Running your own business isn’t just bold—it’s powerful. Today, women own 39.1% of all U.S. businesses, and this number continues to grow.

Still, women are approved for loans 44% of the time, compared to 54% for men, making men nearly three times more likely to secure funding.

But here’s the bright side: Access to capital is expanding. Whether it’s SBA loans, microloans, grants, or women-focused programs, there are more opportunities than ever designed to support women-led businesses like yours.

This guide will walk you through the best options for a small business loan for women, step by step, without the jargon.

We’ll help you understand your choices, boost your approval chances, and take the next confident leap toward your business goals.

Let’s dive in.

How are women-focused loans any different?

Women entrepreneurs can apply for any standard business loan; however, some programs are specifically designed with their unique needs in mind. That’s where women-focused loans come in. They’re not a different type of loan, but they do take a more inclusive and supportive approach to financing.

Here’s what sets them apart:

More flexible qualification

Women-focused lenders often look beyond just credit scores or years in business. They consider:

- Your business vision and plan

- Personal background and potential

- Social or community impact

This is especially helpful if you’re just starting or don’t have a long credit history.

Friendlier terms

Because these programs are often backed by government or nonprofit support, they can offer:

- Lower interest rates

- Longer repayment periods

- Smaller microloans to help you start lean

Support that comes with the loan

This is a major plus. Many women-focused programs bundle funding with:

- Free business coaching

- Financial education and training

- Access to networks and mentorship

You’re not just getting money—you’re getting guidance too.

In short, you don’t need a different loan. But if you want funding that understands your journey and sets you up for success, women-focused programs are worth exploring.

Best small business loans for women

You don’t need a special loan as a woman entrepreneur, but you do need one that fits your stage, needs, and goals. From SBA-backed loans to microloans and online lenders, there are solid options out there.

Let’s start with the most trusted: SBA loans.

1) SBA loans

SBA loans are partially guaranteed by the U.S. Small Business Administration, which makes lenders more confident in offering the loan.

For women entrepreneurs, especially those starting or growing a small business, these loans provide excellent terms, with relatively lower interest rates and longer repayment windows.

SBA offers different types of loans. Here are the main ones you should know:

A) SBA 7 (a) loan

| Detail | Info |

| Loan amount | Up to $5 million |

| Term length | Up to 10 years (25 for real estate) |

| Interest rates | Around 11%–13% (varies by lender) |

| Minimum credit score | 650+ |

| Collateral | Usually required |

| Use case | Working capital, equipment, expansion, real estate |

Pros

- High loan limits

- Wide usage flexibility

- Long repayment terms

Cons

- Slower approval process

- Requires detailed documentation

SBA 7 (a) loan is advantageous for established women-owned businesses ready to grow. The loan size and flexibility give room to scale, but you’ll need strong financials to qualify.

B) SBA Microloan

| Detail | Info |

| Loan amount | Up to $50,000 |

| Term length | Up to 6 years |

| Interest rates | 8%–13% |

| Minimum credit score | Around 620 (varies) |

| Collateral | Sometimes required |

| Use case | Startup costs, supplies, marketing, small equipment |

Pros

- Easier to qualify

- Often includes mentoring and support

Cons

- Lower funding limit

- Fewer lenders available

Microloans are perfect for first-time founders needing small capital and guidance to get started. Many lenders also offer mentoring along with offering the loan, which is a big bonus.

C) SBA 504 loan

| Detail | Info |

| Loan amount | Up to $5.5 million |

| Term length | 10–25 years |

| Interest rates | ~3%–6% (fixed, competitive) |

| Minimum credit score | 680+ |

| Collateral | Yes – the asset being financed is usually used |

| Use case | Purchasing real estate, equipment, or major fixed assets |

Pros

- Low, fixed interest rates

- Great for long-term investments

- Up to 90% financing

Cons

- Strict use restrictions (fixed assets only)

- Not ideal for general working capital

If you’re seeking to buy property or heavy equipment SBA 504 loan is the best type to choose. For women building physical storefronts or manufacturing businesses, this loan can make big moves

D) SBA Express loan

| Detail | Info |

| Loan amount | Up to $5.5 million |

| Term length | 10–25 years |

| Interest rates | ~3%–6% (fixed, competitive) |

| Minimum credit score | 680+ |

| Collateral | Yes – the asset being financed is usually used |

| Use case | Purchasing real estate, equipment, or major fixed assets |

Pros

- Fast approval (often within 36 hours)

- Less paperwork than standard SBA 7(a)

Cons

- Lower loan limits

- Slightly higher interest

Business women who need quick funding to manage cash flow or take advantage of opportunities, the SBA Express Loan is a smart option—it offers faster approval, less paperwork, and up to $500,000 to keep your operations moving without long delays.

Simplify SBA lending with expert assistance

SBA loans offer low interest rates, longer repayment terms, and higher approval chances—but getting one isn’t always simple. Why?

- Too much paperwork and documentation

- Confusing eligibility requirements

- Hard to find the right lender

- Long and slow approval process

- A weak business plan can lead to rejection

Moreover, the process demands constant follow-up, time, and unexpected costs—often more than you planned for.

Upmetrics’ expert team helps you avoid this:

Upmetrics offers expert support to help you get SBA loan-ready faster and with less stress. Here’s how we make it easier:

- Business plan review: We fine-tune your plan to meet lender expectations and boost approval chances.

- Lender matching: Get connected with the right SBA-approved lenders based on your goals and profile.

- Direct introductions: Skip the search—we introduce you to trusted, pre-vetted SBA lending partners.

- Application guidance: Know exactly what to submit and how, so you avoid common delays and rejections.

2) Business lines of credit

| Feature | Details |

| Loan amount | $10,000 – $250,000+ |

| Term length | 6 months to 5 years |

| Interest rates | 8% – 25% (varies by lender) |

| Minimum credit score | 600 – 680+ |

A business line of credit works a bit like a credit card—you get access to a set amount of money, and you can draw from it whenever you need. You only pay interest on the amount you use, not the full limit.

It’s a great option for managing cash flow, handling unexpected expenses, or covering short-term needs like inventory, payroll, or marketing.

Pros

- Flexible access to cash when needed

- Pay interest only on the amount used

- Can be reused over and over—ideal for ongoing expenses

- Fast funding from some online lenders (as quick as 1–2 days)

Cons

- May have lower limits than loans

- Interest rates can be higher if credit is weak

- Some lines come with maintenance or draw fees

For women running seasonal, service-based, or product-driven businesses, a line of credit provides flexible, on-demand funding without needing to reapply for a new loan each time.

It’s especially helpful for managing slow months, filling short-term gaps, or seizing last-minute growth opportunities, without putting strain on your cash reserves.

3) Term loans (From banks or online lenders)

| Feature | Details |

| Loan amount | $5,000 – $500,000+ |

| Term length | 1 to 10 years |

| Interest rates | 6% – 25% (lower with banks) |

| Minimum credit score | l620+ (banks may require 680+) |

These are traditional lump-sum loans you repay over time with fixed payments or in installments. You receive the full loan amount upfront and pay it back over a set period—great for funding big purchases, expansion, or long-term projects.

Pros

- Predictable monthly payments

- Larger funding amounts are available

- Lower interest rates with strong credit or bank relationships

- Good for long-term planning and large investments

Cons

- Tougher approval process at traditional banks

- Requires good credit and stable revenue

- Fixed repayment starts immediately—even if cash flow is tight

For women running growth-focused businesses, term loans provide structure and scale. You can invest in equipment, hire staff, or open a new location with clear, fixed repayment terms.

While banks may be stricter, online lenders often offer more flexibility—some consider overall business potential, not just credit score, which is a big win for women founders still building financial history.

4) Microloans and nonprofit lenders

| Feature | Details |

| Loan Amount | $500 – $50,000 |

| Term Length | 1 to 6 years |

| Interest Rates | 8% – 15% (varies by organization) |

| Minimum Credit Score | Around 600 (often flexible) |

Microloans are small business loans—usually under $50,000—offered by nonprofit organizations, community lenders, or mission-driven programs. They’re designed to support early-stage or underserved entrepreneurs who may not qualify for traditional loans.

Pros

- Easier to qualify for than bank loans

- Lower credit score requirements

- Often includes mentorship, training, or business coaching

- Mission-driven—aimed at helping small and women-owned businesses succeed

Cons

- Lower loan amounts (may not suit larger needs)

- Not every nonprofit lender operates in all areas

- Approval may still take time, depending on demand

Microloans are one of the most accessible forms of funding for first-time women founders, solopreneurs, or home-based business owners.

Many nonprofit lenders specifically target women entrepreneurs and offer more than just capital—you get access to business training, peer networks, and personalized support.

5) Grant and alternative options

| Feature | Details |

| Funding Amount | Varies: $500 – $100,000+ |

| Repayment Required | None (for grants) |

| Minimum Credit Score | Not applicable (for most grants) |

| Use Case | Startup costs, R&D, social impact, growth, and creative projects |

Grants are non-repayable funds given by government bodies, nonprofits, or private organizations—no interest, no repayments. Other alternative funding options, like crowdfunding or revenue-based financing, can also be great fits depending on your business stage and model.

Pros

- Grants don’t require repayment—free funding

- No interest or debt added to your business

- Many programs specifically support women, minorities, and underserved founders

- Great for early-stage or mission-driven businesses

Cons

- Highly competitive and time-consuming to apply

- Specific eligibility requirements (industry, impact, stage)

- Limited availability and funding cycles

Alternative options (besides grants)

- Crowdfunding (Kickstarter, IFundWomen): Raise money from supporters

- Revenue-based financing: Repay a % of monthly revenue instead of fixed payments

- Peer-to-peer lending: Borrow from individual investors online

- Angel investors or competitions: Great if you’re willing to pitch

Grants and alternative funding are ideal for women building innovative, creative, or impact-driven businesses. Many grant programs are specifically designed to close the gender funding gap and come with zero repayment pressure.

If you’re early-stage, mission-focused, or simply want to avoid debt, this path offers capital plus credibility without the loan burden.

How to get a small business loan for women?

Getting a loan for a small business for women isn’t very different, but knowing what lenders look for and where to apply can make the process smoother.

Here’s a quick step-by-step guide to get a small business loan:

Step 1: Know how much you need

Estimate your funding needs and what you’ll use the money for (working capital, inventory, equipment, etc.). Knowing your needs helps you choose the right loan type and avoid borrowing too much or too little.

Step 2: Gather key documents

Be ready with financial projections, tax returns, business licenses, and any legal documents. Having everything organized upfront speeds up the process and demonstrates to lenders that you’re prepared and credible.

Step 3: Check your credit score

Most lenders require a personal credit score of 600+—higher scores get better rates. If your score is low, consider building credit first or applying through lenders that accept alternative qualifications.

Step 4: Prepare or update your business plan

A strong, clear business plan improves your chances of approval, especially with SBA and nonprofit lenders. It shows lenders you’ve thought through your goals, finances, and how you’ll repay the loan.

For example, check out how STREAM Academy secured $500,000 in SBA funding using a business plan they built with Upmetrics. It’s a great example of what good planning achieves.

Step 5: Find the right lender

Compare loan types—SBA, microloans, banks, online lenders, or nonprofits that support women-owned businesses. Each option has different terms, approval criteria, and benefits—choose the one that aligns best with your business stage and goals.

How to compare business loans for women

Not all business loans are created equal, and choosing the wrong one can cost you more than just money. Here’s what you should look at when comparing loan options:

1) Interest rate

This is what you’ll pay on top of the loan. A lower rate means lower total cost—but ensure you’re looking at the annual percentage rate (APR), which includes fees too. APR is the total yearly cost of your loan, including interest plus fees like origination or processing charges.

APR = (Total Interest + Fees ÷ Loan Amount) ÷ Loan Term × 100

2) Repayment terms

How long do you have to repay the loan? Shorter terms mean higher monthly payments, but less interest. Longer terms = smaller payments, but more interest over time.

3) Fees

Check for extra charges like application fees, origination fees, early repayment penalties, or maintenance fees on lines of credit. These hidden costs can quietly add hundreds (or thousands) to your total loan amount, so always read the fine print before signing.

4) Collateral requirements

Some loans require you to put up assets (like property or equipment). If you’re just starting out, look for unsecured loans or lenders that accept other forms of security. If you can’t repay the loan, the lender can seize your collateral—so only pledge assets you’re willing (and able) to risk.

5) Loan purpose

Some loans are flexible, others have strict usage rules (like SBA 504 loans for fixed assets). Choose based on what you need funding for—growth, equipment, working capital, etc.

6) Speed of funding

Need cash fast? Online lenders or SBA Express loans move quicker than banks or nonprofit programs. However, you need to check whether the faster funding comes with higher interest rates or stricter repayment terms.

7) Lender reputation & support

A good lender doesn’t just give you money—they guide you too. Women-focused lenders often offer mentorship and flexible terms, which can be a big help when you’re just starting out.

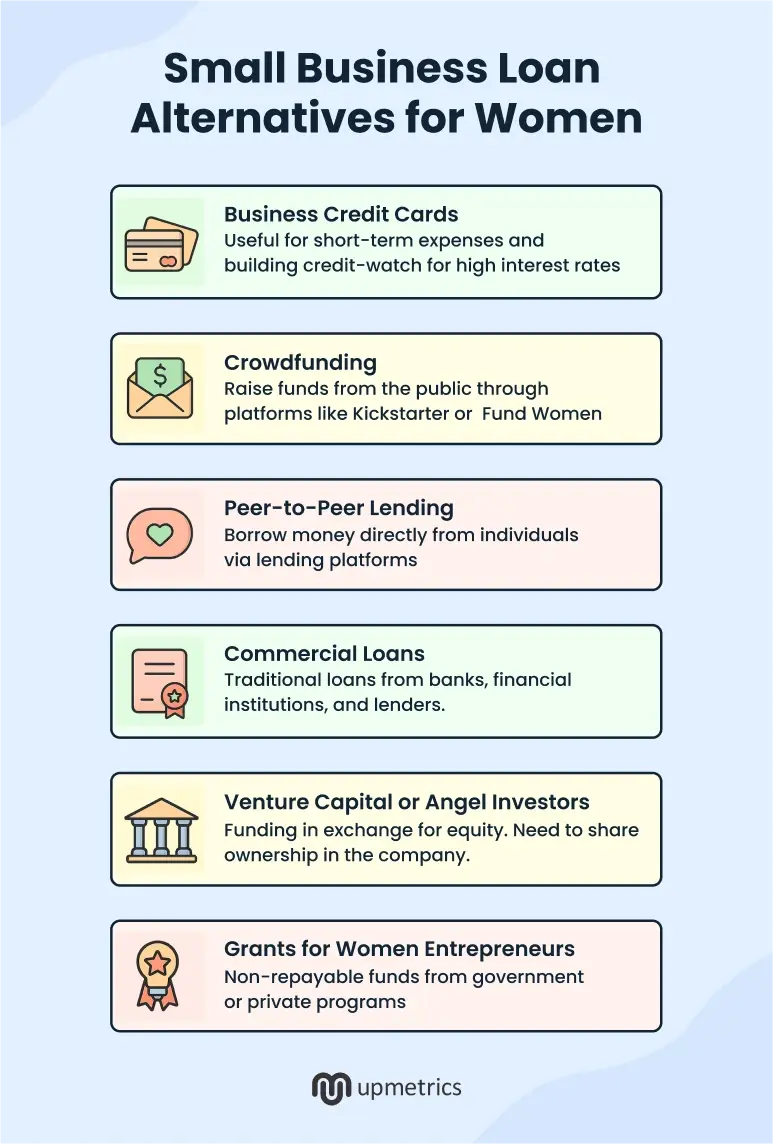

Small business loan alternatives for women

Not every woman entrepreneur needs—or wants—a traditional loan. Luckily, there are other ways to fund your business that don’t involve banks or heavy paperwork. Here are some smart alternatives worth exploring.

Other small business resources for women

Upmetrics goes beyond just SBA loan assistance—we provide tools, guidance, and resources designed to make funding more accessible and less overwhelming for women entrepreneurs.

Here’s a list of resources offered to help you grow your business with confidence and clarity.

- Free busine ss plan generator: It helps women entrepreneurs start with a clear, focused business plan, making it easier to communicate their vision before building a detailed version for loan applications.

- Business plan templates for a loan: Professionally designed, ready-to-use templates tailored for loan applications, helping women present their business clearly and confidently to lenders.

- Free business tools: A toolkit of AI-powered resources like SWOT and Competitor Analysis generators—built to help small business owners make smart, strategic decisions faster.

- Lender-ready business plan: A structured, professional plan format tailored to meet lender expectations, helping women business owners and entrepreneurs boost their chances of loan approval.

- Financial statement templates: Easy-to-use templates that help women business owners and entrepreneurs organize key financials like income statements, balance sheets, and cash flow, essential for loan applications.

Conclusion

Securing a loan for women in a small business isn’t always easy, but it’s possible with the right guidance and tools.

In this guide, we covered everything from the best small business loans for women to grants and funding alternatives, plus how to compare options and boost your approval chances.

At Upmetrics, we’re here to make the journey smoother. From SBA lending support to lender-ready business plans, templates, and smart planning tools—we’re your partner in turning ideas into action.

You’ve got the vision. We’ve got your back.

Now go build something amazing—good luck!