Leaving a steady accounting job to start your own firm?

That’s a big move, and an exciting one! You finally get to be your own boss and build a business around your financial skills and what you do best.

But even with years of experience, diving in without a clear plan can lead to confusion and missed opportunities. To avoid that, you’ll need a strong business plan that gives you direction.

It helps you stay focused, organize your services, set smart goals, and build a steady flow of clients, without scrambling when things get busy.

Not sure how to draft one?

Worry not! This accounting firm business plan template will guide you through it.

What is an accounting firm business plan?

An accounting firm business plan is a simple document that explains what the firm does, who it serves, and how it plans to grow.

It covers services offered, target clients, pricing, marketing plans, and financial goals. It helps keep the business organized and focused, and is useful for planning, decision-making, or getting funding.

Why do you need an accounting firm business plan?

A business plan is more than just a document. It serves as your accounting firm’s roadmap to success.

Even though starting an accounting firm might not require huge upfront investments in equipment or inventory, you still need a clear plan.

In fact, 71% of fast-growing companies have business plans, and they actively use them to guide their business growth. Simply put, entrepreneurs who plan are more likely to build successful, sustainable businesses.

Let’s explore how a business plan can help you:

- Stay clear on your services, pricing, and target clients

- Set short-term and long-term goals for growth

- Stay organized with day-to-day operations

- Plan your income and track your spending

- Make better decisions as your firm grows

- Build trust with banks, investors, or partners

In short, having a business plan greatly increases your firm’s chances of success. It’s like performing an audit on your business idea—identifying strengths and gaps so you can address them proactively.

Now, let’s dive into the key sections your accounting firm business plan should include.

How to draft a solid business plan for an accounting firm

Every effective accounting firm business plan includes several main sections. Below, we break down each component and what to cover.

1. Executive Summary

The executive summary is the elevator pitch for your accounting firm business plan. It’s a concise overview of your entire plan, giving readers (investors, partners, or even yourself) a quick snapshot of your accounting firm and why it will succeed.

Although this section comes first, write it last – after you’ve worked out all the details in the rest of your plan.

Your executive summary should cover the most important highlights of your plan, including:

- Firm overview: What is your accounting firm about? Where is it located?

- Services: What services will you offer (bookkeeping, tax preparation, financial consulting, etc.?

- Target clients: Who are your target clients (e.g., local small businesses, freelancers, startups in a certain niche)?

- Unique Value Proposition: What sets your firm apart? Make it clear why clients will choose you over others.

- Future goals: How will you make money, and how much do you expect to make?

- Financial highlights: How will you make money, and how much do you expect to make? Mention your revenue model (hourly fees, monthly retainers, project-based fees) and projections.

- Funding request: If you need funding, state how much and what it’s for.

In short, the executive summary distills your entire accounting business plan into one section. Hence, keep it clear and compelling to grab the reader’s attention and get them excited about your firm’s potential.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $14/month

2. Company Overview

Now it’s time to describe your accounting firm in more detail!

The company overview section covers the foundational information about your firm: Who you are, what you do, and why you’re in business. Think of it as the introduction to your company’s story.

The following are the key elements to include in your business overview:

- Your accounting firm’s name and location

- Legal structure of your business (e.g., sole proprietorship, LLC, partnership)

- Short, inspiring mission statement

- Long-term vision for your firm

- Background history and milestones (if any)

- Short-term and long-term goals

Overall, the business overview provides a snapshot of your accounting firm’s identity and strategy. By the end of this section, the reader should fully understand what your firm is and aims to achieve.

3. Market Research

Before launching an accounting firm, you need to understand the industry and market you’ll operate in. This section demonstrates your knowledge of the accounting industry and the local market demand.

Essentially, you’re answering: “What is the business environment like for my services?”

Here’s what to research and include while planning this section:

Industry Size & Growth

How big is the accounting services industry, and is it growing?

Highlight any growth stats or positive outlook, such as an increasing number of small businesses needing accounting help or new tax laws driving demand for expert advice.

Market Needs

Identify the pain points or needs in the market. Perhaps small business owners struggle with staying on top of bookkeeping and tax filings – this is a need your firm can fulfill.

Articulate the gap you plan to fill (e.g., accessible, affordable accounting for freelancers, or specialized advisory for tech startups that traditional firms don’t offer).

Target Customer

Define who your ideal clients are and what they need. This helps adjust your services and marketing directly to those clients. Identify the specific groups of clients you plan to serve.

For example, your segments might be:

- Small business owners who need bookkeeping, payroll, and tax services

- Independent professionals (freelancers, real estate agents, gig economy workers) who need tax help

- Corporations or larger businesses (if you target medium-sized companies for outsourced accounting or CFO services)

- Individuals who seek personal tax preparation or financial planning assistance

For each segment, describe its key needs or problems. Consider how your target clients prefer to access services. The better you understand your audience, the easier it will be to attract and retain those clients.

Further, developing a detailed buyer persona can be a helpful exercise as it lets you better understand your ideal clients.

Industry Trends

Discuss trends affecting accounting firms. For example, the rise of cloud accounting software and AI automation.

Also, mention if businesses are outsourcing accounting more now (many are, to save costs) or any shifts like virtual accounting becoming common.

Regulatory Environment

Since accounting is tied to tax laws and financial regulations, note any important regulatory considerations.

Are there recent tax law changes or compliance requirements that create opportunities or challenges?

4. Competitive Analysis

In any industry, knowing who your competitors are and how you’ll stand out is crucial.

For an accounting firm, your competition might include other local accounting or bookkeeping firms, solo accounts in your area, and even DIY software like QuickBooks or TurboTax that some clients use instead of hiring an accountant.

This section of your plan will show that you understand the competitive landscape and have a strategy to differentiate your firm.

Here’s how to conduct your competitive analysis:

Step 1: Identify and list out the main competitors in your market. This could be:

- Established accounting firms or Certified Public Accountant (CPA) offices in your town/city.

- Independent bookkeepers or tax preparers offering similar services.

- Online accounting services or national firms (if you operate virtually)

Step 2: For each significant competitor, note their offerings, target clients, and any specialties. This helps illustrate where each competitor sits in the market.

Step 3: Assess what each competitor does well and where they fall short. Compare factors like pricing, range of services, quality, reputation, technology use, customer reviews, location convenience, etc.

Step 4: Identify if there’s a gap in the market that none of the competitors fully cover, and that you intend to fill.

Step 5: Highlight your competitive advantages: This is the most important part, so clearly articulate how you will differentiate your accounting firm.

If required, conduct a simple SWOT analysis for your business. SWOT stands for Strengths, Weaknesses, Opportunities, Threats. It’s often a helpful practice to get a good sense of internal and external factors that might affect your firm.

By examining your competitors, you not only show readers you understand the competitive landscape, but you also reassure yourself that you have a plan to outshine the competition. Emphasize what makes your firm special.

5. Sales and Marketing Strategies

Marketing is often the make-or-break part of launching an accounting firm. You might have the best service in town, but you need clients to survive and thrive.

In the marketing strategy section, you’ll outline how you plan to attract and retain clients. This includes your branding, pricing, promotion, and sales tactics.

An effective marketing strategy for an accounting firm should cover:

Branding & positioning

Describe how you will position your firm in the market and reflect on your brand identity (name, logo, tagline).

Service packaging and pricing

Outline your service packages and pricing strategy. Will you charge hourly, offer monthly retainer packages, or fixed fees for certain services?

Promotion channels

This is the core of your marketing plan – how you’ll get the word out and generate leads.

Consider a mix of both traditional and digital marketing channels: Networking & Referrals, Online Presence through a professional website, Social Media & Advertising, Educational Workshops/Webinars, Print and Local Media (brochures or newspapers).

Sales process

Describe how you will turn prospects into paying clients. Also, mention how you’ll follow up with leads who inquire but don’t commit immediately (perhaps an email newsletter or a follow-up call).

Retention and relationship management

Marketing isn’t just about finding clients, it’s also about keeping them. Explain how you’ll retain clients, since recurring clients are gold in accounting.

Marketing goals & budget

It’s good to set some measurable goals you want to achieve soon. Also, consider your marketing budget: how much will you allocate to ads, networking events, etc.

Overall, this section basically lays out your plan to get customers in the door and grow your revenue. Be as specific as possible so you have a clear action plan.

6. Management Team

Investors and stakeholders often say they invest in people as much as in ideas. And as the name indicates, this section highlights who is behind the company and why they’re capable of making the business succeed.

For an accounting firm, this usually means highlighting the credentials and expertise of the owner(s) and any key team members or advisors.

Start by introducing yourself if it’s likely you’re a solo entrepreneur! Include your name, qualifications, and experience. Highlight expertise that directly relates to your firm’s services. This establishes credibility.

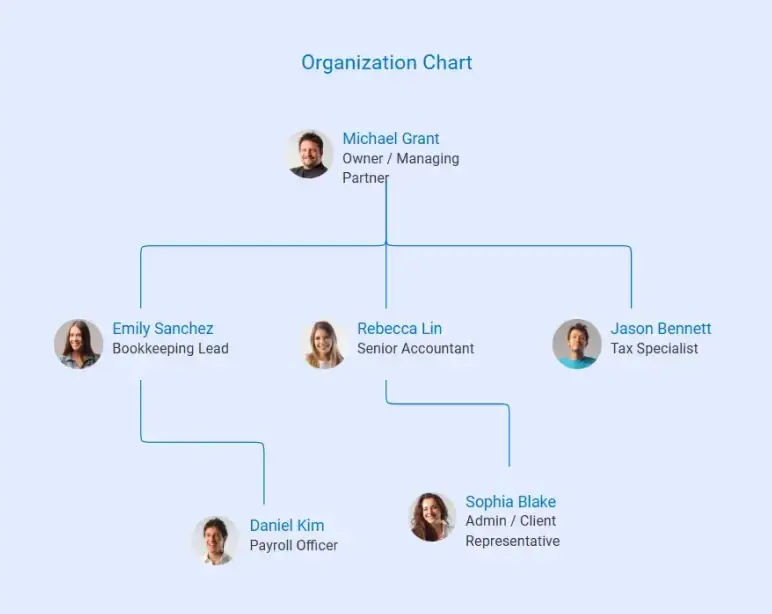

If you have partners or key team members lined up, introduce them. For each person, mention their role and a brief about their background.

Next, describe how the team is structured. Build a clear Organizational structure that shows who reports to whom, and how responsibilities are divided.

Lastly, don’t forget to mention advisors or board members who guide you and help in decision-making.

7. Operations Plan

The operations plan section explains how your accounting firm will actually run on a day-to-day basis. It covers the behind-the-scenes processes, tools, and logistics that will allow you to deliver your services efficiently.

In other words, while the earlier sections described what you’re going to do, the operations plan describes how you’re going to do it.

Consider answering these few key questions while drafting your business operations plan:

- Where will you work from? Your home, a rented office, or fully online?

- What tools, software, and office items will you need to run your business safely and smoothly?

- Will you work alone at first or have a team? Will you hire more people later?

- How will you deliver your services to your clients, step by step?

- How will you stay in touch with your clients and keep track of their needs?

- How will you make sure your work is correct and accurate?

- Are there any important vendors or third-party services you will rely on to operate your firm?

Besides these operational aspects, it’s good to mention your contingency plans briefly. How will you handle busy seasons or emergencies?

In short, use this section to assure the reader (and yourself) that you have the systems, tools, and processes in place to run the firm smoothly. Efficient operations lead to better client service and profitability.

8. Financial Plan

The financial plan is a critical component of your business plan as it shows the numbers behind your vision and sheds light on the financial viability of your firm.

In your accounting firm’s financial plan, you need to project the overall financial performance and outline your funding needs (if any). The goal is to demonstrate that your business can be profitable and financially sustainable.

Key elements to include in your financial plan:

- Startup Costs

- Revenue Projections

- Expense Projections

- Tax considerations

- Profit & loss projection

- Cash flow estimates

- Break-even analysis

If you require funding to start or grow, state how much you need and what it will be used for. If you’re not seeking outside funds, you can note that the business will be self-funded or bootstrapped by reinvesting profits.

In a full business plan, you’d typically include financial statements: income statements, cash flow statements, and a balance sheet projection for at least the first 3-5 years.

This gives investors a clear picture of your business’s financial performance, strength, and future potential.

For instance, you may refer to the below projections to create your own:

Income Statement

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | |||

| Bookkeeping Services | $45,000 | $52,000 | $60,000 |

| Tax Preparation Services | $35,000 | $40,000 | $45,000 |

| Advisory & Consulting | $20,000 | $25,000 | $30,000 |

| Other Income (Workshops, etc.) | $5,000 | $7,000 | $8,000 |

| Total Revenue | $105,000 | $124,000 | $143,000 |

| Expenses | |||

| Salaries / Contractor Fees | $40,000 | $48,000 | $55,000 |

| Office Rent / Home Office | $6,000 | $6,500 | $7,000 |

| Software Subscriptions | $3,000 | $3,300 | $3,500 |

| Marketing & Advertising | $5,000 | $6,000 | $7,000 |

| Internet & Phone | $1,200 | $1,300 | $1,400 |

| Office Supplies | $800 | $900 | $1,000 |

| Insurance & Licenses | $1,500 | $1,600 | $1,700 |

| Travel & Meetings | $1,000 | $1,200 | $1,400 |

| Professional Fees (Legal/CPA) | $1,500 | $1,600 | $1,800 |

| Miscellaneous Expenses | $1,000 | $1,200 | $1,400 |

| Total Expenses | $61,000 | $71,600 | $80,300 |

| Net Profit (Before Tax) | $44,000 | $52,400 | $62,700 |

Cash Flow Statement

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Cash Inflows | |||

| Revenue from Services | $105,000 | $124,000 | $143,000 |

| Owner Investment | $20,000 | $0 | $0 |

| Loan Received (Short-Term Loan) | $10,000 | $0 | $0 |

| Total Cash Inflows | $135,000 | $124,000 | $143,000 |

| Cash Outflows | |||

| Salaries / Contractor Fees | $40,000 | $48,000 | $55,000 |

| Rent / Office Expenses | $6,000 | $6,500 | $7,000 |

| Software and Tools | $3,000 | $3,300 | $3,500 |

| Marketing & Advertising | $5,000 | $6,000 | $7,000 |

| Loan Repayment | $2,000 | $3,000 | $3,000 |

| Other Operating Expenses | $8,000 | $9,000 | $10,000 |

| Taxes Paid | $2,000 | $2,500 | $3,000 |

| Total Cash Outflows | $66,000 | $78,300 | $88,500 |

| Net Cash Flow | $69,000 | $45,700 | $54,500 |

| Opening Cash Balance | $0 | $69,000 | $114,700 |

| Closing Cash Balance | $69,000 | $114,700 | $169,200 |

Balance Sheet

| Category | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash | $20,000 | $30,000 | $40,000 |

| Accounts Receivable | $10,000 | $12,000 | $15,000 |

| Office Equipment (Net of Depreciation) | $8,000 | $7,000 | $6,000 |

| Prepaid Expenses | $2,000 | $2,500 | $3,000 |

| Total Assets | $40,000 | $51,500 | $64,000 |

| Liabilities | |||

| Accounts Payable | $3,000 | $3,500 | $4,000 |

| Short-Term Loan | $10,000 | $8,000 | $5,000 |

| Taxes Payable | $2,000 | $2,500 | $3,000 |

| Total Liabilities | $15,000 | $14,000 | $12,000 |

| Owner’s Equity | |||

| Owner’s Investment | $20,000 | $20,000 | $20,000 |

| Retained Earnings (Profits) | $5,000 | $17,500 | $32,000 |

| Total Equity | $25,000 | $37,500 | $52,000 |

| Total Liabilities + Equity | $40,000 | $51,500 | $64,000 |

Download a free accounting firm business plan template

Ready to put together your own accounting firm business plan? But need a little extra help? We’ve got you covered. Download our free accounting firm business plan template (PDF) to jumpstart your planning.

This template is pre-filled with example content and an outline for all the sections, so you can easily customize it to your needs. This saves your time and ensures you’re not missing any crucial sections. It’s an excellent starting point for writing the first draft of your plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Conclusion

Let’s conclude! We’ve discussed all the key sections of an accounting firm business plan and explained how to draft them.

Plus, we’ve shared a free sample business plan for an accounting firm to help get you started. So, now it should be much easier for you to write your own business plan.

However, if you’re still feeling confused about details or seeking an easy way to create a plan, modern tools like Upmetrics can be your go-to tool.

With step-by-step guides, financial forecasting tools, and even AI assistants, Upmetrics helps you streamline the planning process and speed up writing. Further, it lets you generate an actionable plan in just a few minutes!