A mortgage broker business can be very profitable. Brokers earn commissions from the loans they help clients secure. And with the right skills and strategies, it can grow into a successful, long‑term venture.

If you’re planning to start or expand your brokerage, you’ll need a clear plan and a strong understanding of the market.

Don’t know how to start?

This mortgage broker business plan template will guide you through every step so you can get started with confidence.

What is a mortgage broker business plan?

A mortgage broker business plan is a written document that describes the operations and growth of your mortgage brokerage. It can help you specify your services, target market, competitive environment, marketing strategies, and financial projections.

Overall, it’s a map for you to run and grow your mortgage brokerage, covering everything from managing clients’ loan applications to creating a sustainable and profitable business.

Why is a mortgage broker business plan important?

Writing a business plan for your mortgage brokerage might seem like extra work, but it’s important. Here’s how it can help you:

- Set clear objectives: Business plans allow you to articulate both long-term and short-term objectives in order to have a true focus.

- Stay compliant: Helps you ensure you’re aware of all the licenses and NMLS (Nationwide Multistate Licensing System & Registry) registration, the compliance rules, and insurance requirements.

- Secure funding: Investors and lenders want to see that you’ve put thought into your business. A written business plan simply conveys that you’re serious.

- Avoid costly errors: When you write the plan, the process can uncover gaps or weaknesses well in advance to avoid huge issues for your business.

- Make well-informed decisions: Your business plan will guide day-to-day business decisions, including pricing, how you’ll provide services, lender involvement, and the potential for hiring employees.

In short, a well‑prepared business plan gives your mortgage brokerage direction, credibility, and a stronger chance of long‑term success.

How to Write a mortgage broker Business Plan?

Writing a mortgage broker business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

Here are a few key components to include in your executive summary:

1. Executive Summary

An executive summary is the first section that offers a high-level overview of the entire business plan. However, it’s written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

- Brief business overview: Outline the name of your mortgage broker business, its location, when it was founded, and the type of mortgage broker business you’ll operate.

- Market opportunity: Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap.

- Mortgage services: Highlight the mortgage broker services you offer your clients. The USPs and differentiators you offer are always a plus.

For instance, you may include loan orientation, loan processing, and real-estate consultancy as some of your services.

- Marketing and sales strategies: Outline your sales and marketing strategies—what marketing platforms you use, how you plan on acquiring customers, etc.

- Financial highlights: Briefly summarize your financial projections for the initial years of business operations. Include any capital or investment requirements, associated startup costs, projected revenues, and profit forecasts.

- Call to action: Summarize your executive summary section with a clear CTA, for example, inviting angel investors to discuss the potential business investment.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Business Overview

The business overview section offers detailed information about your company. The details you add will depend on how important they are to your business.

Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section.

First of all, explain what kind of mortgage broker company you run and the name of it. You may specialize in one of the following mortgage broker businesses:

- Traditional mortgage broker

- Niche mortgage broker

- Wholesale mortgage broker

- Mortgage lender-brokerage firm

Describe the legal structure of your mortgage broker company, whether it’s a sole proprietorship, LLC, partnership, or other.

Explain where your business is located and why you selected the place.

After that, list the names of your mortgage broker company’s founders or owners. Describe what shares they own and their responsibilities for efficiently managing the business.

Further, summarize your business’s objective, core principles, and values in your mission statement. This statement needs to be memorable, clear, and brief.

If you’re an established mortgage broker service provider, briefly describe your business history and awards or recognition (if any).

Lastly, mention your short-term and long-term goals; they can be specific targets for revenue, market share, or expanding your services.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities.

You should include the following components in this section.

Target Market

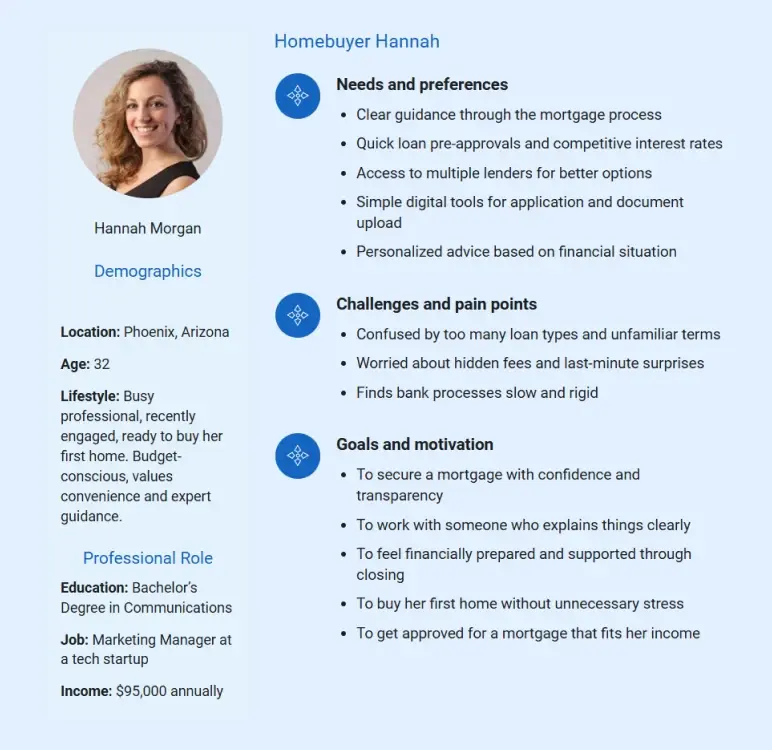

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

For instance, first-time homebuyers, real estate investors, and self-employed borrowers can be your target market.

Market Size and Growth Potential

Describe the mortgage industry size and its growth opportunity. You can add statistical data from credible sources. For example:

“The global mortgage brokerage market was valued at $112.68 billion in 2024 and is projected to reach $268.06B by 2031, growing at a 13.2% CAGR, showing strong global demand.”

Competitive Analysis

Identify and analyze your direct and indirect competitors. Identify their strengths and weaknesses, and describe what differentiates your mortgage broker services from them. Point out how you have a competitive edge in the market.

Market Trends

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

For instance, the use of online portals to collect client information, using digital signatures to sign documents, and the usage of online tools are increasing, so how do you plan on coping with the trends?

Regulatory Environment

List regulations and licensing requirements that may affect your mortgage broker company, such as business registration, licensing, fiduciary duty, etc.

4. Services Offered

This section describes the specific services that will be offered to customers. To write this section, follow the steps given below:

Step 1: Mention the mortgage broker services your business will offer. This list may include services like (Fixed-rate mortgages, Adjustable-rate mortgages, Government-backed loans)

Step 2: Give a thorough explanation of the particular services your company will offer.

It can include support with pre-qualification and pre-approval, rate comparisons for mortgages, and aid with filling out loan applications.

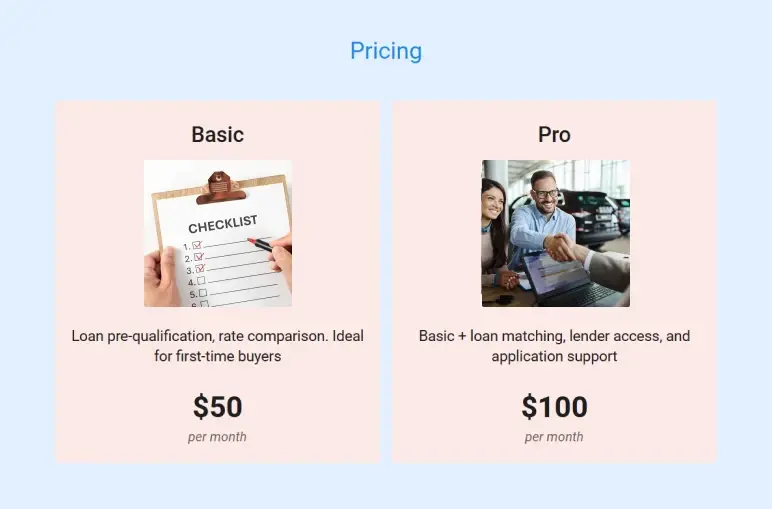

Step 3: Describe your pricing strategy—how you plan to price your services and stay competitive in the local market. Here’s a sample of a pricing plan to help you get a better understanding:

In short, this section of your mortgage broker plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you’ll use to attract and retain your clients. Here are some key elements to include:

Marketing strategies: Explain how you’ll promote your services to reach potential clients. This may include:

- Targeted social media campaigns & Google ads

- Distributing brochures

- Using print advertising

- Attending local events

- Networking with real estate professionals.

Sales strategies: Detail the methods you’ll use to increase sales, such as direct outreach to potential clients or financial advisors, offering referral incentives, and creating attractive service packages.

Customer retention: Outline how you’ll keep clients engaged and loyal over time. This could include loyalty programs, personalized service, regular follow‑ups, and ongoing support even after closing a deal.

Overall, this section of your mortgage broker business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data‑driven approach for your sales and marketing strategies. Be prepared to adapt or make changes based on feedback and results.

6. Operations Plan

The operations plan section explains how your mortgage brokerage will function day to day. While other sections describe your services, this part shows how you’ll actually run the business behind the scenes.

Here’s how to approach and what to include in your operations plan:

- Where will you operate from? Will you run your business from a home office, shared workspace, or a dedicated office? Mention the location and setup.

- What tools and systems will you use? List the software and equipment needed—loan origination systems, CRM tools, secure document portals, computers, printers, etc.

- Who will handle daily operations? Will you manage everything yourself or work with loan officers, processors, admin staff, or assistants? Note staffing needs and roles.

- How will you serve clients? Explain how clients will reach out, submit loan documents, receive updates, and get matched with lenders, from inquiry to closing.

- How will you manage communication? Outline how you’ll stay in touch with clients. Through email, phone, SMS reminders, or a customer portal?

- How will you ensure compliance and quality? Mention how you’ll stay compliant with lending regulations, maintain client records, protect sensitive data, and stay up to date with licenses and training.

This section should show that you’ve thought through the practical side of your business. Reliable operations help deliver a better client experience and keep your business running smoothly.

7. Management Team

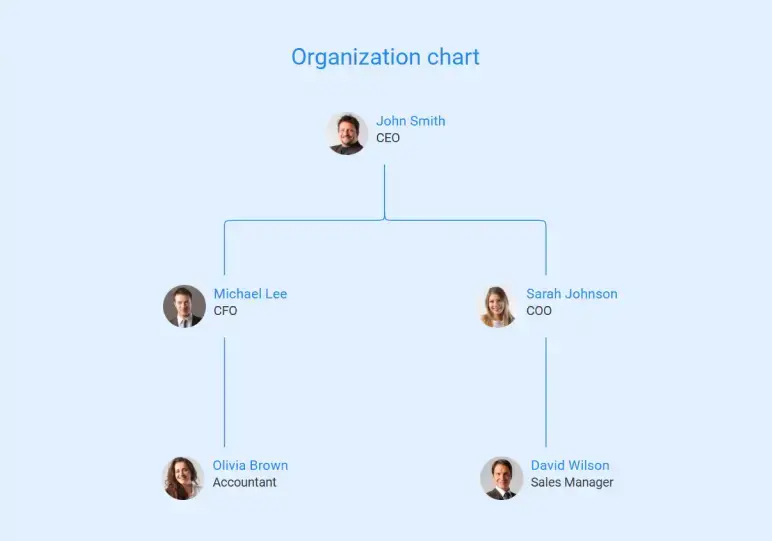

The management team section outlines your mortgage broker business’s leadership structure. It should include details on each manager’s background, qualifications, and specific responsibilities.

Begin with the founders and CEO of your mortgage broker company, and describe their roles and responsibilities in successfully running the business.

Next, introduce key members of your team, such as loan officers, processors, or admin leads.

Briefly outline what they handle—client support, application review, lender coordination, etc. Explain how their roles contribute to daily operations and long-term goals.

If required, explain the organizational structure of your management team. Include the reporting line and decision-making hierarchy. For instance:

In addition to that, describe your compensation plan for the management and staff. Include their salaries, incentives, and other benefits.

If you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience. Mentioning advisors or consultants in your business plans adds credibility to your business idea.

In short, this section should describe the key personnel for your mortgage broker services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement

Describe details such as projected revenue, operational costs, and service costs in your projected profit and loss statement. Make sure to include your business’s expected net profit or loss.

| Income Statement | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | $250,000 | $300,000 | $350,000 |

| Cost of Services (Commission Payouts) | ($100,000) | ($120,000) | ($140,000) |

| Gross Profit | $150,000 | $180,000 | $210,000 |

| Operating Expenses: | |||

| Marketing | ($30,000) | ($35,000) | ($40,000) |

| Salaries and Wages | ($60,000) | ($70,000) | ($80,000) |

| Technology (CRM/Website) | ($5,000) | ($5,000) | ($6,000) |

| Office Rent & Utilities | ($15,000) | ($16,000) | ($17,000) |

| Miscellaneous | ($5,000) | ($6,000) | ($7,000) |

| Total Operating Expenses | ($115,000) | ($133,000) | ($150,000) |

| Net Operating Profit | $35,000 | $47,000 | $60,000 |

| Taxes (20%) | ($7,000) | ($9,400) | ($12,000) |

| Net Profit | $28,000 | $37,600 | $48,000 |

Cash flow statement

The cash flow for the first few years of your operation should be estimated and described in this section. This may include billing invoices, payment receipts, loan payments, and any other cash flow statements.

| Cash Flow Statement | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Cash Inflows | |||

| Revenue from Services | $250,000 | $300,000 | $350,000 |

| Funding Received | $100,000 | — | — |

| Total Inflows | $350,000 | $300,000 | $350,000 |

| Cash Outflows | |||

| Service Costs (Commission Payouts) | ($50,000) | ($60,000) | ($70,000) |

| Operating Expenses | ($120,000) | ($135,000) | ($150,000) |

| Taxes | ($15,000) | ($20,000) | ($25,000) |

| Total Outflows | ($185,000) | ($215,000) | ($245,000) |

| Net Cash Flow | $165,000 | $85,000 | $105,000 |

| Starting Cash Balance | $0 | $165,000 | $250,000 |

| Ending Cash Balance | $165,000 | $250,000 | $355,000 |

Balance sheet

Create a projected balance sheet documenting your mortgage broker business’s assets, liabilities, and equity.

| Balance Sheet | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash | $165,000 | $250,000 | $355,000 |

| Prepaid Expenses (Licensing, NMLS Fees) | $5,000 | $6,000 | $7,000 |

| Office Equipment & Technology | $15,000 | $12,000 | $10,000 |

| Total Assets | $185,000 | $268,000 | $372,000 |

| Liabilities | |||

| Short-term Liabilities | $0 | $0 | $0 |

| Long-term Debt | $0 | $0 | $0 |

| Total Liabilities | $0 | $0 | $0 |

| Equity | |||

| Owner’s Equity | $185,000 | $268,000 | $372,000 |

| Total Liabilities + Equity | $185,000 | $268,000 | $372,000 |

Break-even point

Determine and mention your business’s break-even point—the point at which your business’s costs and revenue will be equal. This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

Financing needs

Calculate costs associated with starting a mortgage broker business, and estimate your financing needs and how much capital you need to raise to operate your business. Be specific about your short-term and long-term financing requirements, such as investment capital or loans.

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Include financial documents such as tax returns, asset lists, and credit history, along with your financial statements.

- Ensure statements are up‑to‑date and include projections for the first 3–5 years.

- Provide market research data, including industry stats, user demographics, and trends.

- Attach legal documents like permits, licenses, and contracts.

- Add other relevant materials such as brochures, marketing assets, and operational procedures.

While planning, make sure you create a table of contents for the appendix to help readers find information quickly. Use clear headings and labels for each section so that readers can easily find the necessary information.

Remember, the appendix section of your mortgage company business plan should only include relevant and important information supporting your plan’s main content.

Download a free mortgage broker business plan template

Ready to start writing your mortgage broker business plan from scratch? But need a bit more help? Worry not! Download our free mortgage broker business plan template PDF to get started.

This template is designed specifically for mortgage brokerage businesses and includes all key sections—from staffing and operations to marketing and financials. Use it as a starting point and feel free to customize it based on your services, goals, and business style.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Conclusion

Now that you’ve gone through the guide and downloaded the free template, creating your mortgage broker business plan should feel more straightforward.

However, still feeling stuck or short on time? Upmetrics can help. It’s an AI-powered business planning tool that speeds up the process and helps you create a clear, professional plan.

From financial forecasting to market insights, Upmetrics gives you everything you need to build a mortgage broker plan that’s ready for investors.

Start your mortgage business plan today with Upmetrics.