning and business consulting services. |

| Client Acquisition Challenges | Getting new clients takes time and money, especially in the beginning. | We focus on local marketing, referrals, and great service to build trust and attract clients. |

| Technology or Data Security Risks | A data breach or tech issue could harm client trust. | We use secure systems, back up data often, and have regular cybersecurity checks. |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.