Executive Summary

Chicago’s hospitals and tech companies are growing fast—but finding the right talent isn’t always easy. That’s where Windy City Talent Solutions, LLC comes in. Founded to meet the rising demand for healthcare professionals and IT specialists across Cook County and the Midwest, this Loop-based temp agency is perfectly positioned between the city’s medical district and its booming tech corridor.

The market opportunity is strong. Chicago’s healthcare and IT sectors continue to expand, and many hospitals and tech companies face persistent staffing challenges. Windy City steps in to provide reliable solutions in these high-demand areas.

The agency focuses on serving:

- Healthcare: Hospitals and clinics, placing registered nurses, medical assistants, and respiratory therapists

- IT: Startups and mid-market companies, placing junior developers, helpdesk support, and cybersecurity analysts

This dual focus helps Windy City balance stable, recession-proof healthcare staffing with high-growth IT placements.

The leadership team combines experience, industry knowledge, and compliance expertise.

Angela Rivera (CEO, 55%) brings over 15 years of experience in healthcare staffing and managed emergency nursing pools during COVID-19. Darnell Brooks (COO, 30%) is a former Robert Half recruiter specializing in IT staffing and compliance. Leah Chen (15%) is a silent investor contributing capital and strategic guidance.

Together, they provide operational excellence and credibility that clients and investors value.

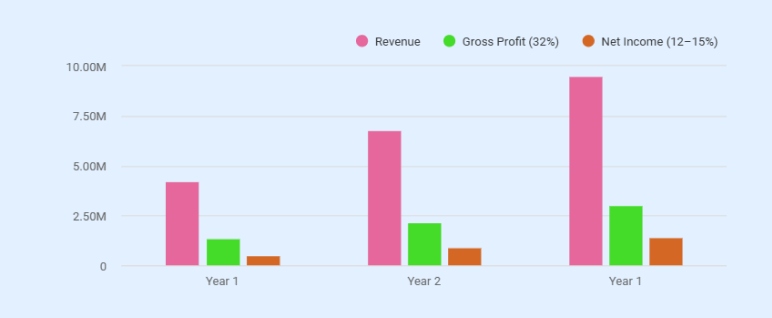

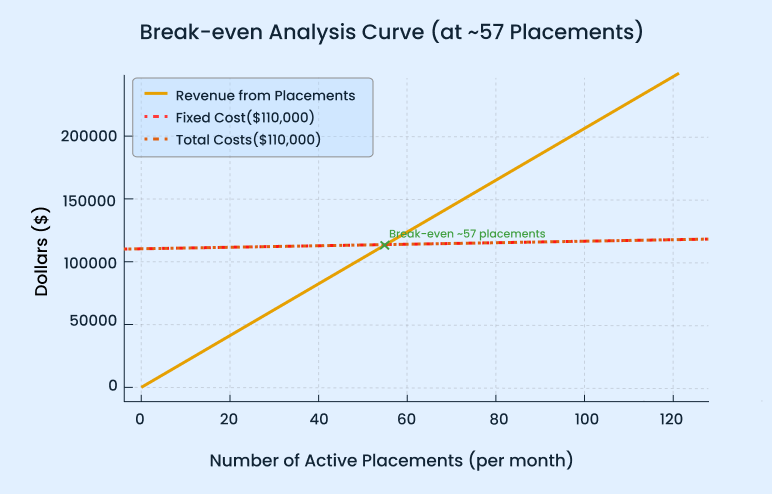

Financially, Windy City is designed for growth and sustainability. The agency projects $4.2M in Year 1, scaling to $9.5M by Year 3, with break-even achievable at just 57 active temporary placements per month.

| Year | Revenue | Gross Profit (32%) | Net Income (12–15%) |

|---|---|---|---|

| 1 | $4,200,000 | $1,344,000 | $504,000 (12%) |

| 2 | $6,800,000 | $2,176,000 | $884,000 (13%) |

| 3 | $9,500,000 | $3,040,000 | $1,425,000 (15%) |

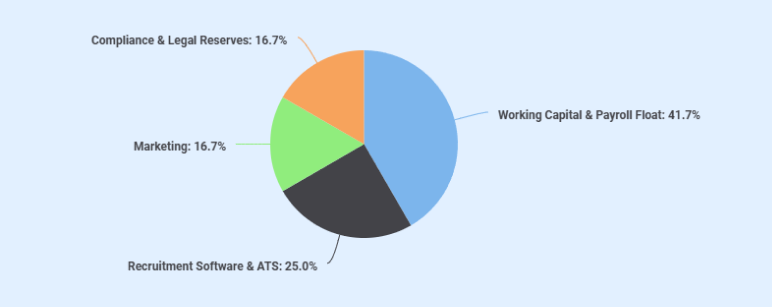

To achieve these goals, Windy City is seeking $600,000 in equity for 20% ownership. The funds will cover payroll reserves ($250,000), recruitment software and applicant tracking system (ATS) ($150,000), marketing ($100,000), and compliance/legal costs ($100,000). This investment will help the company scale, stay compliant, and meet the strong demand for staffing in Chicago’s healthcare and IT sectors.

Company Overview

Windy City Talent Solutions, LLC is a recruitment firm that specializes in healthcare and IT contract staffing. The office is located at 233 N Michigan Avenue, Suite 1725, in Chicago’s Loop, near Millennium Park. This spot is right between major hospitals and the city’s growing tech offices, making it easy to serve both industries. The company is registered as an Illinois Limited Liability Company (LLC).

Ownership

The agency is led by three founders with different strengths that balance each other:

Angela Rivera — Chief Executive Officer (55% ownership): A healthcare staffing expert who built and managed emergency nursing pools during COVID-19. She now leads hospital client relationships and recruiter teams.

Darnell Brooks — Chief Operating Officer (30% ownership): A former senior recruiter at Robert Half Technology with years of experience placing IT professionals at startups and large companies. He manages IT client growth and recruiter workflow.

Leah Chen — Silent Investor (15% ownership): Provides capital support and guidance, helping the agency scale without day-to-day operational involvement.

Together, they bring a mix of healthcare, IT, and compliance knowledge that builds trust with clients and lowers risk for investors.

Mission & Vision

- Mission: To connect healthcare and IT professionals with Chicago employers through fast, compliant, and reliable staffing.

- Vision: To grow into a leading Midwest staffing firm in both healthcare and IT, with a business model ready for long-term expansion or acquisition.

Startup Costs Overview

To launch Windy City Talent Solutions, we estimate startup costs of about $345,000. This investment will cover the Chicago Loop office setup, ATS/CRM software, marketing campaigns to reach hospitals and tech firms, payroll reserves to cover temporary staff, and initial vendor deposits. This funding ensures the business can launch smoothly and scale confidently in its first years.

Milestones & Timeline

Market Analysis

In Illinois, staffing firms place about 855,000 people each year, generating around $9.5 billion in sales through more than 1,580 offices. This local demand reflects a bigger national trend, with the U.S. staffing industry projected to reach $198.17 billion in 2025. Most of the growth is in healthcare staffing—such as travel nurses, allied health workers, and shift coverage—and in technology staffing, including cloud engineers and cybersecurity experts. Because there aren’t enough skilled workers in these areas, companies continue to rely on staffing help even when the economy slows down.

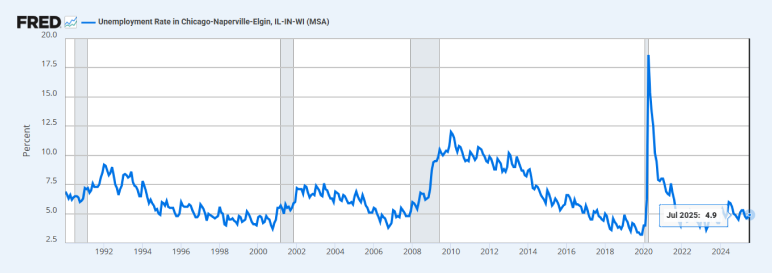

The unemployment rate in the Chicago-Naperville-Elgin metro area is about 4.9% as of July 2025.

This level of unemployment means there is a sizable pool of people looking for work, making staffing services especially valuable in providing connections between job seekers and employers.

Target Segments

Windy City Talent Solutions focuses on three main types of clients:

1) Hospitals and healthcare systems

Hospitals and healthcare systems often need nurses, lab techs, and admin staff quickly. Contracts usually range from $200k to $500k a year. The highest demand is for registered nurses (RNs), medical assistants, and respiratory therapists, since there’s always a shortage of these roles. In Cook County, hospitals depend on staffing partners like Windy City to keep shifts covered and reduce burnout for full-time staff.

2) Mid-sized tech companies and startups

These firms are looking for cybersecurity analysts, cloud engineers, and DevOps staff. A placement for a $120k role can bring about $24k in revenue. Many of them are based in River North and the West Loop, where the fight for talent is especially tough. They also hire junior developers and helpdesk support staff, who are in steady demand as companies grow.

3) Corporate clients

Corporate clients often need temporary staff for back-office and IT support. Many prefer bilingual workers, which makes this a consistent source of placements at a 25–30% markup. These companies value speed and compliance, knowing Windy City can send pre-screened candidates who are ready to work. Over time, these contracts bring recurring revenue and stronger client relationships.

Market Size

The market numbers back this up:

| Layer | Definition | Value |

|---|---|---|

| TAM (Total Addressable Market) | U.S. staffing industry (2025 projection) |

$198.17B |

| SAM (Serviceable Available Market) | Chicago metro healthcare + IT staffing (~6% of TAM) |

$11.89B |

| SOM (Serviceable Obtainable Market) | Windy City’s Year-3 target (~0.08% of SAM) |

$9.5M |

This shows that reaching $9.5M in revenue by Year 3 is very realistic, requiring only a small fraction of the Chicago market.

Competitive Landscape

Chicago’s staffing market is competitive, but Windy City Talent Solutions has room to grow.

Direct Competitors

Medix Staffing Solutions – 222 S Riverside Plaza, Chicago, IL

Medix is strong in healthcare staffing and has many hospital clients. Their rates are higher, and they don’t have bilingual recruiters, which limits access to Spanish-speaking candidates in Cook County.

Addison Group – 125 S Wacker Dr, Chicago, IL

Addison Group works in many sectors and has a large recruiter team. They don’t focus on healthcare or IT specifically, which means they may not provide as specialized service as Windy City.

Advanced Resources – 101 N Wacker Dr, Chicago, IL

Advanced Resources focuses mainly on IT staffing. They are good at finding tech talent but have little experience in healthcare and compliance. They mostly work with larger IT firms, leaving room for Windy City to serve smaller or mid-sized clients with personalized service.

Indirect Competitors

Other agencies and platforms indirectly compete by offering alternative hiring solutions:

- LinkedIn talent solutions – Let companies source candidates directly.

- Upwork & Toptal – Freelance platforms for IT talent.

- Hospital HR teams – Some larger hospitals manage their own temp staffing internally.

Competitive Advantage

Windy City stands out because it works in both healthcare and IT, balancing the steady demand of one with the fast growth of the other. The agency also brings a bilingual recruiter team to connect better with Cook County’s Spanish-speaking workforce. An ATS system with AI tools makes hiring faster, and a compliance-first approach ensures everything follows Illinois and federal labor laws.

Services & Revenue Model

Windy City Talent Solutions provides staffing solutions for healthcare and IT, combining steady income with high-profit opportunities.

Temporary staffing

This is the main service. Contractors are on Windy City’s payroll, and clients pay a 30% markup on their hourly wage. For example, a nurse billed at $60/hour costs Windy City $46/hour in wages and taxes, leaving a $14/hour margin. This creates steady weekly revenue and helps keep long-term clients.

Temp-to-hire staffing

Clients can hire temporary staff permanently after 90 days. Windy City charges 20% of the employee’s yearly salary for conversion. For instance, an IT helpdesk worker earning $70,000 would generate $14,000 for Windy City. This adds occasional lump-sum income on top of regular temp work.

Direct placement

Direct placement is a high-profit service. Clients pay a one-time fee of 18–22% of the employee’s first-year salary. For example, a cybersecurity analyst with a $120,000 salary brings in $24,000 at a 20% fee. This service complements the recurring temp and temp-to-hire revenue while creating highly profitable opportunities for the agency.

Payroll & admin services

Windy City can also manage payroll for client contractors as the official employer-of-record. A small administrative fee, about 5% of payroll, covers taxes, benefits, and compliance. This service builds long-term contracts, especially for startups and mid-sized companies needing flexible staff.

Specialized Services

Windy City also offers specialized services to fill hard-to-cover roles:

- Night-shift nursing float pool: Supplies trained nurses for night shifts to reduce burnout and keep hospitals running smoothly.

- Contract cybersecurity staffing: Provides mid-sized banks and tech companies with IT experts for short-term projects or contracts.

By offering both standard staffing and specialized services, Windy City ensures clients get reliable coverage and skilled talent, building trust and making the agency a key partner in Chicago’s staffing market.

Want to create a plan like this for your business?

Create your own business plan in minutes using Upmetrics AI

Operations Plan

Windy City Talent Solutions is built to deliver strong staffing services in both healthcare and IT. This plan explains the office setup, staffing, workflow, payroll, compliance, and tools that keep operations running smoothly.

Headquarters & Infrastructure

Windy City works from a 2,200 sq. ft. office in the Chicago Loop, close to hospitals in the Illinois Medical District and tech firms in River North and the West Loop.

The space is set up to support daily operations with:

- Six recruiter pods equipped with dual monitors, headsets, and ATS/CRM access

- Video-enabled rooms for candidate interviews and virtual meetings

- A compliance area for I-9 checks, Affordable Care Act (ACA) tracking, and payroll tax filings

- A shared training and meeting room for team sessions and client discussions

Staffing Structure

The team is built to balance healthcare and IT recruiting.

| Role | Number of Staff | Compensation | Key Responsibilities |

|---|---|---|---|

| CEO (Angela Rivera) | 1 | $110,000/year + equity | Leads the company, oversees healthcare recruiting |

| COO (Darnell Brooks) | 1 | $95,000/year | Manages IT recruiting, sales, and operations |

| Healthcare Recruiters | 3 | $55,000 base + 5% commission each | Staff hospitals, clinics, and allied health roles |

| IT Recruiters | 2 | $60,000 base + 5% commission each | Place cloud engineers, cybersecurity, and DevOps staff |

| Compliance Specialist | 1 | $50,000/year | Handles audits, licenses, and legal compliance |

| Payroll/Admin Staff | 2 | $42,000/year each | Payroll, invoices, HR records |

Work Hours & Shift Coverage

- Office hours: Monday–Friday, 8:00 AM – 7:00 PM

- On-call: Recruiters available after hours for urgent healthcare shifts

Shift structure:

- 7 AM – 3 PM: Covers hospital HR needs and nurse scheduling

- 1 PM – 9 PM: Supports IT clients and evening candidate sourcing

This structure ensures 14 hours of daily coverage without adding extra overhead, keeping operations efficient while meeting both healthcare and IT client needs.

Recruiter Workflow

Recruiters start by receiving client requests either through the ATS system or direct calls. They then source candidates using job boards like Indeed and LinkedIn, the internal Windy City talent pool, and referrals. Next, candidates are screened via phone or video interviews, with skills checked and licenses, backgrounds, and references verified.

Once suitable candidates are selected, their resumes and compliance documents are submitted to the client. After a placement is confirmed, W-2 forms are created in ADP, and time entry instructions are provided. Finally, recruiters follow up at 30, 60, and 90 days to ensure retention, while the compliance desk audits ACA and OSHA reporting to maintain regulatory standards.

Compliance & Licensing

Strong compliance keeps the business safe and trusted.

- License: Illinois Private Employment Agency License, renewed yearly.

- Insurance: $2M general liability, $1M professional liability, workers’ compensation.

- Legal rules: ACA reporting, Illinois Wage Act, OSHA healthcare rules.

Vendor & Tech Tools

Reliable systems help recruiters and admin staff stay efficient:

- ATS/CRM: Bullhorn for candidate and client records.

- Payroll/HRIS: ADP for payroll, taxes, and benefits.

- Background checks: Check for screening.

- Communication: Slack for team chats, VoIP for recruiter calls.

On the vendor side, waste management services are contracted at $180 per month to maintain a clean and safe office environment, while managed IT services are provided by CDW at $1,500 per month to support all computer systems and networks. These tools and vendor partnerships together ensure the agency can operate efficiently and provide high-quality staffing services.

Key Metrics (KPIs)

Windy City tracks a few important numbers to stay on target

| KPI | Target / Standard |

|---|---|

| Fill Rate | >85% of requisitions filled |

| Time-to-Fill (Healthcare) | <10 days |

| Time-to-Fill (IT) | <15 days |

| Gross Margin per Temp | $13–$15/hour (healthcare placements) |

| Retention Rate | >85% of placements retained beyond 90 days |

| Payroll Accuracy | 100% compliance on weekly deposits |

Marketing & Sales Strategy

Windy City Talent Solutions is building its marketing and sales program with one clear objective: To win contracts quickly in healthcare and IT while keeping customer acquisition costs low compared to the lifetime value of each client. The goal is to show investors that recruiters can build strong pipelines, scale clients without overspending, and maintain long-term relationships.

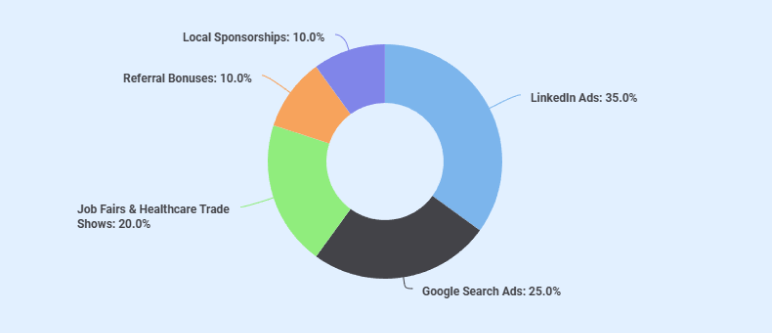

Marketing Channels & Budget

Windy City is setting aside $100,000 for marketing in the first year, using a mix of online ads, events, and local programs to reach both clients and candidates.

1) LinkedIn Ads (35% | $7,000/month, CPC ~$3.80)

Sponsored posts and direct outreach to hospital HR teams and IT company leaders. This helps connect with the people who make hiring decisions.

2) Google Search Ads (25% | $5,000/month, CPC ~$5.20)

Ads that show up when people search for terms like “Chicago nurse staffing” or “temp IT jobs.” These are aimed at businesses in Cook County who are already looking for staffing help.

3) Job fairs & healthcare trade shows (20% | $4,000/month annualized)

Taking part in events like the Illinois Nursing Expo and the Midwest Healthcare Talent Summit. These events help meet candidates face-to-face and build stronger relationships with hospitals.

4) Referral bonuses (10% | $2,000/month)

Offering $250 bonuses for candidates who get placed and $500 service credits for client referrals. This motivates both job seekers and employers to spread the word.

5) Local sponsorships (10% | $2,000/month)

Partnering with programs like the University of Illinois Chicago (UIC) Nursing program and the 1871 Tech Hub. These sponsorships boost the agency’s reputation and connect it with new healthcare and tech talent.

Sales Targets & Client Growth

The agency is focusing on the main verticals:

| Vertical | Timeline | Target | Focus Areas |

|---|---|---|---|

| Healthcare | Year 1 | 15 hospital/clinic contracts ($200k–$400k each) | Night-shift nurses, lab technicians, bilingual admin staff |

| IT | By Year 2 | 25 mid-sized IT client companies | Cybersecurity analysts, cloud engineers, and DevOps talent |

| Placement Growth | By Year 3 | 15–20% of temps converted to permanent hires + 40+ direct IT placements | Temp-to-hire and direct placements |

Sales Process

The sales funnel is designed to be simple and effective. Leads come from online campaigns, recruiter calls, and networking at events. Once a lead is identified, the COO reviews staffing needs, and the compliance director checks contract risk. From there, the agency presents a transparent proposal that includes compliance assurance.

To build trust, new clients receive a “First Placement Free” offer, where they only cover wages, not the markup. After a successful trial, clients are moved into long-term contracts. Dedicated account managers and a referral program help maintain relationships, keeping client turnover below 15%.

Launch Promotions

To build momentum and attract our first wave of clients, Windy City Talent Solutions is rolling out special launch promotions.

- First placement free: Clients pay only wages, no markup, on their first candidate.

- $250 referral bonus: For placed healthcare workers.

- $500 service credit: For new client referrals.

- Discounted 3-month pilot: Early hospital clients get reduced rates to build long-term trust.

Reputation & Brand Building

A strong reputation is key to long-term growth. Windy City’s plan includes:

- Collecting 100 verified Google and LinkedIn reviews in the first year.

- Using automated post-placement surveys through Bullhorn ATS.

- Publishing case studies after every major hospital contract and IT placement.

- Sharing thought-leadership posts by Angela Rivera and Darnell Brooks on staffing trends in healthcare and IT.

By combining targeted marketing, efficient sales processes, and a reputation for compliance and speed, Windy City Talent Solutions is building a strong foundation to scale in Chicago’s competitive staffing market.

Don’t spend weeks on your first draft

Complete your business plan in less than an hour

Financial Plan

The financial plan for Windy City Talent Solutions is built on realistic revenue goals and carefully planned expenses. The total startup cost is $345,000, covered by a mix of owner equity and support from angel investors.

| Item | Cost |

|---|---|

| Office Buildout & Furniture | $95,000 |

| ATS/CRM & Payroll Software Setup | $45,000 |

| Initial Marketing Launch | $60,000 |

| Legal & Compliance Setup | $25,000 |

| Working Capital Reserve | $120,000 |

| Total Startup Costs | $345,000 |

Key Assumptions

- Average gross profit per nurse placement: $1,920/month (based on $12/hour margin × 160 hours).

- Fixed monthly costs: $110,000 (payroll, rent, marketing).

- Break-even point: ~57 active temporary placements per month.

- Gross margin target: 32%.

- Net margin target: 12%.

- Hospitals and IT firms pay on net-30 to net-60 terms, so a 60-day payroll float buffer of $250,000 is maintained.

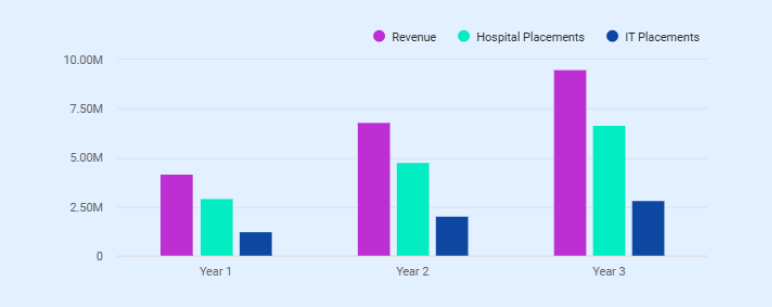

Revenue Forecasts

| Revenue Stream | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Hospital Placements | $2,940,000 | $4,760,000 | $6,650,000 |

| IT Placements | $1,260,000 | $2,040,000 | $2,850,000 |

| Total Revenue | $4,200,000 | $6,800,000 | $9,500,000 |

Projected Profit & Loss

| Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | $4,200,000 | $6,800,000 | $9,500,000 |

| Cost of Goods Sold (68%) | $2,856,000 | $4,624,000 | $6,460,000 |

| Gross Profit (32%) | $1,344,000 | $2,176,000 | $3,040,000 |

| Payroll & Benefits | $480,000 | $720,000 | $960,000 |

| Rent & Office Overheads | $120,000 | $160,000 | $200,000 |

| Marketing & Sales | $160,000 | $240,000 | $320,000 |

| Legal, Compliance & Admin | $40,000 | $60,000 | $80,000 |

| Technology (ATS/CRM, IT) | $200,000 | $280,000 | $340,000 |

| Total Operating Expenses | $1,000,000 | $1,460,000 | $1,900,000 |

| Net Profit (12%) | $504,000 | $816,000 | $1,140,000 |

Projected Balance Sheet

| Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Assets | |||

| Cash & Equivalents | $250,000 | $500,000 | $1,000,000 |

| Accounts Receivable | $700,000 | $1,100,000 | $1,600,000 |

| Fixed Assets | $165,000 | $150,000 | $135,000 |

| Total Assets | $1,115,000 | $1,750,000 | $2,735,000 |

| Liabilities | |||

| Accounts Payable/Float | $250,000 | $250,000 | $250,000 |

| Short-term Liabilities | $50,000 | $50,000 | $50,000 |

| Long-term Debt | $0 | $0 | $0 |

| Total Liabilities | $300,000 | $300,000 | $300,000 |

| Equity | |||

| Owner & Angel Equity | $345,000 | $345,000 | $345,000 |

| Retained Earnings | $470,000 | $1,105,000 | $2,090,000 |

| Total Equity | $815,000 | $1,450,000 | $2,435,000 |

| Total Liabilities + Equity | $1,115,000 | $1,750,000 | $2,735,000 |

Spreadsheets are exhausting & time-consuming

Build accurate financial projections w/ AI-assisted features

Projected Cash Flow

| Item | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Operating Cash Flow | $500,000 | $820,000 | $1,140,000 |

| Net Profit | $504,000 | $816,000 | $1,140,000 |

| Depreciation | $15,000 | $15,000 | $15,000 |

| Change in Working Capital | −$19,000 | −$11,000 | −$15,000 |

| Investing Cash Flow | −$345,000 | −$20,000 | −$20,000 |

| Financing Cash Flow | $345,000 | $0 | $0 |

| Net Change in Cash | $500,000 | $800,000 | $1,120,000 |

| Opening Cash Balance | $0 | $500,000 | $1,300,000 |

| Closing Cash Balance | $500,000 | $1,300,000 | $2,420,000 |

Break-Even Analysis

- Fixed costs: ~$110,000 per month

- Gross profit per placement: ~$1,920/month

- Break-even point: ~57 active temp placements per month

Business Ratios

| Ratio | Value |

|---|---|

| Gross Margin | 32% |

| Net Margin | 12% |

| Current Ratio | 1.6 (est.) |

| Debt-to-Equity | 0.7 (est.) |

| Client Retention Rate | >85% |

Funding Needs

Windy City Talent Solutions is raising $600,000 in equity to grow its healthcare and IT staffing business in Chicago. This money will give the company enough payroll reserves, the right recruiting tools, marketing campaigns, and compliance support to run smoothly and scale. Investors will receive 20% ownership for their investment, while the founders keep 80%, showing their strong commitment. The plan does not include loans, so there will be no debt pressure.

Use of Funds

| Category | Amount | Notes |

|---|---|---|

| Working Capital & Payroll Float | $250,000 | Ensures timely payroll for temps despite client billing cycles |

| Recruitment Software & ATS | $150,000 | Bullhorn ATS, HRIS setup, AI-enabled sourcing tools |

| Marketing | $100,000 | LinkedIn campaigns, Google Ads, job fairs, referral bonuses |

| Compliance & Legal Reserves | $100,000 | Licensing, insurance, audits, labor law compliance |

| Total | $600,000 | — |

Investor Exit Plan

Investors will own equity, which means they become partners in the company. The plan is to grow Windy City for 6–8 years and then sell to a larger staffing firm such as Robert Half, Randstad, or Adecco. At that time, the company is expected to be valued at 6–8 times its earnings.

This could give investors a return of 6–8x their original investment. For example, if the company grows to a value of $12M–$18M, the 20% stake bought for $600,000 could be worth $2.4M–$3.6M.

Risk & Mitigation

Staffing comes with certain risks, including cash flow challenges, recruiter turnover, compliance requirements, client concentration, competition, and market cycles. Windy City Talent Solutions has structured its operations to manage these risks and protect both clients and investors.

Payroll float & cash flow

Because temps are paid weekly while clients often pay on net-30 to net-60 terms, cash flow can be tight. Without proper planning, this could halt operations and harm the reputation. Windy City mitigates this with a $150,000 payroll reserve funded by equity, an approved factoring line with BlueVine to advance receivables when needed, and weekly billing for larger hospital clients to shorten the receivable cycle.

Recruiter turnover & productivity

High churn among recruiters can disrupt client relationships, slow placements, and increase acquisition costs. To reduce this risk, Windy City offers competitive pay with base salary plus commission, clear career paths from recruiter to team lead, and quarterly performance incentives and retention bonuses.

Compliance & legal exposure

Non-compliance with Illinois staffing law, ACA reporting, or OSHA standards could result in fines or contract losses. The company addresses this by having a dedicated Compliance Director, monthly I-9 and ACA file audits logged in Bullhorn ATS, and professional liability insurance ($1M) alongside $2M general liability coverage.

Client concentration

Relying too heavily on a few clients can make revenue volatile. Windy City spreads risk by serving both healthcare and IT clients, ensuring no single client accounts for more than 15% of revenue, and expanding into payroll outsourcing to create stable, recurring contracts.

Competition from established firms

Larger firms like Medix, Addison Group, and Advanced Resources may compete on price or brand. Windy City differentiates itself with bilingual recruiters, a compliance-first approach, ATS-driven efficiency, and a focus on mid-sized contracts ($200k–$500k) where national firms are less aggressive.

Market cyclicality

Staffing demand can fluctuate with hospital budgets and tech hiring trends. Windy City hedges this risk by balancing recession-resistant healthcare staffing with high-growth IT placements and maintaining at least 10% of revenue from recurring payroll outsourcing contracts.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.