Executive Summary

CleanSpin Laundromat is a self-service laundromat business in the neighbourhood owned and operated by Caleb Morrison at Madison Street, Chicago, Illinois. The company provides coin and card-operated laundry services, including very limited wash-and-fold, to apartment tenants, college students, and families who cannot use in-unit laundry facilities.

Local housing conditions drive this operating focus. Many nearby multifamily rental buildings lack in-unit laundry, which makes laundromat use a routine household need rather than a discretionary choice.

CleanSpin’s business model is based on recurring, need-driven demand. The facility is equipped with 20 commercial washers and 20 commercial dryers, sized to handle routine household laundry volumes rather than peak commercial loads. Primary revenue is generated through self-service wash-and-dry cycles, with supplemental income from limited wash-and-fold service and vending sales.

The company does not deal with dry cleaning and commercial laundry contracts, as these may cause complexity in the business and need special equipment. An owner-operator type has a restricted labour outlay yet direct control of daily business, equipment repairs, and cash expenditure.

CleanSpin needs a total start-up of $420,000 to stabilize its operations:

- $220,000 bank term loan from Wintrust Community Banks

- $200,000 owner cash contribution, representing a majority-equity capitalization structure

Startup funds will be used for laundry equipment purchases, buildout and installation, lease-related costs, payment systems, and initial working capital to support the early operating period.

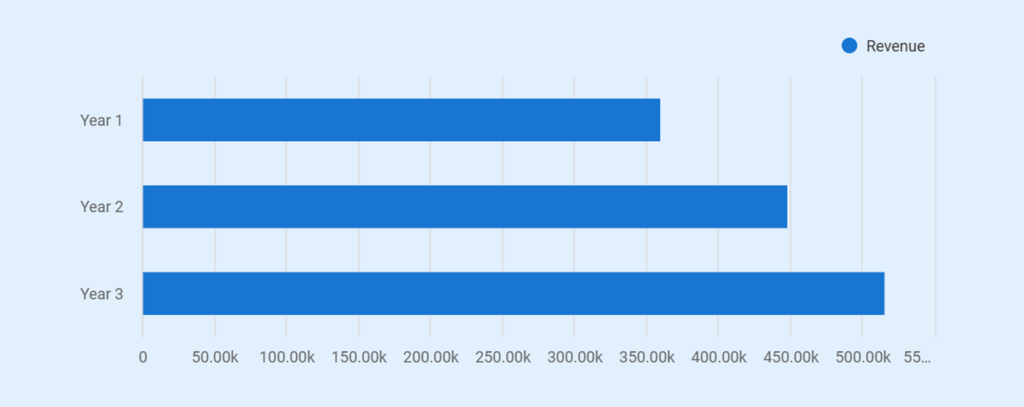

The business is projected to generate revenue of $360,000 in Year 1, $448,500 in Year 2, and $516,000 in Year 3.

The requested bank loan is structured as a 7-year amortizing term loan, with repayment supported by operating cash flow generated through normal business activity. To preserve liquidity during the ramp-up phase, the owner does not take a salary in Year 1. The high level of owner equity reduces lender risk and allows the business to operate conservatively until utilization reaches stabilized levels.

A business plan shouldn’t take weeks

Company Description

Legal Structure and Ownership

CleanSpin Laundromat is a single-member limited liability company, which is completely owned by Caleb Morrison. The business structure adopted is an owner-managed structure that facilitates the smooth decision-making process and also restricts the liability of the owner. The structure is suitable for a localized operating footprint, a small and equipment-driven service business.

Business Location and Service Area

The company is based in a leased retail building at 1426 W. Madison Street, Chicago, Illinois, which is a mixed-use district with multifamily residential housing and local retail. The site was chosen because of its visibility on the street, the ease of access by pedestrians, and closeness to other residential quarters and student accommodation.

The neighbourhood boasts a large number of renters, and this is compatible with the fact that the business aims at recurrent, necessity-based laundry services and not destination or specialty services.

Operating Model and Scope

CleanSpin provides laundry services to people who are dependent on shared laundry or off-site laundry. Self-service laundry service with a limited wash-and-fold feature is the main service package, and the operational focus is on equipment durability and neatness.

The company does not provide dry cleaning, pick and delivery services, or commercial laundry contracts.

Ownership & Responsibilities

- Owner: Caleb Morrison

Caleb Morrison takes care of daily operations and has direct control over all the operations, financial, and compliance functions. This feature maintains centralized and operating costs in the initial years of the business.

Primary responsibilities include:

- Management and coordination of leasing and landlords

- Managing equipment maintenance and service

- Supplies, repair, and utility vendor organization

- Check clearing, coinage, and reconciliation of the payment system

- The part-time attendant and service technicians will be supervised

- Adherence to local licensing, health, safety, and accessibility standards

The owner does not draw a salary in Year 1 to maintain the liquidity in the ramp-up period. This practical management style facilitates lean cost management, quicker resolution, and uniformity of service delivery in the initial operation.

Products & Services

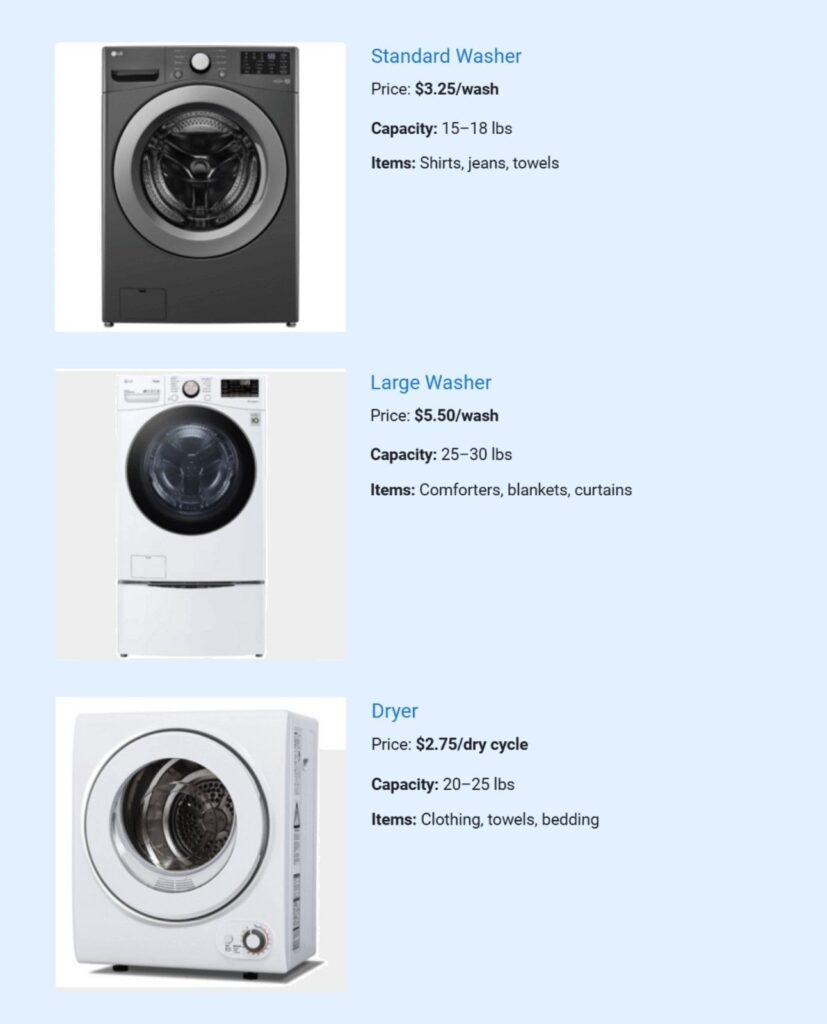

CleanSpin offers a focused set of laundry services centered on self-service washing and drying. The business keeps the service mix intentionally narrow to maintain operational control, predictable costs, and a consistent customer experience. All services operate on-site using commercial-grade equipment.

Self-Service Laundry (Wash & Dry)

Self-service laundry is the primary revenue source. Customers load, wash, and dry their laundry independently using commercial machines available throughout operating hours. Payments are accepted via both coin and card systems.

Dryers will be of the same size as the washer throughput to reduce bottlenecks during peak seasons. The quantity of dryers is the same as the quantity of washers in order to facilitate the flow of customers and minimize congestion.

Wash-and-Fold Laundry Service (Limited Availability)

CleanSpin offers a wash-and-fold service as a convenience option, not as a core operation. The owner processes all orders on-site using the same machines as self-service customers.

- Price: $1.35 per pound

- Available only during select staffed hours

- No pickup, delivery, or commercial volumes

- Capacity capped to avoid labour strain and service delays

This structure allows incremental revenue without increasing staffing complexity or turnaround risk.

Laundry Supply Vending Machines

The facility includes a vending machine that provides basic laundry supplies for customer convenience. Price depends on the product type.

Products available:

- Laundry detergent

- Fabric softener

- Dryer sheets

- Basic stain removers

Vending sales serve as a high-margin supplemental revenue stream. The owner monitors inventory and restocks regularly to avoid service interruptions.

Excluded Services and Scope Boundaries

CleanSpin does not provide dry cleaning services, pick up or delivery services, or hotel/hospital and other institution commercial laundry services. These omissions maintain the operations as neighbourhood-demand-oriented and prevent the extravagance of additional equipment and staffing.

Market Analysis

Local Market Overview (Chicago)

The laundromat business serves a basic household need and depends on regular, repeat use. For households without in-unit laundry, using a laundromat is not optional. This keeps demand steady and less affected by economic changes.

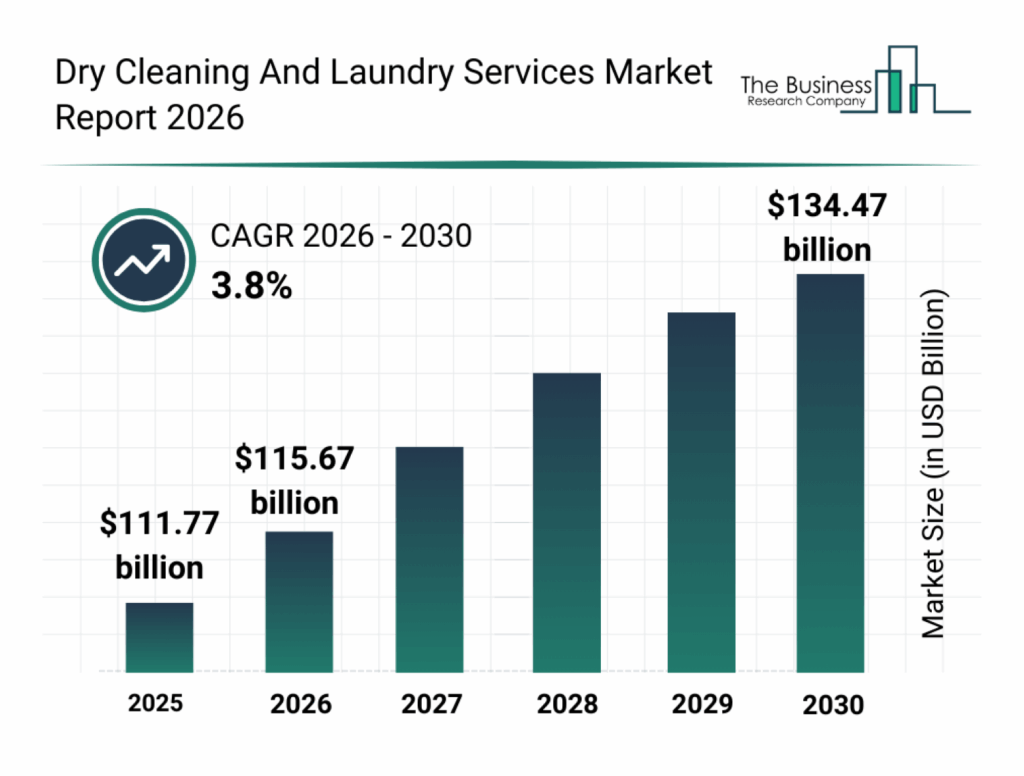

The global laundry and dry-cleaning market is valued at $111.77 billion in 2025 and is expected to reach $134.47 billion by 2030. This growth is tied to city living, rental housing, and shared laundry use.

In the United States, the laundromat industry is valued at $6.8 billion in 2025. Laundromats are known to be stable businesses, with an estimated five-year success rate of around 94–95%. Customers return regularly because laundry is a routine need.

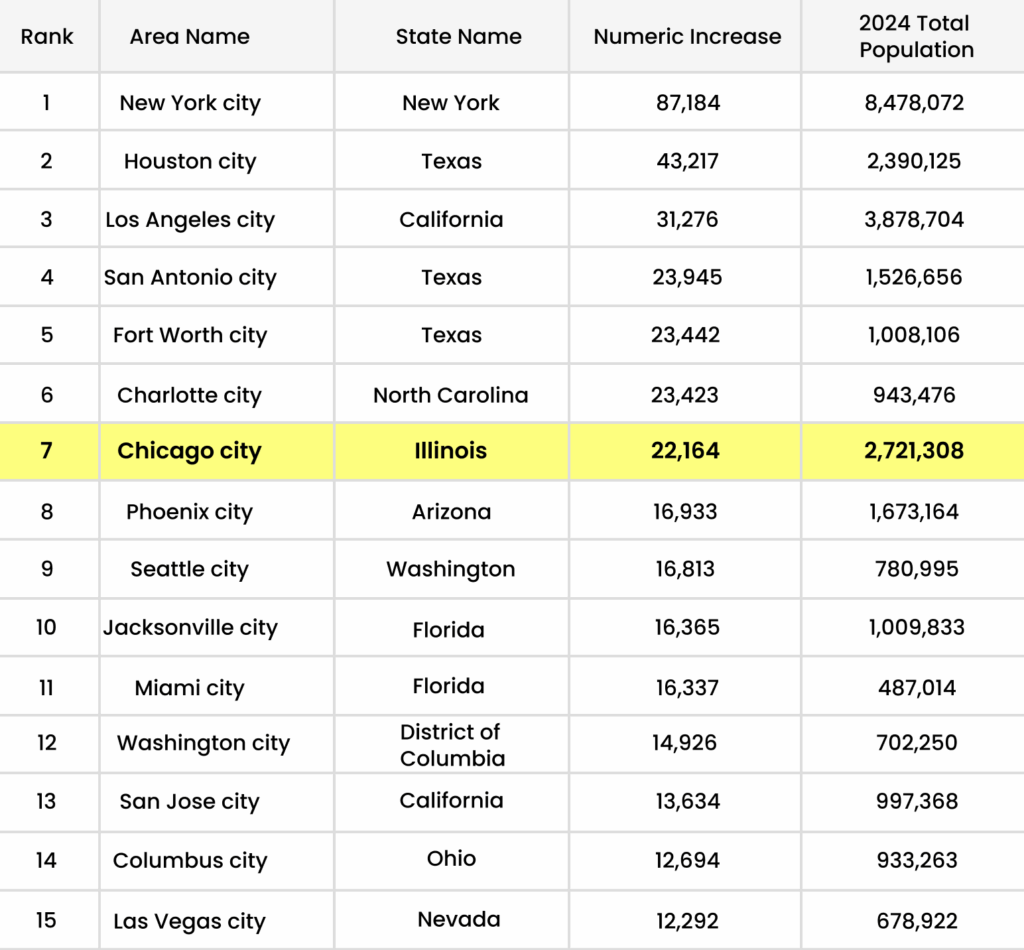

Chicago has a population of 2,721,308.

Many residents live in apartments or multi-unit buildings where in-unit laundry is limited or not available. This fits CleanSpin’s target customers, including renters, students, and smaller households who rely on local laundromats every week or every other week.

Overall, this is a steady and reliable business. Demand is repeat-based, predictable, and driven by necessity.

Target Customer

CleanSpin serves local residents who do not have in-unit laundry access. The primary customers include:

- Renters in multifamily buildings

- Students

- Small households without private laundry facilities

Customers live within walking or short driving distance of the location and use the laundromat as part of a regular household routine.

Demand is stable and necessity-driven. Laundry use follows a weekly or bi-weekly pattern and is not discretionary. Customer choice is based on proximity, machine availability, cleanliness, and operating hours. Once a reliable location is established, usage becomes repeat-based with low churn.

Competitive Landscape

Several independent neighbourhood laundromats operate within a one to two-mile radius of the West Madison Street location. Most occupy 1,600–2,400 square feet and operate with 18–32 washers and dryers, offering primarily self-service laundry with limited additional services.

Direct Competitors

| Competitor | Location | Services | Where They Fall Short |

|---|---|---|---|

| Wash Smart Laundry | Near West Chicago | Self-service; coin & card; extended hours | Limited wash-and-fold; limited owner oversight |

| Austin Laundromat | Austin, Chicago | Self-service; coin & card; 24/7 | Inconsistent maintenance; limited cleanliness |

| Yo-Yo Coin Laundromat & Drop Off | West/Northwest Chicago | Coin laundry; basic drop-off | Older equipment; limited payment options |

Indirect Competitors

| Competitor | Model | Services | Limitations |

|---|---|---|---|

| Drop & Dash Laundry | Pickup & delivery | Wash-and-fold | Higher cost; scheduled service only |

| Rinse Laundry Delivery | App-based | Wash-and-fold, dry cleaning | Premium pricing; no walk-in option |

Competitive Positioning

CleanSpin aims to be the kind of neighbourhood laundromat people stick with. Customers come back because the machines work when they need them, the store stays clean, and the hours are predictable. With several laundromats nearby, most customers choose based on everyday experience rather than extra services or branding.

The owner-operator model allows faster issue resolution, closer supervision, and stronger cost control. Approximately 85–90% of revenue comes from self-service laundry, with wash-and-fold and vending serving as secondary support services. This focus aligns with conservative operating assumptions and long-term neighbourhood demand.

Operations Plan

Operating Hours and Facility Access

CleanSpin will be open throughout the week, 6:00 am to 10:00 pm, depending on the schedules of the renters and students, as well as the shift workers in the neighborhood. The laundromat is a type of self-service operation, and workers are only employed to work during particular peak hours and not all day. This design helps the customers to have extended daily access, and the labor hours are controlled and predictable.

Equipment Configuration

The facility is designed to meet the steady, household-level laundry demand instead of high-volume commercial demand. This optimizes the throughput, utility, and workability of maintenance.

- 20 commercial washers with mixed load capacities to serve both small weekly loads and larger family or bedding washes

- 20 stacked commercial dryers, matched to washer throughput to reduce wait times and congestion

- A vending machine for end-of-moment laundry care products

Machine selection prioritizes durability, serviceability, and consistent utility usage over oversized or high-consumption equipment.

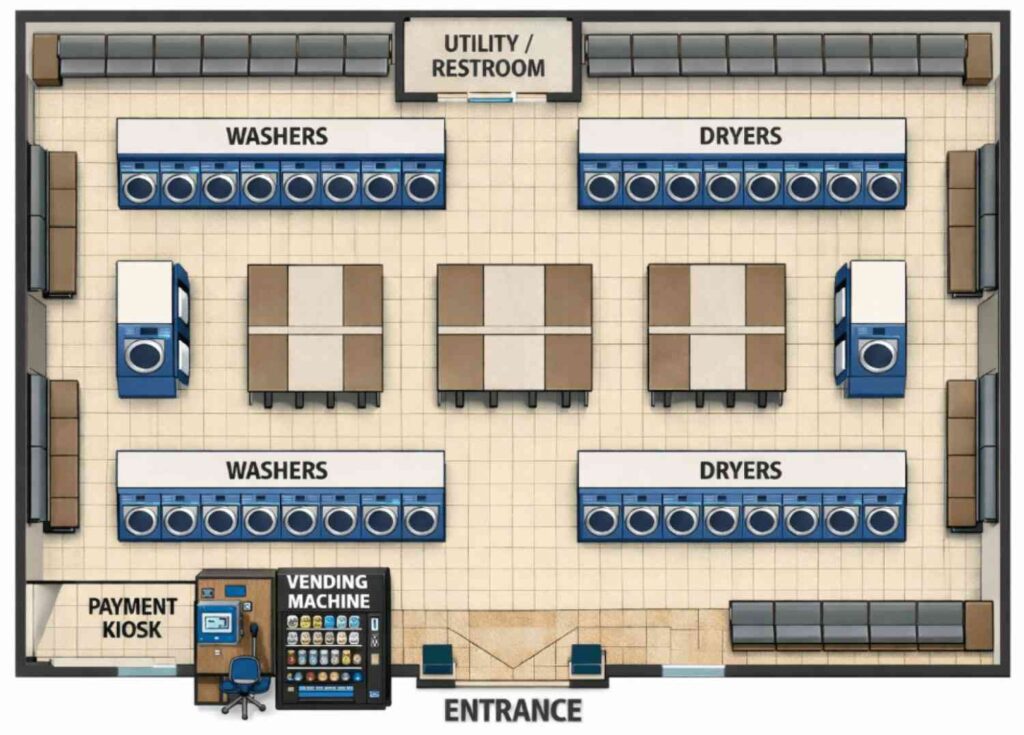

Layout and Floor Plan Design

The laundromat adheres to an open, linear floor plan so that there is smooth movement, easy supervision, and efficient cleaning of the place.

Key layout elements include:

- Centralized folding tables accessible from all washer and dryer rows

- Seating is placed along perimeter walls to prevent aisle congestion

- The payment kiosks and vending machine is placed close to the entrance to be seen and made convenient.

- Large and clear aisles to facilitate ADA (Americans with Disabilities Act) compliance and access to cleaning.

This layout supports safe customer circulation and quick visual checks without obstructing workflow.

Daily Workflow and Owner Oversight

Daily operations follow a consistent routine focused on readiness, cleanliness, and basic system checks.

Opening Checks:

- Confirm storefront access, lighting, and common-area safety

- Clean floors, folding tables, seating areas, and high-touch surfaces

During Operating Hours:

- Visually check washers and dryers for leaks, error messages, or operational issues

- Monitor payment systems to confirm that machines accept coin and card payments correctly

- Refill vending machines as needed to maintain supply availability

End-of-day Checks:

- Confirm machine status and general facility condition

- Review payment system activity to ensure proper operation

Maintenance and Vendor Management

CleanSpin concentrates on preventive maintenance to limit downtime and deal with long-term repairs. The company contracts certified commercial laundry equipment service technicians to service equipment during specified times and give repairs where necessary. It has maintenance reserves so that parts can be replaced in time without disrupting the operations.

Vending inventory and laundry supplies are obtained through a local or regional wholesaler. Reliability, response time, and consistency in the service are what determine the vendors that are selected.

Staffing Model and Labour Controls

Caleb Morrison has the responsibility of daily supervision, facility standards, equipment coordination, relations with vendors, cash controls, and compliance. In Year 1, he will not earn a salary to keep a liquidity situation at the ramp-up stage.

The company has a single part-time attendant who works approximately 22 hours per week with a salary of $16 an hour. Responsibilities include:

- Routine facility cleaning

- Customer assistance during staffed hours

- Support for limited wash-and-fold services

Staffing is scheduled around peak usage periods and weekends rather than full-day coverage, keeping labor costs aligned with actual demand.

Cash Handling and Internal Controls

CleanSpin uses a combination of coin-based and card-based payment systems. Card payments provide digital transaction records, while coin systems serve customers who prefer cash. The owner performs regular coin collection and reconciliation. Only the owner is allowed to access cash, payment systems, and machine controls to provide the sole point of financial accountability.

Safety, Compliance, and Insurance

The facility meets all local building, fire, health, and accessibility codes and regulations of self-service laundromats. Electrical systems, gas connections, and water flow controls are installed and inspected by professionals.

There is sufficient lighting, non-slip flooring, signage, and access limitations to mechanical and electrical spaces as part of customer safety. The insurance coverage will consist of general liability, property insurance, and equipment coverage, which is suitable for a commercial laundromat.

Does your plan sound generic?

Refine your plan to adapt to investor/lender interests

Marketing and Sales Strategy

CleanSpin follows a local marketing approach that fits how neighborhood laundromats operate. The focus is on making sure nearby residents know the location before opening and continue to notice the business after launch. Marketing is kept simple and controlled, without heavy or ongoing advertising.

A one-time $6,000 pre-opening and signage budget covers exterior signage, window branding, flyer printing and distribution, Google Business setup, and early online promotion. After opening, marketing is limited to $750 per month (for Year 1) for light local promotion, small social media ads, and upkeep of online listings. These costs are planned and do not increase with revenue.

Marketing Channels

Local Flyer Distribution

Flyers are distributed directly door-to-door in the neighborhoods and put in apartments and small local businesses. This helps those customers who are most likely to visit the laundromat due to its proximity.

Exterior Signage and Window Branding

The storefront is a major source of visibility. Clear exterior signage makes the laundromat easy to spot from the street. The window branding indicates that the store is available, clean, and well-kept, giving the impression of walking in.

Google Business Profile and Local Listings

CleanSpin maintains its Google Business Profile and local listings up to date. The listings include hours, location, photos, and services, thus enabling the customers to find the laundromat within seconds when they search online.

Social Media Promotion

Social media is used mainly during the opening period. Posts share opening details, basic service information, and early offers. A small monthly ad spend is used to reach people living close to the location.

Early Promotion Offers

Short-term opening offers are used during the first few weeks to encourage first-time visits. These may include:

- Discounted first wash

- Free dry time with a wash

- Small detergent giveaway

These offers are limited to the launch period. Regular pricing remains unchanged and clearly posted.

Customer Retention

Customer retention depends on consistency and ease of use. Clean machines, high reliability, definite prices, and constant hours promote repeat visits. The owner participates in the day-to-day management, so the problems can be addressed quickly.

CleanSpin also uses a simple loyalty program to reward regular customers:

- Stamp card or digital credit system

- Free wash or free dry after a set number of visits

This approach encourages repeat use without changing standard pricing or adding unnecessary complexity.

Investors hate amateur writing errors

Instantly improve your plan w/ our AI writing assistant

Financial Plan

The financial forecast is premised on the low use of equipment, constant prices, and regulated operating expenses. The model assumes a gradual ramp toward steady-state utilization rather than immediate full-capacity performance. Owner compensation is deferred during the initial operating period to preserve cash flow and support debt service.

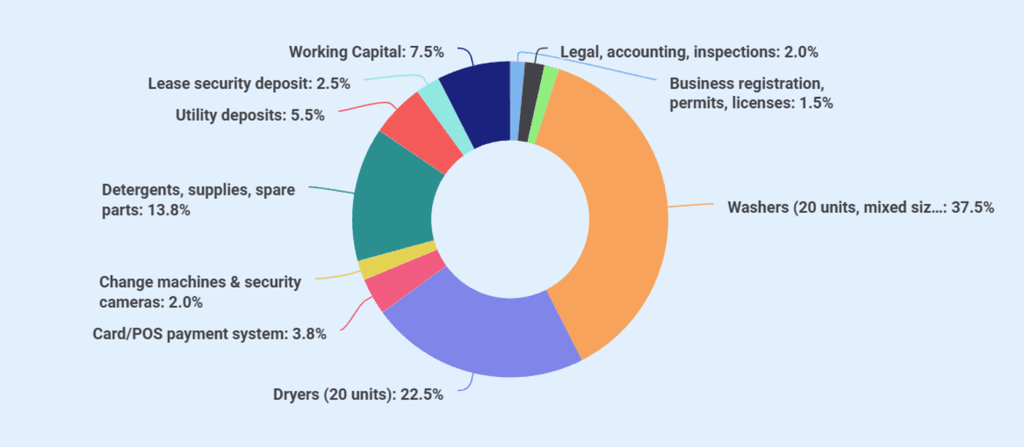

Startup Costs

Startup costs reflect the equipment-driven nature of the business and include sufficient working capital to support early operations.

| Category | Cost |

|---|---|

| Pre-Launch & Soft Costs | |

| Business registration, permits, licenses | $6,000 |

| Legal, accounting, inspections | $8,000 |

| Branding, signage, and initial marketing | $6,000 |

| Subtotal (Pre-Launch) | $20,000 |

| Equipment (Capitalized) | |

| Washers (20 units, mixed sizes) | $150,000 |

| Dryers (20 units) + Vending machine | $90,000 |

| Card/POS payment system | $15,000 |

| Change machines & security cameras | $8,000 |

| Subtotal (Equipment) | $263,000 |

| Buildout & Installation (Capitalized) | |

| Plumbing, electrical, venting | $55,000 |

| Flooring, walls, and lighting | $22,000 |

| Utility connections & inspections | $10,000 |

| Subtotal (Buildout) | $87,000 |

| Opening Inventory & Deposits | |

| Detergents, supplies, spare parts | $5,000 |

| Utility deposits | $5,000 |

| Lease security deposit | $10,000 |

| Subtotal (Inventory & Deposits) | $20,000 |

| Working Capital (Opening Cash) | $30,000 |

| Total Startup Costs | $420,000 |

Key Financial Assumptions

| Category | Key Assumptions |

|---|---|

| Forecast Period | 3 years total: Year 1 stabilization, Year 2 ramp-up, Year 3 steady operations |

| Operating Hours | 6:00 AM to 10:00 PM, 7 days per week |

| Utilization | Year 1: ~60% • Year 2: ~75% • Year 3: ~85% |

| Machine Expansion | No new machines added during Years 1–3 |

| COGS | Utilities, maintenance, supplies, wash-and-fold labor, card fees; mostly variable |

| Utilities Share | About 22–25% of self-service revenue |

| Rent | $6,000 per month (base rent only) |

| Total Facility Cost | About $14,000 per month, including utilities |

| Insurance | About $800 per month |

| Software / POS | About $500 per month |

| Cleaning & Security | About $550 per month |

| Marketing | $750 per month (for Year 1) |

| Owner Pay | Year 1: $0 • Year 2: $12,000 • Year 3: $24,000 |

| EBITDA Margin | Roughly 26% to 31% |

| Depreciation | Equipment over 7 years; buildout over 10 years |

| Annual Depreciation | About $41,000 |

| Receivables | None (cash and card sales only) |

| Owner Withdrawals | None during the projection period |

| Monthly Fixed Costs | About $10,600 |

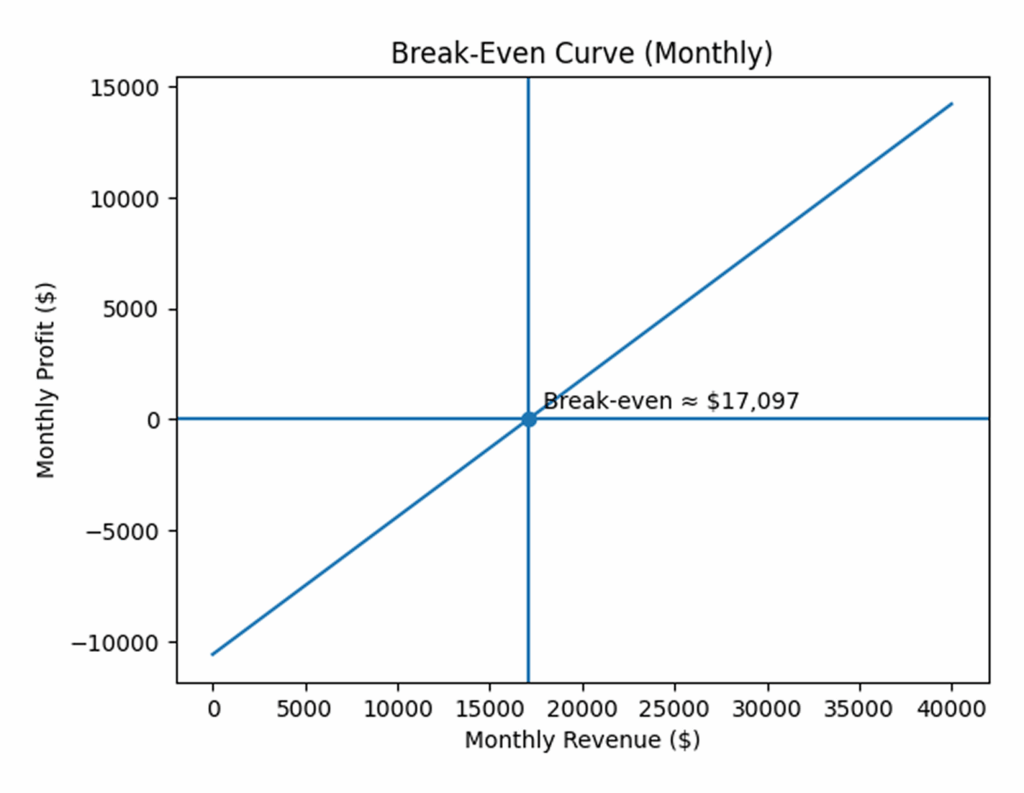

| Break-Even Revenue | About $17,100 per month |

| Tax Treatment | Pre-tax model only |

Sources of Funds

| Source | Amount |

|---|---|

| Bank Term Loan | 220,000 |

| Owner Cash Contribution | 200,000 |

| Total Funding | 420,000 |

Revenue Forecast (3 Years)

Wash-and-fold services are intentionally capacity-limited and are not expected to materially change the overall revenue mix or operating cost structure.

| Revenue Stream | Year 1 ($) | Year 2 ($) | Year 3 ($) |

|---|---|---|---|

| Self-Service Washers & Dryers | 318,000 | 396,000 | 456,000 |

| Wash-and-Fold (Limited) | 24,500 | 31,000 | 36,000 |

| Vending & Ancillary Sales | 17,500 | 21,500 | 24,000 |

| Total Revenue | 360,000 | 448,500 | 516,000 |

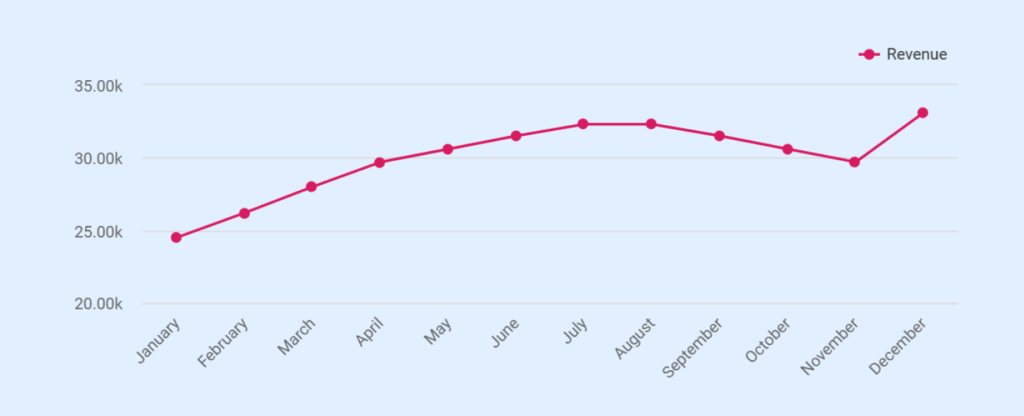

Monthly Revenue Projection (Year 1)

| Month | Adjusted Revenue ($) |

|---|---|

| January | 24,500 |

| February | 26,200 |

| March | 28,000 |

| April | 29,700 |

| May | 30,600 |

| June | 31,500 |

| July | 32,300 |

| August | 32,300 |

| September | 31,500 |

| October | 30,600 |

| November | 29,700 |

| December | 33,100 |

| Total Year 1 | 360,000 |

Income Statement (3 Years)

| Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

| Revenue | 360,000 | 448,500 | 516,000 |

| Self-Service Washers & Dryers | 318,000 | 396,000 | 456,000 |

| Wash-and-Fold Service | 24,500 | 31,000 | 36,000 |

| Vending & Ancillary Sales | 17,500 | 21,500 | 24,000 |

| Cost of Goods Sold (COGS) | 138,000 | 170,000 | 193,500 |

| Utilities (Water, Gas, Electric) | 82,000 | 101,000 | 114,000 |

| Wash-and-Fold Labor | 14,500 | 18,500 | 21,000 |

| Detergents & Chemicals | 8,500 | 10,500 | 12,000 |

| Repairs & Maintenance (usage-driven) | 18,000 | 22,000 | 26,000 |

| Cleaning & Security (uptime-related) | 6,000 | 7,000 | 8,000 |

| Payment Processing Fees | 9,000 | 11,000 | 12,500 |

| Gross Profit | 222,000 | 278,500 | 322,500 |

| Gross Margin | 61.70% | 62.10% | 62.50% |

| Operating Expenses (OPEX) | 127,300 | 144,000 | 160,700 |

| Rent (fixed portion) | 72,000 | 72,000 | 72,000 |

| Part-Time Attendant Wages | 18,300 | 19,000 | 19,700 |

| Insurance | 9,500 | 10,000 | 10,500 |

| Software / POS / Monitoring | 6,000 | 6,500 | 7,000 |

| Cleaning & Security (fixed portion) | 6,500 | 7,000 | 7,500 |

| Marketing & Promotions | 9,000 | 9,500 | 10,000 |

| Owner Compensation | 0 | 12,000 | 24,000 |

| Operational Drag / Inefficiency Reserve | 6,000 | 8,000 | 10,000 |

| EBITDA | 94,700 | 134,500 | 161,800 |

| EBITDA Margin | 26.30% | 30.00% | 31.40% |

| Depreciation | 41,000 | 41,000 | 41,000 |

| EBIT | 53,700 | 93,500 | 120,800 |

| Interest Expense | 18,000 | 15,500 | 13,000 |

| Net Income (Pre-Tax) | 35,700 | 78,000 | 107,800 |

Cash Flow Statement (3 Years)

| Line Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Operating Activities | |||

| Net Income (Pre-Tax) | 35,700 | 78,000 | 107,800 |

| Depreciation (non-cash) | 41,000 | 41,000 | 41,000 |

| Change in Working Capital | 0 | 0 | 0 |

| Net Cash from Operations | 76,700 | 119,000 | 148,800 |

| Investing Activities | |||

| Equipment & Buildout Capex | -420,000 | 0 | 0 |

| Net Cash from Investing | -420,000 | 0 | 0 |

| Financing Activities | |||

| Bank Loan Proceeds | 220,000 | 0 | 0 |

| Owner Capital Contribution | 200,000 | 0 | 0 |

| Loan Principal Repayment | -29,000 | -31,000 | -33,000 |

| Owner Distributions | 0 | 0 | 0 |

| Net Cash from Financing | 391,000 | -31,000 | -33,000 |

| Net Change in Cash | 47,700 | 88,000 | 115,800 |

| Beginning Cash Balance | 30,000 | 77,700 | 165,700 |

| Ending Cash Balance | 77,700 | 165,700 | 281,500 |

Balance Sheet (3 Years)

| Year 1 | Year 2 | Year 3 | |

|---|---|---|---|

| Assets | |||

| Cash | 77,700 | 165,700 | 281,500 |

| Inventory & Supplies | 5,000 | 6,000 | 7,000 |

| Total Current Assets | 82,700 | 171,700 | 288,500 |

| Laundry Equipment (Gross) | 263,000 | 263,000 | 263,000 |

| Buildout & Installation (Gross) | 87,000 | 87,000 | 87,000 |

| Accumulated Depreciation | -41,000 | -82,000 | -123,000 |

| Net Fixed Assets | 309,000 | 268,000 | 227,000 |

| Total Assets | 391,700 | 438,700 | 513,500 |

| Liabilities | |||

| Current Portion of Term Loan | 29,000 | 31,000 | 33,000 |

| Long-Term Term Loan | 162,000 | 129,000 | 94,000 |

| Total Liabilities | 191,000 | 160,000 | 127,000 |

| Equity | |||

| Owner Capital Contribution | 200,000 | 200,000 | 200,000 |

| Retained Earnings – Opening | -35,000 | 700 | 78,700 |

| Current Year Net Income | 35,700 | 78,000 | 107,800 |

| Ending Retained Earnings | 700 | 78,700 | 186,500 |

| Total Equity | 200,700 | 278,700 | 386,500 |

| Liabilities + Equity | 391,700 | 438,700 | 513,500 |

Don’t waste time using spreadsheets

Break-Even Analysis

| Category | Line Item / Metric | Amount / Notes |

|---|---|---|

| Fixed Costs (Monthly) | Rent (fixed portion only) | 6,000 |

| Insurance | 800 | |

| Software / POS / Monitoring | 500 | |

| Cleaning & Security (fixed portion) | 550 | |

| Marketing & Promotions | 750 | |

| Part-Time Attendant Wages (fixed hours) | 1,600 | |

| Admin / Misc Buffer | 400 | |

| Total Fixed Monthly Costs | 10,600 | |

| Variable Costs (Usage-Based) | Utilities (water, gas, electric) | Usage-driven |

| Wash-and-fold labor | Usage-driven | |

| Detergents & chemicals | Usage-driven | |

| Repairs & maintenance (usage portion) | Usage-driven | |

| Payment processing fees | ~3% of card revenue | |

| Margin Assumptions | Variable costs as % of revenue | ~38% |

| Contribution margin | ~62% | |

| Break-Even Calculation | Monthly break-even revenue | ~17,100 |

| Annualized break-even revenue | ~205,000 | |

| Operating Cushion (Year 1) | Avg monthly revenue (Year 1) | ~30,000 |

| Margin of safety | ~75% above break-even |

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.